Europe Spinal Implants Market

Market Size in USD Billion

CAGR :

%

USD

3.31 Billion

USD

4.94 Billion

2024

2032

USD

3.31 Billion

USD

4.94 Billion

2024

2032

| 2025 –2032 | |

| USD 3.31 Billion | |

| USD 4.94 Billion | |

|

|

|

|

Europe Spinal Implants Market Size

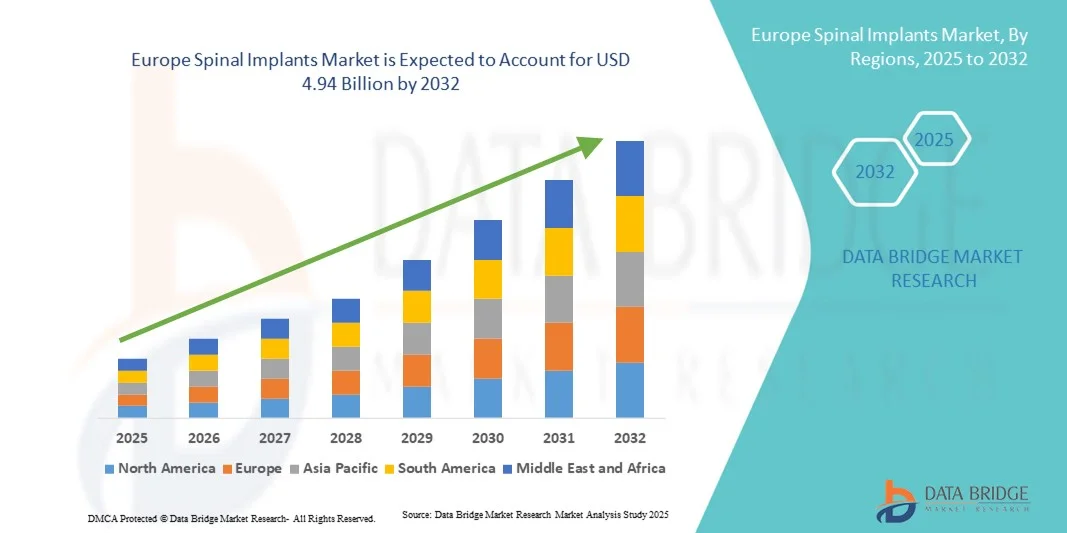

- The Europe spinal implants market size was valued at USD 3.31 billion in 2024 and is expected to reach USD 4.94 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the growing prevalence of spinal disorders, increasing orthopedic surgeries, and the rising aging population, leading to higher demand for advanced spinal implants in both hospitals and specialty clinics

- Furthermore, technological advancements in implant materials, such as titanium and PEEK, as well as innovations in minimally invasive surgical techniques, are enhancing patient outcomes and reducing recovery times, driving adoption of spinal implants

Europe Spinal Implants Market Analysis

- Spinal implants, including rods, screws, cages, and interbody devices, are increasingly vital components in modern orthopedic and neurosurgical procedures due to their effectiveness in spinal stabilization, deformity correction, and fusion surgeries

- The escalating demand for spinal implants is primarily fueled by the rising prevalence of spinal disorders, increasing geriatric population, technological advancements in implant materials and designs, and a growing number of minimally invasive spinal surgeries

- Germany dominated the spinal implants market in Europe with the largest revenue share of 28% in 2024, characterized by advanced healthcare infrastructure, high surgical procedure volumes, strong presence of key industry players, and early adoption of innovative spinal implant technologies. The country’s hospitals and specialized spine centers are increasingly utilizing advanced implants for complex spinal reconstructions, fusion procedures, and minimally invasive surgeries

- Italy is expected to be the fastest-growing country in the Europe spinal implants market during the forecast period due to rising awareness of spinal health, increasing healthcare expenditure, and adoption of advanced spinal surgical techniques in both private and public healthcare facilities

- Open surgeries dominated the Europe spinal implants market with a revenue share of 56.4% in 2024. This strong position can be attributed to the widespread use of open procedures for complex spinal corrections, deformity management, and trauma-related interventions

Report Scope and Spinal Implants Market Segmentation

|

Attributes |

Spinal Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Spinal Implants Market Trends

Advancements in Minimally Invasive and Patient-Specific Spinal Implants

- A prominent trend in the Europe spinal implants market is the increasing use of minimally invasive spinal surgeries, which aim to reduce tissue damage, shorten hospital stays, and accelerate postoperative recovery. Surgeons are increasingly adopting precision-guided instrumentation and navigation systems that allow for more accurate placement of spinal implants

- The introduction of patient-specific and 3D-printed spinal implants is gaining traction, providing customized solutions tailored to individual anatomical requirements. These implants help improve surgical outcomes and reduce complications such as implant misalignment or subsidence

- For instance, hospitals in Germany and France have successfully implemented 3D-printed titanium cages and rods designed specifically for complex spinal deformities, demonstrating improved patient outcomes and lower revision rates

- Research and development efforts are also focused on the use of bioresorbable and composite materials, which enhance biocompatibility while supporting bone growth and long-term stability

- There is an increasing adoption of robotic-assisted spinal surgery systems, which improve precision, reduce human error, and enable complex procedures with better outcomes

- Growing awareness among patients and healthcare providers regarding the benefits of minimally invasive techniques is accelerating demand for advanced spinal implant solutions

- Partnerships between medical device companies and hospitals for clinical trials and training programs are helping accelerate the adoption of innovative spinal implants

Europe Spinal Implants Market Dynamics

Driver

Increasing Incidence of Spinal Disorders and an Aging Population

- The growing prevalence of spinal conditions such as degenerative disc disease, scoliosis, spinal stenosis, and traumatic spinal injuries is a major driver for the Europe Spinal Implants market

- Europe’s aging population is more prone to osteoporosis and spinal deformities, creating higher demand for spinal surgeries that restore mobility, reduce chronic pain, and improve overall quality of life

- For instance, hospitals in Italy and Spain have observed rising numbers of spinal fusion and decompression procedures, directly boosting the adoption of modern spinal implants

- Continuous advancements in implant design, surgical tools, and navigation technologies are encouraging healthcare providers to adopt newer implant systems over conventional methods

- Supportive government initiatives promoting minimally invasive procedures and advanced surgical techniques are further enabling growth across European healthcare facilities

- Increasing investments by hospitals and surgical centers in state-of-the-art operating rooms and imaging systems facilitate the use of advanced spinal implants

- Rising patient awareness and preference for faster recovery, reduced hospital stays, and lower postoperative complications are compelling surgeons to choose newer implant systems

- Insurance coverage expansion for spinal procedures in several European countries has made advanced implants more accessible to patients, fueling market growth

Restraint/Challenge

High Costs and Regulatory Compliance Barriers

- The high cost of advanced spinal implants, including 3D-printed and patient-specific devices, can limit their adoption, particularly in smaller hospitals or facilities with budget constraints

- Strict regulatory requirements in Europe, including CE marking and compliance with the Medical Device Regulation (MDR), often prolong product approval timelines and delay market entry

- For instance, some European manufacturers of 3D-printed spinal implants have experienced approval delays due to extended MDR evaluation, impacting timely availability of innovative solutions

- Differences in reimbursement policies across countries can also influence adoption rates, as some hospitals may prefer standard implants over more expensive, customized alternative

- The requirement for specialized surgical expertise to implement advanced implant systems can pose an additional challenge, especially in less experienced centers

- Limited awareness and training among surgeons regarding newer minimally invasive and patient-specific implants can slow adoption rates

- The cost of acquiring advanced surgical tools and navigation systems alongside the implants themselves can deter mid-sized hospitals from adopting the latest technology

- Potential complications or failures in complex spinal procedures with newer implants may lead to cautious adoption until long-term clinical outcomes are fully validated

Europe Spinal Implants Market Scope

The market is segmented on the basis of product, material, technology, surgery type, end user, and distribution channel.

- By Product

On the basis of product, the Europe Spinal Implants market is segmented into fusion devices, non-fusion devices, spine biologics, spine bone stimulators, and others. The fusion devices segment dominated the market with the largest revenue share of 38.5% in 2024. This dominance is driven by the high clinical preference for fusion devices in stabilizing the spine, correcting deformities, and treating degenerative disc disease. Hospitals and specialty clinics extensively rely on fusion devices due to their proven efficacy, long-term durability, and compatibility with a range of surgical techniques. Continuous innovations in implant design, including enhanced biocompatibility, improved fixation systems, and 3D-printed components, further strengthen the segment’s leadership. In addition, growing awareness about spinal disorders, rising patient volumes in orthopedic and trauma care, and favorable reimbursement policies in Europe contribute to robust adoption of fusion devices. Physician confidence in established fusion technologies, combined with the expanding volume of minimally invasive fusion procedures, also underpins sustained growth for this segment.

The spine biologics segment is expected to witness the fastest CAGR of 9.7% from 2025 to 2032. The rapid growth is fueled by increasing adoption of regenerative therapies aimed at enhancing bone healing and improving fusion outcomes. Biologics, including bone morphogenetic proteins, demineralized bone matrix, and other growth factors, are being integrated with spinal implants to reduce complications and promote faster recovery. Rising investment in research and development, technological advancements in delivery systems, and growing clinical awareness of biologics’ advantages in complex cases are driving adoption. Favorable reimbursement policies, increased surgeon preference for biologics, and the trend toward minimally invasive approaches are further supporting the accelerated expansion of this segment.

- By Material

On the basis of material, the Europe Spinal Implants market is segmented into metals, ceramic, biomaterial, polymers, and others. The metals segment held the largest market revenue share of 42.1% in 2024. Metals such as titanium and its alloys are favored due to their high strength, durability, and proven clinical performance in spinal stabilization. These materials are widely used across fusion and non-fusion implants, particularly in hospitals and specialized clinics where complex spinal surgeries are performed. The biocompatibility, corrosion resistance, and imaging compatibility of metals ensure they remain the material of choice for many spinal implant procedures, supporting consistent demand.

Polymers are anticipated to witness the fastest CAGR of 8.9% from 2025 to 2032. The growth is driven by their use in intervertebral spacers, motion preservation devices, and cages for minimally invasive procedures. Advanced polymer composites and bioresorbable materials offer benefits such as reduced stress shielding and enhanced bone growth, which are increasingly preferred by surgeons. The rising demand for patient-specific implants, design flexibility, and improved surgical outcomes is fueling adoption in hospitals, spine centers, and ambulatory surgical centers. Ongoing research and development in polymer-based biomaterials are leading to more durable and biocompatible implants, while increasing awareness among surgeons about minimally invasive polymer solutions is accelerating market penetration.

- By Technology

On the basis of technology, the Europe Spinal Implants market is segmented into fusion, spine biologics, VCF, decompression, motion preservation, and others. The fusion technology segment dominated with a market share of 39.8% in 2024. Fusion technology is widely preferred due to its ability to stabilize the spine, correct deformities, and treat degenerative conditions with high success rates. Hospitals and spine centers depend on fusion devices for their long-term reliability and compatibility with advanced imaging and navigation systems. Continuous technological innovations such as 3D-printed implants and enhanced screw-rod systems further strengthen adoption.

Motion preservation technology is expected to witness the fastest CAGR of 9.3% from 2025 to 2032. Devices like artificial discs and dynamic stabilization systems, which preserve spinal mobility, are increasingly adopted for younger patients and those seeking quicker recovery. Advances in implant design, improved surgical techniques, and rising awareness of preserving biomechanics are driving rapid growth in this segment across hospitals, specialty clinics, and spine centers. Increasing collaborations between device manufacturers and healthcare providers are also expanding clinical adoption, while favorable reimbursement policies for motion-preserving procedures are further supporting market growth.

- By Surgery Type

On the basis of surgery type, the Europe Spinal Implants market is segmented into open surgeries and minimally invasive surgeries. Open surgeries dominated the market with a revenue share of 56.4% in 2024. This strong position can be attributed to the widespread use of open procedures for complex spinal corrections, deformity management, and trauma-related interventions. Open surgeries allow surgeons direct visualization of the operative site, facilitating precise implant placement, improved spinal alignment, and optimal stabilization outcomes. Hospitals and specialty clinics often prefer open surgeries for multi-level fusions and cases involving severe spinal deformities, where accuracy and control are critical. In addition, the established clinical protocols, extensive surgeon experience, and compatibility with a wide range of spinal implants contribute to the segment’s sustained dominance. The segment also benefits from the availability of robust post-operative care infrastructure and comprehensive rehabilitation programs, ensuring high patient success rates and long-term outcomes.

Minimally invasive surgeries (MIS) are expected to witness the fastest CAGR of 10.2% from 2025 to 2032. The growth of this segment is being driven by increasing surgeon expertise, advancements in surgical instruments and imaging technologies, and the growing patient preference for procedures that reduce tissue trauma and minimize blood loss. MIS techniques offer smaller incisions, shorter hospital stays, quicker recovery periods, and reduced post-operative pain, making them highly attractive for both elective and complex spinal procedures. Rising awareness about the clinical and economic benefits of MIS among healthcare providers, coupled with favorable reimbursement policies in several European countries, is further accelerating adoption. The segment is also supported by ongoing innovations in navigation systems, robotic-assisted surgery, and specialized implants designed for minimally invasive procedures, which are enabling broader application of MIS in spine centers and hospitals.

- By End User

On the basis of end user, the Europe Spinal Implants market is segmented into hospitals, specialty clinics, spine centers, trauma centers, ambulatory surgical centers (ASCs), and others. Hospitals dominated the market with a revenue share of 48.7% in 2024. This dominance is due to hospitals’ access to advanced surgical infrastructure, high patient volumes, and specialized operating rooms capable of handling complex spinal surgeries. Hospitals provide comprehensive care, from pre-operative evaluation to post-operative rehabilitation, which supports large-scale adoption of a wide range of spinal implants. The presence of experienced surgeons and multidisciplinary care teams further reinforces hospitals’ role as the primary end user of spinal implants in Europe.

Spine centers are expected to witness the fastest CAGR of 9.5% from 2025 to 2032. Their rapid growth is driven by the establishment of specialized centers focused on complex spinal procedures, including minimally invasive surgeries and regenerative therapies. Patients increasingly prefer spine centers for their specialized expertise, focused care, and high-quality outcomes. The adoption of cutting-edge technologies, such as image-guided navigation and patient-specific implants, supports the segment’s expansion. In addition, spine centers often collaborate with research institutions and participate in clinical trials, further enhancing their attractiveness to patients seeking advanced spinal care solutions.

- By Distribution Channel

On the basis of distribution channel, the Europe Spinal Implants market is segmented into direct tender and retail sales. Direct tender dominated the market with a share of 62.3% in 2024. This segment benefits from bulk procurement by hospitals, government healthcare programs, and large-scale health systems, ensuring consistent supply, favorable pricing, and streamlined logistics. Direct tender agreements also facilitate long-term partnerships with manufacturers, guaranteeing access to the latest implant technologies and comprehensive service support. In addition, direct tender channels help standardize procurement processes across multiple facilities, improving operational efficiency and reducing administrative overhead.

Retail sales are expected to witness the fastest CAGR of 8.7% from 2025 to 2032. This growth is fueled by increasing demand from specialty clinics, smaller hospitals, and ambulatory surgical centers for advanced spinal implants, biologics, and minimally invasive solutions. Retail channels allow these facilities to procure implants directly from distributors or manufacturers, enabling faster access to new technologies and customized solutions. The rising adoption of patient-specific implants, growing awareness among smaller healthcare providers, and the expansion of supply chain networks are key factors supporting the accelerated growth of the retail sales segment in Europe.

Europe Spinal Implants Market Regional Analysis

- The Europe spinal implants market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising awareness of spinal health, increasing prevalence of spinal disorders, and adoption of advanced surgical techniques

- The region is witnessing significant investments in hospital infrastructure and specialized spine centers, which are increasingly utilizing minimally invasive and patient-specific spinal implants

- Technological advancements, such as navigation-assisted surgeries and 3D-printed implants, are improving surgical outcomes, reducing recovery times, and fostering greater adoption of spinal implants across both public and private healthcare facilities

Germany Spinal Implants Market Insight

The Germany spinal implants market dominated the European Spinal Implants market with the largest revenue share of 28% in 2024, characterized by advanced healthcare infrastructure, high surgical procedure volumes, and the strong presence of key industry players. The country has been an early adopter of innovative spinal implant technologies, with hospitals and specialized spine centers increasingly employing advanced implants for complex spinal reconstructions, fusion procedures, and minimally invasive surgeries. For instance, German hospitals have successfully integrated patient-specific 3D-printed implants into spinal surgeries, enhancing surgical precision and improving patient outcomes. Germany’s focus on research, innovation, and sustainable medical solutions continues to drive market growth.

Italy Spinal Implants Market Insight

The Italy spinal implants market is expected to be the fastest-growing country in Europe during the forecast period, fueled by rising awareness of spinal health, increasing healthcare expenditure, and growing adoption of advanced spinal surgical techniques. Both public and private hospitals in Italy are investing in state-of-the-art spinal implants and minimally invasive procedures to improve patient care and optimize surgical outcomes. For instance, Italian spine centers are incorporating 3D navigation systems and bioresorbable implants into routine surgeries, reflecting a trend toward precision medicine and patient-specific solutions. Additionally, government initiatives promoting advanced healthcare infrastructure and training programs for surgeons are further accelerating the market growth in Italy.

Europe Spinal Implants Market Share

The spinal Implants industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- NuVasive, Inc. (U.S.)

- SeaSpine (U.S.)

- Globus Medical (U.S.)

- RTI Surgical (U.S.)

- XTANT Medical (U.S.)

- Orthofix Medical, Inc. (U.S.)

- Alphatec Holdings, Inc. (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Canwell Medical Co., Ltd. (China)

Latest Developments in Europe Spinal Implants Market

- In August 2024, Medtronic launched a new minimally invasive spinal implant system, enhancing surgical precision and patient recovery times. This innovation underscores Medtronic's commitment to advancing spinal care through cutting-edge technology

- In September 2025, IMPLANET entered into an exclusive distribution agreement with Tinavi Medical Technologies for the TIROBOT spine surgery system. This collaboration aims to strengthen the commercialization of robotic solutions in orthopedic surgery across Europe

- In September 2025, SMAIO signed its first major distribution agreement for its open platform KEOPS-4ME with Highridge Medical in the U.S. This partnership provides surgeons with personalized spinal realignment planning capabilities, marking a significant milestone in SMAIO's expansion

- In September 2025, Medacta launched the QuickStitch and expanded its fixation solutions at the AGA 2025 conference. These advancements aim to enhance surgical efficiency and patient outcomes in spinal procedures

- In March 2025, Johnson & Johnson MedTech showcased a new era of digital orthopaedics at the AAOS 2025, introducing cutting-edge implants, advanced techniques, and data-driven technologies across orthopaedic specialties, including spine

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.