Europe Sports Medicine Market

Market Size in USD Billion

CAGR :

%

USD

7.36 Billion

USD

11.73 Billion

2025

2033

USD

7.36 Billion

USD

11.73 Billion

2025

2033

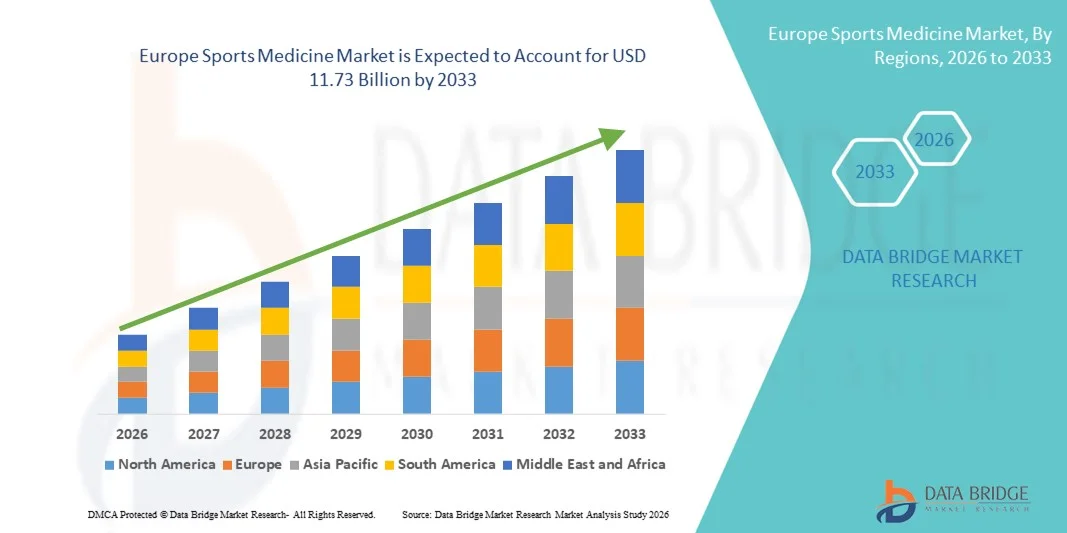

| 2026 –2033 | |

| USD 7.36 Billion | |

| USD 11.73 Billion | |

|

|

|

|

Europe Sports Medicine Market Size

- The Europe sports medicine market size was valued at USD 7.36 billion in 2025 and is expected to reach USD 11.73 billion by 2033, at a CAGR of 6.00% during the forecast period

- The market growth is largely driven by the rising incidence of sports-related injuries, increasing participation in professional and recreational sports activities, and the growing awareness regarding physical fitness and injury prevention across European countries

- Furthermore, advancements in minimally invasive surgical procedures, regenerative medicine therapies, and the expanding presence of specialized sports injury clinics are positioning sports medicine solutions as a critical component of orthopedic and rehabilitation care. These converging factors are accelerating the adoption of innovative treatment and recovery solutions, thereby significantly boosting the region’s market growth

Europe Sports Medicine Market Analysis

- Sports medicine, encompassing products and services for the prevention, diagnosis, treatment, and rehabilitation of sports-related injuries, plays a critical role in maintaining athlete performance and supporting active lifestyles across Europe, with applications spanning hospitals, orthopedic clinics, physiotherapy centers, and specialized sports injury facilities

- The escalating demand for sports medicine solutions is primarily fueled by the increasing incidence of sports injuries, rising participation in professional and recreational sports, and growing awareness regarding fitness, injury prevention, and faster recovery options among all age groups

- Germany dominated the Europe sports medicine market with the largest revenue share of 28.76% in 2025, characterized by advanced healthcare infrastructure, strong presence of leading orthopedic device manufacturers, and high sports participation rates, with the country witnessing substantial adoption of minimally invasive procedures and regenerative therapies supported by favorable reimbursement frameworks

- The United Kingdom is expected to be the fastest growing country in the Europe sports medicine market during the forecast period due to increasing investments in sports healthcare facilities, rising government initiatives promoting physical activity, and expanding access to specialized rehabilitation services

- Body Reconstruction Products segment dominated the Europe sports medicine market with a market share of 41.9% in 2025, driven by the high volume of ligament repair, arthroscopy, and joint reconstruction procedures, along with continuous technological advancements in bioabsorbable implants and fixation devices

Report Scope and Europe Sports Medicine Market Segmentation

|

Attributes |

Europe Sports Medicine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Sports Medicine Market Trends

Rising Adoption of Regenerative and Minimally Invasive Therapies

- A significant and accelerating trend in the Europe sports medicine market is the growing adoption of regenerative medicine solutions and minimally invasive surgical techniques across orthopedic and sports injury care settings. This convergence of biologics and advanced surgical technologies is significantly enhancing patient recovery outcomes and reducing downtime for athletes

- For instance, platelet-rich plasma (PRP) injections and stem cell–based therapies are increasingly utilized in leading European sports clinics to treat ligament injuries and tendon disorders, while arthroscopic procedures are widely adopted for faster rehabilitation and reduced hospital stays

- Integration of biologics in sports medicine enables improved tissue healing, reduced post-operative complications, and enhanced long-term joint functionality. For instance, bioabsorbable fixation devices and advanced graft systems are being deployed to support ligament reconstruction and soft tissue repair with improved precision. Furthermore, minimally invasive approaches offer patients shorter recovery timelines and lower risk of infection, strengthening their preference among professional and amateur athletes alike

- The seamless incorporation of advanced imaging, rehabilitation robotics, and performance monitoring technologies facilitates comprehensive injury management across the treatment continuum. Through coordinated care pathways, healthcare providers can manage diagnosis, surgery, and physiotherapy within specialized sports medicine centers, creating a streamlined and outcome-focused recovery experience

- This trend toward biologically enhanced and technology-driven treatment solutions is fundamentally reshaping clinical practices in sports injury management. Consequently, companies such as Smith+Nephew are developing advanced arthroscopy systems and regenerative repair solutions tailored to evolving athlete and patient needs across Europe

- The demand for innovative regenerative therapies and minimally invasive interventions is growing rapidly across hospitals, orthopedic clinics, and sports academies, as healthcare systems increasingly prioritize faster recovery, reduced hospital burden, and improved long-term mobility outcomes

- The collaboration between sports federations, research institutions, and medical device manufacturers is fostering continuous innovation in surgical instruments, biomaterials, and rehabilitation technologies, strengthening Europe’s position as a leading hub for sports medicine advancement

Europe Sports Medicine Market Dynamics

Driver

Growing Sports Participation and Increasing Incidence of Musculoskeletal Injuries

- The rising participation in professional leagues, community sports, and fitness activities across European countries, coupled with the increasing incidence of musculoskeletal injuries, is a significant driver for the heightened demand for sports medicine products and services

- For instance, national initiatives promoting physical activity and large-scale sporting events across Germany, France, and the United Kingdom have led to a measurable rise in ligament injuries, fractures, and tendon-related conditions requiring specialized orthopedic care. Such strategies by sports authorities and healthcare institutions are expected to drive the sports medicine market growth during the forecast period

- As awareness regarding early diagnosis and specialized treatment improves, patients are increasingly opting for advanced orthopedic implants, braces, and rehabilitation programs that offer faster and more effective recovery compared to conventional treatment methods

- Furthermore, the expansion of dedicated sports injury clinics and rehabilitation centers is making specialized care more accessible, positioning sports medicine as an essential component of modern orthopedic healthcare systems across Europe

- The emphasis on performance optimization, injury prevention programs, and structured physiotherapy regimens for both elite athletes and aging active populations is propelling the adoption of innovative surgical devices and recovery technologies. The growing collaboration between sports organizations and healthcare providers further contributes to market expansion

- Rising geriatric population participation in recreational fitness and wellness programs is also increasing demand for joint reconstruction, soft tissue repair, and rehabilitation services tailored to age-related musculoskeletal conditions

- In addition, increasing private investments and partnerships between healthcare providers and professional sports clubs are accelerating the establishment of specialized sports medicine centers across major European cities

Restraint/Challenge

High Treatment Costs and Reimbursement Variability Across Countries

- Concerns surrounding the high cost of advanced surgical procedures and regenerative therapies pose a significant challenge to broader market expansion across Europe. As many sports medicine interventions involve specialized implants and biologics, treatment expenses can be substantial, creating affordability barriers in certain regions

- For instance, variability in reimbursement frameworks between Western and Eastern European countries has led to inconsistent patient access to advanced arthroscopic and regenerative procedures, limiting uniform adoption rates across the region

- Addressing these cost and reimbursement disparities through standardized coverage policies and value-based healthcare models is crucial for improving patient accessibility. Companies such as Arthrex emphasize cost-effective surgical systems and training programs to support broader adoption. In addition, stringent regulatory requirements for medical devices and biologics can extend approval timelines and increase compliance costs for manufacturers operating within the European Union

- While technological innovation continues to advance, budget constraints within public healthcare systems and price sensitivity among smaller clinics can slow procurement of premium sports medicine equipment and implants

- Overcoming these challenges through improved reimbursement harmonization, cost-optimization strategies, and stronger public–private partnerships will be vital for sustaining long-term market growth across the Europe sports medicine landscape

- Limited availability of skilled orthopedic surgeons and sports rehabilitation specialists in certain regions may further restrict timely access to advanced procedures and specialized care

- Moreover, stringent post-market surveillance requirements and evolving EU medical device regulations can increase administrative burdens and operational costs for manufacturers, potentially delaying product launches and innovation cycles

Europe Sports Medicine Market Scope

The market is segmented on the basis of products, application, procedure, and end-user.

- By Products

On the basis of products, the Europe sports medicine market is segmented into body reconstruction products and body support and recovery products. The body reconstruction products segment dominated the market with the largest revenue share of 41.9% in 2025, driven by the high volume of ligament repair, tendon reconstruction, and joint stabilization procedures across major European countries. These products include implants, fixation devices, arthroscopy instruments, and grafts widely used in knee and shoulder surgeries. The growing prevalence of anterior cruciate ligament (ACL) injuries and rotator cuff tears has significantly increased procedural demand. Advanced bioabsorbable implants and minimally invasive surgical systems further strengthen segment growth. Strong reimbursement coverage for orthopedic surgeries in Western Europe also supports revenue expansion.

The body support and recovery products segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising emphasis on non-surgical injury management and post-operative rehabilitation. This segment includes braces, compression garments, physiotherapy equipment, and cryotherapy solutions increasingly adopted in outpatient settings. Growing awareness regarding injury prevention among amateur athletes and aging populations contributes to demand. Technological advancements in lightweight, ergonomic support devices enhance patient compliance and comfort. Expansion of home-based rehabilitation programs and sports physiotherapy clinics further accelerates growth. Increasing preference for cost-effective recovery solutions compared to surgical alternatives also supports rapid adoption.

- By Application

On the basis of application, the market is segmented into knee, hip, shoulder and elbow, foot and ankle, hand and wrist, back and spine injuries, and other injuries. The knee segment dominated the Europe sports medicine market in 2025, primarily due to the high incidence of ACL tears, meniscus injuries, and cartilage damage among athletes and physically active individuals. Knee injuries are among the most commonly reported sports-related conditions across football, skiing, and basketball activities. The availability of advanced arthroscopic techniques and specialized implants further strengthens this segment. Favorable reimbursement policies in countries such as Germany and France support high procedural volumes. Increasing participation in high-impact sports continues to sustain demand. Continuous innovation in knee reconstruction technologies enhances clinical outcomes and adoption rates.

The shoulder and elbow segment is projected to be the fastest growing during the forecast period, driven by rising cases of rotator cuff injuries and ligament tears linked to racket sports and gym-based training. Growing participation in tennis, handball, and fitness activities contributes to injury prevalence. Advancements in minimally invasive arthroscopy procedures improve treatment success rates. Increasing awareness about early diagnosis and targeted physiotherapy also fuels demand. Sports medicine specialists are increasingly adopting bio-composite anchors and soft tissue repair systems. Expanding rehabilitation programs for upper-limb mobility further supports segment expansion.

- By Procedure

On the basis of procedure, the market is segmented into knee arthroscopy procedures, hip arthroscopy procedures, shoulder and elbow arthroscopy procedures, foot and ankle arthroscopy procedures, hand and wrist arthroscopy procedures, and others. The knee arthroscopy procedures segment dominated the market in 2025 due to the large number of minimally invasive knee surgeries performed annually across Europe. Arthroscopy offers reduced hospital stays, quicker recovery times, and lower complication risks compared to open surgeries. Increasing sports participation among youth and professional athletes contributes to procedural growth. Technological improvements in visualization systems and precision instruments enhance surgical efficiency. The presence of specialized orthopedic centers across Western Europe supports high adoption. Continuous clinical advancements in ligament reconstruction further solidify dominance.

The hip arthroscopy procedures segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising diagnosis of femoroacetabular impingement and labral tears. Growing awareness regarding early hip preservation techniques is driving procedural volumes. Improvements in imaging and surgical navigation systems enhance treatment accuracy. Increasing preference for minimally invasive hip interventions among younger patients supports growth. Expansion of ambulatory surgical centers performing arthroscopic procedures further accelerates adoption. Technological innovation in suture anchors and fixation devices strengthens market potential.

- By End-User

On the basis of end-user, the Europe sports medicine market is segmented into hospitals, orthopedic clinics, ambulatory surgical centers, and others. The hospitals segment dominated the market in 2025, supported by advanced surgical infrastructure and availability of multidisciplinary care teams. Hospitals perform a high volume of complex reconstruction and arthroscopy procedures. Strong reimbursement systems in developed European countries further support hospital-based treatments. Access to advanced imaging and intensive care facilities enhances treatment outcomes. Large patient inflow for trauma and sports injuries ensures sustained procedural demand. Public healthcare funding in Western Europe reinforces segment stability.

The ambulatory surgical centers (ASCs) segment is anticipated to witness the fastest growth during the forecast period, driven by increasing preference for cost-effective and same-day surgical interventions. ASCs offer shorter waiting times and lower procedure costs compared to hospitals. Rising adoption of minimally invasive arthroscopy techniques supports outpatient settings. Improvements in anesthesia and pain management enable safe same-day discharge. Growing patient preference for convenient treatment pathways further boosts demand. Expansion of private healthcare investments across Europe accelerates ASC establishment and utilization.

Europe Sports Medicine Market Regional Analysis

- Germany dominated the Europe sports medicine market with the largest revenue share of 28.76% in 2025, characterized by advanced healthcare infrastructure, strong presence of leading orthopedic device manufacturers

- Healthcare providers across the region highly prioritize minimally invasive procedures, regenerative therapies, and structured rehabilitation programs to ensure faster recovery and improved functional outcomes for athletes and active individuals

- This widespread adoption is further supported by favorable reimbursement frameworks, growing awareness of injury prevention, and increasing investments in specialized sports injury clinics, establishing sports medicine solutions as a critical component of modern orthopedic and rehabilitation care across Europe

The Germany Sports Medicine Market Insight

The Germany sports medicine market captured the largest revenue share in 2025 within Europe, fueled by advanced healthcare infrastructure and high participation in organized and recreational sports. Healthcare providers are increasingly prioritizing minimally invasive orthopedic procedures and regenerative therapies to enhance recovery outcomes and reduce hospitalization time. The growing number of sports injury cases, particularly knee and shoulder injuries, is driving demand for arthroscopy devices and reconstruction implants. Moreover, strong reimbursement frameworks and the presence of leading medical device manufacturers are significantly contributing to the market’s expansion.

France Sports Medicine Market Insight

The France sports medicine market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising sports participation and increasing awareness regarding injury prevention and rehabilitation. The expansion of specialized sports clinics and physiotherapy centers is fostering the adoption of advanced support and recovery products. French healthcare providers are also emphasizing early diagnosis and minimally invasive treatment approaches. The region is experiencing steady growth across hospital and outpatient settings, with sports medicine solutions being integrated into both public and private healthcare facilities.

U.K. Sports Medicine Market Insight

The U.K. sports medicine market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating focus on physical fitness and structured sports programs. In addition, rising cases of musculoskeletal injuries among athletes and aging active populations are encouraging demand for advanced orthopedic implants and rehabilitation services. The country’s well-established sports culture and increasing investments in sports healthcare infrastructure are expected to continue stimulating market growth.

Italy Sports Medicine Market Insight

The Italy sports medicine market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of advanced orthopedic treatments and rehabilitation therapies. Italy’s developed hospital network and growing adoption of arthroscopic procedures promote demand for body reconstruction products. The integration of innovative fixation devices and biologics into clinical practice is becoming increasingly prevalent. Rising participation in football and winter sports further supports procedural volumes and market expansion.

Europe Sports Medicine Market Share

The Europe Sports Medicine industry is primarily led by well-established companies, including:

- Smith+Nephew (U.K.)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Medtronic (Ireland)

- CONMED Corporation (U.S.)

- KARL STORZ SE & Co. KG (Germany)

- DJO LLC (U.S.)

- Breg, Inc. (U.S.)

- Össur hf (Iceland)

- Bauerfeind AG (Germany)

- Thuasne (France)

- EOS imaging SA (France)

- BoneSupport AB (Sweden)

- Biocomposites Ltd (U.K.)

- Ottobock SE & Co. KGaA (Germany)

- LimaCorporate S.p.A (Italy)

- RTI Surgical Holdings, Inc. (U.S.)

- Performance Health, LLC (U.S.)

- MediTech Solutions (U.K.)

What are the Recent Developments in Europe Sports Medicine Market?

- In October 2025, the first International Conference on Sports Medicine (IC-SM 2025) was successfully held in Kosovo, bringing together leading European experts and driving knowledge exchange in injury prevention, treatment, and sports medicine research

- In September 2025, Sportklinik Hellersen in Germany highlighted advancements in elite sports medicine care as part of the Rhine-Ruhr Olympic bid, emphasizing how Olympic-level medical expertise is benefiting a wider patient population with cutting-edge treatment approaches

- In May 2025, Citius Retreats announced the debut of doctor-led sports medicine and wellness retreats in Europe at Six Senses Ibiza, expanding holistic rehabilitation and performance programs that integrate medical care, physiotherapy, and injury prevention for athletes and active individuals

- In June 2024, the European Commission officially recognized sports medicine as a full medical specialty, allowing sports medicine qualifications to be formally acknowledged across EU member states, strengthening professional mobility and standardizing training for specialists across Europe

- In March 2023, UPMC completed the acquisition of the renowned Sports Surgery Clinic in Dublin, significantly expanding its European sports medicine network and enhancing access to advanced orthopaedic and injury care services in Ireland

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.