Europe Surgical Operating Microscopes Market

Market Size in USD Million

CAGR :

%

USD

479.50 Million

USD

1,105.02 Million

2025

2033

USD

479.50 Million

USD

1,105.02 Million

2025

2033

| 2026 –2033 | |

| USD 479.50 Million | |

| USD 1,105.02 Million | |

|

|

|

|

Europe Surgical Operating Microscopes Market Size

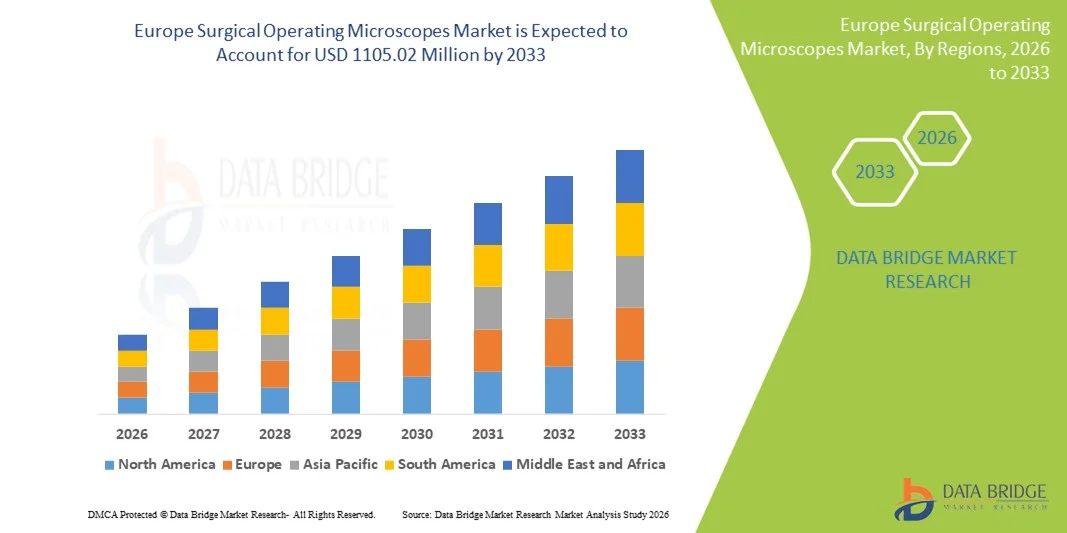

- The Europe surgical operating microscopes market size was valued at USD 479.5 Million in 2025 and is expected to reach USD 1105.02 Million by 2033, at a CAGR of11.00% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced surgical procedures and technological progress in surgical visualization, leading to enhanced precision, safety, and efficiency in both hospital and ambulatory surgical settings

- Furthermore, rising demand for minimally invasive surgeries, improved patient outcomes, and advanced imaging integration is accelerating the uptake of Surgical Operating Microscopes solutions, thereby significantly boosting the industry's growth

Europe Surgical Operating Microscopes Market Analysis

- Surgical operating microscopes, providing high-precision magnification and visualization for surgical procedures, are increasingly vital components of modern operating rooms and ambulatory surgical centers due to their enhanced accuracy, improved patient outcomes, and seamless integration with advanced imaging and surgical technologies

- The escalating demand for surgical operating microscopes is primarily fueled by the growing adoption of minimally invasive procedures, rising awareness of advanced surgical visualization, and a preference for enhanced surgical precision and safety

- U.K. dominated the surgical operating microscopes market with the largest revenue share of approximately 38% in 2025, driven by a well-established healthcare infrastructure, high adoption of minimally invasive and specialty surgeries, advanced surgical training programs, and strong investments in innovative surgical technologies. The presence of leading medical device manufacturers and growing emphasis on precision surgery further bolster the market dominance

- Germany is expected to be the fastest-growing country in the surgical operating microscopes market during the forecast period, registering a CAGR of around 13.5% from 2026 to 2033, supported by increasing healthcare expenditure, expansion of hospital and specialty clinic infrastructure, rising number of surgical procedures, and growing adoption of advanced surgical visualization solutions. Government initiatives to promote minimally invasive surgeries and technological advancements in surgical equipment further accelerate market growth

- The Systems (Microscopes) segment dominated the largest market revenue share of 52.8% in 2025, driven by increasing demand for high-precision surgical interventions across neuro, spine, and ophthalmic surgeries

Report Scope and Surgical Operating Microscopes Market Segmentation

|

Attributes |

Surgical Operating Microscopes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

• Carl Zeiss (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Surgical Operating Microscopes Market Trends

Rising Adoption of Advanced Imaging and Ergonomic Solutions

- A prominent trend in the global surgical operating microscopes market is the increasing adoption of high-definition optical systems and ergonomic designs to enhance surgical precision and user comfort

- For instance, in March 2023, ZEISS launched the OPMI Lumera 700 globally with integrated 4K imaging for ophthalmic surgeries, enabling surgeons worldwide to achieve superior visualization

- Surgeons and hospitals are increasingly favoring microscopes with motorized focus, automated positioning, and adjustable illumination to reduce fatigue during long procedures

- High-throughput surgical centers prefer microscopes that support multi-disciplinary use, including neurosurgery, ophthalmology, ENT, and dental surgeries

- Digital imaging integration and video recording capabilities are becoming standard to facilitate teaching, training, and real-time monitoring globally

- Ergonomic features, including adjustable arms and intuitive controls, are being prioritized to enhance operational efficiency

- Compact and portable microscopes are gaining popularity for use in smaller operating rooms or mobile surgical units in developing regions. The trend toward minimally invasive surgeries is driving demand for precise optical systems with superior resolution

- Microscopes compatible with hospital digital infrastructure enable seamless integration with documentation and patient record systems. Surgeons are increasingly adopting modular systems that allow upgrades of optical and digital components, extending product life cycles

- Manufacturers are focusing on global product standardization to cater to international markets and regulatory requirements. This shift toward advanced, ergonomic, and multi-functional microscopes is fundamentally shaping global surgical visualization practices

Europe Surgical Operating Microscopes Market Dynamics

Driver

Increasing Surgical Volumes and Expanding Healthcare Infrastructure

- The global increase in surgical procedures, particularly in ophthalmology, neurosurgery, ENT, and dental care, is a key driver for the market

- For instance, in July 2024, Leica Microsystems expanded its global microscope portfolio for neurosurgical applications, emphasizing precision and high-resolution optics

- Growing numbers of hospitals and specialty surgical centers worldwide are investing in advanced microscopes to improve patient outcomes

- Government initiatives to modernize healthcare infrastructure across emerging and developed regions support market growth

- Rising patient awareness of advanced surgical techniques and outcomes is motivating hospitals to adopt modern systems. Continuous technological improvements in optics, illumination, and imaging encourage the replacement of older models globally

- Medical tourism, particularly in countries like India, Thailand, and Singapore, is driving investments in state-of-the-art surgical equipment. Teaching hospitals and research centers are increasingly adopting microscopes to support surgical training and simulation programs

- The prevalence of eye, ENT, and neurological disorders worldwide is increasing demand for specialized surgical microscopes. Global collaborations between hospitals and manufacturers for customized solutions and training are accelerating adoption

- Investment in multi-disciplinary and digital-ready microscopes supports workflow efficiency in hospitals across continents. Overall, rising surgical volumes, infrastructure expansion, and continuous technological innovation are propelling global market growth

Restraint/Challenge

High Costs and Operational Complexity

- The global Surgical Operating Microscopes market faces restraint due to the high cost of acquisition, installation, and maintenance, limiting adoption in cost-sensitive regions

- For instance, in June 2022, a report highlighted that several small hospitals in Southeast Asia postponed upgrading to advanced surgical microscopes due to the prohibitive purchase and maintenance costs, reflecting the global challenge of affordability

- Premium microscopes with integrated digital imaging and advanced optics can cost several tens of thousands of dollars, restricting accessibility for smaller healthcare facilities

- Operation requires skilled personnel and trained surgeons to fully utilize advanced features, which is a challenge in some developing regions

- Regular calibration, maintenance, and potential repairs add operational expenses, impacting adoption worldwide

- In remote or underdeveloped regions, a lack of trained staff limits penetration of advanced microscopes

- Rapid technological advancements may render older models obsolete, discouraging investment from budget-conscious buyers

- Global dependency on stable electricity and infrastructure can restrict adoption in certain countries

- Hospitals must balance investment in surgical microscopes with other essential medical equipment needs

- High-end models remain expensive despite some price reductions for mid-range offerings

- Installation and integration with existing operating room systems require additional resources

- Leasing, financing, and local manufacturing could alleviate some cost-related barriers globally. High acquisition costs and operational complexity remain significant challenges for widespread adoption across the world

Europe Surgical Operating Microscopes Market Scope

The market is segmented on the basis of type, application, and end-user.

- By Type

On the basis of type, the Surgical Operating Microscopes market is segmented into Systems (Microscopes), Visualization Systems, and Accessories. The Systems (Microscopes) segment dominated the largest market revenue share of 52.8% in 2025, driven by increasing demand for high-precision surgical interventions across neuro, spine, and ophthalmic surgeries. Surgeons prefer advanced microscope systems for their superior magnification, illumination, and ergonomic designs. The segment benefits from continuous technological upgrades, including digital overlays, 3D visualization, and integrated imaging. Rising global surgical volumes and increasing investments in operating room infrastructure further boost adoption. Hospitals and specialty clinics prioritize microscope systems for their multifunctional capabilities, enabling complex microsurgeries. Additionally, growing awareness about patient safety, surgical accuracy, and postoperative outcomes accelerates demand. Strong R&D investments by key players such as Zeiss, Leica, and Olympus continue to enhance system capabilities. Emerging markets are gradually adopting microscope systems due to improved affordability and financing options. Increasing preference for minimally invasive procedures also drives market dominance. Integration with robotic and navigation-assisted surgery platforms further strengthens the market share. Expansion in specialty clinics and ambulatory surgical centers globally contributes to segment growth. Microscope systems remain central to the overall surgical ecosystem, maintaining their position as the most preferred type in the market.

The Visualization Systems segment is anticipated to witness the fastest CAGR of 9.6% from 2026 to 2033, fueled by the rising need for digital imaging, real-time visualization, and documentation during surgeries. Hospitals increasingly adopt advanced visualization for enhanced intraoperative guidance. Visualization systems facilitate collaboration, teaching, and telemedicine applications. Surgeons benefit from high-definition displays and multi-angle imaging. Growth in minimally invasive and endoscopic surgeries further drives adoption. Integration with AI-assisted surgical planning supports market growth. Rising demand for 3D and 4K imaging platforms boosts the segment. Visualization systems enable better patient outcomes and reduce operative time. Expansion of specialty clinics seeking efficient and cost-effective solutions supports adoption. Increasing focus on training and education in surgical procedures enhances the use of visualization systems. Global regulatory approvals for advanced visualization platforms further accelerate growth. Rising awareness of technological benefits over traditional microscopes encourages hospitals to upgrade systems. Continuous innovations in optics and display technology sustain a high CAGR for this segment.

- By Application

On the basis of application, the Surgical Operating Microscopes market is segmented into Neuro and Spine Surgery, Plastic and Reconstructive Surgery, Ophthalmology, Gynecology and Urology, Oncology, Otolaryngology, Dentistry, and Others. The Neuro and Spine Surgery segment dominated the largest market revenue share of 35.4% in 2025, owing to the increasing prevalence of neurological disorders and spinal injuries. Microsurgical precision is critical in these procedures, driving the adoption of advanced operating microscopes. Hospitals prioritize investments in neuro and spine surgery suites to improve surgical outcomes. The growth of neurosurgical centers in emerging markets supports the segment’s dominance. Integration with intraoperative imaging and navigation systems enhances precision. Rising geriatric populations and the incidence of trauma cases further boost demand. Increasing awareness of minimally invasive spine surgery accelerates adoption. Neuro and spine surgeries require high-quality magnification and illumination, strengthening the segment share. Key players are expanding offerings for specialized neurosurgical applications. Expansion of tertiary care centers globally contributes to segment leadership. Rising reimbursement policies for neurological interventions also aid market growth. Continuous training and certification programs for surgeons drive adoption of advanced microscopes.

The Ophthalmology segment is expected to witness the fastest CAGR of 10.1% from 2026 to 2033, driven by the growing incidence of eye disorders such as cataracts, glaucoma, and retinal diseases. High adoption of cataract and refractive surgeries globally accelerates demand. Advanced microscopes provide precise visualization for delicate ocular procedures. Increasing geriatric population and vision correction awareness further fuel adoption. Growth in outpatient surgical centers enhances accessibility. Integration with imaging systems and digital overlays improves surgical outcomes. Technological innovations such as heads-up display systems encourage adoption. Surgeons prefer microscopes offering ergonomic benefits for long procedures. Expansion of ophthalmology specialty clinics globally supports segment growth. Favorable reimbursement policies in key regions drive adoption. Rising investments in eye care infrastructure increase microscope installations. Collaboration with research institutions fosters advancements in ocular microsurgery. Ophthalmology’s focus on minimally invasive procedures ensures sustained high CAGR for this segment.

- By End User

On the basis of end-user, the market is segmented into Hospitals, Specialty Clinics, and Ambulatory Services. The Hospitals segment dominated the largest market revenue share of 61.2% in 2025, due to high surgical volumes, comprehensive service offerings, and the ability to invest in advanced operating microscopes. Hospitals require multifunctional systems for neuro, spine, ophthalmology, and oncology procedures. Large hospital networks drive bulk procurement of microscope systems. Government funding and private investments enhance infrastructure upgrades. Hospitals benefit from advanced training programs for surgeons, increasing microscope adoption. Expansion of tertiary and quaternary care centers globally supports market dominance. Integration with digital operating rooms and robotic platforms strengthens the segment. Continuous demand for minimally invasive surgeries boosts usage. High patient throughput and diverse surgical procedures sustain segment leadership. Hospitals prefer systems with superior reliability, precision, and service support. Advanced imaging and connectivity options further encourage hospital adoption. Rising focus on patient safety and outcomes maintains a high share for hospitals in the market.

The Specialty Clinics segment is expected to witness the fastest CAGR of 9.7% from 2026 to 2033, driven by the growing trend of outpatient surgeries and cost-effective microsurgical solutions. Clinics focus on high-volume ophthalmology, ENT, and dental procedures. Increasing patient preference for outpatient care accelerates adoption. Specialty clinics leverage compact and portable microscope systems. Growing investments in private healthcare and specialty centers support segment growth. Integration with visualization and recording systems enhances surgical accuracy. Technological upgrades in ergonomic and digital features drive adoption. Expansion of clinics in urban and semi-urban regions contributes to growth. Rising collaborations with research institutions increase equipment deployment. Surgeons prefer user-friendly systems for routine procedures. Awareness about microsurgical benefits in cosmetic and reconstructive procedures further fuels adoption. Clinics increasingly seek cost-efficient alternatives to full-scale hospital systems. The trend of specialized surgical centers ensures sustained high CAGR for this segment.

Europe Surgical Operating Microscopes Market Regional Analysis

- The Europe surgical operating microscopes market is poised to grow at a CAGR of 13.5% during the forecast period of 2026 to 2033

- Driven by increasing healthcare expenditure

- Rising number of surgical procedures, and expanding hospital and specialty clinic infrastructure across the region

U.K. Surgical Operating Microscopes Market Insight

The U.K. surgical operating microscopes market dominated the surgical operating microscopes market with the largest revenue share of approximately 38% in 2025, driven by a well-established healthcare infrastructure, high adoption of minimally invasive and specialty surgeries, advanced surgical training programs, and strong investments in innovative surgical technologies. The presence of leading medical device manufacturers and growing emphasis on precision surgery further bolster market dominance.

Germany Surgical Operating Microscopes Market Insight

Germany surgical operating microscopes market is expected to be the fastest-growing country in the Surgical Operating Microscopes market during the forecast period, registering a CAGR of around 13.5% from 2026 to 2033. Growth is supported by increasing healthcare expenditure, expansion of hospital and specialty clinic infrastructure, rising number of surgical procedures, and growing adoption of advanced surgical visualization solutions. Government initiatives to promote minimally invasive surgeries and technological advancements in surgical equipment further accelerate market growth.

Europe Surgical Operating Microscopes Market Share

The Surgical Operating Microscopes industry is primarily led by well-established companies, including:

• Carl Zeiss (Germany)

• Leica Microsystems (Germany)

• Moller-Wedel (Germany)

• Topcon (Japan)

• Stryker (U.S.)

• Alcon (Switzerland)

• Global Surgical Corporation (U.S.)

• OPMI (Germany)

• Bausch & Lomb (U.S.)

• Seiler Instruments (U.S.)

• Chison Medical Imaging (China)

• Johnson & Johnson Vision (U.S.)

• Nikon Surgical (Japan)

• Hitachi Medical Systems (Japan)

• Brainlab (Germany)

• Alfresa Pharma Corporation (Japan)

• Cynosure Surgical (U.S.)

• Medline Industries (U.S.)

• ConMed Corporation (U.S.)

Latest Developments in Europe Surgical Operating Microscopes Market

- In April 2025, Leica Microsystems launched the Proveo 8x — a 3D digital ophthalmic surgical microscope — at the ASCRS Annual Meeting in California. The Proveo 8x offers real‑time 3D imaging for eye surgeries, with a flexible monitor and viewing setup that supports heads‑up 3D surgery via a C‑arm design. This system allows surgeons to perform complex ophthalmic procedures with enhanced visualization and ergonomic comfort

- In June 2025, Leica introduced the ARveo 8x hybrid surgical microscope — a next‑generation tool for neurosurgery, spine, and reconstructive procedures. The ARveo 8x combines high‑quality Leica optics with 3D visualization and digital data‑integration capabilities, along with advanced illumination and fluorescence imaging. This launch reflects a push toward hybrid microscopes that offer flexibility and precision for complex surgeries worldwide

- In March 2024, Carl Zeiss Meditec AG unveiled the ZEISS ARTEVO 850 — a 3D “heads-up” ophthalmic microscope — at the ASCRS 2024 Conference in Boston. The ARTEVO 850 features true-color high‑definition imaging with two 4K 3‑chip cameras and an HDR monitor. A new “Smart DoF” (depth-of-field) setting increases depth of field by nearly 60%, improving surgeons’ visualization during both anterior and posterior eye surgeries. The microscope integrates a redesigned user interface consolidating controls onto a single touchscreen, demonstrating the trend toward digital surgical workflows

- In September 2024, market analysts reported that surgical microscopes with enhanced digital and visualization capabilities — including models such as robotic‑assisted systems and heads‑up display microscopes — are gaining pace, and forecast that the global surgical microscope market will see strong growth through 2030. This reflects growing demand for advanced surgical visualization across specialties such as neurosurgery, ophthalmology, ENT, and dentistry, supported by global investments in healthcare infrastructure and technological upgrades

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.