Europe Surgical Sealants Adhesives Market

Market Size in USD Million

CAGR :

%

USD

521.11 Million

USD

821.20 Million

2024

2032

USD

521.11 Million

USD

821.20 Million

2024

2032

| 2025 –2032 | |

| USD 521.11 Million | |

| USD 821.20 Million | |

|

|

|

|

Europe Surgical Sealants and Adhesive Market Size

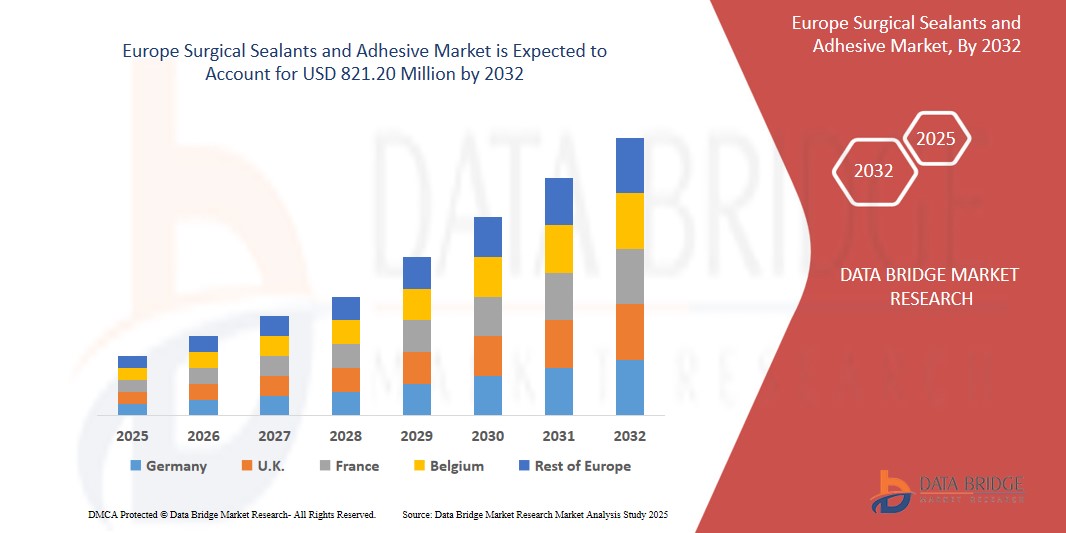

- The Europe Surgical Sealants and Adhesive Market was valued at USD 521.11 million in 2024 and is expected to reach USD 821.20 million by 2032

- During the forecast period of 2025 to 2032, the market is likely to grow at a CAGR of 5.9%, primarily driven by the significant rise in surgical procedures across the region, driven by aging populations, increasing lifestyle diseases, and expanded access to healthcare infrastructure

- This growth is driven by factors such as rising surgical procedures across the region and rising surgical volume and demand for faster post-operative recovery.

Europe Surgical Sealants and Adhesive Market Analysis

- The Europe Surgical Sealants and Adhesives market is seeing significant growth, driven by the increasing number of surgeries, heightened healthcare spending, and the growing adoption of minimally invasive surgical techniques. With a strong focus on improving patient outcomes and reducing recovery times, the demand for advanced wound closure materials is on the rise.

- Continued technological advancements are improving the performance of surgical adhesives. Key innovations, including the development of PEG-based sealants and fibrin glues, are gaining popularity due to their improved biocompatibility, adhesion strength, and biodegradability for both internal and external applications.

- Major countries in the region, such as Germany, U.K., France, and Italy, are making substantial investments in healthcare infrastructure. This is leading to a surge in the demand for cutting-edge hemostatic agents and surgical sealants as part of their efforts to modernize surgical facilities and improve patient care.

Report Scope and Surgical Sealants and Adhesive Market Segmentation

|

Attributes |

Surgical Sealants and Adhesive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Surgical Sealants and Adhesive Market Trends

“Surge in Minimally Invasive and Laparoscopic Surgeries Driving Demand for Advanced Adhesive Solutions ”

- A key trend in the Europe surgical sealants and adhesives market is the increasing adoption of advanced biomaterials such as polyethylene glycol (PEG), fibrin-based, and albumin-based compounds to improve tissue compatibility and healing efficiency

- These materials reduce inflammation and risk of infection while improving adhesion strength, especially in cardiovascular, gastrointestinal, and neurological surgeries

- Research institutions across Europe are partnering with medical device manufacturers to develop next-generation sealants with improved biocompatibility and biodegradability

- For instance, in January 2024, Italy’s Policlinico di Milano partnered with a medtech startup to clinically evaluate a PEG-based surgical sealant designed to reduce post-operative complications during abdominal surgeries.

Surgical Sealants and Adhesive Market Dynamics

Driver

“Rising Surgical Volume and Demand for Faster Post-Operative Recovery ”

- A key factor shaping the Europe Surgical Sealants and Adhesives market is the significant rise in surgical procedures across the region, driven by aging populations, increasing lifestyle diseases, and expanded access to healthcare infrastructure

- With more patients undergoing complex surgeries, there is growing demand for advanced wound closure solutions like surgical sealants and adhesives that reduce the need for sutures, minimize trauma, and enhance healing

- Hospitals and surgical centers are increasingly prioritizing enhanced recovery protocols (ERPs) to reduce hospital stays, improve patient outcomes, and lower healthcare costs—creating higher demand for fast-acting and efficient sealant technologies

- Post-operative complications such as infections, bleeding, and tissue adhesion are being tackled through innovative bio-based and synthetic adhesives, which support quicker recovery and reduce readmission rates

- For instance, In Germany, a multicenter clinical trial demonstrated that hydrogel-based sealants reduced cerebrospinal fluid leaks by 58% compared to traditional sutures in cranial surgeries. This significant improvement in patient outcomes underscores the growing adoption of advanced surgical adhesives to enhance post-operative recovery.

Opportunity

“Rising Investments in Healthcare Infrastructure and Medical Technology ”

- Governments across various European countries including Germany, France and U.K. are significantly increasing investment in healthcare infrastructure

- Expansion of public and private hospitals is driving the adoption of advanced surgical technologies, including sealants and adhesives for improved outcomes and efficiency.

- For instance, The European Union has announced a €500 million investment plan aimed at upgrading healthcare infrastructure across Eastern Europe. This initiative focuses on expanding surgical care facilities and incorporating advanced medical technologies, including surgical adhesives, to enhance patient care

Restraint/Challenge

“Stringent Regulatory Pathways and Approval Delays ”

- Regulatory approvals for surgical sealants and adhesives in many APAC countries are time-consuming due to varying local guidelines, causing delays in market entry for new and innovative products.

- Companies must navigate country-specific requirements for clinical trials and safety documentation, which can increase both time and cost.

- The absence of harmonized regulatory frameworks across countries like India, Indonesia, and the Philippines makes cross-border product launches more complex.

- These challenges often discourage smaller players from entering the APAC market or scaling up operations quickly.

- For instance, Manufacturers of surgical adhesives in Europe face substantial regulatory challenges. The European Medicines Agency (EMA) enforces rigorous safety and efficacy standards, and as a result, approval processes can be slow. This impacts companies' ability to introduce new products in a timely manner, particularly for innovative surgical sealants.

Surgical Sealants and Adhesive Market Scope

The market is segmented on the basis of product, indication, application, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Indication |

|

|

By Application |

|

|

By End User |

|

|

By Distribution Channel |

|

Surgical Sealants and Adhesive Market Regional Analysis

“Germany is the Dominant Country in the Surgical Sealants and Adhesive Market”

- Germany leads the Europe surgical sealants and adhesives market due to its robust healthcare infrastructure, high volume of surgical procedures, and early adoption of advanced medical technologies across various surgical specialties including orthopedics, cardiovascular, and general surgery.

- The country is home to renowned hospitals and research centers, such as Charité – Universitätsmedizin Berlin and University Hospital Heidelberg, which actively utilize cutting-edge wound closure technologies.

- Strong collaborations between German universities, biotech firms, and global medical device manufacturers have positioned the country at the forefront of product innovation in surgical adhesives and hemostatic agents.

“Germany is Projected to Register the Highest Growth Rate”

- Germany is not only the current leader but is also expected to register the highest growth rate in the European surgical sealants and adhesives market due to increasing investment in medical research and the expansion of surgical departments in tertiary care hospitals.

- The federal government's push towards improving post-operative outcomes and reducing healthcare costs is boosting the use of advanced sealants that shorten hospital stays and recovery time.

- Initiatives such as Germany's Medical Informatics Initiative (MII) are fostering innovations that include biologically compatible and biodegradable surgical adhesives.

- The rise in outpatient surgeries and minimally invasive procedures, along with the focus on reducing surgical complications, is expected to further accelerate market growth in the country.

Surgical Sealants and Adhesive Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europepresence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Johnson & Johnson (U.S.)

- Artivion Inc (U.S.)

- BD (U.S.)

- Medtronic PLC (Ireland)

- B. Braun (Germany)

- Mallinckrodt PLC Ordinary Shares - New (U.K.)

- Cardinal Health Inc (U.S.)

- Baxter International Inc (U.S.)

- Integra Lifesciences Holdings Corp (U.S.)

- Stryker Corp (U.S.)

- CryoLife (U.S.)

- Baxter (U.S.)

- BD (U.S.)

- B. Braun Melsungen AG (Germany)

- Vivostat A/S (Denmark)

Latest Developments in EuropeSurgical Sealants and Adhesive Market

- In November 2023, Ethicon, a Johnson & Johnson's MedTech division launched a hemostatic sealing patch, Ethizia, for controlling bleeding in surgeries

- In October 2024, German specialty chemicals company Evonik announced plans to scale back its adhesives and healthcare units to focus on core assets. The restructuring involves shedding operations, including its polyester business and production line for keto acids in Hanau, affecting about 260 employees.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Surgical Sealants Adhesives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Surgical Sealants Adhesives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Surgical Sealants Adhesives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.