Europe Sutures Market

Market Size in USD Billion

CAGR :

%

USD

561.20 Billion

USD

651.70 Billion

2024

2032

USD

561.20 Billion

USD

651.70 Billion

2024

2032

| 2025 –2032 | |

| USD 561.20 Billion | |

| USD 651.70 Billion | |

|

|

|

|

Sutures Market Size

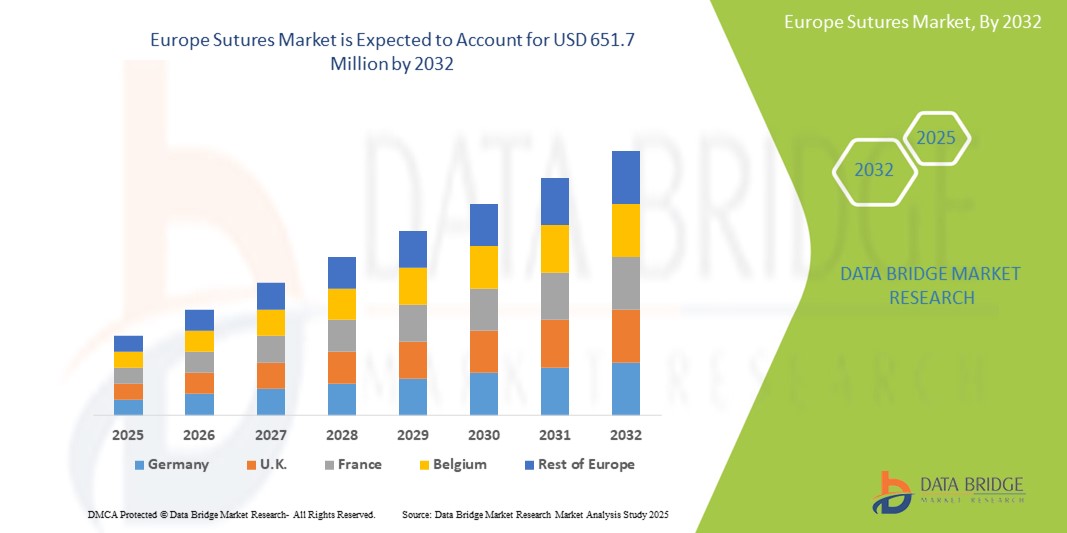

- The Europe Sutures Market was valued at USD 561.2 Million in 2024 and is expected to reach USD 651.7 Million by 2032, at a CAGR of 5.7% during the forecast period.

- The growth of the Europe Sutures Market is driven by several key factors. A major driver is the increasing number of surgical procedures across the region, particularly in cardiovascular, orthopedic, and general surgeries, which significantly raises the demand for suturing materials.

Europe Sutures Market Analysis

- Sutures play a critical role in surgical wound closure and tissue repair by facilitating proper healing and minimizing the risk of infection or wound dehiscence. Advancements in suture materials—such as absorbable, antimicrobial-coated, and barbed sutures—are enhancing surgical outcomes and reducing recovery time. The growing focus on minimally invasive procedures and patient-specific surgical care in Europe has further elevated the demand for innovative suturing solutions.

- The European Sutures market is primarily driven by the increasing number of surgeries related to chronic conditions such as cardiovascular disease, cancer, and orthopedic disorders. With a rapidly aging population and a rise in lifestyle-related health issues, the need for surgical interventions—and thereby sutures—continues to grow across the region.

- Europe holds a prominent share in the global Sutures market, supported by its advanced healthcare systems, high levels of public and private healthcare investment, and widespread adoption of technologically enhanced surgical products. Key markets such as Germany, France, and the U.K. are leading the region due to their strong clinical research infrastructure and presence of major surgical device manufacturers.

- Regulatory oversight from bodies like the European Medicines Agency (EMA) ensures that suture products comply with strict safety and performance standards. Ongoing innovation in suture technology, including bioabsorbable materials and tissue-reactive coatings, is further boosting the adoption of premium surgical sutures. Additionally, sustainability in material sourcing and enhanced sterilization processes are reinforcing market integrity and long-term growth in the European Sutures market.

Report Scope Sutures Market Segmentation

|

Attributes |

Sutures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sutures Market Trends

“Technological Advancements in Surgical Sutures and Rising Demand for Minimally Invasive Procedures”

- The Europe Sutures market is experiencing robust growth due to rising demand for surgical interventions across various medical disciplines, including cardiovascular, orthopedic, and general surgery, driven by an aging population and increasing incidence of chronic diseases.

- Technological advancements in suturing materials—such as antimicrobial-coated sutures, absorbable and non-absorbable variants, and barbed sutures—are enhancing wound closure efficiency, reducing infection risks, and improving healing outcomes.

- For instance, leading manufacturers in Germany and the U.K. are investing in the development of smart sutures embedded with sensors for real-time wound monitoring and infection detection.

- The shift toward minimally invasive and robotic-assisted surgeries across Europe is further fueling demand for precision suturing products that offer superior handling, reduced tissue trauma, and shorter operative times.

- Increasing focus on outpatient and ambulatory care settings is also contributing to the adoption of user-friendly sutures designed for quick application and minimal post-surgical complications.

- Regulatory bodies across Europe, including the EMA, are streamlining the approval process for innovative surgical sutures while maintaining stringent safety and performance standards, encouraging faster time-to-market and greater clinical adoption.

- Despite the emergence of alternatives such as tissue adhesives and stapling devices, sutures remain the gold standard in surgical wound closure due to their versatility, cost-effectiveness, and proven clinical reliability.

Sutures Market Dynamics

Driver

“Increasing Prevalence of Chronic Wounds and Advancements in Regenerative Therapies”

- The Europe Sutures market is significantly driven by the rising number of surgical procedures, fueled by an aging population and the growing prevalence of chronic diseases such as cardiovascular disorders, cancer, and orthopedic conditions.

- The increased adoption of minimally invasive and robotic-assisted surgeries has elevated the demand for precision suturing solutions that offer greater efficiency, reduced tissue trauma, and faster healing.

- Technological advancements—such as the development of antimicrobial-coated sutures, absorbable materials, and knotless barbed sutures—are improving patient outcomes and reducing post-operative complications.

- Integration of these innovations into surgical protocols across Europe, especially in countries like Germany, France, and the U.K., is expanding market reach and physician acceptance.

For instance,

- In 2024, B. Braun (Germany) launched a new range of bioabsorbable sutures designed specifically for laparoscopic and cosmetic procedures, addressing demand for reduced scarring and faster recovery.

- Additionally, favorable reimbursement policies and increased investments in surgical training and infrastructure are supporting sustained growth of the sutures market in both public and private healthcare settings.

Opportunity

“Rising Demand for Smart Sutures and Custom Surgical Solutions”

- The shift toward personalized medicine and smart healthcare is creating opportunities for the development of smart sutures embedded with biosensors to monitor wound healing, detect infections, and deliver drugs locally.

- The rise in day surgeries and outpatient care is driving demand for advanced sutures that are easier to use, reduce procedure time, and support quicker patient turnover.

- Customizable and specialty sutures tailored to specific procedures or patient needs, such as pediatric or cardiovascular surgeries, are gaining traction among surgeons seeking more targeted solutions.

For instance,

- In January 2024, Smith+Nephew (U.K.) partnered with a biotech startup to develop a prototype smart suture capable of real-time pH monitoring in post-operative wounds.

- Growing support from EU innovation programs and collaboration between medical device companies and research institutions are accelerating the commercialization of these next-gen suture technologies across Europe.

Restraint/Challenge

“Cost Constraints and Regulatory Barriers Slowing Market Expansion”

- A major restraint in the Europe Sutures market is the high cost of advanced suture technologies, which can limit their use in publicly funded healthcare systems and low-budget hospitals.

- Regulatory complexity across European nations—especially concerning new material approvals and biocompatibility testing—can delay product launches and increase compliance costs for manufacturers.

- Disparities in surgical training and awareness regarding newer suture options, particularly in rural and less-developed regions, hinder the adoption of innovative solutions.

For instance,

- In 2023, several clinics in Southern and Eastern Europe reported limited use of coated and absorbable sutures due to budget limitations and lack of practitioner familiarity.

- Supply chain disruptions and reliance on imported raw materials for specialty sutures also pose logistical challenges, impacting product availability and pricing consistency across the region.

Sutures Market Scope

The market is segmented on the basis, product, type, application and end user

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Application |

|

|

By End User |

|

In 2025, Suture Threads is projected to dominate the market with a largest share in product segment

The Suture Threads segment is expected to dominate the Sutures Market with the largest share of 32.22% in 2025 due to their critical role in wound closure across a wide range of surgical procedures, including cardiovascular, orthopedic, and general surgeries. Their versatility, ease of use, and availability in both absorbable and non-absorbable forms make them indispensable in hospitals, clinics, and outpatient surgical centers. Continuous advancements in thread materials—such as antimicrobial coatings, synthetic polymers, and barbed designs—are improving surgical efficiency, reducing infection risks, and promoting faster healing. Moreover, the increasing volume of surgeries driven by aging populations and chronic disease prevalence is further reinforcing the demand for high-quality suture threads across Europe.

The Multifilament Sutures is expected to account for the largest share during the forecast period in type market

In 2025, the Multifilament Sutures segment is projected to dominate the Europe Sutures (FBS) market with the largest share, accounting for 61.34%. This dominance is driven by the superior handling characteristics, knot security, and flexibility offered by multifilament sutures, making them highly preferred in complex and delicate surgical procedures. Their braided structure allows for better tensile strength and ease of use, particularly in cardiovascular, gastrointestinal, and plastic surgeries. Additionally, advancements in coating technologies have enhanced the performance of multifilament sutures by reducing tissue drag and minimizing infection risks. The wide clinical acceptance, combined with growing surgical volumes across Europe, further supports the strong market position of this segment.

Sutures Market Regional Analysis

“Germany is the Dominant Country in the Sutures Market”

- Germany holds the leading position in the Europe Sutures market, accounting for the largest market share due to its well-established surgical infrastructure, high surgical volumes, and strong presence of leading suture manufacturers.

- The country’s aging population and rising incidence of chronic diseases such as cardiovascular conditions, cancer, and diabetes are driving the demand for both elective and emergency surgical interventions, significantly boosting suture consumption.

- Germany is home to major medical device companies including B. Braun, Paul Hartmann, and Lohmann & Rauscher, which actively contribute to technological innovation, production capacity, and widespread product availability in domestic and European markets.

- Robust healthcare spending, advanced hospital systems, and a strong regulatory framework under agencies like the European Medicines Agency (EMA) support early adoption of new suture technologies and maintain high product quality standards.

- Furthermore, Germany’s focus on continuous surgical training, minimally invasive techniques, and patient safety enhances clinical outcomes and sustains long-term market dominance.

- Ongoing investments in digital surgery platforms, robotics, and integrated operating rooms also contribute to the growing demand for precision suturing solutions in both public and private healthcare sectors.

“U.K. is Projected to Register the Highest Growth Rate”

- The U.K. is projected to experience the fastest growth in the Europe Sutures market, driven by an increasing number of surgeries, rising demand for advanced surgical materials, and rapid innovation in wound closure technologies.

- Growth is further supported by government-led healthcare reforms, NHS modernization efforts, and strong investments in surgical efficiency and patient care quality across hospitals and ambulatory surgical centers.

- The country’s expanding aging population and growing burden of chronic illnesses are contributing to greater demand for elective procedures, particularly in orthopedics, oncology, and cardiovascular care, boosting suture usage.

- Strategic collaborations between medical universities, research centers, and biotech firms are accelerating the development and adoption of next-generation sutures, including antimicrobial, absorbable, and smart variants.

- The U.K.’s favorable regulatory environment, commitment to clinical excellence, and expanding home-based care initiatives are increasing access to high-quality suturing products, particularly in community care settings.

- These trends, combined with a focus on reducing surgical site infections and optimizing patient outcomes, position the U.K. as the fastest-growing market for sutures in Europe.

Sutures Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- B. Braun Melsungen AG (Germany)

- Smith+Nephew plc (U.K.)

- Johnson & Johnson (Ethicon) (U.S.)

- Medtronic plc (Ireland)

- Péters Surgical (France)

- DemeTECH Corporation (U.S.)

- Assut Medical Sàrl (Switzerland)

- Kono Seisakusho Co., Ltd. (Japan)

- Lohmann & Rauscher GmbH & Co. KG (Germany)

- Sutures India Pvt. Ltd. (India)

Latest Developments in Europe Sutures Market

- In January 2024, MIT researchers introduced smart sutures embedded with sensors that can detect inflammation and release drugs, marking a breakthrough in post-surgical care.

- In October 2024, Chinese scientists developed biodegradable sutures that generate tiny electric currents through body movement to promote faster wound healing.

- In April 2024, Samyang Holdings Corp. inaugurated a $22 million surgical suture facility in Hungary to strengthen its footprint in the European market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.