Europe Thermoplastic Polyurethane Market

Market Size in USD Million

CAGR :

%

USD

852.84 Million

USD

1,498.53 Million

2024

2032

USD

852.84 Million

USD

1,498.53 Million

2024

2032

| 2025 –2032 | |

| USD 852.84 Million | |

| USD 1,498.53 Million | |

|

|

|

|

Europe Thermoplastic Polyurethane (TPU) Market Size

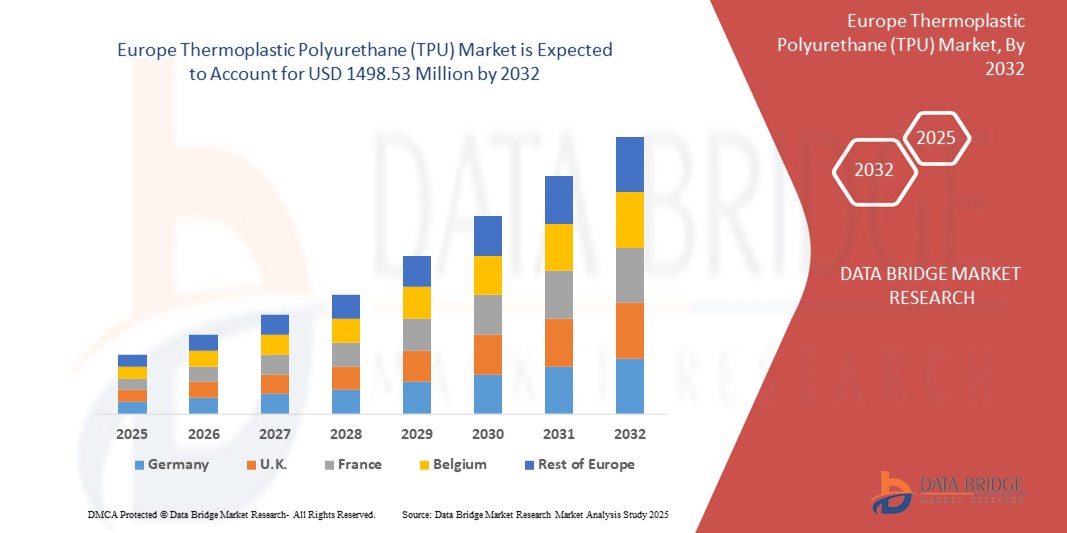

- The Europe thermoplastic polyurethane (TPU) market size was valued at USD 852.84 million in 2024 and is expected to reach USD 1498.53 million by 2032, at a CAGR of 8.7% during the forecast period

- This growth is driven by factors such as the increasing demand for lightweight and durable materials in industries such as automotive, healthcare, and footwear, as well as the rising emphasis on sustainability and recycling initiatives across various sectors

Europe Thermoplastic Polyurethane (TPU) Market Analysis

- The Europe thermoplastic polyurethane market is growing steadily as industries increasingly adopt it for its flexibility and durability in applications such as seals and protective films

- Current market trends show a shift toward recyclable materials, with thermoplastic polyurethane gaining traction for its sustainable use in products such as footwear and electronics

- U.K. is expected to dominate the Europe thermoplastic polyurethane (TPU)s market due to with 25.05% of market share due to its advanced manufacturing infrastructure and widespread adoption in key industries

- Germany is expected to be the fastest growing region in the Europe Thermoplastic Polyurethane (TPU) market during the forecast period with 22.05% of market share due to its strong presence in the automotive and electronics manufacturing industries.

- The polyester segment is expected to dominate the North America thermoplastic polyurethane market with the largest share of 45.05% in 2025 due to its excellent mechanical strength, abrasion resistance, and cost-effectiveness, making it highly suitable for applications in footwear, industrial equipment, and automotive components

Report Scope and Europe Thermoplastic Polyurethane (TPU) Market Segmentation

|

Attributes |

Europe Thermoplastic Polyurethane (TPU) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Thermoplastic Polyurethane (TPU) Market Trends

“Rising Focus on Sustainable Material Applications”

- The thermoplastic polyurethane market is currently showing a clear trend toward increased usage in sustainable and eco-friendly product solutions

- Manufacturers are increasingly prioritizing recyclable and reusable materials to meet consumer preferences and environmental standards

- This trend is influencing product development strategies where thermoplastic polyurethane is favored for its low environmental impact

- Many brands in the footwear industry are using thermoplastic polyurethane to create recyclable shoe soles

- Industries are also aligning with circular economy practices by integrating thermoplastic polyurethane into products that support material recovery

- In conclusion, this growing focus on sustainability continues to shape the thermoplastic polyurethane market as businesses and consumers seek greener alternatives

Europe Thermoplastic Polyurethane (TPU) Market Dynamics

Driver

“Growing Demand from Automotive Sector”

- Thermoplastic polyurethane is widely used in automotive interior and exterior parts such as instrument panels, door trims, and protective coatings due to its abrasion resistance and flexibility

- The shift toward lightweight vehicles for improved fuel efficiency has increased the demand for thermoplastic polyurethane in components such as lightweight bumpers and cable sheathing

- Electric vehicle growth is accelerating the use of thermoplastic polyurethane in battery covers, thermal insulation, and vibration-dampening elements for enhanced performance and sustainability

- For instance, Tesla and BMW have incorporated thermoplastic polyurethane-based materials in EV interiors to reduce weight while enhancing durability and aesthetics

- The material’s recyclability and ability to be molded into complex shapes make it valuable for OEMs focusing on environmentally friendly and high-performance vehicle design

- In conclusion, this increasing integration across automotive applications continues to reinforce thermoplastic polyurethane’s position as a key material in modern vehicle production

Opportunity

“Expanding Applications in Medical Devices”

- Thermoplastic polyurethane is widely adopted in medical devices such as catheters, wound dressings, and surgical tubing due to its biocompatibility and chemical resistance

- The global rise in healthcare investments and technological advancements has increased the demand for materials that ensure high performance and safety in clinical use

- Its easy sterilization, processing flexibility, and ability to be customized for softness or transparency make thermoplastic polyurethane ideal for next-generation medical solutions

- For instance, Medtronic and Abbott are utilizing thermoplastic polyurethane in minimally invasive catheter systems and wearable biosensors for enhanced patient comfort

- The growing need for patient-specific care and an aging population is encouraging innovation using thermoplastic polyurethane in both diagnostic and therapeutic medical equipment

- In conclusion, this ongoing evolution in healthcare technology presents expanding opportunities for thermoplastic polyurethane across medical sectors worldwide

Restraint/Challenge

“Price Volatility of Raw Materials”

- Raw material price volatility, especially for petrochemical-based inputs such as diisocyanates and polyols, significantly impacts thermoplastic polyurethane production costs

- This fluctuation is influenced by factors such as global crude oil price changes, geopolitical conflicts, and regulatory shifts affecting chemical manufacturing and trade

- Manufacturers, particularly small to mid-sized players, face challenges in budgeting and production planning due to sudden cost spikes or material shortages

- For instance, the 2021 Texas winter storm caused a shutdown in chemical plants, leading to a global shortage and price surge in polyol supplies

- These supply chain disruptions and cost uncertainties hinder scalability, forcing companies to seek alternative sourcing strategies or develop cost-efficient production technologies

- In conclusion, this ongoing challenge continues to affect market stability and urges manufacturers to explore more resilient procurement and material innovation solutions

Europe Thermoplastic Polyurethane (TPU) Market Scope

The market is segmented on the basis of raw material, type, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Raw Material |

|

|

By Type |

|

|

By Application |

|

|

By End User

|

|

In 2025, the polyester segment is projected to dominate the market with a largest share in type segment

The polyester segment is expected to dominate the North America thermoplastic polyurethane market with the largest share of 45.05% in 2025 due to its excellent mechanical strength, abrasion resistance, and cost-effectiveness, making it highly suitable for applications in footwear, industrial equipment, and automotive components.

The footwear segment is expected to account for the largest share during the forecast period in end user segment

In 2025, the footwear segment is expected to dominate the market with the largest market share of 34.11% due to the rising demand for lightweight, durable, and flexible materials in sports and casual footwear, with thermoplastic polyurethane offering superior comfort, wear resistance, and design versatility preferred by major global footwear brands.

Europe Thermoplastic Polyurethane (TPU) Market Regional Analysis

“U.K. Holds the Largest Share in the Europe Thermoplastic Polyurethane (TPU) Market”

- The U.K. holds a leading position in the thermoplastic polyurethane market with 25.05% of market share due to its advanced manufacturing infrastructure and widespread adoption in key industries

- Strong demand from the footwear, construction, and automotive sectors supports the material’s consistent usage across various production lines

- Local manufacturers emphasize sustainable practices and innovation, aligning thermoplastic polyurethane usage with broader environmental goals

- The country has a well-established supply chain and robust R&D capabilities that help accelerate the integration of thermoplastic polyurethane into new applications

- Consumer preferences for durable and eco-conscious products further enhance the region's dominance in this market segment

“Germany is Projected to Register the Highest CAGR in the Europe Thermoplastic Polyurethane (TPU) Market”

- Germany is witnessing rapid growth in thermoplastic polyurethane usage with 22.05% of market share due to its strong presence in the automotive and electronics manufacturing industries

- The country’s focus on lightweight and high-performance materials is pushing demand for thermoplastic polyurethane in both traditional and electric vehicle production

- Continuous innovation and high investment in recycling and sustainable plastic alternatives make Germany a key growth contributor

- An increasing number of applications in consumer goods, healthcare, and industrial machinery are driving accelerated market expansion

- The presence of major end-use industries and a strong push toward material efficiency continue to position Germany as the fastest-growing region in this space

Europe Thermoplastic Polyurethane (TPU) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF SE (Germany)

- The Lubrizol Corporation (U.S.)

- Covestro AG (Germany)

- HEXPOL AB (Japan)

- Huntsman Internaional LLC (U.S.)

- Wanhua (China)

- Sanyo Corporation of America (U.S.)

- COIM Group (Italy)

- Mitsui Chemicals, Inc., (Japan)

- Tosoh India Pvt. Ltd. (Japan)

- American Polyfilm Inc., (U.S.)

- Kuraray Co., Ltd (Japan)

- HEXPOL AB (Sweden)

- AVERY DENNISON CORPORATION (U.S.)

- API GROUP (U.S.)

- Kolon Industries (South Korea)Avient (U.S.)

Latest Developments in Europe Thermoplastic Polyurethane (TPU) Market

- In January 2025, the Lubrizol Corporation is set to present its medical-grade thermoplastic polyurethane (TPU) solutions at MD&M West 2025 in Anaheim, CA, from February 4 to 6. Lubrizol’s experts will highlight TPU applications in interventional vascular, ophthalmic, and drug delivery markets, reinforcing its role in advancing medical device innovation

- In November 2024, Wanhua Chemical unveiled polyurethane foam recycling technology at COP29, enabling 30% polyol recovery without degradation. Its bio-based TPU and HDI-type TPU enhance comfort in sports applications, while medical-grade TPU meets healthcare demands. These innovations reinforce sustainable materials' role in reducing carbon emissions across industries

- In November 2024, Lubrizol and Polyhose signed an MoU to expand medical tubing production in Chennai, increasing capacity five-fold. The facility will produce high-performance thermoplastic polyurethane (TPU) tubing for neurovascular and cardiovascular applications, supporting local manufacturing and global exports. Operations are set to begin in 2026

- In October 2024, BASF introduced Elastollan 1400, a new ether-based TPU series with excellent hydrolysis resistance and mechanical properties. It offers superior burst pressure, aging stability, and improved sustainability with a lower carbon footprint. Ideal for various industries, including transportation, footwear, and industrial manufacturing, the TPU is available for sampling after two years of research

- In September 2024, Covestro is building a new Thermoplastic Polyurethane (TPU) application development center in Guangzhou, China, set to open in 2025. The center will enhance customer proximity, foster innovation, and support industries such as electronics, footwear, and mobility. This expansion follows the construction of Covestro's largest TPU plant in nearby Zhuhai

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Thermoplastic Polyurethane Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Thermoplastic Polyurethane Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Thermoplastic Polyurethane Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.