Europe Thyroid Ablation Devices Market

Market Size in USD Billion

CAGR :

%

USD

60.51 Billion

USD

126.90 Billion

2025

2033

USD

60.51 Billion

USD

126.90 Billion

2025

2033

| 2026 –2033 | |

| USD 60.51 Billion | |

| USD 126.90 Billion | |

|

|

|

|

Europe Thyroid Ablation Devices Market Size

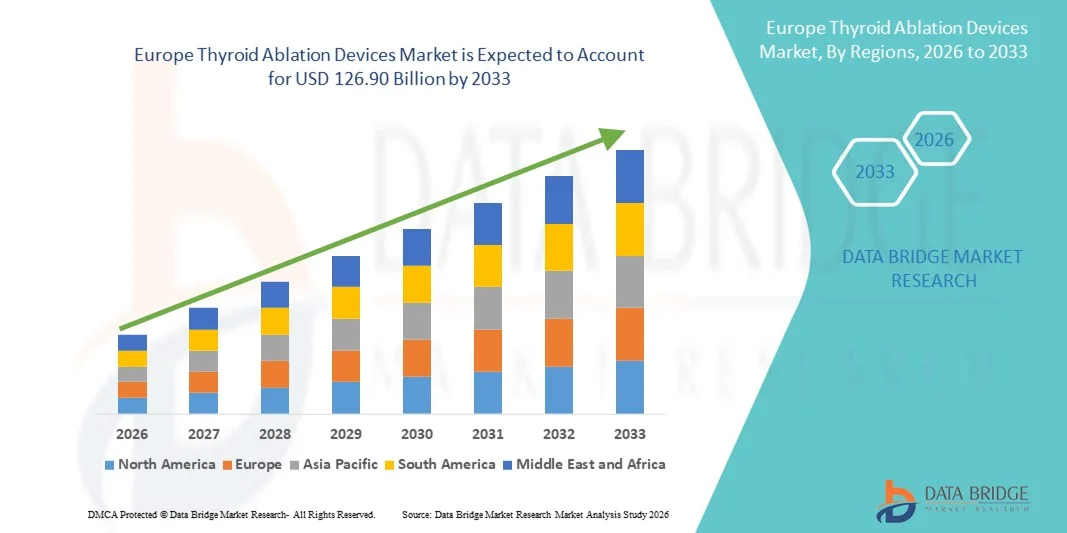

- The Europe thyroid ablation devices market size was valued at USD 60.51 billion in 2025 and is expected to reach USD 126.90 billion by 2033, at a CAGR of 9.7% during the forecast period

- The market growth is largely fueled by the increasing prevalence of thyroid disorders, including hyperthyroidism, thyroid nodules, and thyroid cancer, along with rising adoption of minimally invasive treatment procedures. Advances in ablation technologies, such as radiofrequency, microwave, and laser-based devices, are driving higher clinical adoption in hospitals, endocrine clinics, and outpatient centers

- Furthermore, growing patient preference for non-surgical, low-risk, and cost-effective treatment options is establishing thyroid ablation devices as a preferred solution for thyroid management. These converging factors are accelerating the uptake of thyroid ablation devices, thereby significantly boosting the overall growth of the industry

Europe Thyroid Ablation Devices Market Analysis

- Thyroid ablation devices are increasingly used for the minimally invasive treatment of thyroid nodules, hyperthyroidism, and thyroid cancers. Their adoption is driven by technological advancements in radiofrequency, microwave, laser, and high-intensity focused ultrasound (HIFU) devices, enabling safer, outpatient-based procedures and faster patient recovery

- The escalating demand for thyroid ablation devices is primarily fueled by rising prevalence of thyroid disorders, growing patient preference for non-surgical procedures, and increased awareness among healthcare providers regarding minimally invasive treatment options. These converging factors are accelerating the uptake of thyroid ablation devices, thereby significantly boosting overall market growth

- The U.K. dominated the thyroid ablation devices market with the largest revenue share of approximately 42.7% in 2025, supported by advanced healthcare infrastructure, high procedure volumes, strong insurance coverage, and the presence of leading medical device manufacturers. The country accounted for the majority of regional demand due to widespread clinical adoption of advanced ablation technologies

- Germany is expected to be the fastest-growing region in the thyroid ablation devices market during the forecast period, registering a CAGR driven by increasing prevalence of thyroid disorders, growing awareness about minimally invasive therapies, and expansion of specialized endocrine and radiology clinics across the country

- The thermal-based devices segment dominated the largest market revenue share of 71.2% in 2025, driven by widespread adoption of radiofrequency, microwave, and laser ablation therapies for thyroid treatment

Report Scope and Thyroid Ablation Devices Market Segmentation

|

Attributes |

Thyroid Ablation Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Thyroid Ablation Devices Market Trends

Growing Adoption of Minimally Invasive Thyroid Ablation Procedures Worldwide

- A significant and accelerating trend in the global thyroid ablation devices market is the increasing adoption of minimally invasive and image-guided ablation techniques. These approaches, including radiofrequency, microwave, and laser ablation, are becoming preferred alternatives to traditional surgical interventions due to reduced recovery time, lower complication rates, and enhanced patient comfort

- For instance, in 2023, researchers in South Korea reported a significant increase in the use of radiofrequency ablation (RFA) for benign thyroid nodules, demonstrating comparable efficacy to surgery with fewer complications and shorter hospital stays. Similar adoption trends have been observed in the United States and parts of Europe, highlighting the global expansion of these techniques

- Technological advancements in device precision, imaging guidance, and real-time monitoring are enabling safer and more effective ablation procedures, facilitating their integration into standard clinical practice across multiple regions

- The rising awareness among clinicians and patients of non-surgical options for thyroid disorders is further accelerating the adoption of ablation therapies worldwide

- This trend is reshaping treatment protocols, encouraging hospitals, outpatient clinics, and specialized endocrinology centers globally to invest in modern ablation devices to improve patient outcomes and overall procedural efficiency

Europe Thyroid Ablation Devices Market Dynamics

Driver

Rising Prevalence of Thyroid Disorders and Global Demand for Minimally Invasive Solutions

- The increasing global prevalence of thyroid nodules, goiter, and hyperfunctioning thyroid conditions is driving the demand for minimally invasive ablation therapies

- Patients and clinicians are seeking treatments that minimize surgical risks and improve recovery times

- For instance, the American Thyroid Association (ATA) in 2022 reported growing adoption of RFA and microwave ablation (MWA) in North America, noting shorter recovery periods and improved cosmetic outcomes compared to conventional surgery. Similar trends have been observed in Asia-Pacific and European countries, reflecting worldwide acceptance of ablation therapies

- Expanding thyroid screening programs, preventive healthcare initiatives, and early diagnosis campaigns across regions are contributing to higher detection rates, thereby boosting the need for safe and effective ablation devices

- Collaboration between medical device manufacturers, hospitals, and research institutions worldwide is enhancing access to innovative ablation technologies, increasing global adoption

- The growing emphasis on patient-centric and minimally invasive treatments is expected to continue driving global market growth across hospitals, specialty clinics, and outpatient centers

Restraint/Challenge

Concerns Regarding Cybersecurity and High Initial Costs

- The high cost of advanced thyroid ablation devices and disposable accessories continues to be a major challenge, particularly in developing countries and resource-constrained healthcare systems

- For instance, several hospitals in India and Latin America have reported delays in adopting RFA and MWA technologies due to high equipment costs and limited insurance coverage, despite clinical awareness of their benefits

- Variations in reimbursement policies and regulatory frameworks across regions can hinder the rapid adoption of these devices globally, as hospitals and clinics evaluate cost-effectiveness and procedural viability

- The need for specialized operator training and experience to perform thyroid ablation safely presents another challenge, particularly in regions with limited access to skilled clinicians

- Addressing these challenges through cost reduction strategies, wider insurance coverage, international clinical training programs, and long-term outcome validation studies will be crucial to ensuring sustained global growth of the thyroid ablation devices market

Europe Thyroid Ablation Devices Market Scope

The market is segmented on the basis of disease, product type, modality, type, end-user, and distribution channel.

- By Disease

On the basis of disease, the Thyroid Ablation Devices market is segmented into benign thyroid nodules and thyroid cancers. The benign thyroid nodules segment dominated the largest market revenue share of 62.5% in 2025, driven by the high prevalence of nodular thyroid conditions and increasing preference for minimally invasive ablation procedures over traditional surgery. Patients often opt for ablation due to lower risk, reduced recovery time, and better cosmetic outcomes. Hospitals and surgical centers widely adopt thermal and non-thermal ablation technologies for targeted nodule treatment. Growing awareness among endocrinologists and patients, coupled with advancements in imaging guidance, supports adoption. Technological improvements, such as real-time ultrasound monitoring and precision targeting, enhance procedural accuracy. Increasing screening for thyroid disorders and higher patient volumes in outpatient settings drive revenue dominance. Strong reimbursement policies in developed markets encourage the use of ablation devices. Evidence from clinical studies validates safety and efficacy, further boosting adoption. Rising focus on personalized and patient-friendly treatments sustains demand. Integration with minimally invasive therapy programs in hospitals and surgical centers strengthens market position. Growing preference over conventional surgery reduces hospital stays and costs, further solidifying leadership.

The thyroid cancers segment is expected to witness the fastest CAGR of 10.8% from 2026 to 2033, fueled by rising incidence of thyroid malignancies and adoption of ablation as an adjunct or alternative to surgery. Ablation provides targeted tumor destruction with minimal collateral damage, particularly for small or recurrent tumors. Advancements in radiofrequency, laser, and microwave ablation improve procedural outcomes. Increasing cancer awareness programs and early diagnostic practices boost patient referrals. Hospitals and oncology centers increasingly adopt these devices to manage localized thyroid cancers. Clinical evidence supports high safety and efficacy, encouraging physician adoption. Technological integration with imaging modalities enables precise ablation and better monitoring. Rising investments in cancer care infrastructure, especially in emerging markets, accelerate market penetration. Growth in outpatient thyroid oncology procedures further supports adoption. Favorable reimbursement policies for minimally invasive oncology treatments strengthen market confidence. These factors collectively position thyroid cancers as the fastest-growing disease segment.

- By Product Type

On the basis of product type, the market is segmented into thermal-based devices and non-thermal-based devices. The thermal-based devices segment dominated the largest market revenue share of 71.2% in 2025, driven by widespread adoption of radiofrequency, microwave, and laser ablation therapies for thyroid treatment. Thermal devices offer precise energy delivery, consistent ablation zones, and predictable outcomes, making them the preferred choice for both benign and malignant thyroid conditions. Hospitals and surgical centers favor thermal ablation due to operational efficiency and clinical reliability. Technological advancements, such as temperature-controlled ablation systems and real-time monitoring, improve safety and efficacy. The segment also benefits from strong clinical validation and high physician confidence. Growing patient preference for minimally invasive procedures increases demand. Thermal-based devices integrate well with ultrasound guidance systems, enhancing targeting accuracy. Regulatory approvals and reimbursement support adoption in key markets. Rising clinical trial activity and research on thermal ablation efficacy further boost growth. Expanded use in outpatient procedures reduces hospitalization. Ease of training for clinicians supports broader adoption. These factors collectively establish thermal-based devices as the leading product type segment.

The non-thermal-based devices segment is expected to witness the fastest CAGR of 12.4% from 2026 to 2033, fueled by increasing interest in non-thermal modalities such as electrical ablation, hydrothermal ablation, and innovative non-thermal approaches. Non-thermal devices reduce thermal injury risk to surrounding structures, making them attractive for sensitive patient populations. Growing clinical evidence supports efficacy in nodules and recurrent thyroid tumors. Rising demand for safer, minimally invasive alternatives drives adoption. Integration with advanced imaging technologies enhances procedural precision. Hospitals, clinics, and specialized endocrine centers are increasingly incorporating non-thermal devices. Advancements in device design and energy delivery improve outcomes. Expanding research funding in non-thermal technologies accelerates commercialization. Market penetration in emerging economies grows due to lower complication risk. Increasing awareness among endocrinologists and patients further supports adoption. Regulatory approvals for innovative devices strengthen market confidence. These factors collectively make non-thermal-based devices the fastest-growing product segment.

- By Modality

On the basis of modality, the market is segmented into fixed, standalone, and portable devices. The standalone devices segment dominated the largest market revenue share of 48.7% in 2025, due to their versatility and widespread adoption in hospitals and surgical centers. Standalone ablation systems are self-contained, allowing easy integration into operating rooms and procedure suites. They provide consistent energy delivery, safety features, and real-time monitoring, which ensures high clinical confidence. Hospitals prefer standalone systems for repeated procedures across different patient groups. Strong technical support from manufacturers and proven clinical efficacy reinforce dominance. These devices support a wide range of ablation types, including radiofrequency, microwave, and laser ablation. Growing adoption of minimally invasive thyroid procedures globally drives revenue. Compatibility with imaging guidance systems ensures precise targeting. Clinical workflow efficiency and reduced operator dependency encourage adoption. Reimbursement policies and regulatory approvals enhance market penetration. These factors collectively maintain standalone devices as the leading modality segment.

The portable devices segment is expected to witness the fastest CAGR of 11.7% from 2026 to 2033, driven by increasing demand for point-of-care thyroid ablation in outpatient, clinic, and community healthcare settings. Portable ablation devices enable flexible treatment in resource-limited environments and remote locations. Ease of transport and setup makes them suitable for small clinics and ambulatory surgical centers. Growing interest in minimally invasive procedures outside traditional hospital settings supports adoption. Technological innovations have reduced device size while maintaining safety and energy delivery efficacy. Portable systems allow cost-effective and patient-friendly procedures. Increasing demand for home-based and low-volume thyroid care solutions accelerates growth. Expanding adoption in emerging markets drives market penetration. Rising clinical awareness about mobile and point-of-care ablation therapies supports segment expansion. Strong research backing on efficacy and safety encourages adoption. These factors position portable devices as the fastest-growing modality segment.

- By Type

On the basis of type, the market is segmented into radiofrequency ablation, laser or light ablation, ultrasound ablation, cryoablation, electrical ablation, microwave ablation, hydrothermal ablation, and others. The radiofrequency ablation segment dominated the largest market revenue share of 44.3% in 2025, due to its proven efficacy, precision, and safety profile in both benign and malignant thyroid conditions. RFA is widely adopted in hospitals and surgical centers for nodules and small cancers. Its minimally invasive nature, low complication rates, and rapid recovery time make it preferred over traditional surgery. Integration with ultrasound guidance ensures accurate targeting. Clinical evidence supports long-term efficacy and patient satisfaction. Physicians value predictable ablation zones and thermal control. Technological advancements in electrode design improve outcomes. Regulatory approvals and reimbursement support adoption. High procedural volumes drive revenue dominance. Adoption in outpatient and ambulatory surgical centers expands reach. Ongoing clinical research reinforces adoption. These factors collectively establish RFA as the leading ablation type segment.

The ultrasound ablation segment is expected to witness the fastest CAGR of 12.9% from 2026 to 2033, fueled by increasing demand for non-invasive, image-guided thyroid therapies. Ultrasound ablation allows precise energy delivery while minimizing damage to surrounding tissue. Growing patient preference for non-surgical procedures accelerates adoption. Technological advancements in high-intensity focused ultrasound (HIFU) improve treatment safety and efficacy. Hospitals and clinics adopt ultrasound ablation for benign nodules, small cancers, and recurrent lesions. Expanding research on its clinical outcomes supports market penetration. Outpatient-friendly setup encourages adoption in ambulatory centers. Rising incidence of thyroid disorders globally drives demand. Increased clinical validation enhances physician confidence. Regulatory approvals in multiple regions expand accessibility. Growth in emerging markets contributes to faster adoption. These factors position ultrasound ablation as the fastest-growing ablation type segment.

- By End-User

On the basis of end-user, the market is segmented into hospitals and surgical centers, oncology centers, clinics, community healthcare, and others. The hospitals and surgical centers segment dominated the largest market revenue share of 61.5% in 2025, driven by the high volume of thyroid procedures and infrastructure to support ablation devices. Hospitals offer comprehensive care, including imaging guidance, post-procedural monitoring, and multidisciplinary support, which is essential for safe ablation. Hospitals maintain strict adherence to clinical protocols, ensuring high adoption of advanced devices. Availability of trained personnel and equipment increases procedural efficiency. Rising number of thyroid disorder cases globally sustains demand. Regulatory approvals and reimbursement coverage encourage adoption. Integration of ablation into minimally invasive surgery programs further supports market leadership. High patient throughput reinforces dominance. Hospital-based research programs validate device efficacy. Investments in hospital infrastructure enhance capabilities. These factors collectively position hospitals and surgical centers as the leading end-user segment.

The oncology centers segment is expected to witness the fastest CAGR of 11.5% from 2026 to 2033, driven by rising thyroid cancer incidence and adoption of ablation as part of targeted therapy programs. Oncology centers increasingly prefer minimally invasive ablation to reduce surgical complications and improve patient quality of life. Advanced ablation technologies, including RFA, microwave, and ultrasound, support precise tumor targeting. Rising clinical trials and research programs in cancer therapy accelerate adoption. Growing awareness among physicians and patients about minimally invasive cancer management fuels demand. Oncology centers in emerging markets are rapidly integrating ablation systems. Favorable reimbursement policies encourage adoption. Integration with diagnostic imaging ensures accurate treatment delivery. High efficacy and safety profile boost physician confidence. Technological advancements improve workflow efficiency. Patient preference for non-surgical oncology procedures further drives growth. These factors collectively position oncology centers as the fastest-growing end-user segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales and third-party distributors. The direct sales segment dominated the market with a revenue share of 65.2% in 2025, driven by strong manufacturer relationships with hospitals and surgical centers. Direct sales enable tailored training, on-site support, and maintenance services, which enhance clinician confidence in device adoption. Hospitals prefer direct procurement for high-value and complex ablation systems. Strong brand recognition and post-sales support strengthen dominance. Bulk purchasing agreements further reinforce revenue leadership. Manufacturers can provide customized solutions for high-volume users. Technical support, warranty, and service contracts enhance adoption. Regulatory compliance and adherence to quality standards encourage direct procurement. Direct sales also allow manufacturers to educate clinicians on optimal device usage. High-value devices such as RFA and ultrasound ablation benefit from direct distribution. These factors collectively establish direct sales as the leading distribution channel segment.

The third-party distributor segment is expected to witness the fastest CAGR of 10.7% from 2026 to 2033, fueled by growing demand from smaller clinics, community healthcare centers, and emerging markets. Distributors increase product reach and availability in regions where direct manufacturer presence is limited. They provide cost-effective solutions and local support for installation and maintenance. Expansion of third-party networks in Asia-Pacific, Latin America, and Middle East accelerates growth. Smaller healthcare providers rely on distributors for procurement of portable and mid-range ablation devices. Flexible payment and lease options offered by distributors further encourage adoption. Rising thyroid cancer and nodule incidence in developing regions fuels demand. Distributor partnerships with local healthcare providers enhance market penetration. Training and technical guidance from distributors support safe device usage. Regulatory approval processes are increasingly navigated through established distribution networks. These factors collectively make third-party distributors the fastest-growing distribution channel segment.

Europe Thyroid Ablation Devices Market Regional Analysis

- The Europe thyroid ablation devices market is projected to expand at a substantial CAGR throughout the forecast period

- Supported by increasing prevalence of thyroid disorders, growing adoption of minimally invasive procedures, and rising healthcare expenditure

- Expansion of specialized endocrine and radiology clinics, along with strong R&D capabilities in medical devices, is further driving market growth across the region

U.K. Thyroid Ablation Devices Market Insight

The U.K. thyroid ablation devices market dominated the Thyroid Ablation Devices market, accounting for approximately 42.7% of the regional revenue share in 2025. Growth is supported by advanced healthcare infrastructure, high procedure volumes, strong insurance coverage, and the presence of leading medical device manufacturers. The country accounted for the majority of regional demand due to widespread clinical adoption of advanced thyroid ablation technologies across hospitals and specialized clinics.

Germany Thyroid Ablation Devices Market Insight

Germany thyroid ablation devices market is expected to be the fastest-growing country in the Thyroid Ablation Devices market during the forecast period, driven by increasing prevalence of thyroid disorders, growing awareness about minimally invasive therapies, and expansion of specialized endocrine and radiology centers. Rising investment in healthcare infrastructure and adoption of advanced ablation technologies further contribute to market growth.

Europe Thyroid Ablation Devices Market Share

The Thyroid Ablation Devices industry is primarily led by well-established companies, including:

• Medtronic (Ireland)

• Johnson & Johnson (U.S.)

• Olympus Corporation (Japan)

• Boston Scientific Corporation (U.S.)

• Merit Medical Systems, Inc. (U.S.)

• AngioDynamics, Inc. (U.S.)

• Halyard Health, Inc. (U.S.)

• Terumo Corporation (Japan)

• Siemens Healthineers (Germany)

• Carestream Health, Inc. (U.S.)

• Mindray Medical International (China)

• Samsung Medison (South Korea)

• Stryker Corporation (U.S.)

• W.O.M. World of Medicine GmbH (Germany)

• Medisonic Technologies (U.K.)

• Cook Medical (U.S.)

• Taewoong Medical Co., Ltd. (South Korea)

• Bionics Co., Ltd. (Japan)

• Lumenis Ltd. (Israel)

• Inomed Medizintechnik GmbH (Germany)

Latest Developments in Europe Thyroid Ablation Devices Market

- In April 2023, ASSA ABLOY Group, a Europe leader in access solutions, launched a strategic initiative in South Africa aimed at strengthening the security of residential and commercial properties through its advanced Thyroid Ablation Devices technologies. This initiative underscores the company's dedication to delivering innovative, reliable access control solutions tailored to the unique security needs of the local market. By leveraging its Europe expertise and cutting-edge product offerings, ASSA ABLOY is not only addressing regional challenges but also reinforcing its position in the rapidly growing Europe Thyroid Ablation Devices market

- In March 2023, HavenLock Inc., a veteran-led company based in Tennessee, introduced the Power G version of its smart locking system, specifically engineered for schools and commercial environments. The innovative Haven Lockdown System is designed to enhance security protocols, offering a reliable and effective solution for emergency situations. This advancement highlights HavenLock's commitment to developing cutting-edge safety technologies that safeguard vulnerable spaces, ensuring greater protection and peace of mind for institutions and their communities

- In March 2023, Honeywell International Inc. successfully deployed the Bengaluru Safe City Project, aimed at enhancing urban safety through its advanced Thyroid Ablation Devices and security technologies. This initiative harnesses state-of-the-art solutions to create a more secure and resilient city environment, underscoring Honeywell's dedication to utilizing its expertise in innovative security systems. The project highlights the increasing significance of smart technology in urban safety, contributing to the development of safer, smarter communities

- In February 2023, Sentrilock, LLC, a leading provider of electronic lockbox solutions for the real estate industry, announced a strategic partnership with the Chesapeake Bay and Rivers Association of REALTORS (CBRAR) to create a smart electronic lockbox marketplace for REALTOR members. This collaboration is designed to enhance security and streamline accessibility for real estate professionals, facilitating more efficient and secure property transactions. The initiative underscores Sentrilock's commitment to driving innovation and improving operational effectiveness within the real estate sector

- In January 2023, Schlage, a leading provider of access and home security solutions under Allegion Plc, unveiled the Schlage Encode Smart Wi-Fi Lever at the NAHB International Builders’ Show (IBS) 2023. This innovative residential smart lock, equipped with Wi-Fi connectivity, enables users to manage access remotely through a dedicated app. The Schlage Encode lever highlights the company’s commitment to integrating advanced technology into home security systems, offering homeowners enhanced convenience and control while ensuring robust security

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.