Europe Tobacco Products Market

Market Size in USD Billion

CAGR :

%

USD

300.27 Billion

USD

362.27 Billion

2024

2032

USD

300.27 Billion

USD

362.27 Billion

2024

2032

| 2025 –2032 | |

| USD 300.27 Billion | |

| USD 362.27 Billion | |

|

|

|

|

Europe Tobacco Product Market Size

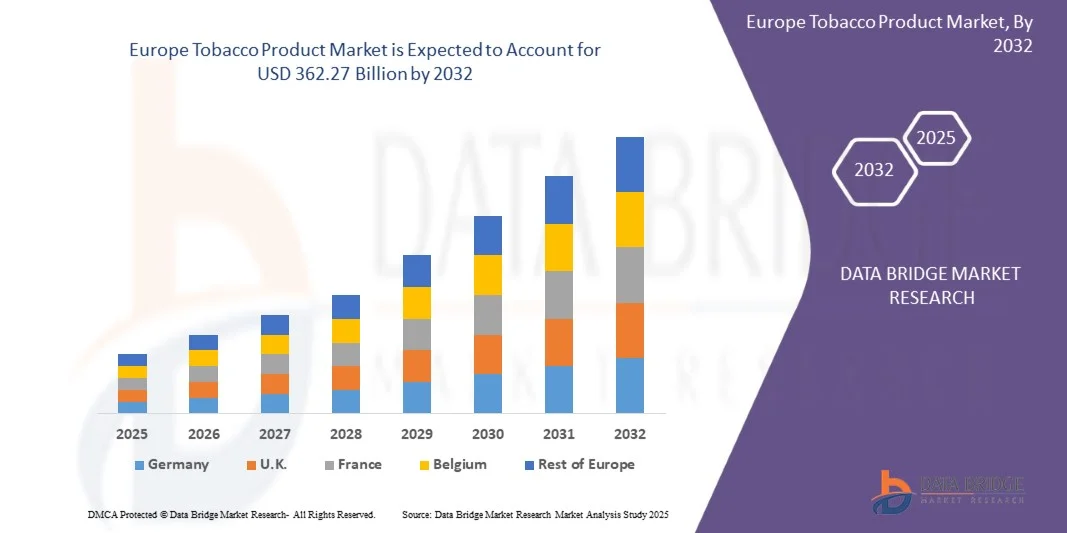

- The Europe Tobacco Product Market size was valued at USD 300.27 billion in 2024 and is expected to reach USD 362.27 billion by 2032, at a CAGR of 2.40% during the forecast period

- The growth of the Europe Tobacco Product Market is primarily driven by the Rising demand in emerging markets, Rising youth and female consumer base and Brand Loyalty & Strong Distribution Networks

- In addition, growth of next generation products, reliable, and Premiumization trends of tobacco consumption positioning tobacco product as essential components in modern cardiac procedures. These factors are collectively accelerating market adoption and significantly contributing to the overall expansion of the industry

Europe Tobacco Product Market Analysis

- Europe tobacco products market comprises the production, distribution, and sale of tobacco-based goods such as cigarettes, cigars, smokeless tobacco, and emerging alternatives such as heated tobacco, driven by consumer preferences, cultural habits, and lifestyle choices while being shaped by regulations and health awareness trends

- The shifting product mix and growing consumer uptake of HTPs, closed-pod vapes, and nicotine pouches are primarily driven by product innovation and tobacco firms’ strategic pivot toward “reduced-risk” alternatives to offset falling combustible volumes

- Russia is expected to dominate the Europe Tobacco Product Market with the largest market share of 22.54% in 2025 and is also expected to grow with the highest CAGR of 3.44% during the forecast period, primarily due to its large smoking population, strong cultural acceptance of tobacco use, and sustained demand for both conventional and reduced-risk products. In addition, the country benefits from the presence of leading domestic manufacturers, favorable regulatory and pricing conditions, and growing popularity of alternatives such as heated tobacco and e-cigarettes, all contributing to sustained market growth

- Cigarette segment is expected to dominate the Europe Tobacco Product Market with the largest market share of 81.65% in 2025, primarily due to its high smoking prevalence, deep-rooted cultural acceptance of cigarette consumption, and strong demand across both urban and rural populations. In addition, the country benefits from the presence of established domestic and international cigarette manufacturers, relatively favorable pricing dynamics, and wide distribution networks, all contributing to its sustained market leadership in this segment

Report Scope and Europe Tobacco Product Market Segmentation

|

Attributes |

Europe Tobacco Product Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Tobacco Product Market Trends

“Rising Youth and Female Consumer Base”

- The rising youth and female consumer base is emerging as a trend of the Europe tobacco products market. Despite increasing regulatory restrictions and public health campaigns, the industry continues to expand its reach among young people and women, who represent significant untapped segments. Targeted marketing, flavored products, and social influences have strengthened uptake in these groups, while socio-economic changes in emerging markets further accelerate this trend. Together, these dynamics secure future demand, broaden the consumer pool, and sustain growth in the Europe tobacco market

- Advances in device miniaturization, ergonomics, and integration with real-time imaging technologies are enabling surgeons to perform complex cardiac interventions through smaller incisions with greater precision. This is particularly beneficial for elderly and high-risk patients who may not tolerate traditional open-heart procedures

- In May 2025, the China National Adult Tobacco Survey (NATS) reported that smoking prevalence among adults aged 15+ was 23.2%, with rural rates higher than urban; notably, female smoking, though lower overall, is on the rise in younger cohorts, signaling future market growth potential

- In June 2025, a government survey in India revealed that approximately 20 million children aged 10–14 were addicted to tobacco, with about 5,500 new users added daily, demonstrating the growing role of youth in sustaining tobacco demand

- In January 2025, official Chinese data confirmed that the country has over 300 million smokers, accounting for nearly one-third of the global smoker population—with a significant share of new uptake occurring among youth and women in urban areas

Europe Tobacco Product Market Dynamics

Driver

“Brand Loyalty & Strong Distribution Networks”

- Brand loyalty and strong distribution networks remain central drivers of the Europe tobacco products market. Consumers in many regions exhibit enduring loyalty to established tobacco brands, reinforced by decades of cultural familiarity, taste preference, and trust. Simultaneously, multinational tobacco companies leverage extensive and resilient distribution infrastructures, ensuring availability across both urban and rural markets, even where regulatory restrictions are tightening. This combination sustains consistent demand, safeguards market share, and enables tobacco products to penetrate emerging markets effectively

- For instance- In October 2023, a survey by CDC on U.S. youth respondents demonstrated strong brand preferences: among middle school smokers, 48.8% preferred Marlboro, with 21.4% choosing Newport; among high school students, Marlboro preference reached 38.3%, followed by Newport at 13.4%, indicating that early brand attachment persists across life stages

- The WHO underscores that this loyalty, once established, is highly durable, while FTC data reveals how the industry sustains it through massive investments in retail price discounts and promotional incentives, ensuring brand visibility at points of sale

- Even as overall advertising expenditures stabilize, these entrenched practices reinforce consumer trust, secure repeat purchases, and extend the reach of tobacco products through well-established retail and wholesale networks. As a result, brand loyalty combined with strong distribution infrastructure continues to anchor and expand the Europe tobacco products market

Restraint/Challenge

“Rising Health Awareness and Anti-Smoking Campaigns”

- Growing health awareness and widespread anti-smoking campaigns have emerged as formidable restraints on the Europe tobacco products market. Through vivid mass-media messaging, national quit initiatives, youth-focused interventions, and regulatory health education, countless governments and public health bodies are reducing demand, disrupting social acceptance, and encouraging cessation

- These efforts shift public perception and norms, making tobacco less appealing and socially acceptable—ultimately suppressing consumption. Below are up-to-date concrete instance (2021–2025) from official sources that highlight how health awareness and advocacy are reshaping the tobacco consumption landscape

- For instance- In June 2025, the WHO’s Global Tobacco Epidemic 2025 report announced that 110 countries now mandate graphic health warnings—up from just 9 in 2007—covering 62% of the world’s population, while 36% now live in countries with best-practice anti-tobacco campaigns, up from 19% in 2022

- By shifting public perception, engaging young populations, and promoting emotional, family-centered messages, these campaigns weaken consumer demand and directly limit tobacco sales. As public health advocacy intensifies worldwide, awareness-driven interventions will remain a strong structural restraint, reducing both consumption and long-term market growth for tobacco products

Europe Tobacco Product Market Scope

The market is segmented on the basis of product type, tobacco type, flavor, price range, age group, end-user, and distribution channel.

- By Product Type

On the basis of product type, the Europe Tobacco Product Market is classified into several segments, including cigarettes, cigars and cigarillos, e-cigarettes, smokeless tobacco, next-generation products, roll-your-own (RYO) tobacco, hookah/shisha tobacco, bidis, pipes, and others. Among these, the cigarettes segment is projected to remain the dominant segment in 2025, accounting for 81.65% of the total market share. The strong growth is attributed to the continued high consumption of cigarettes across both emerging and developed markets. Factors such as well-established brand recognition, widespread retail presence, and consistent demand from consumers are driving this segment’s leading position in the market.

Next Generation Products is also projected to be the fastest-growing segment, with a compound annual growth rate (CAGR) of 3.02% over the forecast period, owing to the rising consumer shift toward reduced-risk alternatives. Growing awareness of health impacts associated with traditional smoking, increasing product innovations such as e-cigarettes and heated tobacco, and supportive government regulations for harm-reduction products are further driving the segment’s rapid expansion globally

- By Tobacco Type

On the basis of tobacco type, the Europe Tobacco Product Market is segmented into Virginia, burley, oriental, mixed, and others. In 2025, the Virginia segment is expected to dominate the market, accounting for 55.93% of the total market share. It is also anticipated to be the fastest-growing segment, with a compound annual growth rate (CAGR) of 2.65% during the forecast period. The growth and dominance of the Virginia segment can be attributed to its widespread consumption across both emerging and developed markets. In addition, strong brand recognition, consistent consumer preference, and easy availability through retail outlets are further supporting its market leadership and growth prospects in the tobacco industry.

- By Flavor

On the basis of Flavor type, the Europe Tobacco Product Market is segmented into flavored, regular, and others. In 2025, the flavored segment is expected to dominate the market, holding 17.87% share of the total market. It is also projected to be the fastest-growing segment, with a compound annual growth rate (CAGR) of 3.36% over the forecast period. The strong growth of the flavored segment is driven by increasing demand among younger adults, who are more inclined toward diverse and innovative tobacco products. In addition, continuous product innovations and aggressive marketing strategies by tobacco companies are further propelling its popularity. These factors are contributing to the flavored segment’s leading position and rapid growth in the global market.

- By Price Range

On the basis of price range, the Europe Tobacco Product Market is segmented into mass, premium, and luxury. In 2025, the mass segment is expected to dominate the market, accounting for 60.14% of the total market share. It is also projected to be the fastest-growing segment, with a compound annual growth rate (CAGR) of 2.59% during the forecast period. The mass segment’s growth is largely driven by its affordability and widespread consumption, particularly in developing economies where price sensitivity is high. At the same time, the premium and luxury segments are expected to witness steady growth, supported by rising disposable incomes and a shift toward lifestyle-driven choices. These factors are collectively shaping the market’s diverse expansion across price ranges.

- By Age Group

On the basis of age group, the Europe Tobacco Product Market is segmented into Generation X (41–56 years), Millennials (25–40 years), and Baby Boomers (57–75 years). In 2025, the Generation X (41–56 years) segment is expected to dominate the market, accounting for 41.44% of the total market share. The strong growth in this age group is attributed to their high adoption of flavored, innovative, and alternative tobacco products such as e-cigarettes and heated tobacco devices. Their willingness to explore new products, combined with disposable income and lifestyle preferences, is driving their increasing influence in the tobacco market.

Millennials (25–40 Years) is anticipated to be the fastest growing during the forecast period, registering a CAGR of 2.67%. This growth is driven by their higher acceptance of innovative products such as e-cigarettes and heated tobacco, increased disposable income, and social smoking trends. Additionally, aggressive marketing strategies, premium product offerings, and lifestyle-driven consumption patterns are further boosting tobacco use among this age group.

- By End User

On the basis of end user, the Europe Tobacco Product Market is segmented into men, women, and unisex. In 2025, the men segment is expected to dominate the market, accounting for 67.59% of the total market share. It is also projected to be the fastest-growing segment, with a compound annual growth rate (CAGR) of 2.52% during the forecast period. The growth is driven by targeted marketing campaigns aimed specifically at men, as well as the rising acceptance of tobacco alternatives such as e-cigarettes and heated tobacco products. In addition, evolving lifestyle trends and increased product availability are contributing to the steady rise in consumption within this demographic segment across both emerging and developed markets.

- By Distribution Channel

On the basis of distribution channel, the Europe Tobacco Product Market is segmented into store-based retailers and non-store retailers. In 2025, the store-based retailers segment is expected to dominate the market, accounting for 84.09% of the total market share. It is also projected to be the fastest-growing segment, with a compound annual growth rate (CAGR) of 2.43% during the forecast period. The growth of this segment is driven by factors such as wide accessibility, immediate product availability, and established consumer trust. In addition, the strong presence of store-based retailers across both urban and rural areas further supports their market dominance, making them the preferred choice for tobacco consumers worldwide.

Europe Tobacco Product Market Regional Analysis

- Europe is expected to see Russia dominate the Europe Tobacco Product Market with the largest revenue share of 22.54% in 2025, primarily driven by high consumption rates, deeply rooted smoking culture, and the continued demand for both traditional and novel tobacco products

- The country further benefits from the presence of established domestic manufacturers, rising popularity of alternative tobacco formats (such as heated tobacco and e-cigarettes), and relatively favorable regulatory and pricing conditions, all contributing to its sustained market leadership within Europe

Russia Europe Tobacco Product Market Insight

The Russia Europe Tobacco Product Market is projected to grow at a substantial CAGR of 3.44% throughout the forecast period, driven by the Rising Youth and Female Consumer Base, Tax Revenue Reliance of Governments, and Growth of Next-Generation Products (NGP) that creates opportunity for market.

Germany Europe Tobacco Product Market Insight

The Germany Europe Tobacco Product Market is projected to experience steady growth during the forecast period, supported by strong consumer demand for both conventional cigarettes and next-generation products such as heated tobacco and vaping devices. The market further benefits from a well-established distribution network, rising popularity of premium tobacco brands, and evolving consumer preferences toward innovative and alternative product categories.

Europe Tobacco Product Market Share

The Europe tobacco product industry is primarily led by well-established companies, including:

- IMPERIAL BRANDS PLC (U.K.)

- BRITISH AMERICAN TOBACCO P.L.C (U.K.)

- JTI SA (Switzerland)

Latest Developments in Europe Tobacco Product Market

- In March 2025, Imperial Brands strengthened its positions in priority markets such as the US, Germany, Spain, Australia, and across Central and Eastern Europe (CEE) and Africa. They have focused on growing market share by product innovation, including new vaping devices, heated sticks, and oral nicotine pouches launched in over 20 markets, achieving 64% cumulative NGP net revenue growth since 2020

- In March 2025, Imperial Brands plc extended its manufacturing and sales footprint in strategic markets. For instance, it highlighted strong growth in African markets such as Morocco, Algeria, Ivory Coast, and Madagascar, leveraging local manufacturing and premiumization strategies. The CEE region showed growth through successful NGP launches and expanding scale

- In July 2025, BAT has entered a global strategic partnership with Accenture to transform its Global Business Solutions and Supply Network Operations. The collaboration will simplify processes, improve speed to market, strengthen compliance agility, and lay the foundation for future growth. Through Accenture’s expertise in data, AI, analytics, and global learning, BAT will accelerate its journey toward a more agile, digital, and future-ready operating model. This partnership reinforces BAT’s broader strategy of leveraging world-class collaborations to drive innovation, efficiency, and sustainable growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING CONSUMER PURCHASING DECISIONS IN THE EUROPE TOBACCO PRODUCTS MARKET

4.2 CONSUMER BUYING BEHAVIOR FOR EUROPE TOBACCO PRODUCTS

4.2.1 HEALTH PERCEPTIONS AND SAFETY AWARENESS

4.2.2 PRICE SENSITIVITY AND VALUE PERCEPTION

4.2.3 BRAND LOYALTY AND MARKETING INFLUENCE

4.2.4 REGULATORY ENVIRONMENT AND COMPLIANCE

4.2.5 SOCIAL NORMS, CULTURE, AND ETHICAL CONCERNS

4.2.6 SUMMARY TABLE: EXPANDED CONSUMER DRIVERS

4.3 PRODUCT ADOPTION SCENARIO IN THE EUROPE TOBACCO PRODUCTS MARKET

4.4 PORTER’S FIVE FORCES

4.4.1 COMPETITIVE RIVALRY – HIGH

4.4.2 THREAT OF NEW ENTRANTS – LOW TO MODERATE

4.4.3 BARGAINING POWER OF BUYERS – MODERATE TO HIGH

4.4.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.4.5 THREAT OF SUBSTITUTES – HIGH

4.5 BRAND OUTLOOK

4.6 IMPACT OF ECONOMIC SLOWDOWN ON THE EUROPE TOBACCO PRODUCTS MARKET

4.7 RAW MATERIAL SOURCING ANALYSIS

4.8 THE EUROPE TOBACCO SUPPLY CHAIN ANALYSIS

4.9 PRICING ANALYSIS OF TOBACCO PRODUCTS IN THE EUROPE MARKET

4.1 IMPORT EXPORT ANALYSIS

4.10.1 IMPORT SCENARIO

4.10.2 EXPORT SCENARIO

4.11 PRODUCTION CAPACITY OUTLOOK

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN EMERGING MARKETS SUCH AS ASIA-PACIFIC

6.1.2 BRAND LOYALTY & STRONG DISTRIBUTION NETWORKS

6.1.3 RISING YOUTH AND FEMALE CONSUMER BASE

6.1.4 TAX REVENUE RELIANCE OF GOVERNMENTS

6.2 CHALLENGES

6.2.1 STRICT REGULATIONS & HIGHER TAXES

6.2.2 RISING HEALTH AWARENESS AND ANTI-SMOKING CAMPAIGNS

6.3 OPPORTUNITIES

6.3.1 GROWTH OF NEXT-GENERATION PRODUCTS (NGP)

6.3.2 PREMIUMIZATION TRENDS OF TOBACCO CONSUMPTION

6.3.3 E-COMMERCE AND DIRECT-TO-CONSUMER CHANNELS

6.4 CHALLENGES

6.4.1 DECREASING TOBACCO CONSUMPTION IN DEVELOPED ECONOMIES

6.4.2 PUBLIC AND POLITICAL SCRUTINY

7 EUROPE TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CIGARETTES

7.3 CIGAR & CIGARILLOS

7.4 E-CIGARETTES

7.5 SMOKELESS TOBACCO

7.6 NEXT GENERATION PRODUCTS

7.7 ROLL-YOUR-OWN (RYO) TOBACCO

7.8 HOOKAH/SHISHA TOBACCO

7.9 BIDIS

7.1 PIPES

7.11 OTHERS

8 EUROPE TOBACCO PRODUCT MARKET, BY AGE GROUP

8.1 OVERVIEW

8.2 GENERATION X (41–56 YEARS)

8.3 MILLENNIALS (25–40 YEARS)

8.4 BABY BOOMERS (57–75 YEARS)

9 EUROPE TOBACCO PRODUCT MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 MASS

9.3 PREMIUM

9.4 LUXURY

10 EUROPE TOBACCO PRODUCT MARKET, BY FLAVOR

10.1 OVERVIEW

10.2 FLAVORED

10.3 REGULAR

10.4 OTHERS

11 EUROPE TOBACCO PRODUCTS MARKET, BY END-USER

11.1 OVERVIEW

11.2 MEN

11.3 WOMEN

11.4 UNISEX

12 EUROPE TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE

12.1 OVERVIEW

12.2 VIRGINIA

12.3 BURLEY

12.4 ORIENTAL

12.5 MIXED

12.6 OTHERS

13 EUROPE TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE-BASED RETAILERS

13.3 TABLE 2 EUROPE STORE BAESD RETAILERS IN TOBACCO PRODUCT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

13.4 NON-STORE RETAILERS

14 EUROPE TOBACCO PRODUCT MARKET, BY REGION

14.1 EUROPE

14.1.1 RUSSIA

14.1.2 GERMANY

14.1.3 FRANCE

14.1.4 ITALY

14.1.5 POLAND

14.1.6 SPAIN

14.1.7 NETHERLANDS

14.1.8 BELGIUM

14.1.9 SWITZERLAND

14.1.10 LUXEMBOURG

14.1.11 REST OF EUROPE

15 EUROPE TOBACCO PRODUCTS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 PHILIP MORRIS PRODUCTS S.A.

17.1.1 COMPANY SNAPSHOT

17.1.2 RECENT FINANCIALS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT UPDATES

17.2 IMPERIAL BRANDS PLC

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 BRITISH AMERICAN TOBACCO P.L.C

17.3.1 COMPANY SNAPSHOT

17.3.2 RECENT FINANCIALS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 JTI SA

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 PT DJARUM

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 CREMO CIGARS

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 EASTERN COMPANY S.A.E

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 GODFREY PHILLIPS INDIA LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 JOYA DE NICARAGUA, S.A

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 KT&G CORP.

17.10.1 COMPANY SNAPSHOT

17.10.2 RECENT FINANCIALS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 PANAFRICAN TOBACCO GROUP HOLDING

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 PYXUS INTERNATIONAL, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 SCANDINAVIAN TOBACCO GROUP A/S

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 AKIYAMA SANGYO CO., LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 VILLIGER SÖHNE AG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 PRICING ANALYSIS IN THE EUROPE TOBACCO PRODUCTS MARKET

TABLE 2 REGULATORY COVERAGE

TABLE 3 EUROPE TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 EUROPE TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 5 EUROPE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE CIGAR & CIGARILLOS IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE ROLL-YOUR-OWN (RYO) TOBACCO IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND

TABLE 38 EUROPE HOOKAH/SHISHA TOBACCO IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE BIDIS IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE PIPES IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE OTHERS TOBACCO IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE GENERATION X (41–56 YEARS) IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND

TABLE 44 EUROPE MILLENNIALS (25–40 YEARS) IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE BABY BOOMERS (57–75 YEARS) IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE MASS IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE PREMIUM IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND

TABLE 49 EUROPE LUXURY IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE TOBACCO PRODUCTS MARKET, BY FLAVOR 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE FLAVORED IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 EUROPE AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE REGULAR IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE OTHERS IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE MEN IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE WOMEN IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE UNISEX IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE VIRGINIA IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE BURLEY IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 EUROPE ORIENTAL IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE MIXED IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 EUROPE OTHERS IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE TOBACCO PRODUCT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE STORE BAESD RETAILERS IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE NON-STORE RETAILERS IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE NON-STORE RETAILERS IN TOBACCO PRODUCT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE TOBACCO PRODUCTS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE TOBACCO PRODUCTS MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 76 EUROPE TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 78 EUROPE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 EUROPE ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 EUROPE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 88 EUROPE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 89 EUROPE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 90 EUROPE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 EUROPE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 92 EUROPE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 EUROPE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 94 EUROPE FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 EUROPE FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 EUROPE MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 EUROPE AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 EUROPE SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 EUROPE ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 EUROPE SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 EUROPE NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 EUROPE SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 EUROPE SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 104 EUROPE SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 105 EUROPE TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 EUROPE TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 107 EUROPE FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 EUROPE FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 EUROPE MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 EUROPE SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 EUROPE AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 EUROPE ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 EUROPE TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 114 EUROPE TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 115 EUROPE TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 116 EUROPE TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 117 EUROPE STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 EUROPE NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 RUSSIA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 RUSSIA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 121 RUSSIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 RUSSIA HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 RUSSIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 124 RUSSIA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 RUSSIA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 RUSSIA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 RUSSIA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 RUSSIA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 RUSSIA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 RUSSIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 131 RUSSIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 132 RUSSIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 133 RUSSIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 RUSSIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 135 RUSSIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 RUSSIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 137 RUSSIA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 RUSSIA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 RUSSIA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 RUSSIA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 RUSSIA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 RUSSIA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 RUSSIA SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 RUSSIA NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 RUSSIA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 RUSSIA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 147 RUSSIA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 148 RUSSIA TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 RUSSIA TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 150 RUSSIA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 RUSSIA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 RUSSIA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 RUSSIA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 RUSSIA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 RUSSIA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 RUSSIA TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 157 RUSSIA TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 158 RUSSIA TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 159 RUSSIA TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 160 RUSSIA STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 RUSSIA NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 GERMANY TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 GERMANY TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 164 GERMANY CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 GERMANY HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 GERMANY CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 167 GERMANY CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 168 GERMANY CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 169 GERMANY CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 170 GERMANY E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 GERMANY E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 172 GERMANY E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 GERMANY E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 174 GERMANY SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 GERMANY NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 GERMANY SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 GERMANY SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 178 GERMANY SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 179 GERMANY TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 GERMANY TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 181 GERMANY TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 182 GERMANY TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 183 GERMANY TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 184 GERMANY TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 185 GERMANY STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 GERMANY NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 FRANCE TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 FRANCE TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 189 FRANCE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 FRANCE HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 FRANCE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 192 FRANCE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 193 FRANCE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 194 FRANCE CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 195 FRANCE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 FRANCE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 197 FRANCE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 FRANCE E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 199 FRANCE SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 FRANCE NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 FRANCE SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 FRANCE SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 203 FRANCE SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 204 FRANCE TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 FRANCE TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 206 FRANCE TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 207 FRANCE TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 208 FRANCE TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 209 FRANCE TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 210 FRANCE STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 FRANCE NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 ITALY TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 ITALY TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 214 ITALY CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 ITALY HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 ITALY CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 217 ITALY CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 218 ITALY CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 219 ITALY CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 220 ITALY E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 ITALY E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 222 ITALY E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 ITALY E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 224 ITALY SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 ITALY NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 ITALY SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 ITALY SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 228 ITALY SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 229 ITALY TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 ITALY TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 231 ITALY TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 232 ITALY TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 233 ITALY TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 234 ITALY TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 235 ITALY STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 ITALY NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 POLAND TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 POLAND TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 239 POLAND CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 POLAND HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 POLAND CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 242 POLAND CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 243 POLAND CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 244 POLAND CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 245 POLAND E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 POLAND E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 247 POLAND E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 POLAND E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 249 POLAND SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 POLAND NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 POLAND SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 POLAND SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 253 POLAND SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 254 POLAND TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 POLAND TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 256 POLAND TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 257 POLAND TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 258 POLAND TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 259 POLAND TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 260 POLAND STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 POLAND NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 SPAIN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 SPAIN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 264 SPAIN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 SPAIN HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 SPAIN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 267 SPAIN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 268 SPAIN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 269 SPAIN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 270 SPAIN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SPAIN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 272 SPAIN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 SPAIN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 274 SPAIN SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 SPAIN NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 SPAIN SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 SPAIN SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 278 SPAIN SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 279 SPAIN TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 SPAIN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 281 SPAIN TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 282 SPAIN TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 283 SPAIN TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 284 SPAIN TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 285 SPAIN STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 SPAIN NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 NETHERLANDS TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 NETHERLANDS TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 289 NETHERLANDS CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 NETHERLANDS HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 NETHERLANDS CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 292 NETHERLANDS CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 293 NETHERLANDS CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 294 NETHERLANDS CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 295 NETHERLANDS E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 NETHERLANDS E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 297 NETHERLANDS E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 NETHERLANDS E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 299 NETHERLANDS SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 NETHERLANDS NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 NETHERLANDS SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 NETHERLANDS SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 303 NETHERLANDS SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 304 NETHERLANDS TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 NETHERLANDS TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 306 NETHERLANDS TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 307 NETHERLANDS TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 308 NETHERLANDS TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 309 NETHERLANDS TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 310 NETHERLANDS STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 NETHERLANDS NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 BELGIUM TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 BELGIUM TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 314 BELGIUM CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 BELGIUM HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 BELGIUM CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 317 BELGIUM CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 318 BELGIUM CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 319 BELGIUM CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 320 BELGIUM E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 BELGIUM E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 322 BELGIUM E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 BELGIUM E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 324 BELGIUM SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 BELGIUM NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 BELGIUM SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 BELGIUM SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 328 BELGIUM SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 329 BELGIUM TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 BELGIUM TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 331 BELGIUM, BY PRICE TOBACCO PRODUCTS MARKET RANGE, 2018-2032 (USD THOUSAND)

TABLE 332 BELGIUM TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 333 BELGIUM TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 334 BELGIUM TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 335 BELGIUM STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 BELGIUM NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 SWITZERLAND TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 SWITZERLAND TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 339 SWITZERLAND CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 SWITZERLAND HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 SWITZERLAND CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 342 SWITZERLAND FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 SWITZERLAND MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 SWITZERLAND SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 SWITZERLAND FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 SWITZERLAND AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 SWITZERLAND ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 SWITZERLAND CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 349 SWITZERLAND CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 350 SWITZERLAND CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 351 SWITZERLAND E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 SWITZERLAND E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 353 SWITZERLAND E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 SWITZERLAND E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 355 SWITZERLAND FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 SWITZERLAND FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 SWITZERLAND MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 SWITZERLAND AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 SWITZERLAND SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 SWITZERLAND ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 SWITZERLAND SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 SWITZERLAND NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 SWITZERLAND SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 SWITZERLAND SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 365 SWITZERLAND SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 366 SWITZERLAND TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 SWITZERLAND TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 368 SWITZERLAND FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 SWITZERLAND FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 SWITZERLAND MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 SWITZERLAND SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 SWITZERLAND AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 SWITZERLAND ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 SWITZERLAND TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 375 SWITZERLAND TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 376 SWITZERLAND TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 377 SWITZERLAND TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 378 SWITZERLAND STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 SWITZERLAND NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 LUXEMBOURG TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 LUXEMBOURG TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 382 LUXEMBOURG CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 LUXEMBOURG HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 LUXEMBOURG CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 385 LUXEMBOURG CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 386 LUXEMBOURG CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 387 LUXEMBOURG CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 388 LUXEMBOURG E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 LUXEMBOURG E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 390 LUXEMBOURG E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 LUXEMBOURG E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 392 LUXEMBOURG SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 LUXEMBOURG NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 394 LUXEMBOURG SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 LUXEMBOURG SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 396 LUXEMBOURG SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 397 LUXEMBOURG TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 LUXEMBOURG TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 399 LUXEMBOURG TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 400 LUXEMBOURG TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 401 LUXEMBOURG TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 402 LUXEMBOURG TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 403 LUXEMBOURG STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 404 LUXEMBOURG NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 405 REST OF EUROPE TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 REST OF EUROPE TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

List of Figure

FIGURE 1 EUROPE TOBACCO PRODUCTS MARKET

FIGURE 2 EUROPE TOBACCO PRODUCTS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE TOBACCO PRODUCTS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE TOBACCO PRODUCTS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE TOBACCO PRODUCTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE TOBACCO PRODUCTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE TOBACCO PRODUCTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE TOBACCO PRODUCTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE TOBACCO PRODUCTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE TOBACCO PRODUCTS MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 TEN SEGMENTS COMPRISE THE EUROPE TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING YOUTH AND FEMALE CONSUMER BASE IS EXPECTED TO DRIVE THE EUROPE TOBACCO PRODUCTS MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE CIGARETTES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE TOBACCO PRODUCTS MARKET IN 2025 AND 2032

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 DROC ANALYSIS

FIGURE 18 EUROPE TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2024

FIGURE 19 EUROPE TOBACCO PRODUCTS MARKET: BY AGE GROUP, 2024

FIGURE 20 EUROPE TOBACCO PRODUCTS MARKET: BY PRICE RANGE, 2024

FIGURE 21 EUROPE TOBACCO PRODUCTS MARKET, BY FLAVOR, 2024

FIGURE 22 EUROPE TOBACCO PRODUCT MARKET, BY END USER, 2024

FIGURE 23 EUROPE TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2024

FIGURE 24 EUROPE TOBACCO PRODUCT MARKET, BY DISTRIBUTION CHANNEL, 2024

FIGURE 25 EUROPE TOBACCO PRODUCT MARKET: SNAPSHOT (2024)

FIGURE 26 EUROPE TOBACCO PRODUCTS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.