Europe Trauma Fixation Market

Market Size in USD Billion

CAGR :

%

USD

4.24 Billion

USD

9.10 Billion

2024

2032

USD

4.24 Billion

USD

9.10 Billion

2024

2032

| 2025 –2032 | |

| USD 4.24 Billion | |

| USD 9.10 Billion | |

|

|

|

|

Europe Trauma Fixation Market Size

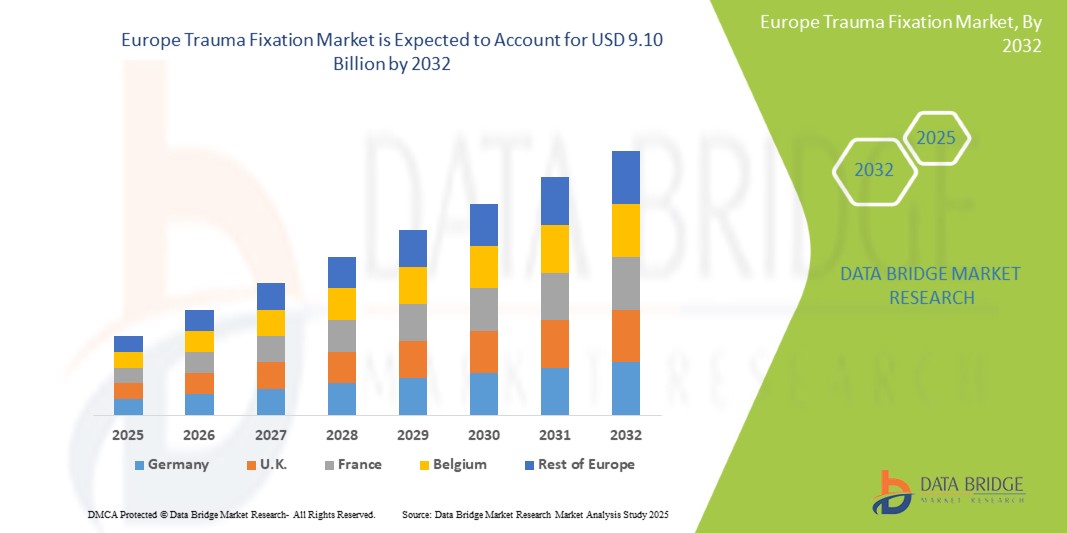

- The Europe Trauma Fixation Market size was valued at USD 4.24 billion in 2024 and is expected to reach USD 9.10 billion by 2032, at a CAGR of 10.0% during the forecast period

- The market growth is largely fueled by the growing incidence of road traffic and sports-related accidents, an increasing geriatric population, and ongoing technological advancements in trauma fixation devices

- Furthermore, rising consumer and institutional demand for secure, precise, and integrated fixation solutions supported by increasing disposable incomes, government support and reimbursements, and improved access to advanced healthcare facilities is positioning trauma fixation devices as the modern standard for fracture management across Europe

Europe Trauma Fixation Market Analysis

- Trauma fixation devices, including internal and external fixation systems, are essential in orthopedic surgery for stabilizing and aligning fractured bones, enabling effective healing and faster patient recovery in both acute injury and post-operative care settings

- The escalating demand for trauma fixation solutions is primarily fueled by increasing road traffic and sports-related injuries, an ageing population with higher fracture risk, and wider adoption of minimally invasive surgical techniques and advanced implant materials.

- Germany dominated the Europe Trauma Fixation Market with the largest revenue share 22.5% in 2024, characterized by its advanced healthcare infrastructure, high surgical volumes, strong reimbursement environment, and the presence of major medical device manufacturers and specialized trauma centers

- Poland is expected to be the fastest-growing country in the Europe Trauma Fixation Market during the forecast period due to improving hospital infrastructure, rising government healthcare spending, greater access to advanced orthopedic treatments, and growing adoption of modern fixation technologies

- The Internal Fixator Devices segment dominated the Europe Trauma Fixation Market with a market share of 65.5% in 2024, driven by surgeon preference for intramedullary nails, plates and screws for complex fractures, shorter recovery times, and better functional outcomes compared with many external fixation options

Report Scope and Europe Trauma Fixation Market Segmentation

|

Attributes |

Europe Trauma Fixation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Trauma Fixation Market Trends

Shift Towards Minimally Invasive and Patient-Specific Fixation Solutions

- A significant and accelerating trend in the Europe Trauma Fixation Market is the adoption of minimally invasive surgical techniques combined with patient-specific implant solutions. This approach is aimed at reducing recovery time, minimizing surgical trauma, and improving patient outcomes

- For instance, companies such as DePuy Synthes and Stryker are offering advanced plating and nailing systems that can be inserted through smaller incisions, reducing blood loss and infection risk. Zimmer Biomet has introduced modular fixation systems adaptable to individual anatomical needs

- Patient-specific implants, often produced using 3D printing, allow for customized fit and optimal load distribution, enhancing bone healing and comfort. This trend is gaining traction in complex fracture cases where off-the-shelf implants may not provide ideal results

- The integration of advanced imaging and computer-assisted surgical planning tools enables surgeons to precisely pre-plan fixation procedures and select or design the most suitable devices for each patient’s anatomy

- Hospitals across Germany, France, and the UK are increasingly investing in robotic-assisted orthopedic systems that pair with these fixation innovations to improve surgical accuracy and reproducibility

- The growing preference for less invasive, technology-enhanced fixation solutions is redefining orthopedic standards in Europe, prompting manufacturers to expand R&D in advanced biomaterials, precision-guided tools, and customized implant production

Europe Trauma Fixation Market Dynamics

Driver

Rising Trauma Cases from Road Accidents and Aging Population

- The increasing incidence of road traffic accidents, sports injuries, and falls among Europe’s aging population is a major driver for trauma fixation demand

- For instance, Eurostat data shows a rising proportion of citizens over 65, many of whom are susceptible to fragility fractures that require internal fixation. In parallel, urban traffic density contributes to higher accident rates, sustaining the need for advanced fracture management solutions

- Advanced fixation devices such as locking plates, cannulated screws, and intramedullary nails offer faster mobilization and better functional recovery, making them preferred choices in modern orthopedic practice

- Supportive government healthcare policies, reimbursement frameworks, and investments in trauma centers are accelerating adoption, particularly in Western Europe

- The presence of major global orthopedic manufacturers with strong distribution networks in Europe further supports rapid technology dissemination and training for healthcare professionals

Restraint/Challenge

High Implant Costs and Stringent Regulatory Pathways

- The relatively high cost of advanced trauma fixation implants, particularly those made from titanium alloys or incorporating bioresorbable materials, can limit adoption in cost-sensitive healthcare systems within parts of Southern and Eastern Europe

- For instance, hospitals operating under constrained budgets may opt for standard stainless-steel implants rather than premium options, potentially affecting overall market penetration for high-end devices

- Stringent regulatory requirements under the EU Medical Device Regulation (MDR) present a further challenge, as obtaining certification for new products demands extensive clinical data, extended timelines, and significant compliance costs

- Smaller manufacturers, in particular, face difficulties navigating MDR processes, which can delay innovation and market entry

- Addressing these challenges through cost-optimized device manufacturing, streamlined regulatory strategies, and partnerships with healthcare providers will be essential to sustaining market growth across the region

Europe Trauma Fixation Market Scope

The market is segmented on the basis of product type, material, application, end user, and distribution channel

- By Product Type

On the basis of product type, the Europe Trauma Fixation Market is segmented into internal fixator devices and external fixator devices. The internal fixator devices segment dominated the market with the largest revenue share of 65.5% in 2024, driven by its superior stability, ability to promote faster patient mobilization, and strong surgeon preference for managing complex or multi-fragment fractures

Products such as locking plates, cannulated screws, and intramedullary nails are widely used in orthopedic surgery due to their proven long-term clinical outcomes, minimal complication rates, and reduced infection risk compared with external systems

The external fixator devices segment is anticipated to witness notable growth during the forecast period, supported by their effectiveness in temporary stabilization, management of open fractures, and situations requiring gradual bone realignment in high-energy trauma cases or polytrauma patients

- By Material

On the basis of material, the Europe Trauma Fixation Market is segmented into metallic implant (steel, titanium, others), carbon fiber (thermoplastic), hybrid implants, bio absorbable, and grafts & orthobiologics. The metallic implant segment held the largest market share in 2024, as steel and titanium remain the gold standard for load-bearing applications, offering excellent strength, corrosion resistance, and biocompatibility

The bio absorbable segment is expected to record the fastest growth during forecast period, driven by rising demand for implants that naturally degrade within the body over time, removing the need for secondary removal surgeries and reducing healthcare costs. Carbon fiber and hybrid implants are emerging as niche but promising categories due to their lightweight structure, radiolucency for clearer imaging, and suitability in sports medicine and pediatric cases

- By Application

On the basis of application, the Europe Trauma Fixation Market is segmented into shoulder & elbow, hand & wrist, pelvic, hip & femur, tibia, craniomaxillofacial, knee, foot & ankle, spinal, and others. The hip & femur segment dominated in 2024 owing to the high incidence of femoral neck and shaft fractures, especially among the aging population susceptible to osteoporosis and fall-related injuries

The craniomaxillofacial segment is projected to grow rapidly during the forecast period due to increasing reconstructive surgeries following facial trauma, coupled with advancements in resorbable plating systems and computer-assisted surgical planning

- By End User

On the basis of end user, the Europe Trauma Fixation Market is segmented into hospitals, ambulatory surgical centers, trauma centers, and others. The hospitals segment held the largest share in 2024, benefitting from high patient throughput, availability of advanced operating rooms, multidisciplinary surgical teams, and comprehensive trauma care services

The ambulatory surgical centers segment is expected to see strong growth during forecast period, due to rising adoption of day-care trauma procedures, cost-efficiency for healthcare systems, and greater patient preference for faster discharge and recovery in outpatient settings

- By Distribution Channel

On the basis of distribution channel, the Europe Trauma Fixation Market is segmented into direct tender, retail sales, and online sales. The direct tender segment led the market in 2024, supported by bulk purchase agreements between large hospitals, government health systems, and device manufacturers, ensuring consistent supply and negotiated pricing advantages

The online sales segment is projected to grow the fastest during forecast period, driven by increased digital procurement by healthcare facilities, improved logistics networks, and the growing role of e-commerce platforms in supplying specialized medical devices

Europe Trauma Fixation Market Regional Analysis

- Germany dominated the Europe Trauma Fixation Market with the largest revenue share 22.5% in 2024, characterized by its advanced healthcare infrastructure, high surgical volumes, strong reimbursement environment, and the presence of major medical device manufacturers and specialized trauma centers

- The country’s dominance is supported by high per capita healthcare expenditure, robust reimbursement systems, and the widespread adoption of technologically advanced fixation devices in both public and private hospitals

- Germany’s aging population, rising incidence of fractures, and increasing focus on minimally invasive surgical techniques are further fueling demand, positioning the country as a key driver of innovation and revenue growth in Europe’s trauma fixation sector

The Germany Trauma Fixation Market Insight

Germany accounted for the largest revenue share of the Europe Trauma Fixation Market in 2024, supported by its high surgical procedure rates, advanced hospital network, and significant investments in orthopedic research and innovation. The country’s emphasis on adopting technologically advanced implants, along with favorable reimbursement systems, has strengthened its position as a key market leader. Growing demand for minimally invasive techniques, combined with a rapidly aging population, is driving the adoption of advanced fixation devices in both public and private healthcare settings.

U.K. Trauma Fixation Market Insight

The U.K. Trauma Fixation Market is anticipated to grow at a healthy CAGR during the forecast period, fueled by an increase in orthopedic surgeries, rising fracture cases from falls and road traffic accidents, and growing access to specialized trauma care. The country’s strong focus on NHS modernization, coupled with technological innovations and the adoption of lightweight, durable fixation devices, is accelerating market growth. Increased awareness of early fracture intervention and expanding private healthcare services are further contributing to the market’s expansion.

France Trauma Fixation Market Insight

The France Trauma Fixation Market is witnessing significant adoption of advanced implants, supported by a well-developed healthcare system and a strong orthopedic device manufacturing base. The rising incidence of osteoporosis-related fractures, particularly among the elderly population, is driving demand for both internal and external fixation systems. Government initiatives to improve access to high-quality surgical care and the integration of digital planning tools in orthopedic surgery are further supporting the market’s upward trajectory.

Italy Trauma Fixation Market Insight

The Italy Trauma Fixation Market is expanding steadily, driven by increasing sports participation, a growing elderly population, and an uptick in complex fracture cases. Investments in healthcare infrastructure modernization, along with the adoption of innovative fixation materials such as carbon fiber and bioabsorbable implants, are contributing to market growth. The country’s orthopedic community is also increasingly embracing minimally invasive fixation techniques, enhancing patient recovery times and outcomes.

Poland Trauma Fixation Market Insight

The Poland Trauma Fixation Market is emerging as the fastest-growing market for trauma fixation in Europe, driven by rapid improvements in healthcare infrastructure, increasing government investments in modern surgical equipment, and expanding access to specialized orthopedic care. Rising incidence of road traffic accidents, coupled with growing sports injury cases, is boosting the demand for advanced fixation devices. The country’s orthopedic community is increasingly adopting minimally invasive techniques and innovative implant materials, positioning Poland as a high-growth market in the region.

Europe Trauma Fixation Market Share

The Europe trauma fixation industry is primarily led by well-established companies, including:

- Johnson & Johnson and its affiliates (U.S.)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Smith + Nephew (U.K.)

- Medtronic (Ireland)

- B. Braun SE (Germany)

- Orthofix Medical Inc. (U.S.)

- Wright Medical Group N.V. (Netherlands)

- ConMed Corporation (U.S.)

- Acumed LLC (U.S.)

- Arthrex, Inc. (U.S.)

- DePuy Synthes Companies (U.S.)

- OsteoMed (U.S.)

- Globus Medical, Inc. (U.S.)

- Integra LifeSciences Holdings Corporation (U.S.)

- BioPro, Inc. (U.S.)

- Medartis AG (Switzerland)

- Double Medical Technology Inc. (China)

- Citieffe S.r.l. (Italy)

- ChM sp. z o.o. (Poland)

What are the Recent Developments in Europe Trauma Fixation Market?

- In August 2025, The AO Research Institute Davos, in partnership with QUT (Australia), is conducting European clinical trials for the Biphasic Plate a novel fixation device that balances mechanical stability with controlled micro-motion to promote callus formation. The 100th patient received the implant late in 2024. Completion of the one-year follow-up is projected by 2026, after which production and wider roll-out may follow

- In June 2025, Johnson & Johnson MedTech announced Europe’s first partial knee (unicompartmental knee arthroplasty) surgeries using the CE-approved VELYS robotic-assisted platform paired with the SIGMA HP partial knee implant. Implemented in nine countries including Germany, U.K., France, and Italy, this technology promises personalized alignment and soft-tissue–preserving surgical insights without reliance on CT scans

- In April 2025, Zimmer Biomet obtained CE certification for its RibFix Advantage system designed for minimally invasive thoracoscopic fixation, stabilization, and fusion of rib fractures. The pre-assembled bridge-plate design contours to rib anatomy and enables less tissue disruption, marking a notable advance in European rib fracture management

- In February 2025. Bioretec Ltd., a pioneer in absorbable orthopedic implants, secured CE marking for its RemeOs Trauma Screw lineup in January 2025. The approval covers over 200 product variants across four lines, intended for both adult and pediatric upper and lower extremities. Made from proprietary magnesium alloy, these screws are absorbable, osteopromotive, and eliminate the need for implant removal—boosting cost-effectiveness and patient comfort

- In October 2024, COBRA-OS, an aortic occlusion device for preventing fatal bleeding in trauma patients, was approved for use in Europe in 2024. The device is smaller and more cost-effective than comparable alternatives and had already been in use within the U.S.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.