Europe Ultrasound Imaging Devices Market

Market Size in USD Million

CAGR :

%

USD

164.89 Million

USD

241.77 Million

2024

2032

USD

164.89 Million

USD

241.77 Million

2024

2032

| 2025 –2032 | |

| USD 164.89 Million | |

| USD 241.77 Million | |

|

|

|

|

Ultrasound Imaging Market Size

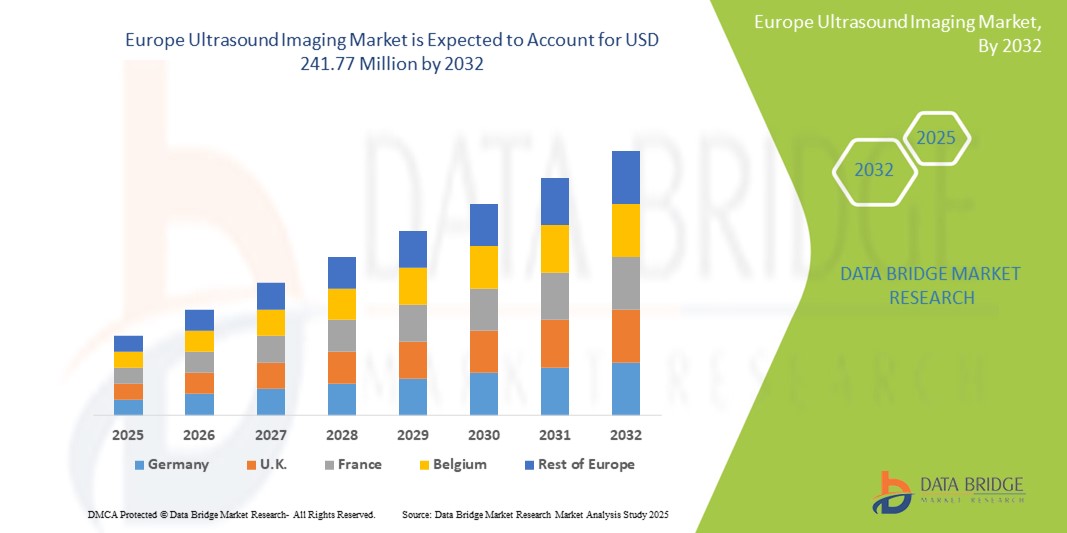

- The Europe Ultrasound Imaging Market was valued at USD 164.89 million in 2024 and is expected to reach USD 241.77 million by 2032, at a CAGR of 5.5% During the forecast period.

- The rising incidence of chronic conditions, increasing demand for minimally invasive diagnostic techniques, and the growing geriatric population across Europe. Additionally, the preference for radiation-free imaging and technological advancements in portable and point-of-care ultrasound devices continue to boost market adoption.

Europe Ultrasound Imaging Market Analysis

- Ultrasound imaging devices are essential for various diagnostic and therapeutic procedures, providing high-resolution images of internal organs. They are widely used in applications like obstetrics, cardiology, and musculoskeletal diagnostics.

- The demand for ultrasound imaging is primarily driven by the increasing prevalence of chronic diseases and advancements in imaging technology.

- Germany is expected to dominate the ultrasound imaging market due to its advanced healthcare infrastructure, high healthcare expenditure, and early adoption of medical innovations.

- The U.K is expected to be the fastest growing market during the forecast period, driven by expanding healthcare access and rising awareness.

- The Cart/Trolley-based segment is expected to lead the market with a share of 40.22%, driven by the increasing use of ultrasound in prenatal care and fetal monitoring.

Report Scope Ultrasound Imaging Market Segmentation

|

Attributes |

Ultrasound Imaging Key Market Insights |

|

Segments Covered |

By Product: Cart/Trolley-based, Compact/Portable |

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ultrasound Imaging Market Trends

“Integration of Smart Technology and AI-Driven Health Insights”

- A key trend is the rising adoption of portable and handheld ultrasound devices, especially in emergency and rural care settings. These devices enable faster diagnostics with improved mobility.

For instance,

U.K. hospitals have increasingly adopted handheld ultrasound scanners to enhance diagnostic efficiency. These devices reduce waiting times in emergency departments and enable quick bedside assessments. Their portability allows clinicians to perform real-time imaging in critical care settings, improving patient outcomes and streamlining workflows across various departments, including emergency medicine and intensive care units.

- Integration of artificial intelligence into ultrasound systems allows for real-time image optimization, automatic measurements, and enhanced diagnostic precision, improving patient outcomes and clinical workflows.

Ultrasound Imaging Market Dynamics

Driver

“Technological Advancements of Ultra sound”

- AI algorithms are enabling ultrasound devices to analyze images quickly and with greater accuracy, reducing the time healthcare providers spend on diagnostics.

- Compact, handheld ultrasound systems are allowing healthcare providers to perform diagnostic imaging in a variety of settings, including emergency rooms, remote areas, and home care environments.

- For instance, handheld ultrasound devices with AI-powered imaging, such as those developed by Butterfly Network, enable quick, high-quality diagnostics in emergency rooms and remote settings. These devices offer cloud connectivity for seamless data sharing, improving collaboration among healthcare professionals and enhancing patient care through more accurate, accessible diagnostics.

- Ultrasound devices with cloud connectivity enable remote data storage and easy sharing of patient information, enhancing collaboration among healthcare professionals and improving patient care outcomes.

- Technological improvements in imaging sensors and software are significantly enhancing the resolution and clarity of ultrasound images, leading to better diagnostics and treatment planning.

Opportunity

“Portable Ultrasound Devices”

- The growing need for portable ultrasound devices in emergency medical services (EMS) allows manufacturers to tap into markets requiring compact, high-performance equipment for on-site diagnostics in remote or rural areas.

- In-home healthcare services are expanding, creating demand for portable ultrasound devices that allow patients to receive care outside of clinical settings, offering convenience and reducing hospital visits.

- In rural areas where access to traditional healthcare facilities is limited, portable ultrasound devices are increasingly used by EMS teams to provide quick diagnostics. These devices enable early detection of conditions like cardiac abnormalities or pregnancy complications, improving patient outcomes while reducing the need for hospital visits.

- The rising prevalence of chronic diseases such as cardiovascular and diabetes-related complications is driving the need for accessible ultrasound devices in primary care and remote monitoring applications.

- Regulatory approval of portable ultrasound devices is improving, which creates opportunities for manufacturers to expand their product lines with devices that meet health standards and cater to various patient needs.

Restraint/Challenge

“High Cost of Advanced Systems”

- Smaller clinics and rural hospitals may struggle to justify the high upfront cost of advanced ultrasound systems, limiting their ability to offer cutting-edge diagnostic capabilities.

- Budget constraints in lower-income healthcare settings result in delayed equipment upgrades, limiting access to newer, more efficient ultrasound technology for patients in need of timely care.

- In rural clinics and small hospitals, the high cost of advanced ultrasound systems can restrict access to the latest technology. For instance, a clinic in a remote area may struggle to afford the upfront cost of cutting-edge ultrasound equipment, impacting its ability to offer accurate and timely diagnostics to patients.

- High maintenance and operational costs associated with advanced systems may further discourage adoption in non-urban and smaller healthcare facilities, which prioritize more cost-effective solutions.

- The steep price point may create barriers for healthcare providers in emerging markets, where affordability is a major consideration in medical equipment procurement.

Ultrasound Imaging Market Scope

The market is segmented on the basis, three notable segments based on By Product, Technology, Application End User.

|

Segmentation |

Sub-Segmentation |

|

Product |

|

|

Technology |

|

|

Application |

|

|

End User |

|

In 2025, the Cart/Trolley-based is projected to dominate the market with a largest share in the product segment

The Cart/Trolley-based segment is expected to lead the Europe Ultrasound Imaging Devices Market with the largest share of 41.42% in 2025. This dominance is attributed to their advanced imaging capabilities, higher processing power, and suitability for comprehensive diagnostics in hospitals. They are widely used in cardiology, radiology, and obstetric applications.

The Radiology/General Imaging Health is expected to account for the largest share during the forecast period in Application market

In 2025, the Radiology/General Imaging segment is expected to dominate the Europe Ultrasound Imaging Devices Market with the largest market share of 41.11%, driven by the growing demand for non-invasive diagnostic imaging across diverse clinical applications. The segment benefits from technological advancements in 3D/4D imaging, widespread adoption in outpatient settings, and increased use in early disease detection. Additionally, rising geriatric populations and chronic disease prevalence further boost utilization across healthcare facilities.

Ultrasound Imaging Market Regional Analysis

“U.K. is the Dominant Country in the Ultrasound Imaging Market”

- The U.K dominates the Europe Ultrasound Imaging Market, accounting for the largest share due to its advanced healthcare infrastructure, high healthcare expenditure, and early adoption of medical innovations, particularly in health monitoring technologies.

- The growing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and hypertension, alongside a large aging population, is driving the demand for digital health devices that enable remote monitoring and early diagnosis in both clinical and homecare settings.

- Major players like Fitbit, Apple, and Medtronic are headquartered in the U.K., offering a broad range of FDA-approved wearable devices and health tracking solutions designed to meet the needs of diverse patient groups.

- Government initiatives aimed at enhancing healthcare access, promoting preventive care, and implementing favorable reimbursement policies further solidify the U.K.'s leadership in the Europen Ultrasound Imaging Market.

“Germany is Projected to Register the Highest Growth Rate”

- Germany is expected to register the fastest growth in the Europe Ultrasound Imaging Market, driven by its publicly funded healthcare system and an increasing focus on chronic disease prevention and remote patient monitoring solutions.

- The rise in government investments in managing chronic conditions like diabetes, hypertension, and obesity, coupled with an aging population, is fueling the demand for home-based Ultrasound Imaging.

- The expansion of multidisciplinary healthcare clinics, rehabilitation centers, and home healthcare services is further propelling the need for accessible, cost-effective health monitoring solutions tailored to diverse patient needs.

- Collaborative efforts between provincial health authorities, patient advocacy groups, and research institutions are fostering innovation and broadening the availability of advanced digital health monitoring technologies across Germany.

Ultrasound Imaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- GE HealthCare (U.S.)

- Siemens Healthineers (Germany)

- Philips Healthcare (Netherlands)

- Canon Medical Systems Corporation (Japan)

- Samsung Medison Co., Ltd. (South Korea)

- Fujifilm Holdings Corporation (Japan)

- Mindray Medical International Limited (China)

- Hitachi Ltd. (Japan)

- Esaote SpA (Italy)

- Butterfly Network, Inc. (U.S.)

Latest Developments in Europe Ultrasound Imaging Market

- A20 ultrasound system at the European Congress of Radiology (ECR) 2025. This advanced system features Acoustic Intelligence Technology, enhancing image clarity and diagnostic precision. The Resona A20 is designed to improve workflow efficiency and support a wide range of clinical applications, including obstetrics, cardiology, and general imaging, thereby addressing the growing demand for high-performance ultrasound solutions across European healthcare settings.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.