Europe Waterproofing Membrane Market

Market Size in USD Billion

CAGR :

%

USD

27.10 Billion

USD

46.74 Billion

2025

2033

USD

27.10 Billion

USD

46.74 Billion

2025

2033

| 2026 –2033 | |

| USD 27.10 Billion | |

| USD 46.74 Billion | |

|

|

|

|

Europe Waterproofing Membrane Market Size

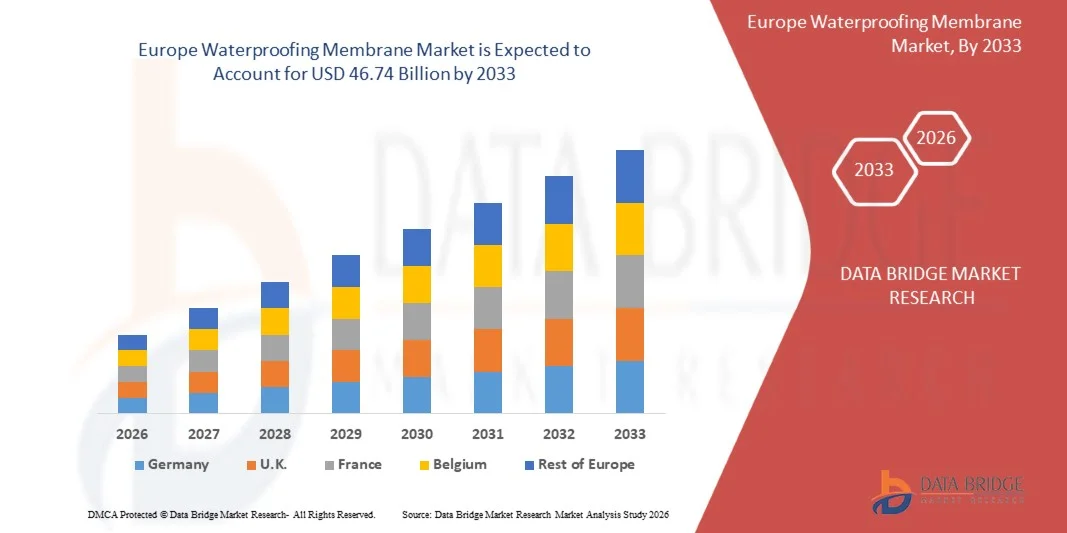

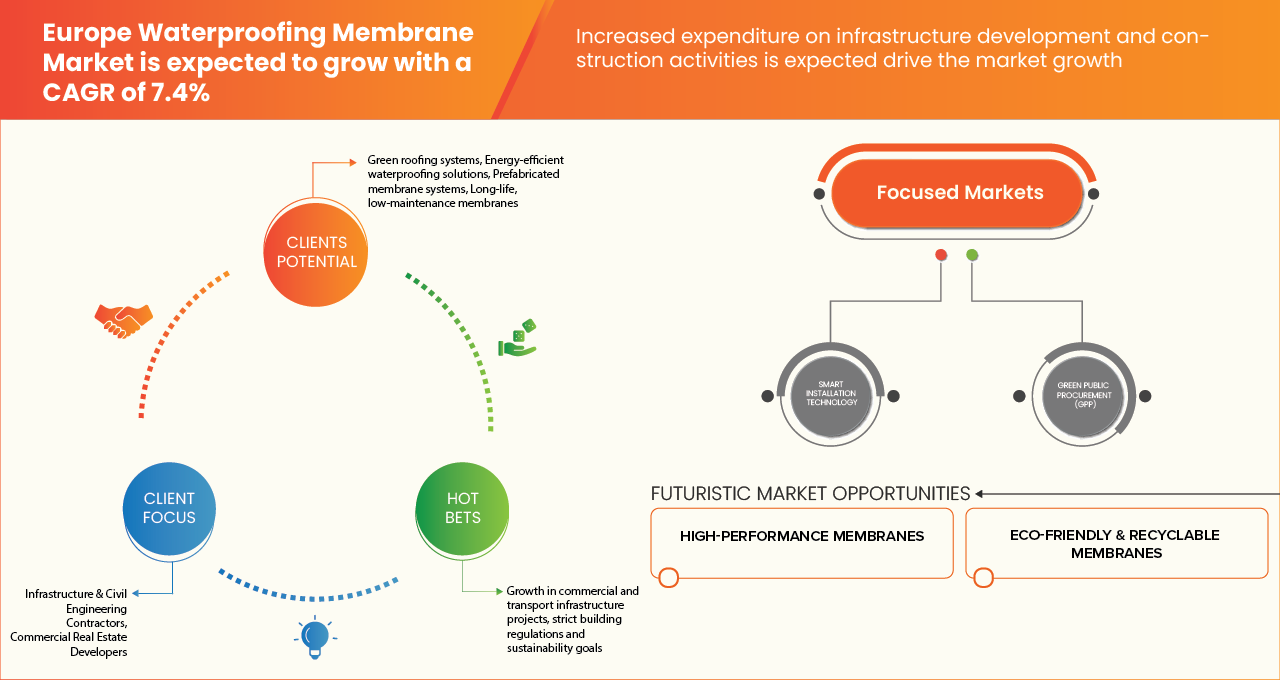

- The Europe Waterproofing Membrane Market size was valued at USD 27.10 Billion in 2025 and is expected to reach USD 46.74 Billion by 2033, at a CAGR of 7.4% during the forecast period

- The waterproofing membrane is a layer of water-tight material such as bitumen, polymer, and others applied on a surface to prevent water leaks or damage. Waterproofing membranes provide valuable protection against condensation and climatic conditions.

Europe Waterproofing Membrane Market Analysis

- The Europe Waterproofing Membrane Market represents a critical segment within the global construction and infrastructure landscape, supporting applications across residential buildings, commercial structures, industrial facilities, tunnels, bridges, landfills, and water-retaining structures. Waterproofing membranes are designed to prevent water ingress, enhance structural durability, and protect assets from moisture-related degradation.

- Market growth is driven by rapid urbanization, rising infrastructure investments, and increasing awareness of long-term building protection. Stricter building codes, climate change–induced rainfall variability, and the need to extend the service life of aging infrastructure are accelerating adoption of advanced waterproofing solutions across new construction and refurbishment projects.

- The building & construction sector is expected to remain the dominant end-use segment within the Europe Waterproofing Membrane Market, supported by strong demand from roofing, basements, foundations, and wet areas. Developers and asset owners benefit from membranes’ ability to reduce maintenance costs, prevent structural damage, and improve overall building performance.

- Germany is dominating the market share 15.52% in 2026, supported by renovation of aging buildings, stringent energy-efficiency regulations, and strong adoption of high-performance waterproofing systems. Countries such as Germany are expected to lead in market value, while Eastern European markets are anticipated to witness faster growth due to infrastructure expansion and public investment programs.

- The Bituminous Waterproofing Membrane segment is anticipated to hold the largest market share 21.69% by 2026 due to its cost-effectiveness, proven performance, ease of installation, and wide availability. These membranes are extensively used in roofing, foundations, and underground structures, making them a preferred choice across residential, commercial, and industrial applications.

Report Scope and Europe Waterproofing Membrane Market Segmentation

|

Attributes |

Europe Waterproofing Membrane Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Europe Waterproofing Membrane Market Trends

“Emphasis On Water Conservation and Wastewater Treatment from Various Governments”

- Waste conservation and wastewater management are the major challenges faced by the government in tackling water shortage and water supply in urban areas. Wastewater, if not treated properly, is the main source of water pollution.

- Since the adaptation of wastewater treatment, the quality of European rivers, lakes and seas has greatly improved. European Union countries have set up challenge systems and wastewater treatment plants with the bits of help of European Union funding. There has been a high level of compliance with the directive across the European Union, with 98% of the wastewater collected and 92% satisfactorily treated.

For instance,

- In February 2022, Design Build Network reported that the project name Osijek Wastewater Treatment Plants- USD 95 million. The project involved the construction of a wastewater plant with the capacity to treat 40,000 cubic meters of water every day, which will serve 170,000 people in Osijek, Croatia. The construction work started in 2021 and is expected to be completed in 2024. The purpose of this project is to enhance the purity of water available in Osijek and to improve the health standard of the people due to the health issues faced by the people due to impure water

- With government involvement and interest in making and maintaining a sustainable environment and making our earth a greener place, wastewater treatment is one of the focuses to achieve this task.

Europe Waterproofing Membrane Market Dynamics

Driver

“Increased Expenditure on Infrastructure Development and Construction Activities”

- The Infrastructure and building are the main commodities that sustain modern human civilization with rapid urbanization development and better personal economic development of people. With the larger population of people moving into the cities, there is a greater demand for quality infrastructure and buildings.

- The increase in infrastructure expenditure includes the creation of huge demand for private and public sector infrastructure developments. The requirement for high-performance materials that are strong, durable and versatile, thus the demand for waterproofing membranes, is increasing for infrastructure development.

For instance,

- In September 2020, Kyrpton Chemicals launched its new waterproofing membranes IMPERMAX B 1K, which is made of one component of polyurethane-bitumen resin. With thixotropy and excellent mechanical properties, it is specially designed for the execution of difficult details and finishes in waterproofing projects in construction and infrastructure buildings

- In March 2025, as per Global Construction Review, the European Investment Bank (EIB) committed €2 billion (USD 2.25) under the EU’s €50 billion (USD 56.34) Ukraine Facility (2024–2027) to support Ukraine’s recovery through key infrastructure projects spanning energy, transport, housing, water systems, and social facilities. This large-scale reconstruction effort is expected to boost demand for construction materials across Europe, as waterproofing solutions are vital for protecting and extending the lifespan of critical structures such as roads, buildings, and utility systems

- In addition, waterproofing has currently seen a significant increase in the construction industry as people expect buildings to last longer. Extensive waterproofing measures are added during construction to provide moisture control to the building. Still, waterproofing can also be done after construction or as part of a building improvement or renovation.

Opportunity

“Growing Interest in Eco-Friendly and New Materials in Waterproofing Membranes”

- New research found that people are driving more to more sustainable and eco-friendly products in both developed and developing countries. In a survey, 66% of all respondents and 77% of millennial respondents said they consider sustainability when making a purchase.

- Increasing demand for eco-friendly and the launching of new products of new advanced materials will attract more customers in the market, and it is expected to be an opportunity for the players involved in this industry to increase R&D for new products and grow their business and increase their overall revenue in the coming forecast periods. This increase in the eco-friendly and new materials in waterproofing membranes is expected to create an opportunity for the market.

For instance,

- According to Alchimica Building Chemicals Ltd, sustainable waterproofing plays a crucial role in ensuring durable, energy-efficient, and eco-friendly construction. The industry is increasingly shifting towards solvent-free, low-VOC alternatives that not only minimize environmental impact but also offer high performance. These innovations in waterproofing solutions are enhancing building longevity and energy efficiency and reducing carbon footprints, aligning with the growing demand for eco-friendly materials in the market. As construction companies prioritize sustainability, the market is witnessing a rise in the adoption of low-VOC, solvent-free products

- In March 2022, according to the article published by Building and Facilities News, Ecofin PU is a sustainable, durable, and eco-friendly waterproofing solution designed for various applications, including flat roofs and walkway decks. With a lifespan of over 25 years and BBA accreditation, Ecofin PU offers cost-effective, high-performance weatherproofing produced under strict quality control standards. This product, benefiting from moisture-triggered curing and extended warranties for approved installers, underscores the growing interest in eco-friendly, long-lasting materials in the waterproofing sector. As demand for sustainable construction increases, Ecofin PU aligns with the market’s shift towards innovative, environmentally-conscious solutions, presenting an opportunity for market growth

The growing shift towards sustainability and eco-friendly products, particularly among younger generations, is significantly influencing the Europe Waterproofing Membrane Market. Technological advancements have led to the development of innovative, eco-friendly waterproofing materials that prioritize environmental safety and health, offering non-toxic and low-impact solutions.

Restraint/Challenge

“Potential Health and Environmental Issues”

- Waterproofing protects land and properties from the impact of water and exciting liquid environments. Waterproofing membranes are made from materials such as polymers, bitumen imbitions and tars, which are ecologically unsafe and cause insignificant damage to the environment and significant health issues to the people.

- Waterproofing membrane products contain harmful chemicals that can be harmful to the soil and groundwater and are potentially poison to plants, animals and people. Long exposure to this product may cause some health issues and symptoms like skin irritation, headaches, nausea, vomiting, and dizziness. In severe cases, long exposure to these chemicals can lead to organ damage and even death.

For instance,

- In January 2022, a study by Guardian News & Media Limited revealed that nearly 75% of water- or stain-resistant consumer products contain toxic PFAS chemicals, which are linked to serious health risks such as cancer, birth defects, and liver disease. The presence of these harmful substances in waterproofing membranes is raising significant health and environmental concerns across Europe, leading to heightened regulatory scrutiny and growing consumer resistance. This shift may restrain market growth by compelling manufacturers to invest in safer alternatives, thereby increasing R&D costs and limiting the use of conventional chemical-based solutions

Waterproofing membranes play a vital role in protecting infrastructure from water damage, their composition poses serious environmental and health risks. The use of hazardous chemicals such as bitumen, naphthenic oils, and synthetic polymers not only contaminates soil and groundwater but also endangers human and animal health through prolonged exposure

Europe Waterproofing Membrane Market Scope

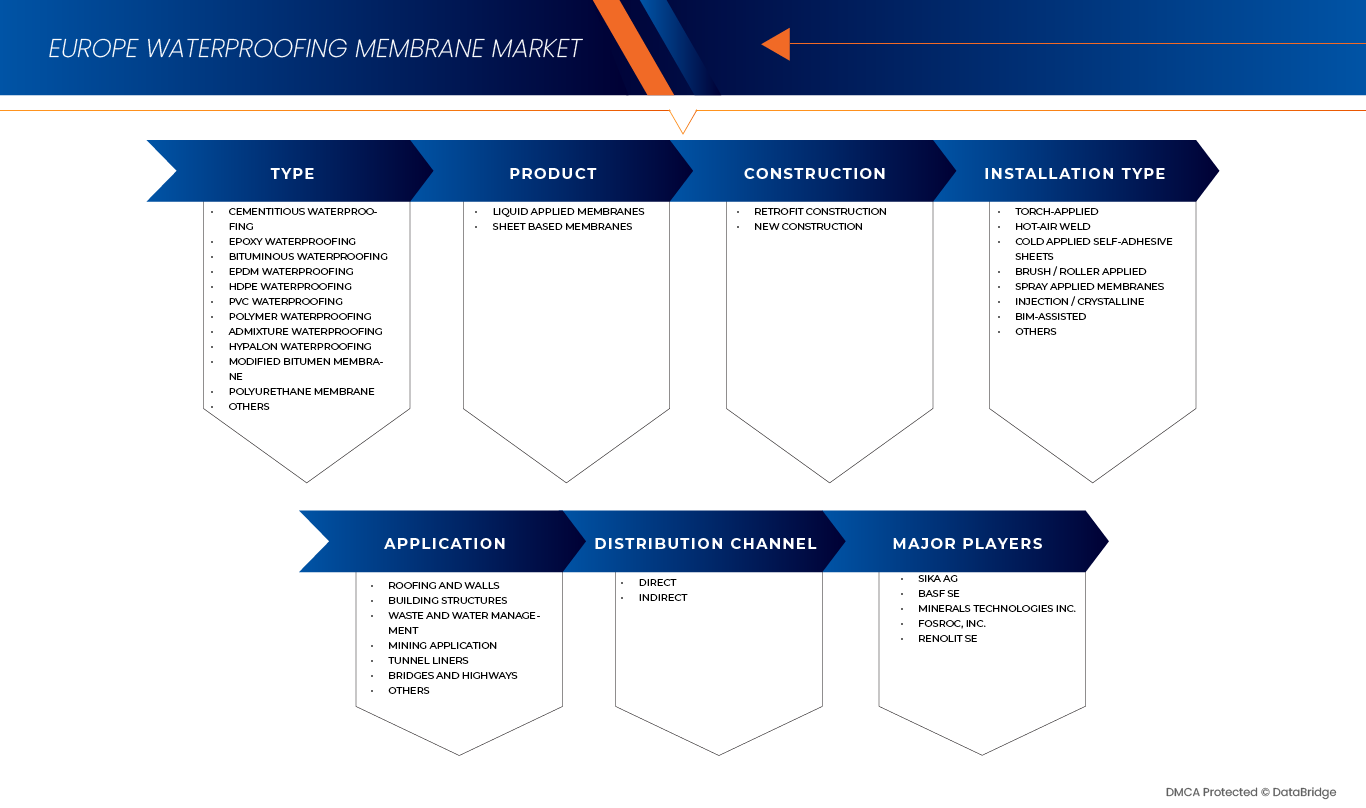

The Europe Waterproofing Membrane Market is segmented into six notable segments based on type, product, construction, installation type, application, distribution channel

• By Type

On the basis of type, the Europe Waterproofing Membrane Market is segmented into Cementitious Waterproofing, Epoxy Waterproofing, Bituminous Waterproofing, EPDM Waterproofing, HDPE Waterproofing, PVC Waterproofing, Polymer Waterproofing, Admixture Waterproofing, Hypalon Waterproofing, Modified Bitumen Membrane, Polyurethane Membrane, Others. In 2026, Bituminous Waterproofing segment is expected to dominate the market share 21.69% Europe Waterproofing Membrane Market because of its unique properties, such as high resistance to weathering and aging. It increases product viability in terms of flexibility at low temperatures, high UV resistance properties, and improved flow resistance at high temperatures.

Polyurethane Membrane and it is anticipated to show the fastest growth during the forecast period. Polyurethane membranes are gaining traction in Europe due to their superior flexibility, crack-bridging ability, and strong adhesion to complex substrates. Their suitability for roofs, balconies, and parking decks, combined with long service life, supports increasing adoption in refurbishment and new construction.

• By product

On the basis of Product, the Europe Waterproofing Membrane Market is segmented into Liquid Applied Membranes, Sheet Based Membranes. In 2026, liquid-applied membranes segment is expected to dominate the market share 58.90% and it is anticipated to show the fastest growth during the forecast periodEurope Waterproofing Membrane Market due to growing awareness of the advantages of the product, such as cost-effectiveness and ease of installation.

• By Installation Type

On the basis of Installation Type, the Europe Waterproofing Membrane Market is segmented into Torch-Applied, Hot-Air Weld, Cold Applied Self-Adhesive Sheets, Brush / Roller Applied, Spray Applied Membranes, Injection / Crystalline, Bim-Assisted, Others. In 2026, Torch-Applied segment is expected to dominate the market share 26.09%. is driven by durability, strong adhesion, and proven performance in flat roofing, along with widespread renovation activity and demand for cost-effective waterproofing solutions.

BIM-ASSISTED and it is anticipated to show the fastest growth during the forecast period. BIM-assisted waterproofing is driving market growth by enabling precise material estimation, clash detection, and lifecycle performance modeling. Increasing BIM mandates in public construction projects across Europe enhance design accuracy, reduce installation errors, and improve long-term waterproofing system reliability.

• By Construction

On the basis of construction, the Europe Waterproofing Membrane Market is segmented into Retrofit Construction, New Construction. In 2025, Retrofit Construction segment is expected to dominate the market share 57.39% and it is anticipated to show the fastest growth during the forecast period. Retrofit construction is a major growth driver for the Europe Waterproofing Membrane Market, fueled by aging building stock, stricter building safety regulations, and rising lifecycle maintenance costs. Increasing incidents of water leakage, structural deterioration, and energy inefficiency are pushing property owners to upgrade existing roofs, basements, and façades. Additionally, climate change–driven extreme rainfall and urban flooding are accelerating demand for high-performance waterproofing solutions in renovation and rehabilitation projects across residential, commercial, and public infrastructure assets.

• By Application

On the basis of Application, the Europe Waterproofing Membrane Market is segmented into roofing and walls, building structures, waste and water management, mining applications, tunnel liners, bridges and highways, and others. In 2025, roofing and walls segment is expected to dominate the market share 34.76% and it is anticipated to show the fastest growth during the forecast period. Europe Waterproofing Membrane Market because of high exposure to rainwater and environmental moisture on the roofs and walls.

• By Distribution Channel

On the basis of Distribution Channel, the Europe Waterproofing Membrane Market is segmented into Direct, Indirect. In 2025, Indirect segment is expected to dominate the 68.56% and it is anticipated to show the fastest growth during the forecast period. Growth in the indirect segment is driven by rising renovation activities, distributor-led sales networks, contractor partnerships, and increasing demand for value-added waterproofing solutions across residential and commercial construction projects.

Europe Waterproofing Membrane Market Regional Analysis

- Germany dominates the Europe Waterproofing Membrane Market with the largest revenue share of 15.52% in 2026, Germany is Projected to Register the Highest CAGR in the Europe Waterproofing Membrane Market.

- Germany dominates the market due to its advanced construction infrastructure, widespread adoption of waterproofing membranes, and presence of leading vendors like Sika AG, Soprema Group, and BASF SE. Germany holds a significant share, driven by high demand for waterproofing membranes in commercial and residential construction, robust R&D investments in polymer-based materials, and stringent EU building regulations. The region benefits from significant advancements in eco-friendly and high-performance membrane technologies, such as TPO and polyurethane, enhancing durability and sustainability in construction projects.

U.K. Soil Health Market Insight

In the U.K. the Europe Waterproofing Membrane Market is driven by large-scale refurbishment of aging buildings, urban redevelopment, and stringent building safety standards. Rising investments in residential housing, infrastructure upgrades, and commercial roofing projects, combined with increased focus on damp-proofing and flood-resistant construction, continue to support market growth.

Italy Soil Health Market Insight

Italy’s Europe Waterproofing Membrane Market is driven by extensive renovation of historic and aging structures, particularly in urban areas. Government incentives for building restoration and energy-efficient upgrades, along with increasing use of membranes in roofing, balconies, and basements, are boosting demand. Infrastructure maintenance and seismic retrofitting further support steady market expansion.

France Soil Health Market Insight

France’s Europe Waterproofing Membrane Market is driven by strong government emphasis on sustainable construction, renovation of residential buildings, and energy-efficiency compliance. Rising demand for green roofs, underground waterproofing, and durable roofing membranes is supporting growth. Infrastructure projects and strict building codes related to moisture control further enhance membrane adoption across end-use sectors.

Spain Soil Health Market Insight

In Spain, the Europe Waterproofing Membrane Market is supported by growing residential construction, tourism-driven commercial development, and infrastructure modernization. The country’s warm climate increases exposure to UV radiation and moisture stress, driving demand for durable roofing and terrace waterproofing solutions. Public investment in transport and urban infrastructure also contributes to market growth.

Switzerland Soil Health Market Insight

In Switzerland, the Europe Waterproofing Membrane Market benefits from high construction quality standards, increased renovation of residential and commercial buildings, and demand for long-lasting building materials. Extreme weather conditions, including heavy rainfall and snow, drive the use of advanced waterproofing systems in roofing, tunnels, and foundations, supporting consistent market demand.

Europe Waterproofing Membrane Market Share

The Europe Waterproofing Membrane Market is primarily led by well-established companies, including:

- Sika AG (Switzerland)

- BASF (Germany)

- Minerals Technologies Inc. (U.S.)

- Fosroc, Inc. (UAE)

- Renolit SE (Germany)

- Bauder Ltd. (U.K.)

- Bermüller & CO GmbH (Germany)

- Juta LTD (Czech Republic)

- Nophadrain BV (Netherlands)

- Rawell Environmental (U.K.)

- Schluter Systems Ltd. (U.K.)

- Soprema (France)

- MAPEI (Italy)

- Polyflex Geomembrane (Netherlands)

- Tremco (U.S.)

- IKO EUROPE (Belgium)

- ARDEX GMBH (Germany)

- IZOTEX - Waterproofing & Membranes (Poland)

- Kingspan Group (Ireland)

Latest Developments in Europe Waterproofing Membrane Market

- In March 2025, Sika AG and BASF launched Baxxodur EC 151, a new epoxy hardener for sustainable construction applications. The product offered low emissions, quick curing at low temperatures, and excellent flow properties. It reduced VOCs by up to 90% and minimized the need for thinners. The hardener enabled durable, high-gloss flooring with better color stability and lower maintenance. Through this launch, BASF and Sika strengthened their positions as leaders in sustainable construction solutions and supported customers efficiency and environmental goals.

- In March 2025, Sika AG fully acquired HPS North America, a supplier of building finishing materials and distributor of Schonox products in the U.S. market. The move strengthened Sika’s position in the growing building finishing segment and created a platform for further expansion. HPS had grown steadily in sales and profitability, especially in flooring applications. With full ownership, Sika aimed to boost efficiency in logistics and production. This acquisition also opened new cross-selling opportunities and reinforced Sika’s U.S. market presence.

- In October 2022, Partners for Environmental Progress (PEP) awarded the BASF SE's facility in McIntosh, Alabama, and a 2022 Environmental Stewardship Award for the site's production of light stabilizers. They worked to enhance the durability of plastics, coatings and membranes for automotive and construction materials applications. This has enhanced the company's reputation in the global market.

- In November 2022, Fosroc, Inc. recently introduced Polyurea WH 100, a product that gives many benefits to a wide range of roof waterproofing applications. Its hand-applied application makes it very easy to install, which is especially beneficial in flat roof applications. The new launch will target new markets, increase market share, sell more and increase revenue streams for the company.

- In May 2020, RENOLIT SE developed the new product RENOLIT ALKORSMART, which is now being marketed with the Smart3 campaign. This new product launch will enhance the company's product portfolio and create momentum and industry recognition for the company.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE WATERPROOFING MEMBRANE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE TIMELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL:

4.2.2 ECONOMIC:

4.2.3 SOCIAL:

4.2.4 TECHNOLOGICAL:

4.2.5 LEGAL:

4.2.6 ENVIRONMENTAL:

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.3.5 CONCLUSION

4.4 IMPORT DATA SETS

4.4.1 EXPORT DATA SETS

4.5 PRICING ANALYSIS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT

4.6.2 MANUFACTURING AND PACKING

4.6.3 MARKETING AND DISTRIBUTION

4.6.4 END USERS

4.7 PRODUCTION CAPACITY OVERVIEW

4.8 RAW MATERIAL PRODUCTION COVERAGE

4.8.1 BITUMEN

4.9 POLYMERS

4.1 POLYMER MODIFIED CEMENT

4.10.1 OTHERS

4.11 TARIFF & ITS IMPACT

4.12 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.13 VENDOR SELECTION CRITERIA

5 EUROPE WATERPROOFING MEMBRANE MARKET: REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED EXPENDITURE ON INFRASTRUCTURE DEVELOPMENT AND CONSTRUCTION ACTIVITIES

6.1.2 GROWING DEMAND FOR WATERPROOFING MEMBRANES FROM THE WASTE AND WATER MANAGEMENT SECTOR

6.1.3 THE APPLICATION OF WATERPROOFING MEMBRANES REDUCES MAINTENANCE COSTS AND INCREASES PROPERTY VALUE

6.1.4 ADVANCEMENTS IN MEMBRANE TECHNOLOGIES DRIVING ADOPTION ACROSS VARIOUS SECTORS

6.2 RESTRAINTS

6.2.1 POTENTIAL HEALTH AND ENVIRONMENTAL ISSUES

6.2.2 LACK OF DEVELOPMENT AND PREPARATION OF SUPERIOR-QUALITY SUBSTRATE

6.3 OPPORTUNITIES

6.3.1 GROWING INTEREST IN ECO-FRIENDLY AND NEW MATERIALS IN WATERPROOFING MEMBRANES

6.3.2 EMPHASIS ON WATER CONSERVATION AND WASTEWATER TREATMENT FROM VARIOUS GOVERNMENTS

6.3.3 STRATEGIC PARTNERSHIPS AND ACQUISITIONS OF MARKET PLAYERS

6.4 CHALLENGES

6.4.1 DEFICIENCY IN DETAILING AND IMPROPER INSTALLATION OF WATERPROOFING MEMBRANES

6.4.2 FLUCTUATIONS IN RAW MATERIAL PRICING

7 EUROPE WATERPROOFING MEMBRANE MARKET, BY TYPE

7.1 OVERVIEW

7.2 CEMENTITIOUS WATERPROOFING

7.3 EPOXY WATERPROOFING

7.4 BITUMINOUS WATERPROOFING

7.5 EPDM WATERPROOFING

7.6 HDPE WATERPROOFING

7.7 PVC WATERPROOFING

7.8 POLYMER WATERPROOFING

7.9 ADMIXTURE WATERPROOFING

7.1 HYPALON WATERPROOFING

7.11 MODIFIED BITUMEN MEMBRANE

7.12 POLYURETHANE MEMBRANE

7.13 OTHERS

7.14 EUROPE WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

7.14.1 CEMENTITIOUS WATERPROOFING

7.14.2 EPOXY WATERPROOFING

7.14.3 BITUMINOUS WATERPROOFING

7.14.4 EPDM WATERPROOFING

7.14.5 HDPE WATERPROOFING

7.14.6 PVC WATERPROOFING

7.14.7 POLYMER WATERPROOFING

7.14.8 ADMIXTURE WATERPROOFING

7.14.9 HYPALON WATERPROOFING

7.14.10 MODIFIED BITUMEN MEMBRANE

7.14.11 POLYURETHANE MEMBRANE

7.14.12 OTHERS

7.15 EUROPE BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

7.15.1 POLYMER-MODIFIED BITUMEN MEMBRANE

7.15.2 SELF-ADHESIVE MODIFIED BITUMINOUS MEMBRANE

7.16 EUROPE WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

7.16.1 POLYMER-MODIFIED BITUMEN MEMBRANE

7.16.2 SELF-ADHESIVE MODIFIED BITUMINOUS MEMBRANE

8 EUROPE WATERPROOFING MEMBRANE MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 LIQUID APPLIED MEMBRANES

8.3 SHEET BASED MEMBRANES

9 EUROPE WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION

9.1 OVERVIEW

9.2 RETROFIT CONSTRUCTION

9.3 NEW CONSTRUCTION

10 EUROPE WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE

10.1 OVERVIEW

10.2 TORCH-APPLIED

10.3 HOT-AIR WELD

10.4 COLD APPLIED SELF-ADHESIVE SHEETS

10.5 BRUSH / ROLLER APPLIED

10.6 SPRAY APPLIED MEMBRANES

10.7 INJECTION / CRYSTALLINE

10.8 BIM-ASSISTED

10.9 OTHERS

11 EUROPE WATERPROOFING MEMBRANE MARKET, BY APPLICATION

11.1 OVERVIEW

11.1.1 ROOFING AND WALLS

11.1.2 BUILDING STRUCTURES

11.1.3 WASTE AND WATER MANAGEMENT

11.1.4 MINING APPLICATION

11.1.5 TUNNEL LINERS

11.1.6 BRIDGES AND HIGHWAYS

11.1.7 OTHERS

11.2 EUROPE ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

11.2.1 FLAT ROOFS

11.2.2 PITCHED ROOFS

11.2.3 GREEN ROOFS

11.2.4 FACADE CLADDING

11.2.5 PARAPET DETAILING

11.2.6 CURTAIN WALLS

11.2.7 OTHERS

11.3 EUROPE ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

11.3.1 BITUMINOUS WATERPROOFING

11.3.2 EPDM WATERPROOFING

11.3.3 PVC WATERPROOFING

11.3.4 POLYMER WATERPROOFING

11.3.5 HYPALON WATERPROOFING

11.3.6 MODIFIED BITUMEN MEMBRANE

11.3.7 POLYURETHANE MEMBRANE

11.3.8 OTHERS

11.4 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

11.4.1 RESIDENTIAL

11.4.2 COMMERCIAL

11.5 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

11.5.1 SINGLE HOUSING

11.5.2 MULTI-FAMILY BLOCKS

11.5.3 APARTMENTS TOWERS

11.5.4 VILLAS & BUNGALOWS

11.5.5 AFFORDABLE HOUSING

11.5.6 LUXURY RESIDENCES

11.5.7 OTHERS

11.6 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

11.6.1 OFFICE COMPLEXES

11.6.2 RETAIL MALLS

11.6.3 HOTELS RESORTS

11.6.4 EDUCATIONAL INSTITUTIONS

11.6.5 HEALTHCARE FACILITIES

11.6.6 INDUSTRIAL PLANTS

11.6.7 OTHERS

11.7 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

11.7.1 CEMENTITIOUS WATERPROOFING

11.7.2 EPOXY WATERPROOFING

11.7.3 BITUMINOUS WATERPROOFING

11.7.4 EPDM WATERPROOFING

11.7.5 PVC WATERPROOFING

11.7.6 POLYMER WATERPROOFING

11.7.7 ADMIXTURE WATERPROOFING

11.7.8 HYPALON WATERPROOFING

11.7.9 MODIFIED BITUMEN MEMBRANE

11.7.10 POLYURETHANE MEMBRANE

11.7.11 OTHERS

11.8 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

11.8.1 WASTE MANAGEMENT

11.8.2 WATER MANAGEMENT

11.9 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

11.9.1 LANDFILLS LINING

11.9.2 HAZARDOUS WASTE CELLS

11.9.3 LEACHATE PONDS

11.9.4 WASTE LAGOONS

11.9.5 COMPOSTING FACILITIES

11.9.6 INCINERATION PLANTS

11.9.7 OTHERS

11.1 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

11.10.1 DAMS RESERVOIRS

11.10.2 WATER TANKS

11.10.3 SEWAGE PLANTS

11.10.4 DRAINAGE CANALS

11.10.5 DESALINATION UNITS

11.10.6 IRRIGATION CHANNELS

11.10.7 OTHERS

11.11 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

11.11.1 CEMENTITIOUS WATERPROOFING

11.11.2 EPOXY WATERPROOFING

11.11.3 BITUMINOUS WATERPROOFING

11.11.4 EPDM WATERPROOFING

11.11.5 HDPE WATERPROOFING

11.11.6 PVC WATERPROOFING

11.11.7 POLYMER WATERPROOFING

11.11.8 ADMIXTURE WATERPROOFING

11.11.9 HYPALON WATERPROOFING

11.11.10 MODIFIED BITUMEN MEMBRANE

11.11.11 POLYURETHANE MEMBRANE

11.11.12 OTHERS

11.12 EUROPE MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

11.12.1 TAILINGS PONDS

11.12.2 HEAP LEACH PADS

11.12.3 SLURRY PONDS

11.12.4 UNDERGROUND SHAFTS

11.12.5 PROCESSING PLANTS

11.12.6 MINE DRAINAGE

11.12.7 OTHERS

11.13 EUROPE MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

11.13.1 CEMENTITIOUS WATERPROOFING

11.13.2 EPOXY WATERPROOFING

11.13.3 BITUMINOUS WATERPROOFING

11.13.4 EPDM WATERPROOFING

11.13.5 HDPE WATERPROOFING

11.13.6 PVC WATERPROOFING

11.13.7 POLYMER WATERPROOFING

11.13.8 ADMIXTURE WATERPROOFING

11.13.9 HYPALON WATERPROOFING

11.13.10 MODIFIED BITUMEN MEMBRANE

11.13.11 POLYURETHANE MEMBRANE

11.13.12 OTHERS

11.14 EUROPE TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

11.14.1 SUBWAY TUNNELS

11.14.2 RAIL TUNNELS

11.14.3 ROAD TUNNELS

11.14.4 UTILITY TUNNELS

11.14.5 METRO STATIONS

11.14.6 STORMWATER TUNNELS

11.14.7 OTHERS

11.15 EUROPE TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

11.15.1 CEMENTITIOUS WATERPROOFING

11.15.2 EPOXY WATERPROOFING

11.15.3 BITUMINOUS WATERPROOFING

11.15.4 HDPE WATERPROOFING

11.15.5 PVC WATERPROOFING

11.15.6 POLYMER WATERPROOFING

11.15.7 ADMIXTURE WATERPROOFING

11.15.8 HYPALON WATERPROOFING

11.15.9 MODIFIED BITUMEN MEMBRANE

11.15.10 POLYURETHANE MEMBRANE

11.15.11 OTHERS

11.16 EUROPE BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

11.16.1 BRIDGE DECKS

11.16.2 EXPANSION JOINTS

11.16.3 FLYOVERS RAMPS

11.16.4 ROAD UNDERPASSES

11.16.5 PAVEMENT OVERLAYS

11.16.6 ELEVATED HIGHWAYS

11.16.7 OTHERS

11.17 EUROPE BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

11.17.1 CEMENTITIOUS WATERPROOFING

11.17.2 EPOXY WATERPROOFING

11.17.3 BITUMINOUS WATERPROOFING

11.17.4 EPDM WATERPROOFING

11.17.5 PVC WATERPROOFING

11.17.6 POLYMER WATERPROOFING

11.17.7 ADMIXTURE WATERPROOFING

11.17.8 HYPALON WATERPROOFING

11.17.9 MODIFIED BITUMEN MEMBRANE

11.17.10 POLYURETHANE MEMBRANE

11.17.11 OTHERS

12 EUROPE WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL

12.1 DIRECT

12.2 INDIRECT

12.3 EUROPE WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

12.3.1 DISTRIBUTORS & WHOLESALERS

12.3.2 RETAIL DEALERS & OUTLETS

12.3.3 BUILDERS MERCHANTS & SUPPLY STORES

12.3.4 ONLINE / E-COMMERCE PLATFORMS

12.3.5 SPECIALIZED APPLICATOR NETWORK

12.3.6 ARCHITECTURAL & CONSULTANT SPECIFICATIONS

12.3.7 OTHERS

13 EUROPE WATERPROOFING MEMBRANE MARKET BY COUNTRIES

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 ITALY

13.1.4 FRANCE

13.1.5 SPAIN

13.1.6 SWITZERLAND

13.1.7 RUSSIA

13.1.8 TURKEY

13.1.9 BELGIUM

13.1.10 NETHERLANDS

13.1.11 DENMARK

13.1.12 NORWAY

13.1.13 FINLAND

13.1.14 SWEDEN

13.1.15 POLAND

13.1.16 PORTUGAL

13.1.17 REST OF EUROPE

14 EUROPE WATERPROOFING MEMBRANE MARKET

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 SIKA AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 BASF

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT NEWS

16.3 MINERALS TECHNOLOGIES INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 SOLUTION PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 FOSROC, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENTS

16.5 RENOLIT SE

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS/NEWS

16.6 BAUDER LTD

16.6.1 COMPANY SNAPSHOT

16.6.2 SOLUTIONS PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 BERMÜLLER & CO GMBH

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 JUTA LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 NOPHADRAIN BV

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 RAWELL ENVIRONMENTAL

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 SCHLUTER SYSTEMS LTD. (UK SUBSIDIARY OF SCHLÜTER-SYSTEMS KG)

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 SOPREMA

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 MAPEI

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 POLYFLEX GEOMEMBRANE

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 TREMCO

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 IKO EUROPE

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 ARDEX GMBH

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATES

16.18 IZOTEX - WATERPROOFING & MEMBRANES

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT UPDATES

16.19 KINGSPAN GROUP

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT UPDATES

16.2 PAUL BAUDER GMBH & CO.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT UPDATES

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION CAPACITY OVERVIEW

TABLE 2 REGULATORY FRAMEWORK

TABLE 3 EUROPE WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 4 EUROPE WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 5 EUROPE BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 6 EUROPE WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 7 EUROPE WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 8 EUROPE WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 9 EUROPE WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 10 EUROPE WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 11 EUROPE ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 12 EUROPE ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 13 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 14 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 15 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 16 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 17 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 18 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 19 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 20 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 21 EUROPE MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 22 EUROPE MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 23 EUROPE TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 24 EUROPE TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 25 EUROPE BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 26 EUROPE BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 27 EUROPE WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 28 EUROPE WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 29 EUROPE WATERPROOFING MEMBRANE MARKET, BY COUNTRY, 2018-2033 (USD MILLION)

TABLE 30 EUROPE WATERPROOFING MEMBRANE MARKET, BY COUNTRY, 2018-2033 (MILLION SQUARE METERS)

TABLE 31 PRICE (USD/SQUARE METERS)

TABLE 32 EUROPE WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 33 EUROPE WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 34 EUROPE BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 35 EUROPE WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 36 EUROPE WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 37 EUROPE WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 38 EUROPE WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 39 EUROPE WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 40 EUROPE ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 41 EUROPE ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 42 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 43 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 44 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 45 EUROPE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 46 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 47 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 48 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 49 EUROPE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 50 EUROPE MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 51 EUROPE MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 52 EUROPE TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 53 EUROPE TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 54 EUROPE BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 55 EUROPE BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 56 EUROPE WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 57 EUROPE WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 58 GERMANY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 59 GERMANY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 60 GERMANY BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 61 GERMANY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 62 GERMANY WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 63 GERMANY WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 64 GERMANY WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 65 GERMANY WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 66 GERMANY ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 67 GERMANY ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 68 GERMANY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 69 GERMANY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 70 GERMANY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 71 GERMANY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 72 GERMANY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 73 GERMANY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 74 GERMANY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 75 GERMANY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 76 GERMANY MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 77 GERMANY MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 78 GERMANY TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 79 GERMANY TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 80 GERMANY BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 81 GERMANY BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 82 GERMANY WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 83 GERMANY WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 84 U.K. WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 85 U.K. WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 86 U.K. BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 87 U.K. WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 88 U.K. WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 89 U.K. WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 90 U.K. WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 91 U.K. WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 92 U.K. ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 93 U.K. ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 94 U.K. BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 95 U.K. BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 96 U.K. BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 97 U.K. BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 98 U.K. WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 99 U.K. WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 100 U.K. WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 101 U.K. WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 102 U.K. MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 103 U.K. MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 104 U.K. TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 105 U.K. TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 106 U.K. BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 107 U.K. BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 108 U.K. WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 109 U.K. WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 110 ITALY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 111 ITALY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 112 ITALY BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 113 ITALY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 114 ITALY WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 115 ITALY WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 116 ITALY WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 117 ITALY WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 118 ITALY ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 119 ITALY ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 120 ITALY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 121 ITALY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 122 ITALY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 123 ITALY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 124 ITALY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 125 ITALY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 126 ITALY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 127 ITALY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 128 ITALY MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 129 ITALY MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 130 ITALY TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 131 ITALY TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 132 ITALY BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 133 ITALY BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 134 ITALY WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 135 ITALY WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 136 FRANCE WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 137 FRANCE WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 138 FRANCE BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 139 FRANCE WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 140 FRANCE WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 141 FRANCE WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 142 FRANCE WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 143 FRANCE WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 144 FRANCE ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 145 FRANCE ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 146 FRANCE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 147 FRANCE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 148 FRANCE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 149 FRANCE BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 150 FRANCE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 151 FRANCE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 152 FRANCE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 153 FRANCE WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 154 FRANCE MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 155 FRANCE MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 156 FRANCE TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 157 FRANCE TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 158 FRANCE BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 159 FRANCE BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 160 FRANCE WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 161 FRANCE WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 162 SPAIN WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 163 SPAIN WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 164 SPAIN BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 165 SPAIN WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 166 SPAIN WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 167 SPAIN WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 168 SPAIN WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 169 SPAIN WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 170 SPAIN ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 171 SPAIN ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 172 SPAIN BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 173 SPAIN BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 174 SPAIN BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 175 SPAIN BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 176 SPAIN WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 177 SPAIN WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 178 SPAIN WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 179 SPAIN WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 180 SPAIN MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 181 SPAIN MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 182 SPAIN TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 183 SPAIN TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 184 SPAIN BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 185 SPAIN BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 186 SPAIN WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 187 SPAIN WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 188 SWITZERLAND WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 189 SWITZERLAND WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 190 SWITZERLAND BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 191 SWITZERLAND WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 192 SWITZERLAND WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 193 SWITZERLAND WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 194 SWITZERLAND WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 195 SWITZERLAND WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 196 SWITZERLAND ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 197 SWITZERLAND ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 198 SWITZERLAND BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 199 SWITZERLAND BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 200 SWITZERLAND BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 201 SWITZERLAND BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 202 SWITZERLAND WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 203 SWITZERLAND WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 204 SWITZERLAND WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 205 SWITZERLAND WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 206 SWITZERLAND MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 207 SWITZERLAND MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 208 SWITZERLAND TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 209 SWITZERLAND TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 210 SWITZERLAND BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 211 SWITZERLAND BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 212 SWITZERLAND WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 213 SWITZERLAND WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 214 RUSSIA WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 215 RUSSIA WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 216 RUSSIA BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 217 RUSSIA WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 218 RUSSIA WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 219 RUSSIA WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 220 RUSSIA WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 221 RUSSIA WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 222 RUSSIA ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 223 RUSSIA ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 224 RUSSIA BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 225 RUSSIA BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 226 RUSSIA BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 227 RUSSIA BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 228 RUSSIA WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 229 RUSSIA WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 230 RUSSIA WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 231 RUSSIA WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 232 RUSSIA MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 233 RUSSIA MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 234 RUSSIA TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 235 RUSSIA TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 236 RUSSIA BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 237 RUSSIA BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 238 RUSSIA WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 239 RUSSIA WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 240 TURKEY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 241 TURKEY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 242 TURKEY BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 243 TURKEY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 244 TURKEY WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 245 TURKEY WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 246 TURKEY WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 247 TURKEY WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 248 TURKEY ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 249 TURKEY ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 250 TURKEY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 251 TURKEY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 252 TURKEY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 253 TURKEY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 254 TURKEY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 255 TURKEY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 256 TURKEY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 257 TURKEY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 258 TURKEY MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 259 TURKEY MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 260 TURKEY TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 261 TURKEY TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 262 TURKEY BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 263 TURKEY BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 264 BY DISTRIBUTION CHANNEL

TABLE 265 TURKEY WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 266 BELGIUM WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 267 BELGIUM WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 268 BELGIUM BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 269 BELGIUM WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 270 BELGIUM WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 271 BELGIUM WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 272 BELGIUM WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 273 BELGIUM WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 274 BELGIUM ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 275 BELGIUM ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 276 BELGIUM BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 277 BELGIUM BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 278 BELGIUM BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 279 BELGIUM BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 280 BELGIUM WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 281 BELGIUM WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 282 BELGIUM WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 283 BELGIUM WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 284 BELGIUM MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 285 BELGIUM MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 286 BELGIUM TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 287 BELGIUM TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 288 BELGIUM BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 289 BELGIUM BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 290 BELGIUM WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 291 BELGIUM WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 292 NETHERLANDS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 293 NETHERLANDS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 294 NETHERLANDS BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 295 NETHERLANDS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 296 NETHERLANDS WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 297 NETHERLANDS WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 298 NETHERLANDS WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 299 NETHERLANDS WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 300 NETHERLANDS ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 301 NETHERLANDS ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 302 NETHERLANDS BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 303 NETHERLANDS BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 304 NETHERLANDS BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 305 NETHERLANDS BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 306 NETHERLANDS WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 307 NETHERLANDS WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 308 NETHERLANDS WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 309 NETHERLANDS WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 310 NETHERLANDS MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 311 NETHERLANDS MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 312 NETHERLANDS TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 313 NETHERLANDS TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 314 NETHERLANDS BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 315 NETHERLANDS BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 316 NETHERLANDS WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 317 NETHERLANDS WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 318 DENMARK WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 319 DENMARK WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 320 DENMARK BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 321 DENMARK WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 322 DENMARK WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 323 DENMARK WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 324 DENMARK WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 325 DENMARK WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 326 DENMARK ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 327 DENMARK ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 328 DENMARK BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 329 DENMARK BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 330 DENMARK BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 331 DENMARK BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 332 DENMARK WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 333 DENMARK WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 334 DENMARK WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 335 DENMARK WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 336 DENMARK MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 337 DENMARK MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 338 DENMARK TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 339 DENMARK TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 340 DENMARK BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 341 DENMARK BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 342 DENMARK WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 343 DENMARK WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 344 NORWAY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 345 NORWAY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 346 NORWAY BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 347 NORWAY WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 348 NORWAY WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 349 NORWAY WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 350 NORWAY WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 351 NORWAY WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 352 NORWAY ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 353 NORWAY ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 354 NORWAY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 355 NORWAY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 356 NORWAY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 357 NORWAY BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 358 NORWAY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 359 NORWAY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 360 NORWAY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 361 NORWAY WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 362 NORWAY MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 363 NORWAY MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 364 NORWAY TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 365 NORWAY TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 366 NORWAY BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 367 NORWAY BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 368 NORWAY WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 369 NORWAY WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 370 FINLAND WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 371 FINLAND WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 372 FINLAND BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 373 FINLAND WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 374 FINLAND WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 375 FINLAND WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 376 FINLAND WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 377 FINLAND WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 378 FINLAND ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 379 FINLAND ROOFING & WALLS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 380 FINLAND BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 381 FINLAND BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY RESIDENTIAL, 2018-2033 (USD MILLION)

TABLE 382 FINLAND BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY COMMERCIAL, 2018-2033 (USD MILLION)

TABLE 383 FINLAND BUILDING STRUCTURES WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 384 FINLAND WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 385 FINLAND WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WASTE MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 386 FINLAND WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY WATER MANAGEMENT, 2018-2033 (USD MILLION)

TABLE 387 FINLAND WASTE & WATER MANAGEMENT WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 388 FINLAND MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 389 FINLAND MINING APPLICATION WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 390 FINLAND TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 391 FINLAND TUNNEL LINERS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 392 FINLAND BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY CATEGORY, 2018-2033 (USD MILLION)

TABLE 393 FINLAND BRIDGES & HIGHWAYS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 394 FINLAND WATERPROOFING MEMBRANE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 395 FINLAND WATERPROOFING MEMBRANE MARKET, BY INDIRECT, 2018-2033 (USD MILLION)

TABLE 396 SWEDEN WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 397 SWEDEN WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 398 SWEDEN BITUMINOUS WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 399 SWEDEN WATERPROOFING MEMBRANE MARKET, BY TYPE, 2018-2033 (MILLION SQUARE METERS)

TABLE 400 SWEDEN WATERPROOFING MEMBRANE MARKET, BY PRODUCT, 2018-2033 (USD MILLION)

TABLE 401 SWEDEN WATERPROOFING MEMBRANE MARKET, BY CONSTRUCTION, 2018-2033 (USD MILLION)

TABLE 402 SWEDEN WATERPROOFING MEMBRANE MARKET, BY INSTALLATION TYPE, 2018-2033 (USD MILLION)

TABLE 403 SWEDEN WATERPROOFING MEMBRANE MARKET, BY APPLICATION, 2018-2033 (USD MILLION)