Europe Wearable Devices Market

Market Size in USD Billion

CAGR :

%

USD

21.20 Billion

USD

59.22 Billion

2024

2032

USD

21.20 Billion

USD

59.22 Billion

2024

2032

| 2025 –2032 | |

| USD 21.20 Billion | |

| USD 59.22 Billion | |

|

|

|

|

Europe Wearable Devices Market Size

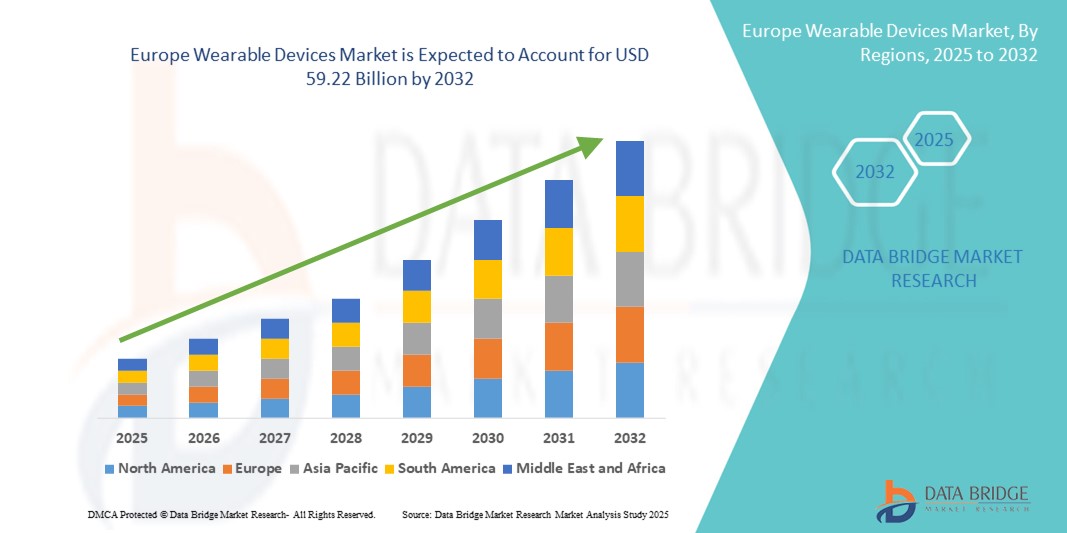

- The Europe wearable devices market size was valued at USD 21.20 billion in 2024 and is expected to reach USD 59.22 billion by 2032, at a CAGR of 13.7% during the forecast period

- The market growth is largely driven by rapid technological advancements in AI, sensors, and connectivity, combined with increasing consumer preference for multifunctional and stylish wearable gadgets. This progress is fostering the integration of wearables across fitness, healthcare, and lifestyle sectors

- In addition, rising demand for remote health monitoring and personalized wellness solutions, supported by favorable regulatory policies in European countries, is accelerating the adoption of wearable devices in both consumer and healthcare markets, thereby significantly propelling industry expansion

Europe Wearable Devices Market Analysis

- Wearable devices, encompassing smartwatches, fitness trackers, and health monitoring gadgets, are becoming essential tools for personal health management and lifestyle enhancement across both consumer and healthcare sectors in Europe, driven by advancements in sensor technology and seamless connectivity with smartphones and IoT ecosystems

- The increasing adoption of wearable technology is primarily propelled by growing health awareness among consumers, rising demand for remote patient monitoring, and the integration of AI-driven features that provide personalized insights and real-time data tracking

- Germany dominated the Europe wearable devices market with the largest revenue share of 28.42% in 2024, supported by a strong healthcare infrastructure, high consumer purchasing power, and active presence of leading technology firms

- The United Kingdom is the fastest-growing country in the Europe wearable devices market, expected to register a highest CAGR, driven by increasing digital health initiatives and government support

- The wrist-wear segment dominated the Europe wearable devices market with a market share of 52.5% in 2024, driven by widespread consumer preference for smartwatches and fitness bands that combine health tracking with communication and lifestyle functionalities

Report Scope and Europe Wearable Devices Market Segmentation

|

Attributes |

Europe Wearable Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Wearable Devices Market Trends

Rising Integration of AI and Health Analytics

- A prominent and accelerating trend in the Europe wearable devices market is the increasing incorporation of artificial intelligence (AI) and advanced health analytics into wearable technology, enabling personalized health monitoring and predictive insights

- For instance, devices such as the Fitbit Sense and Garmin Venu 2 Plus leverage AI algorithms to analyze heart rate variability, sleep patterns, and stress levels, providing tailored wellness recommendations. Similarly, companies such as Withings integrate AI-powered ECG and blood pressure monitoring into their wearables for enhanced health tracking

- AI integration allows wearables to learn user behavior over time, improving the accuracy of health metrics and enabling early detection of anomalies, such as arrhythmias or respiratory issues. Furthermore, these devices increasingly support voice-activated assistants such as Alexa and Google Assistant, enhancing user convenience

- The seamless connectivity of wearables with smartphones and smart home ecosystems enables centralized health and lifestyle management, allowing users to track activity, nutrition, and vital signs through a single interface

- This trend towards smarter, interconnected, and more intuitive wearables is raising user expectations for multifunctional devices that blend health, fitness, and lifestyle features. Companies such as Garmin and Huawei are developing AI-driven wearables with continuous monitoring, automatic alerts, and personalized coaching

- The demand for AI-enabled wearable devices is rapidly growing across Europe, driven by consumers’ increasing focus on proactive health management and digital wellness solutions

Europe Wearable Devices Market Dynamics

Driver

Increasing Health Awareness and Adoption of Digital Health Solutions

- The growing awareness of personal health and fitness, along with rising prevalence of chronic diseases, is a significant driver propelling the demand for wearable devices in Europe

- For instance, in March 2024, Fitbit launched new models with enhanced health sensors and integration with healthcare providers, aiming to facilitate remote patient monitoring and early health intervention. Such innovations by key players are expected to drive robust market growth

- Consumers seek real-time health data, activity tracking, and stress management features, while healthcare providers increasingly use wearables for remote monitoring and preventive care

- In addition, expanding digital health infrastructure and favorable regulatory frameworks supporting telemedicine adoption across European countries are boosting wearable device uptake

- Convenience, portability, and multifunctionality make wearables attractive for a broad consumer base, ranging from fitness enthusiasts to elderly patients managing chronic conditions

Restraint/Challenge

Data Privacy Concerns and Device Interoperability Issues

- The privacy and data security concerns around sensitive health information collected by wearables pose significant challenges to wider market penetration in Europe. With stringent regulations such as GDPR, companies must ensure compliance while assuring consumers about data safety

- For instance, in late 2023, a data breach incident involving a popular fitness tracker brand exposed user health data, leading to heightened consumer skepticism and regulatory scrutiny in Europe

- Reports of data breaches or misuse of personal health data can deter potential users from adopting wearable technology. Companies such as Apple and Samsung emphasize robust encryption and transparent privacy policies to mitigate these fears

- Another challenge is the lack of standardization and interoperability among various wearable platforms and healthcare systems, which can limit seamless data sharing and integration

- High costs associated with premium wearables and frequent need for device upgrades can also inhibit adoption, especially among price-sensitive consumer segments

- Addressing privacy concerns through enhanced data protection measures, improving platform compatibility, and developing more affordable, user-friendly devices will be key to sustaining growth in the Europe wearable devices market

Europe Wearable Devices Market Scope

The market is segmented on the basis of device type, product type, application, industry, and end users

- By Device Type

On the basis of device type, the Europe wearable devices market is segmented into diagnostic and monitoring devices and therapeutic devices. The diagnostic and monitoring devices segment dominated the market in 2024 with the largest revenue share, accounting for over 65% of the market. This dominance is driven by the increasing use of wearables that track vital signs such as heart rate, blood glucose, blood pressure, and oxygen saturation, which are essential for managing chronic diseases and promoting preventive healthcare. The continuous demand for accurate and real-time health monitoring solutions in both consumer wellness and clinical environments cements this segment’s leadership.

The therapeutic devices segment is the fastest-growing, projected to record a CAGR exceeding 15% during the forecast period. This rapid growth stems from technological advancements in wearable neurostimulators, insulin pumps, and drug delivery systems, enabling more effective treatment options for conditions such as chronic pain, diabetes, and neurological disorders. Increasing regulatory approvals and rising awareness about wearable therapeutics are further accelerating this segment’s expansion.

- By Product Type

On the basis of product type, the Europe wearable devices market is segmented into wrist-wear, eyewear, footwear, neckwear, body-wear, and others based on product type. The wrist-wear segment is the dominant category, holding 52.5% market share in 2024. Its popularity is attributed to the versatility and multifunctionality of smartwatches and fitness bands, which not only track physical activity but also integrate communication, music, and health features such as ECG and stress monitoring. High consumer adoption, aided by well-established brands such as Apple, Garmin, and Fitbit, supports this segment’s leadership.

The eyewear segment is the fastest-growing, with an expected CAGR of around 18%. Growth in smart glasses for augmented reality (AR) applications, eye-tracking for medical diagnostics, and enhanced wearable displays are driving this surge. Innovations enabling hands-free health monitoring and AR-guided fitness training also contribute to rising demand.

- By Application

On the basis of application, the Europe wearable devices market is segmented into sports and fitness, remote patient monitoring, and home healthcare applications, the market shows distinct dynamics. The sports and fitness segment remains dominant, accounting for 60% of revenue in 2024. This is supported by the sustained popularity of fitness trackers and smartwatches used by athletes and fitness enthusiasts for activity tracking, calorie monitoring, and performance enhancement. Consumer trends toward healthier lifestyles further bolster this segment.

The remote patient monitoring segment is the fastest-growing application area, anticipated to grow at a CAGR exceeding 16% during forecast period. Fueled by the rising incidence of chronic diseases, aging populations, and expansion of telemedicine services, wearables in this category enable continuous monitoring of vital parameters and enable early interventions, reducing hospital visits and healthcare costs.

- By Industry

On the basis of industry, the Europe wearable devices market is segmented into consumer products, healthcare, industrial, and others industries. The consumer products industry dominates the market, representing over 70% of the wearable device sales in 2024. The broad adoption of wearables for fitness, lifestyle, and wellness tracking in this segment underpins its leadership. Mass-market availability, brand recognition, and product innovation contribute to sustained consumer demand.

The healthcare industry segment is the fastest-growing, expected to grow at a CAGR above 17%. Increased integration of wearables into clinical workflows for remote monitoring, diagnostics, and rehabilitation, alongside supportive healthcare policies and reimbursement models, is driving this growth. Industrial applications, such as worker safety monitoring, though smaller in revenue share, are also gaining traction.

- By End Users

On the basis of end users, the Europe wearable devices market is segmented into personal users and enterprises based on end users. The personal users segment holds the dominant share of over 65% in 2024, driven by individual consumers using wearables primarily for fitness, wellness, and health monitoring. The ease of use, affordability, and variety of available devices support widespread adoption.

The enterprise segment is the fastest-growing end-user category, projected to grow at a CAGR near 18%. This growth is due to rising adoption in healthcare institutions for patient monitoring, corporate wellness programs focused on employee health, and industrial sectors implementing wearable safety and productivity devices. Increasing awareness of the benefits of wearable technology in improving operational efficiency and workforce health is accelerating enterprise uptake.

Europe Wearable Devices Market Regional Analysis

- Germany dominated the Europe wearable devices market with the largest revenue share of 28.42% in 2024, supported by a strong healthcare infrastructure, high consumer purchasing power, and active presence of leading technology firms

- Consumers and healthcare providers in Germany highly value advanced health monitoring capabilities, data accuracy, and integration with digital health ecosystems, which support widespread adoption of wearable devices for both personal wellness and clinical applications

- This strong market position is further reinforced by supportive government initiatives promoting digital health innovation, growing awareness of preventive healthcare, and rising demand for remote patient monitoring solutions, establishing Germany as a leading hub for wearable technology adoption in Europe

The U.K. Wearable Devices Market Insight

The U.K. wearable devices market is expected to grow at a robust CAGR during the forecast period, supported by widespread adoption of fitness trackers and smartwatches among health-conscious consumers. Increasing government support for digital health innovation, rising prevalence of chronic diseases, and strong e-commerce infrastructure contribute to the market’s expansion. The demand for remote patient monitoring and home healthcare wearables is gaining momentum, with consumers and healthcare providers seeking efficient, user-friendly health management tools.

Germany Wearable Devices Market Insight

The Germany dominates the Europe wearable devices market, accounting for the largest revenue share in 2024. The country’s well-established healthcare system, high disposable income, and active presence of major technology manufacturers are key growth drivers. Germany’s focus on innovation, data privacy, and sustainability aligns with consumer preferences for secure, reliable, and eco-friendly wearable devices. Increasing integration of wearables with healthcare services for chronic disease management and preventive care is accelerating market growth.

France Wearable Devices Market Insight

The France wearable devices market is poised for steady growth due to rising consumer interest in fitness and wellness products, alongside expanding healthcare applications. Government initiatives aimed at improving telemedicine infrastructure and promoting digital health solutions bolster market prospects. French consumers show growing acceptance of wearable devices for both lifestyle and medical use, especially in urban centers with high technology penetration.

Italy Wearable Devices Market Insight

The Italy wearable devices market is witnessing increasing adoption, driven by a growing elderly population and the need for remote health monitoring solutions. Rising awareness about personal fitness and chronic disease management is expanding the consumer base for smartwatches, fitness bands, and medical-grade wearables. In addition, collaborations between technology companies and healthcare providers are enhancing the availability of integrated wearable health solutions.

Europe Wearable Devices Market Share

The Europe wearable devices industry is primarily led by well-established companies, including:

- Apple Inc. (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Fitbit, Inc. (U.S.)

- Garmin Ltd. (Switzerland)

- Xiaomi Corporation (China)

- Huawei Technologies Co., Ltd. (China)

- Sony Corporation (Japan)

- Fossil Group, Inc. (U.S.)

- Withings (France)

- Polar Electro Oy (Finland)

- Suunto Oy (Finland)

- Zepp Health Corporation (China)

- Bose Corporation (U.S.)

- Jawbone (U.S.)

- Medtronic (Ireland)

- Philips NV (Netherlands)

- Oura Health Oy (Finland)

- Mobvoi Information Technology Company Limited (China)

- Whoop, Inc. (U.S.)

What are the Recent Developments in Europe Wearable Devices Market?

- In July 2025, The European Commission approved up to EUR 403 million in public funding to support medical device innovation, targeting ten primarily small and medium-sized companies. This initiative aims to foster technological advancements, particularly in incorporating digital and artificial intelligence features into medical devices. The funding is expected to stimulate EUR 826 million in private investments and create approximately 800 new jobs

- In June 2025. PharmaSens AG, a Swiss developer of next-generation insulin patch pump systems, announced a strategic partnership with SiBionics, a leading provider of continuous glucose monitoring (CGM) technologies. Together, they aim to develop the niia signature, an all-in-one wearable device that integrates insulin delivery with real-time glucose sensing to simplify diabetes management

- In June 2025, according to the latest IDC Worldwide Quarterly Wearable Device Tracker data, Huawei ascended to the top position in the global wrist-worn device market in Q1 2025, while maintaining robust growth momentum and retaining its leadership in shipment volume within China. In addition, as of June 2025, Huawei's cumulative global wearable shipments have exceeded 200 million units

- In November 2024, DexCom, Inc, the global leader in glucose biosensing, and ŌURA, maker of the world’s leading smart ring, announced today a strategic partnership to help millions of people improve their metabolic health through the integration of Dexcom glucose data with vital sign, sleep, stress, heart health and activity data from Oura Ring. Combining Dexcom glucose data with the biometrics collected by Oura Ring will provide users of both products with a more complete picture of overall health. Dexcom is also making a USD 75 million strategic investment in ŌURA Series D funding, with ŌURA now valued at more than USD 5 billion

- In June 2024, B-Secur and Galen Data have joined forces to enhance cardiac health monitoring for device manufacturers. B-Secur is known for its advanced biosensing technology, while Galen Data is a trusted software platform for medical device-to-cloud connectivity and data analysis. This partnership combines Galen Data's highly secure and compliant medical device cloud platform with B-Secur's HeartKey® Technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.