Europe Wi Fi Chipset Market

Market Size in USD Billion

CAGR :

%

USD

4.64 Billion

USD

5.74 Billion

2024

2032

USD

4.64 Billion

USD

5.74 Billion

2024

2032

| 2025 –2032 | |

| USD 4.64 Billion | |

| USD 5.74 Billion | |

|

|

|

|

Europe Wi-Fi Chipset Market Size

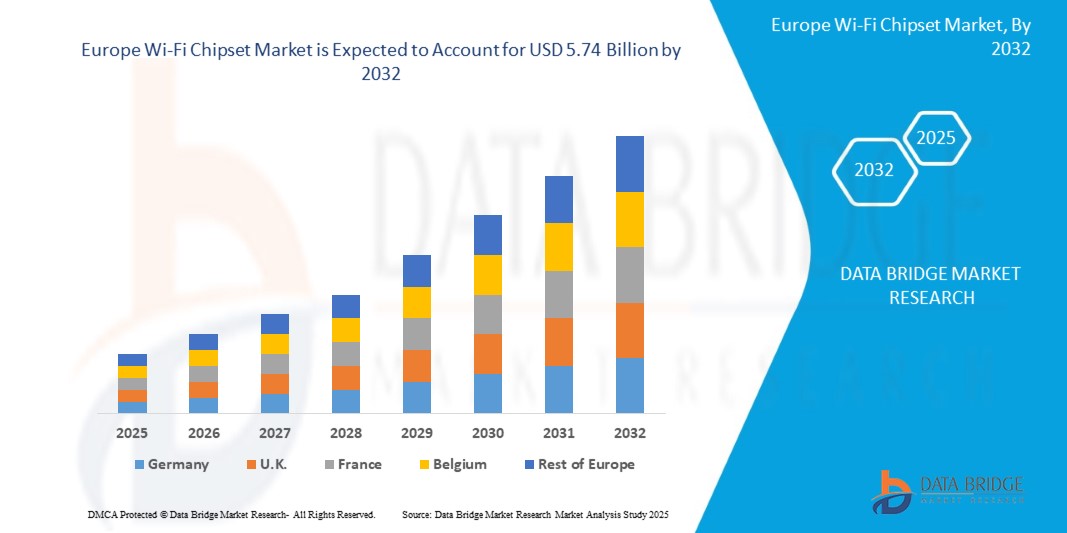

- The Europe Wi-Fi Chipset Market size was valued at USD 4.64 Billion in 2024 and is expected to reach USD 5.74 Billion by 2032, at a CAGR of 3.1% during the forecast period

- The increasing adoption of IoT, rising globalization and growing number of public Wi-Fi hotspots across the globe will emerge as the major factor driving market growth. In addition to this, the surging number of small scale industries aiming to adopt high speed network connectivity along with growing penetration of consumer electronic gadgets like smartphones, laptops and others will further aggravate the market value.

Europe Wi-Fi Chipset Market Analysis

- Telecommunications Sector Leads the Market: The telecommunications industry holds the largest share of the Wi-Fi chipset market in Europe. This dominance is driven by the rapid expansion of fiber optic networks and the accelerated rollout of 5G technology, which significantly increases the demand for high-performance Wi-Fi chipsets to support enhanced connectivity.

- Smartphones Segment Commands Majority Share: The smartphone segment is the leading end-user of Wi-Fi chipsets in Europe, accounting for 53.2% of the market in 2024. Rising consumer demand for high-speed wireless connectivity and the ongoing transition to Wi-Fi 6 and Wi-Fi 6E standards are fueling growth in this segment.

- Germany Dominates Regional Market: Germany leads the European Wi-Fi chipset market with a substantial revenue share of 40.05% in 2024. This leadership is attributed to robust investments in telecommunications infrastructure, rising consumer electronics usage, and the strong presence of semiconductor manufacturers and R&D centers.

- France Emerging as Fastest-Growing Market: France is expected to register the highest growth rate in the European Wi-Fi chipset market. The country is undergoing extensive upgrades to its digital infrastructure, including nationwide 5G deployment and smart city initiatives, driving up demand for advanced Wi-Fi chipset solutions.

- Technological Advancements Driving Market Evolution: The integration of Wi-Fi chipsets with advanced technologies such as Wi-Fi 6, Wi-Fi 6E, and the upcoming Wi-Fi 7 is accelerating market growth. These technologies offer higher data rates, improved latency, and better spectrum efficiency, catering to increasing consumer and industrial bandwidth needs.

- Consumer Electronics and IoT Fuel Demand: Beyond smartphones, the rising penetration of smart home devices, laptops, tablets, and IoT-based applications is contributing significantly to the demand for Wi-Fi chipsets. The need for seamless wireless connectivity across multiple devices is a key driver of chipset innovation and market expansion.

Report Scope and Wi-Fi Chipset Market Segmentation

|

Attributes |

Wi-Fi Chipset Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Wi-Fi Chipset Market Trends

“Rapid Market Expansion Driven by Next-Gen Wireless Connectivity”

• The Europe Wi-Fi Chipset market is undergoing significant growth, driven by the widespread adoption of next-generation wireless technologies such as Wi-Fi 6, Wi-Fi 6E, and the emerging Wi-Fi 7. These technologies are enabling faster data transmission, lower latency, and improved network efficiency across a broad range of devices and sectors.

• Increasing demand from consumer electronics, including smartphones, laptops, tablets, and smart home devices, continues to be a major growth driver. The integration of advanced Wi-Fi chipsets into these products is essential for meeting rising user expectations for seamless connectivity and high-speed performance.

• Key market players are launching innovative chipset solutions to support evolving connectivity standards. For example, Qualcomm and MediaTek have introduced Wi-Fi 7-ready chipsets aimed at supporting high-bandwidth applications such as AR/VR, UHD streaming, and advanced gaming experiences in European markets.

• The trend toward multi-band, multi-antenna chipset designs is accelerating, enabling better spectrum utilization and network performance, especially in dense urban environments.

Europe Wi-Fi Chipset Market Dynamics

Driver

“Growth in 5G Deployment and Smart Device Penetration”

• The rapid rollout of 5G networks across major European economies—such as Germany, France, and the U.K.—is fueling demand for compatible Wi-Fi chipsets that can support higher data rates and advanced features like ultra-reliable low-latency communication (URLLC).

• Integration of Wi-Fi chipsets into a growing ecosystem of connected devices—including IoT endpoints, routers, AR/VR headsets, and automotive systems—is creating new revenue streams for chipset manufacturers.

• Emerging applications such as remote healthcare, smart factories, and autonomous mobility rely heavily on high-speed wireless connectivity, thereby accelerating the adoption of advanced chipsets across multiple verticals.

Restraint / Challenge

“High R&D Costs and Complex Regulatory Standards”

• The development of advanced Wi-Fi chipsets, particularly those supporting Wi-Fi 6E and Wi-Fi 7, involves high R&D expenditures and long innovation cycles, which can restrict new entrants and pressure profit margins for existing players.

• Varying spectrum allocation policies and stringent regulatory standards across different European countries can complicate product deployment and delay time-to-market for chipset vendors.

• Compatibility challenges with legacy infrastructure and fragmented device ecosystems add further complexity, especially in large-scale public and industrial deployments.

• Moreover, supply chain disruptions and the global semiconductor shortage continue to pose operational challenges, affecting chipset availability and pricing stability in the European market.

Europe Wi-Fi Chipset Market Scope

The market is segmented on the basis of device, band, fabrication technology, WI-FI Standard, die size, MIMO configuration and end user.

- By device

On the basis of device, the Wi-Fi Chipset Market is segmented into tablet, connected home devices, smartphones, PCs, access point equipment and others. The table segment dominates the largest market revenue share of 53.2% in 2024, Increased remote work, online education, and digital content consumption across Europe are driving the demand for high-speed, energy-efficient Wi-Fi chipsets in tablets, especially those supporting Wi-Fi 6, enhancing performance, battery life, and connectivity in portable form factors.

The connected home devices segment is anticipated to witness the fastest growth rate of 11.7% from 2025 to 2032, The rapid adoption of smart thermostats, cameras, speakers, and appliances in European homes is boosting demand for robust Wi-Fi chipsets that offer low power consumption, stable connections, and easy integration with home automation platforms like Alexa and Google Assistant.

- By band

On the basis of bond, the Wi-Fi Chipset Market is segmented into single band, dual band and tri band. The single band segment held the largest market revenue share in 2024 Single-band Wi-Fi chipsets remain in demand for cost-sensitive applications such as entry-level devices and budget routers. These chipsets offer simple integration and are sufficient for basic browsing, streaming, and IoT tasks, especially in small households or less congested environments.

The dual band segment is expected to witness the fastest CAGR from 2025 to 2032, Dual-band chipsets are growing rapidly due to the increasing need for better performance, reduced interference, and support for high-bandwidth applications. Consumers and enterprises prefer dual-band connectivity to manage heavy data traffic across both 2.4 GHz and 5 GHz bands effectively.

- By fabrication technology

On the basis of fabrication technology, the Wi-Fi Chipset Market is segmented into FinFET, FDSOI CMOS, silicon on insulator (SOI) and sige. The FinFET segment held the largest market revenue share in 2024, The use of FinFET architecture in Wi-Fi chipsets improves energy efficiency and performance, enabling support for high-speed wireless protocols. It is increasingly adopted in premium devices requiring faster connectivity and lower power consumption, especially in smartphones and smart home hubs.

The FDSOI CMOS is expected to witness the fastest CAGR from 2025 to 2032, FD-SOI (Fully Depleted Silicon on Insulator) CMOS is gaining traction in Europe for its power efficiency and thermal stability, making it ideal for mobile and IoT devices. It enhances chipset performance while reducing leakage current in low-power Wi-Fi applications.

- By Die Size

On the basis of die size, the Wi-Fi Chipset Market is segmented into 28nm, 20nm, 14nm, 10nm and others. The 28 nm segment held the largest market revenue share in 2024, is expected to witness the fastest CAGR from 2025 to 2032 The 28nm process node offers a balanced trade-off between performance, cost, and power efficiency. It remains a popular choice for mid-range Wi-Fi chipsets in consumer electronics, helping manufacturers optimize production costs while maintaining compatibility with modern wireless standards.

- By MIMO configuration

On the basis of MIMO configuration, the Wi-Fi Chipset Market is segmented into SU-MIMO, MU-MIMO, 1X1 MU-MIMO, 2X2 MU-MIMO, 3X3 MU-MIMO, 4X4 MU-MIMO, and 8X8 MU-MIMO. The SU-MIMO segment held the largest market revenue share in 2024, is expected to witness the fastest CAGR from 2025 to 2032 SU-MIMO chipsets are in demand for personal devices like smartphones and tablets, where dedicated bandwidth to a single user ensures smoother streaming and gaming. SU-MIMO helps optimize speed and reliability in scenarios where device density and interference are moderate.

- By End User

On the basis of end user, the Wi-Fi Chipset Market is segmented into consumer, automotive and transportation, healthcare, education, BFSI, travel and hospitality and others. The consumer, segment held the largest market revenue share in 2024, is expected to witness the fastest CAGR from 2025 to 2032 European consumers are increasingly adopting high-speed wireless solutions for seamless streaming, online gaming, and smart home integration. This drives the demand for advanced Wi-Fi chipsets that support new standards and offer better speed, reliability, and device compatibility at affordable prices.

Europe Wi-Fi Chipset Market Regional Analysis

- Germany dominates the Wi-Fi Chipset Market with the largest revenue share of 45.01% in 2024, driven by Germany leads the Europe Wi-Fi Chipset market, driven by its strong consumer electronics industry, expansive 5G rollout, and smart infrastructure projects. Large-scale investments in connected mobility, smart homes, and industrial IoT—especially under Industry 4.0 are significantly boosting demand for high-performance Wi-Fi chipsets across smartphones, automotive systems, and home automation devices, particularly those supporting Wi-Fi 6 and 6E.

France Wi-Fi Chipset Market Insight

The france Wi-Fi Chipset Market captured the largest revenue share of 40.05% in 2024 within Europe , fueled by France is emerging as the fastest-growing Wi-Fi Chipset market in Europe due to aggressive expansion of its digital infrastructure, including 5G networks and fiber broadband. Government-backed smart city initiatives and increased adoption of connected home devices are accelerating chipset demand. Additionally, France’s focus on energy efficiency and smart grids fuels adoption of low-power Wi-Fi solutions in consumer and IoT devices.

Wi-Fi Chipset Market Share

The Wi-Fi Chipset Market is primarily led by well-established companies, including:

- Intel Corporation

- Qualcomm Technologies. Inc

- Sony Semiconductor Israel Ltd

- ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD

- Broadcom

- Hitachi Vantara Corporation

- Cisco Systems, Inc.

- Microsoft

- Apple Inc

- Celeno Communications

- Taiwan Semiconductor Manufacturing Company Limited

- STMicroelectronics

- MediaTek Inc

- Cypress Semiconductor Corporation

- PERASO TECHNOLOGIES INC.

- PERASO TECHNOLOGIES INC

- Semiconductor Components Industries, LLC

- Cypress Semiconductor Corporation

- Texas Instruments Incorporated

Latest Developments in Europe Wi-Fi Chipset Market

- In March 2024, Qualcomm launched its latest Wi-Fi 7 chipset targeting European markets. The new chipset offers enhanced multi-gigabit speeds and improved power efficiency, aiming to support next-generation consumer electronics and industrial IoT applications amid growing demand for high-performance wireless connectivity.

- In July 2024, MediaTek introduced its Wi-Fi 6E chipset with integrated AI features tailored for smart home devices in Europe. This initiative focuses on improving network stability and latency for connected home ecosystems and addresses increasing consumer demand for seamless streaming and gaming.

- Broadcom unveiled a dual-band Wi-Fi 6 chipset in January 2025 designed for European smartphones and tablets. The chipset supports enhanced SU-MIMO technology to boost device connectivity and bandwidth efficiency, aligning with the continent’s expanding mobile and consumer electronics market.

- In September 2024, Intel expanded its portfolio with a FinFET-based Wi-Fi 6E chipset targeting enterprise networking in Europe. The chipset delivers higher throughput and lower latency, enabling robust connectivity for smart office solutions and accelerating digital transformation across European businesses.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Wi Fi Chipset Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Wi Fi Chipset Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Wi Fi Chipset Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.