Europe Wine Market

Market Size in USD Billion

CAGR :

%

USD

32.77 Billion

USD

14.90 Billion

2024

2032

USD

32.77 Billion

USD

14.90 Billion

2024

2032

| 2025 –2032 | |

| USD 32.77 Billion | |

| USD 14.90 Billion | |

|

|

|

|

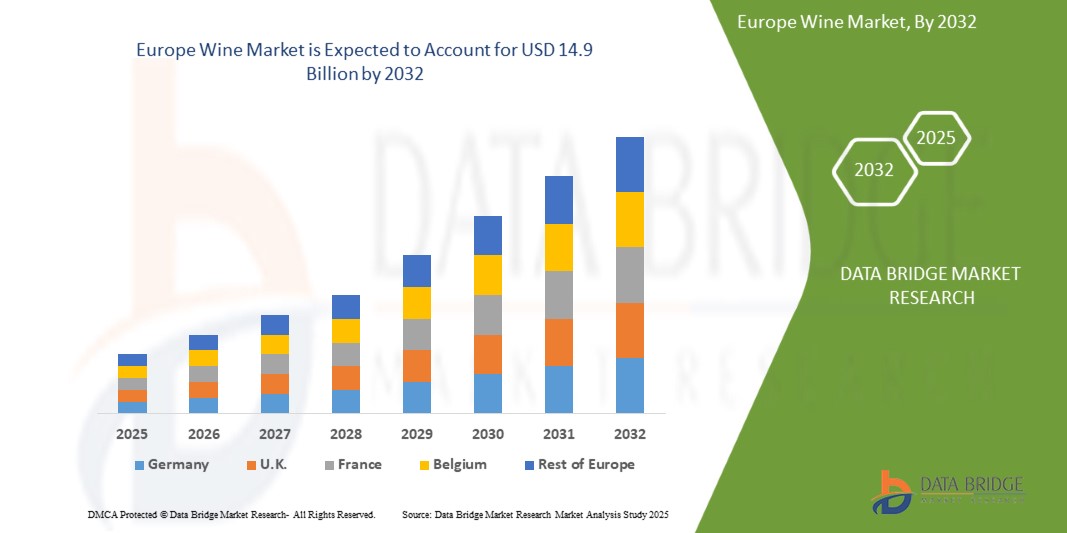

Europe Wine Market Size

- The Europe Wine Market size was valued at USD 32.77 billion in 2024 and is expected to reach USD 14.9 billion by 2032, at a CAGR of 12.7% during the forecast period

- The growth of the Wine Market is driven by several key factors, including the rising consumer preference for premium and craft wines, increasing awareness of the health benefits associated with moderate wine consumption, and the growing demand for organic, biodynamic, and sustainably produced wines

Europe Wine Market Analysis

- The Wine Market in Europe is experiencing steady and robust growth, driven by evolving consumer preferences, increasing health consciousness, and a rising demand for premium, organic, and sustainably produced wines. As consumers become more mindful of their alcohol consumption and seek products with perceived health benefits, interest in moderate wine drinking, especially red and low-sulfite wines, is on the rise. The trend toward natural and biodynamic wines is also gaining momentum across various demographics

- European wine producers are actively innovating, focusing on quality, sustainability, and traceability. Organic, vegan-certified, and low-intervention wines are becoming more common, appealing to ethically driven consumers. In addition, advancements in viticulture and winemaking techniques are helping producers reduce the environmental impact of their operations while maintaining high product standards and unique regional profiles

- Western Europe, particularly countries like France, Italy, and Spain, continues to dominate the wine market, supported by their long-standing wine traditions, established vineyards, and global recognition. These countries are also leading the shift toward sustainable viticulture, with many producers adopting eco-friendly practices, organic certifications, and climate-conscious packaging to meet consumer and regulatory demands

- Eastern Europe is emerging as a promising region in the wine market, with countries like Hungary, Romania, and Bulgaria showing increased production and export activity. Improvements in winemaking quality, along with rising domestic consumption and wine tourism, are contributing to growth in these markets. The rising middle class and expanding retail access are also making wine more available to a broader consumer base in the region

- Europe’s strong regulatory framework, support for geographic indications, and commitment to sustainability are creating a favorable environment for the wine industry. EU policies that promote responsible drinking, organic agriculture, and rural development are encouraging investments and innovation in the wine sector. As consumer interest in authenticity, provenance, and environmental impact continues to grow, the European Wine Market is well-positioned for continued expansion in both domestic and international markets

Report Scope and Europe Wine Market Segmentation

|

Attributes |

Wine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Wine Market Trends

Increasing Popularity of Low-Alcohol and Functional Wines

- A notable trend in the Wine Market is the rising demand for low-alcohol and functional wines that cater to health-conscious consumers seeking moderation without compromising on taste or experience

- Consumers are increasingly looking for wine options that align with wellness-focused lifestyles, including wines with reduced alcohol content, lower calories, and added functional benefits such as antioxidants and natural botanicals.

For instance,

- Many wine brands are now offering low-alcohol or alcohol-removed wines infused with ingredients like adaptogens, resveratrol, and herbal extracts to appeal to a new generation of mindful drinkers

- This trend is encouraging winemakers to innovate and develop functional wine products that support modern health and wellness goals while maintaining the social and cultural appeal of wine consumption

Europe Wine Market Dynamics

Driver

Rising Popularity of Health-Conscious Lifestyles and Mindful Drinking

- As more consumers adopt health-conscious lifestyles, the Wine Market is experiencing notable growth. Increased awareness about the effects of alcohol on health, combined with a desire for balance and moderation, is leading individuals to explore lighter and lower-alcohol wine options

- Functional and low-calorie wines are becoming increasingly popular among health-aware consumers who seek the enjoyment of wine without the excess calories or stronger alcohol content. These products appeal to those following wellness trends such as “mindful drinking,” “sober curiosity,” and “low-and-no” alcohol consumption

- With this growing demand, wine producers are innovating to offer health-forward alternatives that retain the flavor and complexity of traditional wines while aligning with modern lifestyle choices

For instance:

- Manufacturers are launching low- and no-alcohol wines enhanced with added antioxidants, lower sugar content, and clean-label ingredients to appeal to fitness-focused and wellness-oriented consumers

- This shift toward moderation and wellness, along with increasing interest in transparent labeling and natural production methods, is a key driver behind the evolving Wine Market landscape

Opportunity

Increasing Demand for Sustainable and Eco-Friendly Wine Products

- The growing consumer awareness of environmental issues, such as climate change, carbon emissions, and resource conservation, is driving a shift toward more sustainable and eco-friendly wine choices

- Wines produced using organic, biodynamic, and sustainable viticulture methods are gaining popularity, as they are perceived to have a lower environmental footprint and a more ethical production process. This includes reduced use of pesticides, responsible water management, and minimal intervention winemaking practices

- As consumers prioritize sustainability, wine producers are responding by adopting greener practices throughout the supply chain—from vineyard management to packaging and distribution.

For instance:

- Many wineries are using lightweight glass bottles, eco-friendly labels, and alternative packaging like boxed wine or cans to reduce carbon emissions and packaging waste

- The demand for sustainably produced wines presents a major opportunity for market growth, particularly among younger consumers and environmentally conscious buyers who view wine not just as a beverage, but as a reflection of their values and lifestyle choices

Restraint/Challenge

High Cost of Production and Raw Materials in Sustainable Wine Production

- One of the key restraints in the Wine Market is the high cost associated with sustainable wine production and the raw materials required for organic and eco-friendly viticulture

- Producing organic and biodynamic wines often involves labor-intensive farming practices, strict regulatory compliance, and lower yields, all of which contribute to higher production costs compared to conventional wine

- The use of certified organic inputs, manual harvesting, natural fertilizers, and eco-friendly packaging further increases operational expenses for winemakers striving to meet sustainability standards

- High production costs can make sustainably produced wines less competitive in price-sensitive markets or among consumers who are not yet willing to pay a premium for environmental benefits

For instance:

- Smaller wineries adopting sustainable practices may struggle to scale efficiently due to limited access to funding or higher per-unit costs, making it challenging to compete with large-scale producers offering more affordable options

- This economic barrier poses a restraint to market growth, especially in regions with lower disposable incomes or limited awareness of sustainable wine alternatives

Europe Wine Market Scope

The market is segmented on the basis product type, type, colour, packaging, body type, distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Colour |

|

|

By Product Type |

|

|

By Packaging |

|

|

By Body Type |

|

|

By Distribution Channel |

|

In 2025, the still wines is projected to dominate the market with a largest share in type segment

In 2025, still wines are projected to dominate the Europe Wine Market with the largest share in the product type segment, accounting for 45%. This dominance is attributed to the continued consumer preference for traditional, unfortified wines, driven by their versatility, wide availability, and strong cultural appeal across European countries

The Unflavoured is expected to account for the largest share during the forecast period in product type segment

In 2025, the unflavoured wine segment is expected to account for the largest share in the Europe Wine Market, with a projected market share of 58.7%. This dominance is driven by the continued consumer preference for classic, traditional wine varieties, which offer pure, unaltered flavors

Europe Wine Market Regional Analysis

Germany is Projected to Register the Highest Growth in the Europe Wine Market

-

Germany is expected to register the highest growth rate in the Europe Wine Market, driven by increasing consumer demand for premium, sustainable, and locally produced wines that align with growing concerns around environmental impact and wellness

- German consumers are becoming more focused on sustainable and eco-friendly choices, which is fueling the popularity of wines produced using organic, biodynamic, and low-intervention methods

- The growing interest in natural and organic products, along with an increasing preference for clean-label wines, is contributing to a surge in demand for wines with minimal additives and sustainable production practices

- Continuous innovation in packaging, including the shift toward lightweight glass bottles, eco-friendly labels, and alternative packaging options like cans and boxes, is further boosting the growth of sustainable wine offerings in the region

- Strong retail support from major supermarket chains, organic stores, and specialized wine shops, combined with increasing consumer awareness and education about sustainable wines, is enhancing the availability and visibility of these products across Germany

- With increasing investments from both domestic and international producers in sustainable viticulture, as well as the country's long-standing wine culture, Germany is poised to lead the European Wine Market, setting trends and shaping consumer behavior across the continent.

Germany is Projected to Dominate the Europe Wine Market

-

Germany is expected to dominate the Europe Wine Market, driven by strong consumer demand for high-quality, sustainable, and locally produced wines. The country’s progressive wine culture and increasing focus on eco-friendly production practices are accelerating the growth of sustainable wine consumption

- With a well-established retail infrastructure and a strong presence of wine producers, Germany leads in the adoption of wines produced using organic, biodynamic, and low-intervention methods, particularly in urban centers where consumers are more inclined toward clean-label and environmentally conscious products

- The rising preference for wines with minimal additives, along with growing concerns about the environmental impact of conventional farming methods, is prompting German consumers to favor wines that emphasize sustainability, ethical production, and transparency

- The shift towards natural and organic wines, especially among younger, health-conscious demographics, is creating strong momentum for premium wine products across mainstream supermarkets, organic wine shops, and the foodservice industry

- Major wineries and innovative producers are making significant investments in research and development, packaging innovation, and sustainability initiatives, ensuring that Germany remains at the forefront of wine trends in Europe. Germany’s commitment to quality, sustainability, and eco-friendly practices strengthens its position as the leading market for wine in Europe, influencing consumer behavior and product development across the region.

Europe Wine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Castel Group (France)

- Pernod Ricard (France)

- Peter Mertes KG (Germany)

- Symington Family Estates (Portugal)

- Törley (Hungary)

- KEO plc (Cyprus)

- Treasury Wine Estates (Australia)

- Constellation Brands, Inc. (U.S.)

- E. & J. Gallo Winery (U.S.)

- Accolade Wines (Australia/UK)

- The Wine Group (U.S.)

- LVMH Moët Hennessy Louis Vuitton (France)

- Grupo Peñaflor (Argentina)

Latest Developments in Europe Wine Market

- In May 2025, the European Wine Council (EWC) announced a new initiative to promote sustainable wine practices across the continent. The project, aimed at encouraging wine producers to adopt organic, biodynamic, and low-intervention farming methods, will offer grants and technical support to wineries. This initiative is expected to strengthen Europe’s position as a leader in sustainable wine production and meet the growing consumer demand for environmentally conscious and organic wines

- In April 2025, renowned French winery Château Margaux unveiled its new eco-friendly vineyard management system. The system uses AI-driven sensors to optimize water usage, reduce pesticide application, and improve soil health. This innovation reflects the winery’s commitment to reducing its carbon footprint and aligns with the increasing demand for wines produced using sustainable methods. Château Margaux’s move is part of a larger trend in the industry towards incorporating advanced technologies for more sustainable wine production

- In March 2025, Italian wine producer E. & J. Gallo Winery announced the launch of a premium, organic wine collection under the brand name “Viva Verde.” This collection includes red, white, and rosé wines made from certified organic grapes grown without synthetic pesticides or fertilizers. The launch aligns with the increasing consumer preference for organic and clean-label products and positions E. & J. Gallo Winery as a key player in the European market’s shift toward sustainability

- In June 2025, the Spanish Wine Federation introduced a new certification for "Eco Wine," which guarantees the wine is produced with 100% organic methods. The certification aims to support the growing market for organic wines and provide consumers with clearer choices in the wine aisle. With many European consumers prioritizing health and sustainability, this certification is expected to boost the sales of Spanish organic wines both domestically and internationally

- In May 2025, South African wine producer KWV announced the opening of a new production facility in France to expand its presence in the European market. This facility will focus on creating wines using sustainable practices, including reducing water consumption and implementing solar energy solutions in the production process. The expansion reflects the increasing demand for South African wines in Europe and the growing trend towards sustainable production methods in the wine industry

- In April 2025, the French government introduced a new regulation mandating that all wine producers in the country will need to disclose their carbon footprint by 2027. The regulation aims to improve transparency in the wine industry and encourage producers to reduce their environmental impact. This move comes in response to growing consumer demand for more eco-friendly and ethically produced wines, aligning with global sustainability goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Wine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Wine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Wine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.