Europe Wound Closure Devices Market

Market Size in USD Billion

CAGR :

%

USD

4.45 Billion

USD

7.41 Billion

2024

2032

USD

4.45 Billion

USD

7.41 Billion

2024

2032

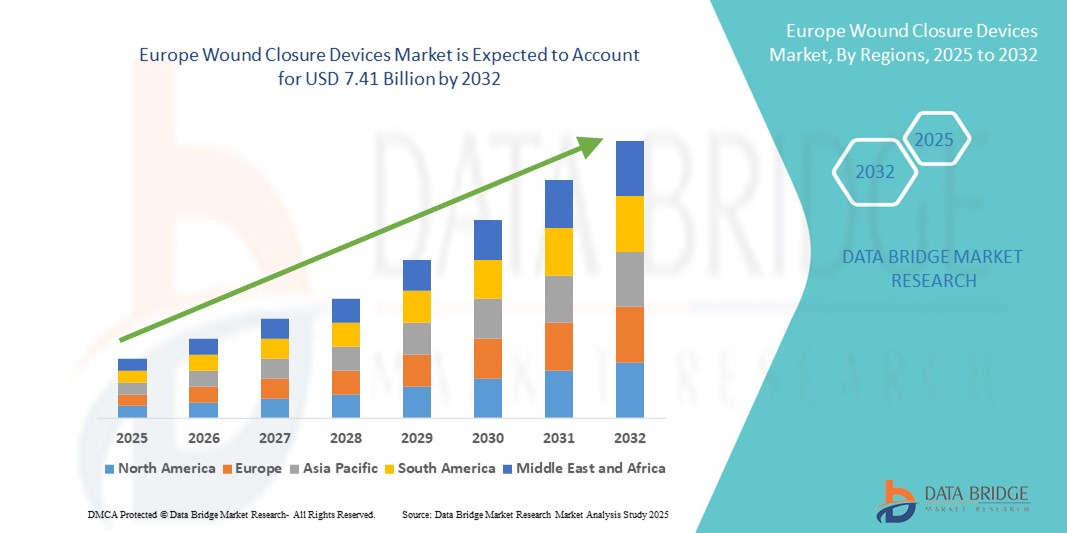

| 2025 –2032 | |

| USD 4.45 Billion | |

| USD 7.41 Billion | |

|

|

|

|

Europe Wound Closure Devices Market Size

- The Europe wound closure devices market size was valued at USD 4.45 billion in 2024 and is expected to reach USD 7.41 billion by 2032, at a CAGR of 6.58% during the forecast period

- The market growth is primarily driven by increasing surgical procedures, rising prevalence of chronic wounds, and advancements in wound closure technologies including absorbable sutures, staples, and tissue adhesives

- In addition, the growing geriatric population and rising awareness of minimally invasive surgery techniques are fueling demand for effective, faster healing wound closure solutions across hospitals and clinics in Europe. These factors collectively contribute to the strong expansion of the wound closure devices market in the region

Europe Wound Closure Devices Market Analysis

- Wound closure devices, including sutures, staples, adhesives, and sealants, are increasingly essential in surgical and trauma care across Europe due to their role in accelerating wound healing and reducing infection risks in both acute and chronic wounds

- The growing number of surgeries, rising prevalence of chronic wounds such as diabetic and pressure ulcers, and demand for minimally invasive wound closure solutions are key factors driving market growth

- Germany dominated the Europe wound closure devices market with the largest revenue share of 39% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, and rapid adoption of innovative wound closure technologies

- Poland is expected to be the fastest-growing country in the Europe wound closure devices market during the forecast period, driven by expanding healthcare infrastructure, increasing investments, and rising awareness of advanced wound care products

- Sutures segment dominated the Europe wound closure devices market with a market share of 47.2% in 2024, attributed to their versatility, proven effectiveness, and widespread use across various surgical procedures.

Report Scope and Europe Wound Closure Devices Market Segmentation

|

Attributes |

Europe Wound Closure Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Wound Closure Devices Market Trends

Advancements in Bioengineered and Minimally Invasive Closure Technologies

- A major trend in the Europe wound closure devices market is the increasing adoption of bioengineered materials and minimally invasive closure techniques that promote faster healing with reduced scarring and infection risks. These innovations include tissue adhesives, sealants, and absorbable sutures with enhanced biocompatibility and antimicrobial properties

- For instance, products such as the CoSeal Surgical Sealant and Dermabond Advanced Adhesive are gaining popularity due to their ease of application and ability to reduce procedure times compared to traditional suturing. Similarly, innovations in barbed sutures allow for knotless closure, improving surgical efficiency and patient comfort

- The growing preference for minimally invasive surgeries in Europe is accelerating demand for these advanced closure devices, especially in outpatient and ambulatory surgical centers. This shift aligns with healthcare providers’ goals of reducing hospital stays and accelerating patient recovery

- Furthermore, regulatory support and reimbursement incentives for innovative wound closure solutions in key countries such as Germany and France are encouraging manufacturers to invest in R&D and bring new technologies to market

- This trend toward more sophisticated, patient-friendly closure options is reshaping clinical practices and driving competitive differentiation among device manufacturers across Europe

- The rising adoption of these advanced products by hospitals and specialized clinics is expected to continue growing rapidly throughout the forecast period.

Europe Wound Closure Devices Market Dynamics

Driver

Increasing Surgical Procedures and Chronic Wound Prevalence

- The steady rise in the number of surgical interventions across Europe, fueled by aging populations and advances in medical care, is a key driver boosting demand for wound closure devices

- In addition, the growing incidence of chronic wounds, including diabetic and pressure ulcers, increases the need for effective closure solutions that support faster healing and prevent complications

- For instance, in 2024, German healthcare providers reported a notable increase in diabetic ulcer cases, prompting wider adoption of advanced closure products that promote tissue regeneration and reduce infection risk

- The rising awareness among clinicians and patients about the benefits of innovative wound closure technologies is further supporting market expansion

- The emphasis on outpatient surgeries and enhanced recovery protocols is also driving demand for easy-to-use, minimally invasive closure options that reduce procedure times and improve patient outcomes

Restraint/Challenge

High Treatment Costs and Reimbursement Limitations

- Despite technological advances, high costs associated with certain advanced wound closure devices, such as bioengineered adhesives and specialized sutures, remain a barrier to widespread adoption in some European countries

- Variability in reimbursement policies and limited coverage for newer products in certain markets constrain hospital procurement decisions and limit patient access to cutting-edge closure technologies

- For instance, some Eastern European countries have slower adoption rates due to budget constraints and less comprehensive reimbursement frameworks compared to Western Europe

- In addition, the need for clinician training on novel products and techniques may slow integration into routine surgical practice, delaying market growth

- Manufacturers must work closely with healthcare authorities to demonstrate clinical and economic benefits and advocate for better reimbursement policies to overcome these challenges

- The stringent regulatory requirements across different European countries for approval and use of new wound closure devices can delay product launches and increase development costs, posing challenges for manufacturers aiming for rapid market entry

- Concerns over potential postoperative complications such as allergic reactions, wound dehiscence, or infections linked to improper use or device failure can limit clinician preference for newer or less familiar wound closure products, impacting market adoption

Europe Wound Closure Devices Market Scope

The market is segmented on the basis of product type, wound type, application, and end user

- By Product Type

On the basis of product type, the Europe wound closure devices market is segmented into adhesives, staples, sutures, sealants, and mechanical devices. The sutures segment dominated the market with a revenue share of 47.2% in 2024, owing to its wide versatility and proven effectiveness across a broad spectrum of surgical applications. Sutures remain the preferred choice among surgeons due to their availability in absorbable and non-absorbable forms, adaptability to various wound types, and cost-effectiveness.

The adhesives segment is expected to witness the fastest growth over the forecast period, driven by the increasing demand for faster, less invasive wound closure techniques. Adhesives offer advantages such as ease of application, reduced procedure time, minimal scarring, and a lower risk of infection, making them especially popular in outpatient surgeries and minimally invasive procedures.

- By Wound Type

On the basis of wound type, the Europe wound closure devices market is divided into acute wounds and chronic wounds. The acute wound segment held the dominant market share of 60% in 2024, fueled by the high incidence of surgical wounds and trauma-related injuries across Europe requiring immediate and effective closure solutions. Acute wounds represent a significant portion of demand due to the frequency of surgeries and accidents.

Conversely, the chronic wound segment is anticipated to be the fastest growing during forecast period, as the aging population and rising cases of lifestyle diseases such as diabetes increase the prevalence of non-healing wounds such as diabetic ulcers, pressure ulcers, and arterial ulcers. Chronic wounds demand specialized closure devices that support prolonged healing, infection control, and tissue regeneration, thus driving growth in this segment.

- By Application

On the basis of application, the Europe wound closure devices market includes burns, ulcers, surgical wounds, pressure ulcers, diabetic ulcers, and arterial ulcers. The surgical wounds segment dominated with 50% market share in 2024, as wound closure devices are most commonly employed post-surgery to ensure proper healing and minimize infection risk. Surgical wounds encompass a broad range of procedures, contributing heavily to the market.

The diabetic ulcers segment is expected to see the fastest growth during forecast period, propelled by increasing diabetes prevalence in Europe, which leads to complications requiring advanced wound closure techniques. The growing focus on improving quality of life for diabetic patients and reducing healthcare costs associated with chronic wound management further supports this trend.

- By End User

On the basis of end user, the Europe wound closure devices market is segmented into hospitals, community healthcare service providers, ambulatory surgical centres, and home care. The hospitals segment dominated with 70.5% revenue share in 2024, driven by the concentration of complex surgical procedures and advanced wound management in hospital settings. Hospitals are the primary purchasers of wound closure devices due to their capacity to handle a wide range of wound care needs.

The ambulatory surgical centres segment is projected to be the fastest growing during forecast period, fueled by the increasing number of outpatient surgeries, preference for minimally invasive procedures, and rising patient demand for quicker recovery times. Ambulatory centres benefit from adopting fast and effective closure devices that reduce hospital stays and enhance patient throughput.

Europe Wound Closure Devices Market Regional Analysis

- Germany dominated the Europe wound closure devices market with the largest revenue share of 39% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, and rapid adoption of innovative wound closure technologies

- Healthcare providers and patients in Germany highly prioritize effective wound management solutions that improve healing outcomes and reduce hospital stays, supporting strong demand for both traditional and advanced closure devices such as sutures, adhesives, and sealants

- This dominant position is further reinforced by robust research and development activities, well-established reimbursement systems, and a growing focus on minimally invasive surgical procedures, positioning Germany as the key market leader in Europe’s wound closure devices landscape

The Germany Wound Closure Devices Market

The Germany wound closure devices market holds the largest market share in the Europe as of 2024. This leadership stems from the country’s highly advanced healthcare system, substantial healthcare expenditure, and strong emphasis on medical research and innovation. Hospitals and surgical centers across Germany are quick to adopt cutting-edge wound closure technologies, including absorbable sutures, bioengineered adhesives, and tissue sealants. Moreover, stringent regulatory requirements ensure only safe and effective products are used, increasing clinician and patient confidence. The country also benefits from well-established reimbursement policies that facilitate access to advanced devices. Germany’s focus on minimally invasive surgeries and enhanced recovery protocols is accelerating the demand for sophisticated wound closure solutions, positioning it as the regional market leader.

France Wound Closure Devices Market

The France wound closure devices market is a significant market contributor, supported by a robust healthcare infrastructure and increasing volumes of both acute and chronic wound care cases. The country’s aging population, combined with rising awareness of chronic wound management, is boosting demand for advanced closure products such as antimicrobial sutures and bioadhesives. French healthcare providers emphasize outpatient care and minimally invasive procedures, which encourages faster adoption of innovative closure techniques. Government initiatives to improve wound care and reduce hospital stays are also fostering growth, making France a key market in Western Europe.

U.K. Wound Closure Devices Market

The U.K. wound closure devices market is growing steadily, driven by a rising prevalence of diabetes and associated chronic wounds, such as diabetic and pressure ulcers. The National Health Service (NHS) has increasingly integrated home-based and community wound care services, expanding the reach of advanced wound closure technologies beyond hospital settings. In addition, government programs aimed at reducing the burden of chronic wounds on healthcare resources are promoting the adoption of effective closure devices. The UK’s strong e-commerce and medical distribution channels also facilitate faster product availability and patient access, supporting overall market growth.

Poland Wound Closure Devices Market

The Poland wound closure devices market stands out as the fastest-growing market in Europe. Rapid improvements in healthcare infrastructure and rising investments in medical technology are key drivers. Increased clinician and patient awareness about the benefits of modern wound closure devices, such as absorbable sutures and advanced adhesives, has accelerated adoption in both public and private healthcare sectors. Government health initiatives aimed at expanding access to quality wound care and the rising prevalence of diabetes and chronic wounds further bolster growth. Poland’s expanding network of hospitals and outpatient clinics is increasingly equipped with state-of-the-art wound care technologies, positioning it as a rapidly emerging market.

Spain Wound Closure Devices Market

The Spain wound closure devices market is expanding rapidly, fueled by an aging population and a growing incidence of chronic wounds such as diabetic and pressure ulcers. Healthcare reforms focusing on integrated wound management and increased funding for ambulatory surgical centers and home care services are creating opportunities for advanced wound closure products. Spanish hospitals are adopting newer technologies such as tissue adhesives and sealants to improve healing outcomes and reduce hospitalization times. Moreover, increasing patient awareness about wound care options is driving demand for innovative and minimally invasive closure solutions.

Europe Wound Closure Devices Market Share

The Europe wound closure devices industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Medtronic (Ireland)

- Baxter International Inc. (U.S.)

- Smith+Nephew (U.K.)

- Stryker Corporation (U.S.)

- B. Braun SE (Germany)

- ConvaTec Group PLC (U.K.)

- Coloplast A/S (Denmark)

- Boston Scientific Corporation (U.S.)

- Arthrex Inc. (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Abbott (U.S.)

- Teleflex Incorporated (U.S.)

- Advanced Medical Solutions Group plc (U.K.)

- Corza Medical (U.S.)

- DermaClip (U.S.)

- AVITA Medical, Inc. (U.S.)

- KitoTech Medical, Inc. (U.S.)

- Riverpoint Medical (U.S.)

What are the Recent Developments in Europe Wound Closure Devices Market?

- In March 2025, Convatec showcased its strongest wound care innovation pipeline ever at the European Wound Management Association (EWMA) conference in Barcelona. The company highlighted its Wound Hygiene protocol, which won the Innovation in Chronic Wound Healing category at the Journal of Wound Care Awards 2025, emphasizing its commitment to advancing wound care solutions

- In February 2025, a collaborative research initiative in Europe focused on developing biodegradable tissue adhesives for wound closure. The project aims to create sustainable and biocompatible materials, enhancing the healing process and reducing complications associated with traditional wound closure methods

- In June 2024, Caltech researchers introduced next-generation smart bandages capable of wirelessly monitoring metabolic and inflammatory biomarkers in wound fluids. These smart bandages aim to revolutionize chronic wound treatment by enabling real-time monitoring and potentially reducing the need for frequent medical visits

- In June 2024, Haemonetics Corporation, a global medical technology company focused on delivering innovative solutions to drive better patient outcomes, has launched a limited market release of its new VASCADE MVP XL mid-bore venous closure device. The VASCADE MVP XL system expands Haemonetics' VASCADE portfolio of vascular closure systems featuring an innovative collapsible disc technology and a proprietary resorbable collagen patch designed to promote rapid hemostasis

- In December 2024, researchers at the University of Pennsylvania and Rutgers University developed a smart bandage that can detect infection and deliver electrotherapy to accelerate healing. The bandage wirelessly transmits data to healthcare providers, enabling remote monitoring and intervention, potentially transforming chronic wound management.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.