Germany Safety Footwear Market

Market Size in USD Million

CAGR :

%

USD

954.94 Million

USD

1,706.01 Million

2025

2033

USD

954.94 Million

USD

1,706.01 Million

2025

2033

| 2026 –2033 | |

| USD 954.94 Million | |

| USD 1,706.01 Million | |

|

|

|

|

Germany Safety Footwear Market Size

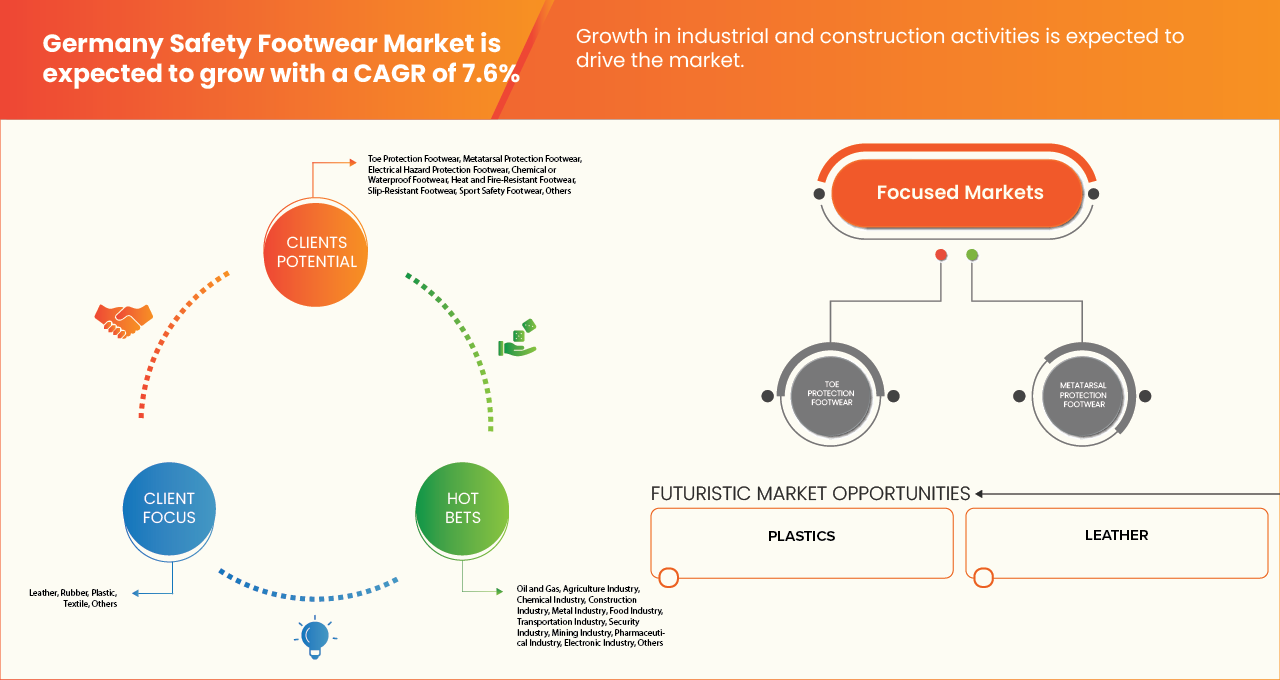

- Germany Safety Footwear Market is expected to reach USD 1706.01 million by 2033 from USD 954.94 million in 2026, growing with a substantial CAGR of 7.6% in the forecast period of 2026 to 2033.

- The Germany Safety Footwear Market is driven by a large skilled workforce, mandatory safety compliance, and strong industrial and logistics networks supporting continuous demand.

- Networks

Germany Safety Footwear Market Analysis

- Rising activity in manufacturing, automotive, construction, logistics, energy, and chemicals is significantly increasing demand for certified safety footwear across Germany, supported by strict workplace safety compliance requirements.

- Government and industry enforcement of occupational safety regulations (EN ISO 20345 and EU PPE Regulation) continues to mandate the use of protective footwear in hazardous work environments, sustaining consistent replacement demand.

- High labor and production costs, coupled with pressure to balance comfort, durability, and sustainability, pose cost challenges for manufacturers operating within Germany.

- Technological advancements in materials and design, including lightweight composites, anti-fatigue soles, slip-resistant outsoles, and ergonomic construction, are enhancing worker comfort and productivity, driving product upgrades.

- Growing adoption of digital sales channels, including e-commerce platforms and direct-to-consumer models, is improving market accessibility and enabling brands to reach SMEs and individual workers more efficiently.

- Sustainability and eco-design trends are reshaping product development, with manufacturers increasingly using recycled materials, environmentally responsible leather, and energy-efficient production processes to meet corporate ESG goals.

- The safety shoes segment is expected to dominate the Germany Safety Footwear Market, accounting for the largest market share of 29.82% in 2026, driven by high usage in construction, manufacturing, logistics, and automotive industries, where lightweight and all-day comfort footwear is preferred over heavy-duty boots.

Report Scope and Germany Safety Footwear Market Segmentation

|

Attributes |

Germany Safety Footwear Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Germany Safety Footwear Market Trends

“Rising infrastructure development activities and sustained construction”

- Rising infrastructure development activities and sustained construction spending across Germany are key factors supporting the growth of the Germany safety footwear market, as large-scale projects increase the need for worker protection on active job sites. Increasing adoption of safety footwear across manufacturing, logistics, utilities, and waste and water management facilities, along with its role in reducing workplace injuries and associated compensation costs, is expected to further drive market expansion.

- The major restraints that may adversely affect the Germany safety footwear market include concerns related to prolonged wear comfort, potential material-related health or environmental issues, and inconsistent adoption of advanced protective designs across smaller enterprises. Limited awareness regarding appropriate footwear selection for specific workplace hazards can also restrict optimal market penetration.

- Growing emphasis on sustainable manufacturing practices and rising interest in eco-friendly, recyclable, and lightweight materials for safety footwear are expected to create new opportunities in the Germany safety footwear market. In addition, stricter occupational safety regulations and government focus on worker welfare are encouraging employers to upgrade protective gear. However, improper selection or use of safety footwear, variation in compliance practices, and fluctuations in raw material prices such as leather, rubber, and polymers are expected to pose challenges to market growth.

- In March 2022, uvex group expanded its safety footwear portfolio in Germany by introducing ergonomically optimized safety shoes manufactured at its Lüneburg facility. The newly launched products were designed to enhance wearer comfort during long working hours while meeting EN ISO safety standards, supporting industries such as construction, manufacturing, and logistics. This expansion strengthened uvex’s position as a domestic supplier focused on high-quality, worker-centric protective footwear solutions.

- In October 2021, Elten GmbH, a Germany-based safety footwear manufacturer, launched a new range of lightweight safety shoes incorporating breathable materials and slip-resistant sole technology. The product line was developed in response to growing demand from industrial and warehousing sectors for footwear that reduces fatigue without compromising safety performance. The introduction supported improved workplace safety compliance while addressing comfort-related concerns among worker

Germany Safety Footwear Market Dynamics

Driver

Strong industrial base and safety regulation compliance

- Germany’s position as Europe’s largest industrial economy, supported by a strong manufacturing base spanning automotive, machinery, construction, chemicals, logistics, and energy sectors, has been a fundamental driver of sustained demand for safety footwear. A significant proportion of the workforce operates in environments with elevated occupational risk, where protective footwear is not optional but a regulatory requirement. This has resulted in safety footwear being embedded as a core component of workplace compliance and risk mitigation strategies across industries.

- The strict enforcement of occupational safety regulations—particularly EN ISO 20345 standards under the German Occupational Safety and Health Act (Arbeitsschutzgesetz)—mandates the use of certified safety footwear offering features such as toe protection, slip resistance, penetration resistance, antistatic properties, and energy absorption. Employers are legally accountable for providing compliant personal protective equipment (PPE), which directly translates into consistent and recurring procurement of safety footwear. Additionally, Germany’s strong presence of large industrial employers and unions further reinforces adherence to safety norms, limiting substitution with non-certified or low-quality alternatives.

- In January 2024, the German Federal Institute for Occupational Safety and Health (BAuA) reiterated that under the Occupational Safety and Health Act (ArbSchG) and the PPE Usage Ordinance (PSA-BV), employers are legally required to provide certified personal protective equipment, including safety footwear, free of charge to employees exposed to workplace hazards. This regulatory obligation directly sustains continuous demand for compliant safety shoes across Germany’s industrial, construction, logistics, and manufacturing sectors.

- In March 2023, the German Social Accident Insurance (DGUV) updated its technical rules for foot and leg protection, emphasizing the mandatory use of safety footwear compliant with EN ISO 20345 in high-risk working environments. These DGUV rules serve as legally recognized benchmarks for compliance, reinforcing standardized procurement of certified safety footwear by German employers.

- In October 2022, the European Commission, through its PPE Regulation (EU) 2016/425, reaffirmed that all safety footwear marketed in EU member states, including Germany, must meet harmonized standards such as EN ISO 20345 and carry CE certification. This regulatory framework ensures uniform safety performance requirements and supports Germany’s reputation for high-quality, regulation-driven industrial safety equipment.

- In April 2024, uvex Safety Group, a Germany-based safety footwear manufacturer, highlighted on its corporate website that all uvex safety shoes are developed and tested in accordance with EN ISO 20345 and DGUV guidelines. The company emphasized in-house testing, ergonomic design, and compliance-driven innovation to meet Germany’s stringent occupational safety regulations, reflecting how domestic manufacturers align product development with regulatory enforcement.

- In conclusion, Germany’s extensive industrial landscape, combined with rigorously enforced occupational safety regulations, creates a structurally resilient and non-discretionary demand environment for safety footwear. The legal obligation to comply with EN ISO 20345 standards, reinforced by national authorities and EU-level regulations, ensures that certified safety footwear remains an essential procurement category rather than a cost-optional item. This regulatory certainty, supported by strong institutional oversight and compliance-oriented employer behavior, not only sustains stable replacement demand but also encourages continuous product innovation by domestic manufacturers, solidifying safety footwear as a long-term, compliance-driven segment within Germany’s industrial ecosystem.

Restraint/Challenge

High production and certification costs

- High production and certification costs remain a notable restraint on the Germany safety footwear market, as manufacturers incur substantial expenses to ensure products meet stringent safety standards and quality expectations. Safety footwear sold in Germany must comply with EN ISO 20345 and the EU PPE Regulation (EU) 2016/425, requiring extensive laboratory testing for impact resistance, compression, penetration resistance, slip performance, and other protective criteria. These certification processes involve repeated testing, quality audits, and documentation, all of which increase development timelines and cost structures—especially for new or innovative designs.

- Manufacturers also face elevated material costs due to the use of premium components such as lightweight composite toe caps, puncture-resistant midsoles, ergonomic cushioning systems, and advanced slip-resistant outsoles. These materials, along with investments in automated manufacturing technologies and skilled workforce training, drive production costs higher compared to non-rated footwear. Smaller and mid-sized producers, in particular, may struggle to absorb these expenditures, reducing their ability to compete on price against imported alternatives that offer basic protection at lower unit costs.

- In 2024, according to uvex Safety Group, investment in multi-stage laboratory testing and in-house quality audits for EN ISO 20345 S3-certified shoes increased production costs by over 10%, highlighting the financial burden of ensuring compliance while maintaining advanced safety and ergonomic features.

- In 2023, ELTEN GmbH reported in its annual review that rising costs of composite toe caps, puncture-resistant midsoles, and ergonomic cushioning systems led to a 12–15% increase in average unit production costs for S3 and ESD-rated models, demonstrating the cost pressures associated with premium material adoption.

- In 2023, the German Federal Ministry for Economic Affairs and Climate Action (BMWK) confirmed that manufacturers of regulated PPE, including safety footwear, allocate a higher proportion of R&D budgets to certification and compliance processes than non-regulated footwear segments, indicating long-term operational cost challenges for smaller producers.

- In 2025, according to HAIX Group, ongoing investments in testing facilities, employee training, and external accredited certification bodies increased overhead costs, particularly affecting pricing flexibility for export-oriented safety footwear models.

- In 2024, the German Federal Institute for Occupational Safety and Health (BAuA) reported that updates to EN ISO 20345 standards and related DGUV technical rules require manufacturers to conduct periodic re-evaluation and re-certification, imposing recurring financial and administrative burdens on safety footwear producers.

- In 2024, the European Commission (EU PPE Regulation 2016/425) noted that changes to harmonized safety standards often necessitate re-certification of existing safety footwear models, creating recurring compliance costs that restrict market agility, especially for small- and mid-sized manufacturers.

- In conclusion, the combined impact of stringent certification requirements, recurring compliance obligations, and the use of premium protective materials continues to place significant financial pressure on safety footwear manufacturers in Germany. While these costs ensure high-quality, regulation-compliant footwear that protects workers across industrial and construction sectors, they also limit pricing flexibility and market agility—particularly for smaller and mid-sized producers. As a result, high production and certification costs remain a persistent restraint, shaping competitive dynamics and influencing product strategy within the German safety footwear market.

Germany Safety Footwear Market Scope

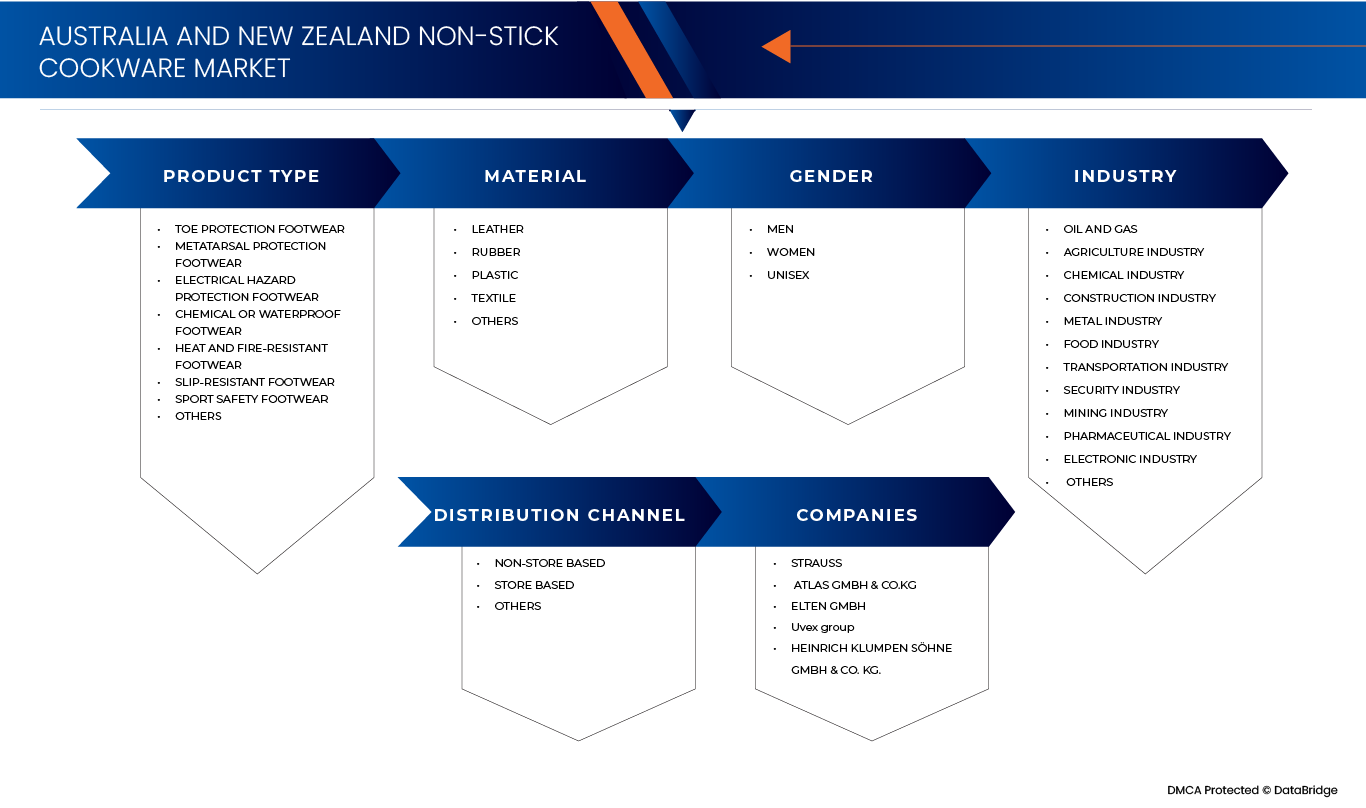

The Germany Safety Footwear Market is segmented into five notable segments based on product type, material gender, industry and distribution channel

- By product type

On the basis of product type, the Germany safety footwear market is segmented into toe protection footwear, metatarsal protection footwear, electrical hazard protection footwear, chemical or waterproof footwear, heat and fire-resistant footwear, slip-resistant footwear, sport safety footwear, others.

In 2026, the toe protection footwear segment is expected to dominate the Germany safety footwear market with a share of 29.82%, driven by its widespread adoption across construction, manufacturing, metal processing, and logistics industries where protection against impact and compression hazards is mandatory. In addition to holding the largest market share, toe protection footwear is also the fastest-growing segment, supported by increasing regulatory enforcement and rising awareness of workplace safety. These products offer enhanced durability, strict compliance with European safety standards, and improved worker confidence, making toe protection footwear a fundamental requirement across high-risk industrial environments.

- By Material

On the basis of material, the Germany safety footwear market is segmented into leather, rubber, plastic, textile, others.

In 2026, leather segment is expected to dominate the Germany Safety Footwear market share of 51.39% due to its superior durability, breathability, and comfort, making it well suited for prolonged industrial usage. Leather-based safety footwear provides enhanced resistance to abrasion, maintains flexibility under varying working conditions, and supports ergonomic footwear design, reinforcing its widespread adoption across construction, manufacturing, and heavy industrial sector.

- By Gender

On the basis of gender, the Germany safety footwear market is segmented into men, women, unisex.

In 2026, the men segment is anticipated to dominate the Germany Safety Footwear market share of 71.63% due to the higher concentration of male workforce across construction, manufacturing, metal processing, and heavy industrial sectors. Men’s safety footwear is widely adopted due to its availability in a broader range of protective designs, load-bearing capacities, and compliance with stringent workplace safety regulations. However, the women and unisex segments are gaining steady traction with increasing female workforce participation and growing demand for ergonomically designed, size-inclusive safety footwear across diverse industries in German.

- By Industry

On the basis of industry, the Germany safety footwear market is segmented into oil and gas, agriculture industry, chemical industry, construction industry, metal industry, food industry, transportation industry, security industry, mining industry, pharmaceutical industry, electronic industry, others.

In 2026, the construction industry segment is anticipated to dominate the Germany Safety Footwear market share of 31.83% due to continuous infrastructure development, strict workplace safety regulations, and high worker exposure to mechanical, electrical, and slip-related hazards across diverse construction environment.

- By Distribution Channel

On the basis of distribution channel, the Germany safety footwear market is segmented into non-store based, store based, others.

In 2026, the non-store based segment is anticipated to dominate the Germany Safety Footwear market share of 63.51% due to strong presence of organized retail networks, easy accessibility for industrial and commercial buyers, and the ability to provide personalized fittings and demonstrations, while the non-store based segment is witnessing steady growth owing to increasing adoption of online platforms and e-commerce channels for convenient procurement and wider product selection.

Germany Safety Footwear Market Share

Some of the major players operating in the Germany Safety Footwear market are listed below:

- Engelbert Strauss Inc. (Germany)

- ATLAS GmbH & Co.KG (Germany)

- ELTEN GmbH (Germany)

- UVEX Safety Group (Germany)

- Heinrich Klumpen Söhne GmbH & Co. KG (Germany)

- Bata Industrials (Netherlands)

- Aigle (France)

- Stabilus Safety GmbH (Germany)

- LUPOS® Gmbh, (Germany)

- FTG safety shoes Srl, (Italy)

- Portwest UC (Ireland)

- footwear talan,

- HAIX GROUP (Germany)

- COFRA S.r.l.(Italy)

Latest Developments in Germany Safety Footwear Market

- During 2024, Engelbert Strauss continued its strategy of biannual safety footwear launches, aligned with Spring/Summer and Autumn/Winter collections. These launches emphasized modern design, lightweight materials, and EN ISO 20345 compliance, targeting construction, logistics, and skilled trades. In 2025, the company further strengthened its direct-to-consumer retail and e-commerce model in Germany, supported by investments in logistics infrastructure and brand experience centers. Sustainability initiatives, including long-term supplier partnerships and responsible sourcing, remained a core focus throughout this period.

- In 2024, ATLAS maintained its position as one of Europe’s largest safety footwear manufacturers by focusing on high-capacity production at its Dortmund facility, reinforcing its “Made in Germany” positioning. Throughout 2025, the company emphasized process optimization, automation, and consistent quality output, rather than major portfolio shifts. ATLAS continued to supply large industrial clients across construction, automotive, manufacturing, and logistics sectors, benefiting from rising compliance-driven demand for certified safety footwear.

- In 2024, ELTEN accelerated implementation of its ELTEN LOOP sustainability strategy, introducing additional safety footwear models using recycled and environmentally responsible materials. The company strengthened its ESG positioning, gaining recognition through high sustainability and CSR ratings, which increased appeal among corporate and industrial buyers. In 2025, ELTEN reinforced brand visibility through participation in major industry exhibitions such as A+A Düsseldorf, while continuing incremental innovation in comfort, durability, and eco-design within its premium safety footwear range.

- During 2024, UVEX expanded its focus on lightweight, ergonomic safety footwear, integrating advanced sole systems and fatigue-reducing designs to support long working hours in industrial environments. In 2025, UVEX entered a new strategic phase following private-equity investment, aimed at accelerating growth, innovation, and international expansion. This development is expected to strengthen UVEX’s safety footwear portfolio through increased R&D investment, sustainable material innovation, and broader market reach while maintaining its German engineering heritage.

- Throughout 2024, HAIX continued to focus on high-performance safety footwear, particularly for industrial, utility, and emergency service applications. Product development emphasized technical performance, durability, slip resistance, and ergonomic comfort. In 2025, HAIX maintained its strategy of incremental product refinement rather than large corporate changes, reinforcing its reputation as a specialist manufacturer. Continued European production and strict quality standards supported strong demand from professional and industrial users in Germany.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GERMANY SAFETY FOOTWEAR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 COMPETITIVE RIVALRY

4.2 INNOVATION TRACKER AND STRATEGIC ANALYSIS – GERMANY SAFETY FOOTWEAR MARKET

4.2.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.2.2 JOINT VENTURES

4.2.3 MERGERS AND ACQUISITIONS

4.2.4 LICENSING AND PARTNERSHIP

4.2.5 TECHNOLOGY COLLABORATIONS

4.2.6 STRATEGIC DIVESTMENTS

4.2.7 NUMBER OF PRODUCTS IN DEVELOPMENT

4.2.8 STAGE OF DEVELOPMENT

4.2.9 TIMELINES AND MILESTONES

4.2.10 INNOVATION STRATEGIES AND METHODOLOGIES

4.2.11 RISK ASSESSMENT AND MITIGATION

4.2.12 FUTURE OUTLOOK

4.2.13 CONCLUSION

4.2.14 EXPLANATION: -

4.2.15 EXPLANATION: -

4.2.16 EXPLANATION: -

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 INTRODUCTION

4.3.2 OVERVIEW

4.3.3 RAW MATERIAL SOURCING & PROCUREMENT

4.3.4 PROCESSING & PRODUCT MANUFACTURING (PRODUCTION)

4.3.5 SUPPLY CHAIN & DISTRIBUTION LOGISTICS (TRANSPORTATION)

4.3.6 LOGISTIC COST SCENARIO

4.3.7 RETAIL & COMMERCIAL BUYER CHANNELS (DISTRIBUTION & SALES)

4.3.8 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.3.9 CONCLUSION

4.4 RAW MATERIAL COVERAGE

4.4.1 LEATHER

4.4.2 RUBBER AND THERMOPLASTIC POLYURETHANE (TPU)

4.4.3 METALS AND COMPOSITE MATERIALS

4.4.4 TEXTILE AND SYNTHETIC FABRICS

4.4.5 CUSHIONING AND SHOCK-ABSORBING MATERIALS

4.5 VALUE CHAIN ANALYSIS

4.5.1 RAW MATERIAL SOURCING

4.5.2 DESIGN AND PRODUCT DEVELOPMENT

4.5.3 MANUFACTURING AND PRODUCTION

4.5.4 DISTRIBUTION AND LOGISTICS

4.5.5 MARKETING AND SALES

4.5.6 AFTER-SALES SUPPORT

4.5.7 CONCLUSION

4.6 COST ANALYSIS BREAKDOWN OF THE GERMANY SAFETY FOOTWEAR MARKET

4.6.1 INTRODUCTION

4.6.2 RAW MATERIAL AND MANUFACTURING COSTS

4.6.3 PACKAGING AND LOGISTICS COSTS

4.6.4 RESEARCH, QUALITY, AND REGULATORY COMPLIANCE COSTS

4.6.5 ENVIRONMENTAL, ENERGY, AND SUSTAINABILITY COSTS

4.6.6 EMERGING COST TRENDS

4.6.7 CONCLUSION

4.7 PROFIT MARGINS SCENARIO OF THE GERMANY SAFETY FOOTWEAR MARKET

4.7.1 INTRODUCTION

4.7.2 COST MANAGEMENT AND MARGIN FORMATION

4.7.3 TECHNOLOGY DIFFERENTIATION AND PRODUCT STRATEGY

4.7.4 SUPPLY CHAIN AND DISTRIBUTION INFLUENCE

4.7.5 REGULATORY AND MACROECONOMIC INFLUENCES

4.7.6 EMERGING TRENDS AND STRATEGIC RESPONSES

4.7.7 CONCLUSION

4.8 PRICING ANALYSIS

4.9 VENDOR SELECTION CRITERIA

4.9.1 CERTIFICATION COMPLIANCE

4.9.2 PRODUCT QUALITY

4.9.3 CUSTOMIZATION ABILITY

4.9.4 COST & COMMERCIAL COMPETITIVENESS

4.9.5 REGULATORY, SAFETY & SUSTAINABILITY PRACTICES

4.9.6 COLLABORATION, INNOVATION & PROGRAM FLEXIBILITY

4.1 BRAND OUTLOOK

4.10.1 COMPANY VS BRAND OVERVIEW

4.11 CLIMATE CHANGE SCENARIO

4.11.1 ENVIRONMENTAL CONCERNS

4.11.2 INDUSTRY RESPONSE

4.11.3 GOVERNMENT’S ROLE

4.11.4 ANALYST RECOMMENDATIONS

4.12 CONSUMER BUYING BEHAVIOUR

4.13 INTRODUCTION

4.13.1 SHIFT TOWARDS COMFORT, ERGONOMICS AND ADVANCE PROTECTION

4.13.2 STRONG EMPHASIS ON REGULATORY COMPLIANCE AND BRAND CREDIBILITY

4.13.3 PRICE SENSITIVITY AND PROCUREMENT-BASED PURCHASING

4.13.4 INFLUENCE OF DISTRIBUTION CHANNELS AND DIGITAL PROCUREMENT

4.13.5 IMPORTANCE OF SUPPLY RELIABILITY AND PRODUCT CONSISTENCY

4.13.6 ROLE OF VALUE-ADDED SERVICES

4.13.7 SUSTAINABILITY, ETHICAL PRACTICES, AND PREMIUM PREFERENCES

4.13.8 INFLUENCE OF INDUSTRY TYPE AND WORKPLACE CULTURE

4.13.9 CONCLUSION

4.14 INDUSTRY ECOSYSTEM ANALYSIS

4.14.1 PROMINENT COMPANIES

4.14.2 SMALL & MEDIUM SIZE COMPANIES

4.14.3 END USERS

4.15 TECHNOLOGICAL ADVANCEMENTS

4.15.1 ADVANCED MATERIALS AND LIGHTWEIGHT PROTECTION

4.15.2 ERGONOMIC AND BIOMECHANICAL ENHANCEMENTS

4.15.3 SMART TECHNOLOGIES AND SENSOR INTEGRATION

4.15.4 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.15.5 PRECISION MANUFACTURING AND DIGITAL DESIGN TOOLS

5 TARIFFS & THEIR IMPACT ON THE GERMANY SAFETY FOOTWEAR MARKET

5.1 INTRODUCTION

5.2 CURRENT TARIFF RATE(S) IN GERMANY AND KEY TRADING PARTNER COUNTRIES

5.3 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE IN GERMANY

5.4 VENDOR SELECTION CRITERIA DYNAMICS IN GERMANY

5.5 IMPACT ON THE GERMANY SAFETY FOOTWEAR SUPPLY CHAIN

5.5.1 RAW MATERIAL PROCUREMENT

5.5.2 MANUFACTURING AND PRODUCTION

5.5.3 LOGISTICS AND DISTRIBUTION

5.5.4 PRICE PITCHING AND MARKET POSITIONING IN GERMANY

5.6 INDUSTRY PARTICIPANTS: PROACTIVE MOVES IN GERMANY

5.6.1 SUPPLY CHAIN OPTIMIZATION

5.6.2 JOINT VENTURE ESTABLISHMENTS

5.7 IMPACT ON PRICES IN GERMANY

5.7.1 REGULATORY INCLINATION AFFECTING GERMANY

5.7.1.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS RELEVANT TO GERMANY

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION IN GERMANY

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF INDUSTRIAL PARKS AND MANUFACTURING CLUSTERS

5.8 CONCLUSION

5.8.1 EXPLANATION:-

6 REGULATORY COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 STRONG INDUSTRIAL BASE AND SAFETY REGULATION COMPLIANCE

7.1.2 GROWTH IN INDUSTRIAL AND CONSTRUCTION ACTIVITIES

7.1.3 INCREASING ADOPTION OF LIGHTWEIGHT COMPOSITE TOE CAPS AND ERGONOMIC SOLE TECHNOLOGIES IMPROVING USER ACCEPTANCE

7.1.4 RISING EMPLOYER FOCUS ON WORKER HEALTH, ERGONOMICS, AND INJURY PREVENTION

7.2 RESTRAINTS

7.2.1 HIGH PRODUCTION AND CERTIFICATION COSTS

7.2.2 LONGER APPROVAL CYCLES FOR NEW DESIGNS

7.3 OPPORTUNITY

7.3.1 GROWING DEMAND FOR SUSTAINABLE AND ECO FRIENDLY FOOTWEAR

7.3.2 EXPANSION OF PREMIUM, ROLE-SPECIFIC SAFETY SHOES

7.3.3 GROWTH OF DIGITAL B2B PROCUREMENT AND E-COMMERCE

7.4 CHALLENGES

7.4.1 INTENSE COMPETITION FROM INTERNATIONAL BRANDS AND PRIVATE-LABEL SUPPLIERS

7.4.2 MANAGING SUPPLY CHAIN DISRUPTIONS AND RAW MATERIAL COST VOLATILITY

8 GERMANY SAFETY FOOTWEAR MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 TOE PROTECTION FOOTWEAR

8.3 METATARSAL PROTECTION FOOTWEAR

8.4 ELECTRICAL HAZARD PROTECTION FOOTWEAR

8.5 CHEMICAL / WATERPROOF FOOTWEAR

8.6 HEAT & FIRE-RESISTANT FOOTWEAR

8.7 SLIP-RESISTANT FOOTWEAR

8.8 SPORT SAFETY FOOTWEAR

8.9 OTHERS

9 GERMANY SAFETY FOOTWEAR MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 LEATHER

9.3 RUBBER

9.4 PLASTIC

9.5 TEXTILE

9.6 OTHERS

9.6.1 GENUINE LEATHER

9.6.2 SYNTHETIC LEATHER

9.6.3 SYNTHETIC RUBBER

9.6.4 NATURAL RUBBER

9.6.5 POLYURETHANE (PU) AND POLYURETHANE FOAM

9.6.6 POLYESTER

9.6.7 ETHYLENE-VINYL ACETATE (EVA)

9.6.8 POLYVINYL CHLORIDE (PVC)

9.6.9 OTHERS

10 GERMANY SAFETY FOOTWEAR MARKET, BY GENDER

10.1 OVERVIEW

10.2 MEN

10.3 WOMEN

10.4 UNISEX

11 GERMANY SAFETY FOOTWEAR MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 OIL & GAS

11.2.1 OIL AND GAS, BY APPLICATION

11.2.1.1 ON SHORE

11.2.1.2 OFF SHORE

11.2.2 OIL AND GAS, BY PRODUCT

11.2.2.1 TOE PROTECTION FOOTWEAR

11.2.2.2 METATARSAL PROTECTION FOOTWEAR

11.2.2.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.2.2.4 CHEMICAL / WATERPROOF FOOTWEAR

11.2.2.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.2.2.6 SLIP-RESISTANT FOOTWEAR

11.2.2.7 SPORT SAFETY FOOTWEAR

11.2.2.8 OTHERS

11.3 AGRICULTURE INDUSTRY

11.3.1 TOE PROTECTION FOOTWEAR

11.3.2 METATARSAL PROTECTION FOOTWEAR

11.3.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.3.4 CHEMICAL / WATERPROOF FOOTWEAR

11.3.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.3.6 SLIP-RESISTANT FOOTWEAR

11.3.7 SPORT SAFETY FOOTWEAR

11.3.8 OTHERS

11.4 CHEMICAL INDUSTRY

11.4.1 TOE PROTECTION FOOTWEAR

11.4.2 METATARSAL PROTECTION FOOTWEAR

11.4.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.4.4 CHEMICAL / WATERPROOF FOOTWEAR

11.4.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.4.6 SLIP-RESISTANT FOOTWEAR

11.4.7 SPORT SAFETY FOOTWEAR

11.4.8 OTHERS

11.5 CONSTRUCTION INDUSTRY

11.5.1 CONSTRUCTION INDUSTRY, BY APPLICATION

11.5.1.1 RESIDENTIAL CONSTRUCTION

11.5.1.2 ENGINEERING CONSTRUCTION

11.5.1.2.1 ENGINEERING CONSTRUCTION, BY TYPE

11.5.1.2.1.1 ROADWAYS

11.5.1.2.1.2 PIPELINES

11.5.1.2.1.3 BRIDGES

11.5.1.2.1.4 TUNNELS AND DAMS

11.5.1.2.1.5 RAILWAYS

11.5.1.2.1.6 AIRPORT CONSTRUCTION

11.5.1.2.1.7 OTHERS

11.5.1.3 COMMERCIAL CONSTRUCTION

11.5.1.3.1 COMMERCIAL CONSTRUCTION, BY TYPE

11.5.1.3.1.1 OFFICES

11.5.1.3.1.2 HEALTHCARE FACILITIES

11.5.1.3.1.3 EDUCATION INSTITUTIONS

11.5.1.3.1.4 HOTELS

11.5.1.3.1.5 RESTAURANTS & BARS

11.5.1.3.1.6 WAREHOUSES

11.5.1.3.1.7 RESEARCH LABORATORIES

11.5.1.3.1.8 OTHERS

11.5.2 CONSTRUCTION INDUSTRY, BY PRODUCT

11.5.2.1 TOE PROTECTION FOOTWEAR

11.5.2.2 METATARSAL PROTECTION FOOTWEAR

11.5.2.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.5.2.4 CHEMICAL / WATERPROOF FOOTWEAR

11.5.2.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.5.2.6 SLIP-RESISTANT FOOTWEAR

11.5.2.7 SPORT SAFETY FOOTWEAR

11.5.2.8 OTHERS

11.6 METAL INDUSTRY

11.6.1 TOE PROTECTION FOOTWEAR

11.6.2 METATARSAL PROTECTION FOOTWEAR

11.6.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.6.4 CHEMICAL / WATERPROOF FOOTWEAR

11.6.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.6.6 SLIP-RESISTANT FOOTWEAR

11.6.7 SPORT SAFETY FOOTWEAR

11.6.8 OTHERS

11.7 FOOD INDUSTRY

11.7.1 FOOD

11.7.1.1 MEAT AND ALTERNATIVES

11.7.1.2 MILK AND MILK PRODUCTS

11.7.1.3 FRUITS AND VEGETABLES

11.7.1.4 GRAIN PRODUCTS

11.7.1.5 OTHERS

11.7.1.6 BEVERAGES

11.7.1.6.1 BEVERAGE, BY TYPE

11.7.1.6.1.1 NON - ALCOHOLIC

11.7.1.6.1.1.1 BOTTLED WATER

11.7.1.6.1.1.2 CARBONATED SOFT DRINKS (CSDS)

11.7.1.6.1.1.3 FUNCTIONAL BEVERAGES

11.7.1.6.1.1.4 FRUIT BEVERAGES

11.7.1.6.1.1.5 SPORTS DRINKS

11.7.1.6.1.1.6 OTHERS

11.7.1.6.1.2 ALCOHOLIC

11.7.1.6.1.2.1 BEER

11.7.1.6.1.2.2 SPIRITS

11.7.1.6.1.2.3 WINES

11.7.1.6.1.2.4 TEQUILA & COCKTAILS

11.7.1.6.1.2.5 CHAMPAGNE

11.7.1.6.1.2.6 OTHERS

11.7.2 FOOD INDUSTRY, BY PRODUCT

11.7.2.1 TOE PROTECTION FOOTWEAR

11.7.2.2 METATARSAL PROTECTION FOOTWEAR

11.7.2.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.7.2.4 CHEMICAL / WATERPROOF FOOTWEAR

11.7.2.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.7.2.6 SLIP-RESISTANT FOOTWEAR

11.7.2.7 SPORT SAFETY FOOTWEAR

11.7.2.8 OTHERS

11.8 TRANSPORT INDUSTRY

11.8.1 TOE PROTECTION FOOTWEAR

11.8.2 METATARSAL PROTECTION FOOTWEAR

11.8.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.8.4 CHEMICAL / WATERPROOF FOOTWEAR

11.8.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.8.6 SLIP-RESISTANT FOOTWEAR

11.8.7 SPORT SAFETY FOOTWEAR

11.8.8 OTHERS

11.9 SECURITY INDUSTRY

11.9.1 TOE PROTECTION FOOTWEAR

11.9.2 METATARSAL PROTECTION FOOTWEAR

11.9.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.9.4 CHEMICAL / WATERPROOF FOOTWEAR

11.9.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.9.6 SLIP-RESISTANT FOOTWEAR

11.9.7 SPORT SAFETY FOOTWEAR

11.9.8 OTHERS

11.1 MINING INDUSTRY

11.10.1 TOE PROTECTION FOOTWEAR

11.10.2 METATARSAL PROTECTION FOOTWEAR

11.10.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.10.4 CHEMICAL / WATERPROOF FOOTWEAR

11.10.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.10.6 SLIP-RESISTANT FOOTWEAR

11.10.7 SPORT SAFETY FOOTWEAR

11.10.8 OTHERS

11.11 PHARMACEUTICAL INDUSTRY

11.11.1 TOE PROTECTION FOOTWEAR

11.11.2 METATARSAL PROTECTION FOOTWEAR

11.11.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.11.4 CHEMICAL / WATERPROOF FOOTWEAR

11.11.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.11.6 SLIP-RESISTANT FOOTWEAR

11.11.7 SPORT SAFETY FOOTWEAR

11.11.8 OTHERS

11.12 ELECTRONIC INDUSTRY

11.12.1 TOE PROTECTION FOOTWEAR

11.12.2 METATARSAL PROTECTION FOOTWEAR

11.12.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.12.4 CHEMICAL / WATERPROOF FOOTWEAR

11.12.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.12.6 SLIP-RESISTANT FOOTWEAR

11.12.7 SPORT SAFETY FOOTWEAR

11.12.8 OTHERS

11.13 OTHERS

11.13.1 TOE PROTECTION FOOTWEAR

11.13.2 METATARSAL PROTECTION FOOTWEAR

11.13.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.13.4 CHEMICAL / WATERPROOF FOOTWEAR

11.13.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.13.6 SLIP-RESISTANT FOOTWEAR

11.13.7 SPORT SAFETY FOOTWEAR

11.13.8 OTHERS

12 GERMANY SAFETY FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 NON-STORE BASED

12.2.1 COMPANY OWNED WEBSITES

12.2.2 THIRD PARTY E COMMERCE PLATFORM

12.3 STORE BASED

12.3.1 SUPERMARKETS/HYPERMARKETS

12.3.2 INDUSTRIAL STORES

12.3.3 BRAND EXCLUSIVE STORES

12.3.4 INDEPENDENT RETAILERS

12.3.5 MULTI BRAND STORE

12.3.6 OTHERS

12.4 OTHERS

13 GERMANY SAFETY FOOTWEAR MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GERMANY

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ENGELBERT STRAUSS INC

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 ATLAS

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVEOPMENT

15.3 ELTEN

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVEOPMENT

15.4 UVEX SAFETY GROUP

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVEOPMENT

15.5 HKS GMBH & CO. KG

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVEOPMENT

15.6 AIGLE (A SUBSIDIARY OF MAUS FRÈRES SA)

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ALBATROS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVEOPMENT

15.8 ALPHA-TEX ARBEITSSCHUTZ GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVEOPMENT

15.9 ARBEITSSCHUTZ-EXPRESS (ASX)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVEOPMENT

15.1 BATA INDUSTRIALS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COFRA S.R.L.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 FOOTWEAR TALAN

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FTG SAFETY SHOES SRL

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 HAIX GROUP

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 LUPOS® GMBH

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 LAYER GROBHANDEL

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVEOPMENT

15.17 PORTWEST UC

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SCENOLIA

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 STABILUS SAFETY GMBH

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TEXTIL-GROSSHANDEL EU

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVEOPMENT

15.21 HASTEDT ECOMMERCE GMBH

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 STOCKETIK GROBHANDE

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVEOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 GERMANY SAFETY FOOTWEAR COST MODEL

TABLE 2 BRAND COMPARATIVE ANALYSIS

TABLE 3 COMPANY VS BRAND OVERVIEW

TABLE 4 CONSUMER PREFERENCE MATRIX

TABLE 5 GERMANY SAFETY FOOTWEAR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 GERMANY SAFETY FOOTWEAR MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 7 GERMANY SAFETY FOOTWEAR MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 8 GERMANY LEATHER IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 GERMANY RUBBER IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 GERMANY PLASTIC IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 GERMANY SAFETY FOOTWEAR MARKET, BY GENDER, 2018-2033 (USD THOUSAND)

TABLE 12 GERMANY SAFETY FOOTWEAR MARKET, BY GENDER, 2018-2033 (THOUSAND UNITS)

TABLE 13 GERMANY SAFETY FOOTWEAR MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 14 GERMANY SAFETY FOOTWEAR MARKET, BY INDUSTRY, 2018-2033 (THOUSAND UNITS)

TABLE 15 GERMANY OIL & GAS IN SAFETY FOOTWEAR MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 16 GERMANY OIL & GAS IN SAFETY FOOTWEAR MARKET, BY APPLICATION, 2018-2033 (THOUSAND UNITS)

TABLE 17 GERMANY OIL & GAS IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 18 GERMANY OIL & GAS IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 19 GERMANY AGRICULTURE INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 20 GERMANY AGRICULTURE INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 21 GERMANY CHEMICAL INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 22 GERMANY CHEMICAL INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 23 GERMANY CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 24 GERMANY CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 25 GERMANY ENGINEERING CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 GERMANY ENGINEERING CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 27 GERMANY COMMERCIAL CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 GERMANY COMMERCIAL CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 29 GERMANY CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 30 GERMANY CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 31 GERMANY METAL INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 32 GERMANY METAL INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 33 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 35 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY FOOD TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY FOOD TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 37 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY BEVERAGES TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY BEVERAGES TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 39 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY NON-ALCOHOLIC, 2018-2033 (USD THOUSAND)

TABLE 40 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY NON-ALCOHOLIC, 2018-2033 (THOUSAND UNITS)

TABLE 41 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY ALCOHOLIC, 2018-2033 (USD THOUSAND)

TABLE 42 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY ALCOHOLIC, 2018-2033 (THOUSAND UNITS)

TABLE 43 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 44 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 45 GERMANY TRANSPORT INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 46 GERMANY TRANSPORT INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 47 GERMANY SECURITY INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 48 GERMANY SECURITY INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 49 GERMANY MINING INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 50 GERMANY MINING INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 51 GERMANY PHARMACEUTICALS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 52 GERMANY PHARMACEUTICALS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 53 GERMANY ELECTRONICS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 54 GERMANY ELECTRONICS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 55 GERMANY OTHERS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 56 GERMANY OTHERS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 57 GERMANY SAFETY FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 58 GERMANY NON-STORE BASED IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 GERMANY STORE BASED IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 GERMANY SAFETY FOOTWEAR MARKET

FIGURE 2 GERMANY SAFETY FOOTWEAR MARKET: DATA TRIANGULATION

FIGURE 3 GERMANY SAFETY FOOTWEAR MARKET: DROC ANALYSIS

FIGURE 4 GERMANY SAFETY FOOTWEAR MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 GERMANY SAFETY FOOTWEAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GERMANY SAFETY FOOTWEAR MARKET: MULTIVARIATE MODELLING

FIGURE 7 GERMANY SAFETY FOOTWEAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GERMANY SAFETY FOOTWEAR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GERMANY SAFETY FOOTWEAR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GERMANY SAFETY FOOTWEAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GERMANY SAFETY FOOTWEAR MARKET: EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 GERMANY SAFETY FOOTWEAR MARKET: SEGMENTATION

FIGURE 14 SEVEN SEGMENTS COMPRISE THE GERMANY SAFETY FOOTWEAR MARKET, BY PRODUCT TYPE (2025)

FIGURE 15 STRONG INDUSTRIAL BASE AND SAFETY REGULATION COMPLIANCE EXPECTED TO DRIVE THE GERMANY SAFETY FOOTWEAR MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 16 TOE PROTECTION FOOTWEAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GERMANY SAFETY FOOTWEAR MARKET IN 2026 & 2033

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 YEAR-WISE STRATEGIC DEAL ACTIVITY IN THE GERMANY SAFETY FOOTWEAR MARKET (2019–2024)

FIGURE 19 BREAKDOWN OF STRATEGIC DEALS BY TYPE IN THE GERMANY SAFETY FOOTWEAR MARKET

FIGURE 20 DISTRIBUTION OF STRATEGIC DEALS BY BUSINESS SEGMENT

FIGURE 21 GERMANY SAFETY FOOTWEAR MARKET, 2018-2033, AVERAGE PRICE (USD/UNIT)

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 PRODUCTION CAPACITY OUTLOOK AND MARKET SHARE DISTRIBUTION OF KEY MANUFACTURERS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GERMANY SAFETY FOOTWEAR MARKET

FIGURE 25 GERMANY SAFETY FOOTWEAR MARKET: BY PRODUCT TYPE, 2025

FIGURE 26 GERMANY SAFETY FOOTWEAR MARKET: BY MATERIAL, 2025

FIGURE 27 GERMANY SAFETY FOOTWEAR MARKET: BY GENDER, 2025

FIGURE 28 GERMANY SAFETY FOOTWEAR MARKET: BY INDUSTRY, 2025

FIGURE 29 GERMANY SAFETY FOOTWEAR MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 30 GERMANY SAFETY FOOTWEAR MARKET: COMPANY SHARE 2025 (%)

FIGURE 31 GERMANY SAFETY FOOTWEAR MARKET, SNAPSHOT (2025)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.