Global 1 Dodecene Market

Market Size in USD Billion

CAGR :

%

USD

1.08 Billion

USD

1.52 Billion

2024

2032

USD

1.08 Billion

USD

1.52 Billion

2024

2032

| 2025 –2032 | |

| USD 1.08 Billion | |

| USD 1.52 Billion | |

|

|

|

|

1-Dodecene Market Size

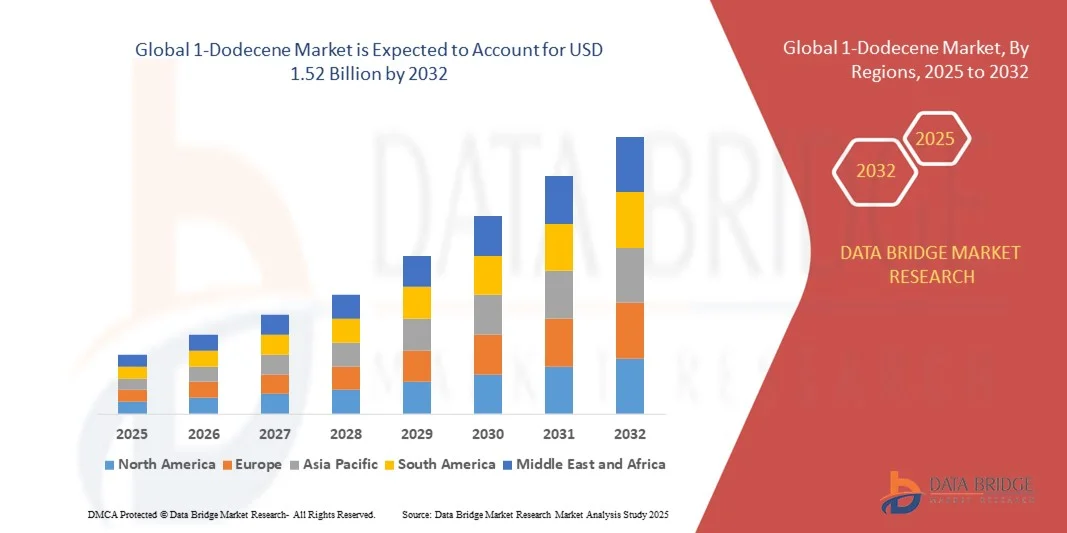

- The global 1-dodecene market size was valued at USD 1.08 billion in 2024 and is expected to reach USD 1.52 billion by 2032, at a CAGR of 4.3% during the forecast period

- The market growth is largely fuelled by the increasing demand for linear alpha olefins in the production of detergents, lubricants, plasticizers, and specialty chemicals, coupled with expanding end-use industries such as automotive, packaging, and construction

- Rising industrialization, urbanization, and the shift toward high-performance materials are further contributing to market expansion

1-Dodecene Market Analysis

- The market is witnessing steady growth due to the versatility of 1-dodecene as a key feedstock for polyethylene production and other chemical derivatives

- Increasing investments in chemical manufacturing infrastructure and technological advancements in production processes are supporting efficient and cost-effective supply

- North America dominated the 1-dodecene market with the largest revenue share of 38.5% in 2024, driven by strong demand from polyethylene, surfactant, and lubricant industries, as well as well-established chemical manufacturing infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global 1-dodecene market, driven by rising industrialization, expanding polymer and surfactant industries, increasing foreign investments, and government initiatives promoting chemical manufacturing and infrastructure development

- The Industrial Grade segment held the largest market revenue share in 2024, driven by its extensive usage in polyethylene production, surfactants, detergents, and lubricating oil additives. Industrial-grade 1-dodecene offers consistent purity and performance, making it the preferred choice for large-scale chemical manufacturing and polymer applications

Report Scope and 1-Dodecene Market Segmentation

|

Attributes |

1-Dodecene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

1-Dodecene Market Trends

Increasing Demand for Linear Alpha Olefins in Industrial Applications

- The growing adoption of 1-dodecene as a linear alpha olefin (LAO) is transforming the chemical and polymer industries by serving as a key comonomer for polyethylene production and specialty chemical synthesis. Its use enhances polymer flexibility, strength, and performance, leading to higher-quality end products in packaging, automotive, and construction applications. In addition, 1-dodecene helps manufacturers meet stringent regulatory standards for durable and safe products, while enabling innovations in high-performance materials that cater to evolving industrial needs

- Rising demand for high-performance lubricants, surfactants, and synthetic detergents is accelerating the adoption of 1-dodecene in chemical manufacturing. These applications benefit from the olefin’s reactivity and chain structure, enabling efficient formulations and improved product properties. Furthermore, the incorporation of 1-dodecene reduces the need for additional chemical additives, optimizing cost-efficiency and sustainability in production processes

- The ease of integration of 1-dodecene into various industrial processes, combined with its availability in high-purity grades, makes it attractive for manufacturers seeking consistent output and enhanced process efficiency. This helps reduce production downtime and supports scalability in chemical plants. Its compatibility with automated production lines also enables large-scale industrial adoption, improving supply chain reliability and throughput

- For instance, in 2023, several European and North American polymer producers reported improved polyethylene quality and higher production efficiency after incorporating 1-dodecene as a comonomer, resulting in stronger, more durable products for packaging and automotive components. This led to increased product demand and strengthened competitive positioning in global polymer markets

- While 1-dodecene is driving innovation in polymers and specialty chemicals, its impact depends on raw material availability, regulatory compliance, and cost-efficiency. Manufacturers must focus on optimized production methods and supply chain management to fully leverage market growth. In addition, continuous R&D for more sustainable and energy-efficient production technologies is expected to further propel market adoption

1-Dodecene Market Dynamics

Driver

Increasing Demand from Polyethylene and Surfactant Industries”

- The rising need for linear low-density polyethylene (LLDPE) in packaging, films, and automotive parts is pushing manufacturers to use 1-dodecene as a critical comonomer. Its incorporation improves polymer flexibility, tensile strength, and chemical resistance, driving market adoption. In addition, end-users benefit from enhanced product durability and lower material wastage, making 1-dodecene a cost-effective solution for high-performance applications

- The surfactant and detergent industries are increasingly recognizing the benefits of 1-dodecene-based intermediates for high-performance formulations. This has fueled investment in LAO production capacity and downstream chemical processing. The ability to produce specialty surfactants with improved stability and biodegradability also supports environmental compliance and aligns with sustainability initiatives

- Expanding applications in lubricants, adhesives, and specialty chemicals further support sustained demand. The ability to tailor molecular weight and purity makes 1-dodecene a versatile feedstock across multiple industrial sectors. In addition, the adoption of 1-dodecene facilitates the development of next-generation chemical products that meet consumer and industrial performance expectations

- For instance, in 2022, major chemical manufacturers in the U.S. and Germany increased production of 1-dodecene to meet growing demand from polymer and surfactant sectors, boosting market penetration. This expansion enabled downstream manufacturers to scale operations and launch innovative products faster, strengthening supply chains globally

- While demand is strong, manufacturers need to address feedstock availability, process efficiency, and cost competitiveness to ensure long-term adoption. Continuous investment in technology and optimization of production processes is crucial for sustaining market growth and meeting future industrial requirements

Restraint/Challenge

High Production Costs and Feedstock Volatility

- The high cost of producing high-purity 1-dodecene, coupled with dependence on ethylene and other hydrocarbon feedstocks, limits its accessibility for smaller chemical producers. Price volatility of raw materials directly impacts production costs. In addition, fluctuating energy prices and regulatory compliance costs further increase operational expenses, creating challenges for price-sensitive markets

- Limited availability of feedstock in certain regions and the complexity of production technologies further restrict market expansion. This makes it challenging for new entrants to compete with established producers. Moreover, logistical and storage constraints for high-purity 1-dodecene exacerbate distribution challenges in emerging economies

- Supply chain constraints and transportation costs can delay delivery and increase operational expenses for end-users in polymer and specialty chemical manufacturing. Delays in feedstock procurement may also disrupt production schedules, impacting timely product launches and supply to key industrial clients

- For instance, in 2023, several chemical plants in Asia reported temporary production slowdowns due to ethylene feedstock shortages, affecting 1-dodecene availability and downstream polymer output. This led to price fluctuations and limited market access for smaller manufacturers reliant on imports

- While 1-dodecene continues to be essential for polymers and surfactants, addressing cost, feedstock stability, and scalable production processes remains critical for sustained market growth. Investment in alternative raw materials, efficient production technologies, and resilient supply chains is expected to mitigate these challenges and support long-term adoption

1-Dodecene Market Scope

The market is segmented on the basis of type, applications, and end-use industry.

- By Type

On the basis of type, the 1-dodecene market is segmented into Analysis Grade and Industrial Grade. The Industrial Grade segment held the largest market revenue share in 2024, driven by its extensive usage in polyethylene production, surfactants, detergents, and lubricating oil additives. Industrial-grade 1-dodecene offers consistent purity and performance, making it the preferred choice for large-scale chemical manufacturing and polymer applications.

The Analysis Grade segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its high purity and suitability for laboratory, R&D, and specialty chemical synthesis applications. Analysis-grade 1-dodecene is particularly valued for precise formulation, quality control, and research purposes, enabling manufacturers and researchers to develop advanced chemical products efficiently.

- By Applications

On the basis of applications, the market is segmented into Surfactant, Detergent, Lubricating Oil Additive, Plasticizer, and Others. The Surfactant segment accounted for the largest share in 2024 due to the increasing demand for high-performance cleaning agents and specialty chemical intermediates in industrial and consumer products.

The Lubricating Oil Additive segment is expected to witness the fastest growth from 2025 to 2032, driven by the rising need for high-performance, durable, and thermally stable additives in automotive and industrial lubricants.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into Packaging, Automotive, Oil & Gas, Beauty & Personal Care, Paper & Pulp, Textile, Electronics, and Others. The Packaging segment held the largest revenue share in 2024, attributed to the increasing use of 1-dodecene as a comonomer in polyethylene films and containers for food, industrial, and consumer applications.

The Automotive segment is expected to witness the fastest growth from 2025 to 2032, owing to the rising demand for lightweight, flexible, and durable polymers in vehicle components, which rely on 1-dodecene-based copolymers for enhanced performance.

1-Dodecene Market Regional Analysis

- North America dominated the 1-dodecene market with the largest revenue share of 38.5% in 2024, driven by strong demand from polyethylene, surfactant, and lubricant industries, as well as well-established chemical manufacturing infrastructure

- Manufacturers in the region value the high-purity grades, consistent supply, and ease of integration of 1-dodecene into various industrial processes, supporting efficiency and quality in end products

- This widespread adoption is further supported by robust industrial base, high technological capability, and increasing demand from automotive, packaging, and specialty chemical sectors, establishing North America as a key market for 1-dodecene

U.S. 1-Dodecene Market Insight

The U.S. 1-dodecene market captured the largest revenue share in 2024 within North America, fueled by the growing use of linear alpha olefins in polyethylene production and surfactant formulations. Manufacturers are increasingly leveraging 1-dodecene to enhance polymer flexibility, tensile strength, and chemical resistance. Rising investments in specialty chemicals and lubricants, combined with demand for high-performance industrial applications, further boost market growth. In addition, the U.S. focus on sustainable and efficient chemical processes is significantly contributing to the market's expansion.

Europe 1-Dodecene Market Insight

The Europe 1-dodecene market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by rising demand from packaging, automotive, and detergent industries. Stringent regulatory standards and environmental initiatives are encouraging the adoption of high-purity, low-impact 1-dodecene-based products. European manufacturers are focusing on process optimization and innovation in specialty chemical applications. The region is experiencing significant growth across industrial and commercial applications, with 1-dodecene increasingly used as a critical feedstock for linear low-density polyethylene and surfactants.

U.K. 1-Dodecene Market Insight

The U.K. 1-dodecene market is expected to witness strong growth from 2025 to 2032, driven by the rising adoption of high-performance polymers and surfactants. Industrial sectors are emphasizing efficiency, product quality, and sustainable chemical usage, encouraging the use of 1-dodecene. In addition, growing demand for advanced lubricants and chemical intermediates in manufacturing processes supports market expansion. The U.K.’s strong industrial infrastructure and R&D investments in specialty chemicals are expected to continue to stimulate growth.

Germany 1-Dodecene Market Insight

The Germany 1-dodecene market is expected to witness substantial growth from 2025 to 2032, fueled by increasing awareness of process efficiency, sustainability, and high-quality polymer production. Germany’s well-established chemical manufacturing base, combined with its emphasis on eco-friendly and innovative solutions, promotes the adoption of 1-dodecene across multiple industrial sectors. Integration of 1-dodecene into surfactants, detergents, and lubricant formulations is also becoming more prevalent, aligning with local consumer and industrial standards.

Asia-Pacific 1-Dodecene Market Insight

The Asia-Pacific 1-dodecene market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and rising demand for polyethylene, detergents, and lubricants in countries such as China, Japan, and India. Government initiatives promoting chemical manufacturing and export-oriented industries are encouraging the adoption of 1-dodecene. Furthermore, APAC emerging as a manufacturing hub for linear alpha olefins enhances affordability, availability, and accessibility for local and international industrial players.

Japan 1-Dodecene Market Insight

The Japan 1-dodecene market is expected to witness strong growth from 2025 to 2032, due to high demand for advanced polymers, lubricants, and surfactants. The Japanese industrial sector places significant emphasis on high-purity chemical feedstocks, efficient production processes, and integration with IoT-enabled manufacturing solutions. In addition, growing investments in sustainable industrial practices and high-performance automotive and packaging materials are fueling market expansion. The aging workforce and automation trends are also likely to increase demand for efficient, high-quality chemical intermediates.

China 1-Dodecene Market Insight

The China 1-dodecene market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding chemical manufacturing base, increasing industrial output, and strong adoption of linear alpha olefins in polyethylene and surfactant production. China’s emphasis on smart chemical plants, government support for industrial growth, and presence of domestic high-purity 1-dodecene manufacturers are key factors propelling market growth. The push toward high-quality industrial polymers and specialty chemicals further drives demand across multiple sectors.

1-Dodecene Market Share

The 1-Dodecene industry is primarily led by well-established companies, including:

- Shell International (U.K.)

- Exxon Mobil Corporation (U.S.)

- SABIC (Saudi Arabia)

- TPC Group (U.S.)

- Qatar Chemical Company Ltd. (Qatar)

- INEOS (U.K.)

- Merck KGaA (Germany)

- BOC Sciences (China)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- Parchem Fine & Specialty Chemicals (U.S.)

- SPEX CertiPrep (U.S.)

- SynQuest Laboratories (U.S.)

- Santa Cruz Biotechnology, Inc. (U.S.)

- Thermo Fisher Scientific (U.S.)

- GELEST, INC. (U.S.)

- Evonik Industries AG (Germany)

- Dow (U.S.)

- Sasol (South Africa)

- Chevron Phillips Chemical Company (U.S.)

Latest Developments in Global 1-Dodecene Market

- In June 2024, Chevron Phillips Chemical Company LLC announced the startup of its new alpha olefins unit at the Cedar Bayou plant in Baytown, Texas, increasing production capacity for 1-decene and other alpha olefins to meet rising demand from automotive and packaging industries, enhancing its market position in North America

- In June 2024, ExxonMobil appointed a new Vice President to oversee its global alpha olefins business, including 1-decene operations, aiming to strengthen leadership, optimize production strategies, and drive growth in specialty chemical markets worldwide

- In June 2024, INEOS Group Ltd partnered with a leading Asian petrochemical firm to distribute 1-decene across key Asia-Pacific markets, expanding regional reach and ensuring steady supply for industrial and lubricant applications

- In June 2024, PJSC Nizhnekamskneftekhim inaugurated a new alpha olefins production facility in Tatarstan, Russia, increasing 1-decene output for domestic and export markets, supporting regional demand growth and enhancing global competitiveness

- In June 2024, SABIC launched a new 1-decene product line targeting high-performance lubricants, aiming to strengthen its position in specialty chemicals and cater to evolving automotive and industrial requirements

- In January 2024, ExxonMobil announced a major investment in its Baytown Olefins Plant, Texas, to expand 1-decene capacity, supporting increased production for packaging and automotive industries, and reinforcing market leadership

- In January 2024, SABIC signed a strategic agreement with a global automotive OEM to supply 1-decene-based lubricants for next-generation engines, boosting adoption of specialty chemicals and enhancing long-term revenue streams

- In January 2024, INEOS Group Ltd completed the expansion of its alpha olefins production facility in Antwerp, Belgium, increasing 1-decene output to meet growing European demand and strengthen supply chain reliability

- In January 2024, PJSC Nizhnekamskneftekhim secured an export contract with a European chemical distributor to supply 1-decene, expanding international reach and reinforcing its position in the global market

- In January 2024, Chevron Phillips Chemical Company LLC signed a long-term supply agreement with a major European lubricant producer to provide 1-decene, ensuring consistent supply, fostering partnerships, and boosting market share

- In January 2024, Gelest Inc., a subsidiary of Mitsubishi Chemical Corporation, expanded 1-decene production capacity at its Pennsylvania facility to support growth in specialty chemical applications, improving operational efficiency and market availability

- In January 2024, Idemitsu Kosan Co., Ltd. launched a bio-based 1-decene product for sustainable lubricant applications, responding to rising demand for eco-friendly chemicals and promoting greener industrial solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL 1-DODECENE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL 1-DODECENE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.10 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL 1-DODECENE MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

6. PRODUCTION CAPACITY OVERVIEW

7. SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8. CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9. GLOBAL 1-DODECENE MARKET, BY GRADE, (2021-2030), (USD MILLION) (TONS)

(VALUE, VOLUME AND ASP FOR EACH SEGMENT WILL BE PROVIDED)

9.1 OVERVIEW

9.2 LESS THAN 99%

9.2.1 ASP

9.2.2 VALUE

9.2.3 VOLUME

9.3 99%

9.3.1 ASP

9.3.2 VALUE

9.3.3 VOLUME

10. GLOBAL 1- DODECENE MARKET, BY APPLICATION, (2021-2030), (USD MILLION) (TONS)

10.1 OVERVIEW

10.2 LUBRICANTS

10.3 SURFACTANTS

10.4 SPECIALTY CHEMICALS

10.4.1 SPECIALTY CHEMICALS, BY APPLICATION

10.4.1.1. EPOXIDES

10.4.1.2. HALOGENATED OLEFINS

10.5 DETERGENTS

10.6 PLASTICIZER

10.6.1 PLASTICIZER, BY APPLICATION

10.6.1.1. FLOORING AND WALL

10.6.1.2. COVERING

10.6.1.3. FILMS & SHEETS

10.6.1.4. COATED FABRICS

10.6.1.5. WIRES AND CABLES

10.6.1.6. CONSUMER GOODS

10.7 FLAVORS

10.8 POLYMER PRODUCTION

10.9 OTHERS

11. GLOBAL 1- DODECENE MARKET, BY REGION, (2021-2030), (USD MILLION) (TONS)

GLOBAL 1- DODECENE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

11.2 EUROPE

11.2.1 GERMANY

11.2.2 U.K.

11.2.3 ITALY

11.2.4 FRANCE

11.2.5 SPAIN

11.2.6 RUSSIA

11.2.7 SWITZERLAND

11.2.8 TURKEY

11.2.9 BELGIUM

11.2.10 NETHERLANDS

11.2.11 REST OF EUROPE

11.3 ASIA-PACIFIC

11.3.1 JAPAN

11.3.2 CHINA

11.3.3 SOUTH KOREA

11.3.4 INDIA

11.3.5 SINGAPORE

11.3.6 THAILAND

11.3.7 INDONESIA

11.3.8 MALAYSIA

11.3.9 PHILIPPINES

11.3.10 AUSTRALIA & NEW ZEALAND

11.3.11 REST OF ASIA-PACIFIC

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 MIDDLE EAST AND AFRICA

11.5.1 SOUTH AFRICA

11.5.2 EGYPT

11.5.3 SAUDI ARABIA

11.5.4 UNITED ARAB EMIRATES

11.5.5 ISRAEL

11.5.6 REST OF MIDDLE EAST AND AFRICA

12. GLOBAL 1- DODECENE MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.5 MERGERS AND ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

12.7 EXPANSIONS

12.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13. SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

14. GLOBAL 1- DODECENE MARKET - COMPANY PROFILES

14.1 SABIC

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 PRODUCTION CAPACITY OVERVIEW

14.1.4 SWOT ANALYSIS

14.1.5 REVENUE ANALYSIS

14.1.6 RECENT UPDATES

14.2 QATAR CHEMICAL COMPANY LTD.

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 PRODUCTION CAPACITY OVERVIEW

14.2.4 SWOT ANALYSIS

14.2.5 REVENUE ANALYSIS

14.2.6 RECENT UPDATES

14.3 INEOS

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 PRODUCTION CAPACITY OVERVIEW

14.3.4 SWOT ANALYSIS

14.3.5 REVENUE ANALYSIS

14.3.6 RECENT UPDATES

14.4 SHELL INTERNATIONAL,

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 PRODUCTION CAPACITY OVERVIEW

14.4.4 SWOT ANALYSIS

14.4.5 REVENUE ANALYSIS

14.4.6 RECENT UPDATES

14.5 TOKYO CHEMICAL INDUSTRY CO., LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 PRODUCTION CAPACITY OVERVIEW

14.5.4 SWOT ANALYSIS

14.5.5 REVENUE ANALYSIS

14.5.6 RECENT UPDATES

14.6 EXXON MOBIL CORPORATION.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 PRODUCTION CAPACITY OVERVIEW

14.6.4 SWOT ANALYSIS

14.6.5 REVENUE ANALYSIS

14.6.6 RECENT UPDATES

14.7 GELEST INC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 PRODUCTION CAPACITY OVERVIEW

14.7.4 SWOT ANALYSIS

14.7.5 REVENUE ANALYSIS

14.7.6 RECENT UPDATES

14.8 EVONIK INDUSTRIES AG

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 PRODUCTION CAPACITY OVERVIEW

14.8.4 SWOT ANALYSIS

14.8.5 REVENUE ANALYSIS

14.8.6 RECENT UPDATES

14.9 DOWPOL CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 PRODUCTION CAPACITY OVERVIEW

14.9.4 SWOT ANALYSIS

14.9.5 REVENUE ANALYSIS

14.9.6 RECENT UPDATES

14.10 DOW

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 PRODUCTION CAPACITY OVERVIEW

14.10.4 SWOT ANALYSIS

14.10.5 REVENUE ANALYSIS

14.10.6 RECENT UPDATES

14.11 CHEVRON PHILLIPS CHEMICAL COMPANY LLC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 PRODUCTION CAPACITY OVERVIEW

14.11.4 SWOT ANALYSIS

14.11.5 REVENUE ANALYSIS

14.11.6 RECENT UPDATES

14.12 SASOL

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 PRODUCTION CAPACITY OVERVIEW

14.12.4 SWOT ANALYSIS

14.12.5 REVENUE ANALYSIS

14.12.6 RECENT UPDATES

14.13 VWR INTERNATIONAL, LLC. A

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 PRODUCTION CAPACITY OVERVIEW

14.13.4 SWOT ANALYSIS

14.13.5 REVENUE ANALYSIS

14.13.6 RECENT UPDATES

14.14 BASF

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 PRODUCTION CAPACITY OVERVIEW

14.14.4 SWOT ANALYSIS

14.14.5 REVENUE ANALYSIS

14.14.6 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

15. RELATED REPORTS

16. QUESTIONNAIRE

17. CONCLUSION

18. ABOUT DATA BRIDGE MARKET RESEARCH

Global 1 Dodecene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global 1 Dodecene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global 1 Dodecene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.