Global 2 Ethylhexanoic Acid Market

Market Size in USD Million

CAGR :

%

USD

981.20 Million

USD

1,191.78 Million

2024

2032

USD

981.20 Million

USD

1,191.78 Million

2024

2032

| 2025 –2032 | |

| USD 981.20 Million | |

| USD 1,191.78 Million | |

|

|

|

|

2-Ethylhexanoic Acid Market Size

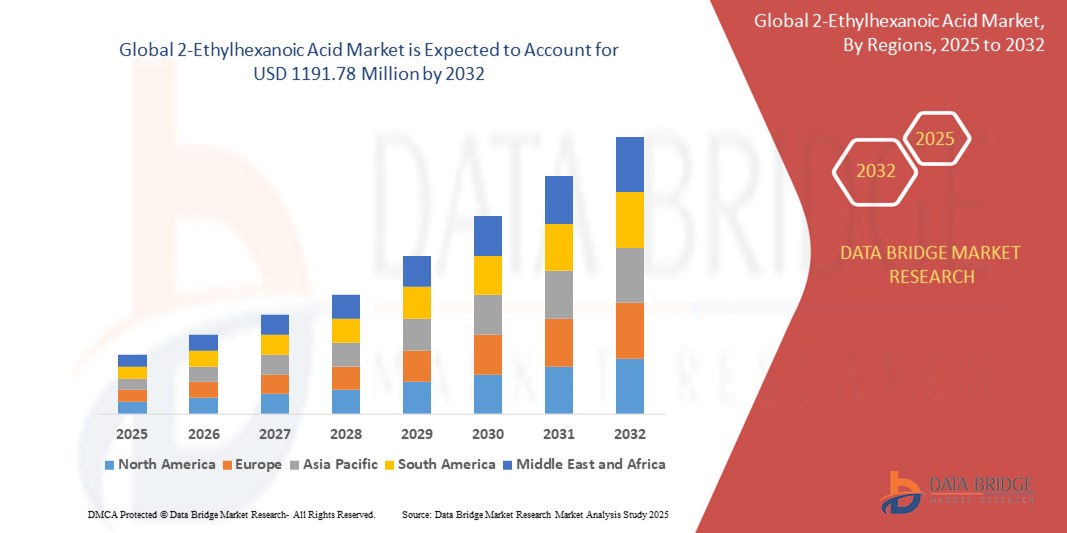

- The global 2-ethylhexanoic acid market size was valued at USD 981.20 million in 2024 and is expected to reach USD 1191.78 million by 2032, at a CAGR of 2.46% during the forecast period

- The market growth is largely fueled by increasing demand for high-performance chemical intermediates across plasticizers, synthetic lubricants, and PVC stabilizers, driven by expanding automotive, construction, and manufacturing sectors globally

- Furthermore, the shift toward lightweight, durable, and energy-efficient materials in industrial applications is boosting the use of 2-ethylhexanoic acid in formulations requiring enhanced thermal stability and functional performance. These factors are accelerating the compound’s adoption across multiple industries, thereby significantly boosting the market's growth

2-Ethylhexanoic Acid Market Analysis

- 2-Ethylhexanoic acid is a versatile branched-chain carboxylic acid used in the production of esters for synthetic lubricants, plasticizers, emollients, and metal salts. Its role as an intermediate in manufacturing high-performance additives and stabilizers makes it essential in coatings, pharmaceuticals, and personal care formulations

- The escalating demand for 2-ethylhexanoic acid is primarily driven by rapid industrialization in emerging markets, growing regulatory focus on high-quality and efficient chemical inputs, and rising demand for advanced formulations in sectors such as automotive fluids, PVC processing, and personal care products

- Asia-Pacific dominated the 2-ethylhexanoic acid market with a share of 34.5% in 2024, due to expanding industrialization, rising consumption of plasticizers and synthetic lubricants, and growing production of PVC-based materials across emerging economies

- North America is expected to be the fastest growing region in the 2-ethylhexanoic acid market during the forecast period due to increasing application in high-performance lubricants, corrosion inhibitors, and personal care products

- Butyraldehyde-Based segment dominated the market with a market share of 59.1% in 2024, due to the established and cost-efficient nature of this production method. This route benefits from widespread industrial availability of butyraldehyde and its streamlined conversion process, which supports scalable manufacturing for downstream applications. Butyraldehyde-based production is also favored for maintaining consistent product quality and meeting industrial-grade purity requirements, which is essential for use in applications such as plasticizers, lubricants, and coatings

Report Scope and 2-Ethylhexanoic Acid Market Segmentation

|

Attributes |

2-Ethylhexanoic Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

2-Ethylhexanoic Acid Market Trends

“Rising Shift Toward Specialty Applications and Regional Expansion”

- Environmental regulations and sustainability initiatives are increasingly influencing the 2-ethylhexanoic acid market, prompting manufacturers to develop lower-emission processes and invest in greener production technologies. This trend is driven by stricter global standards in the chemical industry, especially in major markets across Europe and North America

- For instance, companies such as Perstorp, OXEA, BASF, and Eastman are focusing on the plasticizer segment (especially for flexible PVC) and expanding their market reach in Asia-Pacific, leveraging growing construction, automotive, and electronics industries to drive demand for 2-ethylhexanoic derivatives

- There is a notable increase in demand for 2-ethylhexanoic in the production of metalworking fluids, paint driers, synthetic lubricants, and alkyd resins, spurred by industrial growth and the expansion of the automotive and construction sectors

- The market is seeing incremental innovation in production processes, with leading players investing in efficiency enhancements and new environmentally responsible manufacturing methods to meet sustainability goals and regulatory standards

- In developing economies, rapid urbanization, industrial investment, and favorable government policies—especially in China, India, and Japan—are contributing to higher demand for 2-ethylhexanoic in applications such as safety glass and specialty chemicals

- Strategic alliances, acquisitions, and capacity expansions are ongoing among major chemical producers as they seek to capture emerging regional opportunities and fortify their leadership in application-specific niches

2-Ethylhexanoic Acid Market Dynamics

Driver

“Versatile Industrial Applications”

- 2-Ethylhexanoic acid exhibits wide applicability across multiple industries due to its chemical stability and suitability as an intermediate

- For instance, BASF supplies 2-ethylhexanoic for use in synthetic lubricants, plasticizer production, metalworking fluids, alkyd resin manufacturing, and as an additive in paints for the global construction and automotive sectors

- The use of 2-ethylhexanoic in safety glass for construction, polymer additives, personal care products, and fuel additives further expands its industrial footprint and supports market resilience during fluctuating economic cycles

- Demand from emerging markets is bolstered by infrastructure growth, enhanced building activity, and increased automotive output, driving higher consumption of 2-ethylhexanoic derivatives

- Diversification into high-value specialty chemicals, including technical and industrial grades for advanced end-uses, enhances the versatility and growth prospects for major producers

Restraint/Challenge

“Raw Material Price Volatility”

- The market faces persistent challenges from fluctuating raw material prices, which impact production costs and margin stability

- For instance, major producers such as Furukawa Electric and Prysmian Group have experienced price pressure due to volatility in upstream petrochemical feedstocks, often forcing reliance on recycled or alternative raw materials to mitigate risk

- Supply chain disruptions, including regional shortages and logistics constraints, can hinder steady manufacturing and prompt producers to adjust sourcing strategies and explore process innovations

- Unpredictability in crude oil and chemical feedstock pricing propagates cost uncertainty through the supply chain, complicating both long-term contracting and inventory planning for suppliers and end-users

- Competitive pricing pressure is further intensified by the adoption of alternative plasticizers and evolving regulatory standards favoring more sustainable or bio-based chemicals, which can limit traditional market penetration for 2-ethylhexanoic over time

2-Ethylhexanoic Acid Market Scope

The market is segmented on the basis of production, application, and end user.

• By Production

On the basis of production, the 2-ethylhexanoic acid market is segmented into butyraldehyde-based, octanol-based, and others. The butyraldehyde-based segment dominated the market with the largest revenue share of 59.1% in 2024, owing to the established and cost-efficient nature of this production method. This route benefits from widespread industrial availability of butyraldehyde and its streamlined conversion process, which supports scalable manufacturing for downstream applications. Butyraldehyde-based production is also favored for maintaining consistent product quality and meeting industrial-grade purity requirements, which is essential for use in applications such as plasticizers, lubricants, and coatings.

The octanol-based segment is projected to register the fastest growth rate from 2025 to 2032, driven by increasing environmental and regulatory focus on sustainable feedstocks. Octanol offers an alternative route with improved selectivity and reduced by-product formation, which makes it attractive for manufacturers aiming to enhance process efficiency and reduce waste. The growing interest in green chemistry and advancements in bio-based octanol production further support the adoption of this pathway.

• By Application

On the basis of application, the market is segmented into plasticizers, synthetic lubricants, polyvinylchloride (PVC) stabilizers, paint dryers, emollients, corrosion inhibitors, drugs, and others. The plasticizers segment accounted for the largest revenue share in 2024, supported by its vital role in enhancing the flexibility, durability, and workability of polymers, particularly PVC. The widespread use of plasticized materials across construction, automotive, and consumer goods industries continues to drive steady demand for 2-ethylhexanoic acid in this segment. Its effectiveness in improving the performance characteristics of plastics and ensuring compliance with safety standards further solidifies its market dominance.

The synthetic lubricants segment is expected to witness the highest CAGR from 2025 to 2032, attributed to rising demand for high-performance lubricants in automotive, industrial, and aerospace sectors. 2-ethylhexanoic acid is a key intermediate in producing esters used in synthetic lubricants, which offer superior thermal stability, oxidation resistance, and extended service life. Increasing focus on energy efficiency, equipment longevity, and low-emission formulations are accelerating the adoption of synthetic lubricants, thus boosting growth in this application area.

• By End User

On the basis of end-user, the market is segmented into chemicals, paints and coatings, personal care and cosmetics, agrochemicals, plastics, pharmaceuticals, and others. The chemicals segment led the market with the highest revenue share in 2024, due to its extensive usage as an intermediate in producing various industrial and specialty chemicals. Its versatility and compatibility with other compounds make it a staple in chemical synthesis, enabling manufacturers to develop a broad range of formulations.

The personal care and cosmetics segment is poised to grow at the fastest pace from 2025 to 2032, driven by increasing consumer demand for emollients and functional ingredients in skincare and haircare formulations. 2-ethylhexanoic acid is utilized in emollient esters that impart smoothness, spreadability, and moisture retention to cosmetic products. With rising global spending on personal grooming, clean-label formulations, and skin-friendly products, the use of this compound in cosmetic manufacturing is set to expand significantly.

2-Ethylhexanoic Acid Market Regional Analysis

- Asia-Pacific dominated the 2-ethylhexanoic acid market with the largest revenue share of 34.5% in 2024, driven by expanding industrialization, rising consumption of plasticizers and synthetic lubricants, and growing production of PVC-based materials across emerging economies

- The region’s strong manufacturing base, increasing demand from automotive and construction sectors, and cost-effective labor and raw materials are major contributors to market growth

- Rapid infrastructure development, along with a rising focus on domestic production of specialty chemicals and intermediates, is further accelerating demand for 2-ethylhexanoic acid in both local consumption and export-oriented applications

Japan 2-Ethylhexanoic Acid Market Insight

The Japan market is witnessing steady growth, fueled by consistent demand from high-end lubricants, corrosion inhibitors, and pharmaceutical intermediates. Japan’s strong chemical manufacturing ecosystem, focus on high-purity raw materials, and advanced production technologies contribute to the sustained uptake of 2-ethylhexanoic acid. Domestic producers are also investing in R&D to support applications in electronics-grade chemicals and eco-friendly plastic additives.

China 2-Ethylhexanoic Acid Market Insight

China held the largest share within Asia-Pacific in 2024, supported by its dominant role in global chemical production and extensive use of plasticizers, PVC stabilizers, and synthetic lubricants. The country benefits from large-scale manufacturing infrastructure, government support for industrial expansion, and rising domestic consumption of specialty chemicals. Chinese manufacturers are also focusing on export-oriented production, driving additional demand for 2-ethylhexanoic acid across multiple applications.

Europe 2-Ethylhexanoic Acid Market Insight

The Europe market is projected to grow at a moderate CAGR through the forecast period, supported by strong environmental regulations and demand for sustainable additives in the plastics and coatings industries. The region’s mature automotive and construction sectors, combined with a shift toward non-phthalate plasticizers and bio-based lubricants, are driving consistent demand for 2-ethylhexanoic acid. Increased investment in chemical innovation and circular economy initiatives are enhancing market opportunities.

U.K. 2-Ethylhexanoic Acid Market Insight

The U.K. market is growing steadily, driven by rising adoption of 2-ethylhexanoic acid in synthetic lubricants, personal care formulations, and PVC processing. Regulatory emphasis on safer, sustainable chemicals and increased demand for high-performance materials in the automotive and construction industries are supporting market expansion. The focus on local manufacturing resilience post-Brexit is also encouraging domestic sourcing of chemical intermediates.

Germany 2-Ethylhexanoic Acid Market Insight

Germany is expected to maintain a strong position in the European market, underpinned by its advanced industrial base and demand for eco-friendly lubricants and coatings. The country's leadership in automotive engineering, chemical innovation, and regulatory enforcement for sustainable raw materials is fueling steady demand for 2-ethylhexanoic acid. Germany's push for greener formulations and reduced emissions further accelerates usage in synthetic esters and stabilizers.

North America 2-Ethylhexanoic Acid Market Insight

North America is expected to register notable growth from 2025 to 2032, driven by increasing application in high-performance lubricants, corrosion inhibitors, and personal care products. Rising demand for energy-efficient formulations, coupled with the recovery of manufacturing activities and construction in the region, is supporting uptake. Regulatory trends promoting safe chemicals and the shift toward domestic sourcing are also stimulating market expansion.

U.S. 2-Ethylhexanoic Acid Market Insight

The U.S. accounted for the largest market share in North America in 2024, due to high consumption in synthetic lubricants, pharmaceuticals, and plastics. A well-developed chemical sector, significant R&D activities, and demand for advanced materials in automotive and aerospace industries are driving the adoption of 2-ethylhexanoic acid. Additionally, rising investment in sustainable chemical manufacturing and the presence of key players contribute to the country’s market dominance.

2-Ethylhexanoic Acid Market Share

The 2-ethylhexanoic acid industry is primarily led by well-established companies, including:

- BASF (Germany)

- Dow (U.S.)

- Eastman Chemical Company (U.S.)

- JYT Chemical (China)

- Perstorp (Sweden)

- OQ Chemicals GmbH (Germany)

- Elekeiroz (Brazil)

- KH Neochem Co., Ltd. (Japan)

- Shenyang Zhangming Chemical Co. Ltd. (China)

- Silver Fern Chemical Inc. (U.S.)

- CHEMVERA SPECIALITY CHEMICALS PVT., LTD. (India)

- ALPHA CHEMIKA (India)

- Merck KGaA (Germany)

- TCI Chemicals (India) Pvt. Ltd. (India)

- NATIONAL ANALYTICAL CORPORATION (India)

- Alfa Aesar (U.S.)

- Thermo Fisher Scientific (U.S.)

- Monarch Chemicals Ltd. (U.K.)

Latest Developments in Global 2-Ethylhexanoic Acid Market

- In June 2025, OQ Chemicals is set to commence dedicated heptanoic acid production at its Oberhausen facility in Germany, marking a strategic move to reinforce Europe's supply chain security for carboxylic acids. The initiative supports regional demand by ensuring a stable and localized supply of heptanoic acid, reflecting OQ Chemicals' long-term commitment to strengthening its carboxylic acid portfolio and delivering dependable solutions across industrial sectors

- In October 2024, BASF PETRONAS Chemicals (BPC) inaugurated its second 2-ethylhexanoic acid production line at its integrated site in Kuantan, Malaysia, directly responding to surging demand in the Asia-Pacific market. This expansion significantly enhances regional capacity and reflects BPC’s ongoing dedication to serving customers with high-quality, locally manufactured 2-EHAcid, supporting critical applications in plasticizers, lubricants, and coatings

- In October 2021, BASF and PETRONAS Chemicals Group Berhad announced their plan to double 2-ethylhexanoic acid production capacity from 30,000 to 60,000 metric tons annually by 2024, demonstrating a proactive approach to meet rising global consumption. This move ensures improved supply availability and supports growth across key downstream sectors such as automotive, construction, and personal care

- In June 2021, Perstorp announced plans to expand its 2-ethylhexanoic acid production capacity from 2022 onward, aiming to address escalating global demand. This development reinforces Perstorp’s market position as a major supplier of specialty chemicals and ensures continued support for industries requiring high-performance lubricants, corrosion inhibitors, and plasticizers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global 2 Ethylhexanoic Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global 2 Ethylhexanoic Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global 2 Ethylhexanoic Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.