Global 2d Display For Defense And Aerospace Market

Market Size in USD Billion

CAGR :

%

USD

3.56 Billion

USD

5.55 Billion

2024

2032

USD

3.56 Billion

USD

5.55 Billion

2024

2032

| 2025 –2032 | |

| USD 3.56 Billion | |

| USD 5.55 Billion | |

|

|

|

|

2D Display for Defense and Aerospace Market Size

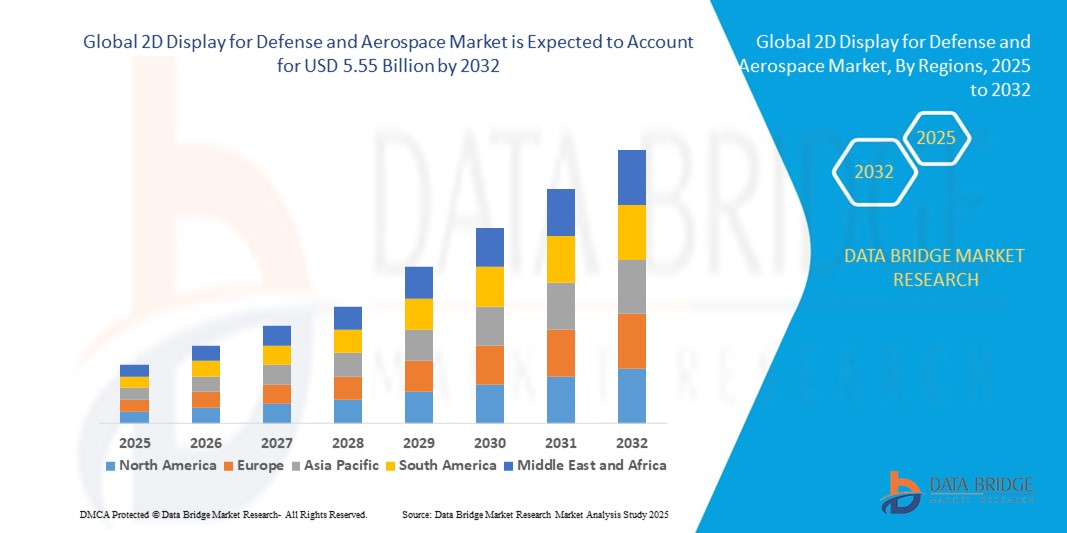

- The global 2D display for defense and aerospace market size was valued at USD 3.56 billion in 2024 and is expected to reach USD 5.55 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fuelled by the rising demand for advanced situational awareness systems, increased investment in modernizing defense platforms, and growing adoption of lightweight, high-resolution display technologies across military aircraft, ground vehicles, and control centers

- In addition, the increasing use of unmanned systems and smart cockpits is creating new avenues for the integration of compact and efficient 2D displays in real-time monitoring and mission-critical applications

2D Display for Defense and Aerospace Market Analysis

- The integration of 2D display technology into next-generation command-and-control systems is enhancing decision-making accuracy across defense and aerospace operations

- Advancements in ruggedized display design, sunlight-readable panels, and multi-function interfaces are enabling seamless deployment in harsh combat and aviation environments

- North America dominated the 2D display for defense and aerospace market with the largest revenue share of 39.6% in 2024, driven by robust defense spending and the early adoption of advanced avionics and display technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global 2D display for defense and aerospace market, driven by rising geopolitical tensions, ongoing upgrades to military aviation infrastructure, and strong government support for domestic aerospace manufacturing and technological advancement

- The LCD segment accounted for the largest revenue share in 2024 due to its cost-effectiveness, reliability, and suitability for various environmental conditions. LCDs are widely used in cockpits, control panels, and mission-critical interfaces in defense aircraft and command centers owing to their long operational life and stable performance

Report Scope and 2D Display for Defense and Aerospace Market Segmentation

|

Attributes |

2D Display for Defense and Aerospace Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Integration of Augmented Reality with 2D Display Systems • Growing Demand for Lightweight and Power-Efficient Display Modules |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

2D Display for Defense and Aerospace Market Trends

Advancements in Micro-LED and OLED Technologies Enhancing Tactical Visualization

- The growing adoption of Micro-LED and OLED displays is revolutionizing cockpit and ground control systems by delivering sharper images, reduced power consumption, and higher brightness levels. These technologies allow for enhanced situational awareness in both daylight and night operations, improving operational effectiveness and decision-making in real-time scenarios

- The integration of ultra-thin, lightweight panels into military gear and aerospace dashboards is supporting ergonomic and compact equipment design. These displays offer greater flexibility and durability, crucial for hostile environments, and are increasingly used in wearable command interfaces and portable systems

- With military operations demanding faster data processing, high-resolution displays such as 4K panels are becoming standard in advanced simulation and training environments. These setups allow defense personnel to engage in hyper-realistic mission planning and reduce the risks involved in live exercises

- For instance, in 2023, Lockheed Martin integrated OLED-based display modules into its next-gen fighter aircraft HUDs (Heads-Up Displays), enabling broader field of view and enhanced visibility in high-velocity flight operations. The improvement boosted pilot responsiveness and target accuracy

- While new display technologies are transforming defense visualization, their long-term success depends on continued R&D, ruggedization for field conditions, and scalability for mass deployment across land, air, and naval platforms

2D Display for Defense and Aerospace Market Dynamics

Driver

Increased Demand for Situational Awareness and Tactical Visualization in Modern Warfare

• The shift toward real-time battlefield intelligence and digitized combat zones has heightened the demand for advanced 2D display solutions. Military and aerospace applications increasingly rely on intuitive interfaces to present critical data such as maps, sensor readings, and target information to field operatives and command units

• Modern aircraft, tanks, and naval vessels are being outfitted with smart displays that offer multi-functionality, allowing seamless switching between navigational data, surveillance inputs, and communication systems. These visual tools help operators make faster, more informed decisions under pressure

• Defense forces are also investing in smart displays for drones, unmanned aerial vehicles, and remote-control stations. As operations shift toward autonomous systems, high-resolution 2D displays become essential in monitoring missions and avoiding threats

• For instance, in 2022, the U.S. Department of Defense expanded its investment in ruggedized smart cockpit displays for military helicopters to support day-and-night flying, boosting mission safety in low-visibility zones

• While situational awareness is a core focus, manufacturers must enhance display responsiveness, ensure low power consumption, and comply with military-grade durability standards to meet defense procurement requirements

Restraint/Challenge

High Cost and Integration Complexity of Advanced Display Modules

• The adoption of high-tech displays such as OLED, Micro-LED, and 4K panels adds substantial cost to defense equipment development. These components require specialized materials and manufacturing processes, making them less accessible for budget-constrained programs and smaller nations’ defense projects

• System compatibility poses another challenge, as legacy defense platforms are not always equipped to support modern display interfaces. Retrofitting existing equipment with advanced screens often demands custom hardware and software integration, driving up both time and expenses

• Environmental durability is a key hurdle, with military-grade displays needing to function in extreme temperatures, high altitudes, and electromagnetic environments. Meeting these ruggedization requirements adds to engineering and testing costs

• For instance, in 2023, a European defense contractor delayed the rollout of smart display upgrades for naval ships due to integration challenges with legacy radar systems, highlighting the complexity of modernizing large fleets

• To address these barriers, vendors must prioritize modular display systems, cost-effective panel manufacturing, and collaborative system development approaches to streamline integration across defense and aerospace infrastructures

2D Display for Defense and Aerospace Market Scope

The global 2D display for defense and aerospace market is segmented on the basis of display technology, type, resolution, panel size, display type, sales channel, and application.

- By Display Technology

On the basis of display technology, the market is segmented into Liquid Crystal Displays (LCD), Light Emitting Diode (LED), Organic LED (OLED), Micro-LED, and others. The LCD segment accounted for the largest revenue share in 2024 due to its cost-effectiveness, reliability, and suitability for various environmental conditions. LCDs are widely used in cockpits, control panels, and mission-critical interfaces in defense aircraft and command centers owing to their long operational life and stable performance.

The OLED segment is expected to witness the fastest growth from 2025 to 2032 due to its superior image quality, lightweight structure, and potential for flexible display configurations. OLEDs are gaining traction in next-generation military equipment, wearable devices, and compact aerospace instrumentation that require high contrast ratios and energy efficiency.

- By Type

On the basis of type, the market is segmented into touch and non-touch displays. The non-touch segment dominated the market in 2024 due to its preference in ruggedized defense environments where minimal user interaction is required. These displays are used in mission dashboards and legacy defense systems where durability and stability are essential.

The touch display segment is expected to witness the fastest growth from 2025 to 2032 owing to the rising demand for interactive interfaces in modern aircraft and command systems. Enhanced usability and integration with real-time data analytics are driving adoption in smart cockpits and mobile command solutions.

- By Resolution

On the basis of resolution, the market is segmented into Full HD, HD, 4K, and others. The Full HD segment held the largest market share in 2024 owing to its balance between clarity, cost, and hardware compatibility. Full HD displays are commonly used in unmanned systems, simulation training modules, and surveillance interfaces.

The 4K segment is expected to witness the fastest growth from 2025 to 2032 due to increasing demand for ultra-high-definition visuals in surveillance drones, satellite imaging, and situational awareness systems in both aerospace and defense sectors.

- By Panel Size

On the basis of panel size, the market is segmented into less than 5 inches, 5 inches to 10 inches, and greater than 10 inches. The 5 inches to 10 inches segment held the dominant share in 2024, driven by its versatility and widespread use in handheld communication devices, portable systems, and embedded instrumentation.

The greater than 10 inches segment is expected to witness the fastest growth from 2025 to 2032, supported by rising demand for large-screen command consoles, aircraft displays, and mission control interfaces where detailed visuals and multi-view layouts are essential.

- By Display Type

On the basis of display type, the market is segmented into conventional display and smart display. The conventional display segment dominated in 2024 due to its extensive use in basic instrumentation panels, legacy systems, and applications where advanced features are not a necessity.

The smart display segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing integration of artificial intelligence and Internet of Things (IoT) in aerospace and defense operations. Smart displays are favored for their ability to provide interactive and real-time feedback to users, improving decision-making capabilities in dynamic environments.

- By Sales Channel

On the basis of sales channel, the market is segmented into OEMs and retailers. The OEM segment held the largest share in 2024, driven by direct procurement for aircraft manufacturing, defense vehicle integration, and custom-designed solutions for national defense contracts.

The retailer segment is expected to witness the fastest growth from 2025 to 2032 steadily due to the growing need for replacement components, upgrades, and standardized display units among secondary suppliers and maintenance service providers.

- By Application

On the basis of application, the market is segmented into aerospace and defense. The defense segment accounted for the largest share in 2024 owing to rising investment in modernization programs, battlefield technology, and unmanned defense systems. 2D displays play a vital role in operational coordination, surveillance, and control systems.

The aerospace segment is expected to witness the fastest growth from 2025 to 2032 due to increasing aircraft production, demand for advanced pilot display systems, and adoption of lightweight display modules to improve fuel efficiency and flight experience.

2D Display for Defense and Aerospace Market Regional Analysis

- North America dominated the 2D display for defense and aerospace market with the largest revenue share of 39.6% in 2024, driven by robust defense spending and the early adoption of advanced avionics and display technologies

- The region benefits from a strong presence of key aerospace and defense contractors, alongside technological leadership in display system innovation. Military modernization programs and commercial aircraft upgrades are accelerating the deployment of high-resolution displays

- In addition, increasing demand for smart cockpits and integrated situational awareness systems is fueling investments across U.S. and Canadian defense sectors

U.S. 2D Display for Defense and Aerospace Market Insight

The U.S. captured the largest revenue share within North America in 2024 due to its large-scale investments in military aircraft modernization and space exploration programs. The demand for advanced 2D display systems is further supported by initiatives such as the Future Vertical Lift (FVL) and Next Generation Air Dominance (NGAD). Moreover, the integration of next-gen displays in command centers and unmanned aerial vehicles (UAVs) is solidifying the U.S. position as a leading contributor to market growth.

Europe 2D Display for Defense and Aerospace Market Insight

The Europe market is expected to witness the fastest growth from 2025 to 2032, backed by expanding defense budgets and efforts to boost indigenous aerospace capabilities. Countries such as Germany, France, and the United Kingdom are upgrading avionics systems in military jets and commercial fleets, driving the adoption of lightweight, high-contrast 2D display modules. Increasing investments in space-based defense and satellite control systems further enhance regional market potential.

Germany 2D Display for Defense and Aerospace Market Insight

Germany is witnessing strong growth in the adoption of 2D display systems, propelled by increasing demand for digitalized cockpit solutions in military aircraft and rotary-wing platforms. The country's push for autonomous and semi-autonomous defense systems is also fostering the need for enhanced visualization technologies. With a focus on indigenous manufacturing and high reliability standards, Germany plays a pivotal role in shaping the European defense display landscape.

U.K. 2D Display for Defense and Aerospace Market Insight

The U.K. is expected to witness the fastest growth from 2025 to 2032, supported by significant defense modernization programs and its involvement in multinational aerospace projects. The U.K.’s investment in sixth-generation fighter programs and upgraded surveillance aircraft platforms is expected to drive demand for advanced multifunction displays. The integration of AI-enabled displays and digital twin technologies is also gaining traction within its aerospace ecosystem.

Asia-Pacific 2D Display for Defense and Aerospace Market Insight

The Asia-Pacific region is expected to witness the fastest growth from 2025 to 2032, driven by escalating defense expenditures, regional security concerns, and expanding commercial aviation infrastructure. Countries such as China, India, and Japan are actively upgrading their air forces and commercial fleets, increasing the demand for smart 2D display systems. The growth is also supported by domestic production initiatives and advancements in miniaturized, ruggedized display technologies.

China 2D Display for Defense and Aerospace Market Insight

China accounted for the largest market share within Asia-Pacific in 2024, fueled by its aggressive military modernization and space programs. The country’s significant investment in developing stealth aircraft, UAVs, and missile systems is creating substantial demand for advanced 2D cockpit and ground control displays. In addition, China’s push for indigenous avionics manufacturing and AI-powered defense interfaces further strengthens its market leadership in the region.

Japan 2D Display for Defense and Aerospace Market Insight

Japan is expected to witness the fastest growth from 2025 to 2032, accelerated adoption of high-resolution 2D displays, especially in surveillance aircraft, coast guard fleets, and next-gen fighter programs. As Japan enhances its self-defense capabilities and aligns with global security coalitions, the demand for integrated avionics and smart visualization systems is rising. The market is further supported by Japan’s expertise in display manufacturing and emphasis on operational reliability in aerospace environments.

2D Display for Defense and Aerospace Market Share

The 2D Display for Defense and Aerospace industry is primarily led by well-established companies, including:

- Korry (U.S.)

- Astronautics Corporation of America (U.S.)

- Crunchbase Inc. (U.S)

- Rosen Aviation (U.S.)

- ScioTeq (Belgium)

- Excelitas Technologies Corp. (U.S.)

- DIEHL STIFTUNG & CO. KG (Germany)

- Nighthawk Flight Systems, Inc (U.S.)

- Aspen Avionics, Inc. (Italy)

- US Micro Products (U.S.)

- Meggitt PLC. (U.K.)

- Honeywell International Inc. (U.S.)

- Barco (Belgium)

- BAE Systems (U.K.)

- Thales (France)

- Garmin Ltd. or its subsidiaries. (U.S.)

- Winmate Inc (Taiwan)

- Collins Aerospace (U.S.)

- D&T Inc (U.S.)

- Elbit Systems Ltd. (Israel)

Latest Developments in Global 2D Display for Defense and Aerospace Market

- In March 2022, Nighthawk Flight Systems, Inc. achieved AS9100/ISO9001 certification, marking a significant quality assurance milestone. This certification enables the company to design and produce compact integrated display systems for general aviation, business jets, military aircraft, regional aircraft, and air transport. The development strengthens Nighthawk’s position in the global 2D display for defense and aerospace market by enhancing reliability, boosting customer trust, and expanding its capabilities in high-performance display solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global 2d Display For Defense And Aerospace Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global 2d Display For Defense And Aerospace Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global 2d Display For Defense And Aerospace Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.