Global 3d Bioprinting Market

Market Size in USD Billion

CAGR :

%

USD

1.73 Billion

USD

6.54 Billion

2025

2033

USD

1.73 Billion

USD

6.54 Billion

2025

2033

| 2026 –2033 | |

| USD 1.73 Billion | |

| USD 6.54 Billion | |

|

|

|

|

3D Bioprinting Market Size

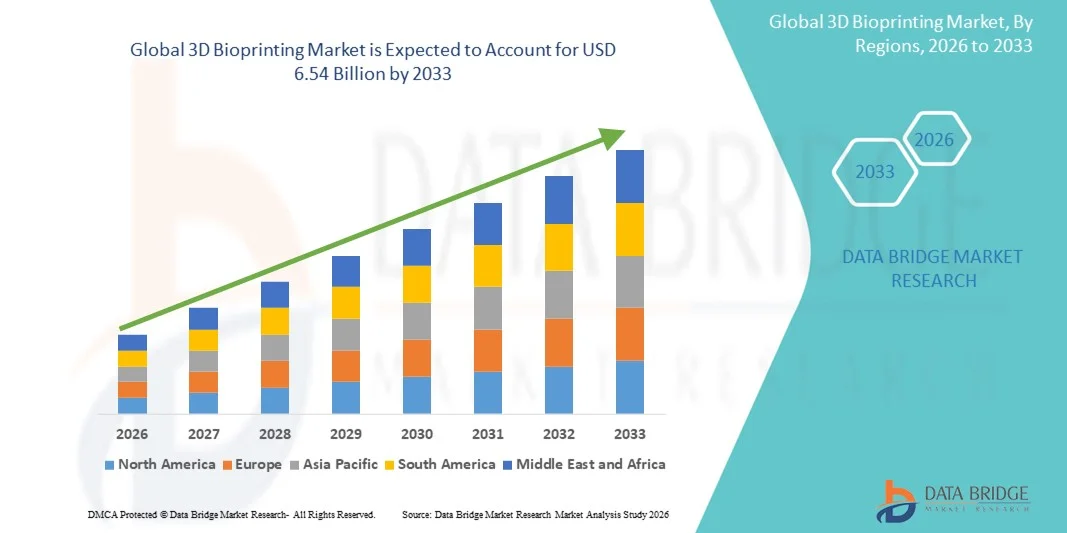

- The global 3D bioprinting market size was valued at USD 1.73 billion in 2025 and is expected to reach USD 6.54 billion by 2033, at a CAGR of 18.10% during the forecast period

- The growth of the 3D Bioprinting market is largely driven by rapid advancements in bioprinting technologies, increasing adoption of tissue engineering and regenerative medicine, and the growing demand for personalized healthcare solutions. These technological innovations are enabling the precise fabrication of complex biological structures, supporting advancements in drug discovery, organ transplantation, and cosmetic surgery applications

- Furthermore, rising investments in biotechnology research, increasing collaborations between academic institutions and biopharma companies, and expanding applications in pharmaceutical testing and prosthetics are accelerating the uptake of 3D bioprinting solutions, thereby significantly boosting the industry’s growth

3D Bioprinting Market Analysis

- 3D Bioprinting, which involves the precise layer-by-layer fabrication of biological tissues and organs using bio-inks composed of living cells, biomaterials, and growth factors, is becoming an essential technology in modern biomedical research, regenerative medicine, and pharmaceutical development due to its ability to replicate complex tissue structures and accelerate clinical innovations

- The rising demand for 3D bioprinting is primarily fueled by advancements in tissue engineering, the growing prevalence of chronic diseases requiring organ transplants, and the increasing focus on personalized medicine and drug testing models

- North America dominated the 3D bioprinting market with the largest revenue share of 41.8% in 2025, attributed to strong research funding, a high concentration of biotechnology firms, and extensive adoption of advanced medical technologies. The U.S. market, in particular, is witnessing substantial growth due to the rapid expansion of bioprinting applications in regenerative medicine, pharmaceutical research, and academic collaborations

- Asia-Pacific is expected to be the fastest-growing region in the 3D bioprinting market, registering a CAGR of around 23.5% during the forecast period. This growth is driven by increasing healthcare investments, expanding biopharma industries, and government initiatives promoting biomedical innovation across countries such as China, Japan, and South Korea

- The 3D Bioprinters segment dominated the largest market revenue share of 62.4% in 2025, attributed to the growing adoption of bioprinting systems across biotechnology, pharmaceutical, and academic institutions for producing functional tissues, organ models, and scaffolds

Report Scope and 3D Bioprinting Market Segmentation

|

Attributes |

3D Bioprinting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

3D Bioprinting Market Trends

Accelerating Technological Integration and Expansion of Bioprinting Applications

- A significant and accelerating trend in the global 3D bioprinting market is the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and robotics into bioprinting processes to improve precision, reproducibility, and scalability of biofabricated tissues

- AI algorithms are being used to optimize bioink formulations, predict cellular behavior, and automate real-time quality control during the printing process

- For instance, companies are employing AI-based image analysis systems to monitor printed constructs layer by layer, ensuring accurate tissue architecture and cell viability

- The market is also witnessing rapid expansion in bioprinting applications beyond research — including drug discovery, regenerative medicine, and cosmetic testing — as bioprinted tissues are increasingly used for personalized medicine and toxicity screening

- Several leading manufacturers are collaborating with academic institutions and pharmaceutical companies to develop organ-on-chip models and functional tissue structures, driving innovation and accelerating regulatory validation for clinical use

- The advancement of multi-material printing, microfluidic-assisted bioprinters, and high-resolution extrusion systems is further broadening the scope of 3D bioprinting to include complex vascularized tissues, bone scaffolds, and skin grafts

- This trend toward multidisciplinary convergence and industrial scalability is positioning 3D bioprinting as a transformative technology in the global life sciences sector, fostering a shift from experimental applications to practical, patient-centered biomedical solutions

3D Bioprinting Market Dynamics

Driver

Growing Demand for Regenerative Medicine and Personalized Therapeutics

- The rising global prevalence of chronic diseases, organ failure, and traumatic injuries is fueling the demand for regenerative medicine solutions, thereby driving the 3D Bioprinting market

- For instance, in May 2023, 3D Systems and United Therapeutics announced progress toward the development of bioprinted human lungs using collagen-based bioinks, marking a significant milestone in organ replacement research. Such collaborations exemplify how bioprinting can address the critical shortage of donor organs

- The growing focus on personalized therapeutics — where patient-specific cells are used to fabricate tissues and implants tailored to individual biological profiles — further supports market expansion

- Increasing investment from both private and public sectors, alongside government-funded research initiatives, is accelerating technological advancements and commercialization of bioprinted tissues and biomaterials

- The capability of 3D bioprinting to reduce animal testing in pharmaceutical research and provide physiologically relevant human tissue models has made it a key tool in drug development pipelines

- As healthcare systems worldwide emphasize precision medicine, the combination of bioprinting, genomics, and cell therapy is expected to significantly enhance patient outcomes, driving the market’s projected CAGR of 22.4% from 2025 to 2033

Restraint/Challenge

High Cost, Limited Cell Availability, and Regulatory Complexity

- Despite rapid advancements, the 3D Bioprinting market faces notable challenges including high initial equipment costs, complex bioink formulations, and difficulties in maintaining cell viability during and after printing

- The development of standardized, clinically safe bioinks remains a critical hurdle, as variations in material properties and biocompatibility can impact tissue functionality and reproducibility

- Furthermore, the high cost of bioprinters (ranging from USD 50,000 to over USD 500,000) and the need for sterile, specialized laboratory environments limit accessibility for smaller research organizations and hospitals

- A major restraint also lies in the regulatory uncertainty surrounding bioprinted organs and tissues. As 3D bioprinting merges biological materials with manufacturing technology, approval pathways remain unclear across regions, delaying clinical translation

- For instance, in August 2022, the U.S. FDA announced its intent to evaluate regulatory frameworks for bioprinted tissues after multiple submissions for bioprinted cartilage implants raised classification challenges — underscoring the market’s regulatory ambiguity

- The limited availability of patient-derived cells and challenges in vascularization of thick tissue constructs further restrict large-scale commercial applications

- To overcome these barriers, companies are increasingly investing in cost-efficient bioprinters, synthetic and hybrid bioinks, and partnerships with regulatory agencies to establish consistent standards. Addressing these issues will be vital to achieving sustainable market growth and clinical adoption over the coming decade

3D Bioprinting Market Scope

The market is segmented on the basis of component, material, application, and end user.

- By Component

On the basis of component, the 3D Bioprinting market is segmented into 3D Bioprinters and Bioinks. The 3D Bioprinters segment dominated the largest market revenue share of 62.4% in 2025, attributed to the growing adoption of bioprinting systems across biotechnology, pharmaceutical, and academic institutions for producing functional tissues, organ models, and scaffolds. Technological advancements in extrusion-based and laser-assisted printers have improved precision, speed, and scalability, making bioprinting an essential part of advanced life sciences research. Increasing partnerships between hardware manufacturers and research centers for developing next-generation bioprinters has expanded adoption. Moreover, the miniaturization of bioprinters, cost reductions, and cloud-based design integration are enhancing workflow efficiency and accessibility. As demand for customized 3D bioprinting hardware grows globally, especially for personalized medicine and drug testing applications, this segment continues to lead the market significantly.

The Bioinks segment is expected to witness the fastest growth rate of 24.6% CAGR from 2026 to 2033, driven by the continuous evolution of biocompatible and cell-supportive materials used for tissue and organ regeneration. Increasing focus on developing hydrogel-based and hybrid bioinks that mimic natural cellular environments is enhancing printing accuracy and biological performance. Researchers are increasingly using advanced bioinks for applications such as vascularized tissue engineering, regenerative skin grafts, and implantable scaffolds. The introduction of ready-to-use and customizable bioinks suitable for multiple printer types has expanded usability. Moreover, the rise in demand for stem cell-compatible and growth factor-enriched bioinks is propelling innovation in material science. As these consumables offer recurring revenue opportunities, manufacturers are heavily investing in R&D for stable and standardized formulations, accelerating long-term market expansion.

- By Material

On the basis of material, the 3D Bioprinting market is segmented into Living Cells, Hydrogels, Extracellular Matrices, and Other Biomaterials. The Living Cells segment dominated the largest market revenue share of 39.7% in 2025, owing to the pivotal role of viable cells in fabricating functional, biologically active tissues. Advancements in stem cell biology, organoid research, and patient-derived cellular models have significantly improved the reproducibility and clinical potential of bioprinted constructs. The integration of living cells allows researchers to recreate complex biological structures, offering realistic testing models for pharmaceuticals and regenerative therapies. Increasing collaborations between cell culture companies and bioprinting technology providers have streamlined the use of differentiated cells in advanced research. Moreover, the growing adoption of patient-specific cells for personalized regenerative medicine is further driving dominance. The expansion of cell banking and cryopreservation solutions is ensuring sustainable supply for bioprinting purposes, reinforcing the segment’s leadership.

The Hydrogels segment is projected to witness the fastest growth rate of 23.8% CAGR from 2026 to 2033, primarily due to their superior biocompatibility, tunable mechanical properties, and high water content, which make them ideal scaffolds for tissue fabrication. Hydrogels serve as effective carriers for living cells, supporting nutrient diffusion and cell proliferation in bioprinted constructs. Increasing advancements in synthetic and natural hydrogel formulations, such as alginate, gelatin methacrylate, and polyethylene glycol-based materials, are improving printing resolution and tissue functionality. Researchers are focusing on smart hydrogels with stimuli-responsive behavior to mimic physiological environments more effectively. The rapid expansion of hydrogel applications in bone, cartilage, and wound healing bioprinting is driving segment growth. In addition, collaborations between bioink developers and universities for cross-linked, bioactive hydrogel systems are expected to boost adoption in the coming years.

- By Application

On the basis of application, the 3D Bioprinting market is segmented into Research Applications and Clinical Applications. The Research Applications segment dominated the largest market revenue share of 68.1% in 2025, primarily fueled by the growing use of 3D bioprinting technologies in preclinical studies, disease modeling, and drug discovery. The ability to reproduce human tissue and organ structures in a lab setting has revolutionized toxicity testing and therapeutic screening processes. Pharmaceutical and academic institutions increasingly rely on bioprinting to create organ-on-chip systems and tissue replicas that provide more accurate human physiological data compared to animal models. Furthermore, the continuous funding from governments and research councils for developing innovative bioprinting technologies is strengthening this segment. The accessibility of low-cost bioprinters and standardized materials is democratizing adoption in smaller research institutions, making this the most prominent revenue contributor.

The Clinical Applications segment is anticipated to grow at the fastest rate of 25.3% CAGR from 2026 to 2033, driven by rising clinical validation and commercialization of bioprinted tissues for transplantation and regenerative medicine. Increasing trials focused on skin grafts, cartilage repair, and vascular structures are transforming the clinical potential of 3D bioprinting. Hospitals and biotech startups are collaborating to develop implantable constructs for reconstructive and orthopedic surgeries. The surge in demand for patient-specific tissue solutions, combined with the global organ donor shortage, is accelerating the adoption of bioprinted substitutes. Technological improvements in biocompatibility, scalability, and sterilization of printed tissues are enhancing regulatory acceptance. With ongoing FDA approvals and investment in clinical-grade biofabrication facilities, this segment is positioned for rapid expansion in the coming decade.

- By End User

On the basis of end user, the 3D Bioprinting market is segmented into Research Organizations and Academic Institutes, Biopharmaceutical Companies, and Hospitals. The Research Organizations and Academic Institutes segment accounted for the largest market revenue share of 57.9% in 2025, driven by strong government and institutional funding for R&D in tissue engineering and regenerative medicine. Universities are leading innovation through collaborative projects with technology developers, focusing on next-generation bioinks and high-precision bioprinters. Academic laboratories serve as key centers for prototyping and proof-of-concept development of complex tissue models. Global initiatives supporting open-access bioprinting research are fostering technological standardization and accelerating adoption. The integration of 3D bioprinting into educational curricula is also nurturing a skilled workforce that sustains long-term industry growth. As innovation and knowledge transfer continue to originate from research institutions, they remain the cornerstone of the market’s leadership.

The Biopharmaceutical Companies segment is projected to register the fastest CAGR of 24.9% from 2026 to 2033, driven by the growing integration of 3D bioprinted human tissue models into drug discovery and development workflows. Companies are increasingly utilizing bioprinted organs for pharmacokinetic and toxicity testing to reduce animal dependency and improve drug accuracy. Strategic collaborations with academic institutes for developing disease-specific models are enabling personalized medicine breakthroughs. In addition, biopharma firms are investing heavily in automated bioprinting systems to enhance throughput and consistency in experimental outcomes. As regulatory frameworks evolve to support tissue-engineered drug testing, major players are scaling up production capacity for bioprinted constructs. This growing commercial use in biopharmaceutical pipelines marks a transformative shift toward clinically validated biofabrication.

3D Bioprinting Market Regional Analysis

- North America dominated the 3D bioprinting market with the largest revenue share of 41.8% in 2025, attributed to robust research funding, a high concentration of biotechnology firms, and the strong adoption of advanced medical technologies

- The region’s leadership is further strengthened by collaborations between universities, research institutes, and biopharma companies aimed at advancing tissue engineering and regenerative medicine

- The presence of major industry players and increasing investments in R&D for organ and tissue bioprinting have positioned North America as a key hub for technological innovation and commercialization

U.S. 3D Bioprinting Market Insight

The U.S. 3D bioprinting market captured the largest revenue share of 82% within North America in 2025, driven by rapid advancements in stem cell research, rising demand for organ transplants, and strong government and private funding for bioprinting innovation. Leading U.S. biotech companies and academic research centers are heavily investing in next-generation bioinks, precision bioprinters, and 3D-printed tissues for drug screening. Moreover, FDA’s growing support for bioprinted medical research and commercialization of tissue-engineered products is significantly propelling market expansion.

Europe 3D Bioprinting Market Insight

The Europe 3D bioprinting market is projected to witness steady growth during the forecast period, primarily fueled by robust regulatory support for tissue engineering and regenerative medicine, coupled with growing healthcare R&D investments. European countries such as Germany, the U.K., and France are making significant progress in adopting bioprinting for pharmaceutical testing and tissue reconstruction. In addition, the presence of advanced healthcare infrastructure and government programs supporting biomedical innovation are contributing to the market’s expansion across the region.

U.K. 3D Bioprinting Market Insight

The U.K. 3D bioprinting market is anticipated to grow at a notable CAGR throughout the forecast period, supported by strong academic research, expanding biopharmaceutical manufacturing, and increasing focus on personalized medicine. The country’s government-backed initiatives and funding programs for life sciences innovation are driving bioprinting adoption in universities and research institutions. Furthermore, the rise of startups focusing on bioink development and 3D-printed tissue models is expected to further boost the market in the coming years.

Germany 3D Bioprinting Market Insight

The Germany 3D bioprinting market is expected to expand at a considerable CAGR, driven by its leadership in medical technology and biotechnology innovation. The country’s strong industrial base and emphasis on precision engineering make it a vital contributor to advancements in 3D bioprinter hardware and materials. Increasing partnerships between academic institutions, healthcare providers, and technology developers are fostering the growth of bioprinting for clinical and pharmaceutical use.

Asia-Pacific 3D Bioprinting Market Insight

The Asia-Pacific 3D bioprinting market is poised to grow at the fastest CAGR of 23.5% during 2026–2033, driven by surging healthcare investments, expanding biopharma industries, and government support for biomedical innovation across China, Japan, India, and South Korea. The region’s large patient population, rising demand for regenerative treatments, and growing network of research facilities are catalyzing market growth. In addition, cost-effective manufacturing capabilities and increasing collaborations with Western biotech firms are enhancing the region’s market potential.

Japan 3D Bioprinting Market Insight

The Japan 3D bioprinting market is witnessing strong growth due to the country’s technological sophistication, focus on regenerative medicine, and significant government support for 3D tissue and organ research. Japan’s healthcare institutions are increasingly incorporating bioprinting in preclinical studies, tissue modeling, and organ-on-chip development. Moreover, partnerships between academic centers and global bioprinting firms are driving innovation and commercialization within the market.

China 3D Bioprinting Market Insight

The China 3D bioprinting market accounted for the largest revenue share in the Asia-Pacific region in 2025, supported by rapid growth in biotechnology R&D, government funding for life sciences innovation, and the presence of emerging local manufacturers. China is witnessing increasing adoption of 3D bioprinting for drug testing, stem cell research, and regenerative therapies. The country’s expanding healthcare infrastructure, along with strategic collaborations between universities and tech firms, continues to drive significant advancements in bioprinting capabilities.

3D Bioprinting Market Share

The 3D Bioprinting industry is primarily led by well-established companies, including:

• Organovo Holdings Inc. (U.S.)

• CELLINK (Sweden)

• 3D Systems Corporation (U.S.)

• Aspect Biosystems Ltd. (Canada)

• EnvisionTEC GmbH (Germany)

• RegenHU SA (Switzerland)

• Poietis (France)

• Allevi Inc. (U.S.)

• Advanced Solutions Life Sciences (U.S.)

• Cyfuse Biomedical K.K. (Japan)

• Pandorum Technologies Pvt. Ltd. (India)

• Bioprinting Solutions (Russia)

• Rokit Healthcare Inc. (South Korea)

• CollPlant Biotechnologies Ltd. (Israel)

• Stratasys Ltd. (U.S.)

Latest Developments in Global 3D Bioprinting Market

- In December 2022, CELLINK and the Indian Institute of Science (IISc) inaugurated the first 3D Bioprinting Centre of Excellence in India, located at the IISc campus in Bengaluru. The collaboration aims to provide researchers with advanced bioprinting systems to accelerate innovations in tissue engineering, regenerative medicine, and drug discovery

- In November 2022, Redwire Corporation launched an upgraded 3D bioprinter to the International Space Station (ISS), designed to support biofabrication and regenerative medicine research under microgravity conditions. This development marked a major step toward studying tissue growth and material testing in space-based environments

- In June 2022, 3DBio Therapeutics announced the world’s first successful human transplantation of a 3D-printed ear made using the patient’s own living cells. This groundbreaking procedure demonstrated the practical potential of bioprinting in regenerative surgery and personalized tissue implants

- In May 2024, L’Oréal announced the creation of bioprinted artificial skin capable of replicating tactile sensations, marking a major leap in both cosmetic testing and medical skin-repair applications. This innovation aims to reduce the reliance on animal testing and enhance product safety assessments

- In July 2025, 3D Systems announced its decision to discontinue operations of its subsidiary, Systemic Bio, which was established in 2022 to focus on the development of bioprinted human tissues. The move reflected a strategic re-evaluation of the company’s bioprinting business model and market approach

- In September 2025, researchers from the Massachusetts Institute of Technology (MIT) and Politecnico di Milano unveiled a novel 3D bioprinting technique that improves the scalability and structural fidelity of engineered tissues. The breakthrough enhances the potential for large-scale tissue production and clinical application in regenerative medicine

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.