Global 3d Cell Culture Market

Market Size in USD Billion

CAGR :

%

USD

2.62 Billion

USD

6.13 Billion

2024

2032

USD

2.62 Billion

USD

6.13 Billion

2024

2032

| 2025 –2032 | |

| USD 2.62 Billion | |

| USD 6.13 Billion | |

|

|

|

|

3D Cell Culture Market Size

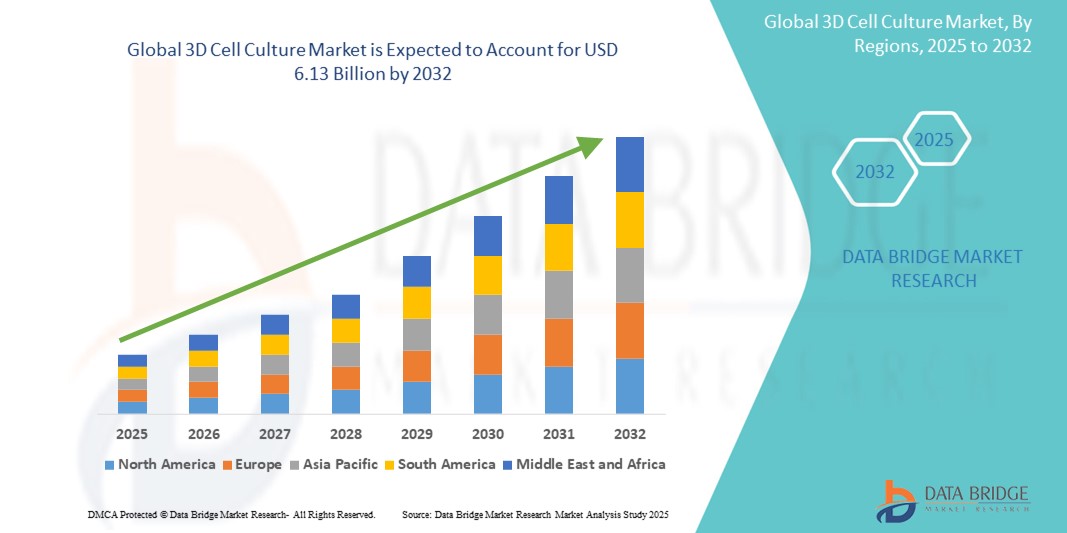

- The global 3D cell culture market size was valued at USD 2.62 billion in 2024 and is expected to reach USD 6.13 billion by 2032, at a CAGR of 11.20% during the forecast period

- This growth is driven by factors such as the increasing demand for more predictive in vitro models in drug discovery, rising adoption of alternatives to animal testing, and advancements in tissue engineering and bioprinting technologies

3D Cell Culture Market Analysis

- 3D cell culture systems are advanced in vitro techniques that allow cells to grow in a three-dimensional environment, closely mimicking in vivo conditions, enhancing their use in drug discovery, cancer research, and tissue engineering

- The market growth is significantly driven by increasing demand for more predictive cell-based assays, reduced reliance on animal testing, and growing applications in regenerative medicine

- North America is expected to dominate the 3D cell cultures market with a market share of 39.59%, due to well-established healthcare infrastructure, high research and development investment, and strong support for advanced biotechnology

- Asia-Pacific is expected to be the fastest growing region in the 3D cell culture market with a market share of 24.68%, during the forecast period due to rapid advancements in biotechnology, growing healthcare investments, and increasing awareness of personalized medicine

- Scaffold-based segment is expected to dominate the market with a market share of 49.35% due to its ability to provide structural support that closely mimics the extracellular matrix, promoting realistic cell growth and differentiation

Report Scope and 3D Cell Culture Market Segmentation

|

Attributes |

3D Cell Culture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

3D Cell Culture Market Trends

“Increasing Adoption of Advanced 3D culture Technologies”

- One major trend in the global 3D cell culture market is the increasing adoption of advanced 3D culture technologies, such as organoids, spheroids, and scaffold-based models, in drug screening and disease modeling

- These systems better replicate human physiological conditions compared to traditional 2D cultures, enhancing the reliability of preclinical studies and reducing dependence on animal models

- For instance, organoid technology is being increasingly utilized in cancer research and personalized medicine, offering insights into patient-specific drug responses and disease progression

- These advancements are revolutionizing drug development pipelines, improving translational research, and fueling demand for innovative 3D cell culture platforms across pharmaceutical and biotechnology sectors

3D Cell Culture Market Dynamics

Driver

“Rising Demand for Predictive and Human-Relevant Drug Testing Models”

- The growing need for more physiologically relevant and predictive in vitro models is a major driver of the 3D cell culture market, especially in drug discovery, toxicology, and cancer research

- Traditional 2D cultures fail to accurately replicate the in vivo environment, often leading to ineffective drug screening and high failure rates in clinical trials

- 3D cell culture systems better mimic the complex cell-to-cell and cell-to-matrix interactions found in living tissues, enhancing the accuracy of preclinical testing and reducing the reliance on animal models

For instance,

- According to a 2023 report by the National Center for Advancing Translational Sciences (NCATS), over 90% of drugs that pass animal testing fail in human trials due to poor model predictivity, highlighting the urgent need for more human-relevant testing platforms such as 3D cell cultures

- As pharmaceutical and biotech companies strive to reduce development costs and improve clinical outcomes, the demand for 3D cell culture technologies continues to surge across global markets

Opportunity

“Expanding Applications in Personalized Medicine and Regenerative Therapies”

- The global 3D cell culture market is witnessing a significant opportunity in the growing adoption of personalized medicine, where patient-derived 3D models are used to tailor treatments based on individual biological responses

- These models enable researchers to recreate patient-specific disease environments, allowing for more precise testing of therapeutic responses and reducing trial-and-error in clinical decision-making

- In regenerative medicine, 3D cell cultures support tissue engineering by facilitating the development of functional tissues and organoids for transplantation and repair

For instance,

- In a 2024 report by Nature Biotechnology, researchers successfully used patient-derived organoids to model cystic fibrosis, enabling clinicians to select the most effective treatment for each individual, significantly improving therapeutic outcomes

- As healthcare systems shift toward personalized and regenerative approaches, the integration of 3D cell culture technologies is opening new avenues for innovation, enhancing treatment efficacy and paving the way for next-generation biomedical applications

Restraint/Challenge

“High Costs of 3D Culture Systems and Limited Standardization”

- The high cost associated with 3D cell culture systems, including specialized equipment, reagents, and scaffolds, presents a significant barrier to widespread adoption, especially in small- and medium-sized research facilities

- Setting up and maintaining 3D cultures requires advanced infrastructure and technical expertise, increasing the overall expenditure for laboratories and pharmaceutical companies

- In addition, the lack of standardized protocols across various 3D culture techniques can lead to inconsistent results, hampering reproducibility and broader acceptance in clinical and regulatory environments

For instance,

- A 2023 review published in Frontiers in Bioengineering and Biotechnology highlighted that 3D cell culture kits and systems can cost up to five times more than 2D counterparts, making them unaffordable for many institutions in emerging markets

- These financial and technical challenges limit market penetration, particularly in cost-sensitive regions, and pose obstacles to scaling up applications in drug development and personalized medicine

3D Cell Culture Market Scope

The market is segmented on the basis of product, type, application, and end user

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Application |

|

|

By End user |

|

In 2025, scaffold-based is projected to dominate the market with a largest share in product segment

The scaffold-based segment is expected to dominate the 3D cell culture market with the largest share of 49.35% in 2025 due to its ability to provide structural support that closely mimics the extracellular matrix, promoting realistic cell growth and differentiation. These scaffolds facilitate complex cell-to-cell and cell-to-matrix interactions, making them ideal for tissue engineering, cancer research, and regenerative medicine. In addition, their versatility and compatibility with various biomaterials enhance their applicability across diverse research areas

The stem cell research is expected to account for the largest share during the forecast period in application market

In 2025, the stem cell research segment is expected to dominate the market with the largest market share of 34.73% due to its growing use in regenerative medicine, disease modeling, and drug screening. 3D cell culture provides a more physiologically relevant environment for stem cells, enhancing their ability to differentiate and self-renew. This supports more accurate studies of developmental biology and personalized medicine. The rising global investment in stem cell therapies further fuels the segment’s growth

3D Cell Culture Market Regional Analysis

“North America Holds the Largest Share in the 3D Cell Culture Market”

- North America dominates the 3D cell culture market with a market share of estimated 39.59%, driven, by well-established healthcare infrastructure, high research and development investment, and strong support for advanced biotechnology

- U.S. holds a market share of 36.5%, due to robust pharmaceutical sector, extensive research activities, and increasing adoption of 3D culture models for drug development, cancer research, and regenerative medicine

- The availability of government funding, favorable regulatory policies, and the presence of leading biotech companies further strengthen market growth

- In addition, the rising prevalence of chronic diseases and the shift towards more accurate and reliable preclinical models in drug testing is driving market expansion across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the 3D Cell Culture Market”

- Asia-Pacific is expected to witness the highest growth rate in the 3D cell culture market with a market share of 24.68%, driven by rapid advancements in biotechnology, growing healthcare investments, and increasing awareness of personalized medicine

- Countries such as China, India, and Japan are emerging as key markets due to the expanding pharmaceutical and biotech industries, alongside rising demand for more advanced, human-relevant cell culture models

- Japan, with its technological expertise and strong focus on regenerative medicine, remains a crucial market for 3D cell culture applications, continuing to lead in innovative biotechnologies

- India is projected to register the highest CAGR in the 3D cell culture market with 7.6% market share, driven by seeing rapid improvements in research capabilities and infrastructure

3D Cell Culture Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SYNTHECON, INCORPORATED (U.S.)

- InSphero (Switzerland)

- Merck KGaA (Germany)

- VWR International, LLC. (U.S.)

- Lonza (Switzerland)

- Agilent Technologies, Inc. (U.S.)

- Corning Incorporated (U.S.)

- Cell Culture Company, LLC (U.S.)

- Advanced instruments (U.S.)

- SHIBUYA CORPORATION (Japan)

- NanoEntek (South Korea)

- FUJIFILM Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- Ventria Bioscience Inc. (U.S.)

- Greiner Bio-One International GmbH (Austria)

- 3D Biotek LLC (U.S.)

- Tecan Trading AG (Switzerland)

Latest Developments in Global 3D Cell Culture Market

- In January 2025, Inventia Life Science introduced the RASTRUM Allegro, an advanced 3D cell culture technology designed to accelerate drug discovery and development. This platform enables high-throughput screening by automating the creation of complex 3D cell models, enhancing the efficiency and scalability of preclinical research

- In November 2024, Emulate Inc. announced the expansion of its organ-on-a-chip technology, integrating 3D cell culture systems to better mimic human physiology. This advancement aims to improve the predictive accuracy of in vitro models in drug testing, reducing reliance on animal models and enhancing translational research outcome

- In September 2024, Corning Incorporated expanded its 3D cell culture product line by introducing new scaffold-based platforms that offer improved cell growth and differentiation. These innovations are tailored to support applications in cancer research, regenerative medicine, and personalized therapeutics, reflecting the company's commitment to advancing cell culture technologies

- In August 2024, Thermo Fisher Scientific unveiled a new range of advanced hydrogels designed for 3D cell culture applications. These hydrogels provide a more physiologically relevant environment for cell growth, facilitating more accurate modeling of tissue architecture and function, thereby enhancing research in drug discovery and disease modelling

- In July 2024, Lonza Group AG launched innovative 3D bioprinting solutions that integrate with existing 3D cell culture systems. These solutions aim to create more complex tissue models, enabling researchers to study cellular interactions in a more in vivo-like environment, which is crucial for advancing tissue engineering and regenerative medicine

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.