Global 3d Cell Culture Scaffolds Market

Market Size in USD Billion

CAGR :

%

USD

1.07 Billion

USD

3.18 Billion

2024

2032

USD

1.07 Billion

USD

3.18 Billion

2024

2032

| 2025 –2032 | |

| USD 1.07 Billion | |

| USD 3.18 Billion | |

|

|

|

|

3D Cell Culture Scaffolds Market Size

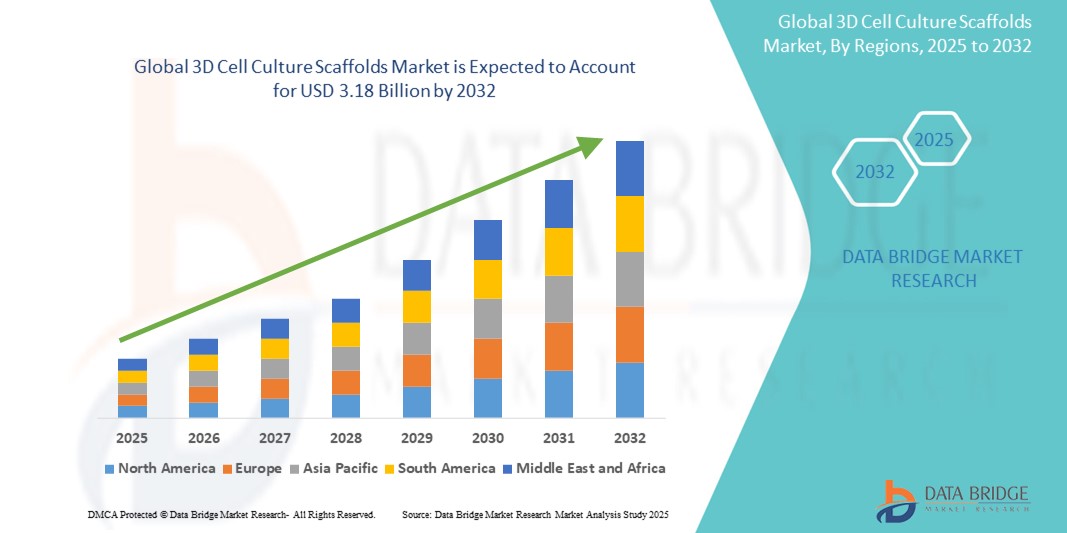

- The global 3D cell culture scaffolds market size was valued at USD 1.07 billion in 2024 and is expected to reach USD 3.18 billion by 2032, at a CAGR of 14.50% during the forecast period

- The market growth is primarily driven by the increasing demand for more physiologically relevant cell models in drug development and disease research, as traditional 2D cultures fail to mimic in vivo environments effectively

- Moreover, advancements in biomaterials and scaffold design, alongside rising investments in regenerative medicine and personalized therapies, are enhancing the adoption of 3D cell culture scaffolds across pharmaceutical, biotech, and academic sectors. These combined factors are fostering innovation and accelerating market expansion globally

3D Cell Culture Scaffolds Market Analysis

- 3D cell culture scaffolds, which provide structural and biochemical support for cell growth in three dimensions, are becoming essential tools in biomedical research and drug development due to their ability to closely mimic the in vivo environment, enhancing the accuracy and relevance of experimental results across pharmaceutical and academic applications

- The rising demand for 3D cell culture scaffolds is primarily fueled by increasing investments in regenerative medicine, growing interest in personalized therapies, and the limitations of traditional 2D culture models in replicating real tissue behavior

- North America dominated the 3D cell culture scaffolds market with the largest revenue share of 39% in 2024, supported by robust biotechnology and pharmaceutical industries, significant R&D funding, and early adoption of advanced cell culture technologies, particularly in the U.S., where institutions and biotechs are increasingly integrating 3D systems into preclinical and toxicology studies

- Asia-Pacific is projected to be the fastest growing region in the 3D cell culture scaffolds market during the forecast period, driven by expanding biotech sectors, increased research initiatives, and supportive government funding in countries such as China, Japan, and South Korea

- The hydrogel-based scaffold segment dominated the 3D cell culture scaffolds market with a share of 42.2% in 2024, owing to its superior biocompatibility, ease of cell encapsulation, and versatility in simulating various tissue environments

Report Scope and 3D Cell Culture Scaffolds Market Segmentation

|

Attributes |

3D Cell Culture Scaffolds Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

3D Cell Culture Scaffolds Market Trends

“Advancing In Vitro Models Through Biomaterial Innovation and 3D Bioprinting”

- A major and accelerating trend in the global 3D cell culture scaffolds market is the integration of advanced biomaterials and 3D bioprinting technologies to develop more physiologically accurate and customizable in vitro tissue models. These innovations are enhancing the relevance of preclinical studies and supporting the shift toward personalized medicine

- For instance, hydrogel-based scaffolds, widely used due to their tunable mechanical properties and high biocompatibility, now incorporate bioactive molecules and matrix-derived cues that simulate native tissue environments more closely. In addition, decellularized extracellular matrix (dECM)-based scaffolds are gaining popularity for tissue-specific applications in cancer and regenerative research

- The incorporation of 3D bioprinting allows precise spatial deposition of cells and scaffold materials, enabling the fabrication of complex organoids and multicellular tissue constructs. Companies such as CELLINK and Allevi are offering integrated bioprinting platforms that support the creation of patient-specific tissues, further enabling translational research

- Moreover, the ability to reproduce disease-specific microenvironments using innovative scaffold formats has led to growing adoption in oncology drug screening, where traditional 2D cultures fall short in mimicking tumor behavior and treatment response

- This convergence of scaffold engineering with 3D bioprinting, microfluidics, and tissue-on-chip technologies is rapidly transforming the drug discovery and regenerative medicine landscapes. As a result, researchers and biopharmaceutical firms are investing heavily in next-generation scaffold systems that enhance predictive accuracy and reduce animal model dependence

- The growing demand for biologically relevant, scalable, and customizable 3D scaffold solutions is expected to further accelerate adoption across academic, commercial, and clinical research settings globally

3D Cell Culture Scaffolds Market Dynamics

Driver

“Rising Demand for Predictive Preclinical Models in Drug Discovery and Regenerative Medicine”

- The increasing need for more accurate, reproducible, and human-relevant preclinical models is a key driver for the adoption of 3D cell culture scaffolds. Compared to 2D models, scaffold-based 3D cultures provide enhanced cell-to-cell and cell-matrix interactions, resulting in better physiological mimicry of in vivo tissue behavior

- For instance, pharmaceutical companies are increasingly integrating 3D scaffold-based systems into their drug screening pipelines to improve toxicity profiling and therapeutic efficacy, especially in oncology and neurodegenerative research. These systems help reduce false positives and negatives associated with traditional 2D screening

- In regenerative medicine, scaffolds are essential for tissue repair, stem cell differentiation, and organ replacement, making them integral to the development of next-gen cell-based therapies

- Recent collaborations between scaffold manufacturers and academic research centers are expanding the reach and innovation of 3D cell models in disease modeling and personalized treatment

- In addition, increasing investments from public and private sectors in stem cell research, tissue engineering, and organ-on-a-chip platforms are fueling market expansion. The integration of scaffold technologies into clinical-grade biomanufacturing further strengthens their role in translational medicine

Restraint/Challenge

“High Cost and Standardization Issues in Scaffold Fabrication”

- One of the major challenges facing the 3D cell culture scaffolds market is the high production cost and lack of standardization in scaffold manufacturing, which can limit broader adoption, especially in resource-constrained settings

- Scaffold design often requires customized biomaterials, complex fabrication techniques (e.g., electrospinning, freeze-drying), and stringent quality control protocols to ensure reproducibility and biological relevance. This increases production complexity and pricing, making high-end scaffold products less accessible to smaller research labs and institutions

- In addition, the lack of uniform protocols and performance benchmarks across different scaffold types and manufacturers creates inconsistency in research outcomes, hindering comparative analysis and scalability

- Addressing these issues through the development of cost-effective, ready-to-use scaffold kits, adoption of open-source fabrication standards, and enhanced cross-sector collaboration for validation and regulatory compliance will be crucial to unlocking the full potential of 3D scaffolds in mainstream biomedical research

- Furthermore, expanding training and awareness among early-stage researchers and regulatory alignment across markets will help bridge the gap between innovation and real-world application

3D Cell Culture Scaffolds Market Scope

The market is segmented on the basis of technology, material type, application, and end user.

- By Technology

On the basis of technology, the 3D cell culture scaffolds market is segmented into scaffold-based technologies, scaffold-free technologies, bioreactors, microfluidics, and bioprinting. The scaffold-based technologies segment dominated the market with the largest revenue share in 2024, owing to its critical role in mimicking the extracellular matrix and supporting three-dimensional cell growth in a controlled environment. These systems are widely adopted in cancer biology, drug screening, and stem cell differentiation due to their structural versatility and compatibility with a wide range of cell types.

The bioprinting segment is projected to witness the fastest growth rate from 2025 to 2032, driven by advancements in 3D printing materials and the increasing demand for personalized tissue constructs. The precision and scalability of bioprinting technology are unlocking new applications in tissue engineering and disease modeling, making it a rapidly emerging tool across academic and commercial research settings.

- By Material Type

On the basis of material type, the 3D cell culture scaffolds market is segmented into hydrogels, polymers, decellularized extracellular matrix (dECM), ceramics, and composite scaffolds. The hydrogels segment held the largest market share of 42.2% in 2024, primarily due to its high biocompatibility, tunable physical properties, and ability to closely simulate native tissue conditions. Hydrogels support a wide variety of cellular functions and are commonly used in oncology, tissue repair, and stem cell research.

The dECM segment is expected to witness significant growth during the forecast period, fueled by rising adoption in personalized medicine and regenerative therapies. dECM-based scaffolds offer organ-specific cues and enhanced cell attachment, making them ideal for disease modeling and functional tissue reconstruction.

- By Application

On the basis of application, the 3D cell culture scaffolds market is segmented into cancer research, stem cell research & tissue engineering, drug discovery & toxicity testing, regenerative medicine, and others. The cancer research segment accounted for the largest share in 2024, driven by the growing need for accurate tumor models that better represent the 3D architecture and microenvironment of human cancers. Scaffold-based 3D cultures are increasingly used in anti-cancer drug screening and to study metastatic behavior.

The stem cell research & tissue engineering segment is projected to grow at the fastest pace, propelled by advancements in cell therapy and regenerative medicine. The ability of 3D scaffolds to support stem cell proliferation and differentiation into functional tissue types makes them indispensable tools in this field.

- By End User

On the basis of end user, the 3D cell culture scaffolds market is segmented into biotechnology & pharmaceutical companies, academic & research institutes, hospitals & diagnostic laboratories, contract research organizations (CROs), and others. The biotechnology & pharmaceutical companies segment dominated the market in 2024, owing to the growing adoption of 3D scaffolds for preclinical drug testing, efficacy studies, and reducing animal testing. These companies are actively incorporating scaffold-based models into high-throughput screening pipelines to improve accuracy and efficiency.

The academic & research institutes segment is anticipated to witness the fastest growth from 2025 to 2032, supported by increasing government and institutional funding for advanced cell biology research. Universities and medical institutes are exploring novel scaffold designs and applications in organoid development, making this segment a key driver of innovation.

3D Cell Culture Scaffolds Market Regional Analysis

- North America led the 3D cell culture scaffolds market with the largest revenue share of 39% in 2024, supported by robust biotechnology and pharmaceutical industries, significant R&D funding, and early adoption of advanced cell culture technologies, particularly in the U.S., where institutions and biotechs are increasingly integrating 3D systems into preclinical and toxicology studies

- Institutions and biotech firms in the region place high value on physiologically relevant models for drug development, regenerative medicine, and cancer research, leading to widespread integration of 3D scaffold systems into laboratory workflows

- This strong demand is further supported by the presence of major pharmaceutical players, a robust academic network, and favorable government initiatives that promote cutting-edge life sciences research, solidifying North America as a leading hub for scaffold-based 3D cell culture innovation across both commercial and academic settings

U.S. 3D Cell Culture Scaffolds Market Insight

The U.S. 3D cell culture scaffolds market captured the largest revenue share of 79% in 2024 within North America, driven by significant R&D investments and widespread adoption of advanced in vitro technologies. Pharmaceutical and biotech companies increasingly rely on 3D scaffolds for more predictive drug screening and toxicity testing. The country’s robust academic infrastructure, coupled with strong government and private funding for regenerative medicine and personalized therapies, continues to fuel market growth. In addition, the growing trend of organoid development and collaboration between research institutions and scaffold manufacturers is accelerating the adoption of innovative scaffold systems.

Europe 3D Cell Culture Scaffolds Market Insight

The Europe 3D cell culture scaffolds market is projected to expand at a substantial CAGR throughout the forecast period, driven by strong academic research capabilities, increasing investment in life sciences, and a growing focus on reducing animal testing in drug development. The region benefits from a well-established biopharmaceutical sector and supportive regulatory frameworks promoting 3D culture adoption. Applications in oncology, stem cell research, and tissue engineering are gaining traction, with scaffold technologies being incorporated into both research and clinical initiatives across academic and commercial laboratories.

U.K. 3D Cell Culture Scaffolds Market Insight

The U.K. 3D cell culture scaffolds market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a rising focus on biomedical research and national funding for life science innovation. The U.K.'s emphasis on advanced therapeutic development and personalized medicine is encouraging the adoption of 3D scaffold platforms. Increasing collaboration between universities and biotech firms, along with ethical concerns over animal models, is driving interest in scaffold-based in vitro testing systems.

Germany 3D Cell Culture Scaffolds Market Insight

The Germany 3D cell culture scaffolds market is expected to expand at a considerable CAGR during the forecast period, bolstered by the country’s strong biotechnology infrastructure and increasing investment in regenerative medicine. German researchers are advancing scaffold engineering for organoid and tissue modeling, particularly in neurological and cardiovascular applications. Sustainability and precision in biomedical tools are highly valued, fostering the integration of innovative and bioresorbable scaffold materials in both research and industrial settings.

Asia-Pacific 3D Cell Culture Scaffolds Market Insight

The Asia-Pacific 3D cell culture scaffolds market is poised to grow at the fastest CAGR of 23.6% from 2025 to 2032, driven by rising healthcare R&D expenditure, increasing biopharmaceutical activities, and supportive government initiatives in countries such as China, Japan, and India. The region’s rapid development in stem cell therapy, cancer research, and tissue engineering is fueling demand for cost-effective and scalable scaffold solutions. In addition, the presence of leading scaffold manufacturers and research institutions is enhancing accessibility and awareness across emerging economies.

Japan 3D Cell Culture Scaffolds Market Insight

The Japan 3D cell culture scaffolds market is gaining momentum due to the country’s leadership in precision medicine, regenerative therapy, and aging-related disease research. Japanese institutions and biotechs are adopting 3D scaffold systems for neurodegenerative and cancer models, supported by government-led initiatives in tissue engineering. The integration of 3D scaffolds with microfluidics and bioprinting is also expanding, reflecting Japan’s commitment to innovative, high-tech research tools.

India 3D Cell Culture Scaffolds Market Insight

The India 3D cell culture scaffolds market accounted for the largest revenue share in Asia-Pacific in 2024, driven by increasing investments in biotechnology, a growing number of CROs, and an expanding base of academic research institutions. India’s focus on affordable innovation, regenerative medicine, and translational research is encouraging the adoption of scaffold-based systems in cancer biology and pharmacology. Government support for biotech startups and rising demand for human-relevant preclinical models are further propelling the scaffold market across academic and commercial sectors.

3D Cell Culture Scaffolds Market Share

The 3D Cell Culture Scaffolds industry is primarily led by well-established companies, including:

- Corning Incorporated (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- Lonza Group AG (Switzerland)

- 3D Biotek LLC (U.S.)

- InSphero AG (Switzerland)

- Synthecon, Inc. (U.S.)

- Greiner Bio-One International GmbH (Austria)

- Advanced BioMatrix, Inc. (U.S.)

- MIMETAS B.V. (Netherlands)

- Reinnervate Ltd. (U.K.)

- Tecan Group Ltd. (Switzerland)

- Kirkstall Ltd. (U.K.)

- Emulate, Inc. (U.S.)

- Cellink AB (Sweden)

- Bio-Techne Corporation (U.S.)

- Organovo Holdings, Inc. (U.S.)

- Nano3D Biosciences, Inc. (U.S.)

- Scivax Corporation (Japan)

- QGel SA (Switzerland)

What are the Recent Developments in Global 3D Cell Culture Scaffolds Market?

- In March 2024, Corning Incorporated announced the expansion of its 3D cell culture product line with the launch of new synthetic scaffolds designed for high-throughput screening in oncology drug discovery. These scaffolds mimic the extracellular matrix and enable researchers to cultivate more physiologically relevant tumor models. This innovation underscores Corning’s commitment to advancing cancer research and accelerating drug development through enhanced biomimicry in 3D cultures

- In February 2024, Thermo Fisher Scientific introduced its AlgiMatrix Plus 3D scaffolding platform to support stem cell proliferation and differentiation. The novel alginate-based scaffold is optimized for long-term culture, offering a more stable environment for regenerative medicine and tissue engineering studies. This launch demonstrates Thermo Fisher’s dedication to providing versatile, high-performance scaffolding tools for complex biological research

- In January 2024, 3D Biotek LLC, a pioneer in scaffold manufacturing, entered a strategic partnership with a U.S.-based cancer institute to co-develop personalized 3D tumor models using its biodegradable scaffolds. This collaboration aims to create patient-specific models that enhance preclinical drug response accuracy. The initiative reflects the growing trend toward precision oncology and personalized medicine using scaffold-based 3D cell culture systems

- In December 2023, Merck KGaA, Darmstadt, Germany, unveiled a new line of collagen-based 3D scaffolds at Bio-Europe 2023. These scaffolds are tailored for neurobiology and cardiotoxicity research, providing a biocompatible matrix for long-term neural and cardiac tissue studies. This development highlights Merck’s strategic focus on enabling advanced cellular modeling in disease research and drug toxicity testing

- In November 2023, InSphero AG launched its Scaffold-Free Scaffold Integration Kit for hybrid 3D cell culture models, allowing researchers to combine scaffold-based and spheroid-based techniques. The solution enhances flexibility in tissue modeling for pharmaceutical and academic labs. This innovation illustrates InSphero’s commitment to expanding the functional landscape of 3D cell culture by bridging traditional scaffold technologies with next-generation culture platforms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.