Global 3d Mobile Mapping Market

Market Size in USD Billion

CAGR :

%

USD

47.51 Billion

USD

129.93 Billion

2025

2033

USD

47.51 Billion

USD

129.93 Billion

2025

2033

| 2026 –2033 | |

| USD 47.51 Billion | |

| USD 129.93 Billion | |

|

|

|

|

3D Mobile Mapping Market Size

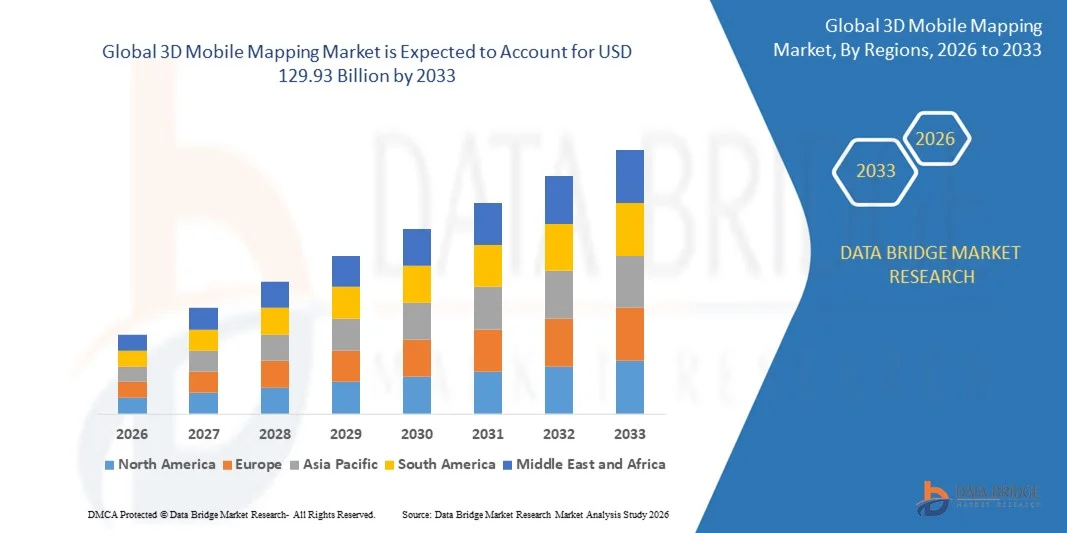

- The global 3D mobile mapping market size was valued at USD 47.51 billion in 2025 and is expected to reach USD 129.93 billion by 2033, at a CAGR of 13.40% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced geospatial technologies and the rising demand for accurate, real-time 3D mapping data across industries such as transportation, construction, logistics, and smart cities

- Furthermore, advancements in LiDAR, SLAM, photogrammetry, and AI-driven mapping software are enabling faster, more precise data capture and processing, expanding the applications of 3D mobile mapping and driving market growth

3D Mobile Mapping Market Analysis

- 3D mobile mapping involves capturing high-resolution spatial data using a combination of sensors, cameras, LiDAR, GPS, and software platforms to generate detailed 3D models of environments. These systems are used for urban planning, infrastructure management, autonomous navigation, and digital twin creation across residential, commercial, and industrial sectors

- The rising demand for 3D mobile mapping is primarily driven by the need for enhanced operational efficiency, improved safety, and real-time decision-making capabilities. In addition, integration with cloud platforms and AI-based analytics is enabling faster data processing and actionable insights, further accelerating the adoption of mobile mapping solutions globally

- North America dominated the 3D mobile mapping market with a share of 27.6% in 2025, due to the growing adoption of geospatial technologies across transportation, logistics, and smart city projects

- Asia-Pacific is expected to be the fastest growing region in the 3D mobile mapping market during the forecast period due to increasing urbanization, smart city initiatives, and rising investment in digital infrastructure across countries such as China, Japan, and India

- 3D mapping segment dominated the market with a market share of 43% in 2025, due to the increasing adoption of 3D spatial data for navigation, urban planning, and autonomous vehicle applications. Enterprises and governments prioritize 3D Mapping for its ability to deliver accurate, real-time, and georeferenced visualization of complex environments, enhancing decision-making and operational efficiency

Report Scope and 3D Mobile Mapping Market Segmentation

|

Attributes |

3D Mobile Mapping Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

3D Mobile Mapping Market Trends

Rising Adoption of AI-Enabled 3D Mapping Solutions

- A significant trend in the 3D mobile mapping market is the increasing adoption of AI-powered solutions that automate data capture, processing, and analysis. These technologies enhance the speed and accuracy of 3D mapping, enabling applications across smart cities, autonomous vehicles, construction, and infrastructure monitoring

- For instance, GeoSLAM’s AI-driven software platform leverages simultaneous localization and mapping (SLAM) to rapidly generate high-resolution 3D models of complex environments, reducing manual post-processing and accelerating project timelines. Such innovations are allowing enterprises to scale mapping operations efficiently and obtain actionable insights in real-time

- The integration of AI with mobile LiDAR, photogrammetry, and sensor fusion systems is enabling the extraction of detailed object and terrain information from large datasets. This is positioning AI-enabled mapping as critical for urban planning, environmental monitoring, and industrial site management

- Autonomous vehicle development is driving the adoption of AI-based 3D mobile mapping as precise spatial data is essential for navigation, obstacle detection, and real-time decision-making. Companies such as Velodyne Lidar are supplying high-density LiDAR sensors that complement AI platforms to improve accuracy and reliability

- The construction and real estate sectors are increasingly utilizing AI-powered 3D mapping to create digital twins and monitor project progress, improving operational efficiency and safety. Leica Geosystems’ BLK2GO and Topcon’s vehicle-mounted systems exemplify tools that integrate AI to streamline large-scale mapping workflows

- Growing demand for immersive mapping applications in virtual reality (VR), augmented reality (AR), and urban simulations is encouraging further AI adoption. This trend is expanding the scope of 3D mobile mapping beyond traditional surveying and infrastructure management, enhancing visualization and planning capabilities

3D Mobile Mapping Market Dynamics

Driver

Increasing Demand for Accurate and Real-Time Geospatial Data

- The rising need for precise, up-to-date spatial information is driving growth in the 3D mobile mapping market. Accurate geospatial data supports better decision-making in transportation, logistics, urban planning, and emergency management, where real-time updates are critical

- For instance, Trimble Inc. provides integrated mobile mapping solutions combining LiDAR, GPS, and photogrammetry that deliver high-precision 3D data for engineering and infrastructure projects. These solutions allow users to rapidly capture and process geospatial information, reducing operational delays and improving asset management

- The growth of smart city initiatives is increasing the demand for real-time geospatial data to optimize traffic flows, utility management, and public safety. Companies such as NAVVIS and Kaarta supply mobile mapping systems that generate instant 3D spatial information for urban planners and facility managers

- Autonomous vehicle development and fleet management require continuous, accurate mapping to ensure safety and efficiency, encouraging broader adoption of mobile mapping technologies. Software platforms from Hexagon AB facilitate data analysis and visualization, enabling enterprises to make informed operational decisions quickly

- Enterprises are increasingly integrating mobile mapping systems with AI, cloud platforms, and IoT devices to streamline workflows and enhance data usability. These converging technologies further accelerate the uptake of 3D mobile mapping solutions globally

Restraint/Challenge

High Cost of Advanced 3D Mobile Mapping Systems

- The 3D mobile mapping market faces challenges due to the high cost of equipment, sensors, and software required for accurate data capture and processing. Advanced LiDAR units, multi-sensor platforms, and AI-enabled software contribute to significant capital expenditure, limiting adoption among small and medium enterprises

- For instance, Topcon’s high-resolution vehicle-mounted 3D mapping systems and Leica Geosystems’ BLK2GO scanners represent premium solutions with substantial upfront investment. These costs can be a barrier for projects with limited budgets or in developing regions

- Maintaining and calibrating sensors, as well as training personnel to operate complex systems, adds operational expenses. This increases the total cost of ownership and can slow deployment, particularly in industries with tight timelines

- The integration of high-precision mapping systems with cloud-based processing and analytics platforms requires ongoing subscription or licensing fees, further elevating overall costs. Such recurring expenses can constrain market expansion for price-sensitive segments

- Supply chain constraints for specialized components such as LiDAR, IMUs, and high-performance cameras can exacerbate costs and limit availability, affecting global deployment of mobile mapping solutions. These financial and logistical challenges collectively act as restraints on market growth

3D Mobile Mapping Market Scope

The market is segmented on the basis of type, component, user type, and end-user.

- By Type

On the basis of type, the 3D mobile mapping market is segmented into Location-Based Services (LBS), Location-Based Search, Indoor Mapping, 3D Mapping, and Licensing Subscription and Support. The 3D Mapping segment dominated the largest market revenue share of 43% in 2025, driven by the increasing adoption of 3D spatial data for navigation, urban planning, and autonomous vehicle applications. Enterprises and governments prioritize 3D Mapping for its ability to deliver accurate, real-time, and georeferenced visualization of complex environments, enhancing decision-making and operational efficiency. The segment also benefits from integration with Geographic Information Systems (GIS) and cloud-based platforms, enabling seamless data storage, analysis, and sharing across multiple stakeholders. Technological advancements in LiDAR, photogrammetry, and sensor fusion further support the dominance of this segment, offering high-resolution mapping capabilities and improved accuracy for critical applications.

The Indoor Mapping segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand in retail, airports, and large commercial facilities for accurate indoor navigation. Indoor Mapping solutions provide precise location tracking and real-time guidance in GPS-limited environments, improving customer experience and operational efficiency. The integration of indoor mapping with augmented reality (AR) applications also creates opportunities for personalized navigation, product discovery, and asset management, driving market adoption. Growing deployment in smart buildings and enterprises seeking data-driven space management further accelerates the adoption of this segment.

- By Component

On the basis of component, the market is segmented into Digital Components, Vehicle Wheel Encoder, IMU (Inertial Measurement Unit), Sensors, GPS, and Software. The Software segment held the largest market revenue share in 2025, driven by the essential role of software in processing, analyzing, and visualizing 3D mapping data. Advanced mapping software enables point cloud processing, 3D modeling, and integration with GIS platforms, supporting applications in autonomous navigation, urban planning, and asset management. Leading software providers, such as Esri and Hexagon Geospatial, offer scalable solutions that enhance mapping accuracy and operational efficiency for enterprises and public sector organizations. Software solutions also facilitate cloud-based collaboration, allowing multiple stakeholders to access real-time data for informed decision-making and operational planning.

The Sensor segment is expected to witness the fastest growth from 2026 to 2033, driven by innovations in LiDAR, cameras, and radar sensors that enhance the precision and resolution of 3D mobile mapping. Sensors enable high-quality data capture for complex environments, supporting autonomous vehicles, robotics, and smart city initiatives. For instance, Velodyne Lidar provides advanced sensor technologies that are increasingly deployed in 3D mobile mapping solutions. The rising need for cost-efficient, compact, and high-performance sensors further contributes to the rapid adoption of this segment across industries.

- By User Type

On the basis of user type, the market is segmented into Individual and Enterprise users. The Enterprise segment dominated the largest market revenue share in 2025, driven by the adoption of 3D mobile mapping in transportation, construction, and smart city projects. Enterprises leverage 3D mapping data to optimize logistics, monitor infrastructure, and enhance decision-making through precise geospatial insights. The segment benefits from partnerships with mapping technology providers and software vendors, enabling end-to-end mapping solutions and real-time data integration.

The Individual segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising use of location-based services and mobile applications offering 3D navigation and augmented reality experiences. For instance, Apple Maps and Google Maps provide AR-enabled 3D navigation features for individual users, enhancing route planning and location discovery. Growing smartphone penetration and increasing reliance on personal navigation and location-based applications drive the adoption of this segment globally.

- By End User

On the basis of end user, the market is segmented into Banking, Financial Services, and Insurance (BFSI), Transportation and Logistics, Government and Public Sector, Real Estate, Manufacturing, Telecommunication, Travel and Hospitality, Retail, Media and Entertainment, and Others. The Transportation and Logistics segment dominated the largest market revenue share in 2025, driven by the need for precise navigation, route optimization, and fleet management in dynamic operational environments. Logistics companies utilize 3D mobile mapping to enhance delivery efficiency, reduce operational costs, and improve safety across transportation networks. For instance, DHL employs advanced 3D mapping and navigation systems to optimize supply chain operations and monitor fleet performance in real time. The integration of mapping data with AI and IoT solutions further enhances operational visibility and predictive analytics.

The Real Estate segment is expected to witness the fastest growth from 2026 to 2033, fueled by the adoption of 3D mapping for property visualization, virtual tours, and construction planning. 3D maps provide immersive experiences for buyers and investors while enabling architects and developers to plan, model, and monitor construction projects accurately. For instance, Matterport offers advanced 3D mapping solutions for real estate, helping stakeholders visualize spaces and make informed decisions. The rising trend of smart buildings and digital twins further accelerates the adoption of 3D mapping in the real estate sector.

3D Mobile Mapping Market Regional Analysis

- North America dominated the 3D mobile mapping market with the largest revenue share of 27.6% in 2025, driven by the growing adoption of geospatial technologies across transportation, logistics, and smart city projects

- Consumers and enterprises in the region highly value the accuracy, real-time data access, and integration of 3D mapping with GIS platforms, which enhances operational efficiency and decision-making

- This widespread adoption is further supported by high technological awareness, strong investment in digital infrastructure, and the increasing deployment of autonomous vehicles, establishing 3D mobile mapping as a critical solution for both commercial and public sector applications

U.S. 3D Mobile Mapping Market Insight

The U.S. 3D mobile mapping market captured the largest revenue share in North America in 2025, fueled by the rapid adoption of location-based services, autonomous navigation systems, and smart infrastructure initiatives. Enterprises and government agencies are prioritizing precise geospatial data for urban planning, fleet management, and asset monitoring. The growing integration of mapping solutions with AI, cloud platforms, and IoT further propels market growth. Moreover, the presence of leading 3D mapping solution providers, such as Esri and Hexagon Geospatial, strengthens the market landscape and supports technological advancements.

Europe 3D Mobile Mapping Market Insight

The Europe 3D mobile mapping market is projected to grow at a substantial CAGR throughout the forecast period, driven by smart city initiatives, stringent regulations for urban development, and the adoption of autonomous and connected transport solutions. Increasing urbanization and the demand for advanced GIS applications are fostering the integration of 3D mapping in both public and private sector projects. European enterprises also focus on sustainability and efficiency, leveraging 3D mapping to optimize infrastructure, monitor assets, and reduce operational costs.

U.K. 3D Mobile Mapping Market Insight

The U.K. 3D mobile mapping market is anticipated to expand at a noteworthy CAGR, fueled by smart city deployments and the rising demand for accurate geospatial data in urban planning, construction, and transport logistics. In addition, government initiatives supporting digital mapping, along with strong adoption of location-based services by enterprises, are encouraging growth. The presence of technology providers offering cloud-based mapping solutions enhances accessibility and operational efficiency across commercial and public sector applications.

Germany 3D Mobile Mapping Market Insight

The Germany 3D mobile mapping market is expected to grow at a considerable CAGR during the forecast period, driven by the country’s focus on smart infrastructure, industrial automation, and precise geospatial analysis for urban and transport planning. Germany’s well-developed digital infrastructure and emphasis on innovation promote the adoption of advanced 3D mapping solutions, particularly in logistics, construction, and government applications. Integration with AI and sensor-based technologies further strengthens market growth.

Asia-Pacific 3D Mobile Mapping Market Insight

The Asia-Pacific 3D mobile mapping market is poised to grow at the fastest CAGR from 2026 to 2033, driven by increasing urbanization, smart city initiatives, and rising investment in digital infrastructure across countries such as China, Japan, and India. The region is witnessing rapid adoption of 3D mapping in transportation, logistics, construction, and real estate applications. Government programs promoting digitalization, combined with growing availability of affordable 3D mapping solutions, are expanding adoption among enterprises and public sector users.

Japan 3D Mobile Mapping Market Insight

The Japan 3D mobile mapping market is gaining momentum due to the country’s technology-driven culture, advanced urban planning requirements, and demand for real-time geospatial intelligence. Enterprises and municipalities are increasingly adopting 3D mapping for infrastructure monitoring, smart building management, and autonomous navigation. The integration of mapping solutions with IoT and AR technologies is fueling market growth, and rising interest in efficient, data-driven urban management further supports adoption.

China 3D Mobile Mapping Market Insight

The China 3D mobile mapping market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, the expanding middle class, and strong government investment in smart city and digital infrastructure projects. China is a leading adopter of 3D mapping technologies in transportation, construction, and logistics applications. The availability of domestic solution providers and affordable mapping systems, combined with the push towards autonomous vehicles and smart city deployments, is propelling market growth across residential, commercial, and industrial sectors.

3D Mobile Mapping Market Share

The 3D mobile mapping industry is primarily led by well-established companies, including:

- Microsoft (U.S.)

- Apple Inc. (U.S.)

- Black & Veatch Holding Company (U.S.)

- Cyclomedia (Netherlands)

- FLIR Systems, Inc. (U.S.)

- Foursquare (U.S.)

- Google (U.S.)

- Trimble Inc. (U.S.)

- TomTom International BV. (Netherlands)

- Qualcomm Technologies, Inc. (U.S.)

- Garmin Ltd. (Switzerland)

- Hexagon AB (Sweden)

- Velodyne Lidar, Inc. (U.S.)

- Kaarta (U.S.)

- NAVVIS (Germany)

- Teledyne Optech (Canada)

- The Sanborn Map Company, Inc. (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Leica Geosystems AG (Switzerland)

- PASCO SCIENTIFIC (U.S.)

Latest Developments in Global 3D Mobile Mapping Market

- In April 2025, ProStar Holdings and Pix4D partnered to launch an integrated 3D mobile mapping tool focused on underground infrastructure, significantly advancing real-time visualization and management of buried assets on mobile devices. This collaboration enables utility, construction, and engineering professionals to capture, map, and view subsurface networks with higher precision and accessibility directly on smartphones, reducing operational risk and improving decision-making efficiency for infrastructure projects. The combined PointMan mobile platform and Pix4D’s photogrammetry software enhances safety and scalability, expanding mobile mapping use cases beyond traditional above-ground applications and driving broader adoption of 3D solutions in engineering sectors

- In March 2025, Topcon Positioning Group unveiled its latest vehicle-mounted 3D mobile mapping system—the IP‑S3—offering up to five times faster scanning performance and richer data capture through a multi‑laser LiDAR and high-resolution camera suite. This launch strengthens the market by enabling surveyors and mapping professionals to collect high-density spatial data more efficiently and with greater image quality, ultimately accelerating project workflows in transportation, surveying, and GIS applications. The IP‑S3’s compatibility with comprehensive post-processing software further enhances data turnaround and analytics, meeting rising demand for precision and speed in large-area 3D mapping

- In January 2025, Trimble Inc. announced a partnership with a leading drone manufacturer to integrate advanced mapping capabilities into UAV platforms, broadening the scope of aerial and ground mobile mapping convergence. This strategic collaboration aims to deliver comprehensive solutions combining aerial data collection with ground-based measurements, empowering industries such as construction, surveying, and environmental monitoring to generate richer and more cohesive 3D datasets. By enhancing interoperability between UAV systems and ground mapping tools, the partnership supports faster, more accurate project outcomes and accelerates adoption of integrated mapping ecosystems across sectors

- In March 2024, Leica Geosystems launched the BLK2GO handheld 3D laser scanner, designed for rapid data collection in complex environments and boosting efficiency across mobile mapping applications. The BLK2GO’s real-time scanning improves field productivity for surveyors and planners by enabling swift capture of 3D point clouds in both indoor and outdoor settings, reducing time on site while maintaining reliable spatial accuracy. This innovation has strengthened workflow adoption in sectors such as construction, infrastructure assessment, and digital twin creation

- In February 2024, GeoSLAM introduced a new AI-powered software platform that automates 3D mapping data processing, accelerating analysis and enabling users to extract actionable insights faster than traditional methods. This software advancement enhances the value of mobile mapping by simplifying complex dataset workflows, reducing human error, and supporting scalable deployment for large projects in smart cities, industrial surveying, and asset management. Its AI-enabled automation also paves the way for higher productivity and more consistent deliverables across diverse end uses in the 3D mapping market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.