Global 3d Printing High Performance Plastic Market

Market Size in USD Million

CAGR :

%

USD

180.50 Million

USD

1,915.93 Million

2025

2033

USD

180.50 Million

USD

1,915.93 Million

2025

2033

| 2026 –2033 | |

| USD 180.50 Million | |

| USD 1,915.93 Million | |

|

|

|

|

3D Printing High Performance Plastic Market Size

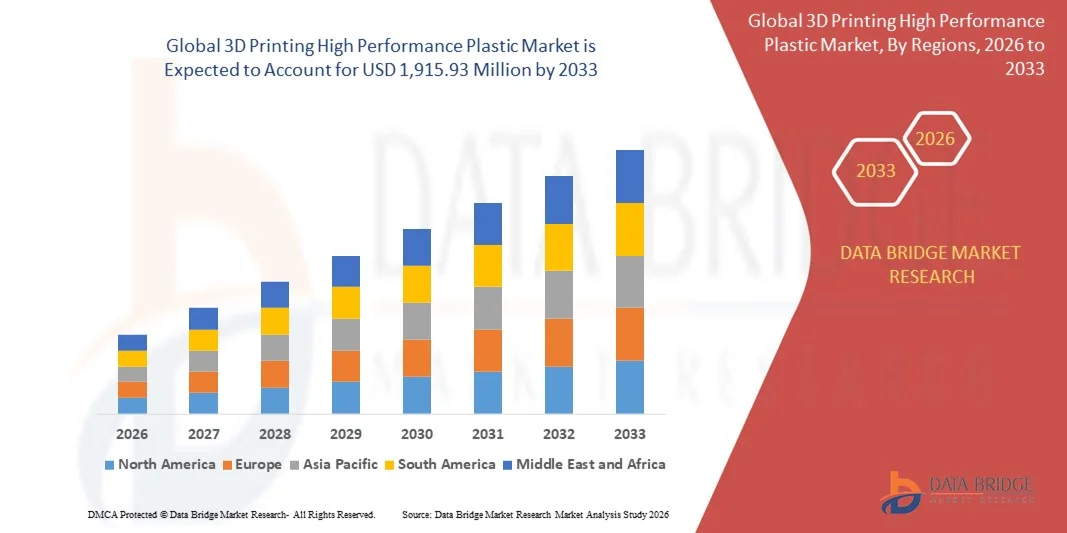

- The global 3D printing high performance plastic market size was valued at USD 180.50 million in 2025 and is expected to reach USD 1,915.93 million by 2033, at a CAGR of 34.35% during the forecast period

- The market growth is largely fuelled by the increasing adoption of additive manufacturing across aerospace, automotive, and healthcare industries

- Growing demand for lightweight, durable, and heat‑resistant materials in industrial applications is driving the need for high performance plastic materials

3D Printing High Performance Plastic Market Analysis

- The 3D printing high performance plastic market is witnessing rapid growth as industries seek advanced materials that offer superior mechanical properties, chemical resistance, and thermal stability

- Enhanced performance requirements for end‑use applications, coupled with the shift towards customized and on‑demand manufacturing, are significantly influencing market dynamics

- North America dominated the 3D printing high performance plastic market with the largest revenue share in 2025, driven by the growing adoption of additive manufacturing across aerospace, automotive, and industrial sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global 3D printing high performance plastic market, driven by increasing urbanization, growing industrial base, rising disposable incomes, and government initiatives promoting advanced manufacturing technologies

- The Polyetheretherketone (PEEK) segment held the largest market revenue share in 2025, due to its superior mechanical strength, thermal stability, and chemical resistance, making it suitable for high-stress and high-temperature applications. It is widely used in aerospace, automotive, and medical industries for critical components that require durability and precision

Report Scope and 3D Printing High Performance Plastic Market Segmentation

|

Attributes |

3D Printing High Performance Plastic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Arkema (France) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

3D Printing High Performance Plastic Market Trends

Rising Adoption of Advanced Materials and Additive Manufacturing

- The growing focus on lightweight, durable, and heat-resistant materials is significantly shaping the 3D printing high performance plastic market, as industries increasingly prefer plastics that offer superior mechanical, thermal, and chemical properties. High performance plastics are gaining traction due to their ability to enhance part performance, dimensional stability, and reliability without compromising design flexibility. This trend strengthens their adoption across aerospace, automotive, healthcare, and industrial applications, encouraging manufacturers to innovate with new polymer formulations that meet evolving engineering requirements

- Increasing awareness around sustainability, cost-efficiency, and on-demand production has accelerated the demand for high performance plastics in 3D printing. Manufacturers are actively seeking materials that reduce weight, improve energy efficiency, and extend component life, prompting partnerships between polymer suppliers and additive manufacturing companies to enhance functional and operational benefits

- Industry trends towards lightweighting, customization, and rapid prototyping are influencing purchasing and adoption decisions, with companies emphasizing material performance, reliability, and compatibility with various 3D printing technologies. These factors are helping brands differentiate their offerings in a competitive market and build trust with industrial end-users

- For instance, in 2024, Stratasys in the U.S. and Evonik in Germany expanded their high performance plastic portfolios for additive manufacturing, introducing new grades compatible with FDM and SLS technologies. These launches were aimed at meeting the growing demand for high-strength, temperature-resistant, and chemical-resistant parts across automotive, aerospace, and medical applications. The materials were also promoted for enabling rapid prototyping and small-batch production, enhancing adoption among industrial customers

- While demand for 3D printing high performance plastics is growing, sustained market expansion depends on continuous R&D, cost-effective material development, and maintaining performance comparable to traditional engineering plastics. Manufacturers are focusing on improving scalability, material consistency, and process compatibility to support broader adoption and long-term market growth

3D Printing High Performance Plastic Market Dynamics

Driver

Growing Adoption of High Performance Polymers in Industrial Applications

- Rising industrial demand for lightweight, durable, and heat-resistant plastics is a major driver for the 3D printing high performance plastic market. Companies are increasingly replacing conventional materials with high performance polymers to enhance part performance, reduce weight, and enable design flexibility, supporting adoption in aerospace, automotive, and medical industries

- Expanding applications in prototyping, tooling, production parts, and custom components are influencing market growth. High performance plastics help improve mechanical strength, chemical resistance, and thermal stability while maintaining design versatility, enabling manufacturers to meet stringent industrial requirements

- Additive manufacturing providers are actively promoting high performance plastic materials through product innovation, technical support, and training programs. These efforts are reinforced by growing industry demand for rapid prototyping, low-volume production, and custom manufacturing, encouraging collaboration between material suppliers and 3D printing service providers

- For instance, in 2023, BASF in Germany and 3D Systems in the U.S. reported increased adoption of high performance polymers in industrial 3D printing for aerospace and automotive applications. This expansion followed higher demand for lightweight, durable, and temperature-resistant components, driving repeat orders and material differentiation. Both companies emphasized material certification and process reliability to strengthen industrial user confidence

- Although rising demand for additive manufacturing supports growth, wider adoption depends on cost optimization, material availability, and compatibility with diverse 3D printing technologies. Investment in R&D, sustainable sourcing, and advanced polymer development will be critical for meeting global demand and maintaining a competitive edge

Restraint/Challenge

High Material Costs and Limited Awareness Compared to Conventional Polymers

- The relatively higher cost of high performance 3D printing plastics compared to standard engineering plastics remains a key challenge, limiting adoption among cost-sensitive industrial users. Higher raw material costs and specialized processing requirements contribute to elevated pricing, affecting market penetration

- Awareness of material benefits remains uneven, particularly in emerging markets where additive manufacturing is still developing. Limited understanding of functional advantages restricts adoption across certain industrial segments and slows innovation uptake

- Supply chain and distribution challenges also impact market growth, as high performance polymers require specialized handling, storage, and transportation. Material consistency and shorter shelf life of some polymers increase operational costs, requiring investments in controlled environments and logistics management

- For instance, in 2024, industrial users in India and Southeast Asia reported slower uptake of high performance 3D printing plastics due to higher costs and limited knowledge of material advantages over conventional polymers. Logistics and technical support were additional barriers, prompting some manufacturers to delay material adoption

- Overcoming these challenges will require cost-efficient material production, expanded distribution networks, and targeted educational initiatives for industrial users. Collaboration with service providers, material suppliers, and certification bodies can help unlock long-term growth potential. Furthermore, developing cost-competitive, high-performance polymers and promoting their functional and sustainability benefits will be essential for widespread adoption

3D Printing High Performance Plastic Market Scope

The market is segmented on the basis of type, form, technology, application, and end-use industry

- By Type

On the basis of type, the 3D printing high performance plastic market is segmented into Polyamide (PA), Polyetheramide (PEI), Polyetheretherketone (PEEK), Polyetherketoneketone (PEKK), and Reinforced HPPs. The Polyetheretherketone (PEEK) segment held the largest market revenue share in 2025, due to its superior mechanical strength, thermal stability, and chemical resistance, making it suitable for high-stress and high-temperature applications. It is widely used in aerospace, automotive, and medical industries for critical components that require durability and precision.

The Polyetheramide (PEI) segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its heat resistance, dimensional stability, and suitability for lightweight functional parts in aerospace and automotive industries. Its growing popularity is also fueled by increasing adoption in electronics, industrial tooling, and custom manufacturing applications.

- By Form

On the basis of form, the market is segmented into filament, pellet, and powder. The filament segment held the largest revenue share in 2025, owing to its compatibility with Fused Deposition Modelling (FDM) technology, ease of use for prototyping, and widespread availability of diverse material grades. Filaments enable cost-effective rapid prototyping and small-batch production for industrial and medical applications.

The powder segment is expected to grow at the fastest rate from 2026 to 2033, supported by rising adoption of Selective Laser Sintering (SLS) technology, which allows manufacturing of complex geometries and high-precision functional parts. The segment is also driven by increasing industrial demand for durable end-use components and customization in aerospace and automotive applications.

- By Technology

On the basis of technology, the market is segmented into Fused Deposition Modelling (FDM) and Selective Laser Sintering (SLS). The FDM segment held the largest market share in 2025, driven by affordability, industrial adoption, and versatility with multiple high performance plastic filaments. It is widely used for prototyping, tooling, and functional parts in several end-use industries.

The SLS segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its ability to produce complex geometries, high-strength functional components, and lightweight parts. Increasing industrial focus on customization, efficiency, and on-demand manufacturing is further boosting the adoption of SLS technology across aerospace, healthcare, and automotive sectors.

- By Application

On the basis of application, the market is segmented into prototyping, and tooling and functional part manufacturing. The prototyping segment held the largest revenue share in 2025, driven by the growing need for rapid product development, cost-effective design testing, and iterative improvements. This application allows companies to reduce time-to-market and experiment with innovative designs without large-scale production investments.

The tooling and functional part manufacturing segment is expected to witness the fastest growth rate from 2026 to 2033, supported by increasing industrial adoption of additive manufacturing for end-use components. Growth is further fueled by demand for lightweight, high-strength parts in aerospace, automotive, and medical equipment manufacturing, enabling improved operational efficiency and performance.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into medical and healthcare, aerospace and defense, transportation, oil and gas, electrical and electronics, and consumer goods and industrial. The aerospace and defense segment held the largest market share in 2025, driven by high demand for lightweight, durable, and temperature-resistant components. The segment benefits from stringent industry standards and increasing use of 3D printed materials for structural and functional applications.

The medical and healthcare segment is expected to witness the fastest growth rate from 2026 to 2033, due to rising adoption of 3D printed surgical instruments, implants, prosthetics, and customized medical devices. Growth is further supported by increasing healthcare investments, aging populations, and the need for patient-specific solutions that improve treatment outcomes and reduce costs.

3D Printing High Performance Plastic Market Regional Analysis

- North America dominated the 3D printing high performance plastic market with the largest revenue share in 2025, driven by the growing adoption of additive manufacturing across aerospace, automotive, and industrial sectors

- Manufacturers and end-users in the region highly value the superior mechanical, thermal, and chemical properties of high performance plastics, which enable lightweight, durable, and precise components for prototyping and functional part production.

- This widespread adoption is further supported by advanced manufacturing infrastructure, high R&D investment, and increasing awareness of additive manufacturing benefits, establishing 3D printing high performance plastics as a preferred solution for industrial applications

U.S. 3D Printing High Performance Plastic Market Insight

The U.S. market captured the largest revenue share in North America in 2025, fueled by the rapid adoption of additive manufacturing technologies and increasing demand for lightweight, high-strength components. Industries such as aerospace, automotive, and healthcare are prioritizing the use of high performance plastics for functional parts, prototypes, and tooling. Moreover, ongoing investments in R&D, innovation in polymer formulations, and integration with advanced 3D printing systems are significantly contributing to market expansion.

Europe 3D Printing High Performance Plastic Market Insight

The Europe market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent industrial standards, increasing demand for high-performance, heat-resistant materials, and rising adoption of additive manufacturing for end-use components. The growing focus on lightweighting, customization, and sustainable production is fostering market growth across aerospace, automotive, and medical applications.

Germany 3D Printing High Performance Plastic Market Insight

The Germany market is expected to witness rapid growth from 2026 to 2033, fueled by technological innovation, strong industrial infrastructure, and increasing awareness of high-performance materials. The country’s emphasis on precision engineering, eco-friendly production, and advanced polymer adoption is promoting 3D printing in aerospace, automotive, and industrial manufacturing sectors.

Asia-Pacific 3D Printing High Performance Plastic Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and rapid industrialization in countries such as China, Japan, and India. Growing adoption of additive manufacturing, coupled with government initiatives to promote advanced manufacturing, is supporting market expansion.

Japan 3D Printing High Performance Plastic Market Insight

The Japan market is expected to witness significant growth from 2026 to 2033, due to the country’s high-tech culture, rapid industrial modernization, and demand for precision-engineered parts. Adoption is fueled by industries seeking lightweight, heat-resistant, and chemically stable components, with increasing integration of advanced 3D printing systems in aerospace, automotive, and healthcare.

China 3D Printing High Performance Plastic Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s growing industrial base, increasing adoption of additive manufacturing, and rising demand for high-performance components in aerospace, automotive, and industrial sectors. The push towards smart factories, availability of affordable high-performance polymers, and strong domestic manufacturing capabilities are key factors propelling market growth.

3D Printing High Performance Plastic Market Share

The 3D Printing High Performance Plastic industry is primarily led by well-established companies, including:

• Arkema (France)

• DSM (Netherlands)

• Stratasys, Ltd. (U.S.)

• 3D Systems, Inc. (U.S.)

• EOS (Germany)

• Evonik Industries AG (Germany)

• Victrex plc. (U.K.)

• Solvay (Belgium)

• Oxford Performance Materials (U.S.)

• SABIC (Saudi Arabia)

• ENVISIONTEC INC. (Germany)

• HP Development Company, L.P. (U.S.)

• PolyOne Corporation (U.S.)

• BASF SE (Germany)

• Filament 3D Printing (U.S.)

• 3DXTECH (U.S.)

• DuPont (U.S.)

• Lehmann & Voss & Co. KG (Germany)

• TORAY INDUSTRIES, INC. (Japan)

• TreeD Filaments (Germany)

Latest Developments in Global 3D Printing High Performance Plastic Market

- In May 2025, Evonik Industries entered a strategic partnership with 3DChimera for the distribution of Evonik's 3D printing PA12 powders in the U.S. The collaboration focuses on Evonik’s high-quality INFINAM powders, including variants with high flexibility, temperature resistance, stiffness, and carbon-black embedding. This development is expected to enhance the availability of advanced materials for industrial 3D printing, supporting manufacturers in producing durable, high-performance components and driving adoption in aerospace, automotive, and engineering sectors

- In June 2024, Nano Dimensions (Markforged) launched Vega, an ultra high-performance filament for 3D printing aerospace components on the FX20 printer. Vega provides exceptional strength while enabling significant advantages in weight reduction, cost efficiency, and faster production cycles. This launch strengthens the adoption of advanced filaments in aerospace and defense applications, encouraging innovation in lightweight and high-strength 3D-printed parts

- In September 2023, Evonik and Lehvoss formed a strategic partnership for industrial 3D printing, under which Lehvoss developed new LUVOSINT formulations based on Evonik’s PA613 polymer chemistry. The development aims to expand the portfolio of high-performance industrial powders, offering enhanced thermal and mechanical properties. This collaboration is expected to boost industrial adoption of 3D printing, particularly in applications requiring durable, precision-engineered components

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global 3d Printing High Performance Plastic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global 3d Printing High Performance Plastic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global 3d Printing High Performance Plastic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.