Global 3d Printing Metal Market

Market Size in USD Billion

CAGR :

%

USD

2.89 Billion

USD

24.71 Billion

2024

2032

USD

2.89 Billion

USD

24.71 Billion

2024

2032

| 2025 –2032 | |

| USD 2.89 Billion | |

| USD 24.71 Billion | |

|

|

|

|

3D Printing Metals Market Size

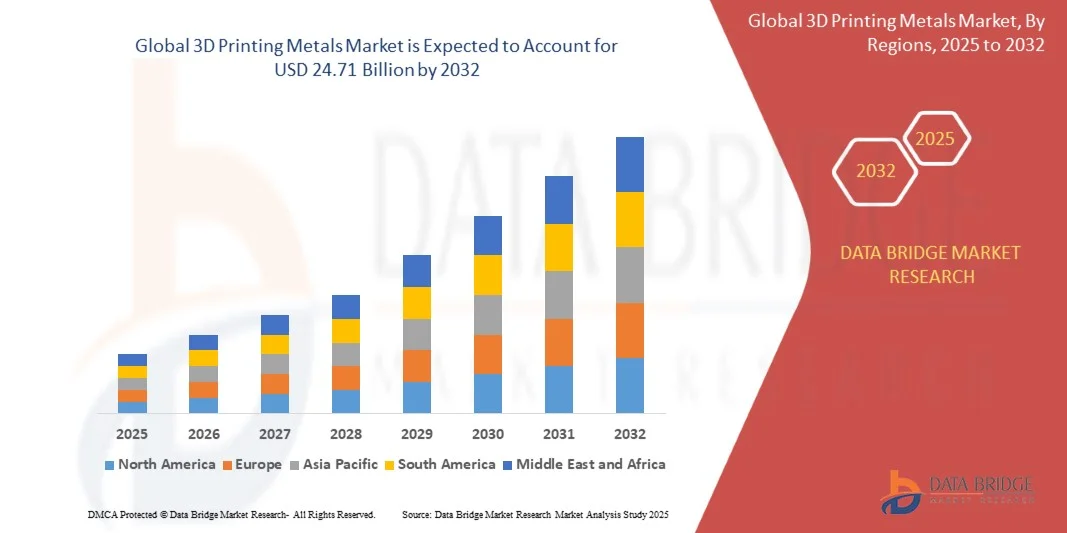

- The global 3D printing metals market size was valued at USD 2.89 billion in 2024 and is expected to reach USD 24.71 billion by 2032, at a CAGR of 30.77% during the forecast period

- The market growth is largely fueled by the increasing adoption of additive manufacturing technologies and advancements in metal 3D printing systems, leading to enhanced production efficiency and design flexibility across industries such as aerospace, automotive, and healthcare

- Furthermore, rising demand for lightweight, high-strength, and customizable metal components is establishing metal 3D printing as a preferred manufacturing method. These factors are collectively accelerating the integration of metal additive manufacturing into industrial production lines, thereby significantly boosting the market’s expansion

3D Printing Metals Market Analysis

- 3D printing metals, enabling the production of complex, durable, and lightweight components, are becoming integral to industrial manufacturing processes in aerospace, defense, automotive, and medical sectors due to their precision, material efficiency, and reduced production waste

- The growing market demand is primarily driven by ongoing technological innovations, material development, and increased investment in digital manufacturing infrastructure, positioning metal 3D printing as a transformative force in next-generation industrial production

- North America dominated the 3D printing metals market with a share of 41.67% in 2024, due to strong industrial adoption across aerospace, automotive, and healthcare sectors

- Asia-Pacific is expected to be the fastest growing region in the 3D printing metals market during the forecast period due to expanding industrialization, technological progress, and increasing adoption across automotive and aerospace industries

- Powdered form segment dominated the market with a market share of 94.5% in 2024, due to its superior suitability for additive manufacturing processes such as powder bed fusion and binder jetting. The fine particle size and high melting consistency of metal powders allow for precise layering and strong bonding, ensuring high-quality finished components. Industries such as aerospace and automotive rely heavily on powdered metals for producing lightweight, complex parts with excellent mechanical properties and dimensional accuracy, driving sustained demand

Report Scope and 3D Printing Metals Market Segmentation

|

Attributes |

3D Printing Metals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

3D Printing Metals Market Trends

“Growth of Multi-Laser and Large-Format Metal 3D Printers”

- The 3D printing metals market is entering a phase of technological advancement driven by the rising adoption of multi-laser and large-format metal 3D printers that enable faster production of high-quality components. These innovations are reshaping additive manufacturing by significantly improving productivity, scalability, and part precision for industrial applications across aerospace, defense, and automotive sectors

- For instance, EOS GmbH and SLM Solutions Group AG have developed multi-laser systems that use up to 12 lasers working simultaneously to build metal parts at unprecedented speeds. This evolution in printing architecture demonstrates how leading manufacturers are focusing on enhancing throughput while maintaining material integrity and dimensional accuracy

- The growing deployment of large-format metal 3D printers allows production of full-scale structural components and assemblies instead of smaller prototypes. This capability is particularly beneficial for heavy industries such as energy, maritime, and construction equipment manufacturing, where large geometries and high mechanical strength are essential

- Advancements in laser power optimization, scan-path algorithms, and powder-bed fusion consistency are supporting better control over density and surface finish. These technological improvements are widening the applicability of metal 3D printing across both high-performance and mid-volume production environments

- The increasing integration of artificial intelligence and machine learning in large-format systems is further improving printing parameters and process repeatability. These smart control mechanisms enable predictive maintenance, defect detection, and real-time quality assurance, enhancing reliability for critical component manufacturing

- As industrial-scale additive manufacturing continues to evolve, the rise of multi-laser and large-format printers marks a significant step toward full production efficiency. This transition from prototyping to end-use manufacturing is expected to drive widespread adoption of 3D printing metals across global industries focused on innovation, customization, and cost-effectiveness

3D Printing Metals Market Dynamics

Driver

“Rising Demand for Lightweight and High-Performance Components”

- The continuous push for high-performance and fuel-efficient systems in aerospace, automotive, and energy industries is driving the demand for lightweight metal components. 3D printing technologies enable complex geometries, weight reduction, and material optimization that are difficult to achieve through conventional machining or casting methods

- For instance, GE Additive and Renishaw plc have produced turbine blades, aircraft brackets, and engine parts using metal additive manufacturing, achieving significant weight savings and performance improvements. These instances illustrate how industry leaders are leveraging 3D printing to meet structural and efficiency targets in advanced engineering applications

- The ability of 3D printing metals to produce near-net-shape components minimizes material wastage and accelerates design iteration cycles. This capability supports manufacturers under pressure to reduce lead times and enhance sustainability in production workflows

- Lightweight metals such as titanium, aluminum, and nickel-based alloys are being widely used in additive manufacturing to improve component strength-to-weight ratios. These materials are essential for high-stress environments where durability and fatigue resistance are critical to performance and safety

- The shift toward electric mobility, renewable energy systems, and high-efficiency aerospace designs continues to reinforce demand for lightweight, high-strength metallic components. The expanding use of 3D printing metals is expected to remain vital for advancing material efficiency and next-generation engineering innovation

Restraint/Challenge

“High Costs and Limited Material Standardization”

- High equipment and material costs remain major challenges restricting large-scale adoption of metal additive manufacturing. The advanced laser systems, inert gas chambers, and precision powder-handling mechanisms required for 3D metal printing significantly raise initial capital investment for manufacturers

- For instance, smaller production firms and Tier-2 suppliers in the automotive and tooling sectors often face cost constraints when procuring powder-bed fusion printers from brands such as EOS or Trumpf. The need for skilled operators, calibration, and post-processing further intensifies total production expenses, limiting cost competitiveness against conventional fabrication methods

- The lack of global standardization in metal powders, feedstock quality, and printing parameters creates variability in mechanical performance and certification challenges. Industries with safety-critical requirements, such as aerospace, demand consistent traceability and quality verification, which remain difficult with current material diversity

- Powder recycling and handling inefficiencies also contribute to high operational costs, particularly when working with reactive or high-value alloys. Manufacturers must adopt strict process controls to minimize contamination risks and ensure powder reuse without quality degradation

- Addressing these challenges will require broader material certification standards, cost-effective printer designs, and improved powder production technologies. As economies of scale and technological advancements converge, the cost and variability barriers in 3D printing metals are expected to diminish, unlocking its full potential for mass industrial adoption

3D Printing Metals Market Scope

The market is segmented on the basis of form, metal type, technology, and end user industry.

- By Form

On the basis of form, the 3D printing metals market is segmented into powdered form and filament form. The powdered form segment dominated the market with the largest revenue share of 94.5% in 2024, owing to its superior suitability for additive manufacturing processes such as powder bed fusion and binder jetting. The fine particle size and high melting consistency of metal powders allow for precise layering and strong bonding, ensuring high-quality finished components. Industries such as aerospace and automotive rely heavily on powdered metals for producing lightweight, complex parts with excellent mechanical properties and dimensional accuracy, driving sustained demand.

The filament form segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising adoption in desktop and mid-scale 3D metal printing systems. Filament-based 3D printing is gaining traction among small manufacturers and prototyping firms due to its cost-effectiveness and ease of material handling. This segment benefits from growing technological advancements in metal-infused polymer filaments that enhance print quality and reduce post-processing requirements, expanding its accessibility across educational, medical, and consumer product applications.

- By Metal Type

On the basis of metal type, the market is segmented into titanium, nickel, stainless steel, aluminum, and others. The titanium segment dominated the market in 2024 due to its exceptional strength-to-weight ratio, corrosion resistance, and biocompatibility, making it the preferred choice for aerospace, defense, and medical applications. High-performance industries utilize titanium powders to manufacture structural components, engine parts, and implants requiring durability under extreme conditions. Its proven performance and long-term reliability in critical sectors continue to reinforce its leadership position.

The aluminum segment is projected to witness the fastest CAGR from 2025 to 2032, attributed to its lightweight characteristics and excellent thermal conductivity, which are highly valued in automotive and consumer electronics manufacturing. Advancements in aluminum alloy powders are enabling improved printability and mechanical strength, enhancing their usability in complex, high-volume production. The growing demand for sustainable, energy-efficient materials in transportation and industrial applications is further accelerating aluminum’s adoption in 3D metal printing processes.

- By Technology

On the basis of technology, the 3D printing metals market is segmented into powder bed fusion, directed energy deposition, binder jetting, metal extrusion, and others. The powder bed fusion segment held the largest market share in 2024 due to its precision, repeatability, and ability to produce highly detailed, complex geometries suitable for aerospace and medical industries. This technology enables excellent control over microstructure and surface finish, making it ideal for producing lightweight yet strong metal components. Its established use across industrial-grade 3D printers reinforces its dominance in the metal additive manufacturing landscape.

The binder jetting segment is expected to register the fastest growth from 2025 to 2032, driven by its cost efficiency and scalability for mass production. This process allows the use of a wide range of metal powders and achieves high throughput without extensive energy input, making it attractive for automotive and industrial tooling applications. The increasing commercial adoption of binder jetting systems by manufacturers for rapid prototyping and end-use parts production highlights its emerging role in reducing lead times and production costs.

- By End User Industry

On the basis of end user industry, the 3D printing metals market is segmented into automotive, aerospace and defense, medical and dental, consumer goods and construction, and others. The aerospace and defense segment dominated the market in 2024, supported by extensive use of metal additive manufacturing for engine components, turbine blades, and structural parts. The technology offers substantial benefits in reducing component weight while enhancing performance, helping companies improve fuel efficiency and design flexibility. The segment continues to thrive due to strong government investments in advanced manufacturing and demand for precision-engineered, durable parts.

The medical and dental segment is expected to experience the fastest growth from 2025 to 2032, propelled by increasing adoption of 3D printing for patient-specific implants, surgical instruments, and dental prosthetics. Metal 3D printing enables high customization with precise anatomical accuracy, significantly improving patient outcomes. The expanding focus on personalized healthcare, combined with regulatory approvals for 3D-printed medical devices, is driving the rapid integration of metal additive manufacturing technologies across hospitals and research institutions.

3D Printing Metals Market Regional Analysis

- North America dominated the 3D printing metals market with the largest revenue share of 41.67% in 2024, driven by strong industrial adoption across aerospace, automotive, and healthcare sectors

- The region benefits from early technological advancements, high R&D investments, and the presence of leading additive manufacturing companies such as 3D Systems, GE Additive, and Desktop Metal

- The growing use of metal 3D printing for producing lightweight, high-strength components and prototypes is propelling regional growth. Government initiatives promoting advanced manufacturing and defense modernization are also enhancing market expansion

U.S. 3D Printing Metals Market Insight

The U.S. 3D printing metals market captured the largest revenue share in 2024 within North America, supported by rapid adoption in aerospace and defense industries. Companies are increasingly utilizing titanium and nickel-based alloys for high-performance parts that require precision and durability. For instance, General Electric has integrated 3D metal printing to manufacture jet engine components with reduced weight and improved efficiency. The U.S. market is further strengthened by robust innovation ecosystems, strong funding for metal additive research, and increasing use in medical implants and dental prosthetics.

Europe 3D Printing Metals Market Insight

Europe’s 3D printing metals market is projected to witness significant growth over the forecast period, driven by rising demand for sustainable manufacturing and the region’s leadership in engineering innovation. Countries such as Germany, the U.K., and France are heavily investing in metal additive technologies to optimize production and reduce material waste. The growing adoption of 3D metal printing in the automotive and healthcare sectors supports regional market expansion. In addition, favorable government policies promoting digital manufacturing and the circular economy are accelerating industrial integration.

U.K. 3D Printing Metals Market Insight

The U.K. 3D printing metals market is anticipated to grow at a substantial CAGR during the forecast period, supported by increased adoption in aerospace and medical manufacturing. Companies are leveraging 3D metal printing to reduce component lead times and improve material efficiency. The strong presence of research institutions and innovation clusters, coupled with growing government support for additive manufacturing under industrial strategy initiatives, is propelling market expansion. The demand for lightweight materials and customized production further strengthens the U.K.’s position in the regional market.

Germany 3D Printing Metals Market Insight

The Germany 3D printing metals market is expected to register steady growth, fueled by the country’s advanced manufacturing infrastructure and emphasis on precision engineering. German manufacturers are rapidly adopting metal additive technologies to produce complex automotive and aerospace components. The market is supported by government-backed programs promoting Industry 4.0 and additive innovation. The integration of 3D printing metals into existing production lines, along with partnerships between industrial firms and research centers, reinforces Germany’s leadership in metal-based additive manufacturing.

Asia-Pacific 3D Printing Metals Market Insight

The Asia-Pacific 3D printing metals market is projected to grow at the fastest CAGR from 2025 to 2032, driven by expanding industrialization, technological progress, and increasing adoption across automotive and aerospace industries. Countries such as China, Japan, and India are investing heavily in additive manufacturing to support domestic production and reduce reliance on imports. The growing number of metal 3D printing service providers and the availability of cost-effective raw materials are further driving growth. The region’s rapid shift toward digital manufacturing and smart factories is enhancing market penetration.

Japan 3D Printing Metals Market Insight

The Japan 3D printing metals market is gaining traction due to the country’s technological sophistication and high adoption of precision manufacturing. Japanese firms are utilizing metal additive manufacturing for applications in electronics, aerospace, and healthcare. The country’s focus on miniaturization and high-quality production supports widespread integration of metal 3D printing systems. Moreover, collaborations between universities and industrial leaders are fostering innovation in metal powder development and post-processing techniques, strengthening Japan’s position in the Asia-Pacific market.

China 3D Printing Metals Market Insight

China accounted for the largest revenue share in the Asia-Pacific 3D printing metals market in 2024, driven by its rapidly expanding manufacturing base and supportive government policies promoting additive manufacturing. Local companies are investing in large-scale production systems to meet rising demand for industrial and aerospace components. The growing availability of affordable 3D printing metal powders and materials, combined with strong domestic innovation and supply chains, reinforces China’s leadership. The country’s continuous push toward smart factories and industrial automation is expected to further accelerate market growth.

3D Printing Metals Market Share

The 3D printing metals industry is primarily led by well-established companies, including:

- Renishaw plc. (U.K.)

- CRS Holdings Inc. (U.S.)

- Proto Labs, Inc. (U.S.)

- GKN Aerospace Services Limited (U.K.)

- Titomic Limited (Australia)

- 3D Systems, Inc. (U.S.)

- General Electric Company (U.S.)

- Stratasys Ltd. (Israel)

- Materialise NV (Belgium)

- Arkema S.A. (France)

- DSM (Netherlands)

- ExOne (U.S.)

- Höganäs AB (Sweden)

- EOS GmbH (Germany)

- Sandvik AB (Sweden)

- voxeljet AG (Germany)

- Optomec, Inc. (U.S.)

- Markforged, Inc. (U.S.)

- Desktop Metal, Inc. (U.S.)

- BASF SE (Germany)

Latest Developments in Global 3D Printing Metals Market

- In November 2024, 3D Monotech launched the Markforged FX10 in India, marking a major advancement in the 3D printing metals market as the world’s first printer capable of processing both metal and advanced composites. This launch significantly enhances India’s position in the global additive manufacturing ecosystem, offering manufacturers greater material versatility and production efficiency. The integration of metal and composite printing within a single platform is expected to accelerate adoption among automotive, aerospace, and industrial sectors seeking lightweight, high-performance components

- In January 2024, Eplus3D introduced its large-format Laser Beam Powder Bed Fusion (PBF-LB) 3D printer, EP-M2050, equipped with up to 64 lasers, with 36 as the standard configuration. This innovation substantially improves production throughput, precision, and scalability in metal 3D printing. The introduction of such high-capacity systems is set to reshape industrial metal printing by enabling mass customization, reducing production time, and supporting the manufacture of larger and more complex parts for aerospace and heavy engineering industries

- In June 2023, Norsk Titanium inaugurated a new production facility in Norway dedicated to manufacturing titanium parts for aerospace and defense applications. This expansion reinforces the company’s capability to meet the growing global demand for high-strength, lightweight metal components. The facility enhances supply chain resilience for critical sectors while boosting the regional additive manufacturing capacity for titanium-based products, a key metal in high-performance engineering

- In May 2023, GE Additive launched its new Binder Jetting 3D printing technology, advancing metal additive manufacturing with higher precision and improved surface finish. This development broadens the industrial application scope of 3D metal printing by enabling faster, scalable, and cost-effective production of complex metal parts. The technology strengthens GE Additive’s market position and supports industries seeking efficient alternatives to traditional metal fabrication methods

- In April 2023, ExOne introduced the InnovateAM metal 3D printing system, designed to enhance productivity and flexibility in metal additive manufacturing. The system delivers improved print speed, material efficiency, and design freedom, making it particularly suitable for industrial and research applications. This launch highlights ExOne’s commitment to driving innovation and supporting the shift toward high-performance, sustainable manufacturing solutions in the global metal 3D printing market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global 3d Printing Metal Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global 3d Printing Metal Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global 3d Printing Metal Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.