Global 3d Rendering Market

Market Size in USD Billion

CAGR :

%

USD

4.86 Billion

USD

24.00 Billion

2025

2033

USD

4.86 Billion

USD

24.00 Billion

2025

2033

| 2026 –2033 | |

| USD 4.86 Billion | |

| USD 24.00 Billion | |

|

|

|

|

3D Rendering Market Size

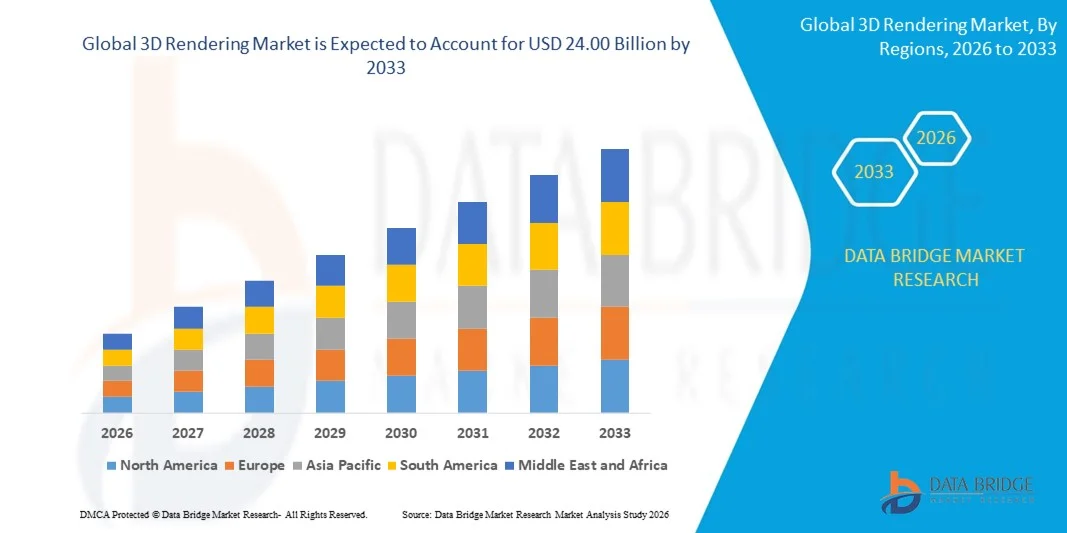

- The global 3D rendering market size was valued at USD 4.86 billion in 2025 and is expected to reach USD 24.00 billion by 2033, at a CAGR of 22.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for realistic visualizations in architecture, gaming, film & animation, and industrial design

- Rising adoption of advanced rendering software and cloud-based rendering solutions is accelerating market expansion

3D Rendering Market Analysis

- The market is witnessing rapid technological advancements, including real-time rendering, AI-assisted rendering, and GPU-accelerated rendering, which enhance efficiency and output quality

- Increasing adoption across industries such as construction, automotive, media & entertainment, and product design is driving market demand

- North America dominated the 3D rendering market with the largest revenue share of 38.75% in 2025, driven by the high adoption of advanced visualization technologies across architecture, gaming, and media industries. The presence of major software providers and the increasing demand for photorealistic content are key growth factors.

- Asia-Pacific region is expected to witness the highest growth rate in the global 3D rendering market, driven by rapid urbanization, rising investments in gaming and animation industries, expanding digital media production, and increasing penetration of cloud and GPU-based rendering technologies

- The software segment held the largest market revenue share in 2025, driven by increasing adoption of advanced 3D rendering applications for design, visualization, and simulation across industries. Software solutions offer high customization, photorealistic rendering, and integration with other digital tools, making them the preferred choice for enterprises and creative studios

Report Scope and 3D Rendering Market Segmentation

|

Attributes |

3D Rendering Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Adobe Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

3D Rendering Market Trends

Rise of Real-Time and Cloud-Based 3D Rendering

- The growing adoption of real-time and cloud-based 3D rendering is transforming the visualization and design landscape by enabling faster, more accurate creation of digital content. The portability and accessibility of cloud platforms allow designers and studios to collaborate globally, reducing project timelines and costs. These solutions also facilitate iterative workflows, enabling clients to review and approve designs in real time, improving overall project efficiency and client satisfaction

- The high demand for immersive experiences in gaming, architecture, and media is accelerating the uptake of GPU-accelerated and AI-powered rendering solutions. These technologies help achieve photorealistic visuals efficiently, supporting creative industries in meeting tight deadlines and high-quality standards. In addition, real-time visualization tools are increasingly integrated with virtual reality (VR) and augmented reality (AR) applications, expanding their utility across multiple sectors

- The scalability and flexibility of modern 3D rendering platforms make them attractive for studios of all sizes, enabling on-demand rendering without significant upfront infrastructure investment. Companies benefit from cost savings and faster iteration cycles, enhancing project outcomes. Cloud-based rendering also allows smaller studios to access enterprise-grade computational power, leveling the playing field with larger competitors

- For instance, in 2023, several architectural firms and game studios reported reduced rendering times and improved visual quality after integrating cloud-based and AI-assisted 3D rendering platforms, boosting productivity and client satisfaction. The adoption of these technologies also contributed to more sustainable operations by minimizing energy-intensive local hardware usage

- While cloud and real-time rendering are driving efficiency and collaboration, their impact depends on continued software innovation, high-speed internet access, and hardware compatibility. Providers must focus on platform optimization and user training to fully capitalize on the growing demand. Emerging markets are expected to benefit significantly as connectivity and cloud adoption improve, expanding the global reach of these solutions

3D Rendering Market Dynamics

Driver

Growing Adoption of Real-Time Rendering and AI Integration

- The increasing adoption of real-time rendering and AI-based rendering tools is pushing studios and enterprises to invest in advanced 3D technologies. These solutions enable high-quality visualization, faster project delivery, and enhanced creative freedom, driving market growth. In addition, AI-powered automation helps reduce repetitive manual tasks, improving team productivity and creativity

- Industries such as gaming, film, architecture, automotive, and e-commerce are increasingly seeking photorealistic visual content for marketing, design, and simulation purposes. This rising demand is promoting frequent adoption of cutting-edge rendering platforms. Enhanced visualization capabilities also aid in client presentations, sales, and virtual prototyping, increasing business opportunities across sectors

- Cloud rendering services and subscription-based software models are making high-performance 3D rendering more accessible to small and mid-sized studios, further expanding the market reach. Pay-as-you-go and scalable options allow firms to manage costs effectively while scaling operations based on project needs, encouraging broader adoption

- For instance, in 2022, leading animation studios in North America and Europe integrated AI-driven rendering pipelines, reducing production times and improving visual fidelity, which strengthened the demand for advanced rendering solutions. These implementations also facilitated multi-location collaboration and real-time updates, enhancing operational efficiency

- While technological adoption and industry demand are strong drivers, continuous innovation, workflow integration, and cost-effective deployment remain critical for sustained growth. Increasing use of AI, real-time engines, and cloud platforms will further shape the market, enabling faster rendering, enhanced realism, and greater accessibility

Restraint/Challenge

High Cost of Advanced Rendering Infrastructure and Limited Technical Expertise

- The high investment required for GPU clusters, cloud rendering subscriptions, and AI-powered software limits adoption for small studios and individual designers. The upfront and recurring costs remain significant barriers for widespread usage. In addition, the need for frequent software updates and licensing fees can further strain budgets, particularly for startups and freelancers

- Many organizations lack skilled personnel to operate complex 3D rendering software or manage cloud-based workflows. The need for training and technical support restricts effective utilization, especially in emerging markets. Talent shortages also slow the integration of advanced AI and real-time rendering solutions into production pipelines, affecting competitiveness

- Bandwidth limitations and inconsistent cloud infrastructure in certain regions can impact rendering speed, quality, and reliability, affecting project timelines and output. Latency issues and network disruptions can cause delays in large-scale rendering projects, particularly in regions with underdeveloped digital infrastructure

- For instance, in 2023, several animation and architectural firms in APAC reported delays in rendering high-resolution content due to hardware limitations and insufficient cloud support, impacting delivery schedules. Such constraints highlight the need for localized data centers and improved cloud infrastructure to support global operations

- While software and cloud technologies continue to advance, addressing cost, technical expertise, and infrastructure challenges is crucial to unlocking the full potential of the 3D rendering market. Stakeholders must invest in training programs, scalable infrastructure, and user-friendly solutions to facilitate broader adoption and sustained market growth

3D Rendering Market Scope

The 3D rendering market is segmented on the basis of component, operating system, organization size, application, end user, and industry vertical

- By Component

On the basis of component, the market is segmented into software and services. The software segment held the largest market revenue share in 2025, driven by increasing adoption of advanced 3D rendering applications for design, visualization, and simulation across industries. Software solutions offer high customization, photorealistic rendering, and integration with other digital tools, making them the preferred choice for enterprises and creative studios.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising demand for cloud-based rendering, on-demand rendering services, and AI-assisted rendering solutions. Services allow companies to scale rendering capacity without heavy infrastructure investments, providing flexibility, cost savings, and faster project delivery for studios of all sizes

- By Operating System

On the basis of operating system, the market is segmented into Windows, macOS, Linux, and others. The Windows segment held the largest market revenue share in 2025 due to its widespread use in design and animation studios and compatibility with most professional rendering software.

The macOS segment is expected to witness the fastest growth rate from 2026 to 2033, driven by growing adoption among creative professionals in media, animation, and architecture, supported by optimized rendering software for Mac environments

- By Organization Size

On the basis of organization size, the market is segmented into small & medium enterprises (SMEs) and large enterprises. Large enterprises held the largest share in 2025, fueled by high investments in rendering infrastructure, cloud solutions, and AI-powered workflows to meet demanding visualization requirements

The SMEs segment is expected to witness the fastest growth rate from 2026 to 2033, driven by cloud-based rendering services, subscription models, and accessible software, enabling smaller studios to compete with larger firms and deliver high-quality visuals

- By Application

On the basis of application, the market is segmented into product design, architectural & interior design, animation & visual effects, and others. The animation & visual effects segment held the largest share in 2025, driven by rising demand from the film, gaming, and media industries for photorealistic content

The product design segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing use of 3D rendering in prototyping, virtual product visualization, and e-commerce, helping designers reduce time-to-market and improve client engagement

- By End User

On the basis of end user, the market is segmented into design students & educators, engineers & technical users, automotive, product designers, marketing & sales specialists, graphics professionals, independent design agencies, and others. Graphics professionals held the largest share in 2025 due to high adoption of rendering tools for animation, gaming, and media content creation

The automotive segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the adoption of 3D rendering in vehicle design, prototyping, and virtual showrooms, enabling manufacturers to visualize and test concepts efficiently

- By Industry Vertical

On the basis of industry vertical, the market is segmented into advertising and marketing, fashion & apparel, architecture, automotive & utility vehicles, construction, consumer packaged goods (CPG), jewelry, footwear, electronics, manufacturing, media and entertainment, retail, technology, machinery, and others. Media and entertainment held the largest market share in 2025, driven by the surge in animated films, gaming, and VR/AR applications requiring advanced 3D visualization

The architecture segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increased adoption of photorealistic architectural visualization, virtual walkthroughs, and interior design renderings across residential and commercial projects

3D Rendering Market Regional Analysis

- North America dominated the 3D rendering market with the largest revenue share of 38.75% in 2025, driven by the high adoption of advanced visualization technologies across architecture, gaming, and media industries. The presence of major software providers and the increasing demand for photorealistic content are key growth factors.

- Consumers and enterprises in the region highly value the efficiency, scalability, and real-time collaboration enabled by cloud-based and AI-assisted rendering platforms, supporting faster project completion and reduced operational costs.

- This widespread adoption is further supported by robust IT infrastructure, a technologically skilled workforce, and the increasing use of subscription-based software models, establishing North America as a leading hub for 3D rendering solutions.

U.S. 3D Rendering Market Insight

The U.S. 3D rendering market captured the largest revenue share in 2025 within North America, fueled by widespread adoption in gaming, film production, and architectural visualization. Studios and enterprises are increasingly investing in GPU-accelerated and cloud-based rendering platforms to achieve high-quality visuals with shorter turnaround times. The integration of AI-driven tools, real-time collaboration features, and subscription software models is further boosting market growth and accessibility for small and mid-sized studios.

Europe 3D Rendering Market Insight

The Europe 3D rendering market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing demand for digital content in animation, VFX, and architectural industries. Stringent quality standards, growing urbanization, and the adoption of virtual reality (VR) and augmented reality (AR) applications are fostering the uptake of advanced rendering technologies. The region is witnessing rapid adoption across creative agencies, architectural firms, and media houses, with cloud-based solutions being integrated into both new projects and retrofitted workflows.

U.K. 3D Rendering Market Insight

The U.K. 3D rendering market is expected to witness significant growth from 2026 to 2033, driven by the rising trend of digital media production, gaming, and virtual simulations. The demand for photorealistic visuals, combined with the country’s strong creative industry and robust digital infrastructure, is encouraging studios and independent designers to adopt advanced rendering platforms. In addition, government initiatives supporting digital innovation and creative content development are expected to further stimulate market expansion.

Germany 3D Rendering Market Insight

The Germany 3D rendering market is expected to witness substantial growth from 2026 to 2033, fueled by strong adoption in automotive, architecture, and industrial design sectors. Germany’s emphasis on technological innovation, precision engineering, and sustainable digital solutions promotes investment in high-performance rendering software. Integration of AI-based rendering and real-time visualization tools is becoming increasingly prevalent, with studios and enterprises seeking faster production cycles and enhanced visual quality.

Asia-Pacific 3D Rendering Market Insight

The Asia-Pacific 3D rendering market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising urbanization, increasing digital content creation, and adoption of cloud and AI-based rendering solutions in countries such as China, Japan, and India. The region’s expanding gaming, animation, and architectural industries, supported by government initiatives promoting digitalization and smart infrastructure, are propelling market growth. In addition, APAC is emerging as a key manufacturing and development hub for 3D rendering software and hardware, making solutions more affordable and accessible to a wider user base.

Japan 3D Rendering Market Insight

The Japan 3D rendering market is expected to witness rapid growth from 2026 to 2033 due to the country’s advanced technological ecosystem, high adoption of gaming and digital media, and demand for efficient design workflows. Japanese enterprises emphasize speed, accuracy, and integration with other digital tools, driving the adoption of AI-assisted and real-time rendering platforms. The growing number of design studios, architectural firms, and independent developers is further accelerating market expansion.

China 3D Rendering Market Insight

The China 3D rendering market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid digitalization, expansion of gaming and film industries, and growing adoption of AI-powered rendering solutions. The country’s large base of creative enterprises, combined with government support for technological innovation and smart content development, is fostering widespread adoption. Affordable cloud-based rendering platforms and domestic software providers are enabling small and mid-sized studios to leverage advanced 3D visualization tools, further driving market growth.

3D Rendering Market Share

The 3D Rendering industry is primarily led by well-established companies, including:

- Adobe Inc. (U.S.)

- Advanced Micro Devices Inc. (U.S.)

- Autodesk Inc. (U.S.)

- Chaos Software EOOD (Bulgaria)

- Christie Digital Systems USA, Inc. (U.S.)

- D5 Render (China)

- Disney-Pixar (U.S.)

- Epic Games, Inc. (U.S.)

- Graphisoft SE (Hungary)

- Intel Corporation (U.S.)

- KeyShot (U.S.)

- Maxon Computer GmbH (Germany)

- NVIDIA Corporation (U.S.)

- OTOY Inc. (U.S.)

- PTC Inc. (U.S.)

- SideFX (Canada)

Latest Developments in Global 3D Rendering Market

- In August 2025, Autodesk Inc. introduced a new, more accessible pricing model for Autodesk Flow Studio, leveraging AI to simplify complex VFX workflows such as motion capture, camera tracking, and character animation. The platform enables creators to seamlessly integrate CG characters into live-action footage with minimal effort, enhancing storytelling and production efficiency. This development democratizes high-quality 3D animation and VFX, expanding accessibility for individual creators and small studios, and is expected to drive wider adoption across the digital content creation market

- In July 2025, Chaos Software EOOD acquired EvolveLAB, enhancing its design-to-visualization capabilities and extending its reach into BIM automation. The integration allows users to perform real-time visualization, photorealistic rendering, and AI-powered automated documentation within a single platform. This streamlines workflows, reduces reliance on multiple tools, and strengthens Chaos Software’s position in the architectural, engineering, and construction visualization market

- In June 2025, PTC Inc. partnered with NVIDIA to integrate NVIDIA Omniverse technologies into its Creo CAD and Windchill PLM platforms. This collaboration enables real-time, photorealistic visualization and simulation of complex products, including AI infrastructure hardware, using digital twin workflows and OpenUSD standards. The integration facilitates seamless team collaboration, version-controlled 3D data access, and faster product development, enhancing quality while minimizing risk, and positioning PTC as a leader in advanced 3D design and engineering solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global 3d Rendering Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global 3d Rendering Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global 3d Rendering Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.