Global 4d Printing In Medical Implants Market

Market Size in USD Million

CAGR :

%

USD

245.03 Million

USD

887.24 Million

2024

2032

USD

245.03 Million

USD

887.24 Million

2024

2032

| 2025 –2032 | |

| USD 245.03 Million | |

| USD 887.24 Million | |

|

|

|

|

4D Printing in Medical Implants Market Size

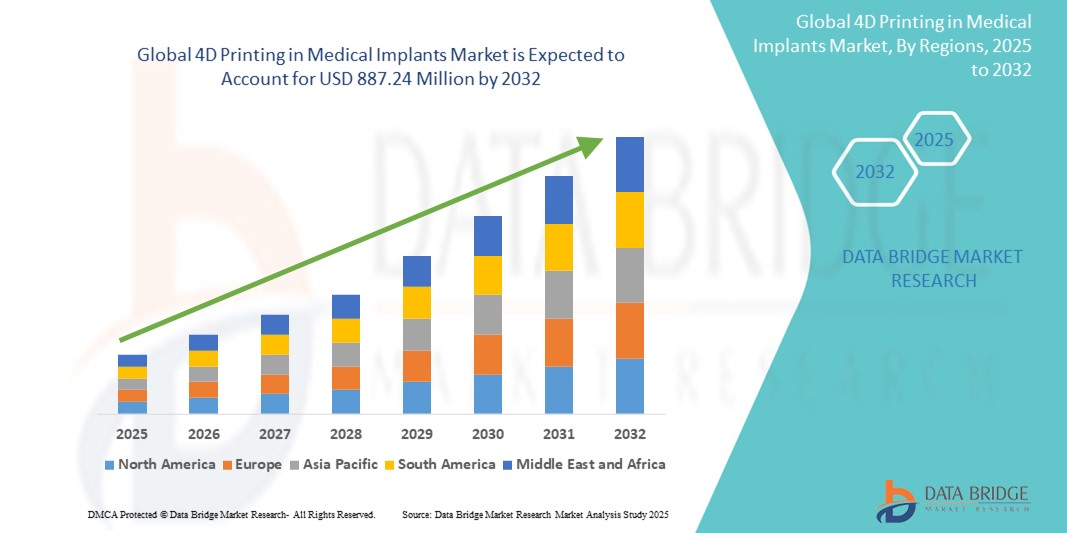

- The global 4D printing in medical implants market size was valued at USD 245.03 million in 2024 and is expected to reach USD 887.24 million by 2032, at a CAGR of 17.45% during the forecast period

- The market growth is largely driven by technological advancements in smart biomaterials and additive manufacturing, enabling implants that adapt to physiological environments and patient-specific conditions

- Furthermore, rising demand for minimally invasive procedures and personalized medical solutions is positioning 4D printed implants as a next-generation innovation in healthcare. These intersecting trends are fueling rapid adoption of 4D printing technologies, thereby significantly accelerating the market’s expansion

4D Printing in Medical Implants Market Analysis

- 4D printing in medical implants, which utilizes smart materials that adapt to physiological conditions over time, is emerging as a transformative technology in healthcare due to its ability to create dynamic, patient-specific implants that respond to environmental stimuli for enhanced therapeutic outcomes

- The growing demand for 4D-printed implants is primarily driven by advancements in programmable biomaterials, increasing focus on personalized medicine, and rising adoption of minimally invasive procedures across global healthcare systems

- North America dominated the 4D printing in medical implants market with the largest revenue share of 41.8% in 2024, propelled by robust research and development, strong regulatory support, and early adoption by hospitals and academic institutions, particularly in the U.S., where collaborations between biotech firms and universities are accelerating clinical deployment

- Asia-Pacific is anticipated to be the fastest growing region in the 4D printing in medical implants market during the forecast period, driven by expanding healthcare infrastructure, government investment in additive manufacturing, and growing awareness of advanced medical technologies

- The patient-specific implants segment dominated the market with a 40.2% share in 2024, attributed to its ability to deliver customized solutions for orthopedics, dental applications, and cardiovascular treatments, enhancing both clinical outcomes and patient satisfaction

Report Scope and 4D Printing in Medical Implants Market Segmentation

|

Attributes |

4D Printing in Medical Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

4D Printing in Medical Implants Market Trends

“Rise of Smart Biomaterials and Stimuli-Responsive Functionality”

- A significant and accelerating trend in the global 4D printing in medical implants market is the advancement of smart biomaterials that respond to environmental stimuli such as temperature, pH, or moisture, enabling implants to change shape or function after implantation for enhanced clinical outcomes

- For instance, shape-memory polymers are being developed for orthopedic implants that conform to anatomical structures once inside the body, while temperature-sensitive hydrogels are used in cardiovascular stents for self-deployment

- These materials allow implants to interact dynamically with the body, mimicking natural tissue behavior, improving biocompatibility, and promoting tissue regeneration with fewer surgical interventions

- The integration of 4D printing with bioactive and adaptive materials supports minimally invasive procedures and accelerates healing by tailoring implant behavior to patient-specific conditions

- This trend is fundamentally reshaping the future of personalized medicine by enabling implants that evolve in response to biological environments. Companies and research institutions are investing heavily in developing clinically viable smart materials and establishing scalable manufacturing processes

- The growing demand for adaptive implants across orthopedics, cardiovascular, and dental applications reflects a broader shift toward next-generation therapeutic solutions that offer long-term functionality and patient-specific performance

4D Printing in Medical Implants Market Dynamics

Driver

“Advancements in Personalized Healthcare and Additive Manufacturing Technologies”

- The increasing demand for personalized medical solutions and the rapid advancement of additive manufacturing technologies are major drivers propelling the growth of the 4D printing in medical implants market

- For instance, collaborations between academic institutions and biotech firms have led to the development of programmable implants that can autonomously reshape post-implantation based on internal body stimuli, enhancing precision and effectiveness in treatment

- As healthcare systems prioritize minimally invasive and patient-centric approaches, 4D-printed implants offer tailored solutions that reduce surgical risks and improve recovery outcomes through intelligent adaptation

- The expanding availability of biocompatible smart materials and improved printing accuracy is encouraging clinical adoption and enabling more complex implant designs

- Supportive government initiatives and funding for innovative medical technologies are further accelerating R&D and commercialization efforts in the field of 4D medical printing

- These advancements are fostering broader application across various specialties, including orthopedics, neurology, dentistry, and tissue engineering, significantly driving market growth

Restraint/Challenge

“Biocompatibility and Regulatory Approval Complexities”

- A significant challenge hindering the growth of the 4D printing in medical implants market is the complexity of ensuring long-term biocompatibility and navigating regulatory approval processes for novel stimuli-responsive materials

- For instance, smart polymers used in implants must meet stringent safety standards and undergo extensive testing for toxicity, durability, and stability in vivo, delaying their path to clinical use

- The lack of standardized regulatory guidelines for 4D-printed medical devices creates uncertainty for manufacturers and complicates product classification and compliance

- High R&D costs, limited commercial-scale manufacturing infrastructure, and the need for multidisciplinary expertise present additional hurdles for new entrants and smaller companies

- While some companies are making progress in clinical validation and regulatory alignment, the time and investment required remain substantial, particularly in regions with stricter medical device approval pathways

- Overcoming these challenges will be critical for widespread adoption and will require collaborative efforts between regulators, material scientists, and medical professionals to develop unified standards and scalable production frameworks

4D Printing in Medical Implants Market Scope

The market is segmented on the basis of component, technology, application, and end user.

- By Component

On the basis of component, the 4D printing in medical implants market is segmented into software & services, equipment, and programmable materials. The programmable materials segment dominated the market with the largest revenue share in 2024, driven by the increasing development and adoption of smart biomaterials capable of responding to external stimuli such as temperature, moisture, and pH. These materials enable implants to adapt to the physiological environment post-implantation, improving treatment outcomes and reducing surgical complications.

The software & services segment is projected to witness the fastest growth rate from 2025 to 2032 due to rising demand for advanced simulation tools, design customization, and modeling services to support the development of patient-specific 4D-printed implants. These tools are crucial in creating dynamic, responsive implants tailored to individual patient needs and anatomical structures.

- By Technology

On the basis of technology, the 4D printing in medical implants market is segmented into Fused Deposition Modeling (FDM), PolyJet, Selective Laser Sintering (SLS), and Stereolithography (SLA). The Fused Deposition Modeling (FDM) segment held the largest market revenue share in 2024, attributed to its cost-effectiveness, ease of use, and widespread application in prototyping and producing functional implants, particularly for orthopedic and dental uses.

The PolyJet segment is expected to witness the highest growth rate during the forecast period, owing to its capability to print high-resolution, multi-material, and multi-color medical models with smooth surface finishes. This technology is particularly valuable for producing complex anatomical models and precision-guided surgical tools in preclinical and clinical environments.

- By Application

On the basis of application, the 4D printing in medical implants market is segmented into patient-specific implants, tissue engineering, medical & research models, surgical guides, organ regeneration, and others. The patient-specific implants segment dominated the market in 2024 with a share of 40.2% due to increasing demand for personalized, anatomically accurate solutions in orthopedics, cranial reconstruction, and dental procedures. These implants enhance patient comfort, reduce recovery time, and improve surgical success rates.

The tissue engineering segment is projected to register the fastest growth during the forecast period, driven by research advancements in regenerative medicine. The ability to create 4D scaffolds that dynamically adapt to biological environments is opening new possibilities in tissue repair and organ reconstruction.

- By End User

On the basis of end user, the 4D printing in medical implants market is segmented into hospitals & surgical centers, dental clinics & laboratories, research institutes, pharmaceutical & biotechnology companies, and others. The hospitals & surgical centers segment accounted for the largest revenue share in 2024 due to high adoption of innovative implant solutions for specialized surgeries and improved clinical outcomes. Their access to advanced infrastructure and collaboration with medical device companies is facilitating the integration of 4D printing technology.

The dental clinics & laboratories segment is anticipated to grow at the fastest pace during the forecast period, supported by the growing demand for customized dental implants and prosthetics. The ability of 4D-printed materials to adapt to oral cavity conditions is significantly improving patient comfort and procedure efficiency in dental care.

4D Printing in Medical Implants Market Regional Analysis

- North America led the 4D printing in medical implants market with the largest revenue share of 41.8% in 2024, propelled by robust research and development, strong regulatory support, and early adoption by hospitals and academic institutions, particularly in the U.S., where collaborations between biotech firms and universities are accelerating clinical deployment

- Healthcare providers in the region prioritize innovation, personalized care, and minimally invasive procedures, fostering the adoption of 4D-printed implants that offer adaptive functionality and improved patient outcomes

- This regional leadership is further supported by favorable government funding, robust regulatory frameworks, and active collaboration between academic institutions and biotechnology firms, positioning 4D printing as a transformative solution in modern medical care

U.S. 4D Printing in Medical Implants Market Insight

The U.S. 4D printing in medical implants market captured the largest revenue share of 78% in 2024 within North America, driven by a strong network of research universities, advanced healthcare systems, and high investment in cutting-edge biomedical technologies. The country's focus on personalized medicine and minimally invasive treatment methods supports the growing adoption of 4D-printed adaptive implants. In addition, favorable regulatory frameworks and collaborations between academia, biotech firms, and healthcare providers are accelerating clinical trials and commercialization, positioning the U.S. as a global innovation hub for 4D medical printing.

Europe 4D Printing in Medical Implants Market Insight

The Europe 4D printing in medical implants market is projected to grow at a substantial CAGR throughout the forecast period, fueled by rising healthcare expenditure, technological innovation, and an increasing emphasis on biocompatible and patient-specific implant solutions. Stringent regulatory standards are prompting medical device companies to invest in advanced and adaptive technologies that meet safety and performance requirements. Widespread academic and industrial collaboration across countries such as Germany, France, and the Netherlands is fostering rapid R&D, especially in tissue engineering and regenerative medicine.

U.K. 4D Printing in Medical Implants Market Insight

The U.K. 4D printing in medical implants market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a strong presence of medical research institutions and growing adoption of advanced manufacturing techniques in the healthcare sector. The U.K.’s National Health Service (NHS) and affiliated research bodies are actively exploring dynamic implants for orthopedic, dental, and craniofacial applications. Government funding and innovation grants are encouraging startups and academic labs to scale their development efforts and bring new solutions to market.

Germany 4D Printing in Medical Implants Market Insight

The Germany 4D printing in medical implants market is expected to expand at a considerable CAGR during the forecast period, owing to its robust engineering expertise, advanced healthcare infrastructure, and focus on sustainability. Germany’s commitment to integrating smart technologies in healthcare is boosting the development and deployment of 4D-printed, stimulus-responsive implants. With growing collaborations between academic institutions and MedTech companies, the country is rapidly advancing research in biocompatible polymers and adaptive scaffolding for orthopedic and cardiovascular applications.

Asia-Pacific 4D Printing in Medical Implants Market Insight

The Asia-Pacific 4D printing in medical implants market is poised to grow at the fastest CAGR of 25.7% during the forecast period of 2025 to 2032, driven by rising healthcare investments, a surge in medical tourism, and increased R&D activity in countries such as China, Japan, and India. Government initiatives promoting smart healthcare and advanced manufacturing are supporting the rapid adoption of 4D printing technologies. The availability of cost-effective manufacturing and increasing demand for innovative, personalized treatments are broadening market opportunities across the region.

Japan 4D Printing in Medical Implants Market Insight

The Japan 4D printing in medical implants market is gaining traction due to the country’s deep technological foundation, aging population, and emphasis on precision healthcare. Japan’s universities and medical institutions are pioneering research in stimuli-responsive materials and implantable devices that improve patient comfort and long-term outcomes. Integration with IoT-based healthcare systems and robotics is also contributing to the rising demand for dynamic implants, especially in orthopedics and cardiovascular treatments.

India 4D Printing in Medical Implants Market Insight

The India 4D printing in medical implants market accounted for the largest revenue share in Asia-Pacific in 2024, supported by growing government initiatives in digital health, rapid expansion of private healthcare facilities, and rising demand for affordable yet advanced treatment options. With a strong domestic manufacturing base and increasing investment in medical R&D, India is emerging as a key market for adaptive implants tailored to local clinical needs. The surge in orthopedic surgeries, coupled with efforts to develop patient-specific implant solutions, is driving robust growth in the Indian 4D printing sector.

4D Printing in Medical Implants Market Share

The 4D Printing in Medical Implants industry is primarily led by well-established companies, including:

- Poietis (France)

- CELLINK (Sweden)

- Stratasys (U.S.)

- Materialise (Belgium)

- Organovo Holdings, Inc. (U.S.)

- Dassault Systèmes SE (France)

- EnvisionTEC, Inc. (Germany)

- EOS GmbH (Germany)

- 3D Systems, Inc. (U.S.)

- Biome Makers, Inc. (U.S.)

- ROKIT HEALTHCARE INC. (South Korea)

- Anatomics Pty Ltd. (Australia)

- regenHU (Switzerland)

- Aspect Biosystems Ltd. (Canada)

- Nanoscribe GmbH & Co. KG (Germany)

- Advanced Solutions Life Sciences, LLC (U.S.)

- Medprin (Germany)

- Prellis Biologics (U.S.)

- Tractus3D (Netherlands)

- FABRx Ltd. (U.K.)

What are the Recent Developments in Global 4D Printing in Medical Implants Market?

- In March 2024, researchers at the University of Illinois Urbana-Champaign developed a new class of 4D-printed biomaterials capable of changing shape in response to body temperature, enabling more effective and minimally invasive deployment of medical implants. These materials are designed to expand or contract once inside the human body, improving patient outcomes and reducing surgical complications. This breakthrough marks a significant advancement in stimuli-responsive implant technology and highlights the growing role of academic innovation in driving medical 4D printing forward

- In February 2024, Poietis, a French biotechnology company specializing in bioprinting, announced a strategic partnership with a major European university hospital to pilot clinical trials of 4D-printed tissue scaffolds for regenerative medicine. These scaffolds are designed to adapt to patient-specific environments over time, promoting better tissue integration and healing. This collaboration emphasizes the shift from laboratory research to real-world clinical applications, showcasing the market’s progression toward practical, patient-ready solutions

- In December 2023, MIT engineers unveiled a prototype of a 4D-printed implantable cardiac patch that changes its structure in response to the heart’s motion and temperature. This innovation, intended to support heart function in patients with cardiovascular diseases, demonstrates the potential of 4D printing to create intelligent implants that function harmoniously with biological systems. The development signals a strong push toward integrating mechanical intelligence into next-generation implants for chronic disease management

- In October 2023, the Indian Institute of Science (IISc) launched a government-supported research initiative focused on the development of cost-effective 4D-printed orthopedic implants using locally sourced smart polymers. The project aims to improve access to advanced medical implants in emerging markets and promote domestic innovation in medical device manufacturing. This move aligns with broader national efforts to enhance healthcare affordability and technological self-sufficiency

- In August 2023, CELLINK, a leading bioprinting company, introduced a new 4D bioprinting platform designed to fabricate implants with programmable geometry and bioactivity. The platform enables researchers and clinicians to create dynamic tissue models and adaptive implant prototypes for various clinical applications. This launch reflects the increasing demand for integrated 4D printing solutions that offer precision, versatility, and real-time adaptability in biomedical engineering

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.