Global 5g Fixed Wireless Access Market

Market Size in USD Billion

CAGR :

%

USD

22.28 Billion

USD

5,097.38 Billion

2024

2032

USD

22.28 Billion

USD

5,097.38 Billion

2024

2032

| 2025 –2032 | |

| USD 22.28 Billion | |

| USD 5,097.38 Billion | |

|

|

|

5G Fixed Wireless Access Market Analysis

The 5G fixed wireless access (FWA) market is rapidly growing, driven by the need for high-speed internet connectivity in both urban and rural areas. 5G FWA provides a cost-effective alternative to traditional broadband services, offering high-speed internet through wireless connectivity rather than fiber or cable. It leverages 5G technology to deliver faster speeds, lower latency, and enhanced network reliability, which is crucial for applications such as streaming, online gaming, and smart home devices. Key drivers of this market include the global rollout of 5G infrastructure, the growing demand for seamless connectivity, and the expansion of digital services in underserved regions. Recent developments, such as partnerships between telecom providers and infrastructure companies, are accelerating the deployment of 5G FWA services. In addition, advancements in 5G technology are further enhancing the capabilities and scalability of FWA solutions, making them increasingly attractive for both consumers and businesses alike.

5G Fixed Wireless Access Market Size

The global 5G fixed wireless access market size was valued at USD 22.28 billion in 2024 and is projected to reach USD 5097.38 billion by 2032, with a CAGR of 97.21% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

5G Fixed Wireless Access Market Trends

“Expansion in Rural and Underserved Areas”

A key trend in the 5G fixed wireless access market is the growing adoption of this technology to provide high-speed internet to remote and rural areas. In many of these regions, traditional broadband infrastructure such as fiber and cable is either limited or prohibitively expensive to install. 5G fixed wireless access offers an effective alternative by utilizing wireless signals to deliver high-speed connectivity. This enables telecom operators to extend coverage to underserved populations without the need for costly infrastructure investments. The deployment of 5G fixed wireless access is bridging the digital divide and ensuring reliable internet connectivity for rural communities, making it a crucial driver of market growth.

Report Scope and 5G Fixed Wireless Access Market Segmentation

|

Attributes |

5G Fixed Wireless Access Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Nokia (Finland), SAMSUNG (South Korea), Huawei Technologies Co., Ltd. (China), Telefonaktiebolaget LM Ericsson (Sweden), Mimosa Networks, Inc. (U.S.), Ceragon (Israel), Verizon (U.S.), Inseego Corp. (U.S.), Vodafone Group (U.K.), Wireless Excellence Limited (U.K.), Gemtek Technology Co., Ltd. (Taiwan), Arqiva (U.K.), Cisco Systems, Inc. (U.S.), Qualcomm Technologies, Inc. (U.S.), ZTE Corporation (China), AT&T Intellectual Property (U.S.), Telefónica S.A. (Spain), D-Link Corporation (Taiwan), NETGEAR (U.S.), Singtel Optus Pty Limited (Australia) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

5G Fixed Wireless Access Market Definition

5G fixed wireless access refers to the use of 5G technology to provide high-speed internet connectivity to homes and businesses without the need for traditional wired infrastructure such as fiber or cable. Instead of relying on underground or overhead cables, 5G FWA uses wireless signals transmitted through 5G cellular networks to deliver broadband speeds. This technology offers fast, reliable, and low-latency internet access, making it an ideal solution for areas where traditional broadband is not feasible or cost-effective to deploy. 5G FWA is increasingly used to bridge the digital divide, providing high-speed internet in rural and underserved regions.

5G Fixed Wireless Access Market Dynamics

Drivers

- Global Rollout of 5G Infrastructure

The global rollout of 5G networks is a major driver for the expansion of the 5G fixed wireless access market. As telecom operators continue to deploy 5G infrastructure worldwide, they are unlocking the potential for faster and more reliable internet connectivity, making fixed wireless access a viable solution for high-speed broadband. The increased availability of 5G networks enables telecom providers to offer better performance and coverage, especially in areas where traditional wired broadband solutions are impractical or too costly. This enhanced network infrastructure is fostering the adoption of 5G fixed wireless access, particularly in underserved regions.

- Demand for High-Speed Internet

The increasing demand for high-speed internet is a significant driver for the growth of the 5G fixed wireless access market. As streaming, gaming, remote work, and other data-heavy applications continue to rise, consumers and businesses require faster and more reliable internet connections to meet these demands. Traditional broadband solutions often fall short in providing the necessary speeds and bandwidth. In response, 5G fixed wireless access is emerging as an attractive alternative, offering fast, reliable, and cost-effective connectivity. This demand for high-speed internet is accelerating the adoption of 5G fixed wireless access, making it an essential solution for modern connectivity needs.

Opportunities

- Improved Network Reliability and Performance

Advances in 5G technology present a significant opportunity for the growth of the 5G fixed wireless access market. Enhanced coverage, faster speeds, and lower latency are improving the reliability and performance of fixed wireless access solutions, making them increasingly suitable for both residential and business applications. These technological advancements enable telecom providers to offer a more consistent and high-quality service, meeting the growing demand for fast and stable internet. As 5G networks evolve and continue to expand, they provide a unique opportunity to enhance fixed wireless access, particularly in underserved regions and areas where traditional broadband infrastructure is challenging to deploy.

- Increased Investment by Telecom Providers

Telecom companies are increasingly investing in the rollout of 5G networks, recognizing the vast potential of fixed wireless access to capture a substantial share of the broadband market. This is particularly true in underserved regions where traditional broadband infrastructure is either too costly or logistically challenging to deploy. By leveraging 5G technology, telecom providers can offer faster, more reliable internet connectivity without the need for extensive physical infrastructure. This investment opens up significant opportunities for market growth, enabling telecom companies to expand their customer base and meet the growing demand for high-speed internet services, particularly in remote and rural areas.

Restraints/Challenges

- Competition with Fiber Optic and Cable

The 5G fixed wireless access (FWA) market faces significant competition from established broadband technologies such as fiber optic and traditional cable broadband. These technologies already have extensive infrastructure in place, making them the preferred choice for many consumers, especially in urban areas. Fiber optic broadband offers high speeds and reliability, while cable broadband provides widespread availability at competitive prices. The existing dominance of these technologies presents a major challenge for 5G FWA adoption, as consumers may be hesitant to switch to a new, less established technology unless 5G FWA can offer comparable or superior performance at competitive pricing. This competition slows market penetration.

- High Infrastructure Costs

Deploying 5G networks demands a significant financial investment in infrastructure, which acts as a key market restraint. To ensure optimal performance and coverage, telecom companies must install new base stations, expand fiber networks, and enhance backhaul systems to support the high data speeds and low latency promised by 5G. The cost of upgrading existing infrastructure, especially in rural or underserved areas, can be prohibitive. Furthermore, the need for continuous investment to maintain and expand these networks over time can be a financial burden for companies. These high upfront costs create a barrier to widespread 5G adoption, hindering its growth potential.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

5G Fixed Wireless Access Market Scope

The market is segmented on the offering, operating frequency, demography, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Hardware

- Services

Operating Frequency

- Sub–6 GHz

- 26 GHz–39 GHz

- Above 39 GHz

Demography

- Urban

- Semi-Urban

- Rural

Application

- Residential

- Commercial

- Industrial

- Government

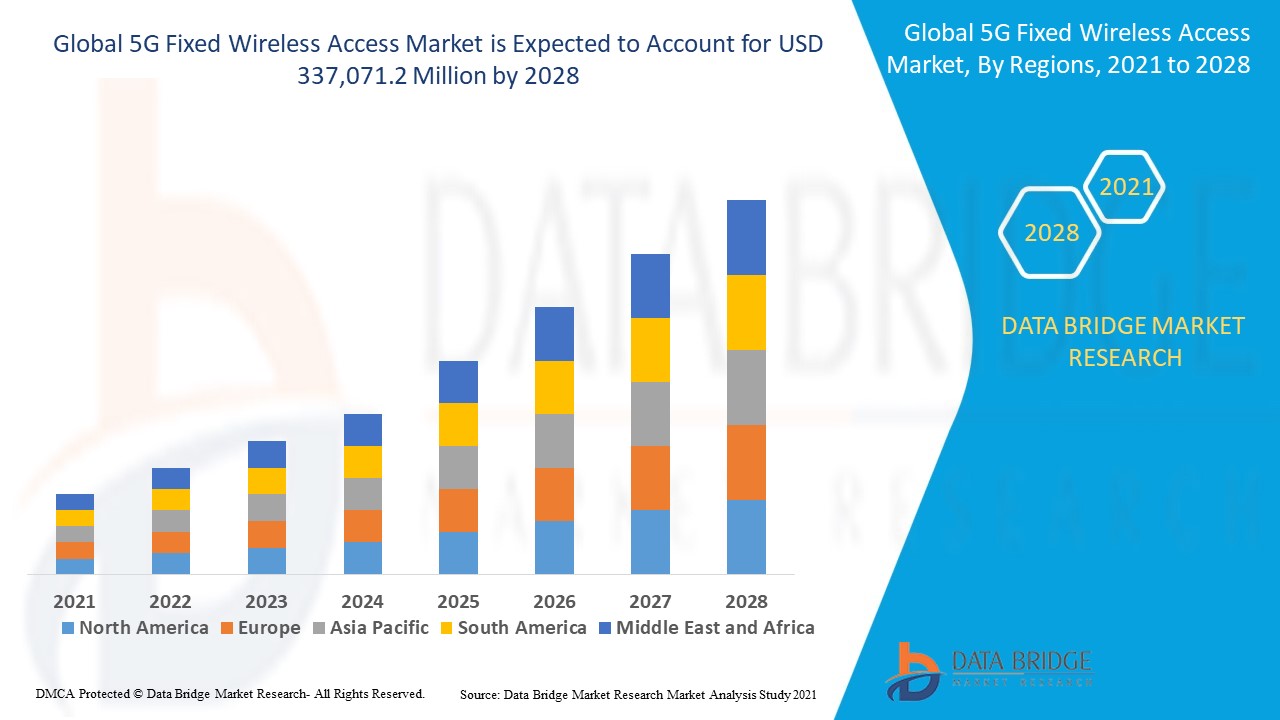

5G Fixed Wireless Access Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, offering, operating frequency, demography, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the 5G fixed wireless access market, driven by its robust IT infrastructure and a high concentration of industry players. The region also benefits from easy access to skilled technical expertise, fostering rapid adoption and innovation. These factors combined position North America as a leader in the development and deployment of 5G FWA technologies.

The Asia Pacific region is expected to be the fastest-growing segment during the forecast period, driven by a large and rapidly expanding population, as well as the increasing adoption of 5G technology. The region's booming e-commerce market and rising demand for digital services, such as online gaming, streaming, and social media, are key growth factors. 5G fixed wireless access offers the high-speed internet necessary to support these services, making it an appealing choice for consumers in Asia Pacific.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

5G Fixed Wireless Access Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

5G Fixed Wireless Access Market Leaders Operating in the Market Are:

- Nokia (Finland)

- SAMSUNG (South Korea)

- Huawei Technologies Co., Ltd. (China)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Mimosa Networks, Inc. (U.S.)

- Ceragon (Israel)

- Verizon (U.S.)

- Inseego Corp. (U.S.)

- Vodafone Group. (U.K.)

- Wireless Excellence Limited (U.K.)

- Gemtek Technology Co., Ltd. (Taiwan)

- Arqiva (U.K.)

- Cisco Systems, Inc. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- ZTE Corporation (China)

- AT&T Intellectual Property (U.S.)

- Telefónica S.A. (Spain)

- D-Link Corporation (Taiwan)

- NETGEAR (U.S.)

- Singtel Optus Pty Limited (Australia)

Latest Developments in 5G Fixed Wireless Access Market

- In November 2022, NBN, a leading network provider in Australia, formed a strategic partnership with Ericsson to enhance the fixed wireless access (FWA) infrastructure across the country. This collaboration designates Ericsson as the exclusive supplier of both 4G and 5G radio access, as well as microwave transport solutions. The deployment will include Ericsson’s advanced 4G and 5G antenna-integrated radios, which will be used across NBN’s current and future spectrum bands. In addition, the latest Massive MIMO technology will be incorporated, ensuring improved network efficiency and high-speed internet for users

- In November 2022, Vodafone announced the expansion of its 5G FWA services to homes and businesses throughout Spain. The company revealed that its 5G network would cover 1,000 municipalities by the end of the year, reaching approximately 46% of Spain’s population. With the deployment of 5G technology, Vodafone aims to provide high-speed internet services to underserved areas, enhancing connectivity for both residential and commercial customers. This initiative forms part of Vodafone's broader strategy to lead in Spain’s digital transformation

- In October 2022, Ericsson partnered with Jio to build India’s first 5G Standalone network. This landmark collaboration will see Ericsson deploy its advanced 5G radio access network (RAN) products and solutions across the country. In addition, E-band microwave mobile transport solutions will be implemented in the 5G network, supporting high-speed connections for Jio's customers. The focus of the partnership is to enable 5G fixed wireless access for home broadband users and businesses, significantly enhancing internet access in India

- In October 2022, Verizon expanded its 5G Home and LTE Home FWA services through the Verizon Forward Program, offering the service nationwide. By leveraging its extensive LTE and 5G wireless network, Verizon made these services available to customers across the United States, even beyond its Fios fiber network coverage. This move marked a strategic effort by Verizon to broaden its home broadband options and provide high-speed internet access to a larger customer base, enhancing competition in the broadband market

- In October 2022, Singtel entered into a partnership with Ericsson to integrate the Ericsson AIR 3268 into its 5G network as part of its commitment to achieving net-zero emissions. This collaboration aims to expand Singtel’s 5G FWA coverage across Singapore, providing more reliable and faster internet connections to both consumers and businesses. The deployment of Ericsson’s advanced technology will strengthen Singtel’s 5G infrastructure, enhancing its service offerings while contributing to environmental sustainability goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global 5g Fixed Wireless Access Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global 5g Fixed Wireless Access Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global 5g Fixed Wireless Access Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.