Global 5g Processor Market

Market Size in USD Billion

CAGR :

%

USD

7.78 Billion

USD

29.85 Billion

2024

2032

USD

7.78 Billion

USD

29.85 Billion

2024

2032

| 2025 –2032 | |

| USD 7.78 Billion | |

| USD 29.85 Billion | |

|

|

|

|

5G Processor Market Size

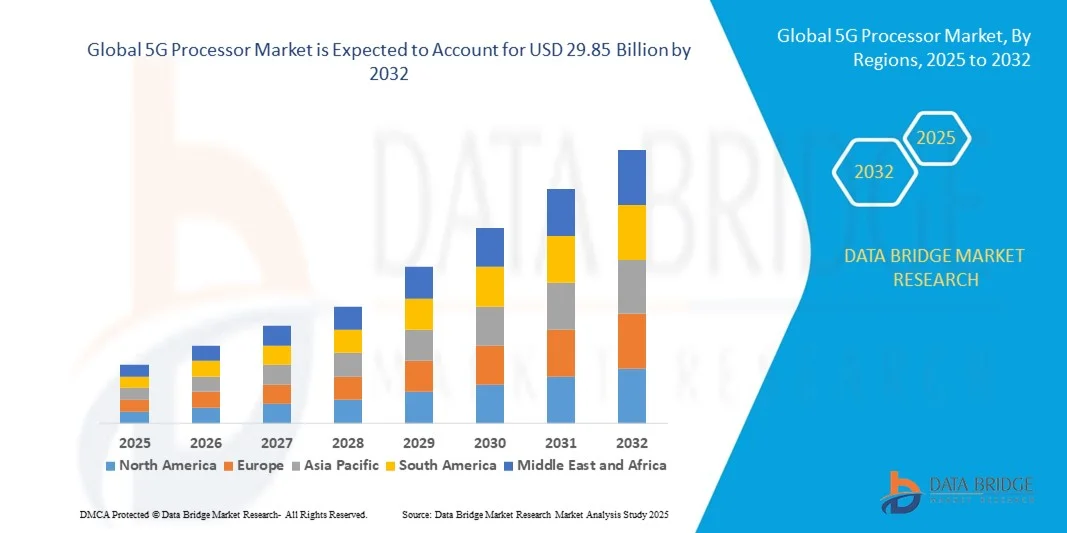

- The global 5G processor market size was valued at USD 7.78 billion in 2024 and is expected to reach USD 29.85 billion by 2032, at a CAGR of 18.3% during the forecast period

- The market growth is largely fueled by the rapid deployment and adoption of 5G networks, coupled with technological advancements in mobile processors, enabling high-speed, low-latency connectivity across smartphones, IoT devices, and industrial applications

- Furthermore, increasing demand for powerful, energy-efficient processors to support AI, edge computing, and immersive applications in both consumer and enterprise segments is driving the uptake of 5G processors. These converging factors are accelerating the adoption of advanced 5G chipsets, thereby significantly boosting market growth

5G Processor Market Analysis

- 5G processors are specialized chipsets designed to handle high-speed data transmission, low-latency communication, and advanced computing tasks for 5G-enabled devices. They integrate multiple functionalities, including AI processing, graphics rendering, and connectivity management, supporting applications from smartphones and connected vehicles to smart factories and IoT ecosystems

- The escalating demand for 5G processors is primarily fueled by the expansion of 5G networks, rising adoption of connected devices, growing requirements for high-performance mobile computing, and the need for reliable, efficient, and scalable processing solutions across various end-user segments

- North America dominated the 5G processor market in 2024, due to the rapid deployment of 5G networks and strong adoption of connected devices across telecommunication and industrial sectors

- Asia-Pacific is expected to be the fastest growing region in the 5G processor market during the forecast period due to rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- Gigabit LTE spectrum segment dominated the market with a market share of 62.9% in 2024, due to its widespread adoption across existing 4G infrastructure and compatibility with a wide range of devices. This spectrum offers reliable high-speed connectivity with broad coverage, making it ideal for consumer electronics, smartphones, and telecommunication networks seeking incremental 5G upgrades without extensive infrastructure overhaul. The established ecosystem and interoperability with current LTE networks further enhance its adoption, making it a preferred choice among telecom operators and device manufacturers

Report Scope and 5G Processor Market Segmentation

|

Attributes |

5G Processor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

5G Processor Market Trends

AI and Edge Computing Integration in 5G Processors

- The growing integration of artificial intelligence and edge computing capabilities into 5G processors is a transformative trend driving market innovation. These processors are being designed to handle real-time data analysis and intelligent decision-making at the network edge, significantly reducing latency and enhancing application performance across industries

- For instance, Qualcomm has introduced 5G processors integrated with AI acceleration features in its Snapdragon series, enabling advanced tasks such as real-time language translation, enhanced camera functions, and low-latency gaming. This demonstrates how manufacturers are embedding AI functionality into chipsets to improve user experiences and enable next-generation applications

- The integration of AI in 5G processors allows optimization across multiple functions, including power consumption, spectrum efficiency, and bandwidth allocation. Such intelligent processing helps improve network reliability and adaptability while supporting applications such as AR/VR, autonomous driving, and smart healthcare systems

- Edge computing functionality is further strengthening 5G processor demand by enabling localized data processing closer to end devices. This reduces network congestion and enhances the responsiveness of mission-critical applications, making it vital for sectors such as industrial automation and IoT ecosystems

- This trend is also advancing enterprise capabilities, as businesses leverage AI-enabled 5G processors to enhance real-time analytics and optimize operations in logistics, manufacturing, and cloud services. By combining speed, intelligence, and efficiency, these processors are central to digital transformation initiatives

- In summary, the merging of AI and edge computing within 5G processor designs is redefining performance standards. This development is creating new possibilities for high-demand applications while positioning 5G processors as critical enablers of the next wave of connected technologies

5G Processor Market Dynamics

Driver

Rapid 5G Network Expansion

- The rapid expansion of global 5G networks is a primary driver for the 5G processor market. As telecom operators continue large-scale rollouts of 5G infrastructure, there is a growing need for highly capable processors to support improved connectivity, low latency, and higher data throughput

- For instance, MediaTek has launched its Dimensity line of 5G chipsets, designed to support new-generation devices across mid-range and premium markets. This expansion reflects how growing network rollouts are directly creating opportunities for processor manufacturers to diversify offerings across geographies and price levels

- The adoption of 5G-enabled devices is rising significantly among consumers due to its superior speed and connectivity benefits. Smartphones, laptops, and IoT devices equipped with 5G processors are quickly becoming mainstream, further accelerating demand for advanced chipsets

- The use of 5G technology in multiple industries, including healthcare, automotive, and industrial automation, is creating strong demand for processors that can handle high-bandwidth data-intensive applications. This cross-sector expansion broadens market opportunities for chipset producers globally

- In conclusion, the accelerated pace of 5G network deployment and its wide range of industrial and consumer applications are ensuring sustained demand for processors. This driver will continue to fuel innovation and growth in the 5G processor market for the foreseeable future

Restraint/Challenge

High R&D and Manufacturing Complexity

- The high R&D and manufacturing complexity associated with 5G processors remains a major challenge for the market. Designing chipsets with integrated AI and edge computing capabilities requires cutting-edge semiconductor technologies, advanced architectures, and substantial financial investments

- For instance, companies such as Samsung and TSMC have acknowledged the heavy costs and technical hurdles involved in producing advanced 5nm and 3nm processors for 5G devices. These complexities limit the number of firms capable of competing, concentrating market power among a few large players

- The manufacturing of 5G processors demands specialized equipment, extreme precision, and highly skilled expertise. Minor defects can significantly impact processor performance, raising production risks and costs while reducing yield rates, especially in advanced fabrication nodes

- Furthermore, ongoing innovation pressures require companies to invest heavily in continuous R&D to remain competitive. This heightens long-term operational burdens, making it difficult for smaller players to enter the market or sustain growth against major semiconductor giants

- In conclusion, the complexity and high cost of manufacturing advanced 5G processors pose significant restraints to broader market growth. Overcoming this challenge will rely on breakthroughs in semiconductor design, collaborative innovation, and scaling production efficiencies to reduce costs while meeting performance expectations

5G Processor Market Scope

The market is segmented on the basis of spectrum and end user.

- By Spectrum

On the basis of spectrum, the 5G processor market is segmented into Gigabit LTE Spectrum and mmWave Spectrum. The Gigabit LTE Spectrum segment dominated the largest market revenue share of 62.9% in 2024, driven by its widespread adoption across existing 4G infrastructure and compatibility with a wide range of devices. This spectrum offers reliable high-speed connectivity with broad coverage, making it ideal for consumer electronics, smartphones, and telecommunication networks seeking incremental 5G upgrades without extensive infrastructure overhaul. The established ecosystem and interoperability with current LTE networks further enhance its adoption, making it a preferred choice among telecom operators and device manufacturers.

The mmWave Spectrum segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its ultra-high-speed data capabilities and low-latency performance. This spectrum is particularly suited for dense urban environments, industrial automation, and advanced IoT applications requiring real-time communication. The increasing deployment of 5G small cells and the rising demand for bandwidth-intensive applications, such as AR/VR and autonomous systems, are driving rapid adoption of mmWave-based 5G processors.

- By End User

On the basis of end user, the 5G processor market is segmented into Telecommunication, Manufacturing, IoT, Automotive, Consumers, and Others. The Telecommunication segment dominated the largest market revenue share in 2024, supported by the ongoing rollout of 5G networks and the high demand for network infrastructure upgrades. Telecom operators rely on advanced 5G processors to enable faster data transmission, reduce latency, and efficiently manage network traffic, making this segment a cornerstone of overall market growth. In addition, government initiatives and investments to expand 5G coverage globally have further reinforced the demand for telecom-focused processors.

The Automotive segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing integration of 5G processors in connected vehicles, autonomous driving systems, and vehicle-to-everything (V2X) communication. High-speed connectivity and real-time data processing are critical for advanced driver-assistance systems (ADAS), in-car infotainment, and smart fleet management. Rising consumer preference for connected and autonomous vehicles, combined with industry push toward intelligent transportation systems, is accelerating the adoption of 5G processors in the automotive sector.

5G Processor Market Regional Analysis

- North America dominated the 5G processor market with the largest revenue share in 2024, driven by the rapid deployment of 5G networks and strong adoption of connected devices across telecommunication and industrial sectors

- Consumers and enterprises in the region are increasingly demanding high-speed, low-latency connectivity for applications such as autonomous vehicles, smart factories, and IoT ecosystems

- This widespread adoption is further supported by advanced infrastructure, high R&D investment, and favorable government policies promoting 5G technology, establishing 5G processors as a critical component across multiple end-user segments

U.S. 5G Processor Market Insight

The U.S. 5G processor market captured the largest revenue share in North America in 2024, fueled by rapid adoption of 5G-enabled devices and continuous upgrades in telecom infrastructure. The increasing demand for high-performance mobile devices, cloud computing, and edge processing is propelling market growth. Moreover, the integration of AI and machine learning capabilities within 5G processors for smart applications, alongside strong collaboration between chip manufacturers and telecom operators, is further driving market expansion.

Europe 5G Processor Market Insight

The Europe 5G processor market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by government initiatives to deploy 5G networks and increasing adoption across telecommunication, automotive, and industrial sectors. The growing need for ultra-fast connectivity and low-latency processing is encouraging the adoption of advanced 5G processors. Countries such as Germany, the U.K., and France are witnessing significant growth due to investments in smart manufacturing, connected vehicles, and IoT infrastructure, fostering the integration of 5G processors in both commercial and consumer applications.

U.K. 5G Processor Market Insight

The U.K. 5G processor market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding 5G network coverage and rising adoption in automotive, telecom, and IoT applications. Increasing demand for edge computing and cloud-based services is further boosting market growth. Robust investment in smart city initiatives and connected infrastructure is supporting the adoption of 5G processors across enterprise and consumer segments.

Germany 5G Processor Market Insight

The Germany 5G processor market is expected to expand at a considerable CAGR during the forecast period, fueled by strong government support for digital transformation and the proliferation of Industry 4.0 initiatives. High investment in connected manufacturing, automotive telematics, and smart infrastructure is driving demand for high-performance 5G processors. The integration of 5G technology with AI-driven analytics and IoT devices in industrial and commercial applications is accelerating market growth.

Asia-Pacific 5G Processor Market Insight

The Asia-Pacific 5G processor market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The growing deployment of 5G networks, coupled with increasing adoption of smartphones, connected devices, and IoT applications, is driving demand for 5G processors. Government initiatives promoting digital infrastructure, smart cities, and Industry 4.0 adoption are further supporting market growth, making Asia-Pacific a hub for both manufacturing and consumption of advanced 5G processors.

Japan 5G Processor Market Insight

The Japan 5G processor market is gaining momentum due to the country’s strong technological ecosystem, early adoption of 5G networks, and increasing demand for connected devices. Applications such as autonomous vehicles, smart factories, and advanced robotics are driving processor adoption. Moreover, Japan’s aging population is boosting the demand for smart healthcare solutions and home automation systems that rely on 5G connectivity, further expanding the market.

China 5G Processor Market Insight

The China 5G processor market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid 5G network rollout, high smartphone penetration, and strong domestic chip manufacturing capabilities. China is at the forefront of adopting smart cities, industrial IoT, and connected automotive solutions, which rely heavily on 5G processors. The presence of leading domestic semiconductor companies, coupled with government support for advanced digital infrastructure, is driving widespread adoption across both consumer and enterprise sectors.

5G Processor Market Share

The 5G processor industry is primarily led by well-established companies, including:

- AT&T (U.S.)

- Deutsche Telekom AG (Germany)

- Verizon (U.S.)

- Samsung (South Korea)

- Apple Inc. (U.S.)

- HiSilicon (China)

- Unisoc (China)

- Intel Corporation (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Advanced Micro Devices, Inc. (U.S.)

- MediaTek Inc. (Taiwan)

- Arm Limited (U.K.)

- Imagination Technologies Limited (U.K.)

- NVIDIA Corporation (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Broadcom (U.S.)

- u-blox (Switzerland)

Latest Developments in Global 5G Processor Market

- In September 2025, Samsung introduced the Galaxy F17 5G in India, expanding its F-series lineup. Priced from ₹13,999, the device features a 7.5mm slim design, Corning Gorilla Glass Victus for durability, and a 50MP camera. It also offers a 5,000mAh battery and promises six years of OS and security updates. This launch strengthens Samsung's position in the budget 5G segment, appealing to consumers seeking durability and long-term software support

- In August 2025, Honor launched the X7c 5G in India, targeting the budget-conscious segment. Priced at ₹14,999, it boasts a 6.8-inch FHD+ display, Snapdragon 4 Gen 2 chipset, and a 5,200mAh battery. The device's 120Hz refresh rate and large display cater to users seeking an immersive viewing experience at an affordable price point, expanding Honor’s reach in India’s growing 5G market

- In April 2025, OPPO India unveiled the K13 5G, emphasizing "Overpowered" performance. Priced between ₹17,999 and ₹19,999, it features a 7,000mAh battery, Snapdragon 6 Gen 4 processor, and a 120Hz AMOLED display. The device’s robust battery and performance capabilities make it suitable for power users and gamers seeking reliable 5G connectivity, further solidifying OPPO’s market presence

- In July 2024, Qualcomm hosted the 'Snapdragon for India' event in Delhi, highlighting its commitment to enhancing 5G accessibility and AI-powered devices in the Indian market. The event featured discussions on the scope of 5G in India and the challenges consumers face in adoption. Qualcomm’s initiatives aim to drive innovation and expand 5G access, supporting ecosystem growth and accelerating market penetration

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global 5g Processor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global 5g Processor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global 5g Processor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.