Global 5g Service Market

Market Size in USD Billion

CAGR :

%

USD

132.06 Billion

USD

1,104.05 Billion

2024

2032

USD

132.06 Billion

USD

1,104.05 Billion

2024

2032

| 2025 –2032 | |

| USD 132.06 Billion | |

| USD 1,104.05 Billion | |

|

|

|

|

5G Service Market Size

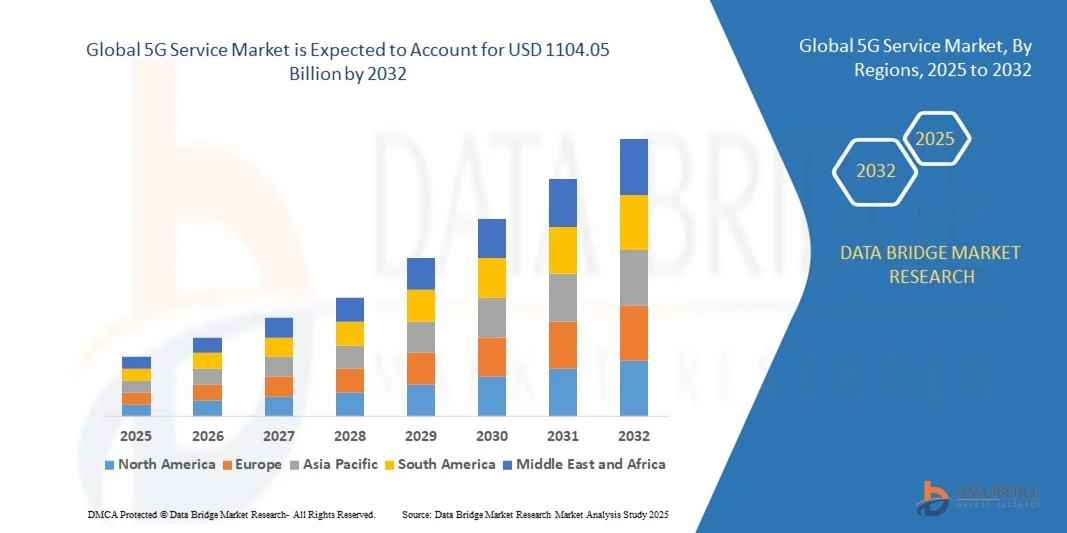

- The global 5G service market size was valued at USD 132.06 billion in 2024 and is expected to reach USD 1104.05 billion by 2032, at a CAGR of 30.40% during the forecast period

- The market growth is largely fueled by the rapid deployment of 5G networks and the increasing adoption of high-speed mobile broadband across both urban and rural areas, enabling faster data transmission and low-latency connectivity for consumers and enterprises

- Furthermore, rising demand for connected devices, IoT applications, autonomous systems, and enhanced mobile experiences is driving telecom operators to expand 5G coverage and introduce innovative services, thereby accelerating market growth

5G Service Market Analysis

- 5G services provide ultra-fast data speeds, low latency, and massive device connectivity, supporting applications such as IoT, AR/VR, smart cities, and industrial automation

- The increasing reliance on data-intensive applications, coupled with growing smartphone penetration and enterprise digitalization, is significantly boosting demand for 5G services worldwide

- Asia-Pacific dominated the 5G service market with a share of 41.8% in 2024, due to rapid adoption of advanced mobile technologies, growing smartphone penetration, and significant investments in 5G network infrastructure

- North America is expected to be the fastest growing region in the 5G service market during the forecast period due to increasing enterprise adoption, high consumer demand for mobile broadband, and robust 5G infrastructure investments

- eMBB segment dominated the market with a market share of 39.91% in 2024, due to the surging demand for high-speed mobile data, HD video streaming, and immersive applications such as AR/VR. Its ability to provide ultra-fast connectivity and high network capacity makes it a preferred choice for urban and densely populated regions. Telecom operators are increasingly prioritizing eMBB deployments to enhance customer experience and support next-generation applications. The segment’s compatibility with a wide range of devices, from smartphones to tablets and laptops, further reinforces its market dominance

Report Scope and 5G Service Market Segmentation

|

Attributes |

5G Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

5G Service Market Trends

Expansion of Private 5G Networks for Enterprises

- The 5G service market is rapidly evolving with a significant shift toward private 5G network deployments tailored for enterprise environments. These private networks offer enhanced control, security, and reliability, addressing specific operational needs across industries such as manufacturing, logistics, healthcare, and smart campuses

- For instance, Infosys reported a growing adoption of private 5G in mid-market enterprises, with solutions implemented in sectors including mining and utilities for automation and real-time operations. Companies such as Ericsson and Nokia are expanding private 5G portfolios, enabling enterprises to harness low-latency connectivity and network customization for mission-critical applications

- Private 5G networks facilitate seamless integration with AI, IoT, and edge computing technologies, enabling enterprises to process data locally with minimal latency. This supports advanced use cases such as predictive maintenance, robotics, and autonomous vehicles while ensuring data privacy and network independence

- Regulatory progress in spectrum allocation, such as the Citizens Broadband Radio Service (CBRS) in the U.S. and dedicated spectrum bands internationally, is reducing barriers to entry for private 5G deployments. Simplified models such as network-in-a-box and 5G as a Service (5GaaS) are further accelerating adoption by lowering complexity and cost

- The emergence of generative AI and edge-enabled applications is amplifying demand for private 5G’s reliable high-speed connectivity, supporting real-time AI inference at the edge. This synergy is driving over 2,700 private 5G deployments globally by the end of 2024, with enterprises increasingly viewing private 5G as a strategic asset for digital transformation

- The continuing expansion of private 5G networks highlights a fundamental market evolution, where dedicated wireless infrastructure becomes a critical enabler of enterprise innovation, operational resilience, and bespoke connectivity solutions

5G Service Market Dynamics

Driver

Rising Demand for High-Speed, Low-Latency Connectivity

- The surge in demand for ultra-fast and low-latency networks across industries is a primary driver for 5G service growth. Applications such as autonomous vehicles, smart manufacturing, immersive media, and IoT ecosystems require reliable, high-capacity connectivity with minimal delay to function effectively

- For instance, manufacturing companies are deploying private 5G to enable real-time communication between robotics, AI-enabled quality control systems, and digital twins, improving production efficiency and reducing downtime. Logistics firms utilize high-speed 5G connectivity for precise asset tracking, automated inventory management, and enhanced supply chain transparency

- The proliferation of connected devices and the rise of data-intensive applications drive the need for scalable networks that support simultaneous high-bandwidth use cases without compromising performance. 5G networks provide the speed and reliability essential for critical operations and innovative service delivery

- Governments and telecom operators are investing heavily in 5G infrastructure upgrades to meet growing consumer and enterprise expectations. This investment fuels continuous advancements in network capability and coverage, increasing adoption rates across diverse sectors

- The inherent capability of 5G to deliver multi-gigabit speeds with ultra-low latency underpins its transformative role in enabling new technologies and business models. Consequently, high-speed and low-latency connectivity requirements reinforce sustained expansion in the 5G service market

Restraint/Challenge

High Infrastructure Deployment Costs

- The substantial costs associated with 5G network infrastructure deployment remain a key challenge for widespread market penetration. This includes expenses related to new base stations, fiber backhaul, spectrum acquisition, and the integration of advanced technologies such as Massive MIMO and edge computing

- For instance, enterprises considering private 5G face high upfront capital expenditures to build and maintain dedicated infrastructure, including spectrum licensing fees and specialized hardware installation. Small and mid-sized businesses often find these costs prohibitive, delaying or limiting adoption despite the potential benefits

- Deploying 5G infrastructure in dense urban areas or challenging terrains also involves significant logistical complexity and regulatory hurdles, increasing project timelines and expenses. In addition, maintaining and upgrading infrastructure to keep pace with evolving standards adds to ongoing operational costs

- Cost constraints drive some organizations to prefer managed or hybrid network models, which can provide partial relief but also introduce dependencies on third parties. The high investment threshold creates disparity in 5G adoption rates between large enterprises and smaller players

- In conclusion, while 5G offers transformative connectivity benefits, the high cost of infrastructure deployment is a major restraint. Innovations in cost-sharing models, regulatory support for spectrum access, and technology advancements aimed at reducing deployment complexity are essential to broaden market access and sustain growth

5G Service Market Scope

The market is segmented on the basis of communication types, end-users, and enterprises.

- By Communication Types

On the basis of communication types, the 5G service market is segmented into Fixed Wireless Access (FWA), enhanced Mobile Broadband (eMBB), Ultra-Reliable Low Latency Communications (URLLC), and Massive Machine-Type Communications (MMTC). The eMBB segment dominated the largest market revenue share of 39.91% in 2024, driven by the surging demand for high-speed mobile data, HD video streaming, and immersive applications such as AR/VR. Its ability to provide ultra-fast connectivity and high network capacity makes it a preferred choice for urban and densely populated regions. Telecom operators are increasingly prioritizing eMBB deployments to enhance customer experience and support next-generation applications. The segment’s compatibility with a wide range of devices, from smartphones to tablets and laptops, further reinforces its market dominance.

The FWA segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the need for broadband connectivity in rural and underserved areas. FWA leverages 5G’s high-speed wireless networks to deliver home and office internet access without the need for extensive fiber infrastructure. Rising adoption in developing regions and the increasing availability of affordable 5G CPE (Customer Premises Equipment) devices contribute to its rapid uptake. Moreover, FWA services are gaining traction as an alternative to fixed-line broadband, providing flexible and scalable internet solutions.

- By End Users

On the basis of end users, the 5G service market is segmented into consumers and enterprises. The consumer segment dominated the largest market revenue share in 2024, driven by the exponential growth of mobile data consumption, high-definition video streaming, gaming, and smart device connectivity. Consumers increasingly demand seamless, high-speed, and low-latency connections, making 5G a key enabler for next-generation digital experiences. The proliferation of 5G-enabled smartphones and devices, coupled with telecom operators’ extensive network expansions, further strengthens consumer adoption.

The enterprise segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the integration of 5G in industrial automation, smart manufacturing, healthcare, and logistics. Enterprises are leveraging 5G to enhance operational efficiency, real-time monitoring, and data-driven decision-making. The low latency, high reliability, and enhanced bandwidth offered by 5G networks enable innovative enterprise applications, including remote robotics, IoT-driven operations, and cloud-based solutions.

- By Enterprises

On the basis of enterprise applications, the 5G service market is segmented into distributors, traders, and dealers; manufacturing; energy and utilities; media and entertainment; government; transportation and logistics; healthcare; and others. The manufacturing segment dominated the largest market revenue share in 2024, driven by the adoption of 5G-enabled automation, smart factories, and predictive maintenance. 5G networks allow manufacturers to achieve real-time monitoring, remote operation of machinery, and seamless connectivity across production lines, improving efficiency and reducing downtime. The integration of 5G with IoT, AI, and AR/VR technologies further strengthens the sector’s digital transformation and competitiveness.

The transportation and logistics segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing need for connected fleet management, autonomous vehicles, and smart warehousing solutions. 5G enables real-time tracking, route optimization, and enhanced communication between vehicles and infrastructure, driving efficiency and reducing operational costs. The rising adoption of smart city initiatives and last-mile delivery solutions also contributes to rapid growth in this segment.

5G Service Market Regional Analysis

- Asia-Pacific dominated the 5G service market with the largest revenue share of 41.8% in 2024, driven by rapid adoption of advanced mobile technologies, growing smartphone penetration, and significant investments in 5G network infrastructure

- The region’s supportive regulatory frameworks, government-led digitalization initiatives, and strong presence of telecom operators are accelerating market growth

- In addition, rising demand for high-speed connectivity in both urban and semi-urban areas, coupled with growing enterprise adoption of digital solutions, is contributing to increased 5G service deployment across the region

China 5G Service Market Insight

China held the largest share in the Asia-Pacific 5G service market in 2024, owing to its leadership in 5G network rollout, substantial telecom infrastructure investments, and early adoption of 5G-enabled devices. The country’s strong government support for next-generation connectivity, robust industrial digitization, and focus on smart city and IoT initiatives are major growth drivers. Demand is further strengthened by the proliferation of eMBB applications, fixed wireless access solutions, and consumer adoption of high-speed mobile internet.

India 5G Service Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding smartphone penetration, government initiatives to enhance digital infrastructure, and increasing enterprise adoption of 5G services. The rollout of 5G networks in major cities, along with growing investments in telecom infrastructure and affordable 5G-enabled devices, is accelerating market expansion. Rising demand for high-speed mobile broadband, e-commerce, and cloud-based enterprise applications is further supporting rapid adoption of 5G services.

Europe 5G Service Market Insight

The Europe 5G service market is expanding steadily, supported by strong regulatory frameworks, growing investments in network modernization, and increasing adoption of industrial and enterprise 5G applications. Countries in the region emphasize high-quality connectivity, low-latency networks, and integration with IoT and Industry 4.0 initiatives. Increasing demand for enhanced mobile broadband, remote monitoring solutions, and smart city projects is further enhancing market growth.

Germany 5G Service Market Insight

Germany’s 5G service market is driven by its leadership in industrial automation, strong telecom infrastructure, and early adoption of smart manufacturing solutions. The country has well-established R&D networks and collaborations between enterprises and research institutions, fostering innovation in 5G applications. Demand is particularly strong for eMBB and URLLC solutions supporting connected factories, autonomous vehicles, and digital enterprise solutions.

U.K. 5G Service Market Insight

The U.K. market is supported by mature telecom networks, government initiatives for nationwide 5G coverage, and rising adoption of enterprise 5G applications. With a focus on digital transformation, smart city projects, and enhanced mobile broadband services, the U.K. continues to expand 5G infrastructure. Increasing collaboration between tech companies and enterprises for low-latency and high-speed connectivity solutions is driving market growth.

North America 5G Service Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing enterprise adoption, high consumer demand for mobile broadband, and robust 5G infrastructure investments. The region’s focus on smart cities, autonomous vehicles, and Industry 4.0 adoption is boosting demand for reliable and high-speed 5G services. In addition, rising investments by telecom operators in network densification and 5G-enabled devices are accelerating market expansion.

U.S. 5G Service Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its strong telecom infrastructure, widespread adoption of 5G-enabled devices, and high consumer demand for ultra-fast connectivity. The country’s focus on enterprise digital transformation, government support for next-generation networks, and early adoption of advanced 5G applications in healthcare, manufacturing, and logistics are major growth drivers. Presence of leading telecom operators and ongoing network upgrades further solidify the U.S.'s leading position in the region.

5G Service Market Share

The 5G service industry is primarily led by well-established companies, including:

- AT&T Intellectual Property (U.S.)

- China Mobile Limited (China)

- SK Telecom Co., Ltd. (South Korea)

- Verizon (U.S.)

- BT Group (U.K.)

- Deutsche Telekom AG (Germany)

- T-Mobile (U.S.)

- China Telecom Global Limited (China)

- Orange S.A. (France)

- Vodafone Group (U.K.)

- China Unicom (Hong Kong) Limited (China)

- Telstra Corporation Limited (Australia)

- Telefonica S.A. (Spain)

- KT Corp. (South Korea)

- Rogers Corporation (Canada)

- Bell Canada (Canada)

- Etisalat (U.A.E.)

- Saudi Telecom Company (Saudi Arabia)

- LG Uplus Corp. (South Korea)

- NTT DOCOMO (Japan)

- KDDI Corporation (Japan)

- Telus Communications Inc. (Canada)

Latest Developments in Global 5G Service Market

- In March 2025, ZTE partnered with China Mobile to unveil two key advancements—‘Communication-Sensing-Computing-Intelligence’ and ‘Ambient IoT’—as part of its latest innovations in 5G-A. This collaboration is expected to strengthen ZTE’s leadership in advanced 5G solutions, enhancing network intelligence and expanding IoT capabilities, which will drive adoption of next-generation services and open new monetization opportunities in the Asia-Pacific 5G market

- In February 2025, Bharti Airtel collaborated with Ericsson to deploy advanced 5G Core technology, marking a significant step toward a full-scale 5G Standalone (SA) network in India. This partnership aims to increase Airtel's network capacity, support network slicing, and enable API exposure, allowing enterprises and consumers to access innovative services. The move is poised to accelerate 5G adoption in India and strengthen Airtel’s competitive position in the enterprise and consumer 5G segments

- In October 2024, SK Telecom partnered with Samsung to enhance 5G connectivity through AI-powered improvements. Utilizing Samsung’s AI-RAN Parameter Recommender, SK Telecom can optimize base station settings based on analyzed mobile network data. This initiative is expected to improve network efficiency and reliability, enhance customer experience, and position SK Telecom as a leader in intelligent 5G solutions within South Korea’s competitive telecom market

- In September 2023, China Mobile and Indosat Ooredoo Hutchison collaborated to develop strategies for expanding 5G services into new and existing markets. This partnership is expected to boost market penetration, enhance service offerings, and accelerate monetization of 5G across Southeast Asia, creating opportunities for both carriers to capture new revenue streams and strengthen regional 5G leadership

- In September 2023, Vodafone partnered with Nokia to introduce Open RAN in Italy through a pilot program. The carrier completed a series of 4G calls over shared commercial network sites in Romania, highlighting progress toward more flexible and cost-efficient network deployments. This development is expected to influence broader European adoption of Open RAN, improve network scalability, and support innovation in multi-vendor 5G ecosystems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.