Global 6g Market

Market Size in USD Billion

CAGR :

%

USD

1.48 Billion

USD

6.14 Billion

2025

2033

USD

1.48 Billion

USD

6.14 Billion

2025

2033

| 2026 –2033 | |

| USD 1.48 Billion | |

| USD 6.14 Billion | |

|

|

|

|

6G Market Size

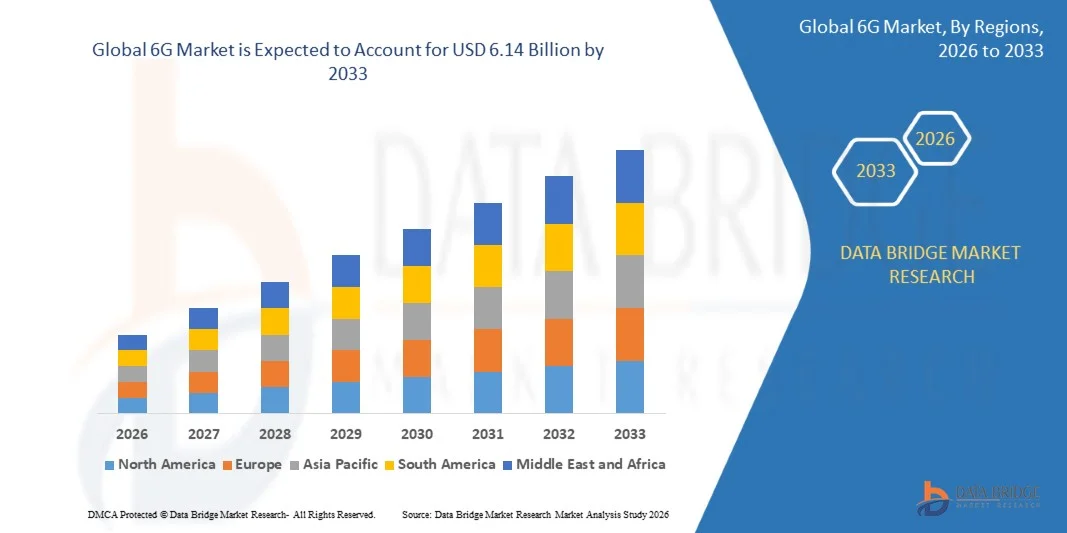

- The global 6G market size was valued at USD 1.48 billion in 2025 and is expected to reach USD 6.14 billion by 2033, at a CAGR of 59.30% during the forecast period

- The market growth is largely fuelled by increasing demand for ultra-high-speed wireless communication, rising adoption of smart devices, and expansion of AI-driven and IoT-enabled applications across industries

- Growing investments in research and development by telecom operators, government initiatives for next-generation networks, and rising focus on digital infrastructure modernization are accelerating 6G deployment

6G Market Analysis

- The 6G market is witnessing rapid technological advancements aimed at achieving terabit-level data speeds, ultra-low latency, and enhanced network reliability to support next-generation applications

- Rising global adoption of smart devices, IoT, AI, and Industry 4.0 initiatives is driving demand for high-performance 6G networks across sectors such as healthcare, automotive, manufacturing, and entertainment

- North America dominated the 6G market with the largest revenue share in 2025, driven by early investments in next-generation wireless infrastructure, increasing adoption of IoT devices, and government support for advanced telecommunications research

- Asia-Pacific region is expected to witness the highest growth rate in the global 6G market, driven by increasing smartphone penetration, rising demand for high-speed connectivity, and growing industrial adoption of IoT and smart city initiatives

- The Terahertz Communication segment held the largest market revenue share in 2025, driven by its ultra-high-speed data transmission capabilities and extremely low latency, making it ideal for mission-critical applications and high-capacity network requirements. Terahertz technology enables seamless connectivity for autonomous systems, immersive XR, and smart city infrastructures, supporting next-generation wireless communication

Report Scope and 6G Market Segmentation

|

Attributes |

6G Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

6G Market Trends

“Rise of Ultra-High-Speed Wireless Networks”

- The growing development of 6G technology is transforming the telecommunications landscape by enabling ultra-high-speed, low-latency, and highly reliable wireless communication. This allows seamless connectivity for advanced applications such as autonomous vehicles, smart cities, and immersive virtual environments, enhancing operational efficiency and user experience. In addition, 6G networks are expected to support holographic communications and next-generation XR applications, opening new avenues for immersive experiences and enterprise solutions

- Increasing demand for real-time data transmission and next-generation applications in sectors such as healthcare, manufacturing, and defense is accelerating the adoption of 6G networks. These networks support AI-driven analytics, IoT integration, and advanced automation, which are critical for industrial digital transformation. The ability to transmit massive volumes of data with near-zero latency enables smarter predictive maintenance, remote surgeries, and autonomous industrial processes

- The ease of integrating 6G with existing 5G and IoT infrastructure is making it attractive for both telecom operators and enterprise users. This interoperability supports smooth network upgrades, faster deployment, and improved service quality across regions. Operators can leverage existing spectrum and hardware investments while offering enhanced services for enterprise, smart city, and consumer applications

- For instance, in 2023, several telecom operators in North America and Europe conducted pilot 6G networks to test ultra-low-latency communication for autonomous drones and connected industrial machinery, demonstrating enhanced network performance and reliability. These pilots also assessed energy efficiency, security protocols, and high-density device management, highlighting practical benefits for large-scale deployment

- While 6G technology promises transformative connectivity, its market impact depends on regulatory approvals, spectrum allocation, and ongoing R&D. Operators and equipment manufacturers must focus on infrastructure development, standardization, and strategic partnerships to fully leverage emerging opportunities. Early collaboration with governments and industry consortia is critical to accelerate commercialization and build a sustainable 6G ecosystem

6G Market Dynamics

Driver

“Rising Demand for Next-Generation Connectivity and IoT Integration”

- Growing adoption of IoT devices, autonomous systems, and AI-driven solutions is driving the demand for high-performance 6G networks capable of supporting massive data throughput and ultra-low latency. These networks enable complex machine-to-machine communication, real-time analytics, and seamless integration of AI-enabled systems across multiple sectors

- Enterprises and governments are increasingly investing in smart infrastructure, digital twin technologies, and real-time analytics, prompting telecom providers to deploy advanced 6G solutions that enhance operational efficiency and connectivity. The networks also support energy-efficient operations and predictive monitoring, reducing costs and downtime in critical applications

- Expanding use cases in healthcare, transportation, and industrial automation are fueling the need for 6G networks, as these sectors require reliable, high-speed communication for critical applications. 6G also facilitates large-scale adoption of autonomous vehicles, smart factories, and AR/VR solutions, driving innovation and boosting economic productivity

- For instance, in 2022, multiple North American and European research institutions collaborated with telecom providers to test 6G networks for real-time autonomous vehicle navigation and AI-enabled factory automation, accelerating deployment timelines. These tests validated network resilience under extreme data loads and provided insights for industrial-grade 6G solutions

- While industrial adoption is a key growth driver, challenges such as high infrastructure costs, spectrum allocation, and standardization need to be addressed to sustain market expansion. Collaborative approaches involving private and public sectors are necessary to accelerate network rollout and support large-scale enterprise applications

Restraint/Challenge

“High Deployment Costs and Regulatory Complexities”

- The high cost of developing and deploying 6G infrastructure, including advanced base stations, satellites, and network equipment, limits adoption among smaller telecom providers and developing regions. Investments in research, testing, and pilot programs are capital-intensive, creating barriers for early market entrants

- Regulatory hurdles, spectrum allocation issues, and international standardization challenges create delays in large-scale 6G rollouts. Different countries’ policies, licensing requirements, and compliance standards add complexity, requiring extensive coordination among global telecom operators and regulatory authorities

- Limited availability of compatible devices and initial technological uncertainties may restrict early adoption, especially in cost-sensitive markets and regions with underdeveloped digital infrastructure. Device manufacturers also face challenges in producing high-speed 6G-compatible modems, sensors, and terminals at scale

- For instance, in 2023, telecom operators in APAC and Africa reported slower 6G pilot deployments due to spectrum licensing delays and budget constraints, impacting initial commercialization timelines. These delays highlighted the need for standardized protocols and multi-stakeholder partnerships to streamline deployment

- While research and innovation continue to enhance 6G capabilities, manufacturers and operators must focus on cost optimization, regulatory alignment, infrastructure sharing, and collaborative development strategies to unlock the full market potential. Investment in training, cybersecurity, and ecosystem readiness will also be critical for successful commercialization

6G Market Scope

The 6G market is segmented on the basis of technology, application, end use, and network type.

• By Technology

On the basis of technology, the 6G market is segmented into Terahertz Communication, Massive MIMO, Advanced Antenna Systems, and Optical Wireless Communication. The Terahertz Communication segment held the largest market revenue share in 2025, driven by its ultra-high-speed data transmission capabilities and extremely low latency, making it ideal for mission-critical applications and high-capacity network requirements. Terahertz technology enables seamless connectivity for autonomous systems, immersive XR, and smart city infrastructures, supporting next-generation wireless communication.

The Massive MIMO segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to improve spectral efficiency, enhance network capacity, and support multi-user environments. Massive MIMO systems are increasingly adopted for dense urban deployments and high-traffic enterprise networks, offering reliable coverage and efficient handling of massive IoT devices, which is crucial for 6G network scalability and performance.

• By Application

On the basis of application, the 6G market is segmented into Autonomous Vehicles, Smart Cities, Augmented Reality, Healthcare, and Industrial Automation. The Smart Cities segment held the largest share in 2025, fueled by the growing demand for connected infrastructure, intelligent transport systems, and IoT-enabled urban management. 6G enables real-time monitoring, predictive maintenance, and efficient resource allocation, enhancing operational efficiency and citizen services.

The Autonomous Vehicles segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the need for ultra-low-latency communication, high reliability, and real-time data processing for connected and autonomous vehicles. 6G networks support vehicle-to-everything (V2X) communication, enabling safer roads and improved traffic management, and accelerating adoption in automotive and mobility sectors.

• By End Use

On the basis of end use, the 6G market is segmented into Telecommunications, Transportation, Healthcare, and Manufacturing. The Telecommunications segment held the largest revenue share in 2025, driven by massive infrastructure investments, the rollout of pilot networks, and the need for high-capacity backbone networks. 6G facilitates enhanced mobile broadband, ultra-reliable low-latency communications, and massive machine-type communications, addressing evolving telecom demands.

The Healthcare segment is expected to witness the fastest growth rate from 2026 to 2033, driven by telemedicine, remote surgeries, and AI-assisted diagnostics requiring high-speed, low-latency connections. 6G networks enable secure and real-time transmission of large medical data sets, improving patient care and operational efficiency across hospitals and research centers.

• By Network Type

On the basis of network type, the 6G market is segmented into Private Networks, Public Networks, and Hybrid Networks. The Public Networks segment held the largest market share in 2025, fueled by national infrastructure initiatives, government-supported deployments, and widespread adoption for consumer and enterprise connectivity. Public 6G networks provide high-speed coverage, reliability, and interoperability for multiple sectors.

The Private Networks segment is expected to witness the fastest growth rate from 2026 to 2033, driven by industrial automation, enterprise IoT deployments, and secure, dedicated connectivity requirements. Private 6G networks offer enhanced data security, reduced latency, and tailored network management, making them essential for mission-critical operations and smart enterprise ecosystems.

6G Market Regional Analysis

- North America dominated the 6G market with the largest revenue share in 2025, driven by early investments in next-generation wireless infrastructure, increasing adoption of IoT devices, and government support for advanced telecommunications research

- Consumers and enterprises in the region highly value ultra-low latency, high-speed connectivity, and seamless integration of 6G networks with existing 5G infrastructure, supporting smart cities, autonomous vehicles, and industrial automation applications

- This widespread adoption is further supported by robust R&D capabilities, high disposable incomes, and strong private and public sector collaboration, establishing North America as a key hub for 6G innovation and deployment

U.S. 6G Market Insight

The U.S. 6G market captured the largest revenue share in North America in 2025, fueled by early trials, government funding for 6G research, and the growing need for high-speed, low-latency wireless communication. Enterprises and telecom operators are investing in pilot networks to test applications in autonomous vehicles, smart factories, and AR/VR environments. The U.S.’s advanced technology ecosystem and emphasis on standardization and spectrum allocation further propel 6G development, positioning the country as a global leader in next-generation connectivity.

Europe 6G Market Insight

The Europe 6G market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent regulatory frameworks, strong governmental support for 6G research, and increasing deployment of smart city infrastructure. Rising urbanization and industrial automation demand are fostering the adoption of high-speed wireless networks. European countries are also emphasizing sustainable and energy-efficient network solutions, enhancing the adoption of 6G across residential, commercial, and industrial applications.

U.K. 6G Market Insight

The U.K. 6G market is expected to witness the fastest growth rate from 2026 to 2033, propelled by government-led initiatives in next-generation connectivity, smart infrastructure projects, and rising demand for ultra-reliable low-latency communications. Businesses and municipalities are adopting 6G-enabled applications in autonomous transport, AR/VR services, and industrial automation. The U.K.’s robust telecom ecosystem and strong e-governance frameworks are expected to accelerate market growth.

Germany 6G Market Insight

The Germany 6G market is expected to witness the fastest growth rate from 2026 to 2033, supported by the country’s focus on digital transformation, Industry 4.0 initiatives, and high-tech manufacturing sectors. Germany’s well-developed infrastructure and emphasis on secure, energy-efficient, and advanced wireless technologies are driving adoption of 6G networks. Integration of 6G with IoT, AI, and industrial automation is becoming increasingly prevalent, meeting both commercial and public sector connectivity requirements.

Asia-Pacific 6G Market Insight

The Asia-Pacific 6G market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, increasing smartphone penetration, and government-backed 6G research programs in countries such as China, Japan, South Korea, and India. Rising industrial automation, smart city projects, and next-generation transport systems are fueling demand for 6G connectivity. APAC’s growing telecom manufacturing capabilities, combined with supportive policies, are enhancing network deployment and reducing costs, broadening access to next-generation wireless services.

Japan 6G Market Insight

The Japan 6G market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high-tech culture, government investment in 6G R&D, and focus on smart mobility and industrial automation. Adoption is driven by ultra-low-latency network requirements for autonomous vehicles, robotics, and immersive AR/VR applications. Japan’s integration of 6G with AI, IoT, and advanced manufacturing systems is enhancing operational efficiency and consumer adoption.

China 6G Market Insight

The China 6G market accounted for the largest revenue share in the Asia-Pacific region in 2025, attributed to strong government initiatives, rapid urbanization, and high technological adoption rates. China is investing heavily in 6G pilot networks for smart cities, industrial IoT, and autonomous transportation. The presence of domestic telecom giants and low-cost network deployment capabilities are driving widespread 6G adoption across both commercial and public sectors.

6G Market Share

The 6G industry is primarily led by well-established companies, including:

- Samsung Electronics Co., Ltd. (South Korea)

- Huawei Technologies Co., Ltd. (China)

- Nokia Corporation (Finland)

- Ericsson AB (Sweden)

- Qualcomm Technologies, Inc. (U.S.)

- ZTE Corporation (China)

- Intel Corporation (U.S.)

- NEC Corporation (Japan)

- Fujitsu Limited (Japan)

- British Telecommunications plc (U.K.)

Latest Developments in Global 6G Market

- In 2024, Ericsson announced plans to launch its 6G network, featuring advanced capabilities aimed at transforming high-speed connectivity and enabling next-generation applications. This development is expected to reshape the telecommunications landscape and drive innovation across global markets

- In 2025, NVIDIA partnered with telecom operators including Booz Allen Hamilton, T-Mobile, Cisco, MITRE, and ODC to develop an AI-native stack for 6G on the NVIDIA AI Aerial Platform. This collaboration aims to enhance network intelligence, improve efficiency, and accelerate the deployment of AI-driven 6G services

- In 2025, L&T Technology Services (LTTS) and Altier launched a 5G and 6G Wireless Center of Excellence in Bengaluru, India, targeting sectors such as automotive, healthcare, and manufacturing. The initiative is expected to boost research, innovation, and commercialization of next-generation wireless technologies

- In February 2024, the U.S., Australia, Canada, the Czech Republic, Finland, France, Japan, South Korea, Sweden, and the UK jointly endorsed a set of principles for 6G, promoting open, global, interoperable, reliable, resilient, and secure connectivity. This framework is expected to guide international 6G standardization and foster global collaboration

- In 2023, Nagoya University in Japan successfully fabricated three-dimensional niobium waveguides for 100 GHz frequency transmission, minimizing signal loss. This breakthrough supports high-frequency 6G communications and advances efficient, high-speed network infrastructure

- In January 2022, Purple Mountain Laboratories in China achieved a world-record data rate of 206.25 Gbit/s within the terahertz frequency band, forming the technological foundation for ultra-fast 6G cellular networks. This milestone demonstrates the potential for next-generation high-speed wireless connectivity and market acceleration

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.