Global Rice Milk Market

Market Size in USD Billion

CAGR :

%

USD

2.53 Billion

USD

4.58 Billion

2024

2032

USD

2.53 Billion

USD

4.58 Billion

2024

2032

| 2025 –2032 | |

| USD 2.53 Billion | |

| USD 4.58 Billion | |

|

|

|

|

Rice Milk Market Size

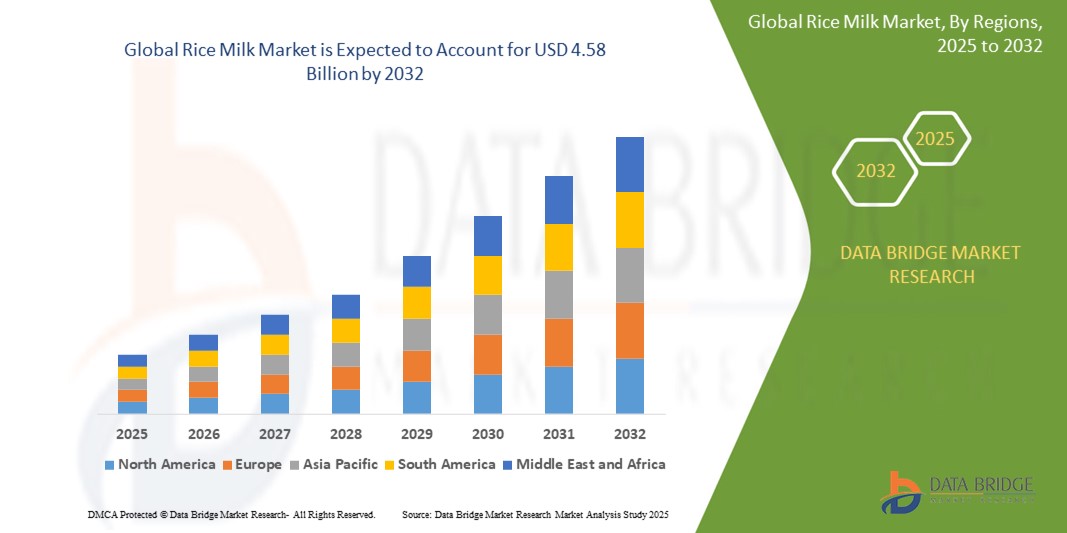

- The global Rice Milk market size was valued at USD 2.53 billion in 2024 and is expected to reach USD 4.58 billion by 2032, at a CAGR of 7.71% during the forecast period

- The market growth is largely fueled by rising health consciousness, increasing lactose intolerance, and the growing popularity of plant-based diets

- Furthermore, increasing consumer demand for dairy alternatives that are low in fat, cholesterol-free, and suitable for vegans is establishing rice milk as a preferred choice among health-conscious individuals. These factors are significantly boosting the adoption of rice milk, thereby accelerating the industry's growth

Rice Milk Market Analysis

- Rice milk, a plant-based dairy alternative made from milled rice and water, is becoming increasingly popular due to its hypoallergenic properties and suitability for vegans and individuals with lactose intolerance or nut allergies.

- The escalating demand for rice milk is primarily fueled by the growing health consciousness among consumers, rising adoption of vegan and vegetarian diets, and the increasing prevalence of lactose intolerance across the globe.

- North America dominates the rice milk market with the largest revenue share of 40.01% in 2025, supported by a well-established plant-based food industry, high consumer awareness about dairy alternatives, and widespread availability of rice milk products in retail and online channels. The U.S. leads regional growth due to strong demand from health-focused and environmentally conscious consumers.

- Asia-Pacific is expected to be the fastest-growing region in the rice milk market during the forecast period due to increasing urbanization, growing health awareness, and a cultural familiarity with rice-based diets. Countries like China, Japan, and India are seeing a surge in demand for non-dairy milk alternatives.

- The unflavored rice milk segment is expected to dominate the market with a share of 43.2% in 2025, driven by its versatility in cooking and baking, neutral taste preferred by health-conscious consumers, and lower sugar content compared to flavored varieties

Report Scope and Rice Milk Market Segmentation

|

Attributes |

Rice Milk Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rice Milk Market Trends

“Clean Label and Nutritional Fortification Driving Consumer Preference”

- A significant and accelerating trend in the global Rice Milk market is the growing consumer demand for clean-label, organic, and fortified plant-based beverages. Shoppers are increasingly scrutinizing ingredient lists and seeking products that are free from artificial additives, preservatives, and allergens.

- For instance, brands such as Earth’s Own and Pacific Foods are launching fortified rice milk products enriched with calcium, vitamin D, and B12 to address common nutrient deficiencies in dairy-free diets. This aligns with the broader clean eating movement, particularly among millennials and Gen Z consumers.

- Nutritional fortification also expands rice milk’s appeal among health-conscious and vegan consumers who want dairy alternatives that offer similar or enhanced functional benefits compared to traditional milk.

- Increasing awareness around dietary intolerances and sustainability is driving demand for rice milk, especially as it is naturally free from lactose, nuts, soy, and gluten.

- This trend toward transparency, health-forward formulation, and sustainability is fundamentally reshaping the product development and marketing strategies of rice milk brands.

- The demand for clean, fortified rice milk products is growing rapidly across retail channels globally, with consumers prioritizing both health benefits and ethical production practices.

Rice Milk Market Dynamics

Driver

“Growing Demand for Plant-Based Alternatives Amid Health and Environmental Awareness”

- The global rise in lactose intolerance, dairy allergies, and the popularity of vegan and flexitarian diets is significantly fueling the demand for rice milk as a safe, accessible, and plant-based dairy alternative.

- For example, Oatly and SunOpta are expanding their rice milk portfolios to cater to health-focused consumers seeking lower-fat, cholesterol-free alternatives with a reduced environmental footprint.

- Consumers are increasingly opting for rice milk due to its digestibility, mild flavor, and suitability for individuals with soy or nut allergies, widening its target market.

- Furthermore, the growing awareness of the environmental impact of traditional dairy farming is prompting consumers to switch to sustainable alternatives like rice milk, which has a comparatively lower carbon and water footprint.

- The rapid proliferation of plant-based products across retail chains, cafés, and foodservice outlets is also contributing to increased visibility and accessibility of rice milk in both developed and emerging markets.

Restraint/Challenge

“Nutritional Limitations and Competition from Other Plant-Based Milks”

- One major challenge in the rice milk market is its relatively low protein content compared to other plant-based options like soy or pea milk, which can deter health-conscious consumers seeking functional benefits.

- For instance, consumers looking to replace dairy milk entirely often turn to higher-protein alternatives, creating a competitive pressure on rice milk manufacturers to innovate and fortify their offerings.

- Additionally, rice milk contains higher natural sugars due to the enzymatic breakdown of rice starch, which may not appeal to individuals managing blood sugar levels or adhering to low-carb diets.

- Another significant challenge is the intense competition within the broader plant-based milk segment, where almond, oat, and soy milk currently dominate shelf space and consumer mindshare.

- To overcome these obstacles, brands must invest in product innovation—such as protein-enriched formulations and sugar-reduced options—while emphasizing rice milk’s hypoallergenic and sustainable advantages to retain and grow market share.

Rice Milk Market Scope

The market is segmented on the basis Form, Source, and Distribution Channel.

- By Form

On the basis of Form, the Rice Milk market is segmented into Powder Rice Milk and Fluid Rice Milk.

The Fluid Rice Milk segment dominates the largest market revenue share of 67.4% in 2025, driven by its widespread use as a direct dairy milk substitute in beverages, cereals, and cooking. Its ready-to-drink nature, availability in multiple flavor variants, and presence across both retail and foodservice channels make it a consumer favorite, especially among lactose-intolerant and vegan populations.

The Powder Rice Milk segment is anticipated to witness the fastest growth rate of 9.8% from 2025 to 2032, fueled by its longer shelf life, ease of transportation, and increasing demand from consumers in regions with limited refrigeration infrastructure. Its suitability for use in dry food formulations, meal kits, and infant nutrition further boosts its market potential.

- By Source

On the basis of Source, the Rice Milk market is segmented into Organic and Conventional.

The Conventional segment held the largest market revenue share in 2025, attributed to its competitive pricing, widespread availability, and strong presence in mainstream retail outlets. Conventional rice milk is often favored by price-sensitive consumers and in foodservice settings due to its affordability and bulk availability.

The Organic segment is expected to witness the fastest CAGR of 10.6% from 2025 to 2032, driven by rising consumer preference for clean-label, non-GMO, and pesticide-free products. Growing awareness of the health and environmental benefits of organic farming practices is encouraging premium shoppers and health-conscious individuals to choose certified organic rice milk options.

- By Distribution Channel

On the basis of Distribution Channel, the Rice Milk market is segmented into Supermarket/Hypermarket, Convenience Stores, Food Specialty Stores, Online Retailers, and Others.

The Supermarket/Hypermarket segment held the largest market revenue share in 2025, driven by the broad product assortment, in-store promotions, and high consumer footfall in physical retail environments. These stores offer a one-stop solution, where consumers can compare multiple brands and variants of rice milk in one location.

The Online Retailers segment is projected to witness the fastest CAGR of 12.1% during the forecast period, fueled by growing e-commerce penetration, the convenience of doorstep delivery, and the expanding digital presence of both legacy brands and new plant-based startups. Consumers increasingly prefer online channels for purchasing specialty rice milk products, including organic and allergen-free variants not always available in local stores.

Rice Milk Market Regional Analysis

- North America dominates the Rice Milk market with the largest revenue share of 40.01% in 2024, driven by a growing demand for plant-based dairy alternatives and increasing consumer awareness regarding lactose intolerance, veganism, and sustainability.

- Consumers in the region highly value the health benefits, clean-label ingredients, and low allergenic potential of rice milk, especially compared to soy or nut-based alternatives.

- This widespread adoption is further supported by high disposable incomes, health-conscious dietary trends, and the growing availability of rice milk products in supermarkets, organic food stores, and online platforms.

U.S. Rice Milk Market Insight

The U.S. Rice Milk market captured the largest revenue share of 81% within North America in 2025, fueled by a strong demand for non-dairy milk alternatives and an evolving food and beverage landscape centered around wellness. The increasing prevalence of lactose intolerance and dairy allergies, along with consumer preferences for plant-based, clean-label beverages, continue to propel the market. Moreover, U.S. brands are actively innovating with organic, flavored, and fortified rice milk variants to appeal to a broad demographic through both retail and foodservice channels.

Europe Rice Milk Market Insight

The European Rice Milk market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by consumer preference for sustainable, ethical, and allergen-free food products. The growing awareness around environmental impacts of dairy production is shifting consumer interest towards plant-based alternatives such as rice milk. The region also benefits from widespread veganism, especially in Western Europe, and governmental encouragement of sustainable food practices.

U.K. Rice Milk Market Insight

The U.K. Rice Milk market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of home automation and a desire for heightened security and convenience. Additionally, concerns regarding burglary and safety are encouraging both homeowners and businesses to choose keyless entry solutions. The UK’s embrace of connected devices, alongside its robust e-commerce and retail infrastructure, is expected to continue to stimulate market growth.

Germany Rice Milk Market Insight

The German Rice Milk market is expected to expand at a considerable CAGR during the forecast period, fueled by a health-oriented population, increasing demand for organic and sustainable products, and the rapid growth of the plant-based sector. Germany’s focus on eco-conscious consumerism and high standards for food safety and labeling are promoting the popularity of organic and minimally processed rice milk options. The presence of leading plant-based brands and ongoing product innovation also strengthen market growth.

Asia-Pacific Rice Milk Market Insight

The Asia-Pacific Rice Milk market is poised to grow at the fastest CAGR of over 24% in 2025, driven by rising health awareness, changing dietary preferences, and expanding urban populations in countries such as China, Japan, and India. As more consumers in the region shift away from traditional dairy due to lactose intolerance or environmental concerns, rice milk is gaining popularity due to its familiarity and cultural acceptability. The affordability of rice milk and its growing availability in both modern trade and online retail channels are also fueling its expansion.

Japan Rice Milk Market Insight

The Japan Rice Milk market is gaining momentum due to increasing health consciousness, widespread lactose intolerance, and a cultural inclination toward rice-based foods. With a mature functional food and beverage industry, Japanese consumers are embracing rice milk for its digestibility, low fat content, and suitability for traditional and modern applications. Innovation in packaging and flavor, along with integration into ready-to-drink formats and convenience store offerings, supports robust market development.

China Rice Milk Market Insight

The China Rice Milk market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s large lactose-intolerant population, growing plant-based food sector, and proactive government support for dairy alternatives. With a flourishing e-commerce ecosystem and rapidly expanding health food market, rice milk brands are increasingly reaching younger, urban consumers through innovative marketing and functional product offerings. Domestic production capabilities and cost-effective sourcing of rice also contribute to the market’s strong performance.

Rice Milk Market Share

The Rice Milk industry is primarily led by well-established companies, including:

- Blue Diamond Growers Inc. (U.S.)

- Earth’s Own Food Company Inc. (Canada)

- Eden Foods Inc. (U.S.)

- Grupo Leche Pascual S.A. (Spain)

- Freedom Foods (Australia) (Now known as Noumi Limited)

- Living Harvest Foods Inc. (U.S.)

- Nutriops S.L. (Spain)

- Oatly AB (Sweden)

- SunOpta Foods (Canada)

- Organic Valley Family of Farms (U.S.)

- Pacific Natural Foods (U.S.) (Now part of Campbell Soup Company)

- Panos Brands LLC (U.S.)

- Pure Harvest (U.S.)

- Sanitarium Health & Wellbeing Company (Australia)

- Streamicks Heritage Foods (India)

- Bridge SRL (Italy)

- Hain Celestial Grocery (U.S.)

- The WhiteWave Foods Company (U.S.) (Acquired by Danone, now Danone North America)

- Turtle Mountain LLC (U.S.) (Now doing business as So Delicious Dairy Free, part of Danone North America)

- Vitasoy Dairy Milk (Hong Kong)

- Kikkoman Corporation (Japan)

Latest Developments in Global Rice Milk Market

- In April 2024, SunOpta Inc., a leading plant-based food and beverage company, announced the expansion of its Allentown, Pennsylvania facility to increase production capacity for its plant-based beverages, including rice milk. The expansion is expected to significantly enhance supply chain efficiency and meet growing consumer demand for dairy alternatives in North America. This move reinforces SunOpta’s strategy to strengthen its presence in the clean-label and organic beverage segment.

- In March 2024, Oatly Group AB partnered with Alpro (Danone) to co-develop a sustainable production initiative aimed at reducing the carbon footprint of plant-based milk products, including rice milk. This joint effort focuses on optimizing water and energy use in manufacturing processes, responding to rising consumer expectations for environmentally responsible products.

- In February 2024, Earth’s Own Food Company Inc. launched a new line of organic fortified rice milk in Canada, enriched with vitamin B12, calcium, and D3, catering to vegan consumers seeking nutritional alternatives to dairy. The product launch aligns with the company’s mission to lead innovation in the plant-based space and address growing health and wellness trends.

- In January 2024, The Hain Celestial Group, Inc. announced a rebranding of its rice milk offerings under the Dream brand, introducing new packaging, lower sugar formulations, and vanilla-flavored variants. The revamp aims to increase appeal among health-conscious consumers and boost shelf visibility in both brick-and-mortar and online retail channels.

- In December 2023, Freedom Foods (Noumi Ltd) unveiled its first rice milk with added plant protein in the Asia-Pacific region. Developed to bridge the gap between low-protein rice milk and high-protein alternatives like soy, the new product addresses consumer demand for functional, allergen-free beverages. It is now available in Australian and Southeast Asian markets, with plans for broader distribution.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rice Milk Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rice Milk Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rice Milk Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.