Global Abaca Fiber Market

Market Size in USD Million

CAGR :

%

USD

592.62 Million

USD

1,969.81 Million

2021

2029

USD

592.62 Million

USD

1,969.81 Million

2021

2029

| 2022 –2029 | |

| USD 592.62 Million | |

| USD 1,969.81 Million | |

|

|

|

|

Market Analysis and Size

Over the last few years, there has been immense growth in the natural fiber industry due to the high demand. Additionally, there has been strong development in manufacturing sector have significantly contributed to the abaca fiber market, which further increases the overall growth for the market.

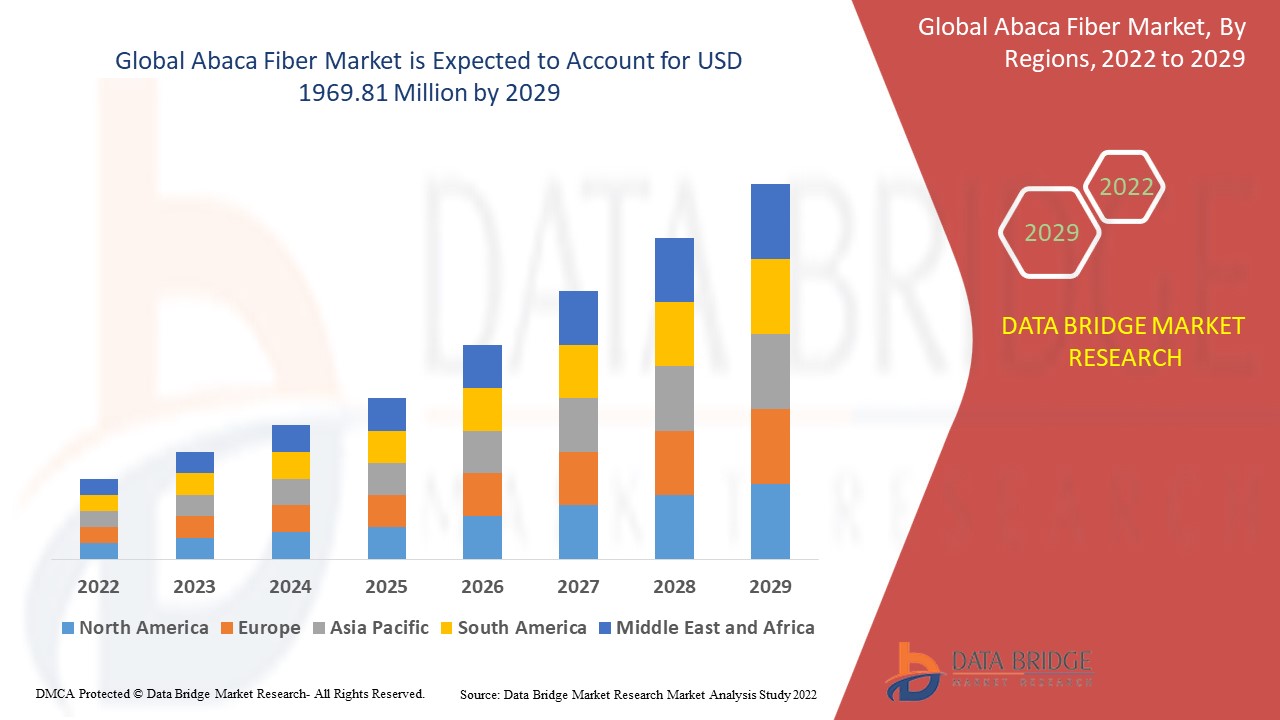

Global abaca fiber market was valued at USD 592.62 million in 2021 and is expected to reach USD 1969.81 million by 2029, registering a CAGR of 16.20% during the forecast period of 2022-2029. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

Market Definition

Abaca (often referred as Manila hemp) is basically a plant leaf fiber derived from the stalks of the plant. When compared to sisal fibers, vegetable fibers, and synthetic fibers, the product has gained widespread popularity due to its high strength, minimal elongation, and resistance to saltwater breakdown. It's also a good raw material for making high-quality papers, napkins, diapers, medicinal fabrics, machinery filters, electrical conduction cables, and other completed goods.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Type (Fine Abaca Fiber, Rough Abaca Fiber), Product (Pulp and Paper, Fiber Craft, Cordage, Textile) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Rhode Island (U.S.), Simor Abaca Products (Philippines), SAMATOA (Cambodia), Terranova Papers (Spain), Wiggleswort& Co. Limited. (London), S&P Global (U.S.) |

|

Market Opportunities |

|

Abaca Fiber Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers:

- High Demand Across End Users

The market is likely to be driven by the increased use of abaca fiber in the pulp and paper industry for applications such as cigarette filter papers, tea and coffee bags, and disposable medical and food papers. Additionally, due to qualities such as exceptional high mechanical strength, long fiber length resistance to salt-water damage, and increasing demand for the product in the manufacture of garments, curtains, paper producing, and screen and furnishings, the industry is predicted to rise. The high utilization and adoption across various end use industries is estimated to carve a way for the market's growth.

The increasing demand for sustainable fibers having advanced properties will further propelled the growth rate of abaca fiber market. Additionally, the superior performance and strength offered by the product will also drive market value growth. The growing emphasis by governments across various countries towards the adoption of natural fibers is also projected to bolster the market's growth.

Opportunities

- Research and Development and Trends

Furthermore, active research and development operations are underway to better understand the pulping characteristics, pulp production, and quality of abaca fibers, further extending profitable opportunities to the market players in the forecast period of 2022 to 2029. Additionally, the latest trend in interior designing practices for both residential and commercial spaces will further expand the future growth of the abaca fiber market.

Restraints/Challenges

- Limitation of Abaca Fibres

However, because of its inherent qualities, abaca fibers may not blend consistently with polymer composites, which could limit market expansion.

- Fluctuations in Supply

Furthermore, because the abaca plant is toxic to many diseases, fluctuations in the supply of abaca fibers is anticipated to be a demerit for the abaca fiber market. Therefore, this will challenge the abaca fiber market growth rate.

Moreover, the factors such as the higher price of abaca fiber and availability of substitute products may hamper the market growth.

This abaca fiber market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the abaca fiber market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Abaca Fiber Market

The recent outbreak of coronavirus had a negative impact on the abaca fiber market. Due to numerous precautionary lockdowns imposed by governments to control the spread of disease, substantial interruptions in various production and supply-chain processes have resulted in significant financial losses for the market. The food and beverage industry is also suffering significant losses along with the transportation infrastructure, which has also been severely interrupted combined with the supply of raw materials. Over the forecast period, the aforementioned determinants will weigh the market's revenue trajectory over the forecast period.

On the brighter side, as people are buying goods through online retailers, demand for abaca fibre is expected to climb as economies prepare to restore their operations. Also, to combat the coronavirus, food and beverage producers minimize direct contact with delivery people and guests, reinforce and communicate proper hygiene practices, execute comprehensive sanitations, and eliminate personnel contact during shift changes.

Global Abaca Fiber Market Scope

The abaca fiber market is segmented on the basis of type and product. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Fine Abaca Fiber

- Rough Abaca Fiber

On the basis of type, the abaca fiber market has been segmented into fine abaca fiber and rough abaca fiber.

Product

- Pulp and Paper

- Fiber Craft

- Cordage

- Textile

On the basis of product, the abaca fiber market is segmented into pulp and paper, fiber craft, cordage and textile.

Abaca Fiber Market Regional Analysis/Insights

The abaca fiber market is analyzed and market size insights and trends are provided by country, type and product as referenced above.

The countries covered in the abaca fiber market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the abaca fiber market because of the increasing initiatives taken to increase the usage of abaca fibers and gain economic benefits and the growing environmental restrictions regarding the usage of non-biodegradable polymeric fibers within the region.

On the other hand, North America is estimated to show lucrative growth during the forecast period of 2022 to 2029 due to the escalating production of papers and paperboards and the increasing rate of commercial and recreational fishing activities within the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Abaca Fiber Market Share Analysis

The abaca fiber market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to abaca fiber market.

Some of the major players operating in the abaca fiber market are

- Rhode Island (U.S.)

- Simor Abaca Products (Philippines)

- SAMATOA (Cambodia)

- Terranova Papers (Spain)

- Wigglesworth & Co. Limited. (London)

- S&P Global (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ABACA FIBER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ABACA FIBER MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.10 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL ABACA FIBER MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. PRICE INDEX OVERVIEW

5. EXECUTIVE SUMMARY

6. PREMIUM

6.1 RAW MATERIAL COVERAGE

6.2 PRODUCTION CONSUMPTION ANALYSIS

6.3 IMPORT EXPORT SCENARIO

6.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

6.5 PORTER’S FIVE FORCES

6.6 VENDOR SELECTION CRITERIA

6.7 PESTEL ANALYSIS

6.8 REGULATION COVERAGE

7. SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8. CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9. GLOBAL ABACA FIBER MARKET, BY TYPE, (2020-2029), (USD MILLION) (TONNS)

10. (VALUE, VOLUME AND ASP FOR EACH SEGMENT WILL BE PROVIDED)

10.1 OVERVIEW

10.2 FINE ABACA FIBER

10.2.1 ASP

10.2.2 VALUE

10.2.3 VOLUME

10.3 ROUGH ABACA FIBER

10.3.1 ASP

10.3.2 VALUE

10.3.3 VOLUME

11. GLOBAL ABACA FIBER MARKET, BY PRODUCT, (2020-2029), (USD MILLION)

11.1 OVERVIEW

11.2 PULP AND PAPER

11.3 FIBER CRAFT

11.4 CORDAGE

11.5 TEXTILE

11.6 OTHERS

12. GLOBAL ABACA FIBER MARKET, BY CHEMICAL COMPOSITION, (2020-2029), (USD MILLION)

12.1 OVERVIEW

12.2 CELLULOSE 76%

12.3 HEMICELLULOSE 14.6%

12.4 LIGNIN 8.4%

12.5 PECTIN 0.3%

12.6 WAX AND FAT 0.1%

13. GLOBAL ABACA FIBER MARKET, BY FIBER THICKNESS, (2020-2029), (USD MILLION)

13.1 OVERVIEW

13.2 1

13.3 5

13.4 10

13.5 15

13.6 20

14. GLOBAL ABACA FIBER MARKET, BY APPLICATIONS, (2020-2029), (USD MILLION)

14.1 OVERVIEW

14.2 CORDAGE PRODUCTS

14.2.1 CORDAGE PRODUCTS, BY APPLICATION

14.2.1.1. ROPES

14.2.1.2. TWINES

14.2.1.3. MARINE CORDAGE

14.2.1.4. BINDERS

14.2.1.5. CORD

14.3 PULP AND PAPER MANUFACTURES

14.3.1 PULP AND PAPER MANUFACTURES, BY APPLICATION

14.3.1.1. TEA BAGS

14.3.1.2. FILTER PAPER

14.3.1.3. MIMEOGRAPH STENCIL

14.3.1.4. BASE TISSUE

14.3.1.5. SAUSAGE SKIN

14.3.1.6. BASE PAPER

14.3.1.7. CIGARETTE PAPER

14.3.1.8. CURRENCY PAPER

14.3.1.9. CHART FILE FOLDERS

14.3.1.10. ENVELOPES

14.3.1.11. TIME CARDS

14.3.1.12. BOOK BINDERS AND PARCHMENT PAPER

14.3.1.13. X-RAY NEGATIVE

14.3.1.14. OPTICAL LENS WIPER

14.3.1.15. VACUUM FILTER

14.3.1.16. OIL FILTE

14.3.1.17. MICROGLASS AIR FILTERS MEDIA

14.4 NONWOVENS

14.4.1 NONWOVENS, BY APPLICATION

14.4.1.1. MEDICAL FACE MASKS AND GOWNS

14.4.1.2. DIAPERS

14.4.1.3. HOSPITAL LINENS

14.4.1.4. BED SHEETS

14.5 HANDMADE PAPER

14.5.1 HANDMADE PAPER, BY APPLICATION

14.5.1.1. PAPER SHEETS

14.5.1.2. STATIONERIES

14.5.1.3. ALL-PURPOSE CARDS

14.5.1.4. LAMP SHADES

14.5.1.5. BALLS

14.5.1.6. DIVIDERS

14.5.1.7. PLACEMATS

14.5.1.8. BAGS

14.5.1.9. PHOTO FRAMES AND ALBUMS

14.5.1.10. FLOWERS

14.5.1.11. TABLE CLOTH

14.6 FIBERCRAFTS

14.6.1 FIBERCRAFTS, BY APPLICATION

14.6.1.1. HANDBAGS

14.6.1.2. HAMMOCKS

14.6.1.3. PLACEMATS

14.6.1.4. RUGS

14.6.1.5. CARPETS

14.6.1.6. PURSES AND WALLETS

14.6.1.7. FISHNETS

14.6.1.8. DOOR MATS

14.6.1.9. TABLE CLOCK

14.7 HANDWOVEN FABRICS

14.7.1 HANDWOVEN FABRICS, BY APPLICATION

14.7.1.1. SINAMAY

14.7.1.2. PINUKPOK

14.7.1.3. TINALAK

14.7.1.4. DAGMAY

14.7.1.5. SACKS

14.7.1.6. HOTPADS

14.7.1.7. HEMP

14.7.1.8. COASTERS

14.7.1.9. BASKETS

14.7.1.10. WALLPAPER

14.8 FURNITURE

14.9 OTHERS

15. GLOBAL ABACA FIBER MARKET, BY REGION, (2020-2029), (USD MILLION)

15.1 GLOBAL ABACA FIBER MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

15.3 EUROPE

15.3.1 GERMANY

15.3.2 U.K.

15.3.3 ITALY

15.3.4 FRANCE

15.3.5 SPAIN

15.3.6 RUSSIA

15.3.7 SWITZERLAND

15.3.8 TURKEY

15.3.9 BELGIUM

15.3.10 NETHERLANDS

15.3.11 REST OF EUROPE

15.4 ASIA-PACIFIC

15.4.1 JAPAN

15.4.2 CHINA

15.4.3 SOUTH KOREA

15.4.4 INDIA

15.4.5 SINGAPORE

15.4.6 THAILAND

15.4.7 INDONESIA

15.4.8 MALAYSIA

15.4.9 PHILIPPINES

15.4.10 AUSTRALIA & NEW ZEALAND

15.4.11 REST OF ASIA-PACIFIC

15.5 SOUTH AMERICA

15.5.1 BRAZIL

15.5.2 ARGENTINA

15.5.3 REST OF SOUTH AMERICA

15.6 MIDDLE EAST AND AFRICA

15.6.1 SOUTH AFRICA

15.6.2 EGYPT

15.6.3 SAUDI ARABIA

15.6.4 UNITED ARAB EMIRATES

15.6.5 ISRAEL

15.6.6 REST OF MIDDLE EAST AND AFRICA

16. GLOBAL ABACA FIBER MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS AND ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17. SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

18. GLOBAL ABACA FIBER MARKET - COMPANY PROFILES

18.1 TERRANOVAPAPERS

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 PRODUCTION CAPACITY OVERVIEW

18.1.4 SWOT ANALYSIS

18.1.5 REVENUE ANALYSIS

18.1.6 RECENT UPDATES

18.2 WIGGLESWORTH & CO. LIMITED

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 PRODUCTION CAPACITY OVERVIEW

18.2.4 SWOT ANALYSIS

18.2.5 REVENUE ANALYSIS

18.2.6 RECENT UPDATES

18.3 M.A.P. ENTERPRISES

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 PRODUCTION CAPACITY OVERVIEW

18.3.4 SWOT ANALYSIS

18.3.5 REVENUE ANALYSIS

18.3.6 RECENT UPDATES

18.4 SPECIALTY PULP MANUFACTURING, INC. (SPMI)

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 PRODUCTION CAPACITY OVERVIEW

18.4.4 SWOT ANALYSIS

18.4.5 REVENUE ANALYSIS

18.4.6 RECENT UPDATES

18.5 CHING BEE TRADING CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 PRODUCTION CAPACITY OVERVIEW

18.5.4 SWOT ANALYSIS

18.5.5 REVENUE ANALYSIS

18.5.6 RECENT UPDATES

18.6 DGL GLOBAL VENTURES LLC

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 PRODUCTION CAPACITY OVERVIEW

18.6.4 SWOT ANALYSIS

18.6.5 REVENUE ANALYSIS

18.6.6 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19. RELATED REPORTS

20. QUESTIONNAIRE

21. CONCLUSION

22. ABOUT DATA BRIDGE MARKET RESEARCH

Global Abaca Fiber Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Abaca Fiber Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Abaca Fiber Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.