Global Abdominal Pain Drugs Market

Market Size in USD Billion

CAGR :

%

USD

89.39 Billion

USD

131.06 Billion

2024

2032

USD

89.39 Billion

USD

131.06 Billion

2024

2032

| 2025 –2032 | |

| USD 89.39 Billion | |

| USD 131.06 Billion | |

|

|

|

|

Abdominal Pain Drugs Market Size

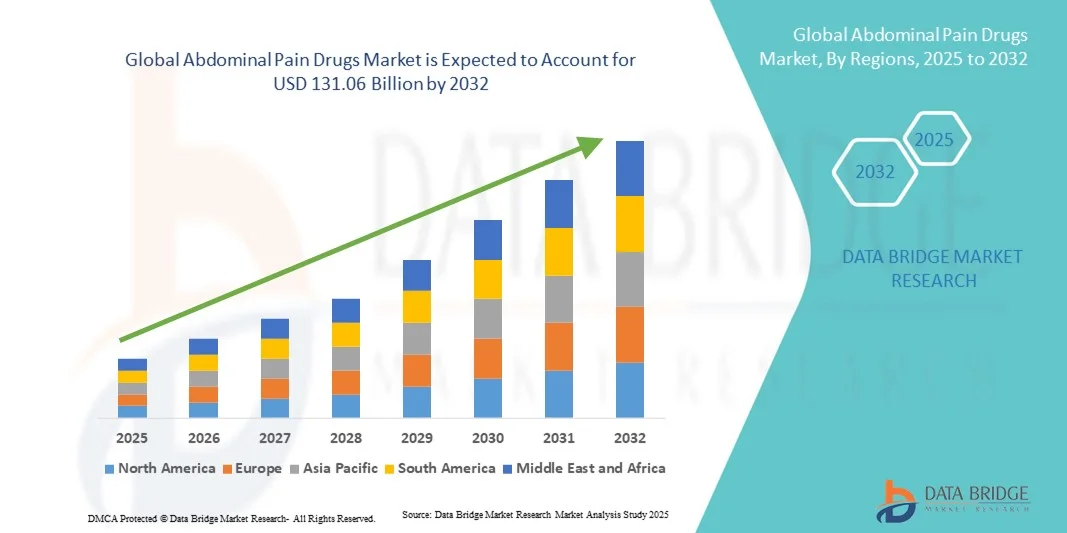

- The global abdominal pain drugs market size was valued at USD 89.39 billion in 2024 and is expected to reach USD 131.06 billion by 2032, at a CAGR of 4.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of gastrointestinal disorders, irritable bowel syndrome (IBS), and other abdominal pain–related conditions, driving higher demand for effective treatment options

- Furthermore, growing patient awareness, the development of novel drug formulations, and the rising adoption of over-the-counter as well as prescription medications are establishing abdominal pain drugs as a critical segment in gastrointestinal therapeutics. These converging factors are accelerating the uptake of Abdominal Pain Drugs solutions, thereby significantly boosting the industry's growth

Abdominal Pain Drugs Market Analysis

- Abdominal Pain Drugs, offering therapeutic relief for conditions such as irritable bowel syndrome, ulcers, and gastrointestinal disorders, are increasingly vital components of modern healthcare due to rising prevalence of digestive issues, greater awareness of gastrointestinal health, and advancements in drug formulations

- The escalating demand for abdominal pain drugs is primarily fueled by the increasing incidence of gastrointestinal diseases, growing healthcare expenditure, and rising patient preference for effective, fast-acting treatments

- North America dominated the abdominal pain drugs market with the largest revenue share of 40.5% in 2024, characterized by high diagnosis rates, advanced healthcare infrastructure, and a strong presence of key pharmaceutical players, with the U.S. experiencing substantial growth in abdominal pain drug prescriptions driven by both innovative formulations and rising adoption of over-the-counter medications

- Asia-Pacific is expected to be the fastest growing region in the abdominal pain drugs market during the forecast period, due to increasing urbanization, growing awareness of gastrointestinal health, and expanding access to healthcare services

- The branded drugs segment accounted for the largest market revenue share of 64.2% in 2024, due to strong brand recognition, patent protection, and physician preference for clinically validated therapies

Report Scope and Abdominal Pain Drugs Market Segmentation

|

Attributes |

Abdominal Pain Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Abdominal Pain Drugs Market Trends

Enhanced Convenience Through AI and Personalized Medicine

- A significant and accelerating trend in the global abdominal pain drugs market is the integration of artificial intelligence (AI) and data-driven personalized treatment approaches. This fusion of technologies is significantly enhancing patient care by enabling more accurate diagnosis, treatment optimization, and monitoring of abdominal pain conditions

- For instance, AI-based clinical decision support tools are increasingly being adopted by healthcare providers to analyze patient data, predict treatment responses, and tailor drug prescriptions to individual needs, thereby improving efficacy and reducing adverse effects

- AI integration in abdominal pain drug development also facilitates faster drug discovery by analyzing large datasets, identifying promising compounds, and accelerating clinical trial design. Furthermore, digital health platforms incorporating AI can assist patients in tracking symptoms, adherence, and treatment outcomes, enabling physicians to make timely interventions

- The growing emphasis on personalized medicine ensures that abdominal pain therapies are no longer “one-size-fits-all” but instead adapted to genetic, metabolic, and lifestyle profiles of patients. This trend is reshaping patient expectations for treatment outcomes and driving pharmaceutical companies to invest in AI-powered solutions

- Consequently, leading market players are collaborating with digital health and AI firms to create holistic treatment ecosystems that combine pharmacological therapy with intelligent symptom management and predictive care

- The demand for abdominal pain drugs that offer seamless integration with AI-driven platforms and personalized medicine approaches is growing rapidly across global healthcare systems, as patients and providers increasingly prioritize convenience, precision, and improved quality of life

Abdominal Pain Drugs Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Gastrointestinal Disorders

- The increasing prevalence of gastrointestinal (GI) disorders such as irritable bowel syndrome (IBS), peptic ulcers, gastritis, and inflammatory bowel disease is a significant driver for the heightened demand for abdominal pain drugs

- For instance, in 2024, the World Gastroenterology Organisation (WGO) reported a steady rise in IBS cases across both developed and developing regions, emphasizing the growing medical need for effective abdominal pain management solutions. Such trends are expected to drive the abdominal pain drugs industry growth in the forecast period

- As healthcare awareness increases, patients are seeking advanced treatment options that not only relieve pain but also address underlying causes. Drugs offering antispasmodic, analgesic, and acid-suppressive properties are witnessing higher adoption among physicians due to their efficacy

- Furthermore, the growing geriatric population, who are more susceptible to GI disorders, along with increasing healthcare expenditure in emerging economies, is fueling market expansion

- The convenience of over-the-counter (OTC) availability of certain abdominal pain drugs, coupled with the rise in prescription-based advanced therapies, is propelling adoption across both developed and developing markets

Restraint/Challenge

Concerns Regarding Side Effects and High Treatment Costs

- Concerns surrounding the potential side effects of abdominal pain drugs pose a significant challenge to broader market penetration. Drugs such as antispasmodics, opioids, and certain NSAIDs are often associated with side effects ranging from mild (drowsiness, constipation) to severe (dependency, gastrointestinal bleeding), raising anxieties among patients and healthcare providers

- For instance, clinical studies have highlighted risks associated with long-term use of opioids and NSAIDs for abdominal pain management, making some physicians cautious in prescribing them

- Addressing these safety concerns through the development of safer formulations, better patient monitoring, and education on drug usage is crucial for building trust among both patients and prescribers. In addition, the relatively high cost of advanced drug therapies compared to generic alternatives can be a barrier to adoption in price-sensitive markets

- While affordability of generic abdominal pain drugs has increased access in low-income regions, premium formulations offering faster or more targeted relief often come with a higher price tag, limiting uptake among budget-conscious patients

- Overcoming these challenges through innovative R&D, affordable pricing strategies, and increased awareness campaigns will be vital for sustained market growth

Abdominal Pain Drugs Market Scope

The market is segmented on the basis of pain cause, drug type, organ, pain type, and end use

- By Pain Cause

On the basis of pain cause, the abdominal pain drugs market is segmented into cramps, ulcers, gas, bloating, and others. The cramps segment dominated the largest market revenue share of 38.5% in 2024, driven by the high prevalence of irritable bowel syndrome (IBS), gastrointestinal spasms, and menstrual-related abdominal pain, which are among the most common causes of abdominal discomfort worldwide. Patients increasingly prefer antispasmodic and analgesic drugs that provide fast and effective relief. Rising outpatient visits, higher physician prescriptions, and widespread availability of both over-the-counter and prescription medications contribute to the segment’s revenue dominance. Strong R&D investments in novel formulations and extended-release therapies further enhance the attractiveness of the cramps segment. Increased awareness about the negative impact of untreated cramps on quality of life drives continuous demand. Healthcare providers frequently recommend specialized drugs targeting abdominal cramps, ensuring sustained adoption. Moreover, this segment benefits from robust marketing strategies by leading pharmaceutical companies emphasizing efficacy and safety. Urbanization, changing dietary habits, and stress-related digestive issues have also fueled the demand for cramps-targeted therapies. Hospital and clinic prescriptions, combined with OTC accessibility, solidify this sub-segment’s market leadership.

In contrast, the bloating segment is projected to witness the fastest CAGR of 7.9% from 2025 to 2032, driven by rising prevalence of functional gastrointestinal disorders and lifestyle-related digestive issues contributing to bloating. Consumers are increasingly adopting probiotics, digestive enzymes, and other therapies specifically formulated to alleviate bloating. OTC availability and convenience of self-medication further boost adoption. Pharmaceutical companies are launching innovative drug formulations targeting bloating symptoms with enhanced efficacy and faster relief. Awareness campaigns and lifestyle intervention programs increase patient knowledge about managing bloating. The segment also benefits from the rising focus on digestive wellness and holistic gut health solutions. Expansion of retail pharmacy networks and online drug delivery services improves accessibility. Emerging markets are witnessing higher incidences of bloating due to dietary shifts and stress, creating growth opportunities. Clinicians are recommending both preventive and curative therapies, further driving adoption. The launch of combination therapies addressing multiple gastrointestinal symptoms complements segment growth. Growing research into gut microbiome modulation also contributes to increasing demand. This fast growth is expected to continue as patient preference for convenient, effective solutions rises.

- By Drug Type

On the basis of drug type, the abdominal pain drugs market is segmented into branded and generic. The branded drugs segment accounted for the largest market revenue share of 64.2% in 2024, due to strong brand recognition, patent protection, and physician preference for clinically validated therapies. Branded abdominal pain drugs are perceived as higher quality, resulting in better patient compliance and trust. Major pharmaceutical players continue to invest heavily in R&D and marketing, reinforcing the segment’s leadership. Branded drugs benefit from diversified delivery forms, including tablets, capsules, and liquid suspensions. Hospitals and clinics often prefer prescribing branded formulations, further boosting market share. Advanced formulations with improved efficacy and fewer side effects support adoption. Regulatory approvals for innovative products maintain exclusivity, sustaining revenue dominance. Awareness programs by manufacturers emphasize therapeutic benefits, strengthening brand loyalty. Urban and high-income populations are key adopters of branded therapies. Physician recommendations, insurance coverage, and availability in hospital pharmacies contribute to robust sales. Branded drugs dominate in developed markets, ensuring a consistent revenue stream.

In contrast, the generic drugs segment is projected to register the fastest CAGR of 8.6% from 2025 to 2032, primarily driven by cost-effectiveness, increasing patent expiries, and higher acceptance in emerging and developed markets. Government initiatives to control healthcare costs encourage generic adoption. Patients in price-sensitive markets prefer generics as affordable alternatives without compromising efficacy. Expansion of manufacturing capacity in Asia-Pacific regions supports global supply. Regulatory pathways for bioequivalence approval streamline market entry. Generic drugs benefit from OTC availability and increasing physician recommendations. Rising healthcare expenditure and emphasis on affordable treatments contribute to growth. Retail pharmacies and online drug platforms facilitate easier access to generic options. Marketing campaigns by generic manufacturers highlight safety, quality, and affordability. Rising demand in chronic abdominal pain conditions supports sustained growth. Combination therapies in generic forms further enhance adoption. Emerging markets are expected to witness strong expansion due to accessibility and affordability factors.

- By Organ

On the basis of organ, the abdominal pain drugs market is segmented into liver, stomach, gall bladder, appendix, kidneys, and others. The stomach segment dominated the market with the largest revenue share of 41.3% in 2024, owing to the high prevalence of stomach-related conditions such as gastritis, ulcers, and acid-induced abdominal pain. The demand for proton pump inhibitors, antacids, and gastroprotective medications ensures strong revenue contribution. Lifestyle factors including poor dietary habits, alcohol consumption, and H. pylori infections significantly drive demand. Hospitals and clinics are primary centers for prescribing stomach-targeted therapies. Branded drugs with proven efficacy in treating stomach-related disorders dominate prescriptions. Physician awareness and treatment guidelines reinforce segment leadership. Continuous innovation in fast-acting and extended-release formulations supports adoption. Urban populations with busy lifestyles contribute to higher prevalence. Prescription and OTC availability ensures accessibility. Increasing healthcare expenditure enables better treatment coverage. Consumer trust in effective symptom relief strengthens market position. Regular marketing and awareness campaigns by pharmaceutical companies highlight therapeutic benefits, maintaining dominance.

Conversely, the liver segment is anticipated to register the fastest CAGR of 7.4% from 2025 to 2032, driven by increasing incidences of liver-related complications including hepatitis, fatty liver disease, and cirrhosis causing abdominal pain. Pharmaceutical companies are developing hepatoprotective and liver-targeted therapies to address rising demand. Early diagnosis and regular screening enhance treatment uptake. Awareness about liver health and preventive care is increasing globally. Clinics and hospitals are promoting therapies to manage liver-associated discomfort. Innovative drug formulations with improved efficacy and safety are boosting adoption. Lifestyle-related liver conditions, such as alcohol-induced liver damage, increase patient pool. Expansion of healthcare infrastructure in emerging markets supports rapid growth. Research in hepatology is accelerating new product launches. Insurance coverage for liver therapies drives treatment affordability. Generic liver-targeted drugs gain traction in cost-sensitive regions. Digital campaigns educate patients on liver wellness, further supporting adoption.

- By Pain Type

On the basis of pain type, the abdominal pain drugs market is segmented into localized, cramp-like, and colicky. The localized pain segment held the largest revenue share of 44.6% in 2024, as localized abdominal pain is frequently reported in clinical settings, often linked to appendicitis, gall bladder stones, and kidney-related disorders. Wide availability of targeted analgesics and condition-specific therapies reinforces this segment’s leadership. Physicians prefer prescribing precise treatment options to manage localized pain effectively. Hospitals and clinics remain primary treatment hubs. Branded medications with proven efficacy dominate prescriptions. The segment benefits from high patient compliance due to predictable symptom management. Availability of extended-release and fast-acting formulations enhances adoption. Urban and high-income populations drive strong demand. Awareness about complications arising from untreated localized pain boosts treatment uptake. Marketing campaigns emphasize rapid symptom relief. OTC options complement hospital prescriptions, supporting revenue. Research and innovation focus on better formulations, maintaining segment dominance.

Conversely, the colicky pain segment is projected to grow at the fastest CAGR of 8.1% from 2025 to 2032, driven by increasing incidences of kidney stones, gallstones, and infantile colic, which lead to intermittent severe abdominal pain. Patients require fast-acting analgesics and combination therapies to manage sudden episodes. Hospitals, clinics, and pharmacies are focusing on providing accessible treatments. Physician recommendations for effective management of colicky pain are rising. OTC and prescription formulations both contribute to adoption. Innovative drug delivery systems enhance therapeutic efficacy. Awareness campaigns educate caregivers and patients about symptom management. Emerging markets witness higher prevalence due to lifestyle and dietary factors. R&D efforts are increasing to provide safer and faster relief options. Patient preference for rapid symptom control drives continuous demand. Expansion of retail pharmacy chains and digital delivery platforms improves access. Overall, this segment is gaining rapid traction due to increasing awareness and clinical adoption.

- By End User

On the basis of end user, the abdominal pain drugs market is segmented into hospitals, clinics, pharmacies, and others. The hospitals segment dominated the market with a revenue share of 46.7% in 2024, as hospitals act as primary centers for diagnosis, prescription, and acute treatment of abdominal pain conditions. The presence of specialist gastroenterologists, advanced diagnostic tools, and hospital pharmacies ensures consistent demand. Branded drugs and advanced formulations are more frequently administered in hospital settings. Urban hospitals see higher patient footfall, strengthening the segment’s market position. Awareness programs and hospital recommendations support physician-driven prescriptions. Acute and chronic abdominal pain cases drive sustained hospital-based drug utilization. Hospital pharmacies also play a significant role in distributing medications. Integration of new treatment protocols enhances adoption. Insurance coverage facilitates higher utilization. Patient trust in hospital-recommended therapies contributes to market dominance. Continuous innovation in hospital-targeted therapies reinforces the segment’s leadership.

Conversely, the pharmacies segment is expected to record the fastest CAGR of 7.6% from 2025 to 2032, driven by the growing trend of self-medication, rising over-the-counter drug sales, and expanding retail pharmacy networks in emerging markets. Online pharmacy platforms are increasing accessibility, particularly for recurring or mild abdominal pain cases. Generic drugs are gaining preference due to affordability. Awareness campaigns by pharmacists and digital healthcare platforms support adoption. Convenience of immediate purchase encourages frequent use. Combination therapies and newer formulations are increasingly stocked at retail outlets. Urbanization and expanding pharmacy chains contribute to growth. Lifestyle-related abdominal pain conditions drive recurring demand. Patients increasingly rely on pharmacies for first-line treatment. Technological integration in pharmacy operations ensures efficient distribution. Overall, this segment is expected to grow rapidly due to accessibility, affordability, and convenience factors.

Abdominal Pain Drugs Market Regional Analysis

- North America dominated the abdominal pain drugs market with the largest revenue share of 40.5% in 2024, characterized by high diagnosis rates, advanced healthcare infrastructure, and a strong presence of key pharmaceutical players

- The markets experienced substantial growth in abdominal pain drug prescriptions, driven by both innovative formulations and the rising adoption of over-the-counter medications

- Increasing awareness among healthcare providers and patients about effective management of abdominal pain, coupled with government initiatives to enhance healthcare accessibility, further supported the market's expansion in the region

U.S. Abdominal Pain Drugs Market Insight

The U.S. abdominal pain drugs market captured the largest revenue share in 2024 within North America, fueled by the swift uptake of new drug formulations and the growing focus on gastrointestinal health. Consumers are increasingly seeking effective treatments for both acute and chronic abdominal pain conditions, which is driving demand for prescription and over-the-counter drugs. Moreover, ongoing research and development, combined with the availability of innovative therapies targeting multiple causes of abdominal pain, is significantly contributing to market growth.

Europe Abdominal Pain Drugs Market Insight

The Europe abdominal pain drugs market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of gastrointestinal disorders and an aging population with higher susceptibility to abdominal pain. Increasing awareness of early diagnosis and treatment options, along with advancements in drug delivery systems and healthcare infrastructure, is fostering market growth. The market is also benefiting from strong regulatory frameworks ensuring the safety and efficacy of abdominal pain medications, along with robust adoption across hospitals, clinics, and retail pharmacies.

U.K. Abdominal Pain Drugs Market Insight

The U.K. abdominal pain drugs market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by growing patient awareness regarding gastrointestinal health and a strong focus on preventive care. The increasing incidence of functional abdominal disorders, coupled with a high rate of over-the-counter drug usage, is fueling market growth. In addition, healthcare policies encouraging timely diagnosis and treatment, along with easy access to innovative therapies, continue to support the expansion of the market in the U.K.

Germany Abdominal Pain Drugs Market Insight

The Germany abdominal pain drugs market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing prevalence of gastrointestinal disorders, rising healthcare expenditure, and strong research initiatives in the pharmaceutical sector. Germany’s emphasis on advanced medical treatments and patient-centric care promotes the adoption of effective abdominal pain medications, both prescription and over-the-counter. The presence of established pharmaceutical companies, along with government support for healthcare innovation, further drives market growth.

Asia-Pacific Abdominal Pain Drugs Market Insight

The Asia-Pacific abdominal pain drugs market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing urbanization, growing awareness of gastrointestinal health, and expanding access to healthcare services in countries such as China, Japan, and India. Rising disposable incomes and improvements in healthcare infrastructure are facilitating the availability and adoption of abdominal pain medications. Furthermore, government initiatives to enhance healthcare accessibility and the presence of both domestic and international pharmaceutical companies are accelerating market growth across the region.

Japan Abdominal Pain Drugs Market Insight

The Japan abdominal pain drugs market is gaining momentum due to the country’s high healthcare standards, increasing focus on preventive care, and an aging population prone to gastrointestinal disorders. Demand for effective treatment options, including advanced drug formulations, is on the rise. In addition, the prevalence of research-driven pharmaceutical innovation in Japan supports the introduction of novel therapies for abdominal pain, further fueling market expansion.

China Abdominal Pain Drugs Market Insight

The China abdominal pain drugs market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing awareness of gastrointestinal health, and expanding access to healthcare services. The country’s growing middle class, rising healthcare expenditure, and the presence of both domestic and multinational pharmaceutical manufacturers are key factors propelling market growth. Moreover, government initiatives to improve healthcare accessibility and the increasing adoption of over-the-counter and prescription medications for abdominal pain further support market expansion.

Abdominal Pain Drugs Market Share

The abdominal pain drugs industry is primarily led by well-established companies, including:

- Takeda Pharmaceutical Company Limited (Japan)

- AbbVie Inc. (U.S.)

- AstraZeneca (U.K.)

- Salix Pharmaceuticals (U.S.)

- Pfizer Inc. (U.S.)

- Bayer AG (Germany)

- Abbott (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Bausch Health Companies Inc. (Canada)

- Sanofi (France)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Dr. Reddy’s Laboratories Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla Inc. (India)

- Gilead Sciences, Inc. (U.S.)

Latest Developments in Global Abdominal Pain Drugs Market

- In January 2023, the U.S. Food and Drug Administration (FDA) approved suzetrigine (Journavx), a first-in-class non-opioid analgesic, for the treatment of moderate to severe acute pain in adults. Suzetrigine targets a pain-signaling pathway involving sodium channels in the peripheral nervous system, offering a novel approach to pain management without the addictive properties of opioids

- In November 2024, researchers at the University of Queensland developed a new class of oral painkillers based on the peptide hormone oxytocin to treat pain caused by irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD). The modified oxytocin analogs are designed to be gut-stable, offering a novel approach to managing abdominal discomfort

- In August 2025, scientists at the University of North Carolina revealed progress in creating a non-addictive painkiller targeting the brain's perception of pain. This development aims to provide effective pain relief without the addictive properties associated with traditional pain medication

- In February 2025, AbbVie and Pfizer received FDA approval for Emblaveo (aztreonam and avibactam), a combination antibiotic therapy, for the treatment of complicated intra-abdominal infections (IAIs) in adults. This approval addresses the growing concern of antibiotic-resistant bacteria and provides a new therapeutic option for IAI patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.