Global Abrasive Market

Market Size in USD Billion

CAGR :

%

USD

72.98 Billion

USD

110.32 Billion

2024

2032

USD

72.98 Billion

USD

110.32 Billion

2024

2032

| 2025 –2032 | |

| USD 72.98 Billion | |

| USD 110.32 Billion | |

|

|

|

|

Abrasives Market Size

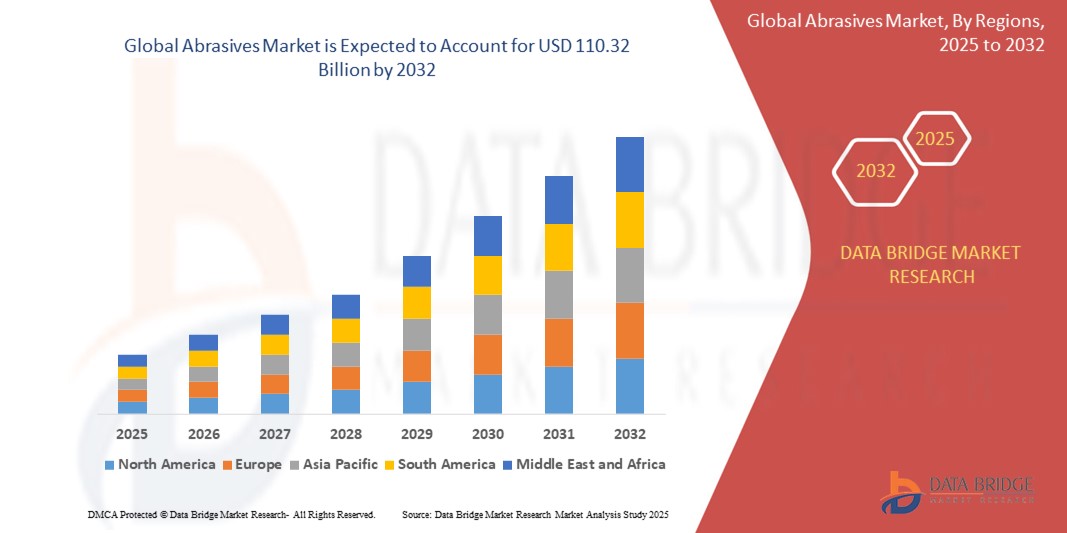

- The global abrasives market size was valued at USD 72.98 billion in 2024 and is expected to reach USD 110.32 billion by 2032, at a CAGR of 5.30 % during the forecast period

- This growth is driven by factors such as the rising demand from the automotive, construction, and metal fabrication industries, along with increased use of precision and super abrasives in advanced manufacturing

Abrasives Market Analysis

- The abrasives market is experiencing steady growth due to increased demand from key industries such as automotive, construction, and metal fabrication, which rely heavily on precision surface finishing

- Technological advancements in abrasive materials are improving cutting efficiency and durability, allowing manufacturers to deliver higher performance solutions across various industrial applications

- North America is expected to dominate the abrasives market due to its well-established manufacturing base, strong presence of key industry players, and high demand from automotive and aerospace sectors

- Asia-Pacific is expected to be the fastest growing region in the abrasives market during the forecast period due to rapid industrialization, infrastructure development, and expanding electronics and automotive manufacturing industries

- The synthetic segment is expected to dominate the abrasives market with the largest share of 67.5% in 2025 due to its superior hardness, durability, and consistent performance across industrial applications. Unlike natural abrasives, synthetic materials such as aluminum oxide and silicon carbide are engineered to deliver uniform results, which enhances efficiency and product quality. These abrasives are widely adopted in high-precision industries such as automotive, aerospace, and electronics, where reliability and precision are critical. Their growing demand is also supported by ongoing technological advancements and large-scale industrialization

Report Scope and Abrasives Market Segmentation

|

Attributes |

Abrasives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Abrasives Market Trends

“Growing Adoption of Super abrasives in High-Precision Applications”

- Super abrasives such as synthetic diamonds and cubic boron nitride are increasingly favored for their unmatched hardness and precision in cutting and grinding tasks

- For instance, in aerospace manufacturing, synthetic diamond tools are used for finishing turbine blades to ensure tight tolerances and high performance

- These abrasives are vital for machining hardened metals, reducing tool replacement frequency and improving productivity in automotive parts production

- For instance, Cubic boron nitride wheels are used to grind transmission gears and engine blocks, helping reduce wear and energy consumption

- Super abrasives enhance efficiency by providing longer tool life, stable performance, and cleaner finishes, especially in high-volume industrial settings

- The electronics sector uses super abrasives for tasks such as wafer slicing and polishing, where fine tolerances and material integrity are critical

- Ongoing R&D is enabling the creation of tailored abrasive solutions, leading to wider adoption across industries seeking enhanced surface quality and speed

Abrasives Market Dynamics

Driver

“Rising Demand from Automotive and Machinery Manufacturing”

- The automotive industry heavily relies on abrasives for operations such as cutting, grinding, and polishing to meet the increasing production of vehicles, especially electric models

- For instance, electric vehicle manufacturers use high-precision abrasives to ensure tight tolerances in battery components and motor housings

- Abrasives enhance surface quality and dimensional accuracy, supporting faster and more efficient production in automotive assembly lines

- For instance, A major car manufacturer in Germany implemented high-performance coated abrasives to reduce cycle time and improve finish consistency

- The industrial machinery sector uses abrasives for preparing and finishing parts that require high durability and wear resistance, making them vital in construction and infrastructure development

- Growing infrastructure investments in developing countries are boosting the demand for construction equipment, leading to increased abrasive usage in equipment manufacturing and maintenance

- The emergence of advanced bonded and super abrasives such as diamond and cubic boron nitride is enabling the machining of harder materials with greater precision and lower energy consumption

Opportunity

“Technological Innovation in Abrasive Products”

- Technological advancements in super abrasives such as synthetic diamonds and cubic boron nitride are enabling extreme durability and precision for high-end applications

- For instance, aerospace component manufacturers use cubic boron nitride wheels to machine turbine blades with minimal thermal damage

- Nanotechnology is facilitating the production of ultra-fine abrasive grits that provide superior surface finishes and reduce material loss in precision tasks

- Nano-abrasives are increasingly applied in semiconductor manufacturing, where components require ultra-smooth finishes and exact tolerances for optimal performance

- Coated abrasives with multilayer structures and self-sharpening grains are enhancing efficiency by offering longer tool life and reducing production line downtime

- The rise of digital manufacturing is creating demand for smart abrasives that work seamlessly with robotic arms and CNC systems, paving the way for customized, automation-ready solutions

Restraint/Challenge

“Fluctuating Raw Material Prices”

- Price and supply fluctuations of raw materials such as aluminum oxide, silicon carbide, and synthetic diamonds present major challenges for abrasives manufacturers

- Global supply chain issues, energy cost volatility, and geopolitical tensions frequently disrupt raw material availability and drive-up production costs

- For instance, China’s strict environmental policies and mining restrictions have limited exports of key abrasive materials, impacting international supply chains

- Smaller manufacturers often struggle to purchase raw materials in large quantities or at stable prices, hindering their scalability and market competitiveness

- In such a sensitive cost-driven industry, any imbalance between material availability, quality, and affordability directly affects profitability and customer retention

Abrasives Market Scope

The market is segmented on the basis of raw materials, type, product, form, application, end- user.

|

Segmentation |

Sub-Segmentation |

|

By Raw Materials |

|

|

By Type |

|

|

By Product |

|

|

By Form |

|

|

By Application |

|

|

By End- User |

|

In 2025, the synthetic is projected to dominate the market with a largest share in raw materials segment

The synthetic segment is expected to dominate the abrasives market with the largest share of 67.5% in 2025 due to its superior hardness, durability, and consistent performance across industrial applications. Unlike natural abrasives, synthetic materials such as aluminum oxide and silicon carbide are engineered to deliver uniform results, which enhances efficiency and product quality. These abrasives are widely adopted in high-precision industries such as automotive, aerospace, and electronics, where reliability and precision are critical. Their growing demand is also supported by ongoing technological advancements and large-scale industrialization.

The bonded abrasives is expected to account for the largest share during the forecast period in type segment

In 2025, the bonded abrasives segment is expected to dominate the market with the largest market share of 49% due to its widespread use in cutting, grinding, and finishing applications. Bonded abrasives, made by fusing abrasive grains with bonding agents, offer excellent dimensional control and surface quality, making them indispensable in heavy-duty operations. Their versatility and compatibility with a wide range of materials, including metals and composites, drive their preference in automotive manufacturing, metal fabrication, and industrial machinery sectors.

Abrasives Market Regional Analysis

“North America Holds the Largest Share in the Abrasives Market”

- North America is expected to dominate the global abrasives market with a market share of approximately 38.5%

- North America leads the global abrasives market due to its well-established automotive, aerospace, and construction sectors

- The U.S. accounts for a major share, supported by advanced manufacturing and high demand for precision machining

- Significant investments in infrastructure and defence manufacturing are boosting the consumption of high-performance abrasives

- Technological advancements and the presence of key industry players make North America a hub for innovation in abrasive tools

“Asia-Pacific is Projected to Register the Highest CAGR in the Abrasives Market”

- Asia-Pacific is the fastest-growing region driven by rapid industrialization and increasing manufacturing output in countries such as China and India

- Government initiatives such as “Make in India” and rising foreign investments are fuelling demand for abrasives in various applications

- The electronics and automotive sectors in China, Japan, and South Korea are creating a strong market for high-precision abrasives

- Expansion of construction and infrastructure projects across Southeast Asia further accelerates market growth in the region

Abrasives Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Saint-Gobain (France)

- 3M (U.S.)

- DuPont (U.S.)

- VSM AG (Germany)

- NORITAKE CO.,LIMITED (Japan)

- NIPPON RESIBON CORPORATION (Japan)

- Robert Bosch GmbH (Germany)

- Asahi Diamond Industrial Co., Ltd. (Japan)

- Fujimi Incorporated (Japan)

- WASHINGTON MILLS (U.S.)

- Henan DOMILL Abrasive Technology Co., Ltd (Russia)

- GMA Garnet Pty Ltd (Australia)

- Winoa (France)

- sia Abrasives Industries AG. (Switzerland)

- Sankyo-Rikagaku Co., Ltd. (Japan)

- Mirka Ltd. (Finland)

- Henkel AG & Co. KGaA (Germany)

- SAIT ABRASIVI S.p.A. (Italy)

- Radiac Abrasive (U.S.)

Latest Developments in Global Abrasives Market

- In October 2023, Tyrolit Group completed the acquisition of Acme Holding Company, a Michigan-based abrasives manufacturer. This strategic development expands Tyrolit’s grinding solutions portfolio and marks its seventh production facility in the U.S. The acquisition enhances the company’s ability to serve critical sectors such as foundry, steel, and rail. With this move, Tyrolit strengthens its operational footprint and responsiveness in North America. The deal is expected to improve customer access and reinforce Tyrolit’s leadership in high-performance abrasives

- In October 2023, Saint-Gobain announced a strategic partnership with Dedeco Abrasive Products to market Dedeco’s Sunburst abrasive line. This collaboration enhances Saint-Gobain’s product offerings with specialty abrasives designed for precision finishing. It aligns with Saint-Gobain’s strategy of delivering complete abrasive solutions across industries. By integrating Dedeco’s innovations, the partnership boosts product diversity and market adaptability. The move reinforces Saint-Gobain’s competitive positioning in niche abrasive segments

- In May 2023, Sak Abrasives Limited acquired Jowitt & Rodgers Co., a Philadelphia-based manufacturer known for resin-bonded grinding wheels, discs, and segments. The acquisition significantly broadens Sak Abrasives’ product portfolio and technical capabilities. This strategic move strengthens its footprint in the U.S. abrasives market and enables better access to North American customers. It also supports diversified industrial applications and reinforces growth in customized abrasive solutions. The deal is expected to enhance the company’s competitiveness and innovation pipeline

- In August 2022, Tyrolit acquired a majority stake of over 75% in Egeli Egesan Group, a leading abrasives company based in the Middle East. This acquisition was aimed at expanding Tyrolit’s regional market presence and leveraging local expertise for product distribution. It enables Tyrolit to serve regional demand more effectively while optimizing supply chain efficiencies. The move positions the company to benefit from growing industrial demand in the Middle East. It is anticipated to accelerate sustainable growth and reinforce Tyrolit’s global reach

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Abrasive Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Abrasive Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Abrasive Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.