Global Abscisic Acid Aba Market

Market Size in USD Million

CAGR :

%

USD

550.52 Million

USD

765.09 Million

2024

2032

USD

550.52 Million

USD

765.09 Million

2024

2032

| 2025 –2032 | |

| USD 550.52 Million | |

| USD 765.09 Million | |

|

|

|

|

Abscisic Acid (ABA) Market Size

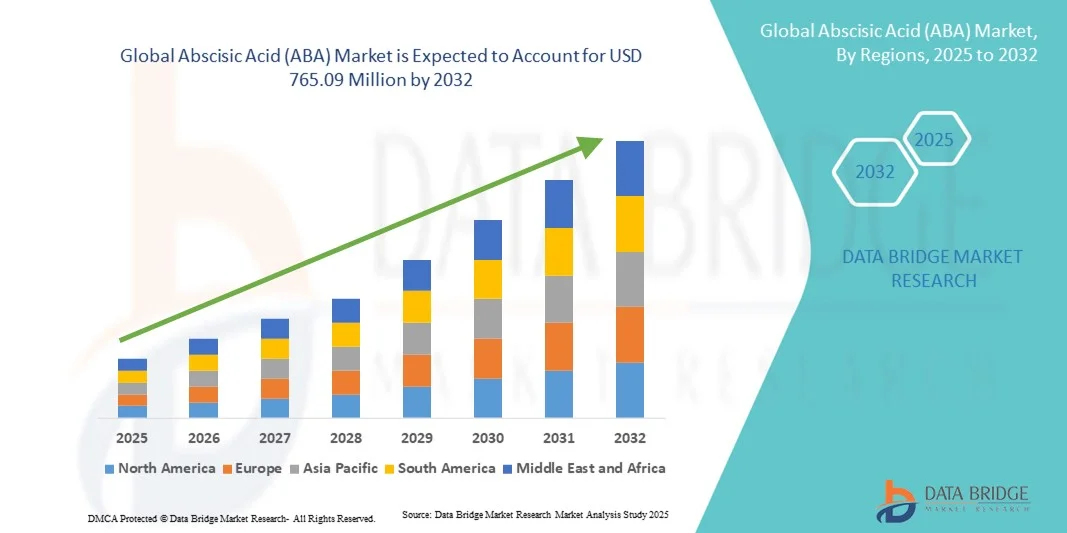

- The global abscisic acid (ABA) market size was valued at USD 550.52 million in 2024 and is expected to reach USD 765.09 million by 2032, at a CAGR of 4.2% during the forecast period

- The market growth is largely fuelled by the increasing demand for crop protection solutions, advancements in plant growth regulation technologies, and rising adoption of sustainable agricultural practices

- Growing R&D investments in biotechnology and plant hormone applications are further enhancing the potential of ABA in agriculture and pharmaceutical sectors

Abscisic Acid (ABA) Market Analysis

- The abscisic acid (ABA) market is witnessing steady growth, primarily driven by its expanding applications in agriculture, horticulture, and plant biotechnology. Its role in enhancing stress tolerance, improving crop yield, and regulating plant growth is making it increasingly vital in modern farming practices

- Rising concerns regarding climate change and water scarcity have further boosted demand for ABA-based products, as they help crops withstand drought and other abiotic stresses. Growing research investments and technological advancements in plant growth regulators are also accelerating the adoption of ABA globally

- North America dominated the ABA market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of ABA in precision agriculture and crop stress management

- Asia-Pacific region is expected to witness the highest growth rate in the global abscisic acid (ABA) market, driven by increasing adoption of bio-based plant growth regulators, expanding commercial farming activities, and rising awareness about crop resilience in countries such as China, Japan, and Australia

- The 99% and above purity segment held the largest market revenue share in 2024, driven by its high efficacy in precision agriculture and commercial crop applications. High-purity ABA is preferred for consistent stress tolerance results, better crop performance, and compatibility with modern agricultural formulations

Report Scope and Abscisic Acid (ABA) Market Segmentation

|

Attributes |

Abscisic Acid (ABA) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Abscisic Acid (ABA) Market Trends

Rising Adoption Of ABA In Stress Tolerance And Crop Productivity

- The increasing use of abscisic acid in enhancing plant stress tolerance is transforming modern agriculture by enabling crops to withstand drought, salinity, and temperature fluctuations. This helps farmers achieve higher yields even in adverse climatic conditions, supporting food security and profitability. Its role in plant signaling also makes it a key element for climate-resilient farming practices

- The demand for natural plant growth regulators is accelerating the adoption of ABA formulations across developing regions, particularly where environmental stress and limited irrigation facilities impact agricultural productivity. This shift is further supported by government initiatives promoting sustainable crop inputs, ensuring ABA adoption aligns with broader green agriculture goals

- The growing role of ABA in precision agriculture is making it a preferred choice for targeted crop management, as it allows farmers to optimize input use and improve efficiency. This leads to better resource utilization and higher returns on investment, driving its adoption in commercial farming. As digital farming expands, ABA integration into precision systems is expected to grow

- For instance, in 2023, several agricultural cooperatives in Asia reported improved rice yields after integrating ABA-based products into stress management programs, resulting in reduced crop loss during dry spells. Such success stories are encouraging broader usage across multiple crop types. Industry partnerships are also fostering the development of localized ABA solutions

- While the use of ABA is advancing crop resilience, its long-term growth depends on continued research, cost optimization, and effective farmer awareness programs. Manufacturers must focus on scalable solutions to fully unlock the benefits of ABA in global agriculture. Aligning R&D with regional needs will be vital to sustain momentum

Abscisic Acid (ABA) Market Dynamics

Driver

Growing Demand For Sustainable Crop Regulators And Stress Management Solutions

- Rising concerns over climate change and unpredictable weather patterns are pushing farmers and agribusinesses to prioritize stress-tolerant crop solutions. Abscisic acid plays a critical role in regulating plant responses to environmental stress, fueling its demand worldwide. Its contribution to water conservation further enhances its market appeal

- Farmers are becoming increasingly aware of the financial risks of crop failure, including reduced yields and revenue losses. This awareness is driving greater adoption of ABA products as a proactive measure to safeguard agricultural productivity. Adoption is particularly strong in regions prone to recurrent drought

- Public and private sector initiatives are enhancing access to bio-based crop regulators, with subsidies and partnerships supporting the introduction of ABA into mainstream agriculture. Such frameworks are strengthening supply chains and market availability. International collaboration is also expanding funding for ABA research projects

- For instance, in 2022, the European Union introduced support schemes for natural plant growth regulators, boosting research and commercial adoption of ABA-based products across the region. These measures were part of broader sustainability policies aimed at reducing chemical pesticide reliance

- While rising awareness and institutional backing are supporting the market, further investments in education, distribution, and localized formulations are required to accelerate adoption among smallholder farmers. Without effective outreach, penetration in low-income markets will remain limited

Restraint/Challenge

High Production Costs And Limited Commercial Availability

- The complex extraction and synthesis processes involved in producing abscisic acid make it relatively expensive, limiting adoption among small and mid-sized farmers. Cost competitiveness against traditional regulators remains a key barrier in price-sensitive markets. Manufacturers are under pressure to develop cost-efficient biosynthetic pathways

- Limited large-scale commercial availability also restricts consistent access, particularly in developing regions where supply chains are underdeveloped. This creates dependence on imports, increasing procurement costs and delaying widespread usage. Global supply chain disruptions further intensify these challenges

- Technical challenges in stability and formulation further hinder its deployment in diverse climatic conditions, reducing its effectiveness in some agricultural settings. Without innovation, adoption rates may remain limited outside high-value crops. Long-term shelf stability and application efficiency are critical hurdles for scaling

- For instance, in 2023, farmers in Africa reported difficulty in accessing ABA-based solutions due to higher costs and lack of established distribution networks, slowing market penetration despite rising interest. Regional cooperatives highlighted the need for more affordable localized formulations

- While technological advancements are gradually improving efficiency and scalability, addressing cost and availability issues will be critical for achieving mainstream commercialization of ABA products across global agriculture. Strategic partnerships between biotech firms and governments will play a central role

Abscisic Acid (ABA) Market Scope

The market is segmented on the basis of product type and application.

-

- By Product Type

On the basis of product type, the ABA market is segmented into 99% and above purity and no greater than 99% purity. The 99% and above purity segment held the largest market revenue share in 2024, driven by its high efficacy in precision agriculture and commercial crop applications. High-purity ABA is preferred for consistent stress tolerance results, better crop performance, and compatibility with modern agricultural formulations.

The no greater than 99% purity segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness and suitability for bulk crop management and large-scale field applications. This segment is particularly popular among developing regions where affordability and moderate stress tolerance enhancement are primary considerations.

- By Application

On the basis of application, the ABA market is segmented into fruits and vegetables, grains and pulses, ornamentals, and others. The fruits and vegetables segment held the largest market share in 2024, due to the high demand for quality improvement, shelf-life extension, and stress management in horticultural crops. ABA use ensures better uniformity, enhanced yield, and improved post-harvest performance in high-value crops.

The grains and pulses segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising adoption of ABA in cereal and pulse crops for drought and heat stress tolerance. Farmers are increasingly deploying ABA in staple crops to secure yields and support food security in regions vulnerable to climatic variability.

Abscisic Acid (ABA) Market Regional Analysis

- North America dominated the ABA market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of ABA in precision agriculture and crop stress management

- Farmers and agribusinesses in the region are leveraging ABA to enhance crop yields, improve drought tolerance, and optimize resource usage, particularly in high-value crops such as fruits and vegetables

- The widespread adoption is further supported by advanced agricultural practices, government initiatives promoting sustainable crop inputs, and strong R&D infrastructure, establishing ABA as a key solution in modern farming

U.S. Abscisic Acid (ABA) Market Insight

The U.S. ABA market captured the largest revenue share in North America in 2024, fueled by rapid adoption of bio-based crop regulators and stress-tolerant solutions. Farmers are increasingly integrating ABA into irrigation and crop protection programs to safeguard against environmental stress. Moreover, research collaborations, regulatory support, and increasing awareness of natural growth regulators are further propelling the ABA market in the U.S.

Europe Abscisic Acid (ABA) Market Insight

The Europe ABA market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising environmental regulations and the demand for sustainable crop management solutions. Increased adoption of precision agriculture, coupled with government incentives for natural plant growth regulators, is fostering ABA uptake. European farmers are also attracted to the efficiency gains and enhanced crop resilience provided by ABA-based formulations.

U.K. Abscisic Acid (ABA) Market Insight

The U.K. ABA market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing emphasis on sustainable agriculture and climate-resilient farming practices. Concerns regarding crop losses due to drought and temperature fluctuations are encouraging widespread use of ABA solutions. In addition, the U.K.’s adoption of modern farming technologies and strong agricultural advisory networks supports continued market expansion.

Germany Abscisic Acid (ABA) Market Insight

The Germany ABA market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness of climate-resilient crops and advanced agricultural infrastructure. German farmers are integrating ABA into crop management programs to improve stress tolerance and yield stability. The country’s emphasis on research, innovation, and sustainable agricultural practices promotes strong market adoption across multiple crop types.

Asia-Pacific Abscisic Acid (ABA) Market Insight

The Asia-Pacific ABA market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising adoption of ABA in emerging economies such as India, China, and Japan. Increased focus on food security, government support for bio-based crop inputs, and rising awareness among farmers are key growth factors. In addition, the region’s large agricultural base and expansion of distribution channels are enhancing ABA accessibility to a wider farming community.

Japan Abscisic Acid (ABA) Market Insight

The Japan ABA market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s focus on technological innovation in agriculture, high-value crop production, and precision farming practices. ABA adoption is driven by increasing demand for yield stability and environmental stress mitigation. Moreover, integration with modern irrigation systems and growing awareness of natural plant growth regulators are supporting consistent market growth in both commercial and horticultural applications.

China Abscisic Acid (ABA) Market Insight

The China ABA market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid agricultural modernization, government initiatives promoting sustainable inputs, and large-scale cultivation of stress-sensitive crops. ABA is becoming increasingly popular for enhancing drought and salinity tolerance in key crops such as rice, wheat, and fruits. The focus on improving crop productivity, along with strong domestic manufacturing and distribution networks, is propelling ABA market growth in China.

Abscisic Acid (ABA) Market Share

The Abscisic Acid (ABA) industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- DuPont (U.S.)

- TATA Chemicals Limited (India)

- Nufarm (Australia)

- Arysta LifeScience (Japan)

- Fine Agrochemicals (India)

- Vizag Chemical (India)

- ALPHA CHEMIKA (India)

- Syngenta (Switzerland)

- Sumitomo Chemical Co., Ltd (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.