Global Accelerometer Sensor Market

Market Size in USD Billion

CAGR :

%

USD

190.84 Billion

USD

327.90 Billion

2021

2029

USD

190.84 Billion

USD

327.90 Billion

2021

2029

| 2022 –2029 | |

| USD 190.84 Billion | |

| USD 327.90 Billion | |

|

|

|

|

Market Analysis and Size

Various sensors have applications in numerous industry vertical, such as consumer electronic products, IT and telecommunication, and automotive, among others. Accelerometers are being widely used for measuring the acceleration of a moving body.

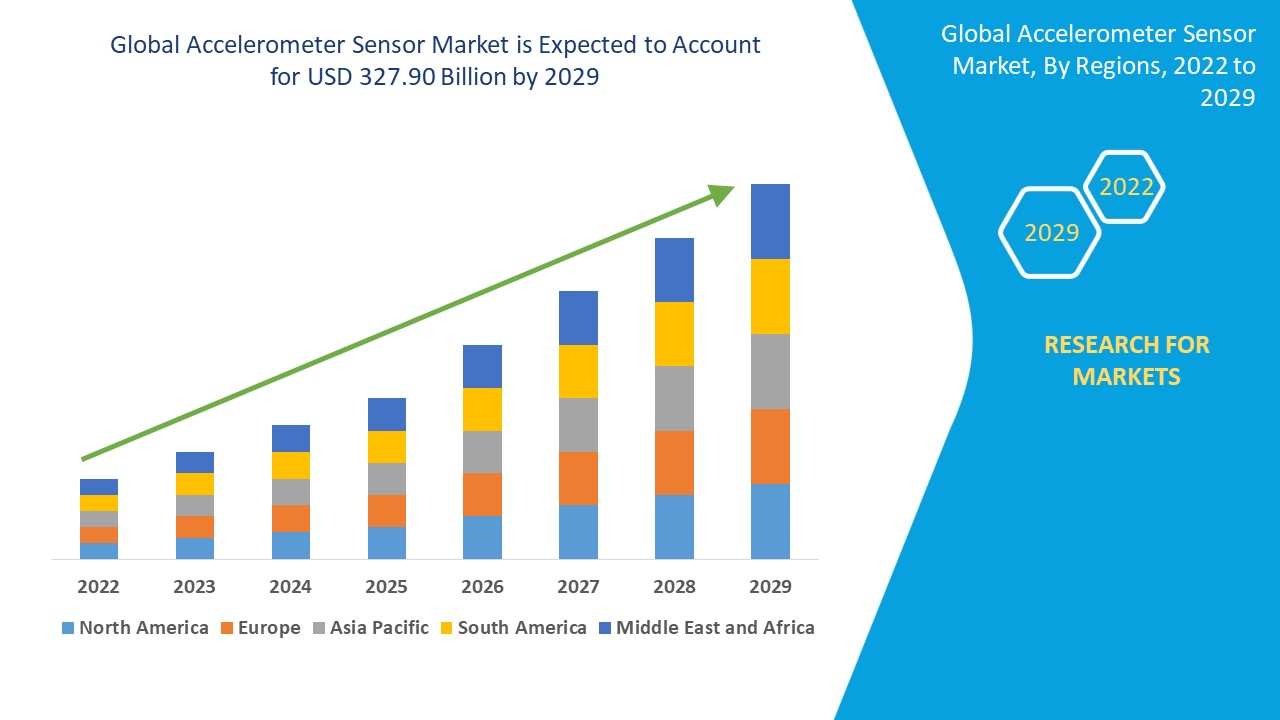

Global Accelerometer Sensor Market was valued at USD 190.84 billion in 2021 and is expected to reach USD 327.90 billion by 2029, registering a CAGR of 7.00% during the forecast period of 2022-2029. Automotive accounts for the largest industry vertical in the respective market owing to the increased product usage in vehicles to detect mechanical vibrations. The automotive sector accounts for the largest segment in the end use industry owing to the high adoption of these sensors to ensure that air inside the car is optimally regulated.

Market Definition

An accelerometer refers to a sensor that measures acceleration. It also measures change in velocity of an object with time. The measurement is utilized for determining whether a car or other vehicle is accelerating and at what speed. These sensors are being deployed for analyzing earthquakes by measuring seismic waves.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Dimension (1-Axis, 2-Axis, 3-Axis), Industry Vertical (Consumer Electronics, Automotive, Aerospace and Defense, Industrial, Healthcare), Technology (CMOS, MEMS, NEMS, Others), Type (MEMS Accelerometer, Piezoelectric Accelerometer, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA). |

|

Market Players Covered |

STMicroelectronics (Switzerland), TE Connectivity (Switzerland), Qualcomm Technologies, Inc. (US), NXP Semiconductors. (Netherlands), Infineon Technologies AG (Germany), Texas Instruments Incorporated. (US), Robert Bosch GmbH (Germany), Microchip Technology Inc. (US), Honeywell International Inc. (US), ROHM Co. LTD. (Japan), Taiwan Semiconductor Manufacturing Company Limited (Taiwan), TDK Corporation. (Japan), KIONIX, Inc. (US), Murata Manufacturing Co., Ltd. (Japan), Northrop Grumman LITEF GmbH (Germany), and Sensonor (Norway), among others |

|

Market Opportunities |

|

Accelerometer Sensor Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- High Adoption of Accelerometer

The increase in the adoption of accelerometer due to the benefits offered by these sensors, such as simple installation, good response at high frequencies, and low cost acts as one of the major factors driving the growth of accelerometer sensor market. These sensors are also used for measuring high vibration levels of robotic machinery in high-end industrial applications.

- Demand for Micro-Electromechanical System (MEMS)

The rise in demand for Micro-Electromechanical System (MEMS)-based vibration sensors, including aerospace and defense, and automobile, among others accelerate the market growth. Also, these sensors are capable of controlling the damage caused to critical materials during high-speed activities.

- Use in Navigation Systems

The surge in the navigation systems where GPS is not available, such as submarines and satellites further influence the market. The adoption of automated condition monitoring technologies for development of smart factories has a positive impact on the market.

Additionally, rapid industrialization, surge in investments and development of manufacturing sectors positively affect the accelerometer sensor market.

Opportunities

Furthermore, advent of machine learning and big data analytics and development of advanced sensor technologies extends profitable opportunities to the market players in the forecast period of 2021 to 2029. Also, adoption of IIoT in different industries for vibration monitoring is will further assist in the expansion of the market.

Restraints/Challenges

On the other hand, additional retrofitting costs for incorporating vibration monitoring solutions in existing machinery and adherence to regulatory standards are expected to obstruct market growth. Also, trade restrictions imposed by US on China, and limited accessibility to expertise at remote locations are projected to challenge the accelerometer sensor market in the forecast period of 2022-2029.

This accelerometer sensor market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on accelerometer sensor market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Accelerometer Sensor Market

COVID-19 has a major impact on the accelerometer sensor market. The factories in several countries witnessed shut downs in the initial stages of the pandemic as the governments implemented strict lockdowns in order to prevent the spread of the virus. In the post-pandemic, the lockdowns are being lifted and restrictions are being eased. Numerous companies were allowed to resume factory operations but at a limited capacity that use accelerometer sensor after the pandemic. The accelerometer sensor market is expected to gain its pace in the post-pandemic scenario owing to the easing on the restrictions.

Recent Developments

- STMicroelectronics announced the launch of AIS2IH, next-generation MEMS three-axis linear accelerometer in May’2021. This sensor is capable of improving resolution, mechanical robustness and stability to automotive applications, including telematics infotainment.

- Reality Analytics Inc. announced their partnership with Fujitsu Component Ltd. in September’2021 for bringing Fujitsu Component Ltd.’s contactless vibration sensor to manufacturing and industrial applications.

Global Accelerometer Sensor Market Scope and Market Size

The accelerometer sensor market is segmented on the basis of type, technology, dimension, and industry vertical. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- MEMS Accelerometer

- Piezoelectric Accelerometer

- Others

Technology

Dimension

- 1-Axis

- 2-Axis

- 3-Axis

Industry Vertical

- Consumer Electronics

- Automotive

- Aerospace and Defense

- Industrial

- Healthcare

Accelerometer Sensor Market Regional Analysis/Insights

The accelerometer sensor market is analyzed and market size insights and trends are provided by country, type, technology, dimension, and industry vertical as referenced above.

The countries covered in the accelerometer sensor market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

North America dominates the accelerometer sensor market because of the increased adoption of vibration sensors and well-established automotive sector within the region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2022 to 2029 because of the increase in need for advanced vibration sensors in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Accelerometer Sensor Market

The accelerometer sensor market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to accelerometer sensor market.

Some of the major players operating in the accelerometer sensor market are

- STMicroelectronics (Switzerland)

- TE Connectivity (Switzerland)

- Qualcomm Technologies, Inc. (US)

- NXP Semiconductors. (Netherlands)

- Infineon Technologies AG (Germany)

- Texas Instruments Incorporated. (US)

- Robert Bosch GmbH (Germany)

- Microchip Technology Inc. (US)

- Honeywell International Inc. (US)

- ROHM Co. LTD. (Japan)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

- TDK Corporation. (Japan)

- KIONIX, Inc. (US)

- Murata Manufacturing Co., Ltd. (Japan)

- Northrop Grumman LITEF GmbH (Germany)

- Sensonor (Norway)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ACCELEROMETER SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ACCELEROMETER SENSOR MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 MULTIVARIATE MODELLING

2.7 TOP TO BOTTOM ANALYSIS

2.8 STANDARDS OF MEASUREMENT

2.9 VENDOR SHARE ANALYSIS

2.1 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.12 GLOBAL ACCELEROMETER SENSOR MARKET: RESEARCH SNAPSHOT

2.13 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES MODEL

5.2 TECHNOLOGY ANALYSIS

5.3 VALUE CHAIN ANALYSIS

6 GLOBAL ACCELEROMETER SENSOR MARKET, BY TYPE

6.1 OVERVIEW

6.2 MEMS ACCELEROMETER

6.3 PIEZOELECTRIC ACCELEROMETER

6.3.1 BY FORM

6.3.1.1. PIEZOELECTRIC CHARGE (PE) ACCELEROMETERS

6.3.1.2. IEPE ACCELEROMETERS

6.4 PIEZORESISTIVE ACCELEROMETER

6.5 OTHERS

7 GLOBAL ACCELEROMETER SENSOR MARKET, BY DIMENSION

7.1 OVERVIEW

7.2 1 AXIS

7.3 2 AXIS

7.4 3 AXIS

8 GLOBAL ACCELEROMETER SENSOR MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 CMOS

8.3 MEMS

8.4 NEMS

8.5 OTHERS

9 GLOBAL ACCELEROMETER SENSOR MARKET, BY TYPE OF SENSOR

9.1 OVERVIEW

9.2 ANALOG ACCELEROMETERS SENSORS

9.3 DIGITAL ACCELEROMETERS SENSORS

10 GLOBAL ACCELEROMETER SENSOR MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 LOW-END APPLICATION

10.2.1 TRANSPORTATION

10.2.1.1. RAILWAY

10.2.1.2. AUTOMOTIVE

10.2.2 ELECTRONICS

10.2.2.1. SMARTPHONES, TABLETS, AND LAPTOPS

10.2.2.2. WEARABLE DEVICES

10.2.2.3. PORTABLE NAVIGATION DEVICES (PNDS)

10.2.2.4. PORTABLE MEDIA PLAYERS

10.2.2.5. DIGITAL CAMERAS

10.2.2.6. OTHERS

10.2.3 OTHERS

10.3 HIGH-END APPLICATION

10.3.1 DEFENSE

10.3.2 AEROSPACE

10.3.2.1. COMMERCIAL AIRCRAFT

10.3.2.2. MILITARY AIRCRAFT

10.3.2.3. SPACECRAFT

10.3.3 REMOTELY OPERATED VEHICLE (ROV)

10.3.3.1. UNMANNED UNDERWATER VEHICLE (UUV)

10.3.3.2. UNMANNED AERIAL VEHICLE (UAV)

10.3.3.3. UNMANNED GROUND VEHICLE (UGV)

10.3.4 INDUSTRIAL

10.3.5 MEDICAL

10.3.6 OTHERS

11 GLOBAL ACCELEROMETER SENSOR MARKET, BY REGION

11.1 GLOBAL ACCELEROMETER SENSOR MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1.1 NORTH AMERICA

11.1.1.1. U.S.

11.1.1.2. CANADA

11.1.1.3. MEXICO

11.1.2 EUROPE

11.1.2.1. GERMANY

11.1.2.2. FRANCE

11.1.2.3. U.K.

11.1.2.4. ITALY

11.1.2.5. SPAIN

11.1.2.6. RUSSIA

11.1.2.7. TURKEY

11.1.2.8. BELGIUM

11.1.2.9. NETHERLANDS

11.1.2.10. SWITZERLAND

11.1.2.11. REST OF EUROPE

11.1.3 ASIA PACIFIC

11.1.3.1. JAPAN

11.1.3.2. CHINA

11.1.3.3. SOUTH KOREA

11.1.3.4. INDIA

11.1.3.5. AUSTRALIA

11.1.3.6. SINGAPORE

11.1.3.7. THAILAND

11.1.3.8. MALAYSIA

11.1.3.9. INDONESIA

11.1.3.10. PHILIPPINES

11.1.3.11. REST OF ASIA PACIFIC

11.1.4 SOUTH AMERICA

11.1.4.1. BRAZIL

11.1.4.2. ARGENTINA

11.1.4.3. REST OF SOUTH AMERICA

11.1.5 MIDDLE EAST AND AFRICA

11.1.5.1. SOUTH AFRICA

11.1.5.2. EGYPT

11.1.5.3. SAUDI ARABIA

11.1.5.4. U.A.E.

11.1.5.5. ISRAEL

11.1.5.6. REST OF MIDDLE EAST AND AFRICA

11.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

12 GLOBAL ACCELEROMETER SENSOR MARKET,COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT & APPROVALS

12.7 EXPANSIONS

12.8 REGULATORY CHANGES

12.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 GLOBAL ACCELEROMETER SENSOR MARKET, SWOT ANALYSIS

14 GLOBAL ACCELEROMETER SENSOR MARKET, COMPANY PROFILE

14.1 ROBERT BOSCH GMBH

14.1.1 COMPANY OVERVIEW

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 GEOGRAPHIC PRESENCE

14.1.5 RECENT DEVELOPMENTS

14.2 STMICROELECTRONICS N.V.

14.2.1 COMPANY OVERVIEW

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 GEOGRAPHIC PRESENCE

14.2.5 RECENT DEVELOPMENTS

14.3 ANALOG DEVICES, INC.

14.3.1 COMPANY OVERVIEW

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 GEOGRAPHIC PRESENCE

14.3.5 RECENT DEVELOPMENTS

14.4 COLIBRYS LTD.

14.4.1 COMPANY OVERVIEW

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 GEOGRAPHIC PRESENCE

14.4.5 RECENT DEVELOPMENTS

14.5 HONEYWELL INTERNATIONAL, INC.

14.5.1 COMPANY OVERVIEW

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 GEOGRAPHIC PRESENCE

14.5.5 RECENT DEVELOPMENTS

14.6 NORTHROP GRUMMAN LITEF GMBH

14.6.1 COMPANY OVERVIEW

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 GEOGRAPHIC PRESENCE

14.6.5 RECENT DEVELOPMENTS

14.7 KVH INDUSTRIES, INC.

14.7.1 COMPANY OVERVIEW

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 GEOGRAPHIC PRESENCE

14.7.5 RECENT DEVELOPMENTS

14.8 MURATA MANUFACTURING CO., LTD.

14.8.1 COMPANY OVERVIEW

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 GEOGRAPHIC PRESENCE

14.8.5 RECENT DEVELOPMENTS

14.9 NXP SEMICONDUCTORS N.V.

14.9.1 COMPANY OVERVIEW

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 GEOGRAPHIC PRESENCE

14.9.5 RECENT DEVELOPMENTS

14.1 INVENSENSE, INC.

14.10.1 COMPANY OVERVIEW

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 GEOGRAPHIC PRESENCE

14.10.5 RECENT DEVELOPMENTS

14.11 KIONIX, INC.

14.11.1 COMPANY OVERVIEW

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 GEOGRAPHIC PRESENCE

14.11.5 RECENT DEVELOPMENTS

14.12 FIZOPTIKA CORP.

14.12.1 COMPANY OVERVIEW

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 GEOGRAPHIC PRESENCE

14.12.5 RECENT DEVELOPMENTS

14.13 INNALABS HOLDING INC.

14.13.1 COMPANY OVERVIEW

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 GEOGRAPHIC PRESENCE

14.13.5 RECENT DEVELOPMENTS

14.14 SENSONOR AS

14.14.1 COMPANY OVERVIEW

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 GEOGRAPHIC PRESENCE

14.14.5 RECENT DEVELOPMENTS

14.15 SYSTRON DONNER INERTIAL

14.15.1 COMPANY OVERVIEW

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 GEOGRAPHIC PRESENCE

14.15.5 RECENT DEVELOPMENTS

14.16 TE CONNECTIVITY

14.16.1 COMPANY OVERVIEW

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 GEOGRAPHIC PRESENCE

14.16.5 RECENT DEVELOPMENTS

14.17 QUALCOMM TECHNOLOGIES, INC.

14.17.1 COMPANY OVERVIEW

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 GEOGRAPHIC PRESENCE

14.17.5 RECENT DEVELOPMENTS

14.18 INFINEON TECHNOLOGIES AG

14.18.1 COMPANY OVERVIEW

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 GEOGRAPHIC PRESENCE

14.18.5 RECENT DEVELOPMENTS

14.19 MICROCHIP TECHNOLOGY INC.

14.19.1 COMPANY OVERVIEW

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 GEOGRAPHIC PRESENCE

14.19.5 RECENT DEVELOPMENTS

14.2 ROHM CO. LTD.

14.20.1 COMPANY OVERVIEW

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 GEOGRAPHIC PRESENCE

14.20.5 RECENT DEVELOPMENTS

14.21 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

14.21.1 COMPANY OVERVIEW

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 GEOGRAPHIC PRESENCE

14.21.5 RECENT DEVELOPMENTS

14.22 IXBLUE SAS

14.22.1 COMPANY OVERVIEW

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 GEOGRAPHIC PRESENCE

14.22.5 RECENT DEVELOPMENTS

14.23 AERON SYSTEMS LTD.

14.23.1 COMPANY OVERVIEW

14.23.2 REVENUE ANALYSIS

14.23.3 PRODUCT PORTFOLIO

14.23.4 GEOGRAPHIC PRESENCE

14.23.5 RECENT DEVELOPMENTS

14.24 LORD CORPORATION

14.24.1 COMPANY OVERVIEW

14.24.2 REVENUE ANALYSIS

14.24.3 PRODUCT PORTFOLIO

14.24.4 GEOGRAPHIC PRESENCE

14.24.5 RECENT DEVELOPMENTS

14.25 VECTORNAV TECHNOLOGIES LLC.

14.25.1 COMPANY OVERVIEW

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 GEOGRAPHIC PRESENCE

14.25.5 RECENT DEVELOPMENTS

14.26 MEMSIC INC.

14.26.1 COMPANY OVERVIEW

14.26.2 REVENUE ANALYSIS

14.26.3 PRODUCT PORTFOLIO

14.26.4 GEOGRAPHIC PRESENCE

14.26.5 RECENT DEVELOPMENTS

14.27 SBG SYSTEMS S.A.S.

14.27.1 COMPANY OVERVIEW

14.27.2 REVENUE ANALYSIS

14.27.3 PRODUCT PORTFOLIO

14.27.4 GEOGRAPHIC PRESENCE

14.27.5 RECENT DEVELOPMENTS

14.28 SYSTRON DONNER INC.

14.28.1 COMPANY OVERVIEW

14.28.2 REVENUE ANALYSIS

14.28.3 PRODUCT PORTFOLIO

14.28.4 GEOGRAPHIC PRESENCE

14.28.5 RECENT DEVELOPMENTS

15 RELATED REPORTS

16 QUESTIONNAIRE

17 ABOUT DATA BRIDGE MARKET RESEARCH

Global Accelerometer Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Accelerometer Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Accelerometer Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.