Global Access Control As A Service Acaas Market

Market Size in USD Billion

CAGR :

%

USD

1.51 Billion

USD

5.19 Billion

2024

2032

USD

1.51 Billion

USD

5.19 Billion

2024

2032

| 2025 –2032 | |

| USD 1.51 Billion | |

| USD 5.19 Billion | |

|

|

|

|

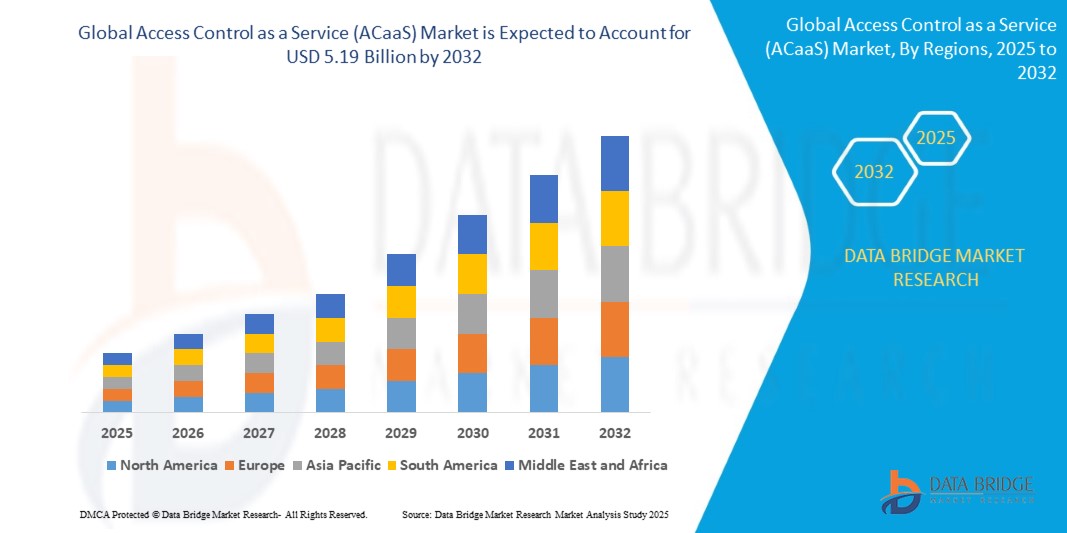

What is the Global Access Control as a Service (ACaaS) Market Size and Growth Rate?

- The global access control as a service (ACaaS) market size was valued at USD 1.51 billion in 2024 and is expected to reach USD 5.19 billion by 2032, at a CAGR of 16.70% during the forecast period

- The growth is primarily driven by increasing adoption of connected home and commercial security systems, coupled with advancements in cloud-based technology and IoT-enabled devices

- Rising demand for secure, convenient, and easily managed access solutions is further propelling the market, as businesses and homeowners increasingly prioritize remote monitoring, digital authentication, and integration with broader smart building ecosystems

- Technological innovations in AI, mobile credentials, and multi-factor authentication are enhancing the capabilities of ACaaS solutions, creating a more robust, scalable, and user-friendly access control experience, which is accelerating adoption worldwide

What are the Major Takeaways of Access Control as a Service (ACaaS) Market?

- ACaaS solutions, providing cloud-based or digital access control for doors, gates, and entry points, are becoming essential for modern home and commercial security systems due to their convenience, remote accessibility, and compatibility with smart ecosystems

- Growing security concerns, rising preference for keyless entry, and increasing adoption of smart building solutions are the primary drivers of ACaaS demand

- Integration with other smart technologies, such as surveillance cameras, lighting, and climate control systems, is further enhancing the value proposition of ACaaS platforms, making them the preferred choice for both residential and commercial applications

- Cloud-based management, AI-assisted monitoring, and mobile-friendly controls allow users to track, manage, and customize access remotely, supporting the trend toward centralized, automated, and secure access control solutions

- North America dominated the ACaaS market with the largest revenue share of 36.11% in 2024, driven by high adoption of smart home technologies, growing demand for secure keyless entry, and heightened awareness of connected devices

- Asia-Pacific ACaaS market is expected to grow at the fastest CAGR of 11.03% from 2025 to 2032, fueled by rapid urbanization, increasing disposable incomes, and technological advancements in countries such as China, Japan, and India

- The Hardware segment dominated the market with the largest revenue share of 45.6% in 2024, driven by the increasing demand for secure and reliable physical access control devices such as smart locks, controllers, and biometric readers

Report Scope and Access Control as a Service (ACaaS) Market Segmentation

|

Attributes |

Access Control as a Service (ACaaS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Access Control as a Service (ACaaS) Market?

Enhanced Convenience Through AI and Voice Integration

- A major trend in the global ACaaS market is the growing integration of artificial intelligence (AI) and voice-controlled platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit, enhancing convenience and user control

- For instance, August Wi-Fi ACaaS systems allow users to lock or unlock doors via voice commands, while Level Lock+ integrates with Siri and Apple HomeKit, offering a seamless and discreet access control experience

- AI-enabled ACaaS can learn user access patterns, optimize security alerts, and improve authentication accuracy over time, as seen in some Ultraloq models. Voice control also allows hands-free operation, making remote management effortless

- The integration of ACaaS with smart home ecosystems enables centralized control of doors, lighting, climate, and other devices through a single interface, promoting a unified automated environment

- Companies such as WELOCK are developing AI-powered ACaaS with features such as automatic locking/unlocking and compatibility with major voice assistants

- Growing demand for AI and voice-enabled ACaaS is evident across residential and commercial sectors, reflecting consumers’ increasing preference for convenience and smart home functionality

What are the Key Drivers of Access Control as a Service (ACaaS) Market?

- Rising security concerns among homeowners and businesses, combined with increasing adoption of smart home technologies, are key drivers of ACaaS demand

- In April 2024, Onity, Inc. (Honeywell International, Inc.) announced IoT-enabled self-storage security upgrades, integrating advanced sensors into the Passport locking solution, illustrating how technological innovation drives market growth

- ACaaS offers features such as remote monitoring, activity logs, and tamper alerts, providing superior protection compared to traditional mechanical locks

- The increasing adoption of interconnected smart devices makes ACaaS a critical component in modern homes and commercial spaces, enabling seamless integration across platforms

- Convenience factors such as keyless entry, smartphone-based remote access, and multi-user management are propelling adoption, alongside DIY-friendly installation options and user-friendly designs

Which Factor is Challenging the Growth of the Access Control as a Service (ACaaS) Market?

- Cybersecurity risks pose a major challenge, as ACaaS devices rely on network connectivity and are vulnerable to hacking and data breaches, raising consumer concerns

- High-profile IoT security vulnerabilities have made some users hesitant to adopt connected access control solutions

- Addressing these concerns through robust encryption, secure authentication, and regular software updates is essential for building trust. Companies such as August and Level Home highlight advanced security in their marketing strategies

- The relatively high cost of advanced ACaaS systems compared to traditional locks may limit adoption in price-sensitive regions, though basic models from brands such as Wyze are becoming more affordable

- Despite declining prices, the perceived premium for smart access technology can still hinder widespread adoption

- Overcoming these barriers through improved cybersecurity, consumer education, and affordable ACaaS options is critical for sustained market growth

How is the Access Control as a Service (ACaaS) Market Segmented?

The market is segmented on the basis of component, ACaaS deployment, authentication method, connectivity technology, and application.

- By Component

On the basis of component, the ACaaS market is segmented into Hardware, Software, and Services. The Hardware segment dominated the market with the largest revenue share of 45.6% in 2024, driven by the increasing demand for secure and reliable physical access control devices such as smart locks, controllers, and biometric readers. Hardware remains critical as the backbone of ACaaS systems, and its integration with cloud-based platforms enhances the overall security and functionality of solutions.

The Software segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, fueled by rising adoption of cloud-based management platforms, AI-powered monitoring, and analytics for intelligent access control. Growing demand for remote management, predictive maintenance, and seamless integration with smart building solutions is accelerating software deployment across residential, commercial, and industrial sectors.

- By ACaaS Deployment

On the basis of ACaaS deployment, the market is segmented into Hosted, Managed, and Hybrid. The Hosted segment held the largest market revenue share of 48.1% in 2024, owing to its cost-effectiveness, scalability, and ease of implementation for both residential and commercial clients. Hosted ACaaS allows centralized control and monitoring without the need for heavy IT infrastructure, making it attractive for small-to-medium enterprises and multi-site operations.

The Managed deployment segment is expected to witness the fastest CAGR of 20.7% during 2025–2032, as organizations increasingly rely on service providers for full lifecycle management, enhanced security, and compliance. Managed solutions reduce operational complexity and offer real-time monitoring, incident response, and expert support, driving adoption among enterprises with high-security requirements.

- By Authentication Method

On the basis of authentication method, the ACaaS market is segmented into Single-Factor, Multi-Factor, and Mobile Credential. The Single-Factor segment dominated with a market revenue share of 42.8% in 2024, primarily due to the simplicity, cost-effectiveness, and widespread familiarity of single-factor authentication using passwords, PINs, or physical keys.

The Mobile Credential segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, driven by the proliferation of smartphones and mobile applications that allow secure, convenient, and contactless access. Mobile credential solutions are increasingly integrated with cloud-based platforms, enabling dynamic access control, remote revocation, and real-time activity logs for both residential and enterprise applications.

- By Connectivity Technology

On the basis of connectivity technology, the ACaaS market is segmented into RFID/NFC, Smart Cards, Bluetooth LE, and UWB. The RFID/NFC segment dominated the market with a revenue share of 44.3% in 2024, supported by the widespread use of contactless cards and badges across commercial, industrial, and institutional sectors.

The Bluetooth LE segment is expected to witness the fastest CAGR of 21.5% during 2025–2032, as it offers low-power, reliable, and smartphone-compatible access control solutions. Bluetooth-enabled ACaaS facilitates seamless mobile credentials, proximity-based authentication, and integration with smart building systems, driving adoption in residential, commercial, and enterprise environments.

- By End-User Vertical

On the basis of end-user vertical, the ACaaS market is segmented into Commercial, Industrial, Government, and Others. The Commercial segment dominated with the largest market revenue share of 46.7% in 2024, driven by the growing demand for centralized security, employee access management, and compliance with audit requirements. Corporate offices, retail outlets, and hospitality businesses prefer ACaaS for scalable, cloud-managed access control.

The Industrial segment is expected to witness the fastest CAGR of 22.8% from 2025 to 2032, fueled by the need for enhanced safety, restricted area access, and integration with IoT-based monitoring systems in manufacturing plants, warehouses, and energy facilities. Industrial users benefit from multi-site access management, real-time alerts, and workforce accountability features offered by ACaaS solutions.

Which Region Holds the Largest Share of the Access Control as a Service (ACaaS) Market?

- North America dominated the ACaaS market with the largest revenue share of 36.11% in 2024, driven by high adoption of smart home technologies, growing demand for secure keyless entry, and heightened awareness of connected devices

- Consumers value the convenience, advanced security features, and seamless integration offered by ACaaS with smart home ecosystems, including lighting, thermostats, and other IoT devices

- Widespread adoption is supported by high disposable incomes, tech-savvy populations, and the preference for remote monitoring and control, establishing ACaaS as the preferred access solution for both residential and commercial properties

U.S. Access Control as a Service (ACaaS) Market Insight

U.S. ACaaS market captured the largest revenue share of 81% in North America in 2024, fueled by rapid adoption of connected devices and smart home automation. Consumers increasingly prioritize intelligent keyless entry systems, DIY smart home setups, and integration with voice assistants such as Alexa, Google Assistant, and Apple HomeKit. Growing adoption of mobile apps, centralized control systems, and enhanced security features continues to drive market expansion across residential and commercial sectors.

Saudi Arabia Access Control as a Service (ACaaS) Market Insight

Saudi Arabia ACaaS market is witnessing strong growth due to increasing investments in smart cities, government-driven digital transformation initiatives, and rising awareness of security solutions. Adoption is driven by commercial buildings, residential projects, and industrial facilities, with a focus on keyless entry, remote monitoring, and mobile-based access management. Integration with smart building systems and centralized management platforms is boosting demand for ACaaS solutions in the region.

U.A.E. Access Control as a Service (ACaaS) Market Insight

U.A.E. ACaaS market is expanding rapidly, supported by advanced infrastructure, high disposable incomes, and the government’s push for smart city developments. Businesses and homeowners are increasingly adopting cloud-based, AI-enabled access control systems for enhanced security, convenience, and integration with IoT ecosystems. The market is seeing significant growth across commercial complexes, hospitality, and residential developments, driven by the need for scalable, remotely managed security solutions.

Which Region is the Fastest Growing in the Access Control as a Service (ACaaS) Market?

Asia-Pacific ACaaS market is expected to grow at the fastest CAGR of 11.03% from 2025 to 2032, fueled by rapid urbanization, increasing disposable incomes, and technological advancements in countries such as China, Japan, and India. Rising smart home adoption, government digitalization initiatives, and the emergence of APAC as a manufacturing hub for ACaaS components are driving affordability and accessibility for a wider consumer base.

Japan Access Control as a Service (ACaaS) Market Insight

Japan’s ACaaS market is gaining momentum due to its high-tech culture, rapid urbanization, and convenience-driven consumer base. The integration of ACaaS with other IoT devices, including home security cameras and lighting systems, is boosting adoption in both residential and commercial sectors. The aging population also increases demand for easy-to-use, secure access solutions.

China Access Control as a Service (ACaaS) Market Insight

China accounted for the largest market revenue share in APAC in 2024, driven by rapid urbanization, a growing middle class, and high technological adoption rates. ACaaS adoption is increasing across residential, commercial, and rental properties due to smart city initiatives and affordable, scalable solutions. Strong domestic manufacturers and government support for digital infrastructure are further propelling market growth.

Which are the Top Companies in Access Control as a Service (ACaaS) Market?

The access control as a service (ACaaS) industry is primarily led by well-established companies, including:

- Johnson Controls Inc. (Ireland)

- Honeywell International Inc. (U.S.)

- Thales Group (France)

- ASSA ABLOY Group (Sweden)

- dormakaba Group (Switzerland)

- Identiv, Inc. (U.S.)

- HID Global Corporation (U.S.)

- Kastle Systems (U.S.)

- AMAG Technology (U.S.)

- Brivo Systems, LLC (U.S.)

- Cloudastructure Inc. (U.S.)

- Genetec Inc. (Canada)

- STANLEY Security (Securitas Technology) (U.S.)

- DataWatch Systems (U.S.)

- Telcred (Sweden)

- Forcefield Systems (Canada)

- Vanderbilt Industries (Ireland)

- Kisi Inc. (U.S.)

- Acre Security (Canada)

- Servsys Inc. (U.S.)

- Spectra Technovision Pvt. Ltd. (India)

- M3T Corporation (U.S.)

- Vector Security (U.S.)

- Delinea (U.S.)

- GALLAGHER GROUP LIMITED (New Zealand)

- DSX Access Systems Inc. (U.S.)

- ZKTeco Co., Ltd. (China)

What are the Recent Developments in Global Access Control as a Service (ACaaS) Market?

- In January 2025, ASSA ABLOY is set to acquire 3millID Corporation and Third Millennium Systems Ltd, companies based in the U.S. and U.K. that specialize in readers and credentials for physical access control, enhancing its existing solutions with advanced technology and creating complementary growth opportunities. This acquisition is expected to strengthen ASSA ABLOY’s leadership in the global access control market

- In June 2024, Honeywell (U.S.) acquired the Global Access Solutions (GAS) division of Carrier, located in Florida, which focuses on advanced access control and security systems for commercial buildings, including electronic access control, video surveillance, and integrated security management. This move expands Honeywell’s portfolio in commercial building security solutions

- In November 2023, Kastle, a leader in property technology and managed security, launched Kastle EverPresence, the first fully interoperable physical access control system, designed to integrate seamlessly with existing infrastructure, improving efficiency and flexibility in security management. This innovation positions Kastle as a pioneer in smart and scalable access solutions

- In September 2023, ASSA ABLOY (Sweden) introduced the Aperio KL100, a wireless access solution for lockers and cabinets that integrates with over 100 existing access control systems, operates on a single battery, and supports multiple credential technologies. This product simplifies securing small access points with minimal disruption

- In July 2023, Johnson Controls (Ireland) acquired FM:Systems (U.S.), a company specializing in workplace management software to optimize space usage and efficiency, strengthening Johnson Controls’ smart building solutions. This acquisition enhances their integrated building management capabilities

- In July 2022, Thales (France) acquired OneWelcome, a supplier of cloud-based customer identity and access management solutions for highly regulated sectors, enabling secure connections for customers and business partners. This acquisition expands Thales’ digital identity and security offerings globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Access Control As A Service Acaas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Access Control As A Service Acaas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Access Control As A Service Acaas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.