Global Accidental Damage Insurance Market

Market Size in USD Billion

CAGR :

%

USD

71.30 Billion

USD

94.62 Billion

2024

2032

USD

71.30 Billion

USD

94.62 Billion

2024

2032

| 2025 –2032 | |

| USD 71.30 Billion | |

| USD 94.62 Billion | |

|

|

|

|

Accidental Damage Insurance Market Analysis

The accidental damage insurance market is evolving with advanced methods and technologies to enhance claim processes and customer experience. Blockchain technology is being integrated for secure and transparent claims management, reducing fraud and processing time. Insurers are leveraging artificial intelligence (AI) to predict risks, assess claims faster, and improve underwriting accuracy. AI-powered chatbots are also used for customer support, streamlining communication.

Telematics and IoT devices play a pivotal role in personalizing policies, especially in auto and home insurance. Devices such as smart home sensors and vehicle tracking systems help insurers gather real-time data, offering tailored premiums and proactive risk mitigation. In addition, digital platforms simplify policy management, enabling customers to access services online.

The usage of such innovations drives growth by attracting tech-savvy consumers seeking convenience and efficiency. Emerging markets show significant uptake due to rising digital penetration. With these advancements, the market is expected to expand as insurers tap into automation, personalization, and enhanced service delivery to meet evolving customer demands.

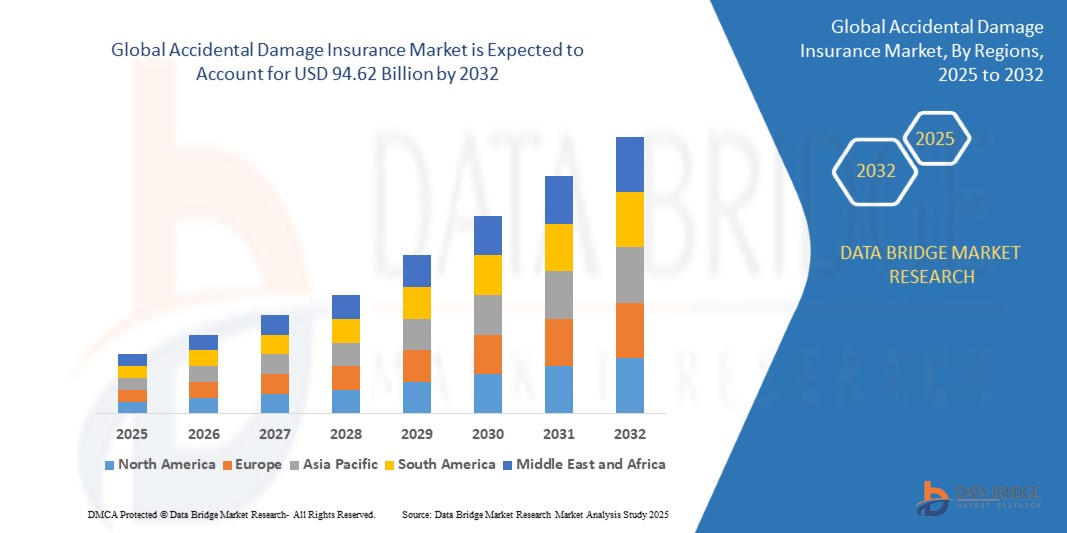

Accidental Damage insurance Market Size

The global accidental damage insurance market size was valued at USD 71.3 billion in 2024 and is projected to reach USD 94.62 billion by 2032, with a CAGR of 3.60% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Accidental Damage Insurance Market Trends

“Integration of Artificial Intelligence in Accidental Damage Insurance”

The adoption of Artificial Intelligence (AI) is significantly propelling the growth of the accidental damage insurance market. AI enhances efficiency and customer experience by automating claims processing, detecting fraud, and providing personalized support. For instance, AI-powered chatbots offer real-time assistance to policyholders, streamlining communication and expediting claim resolutions. Predictive analytics enable insurers to assess risks more accurately, leading to tailored policy offerings and competitive pricing. This technological integration not only reduces operational costs but also improves customer satisfaction, thereby attracting a broader clientele and driving market expansion.

Report Scope and Accidental Damage Insurance Market Segmentation

|

Attributes |

Accidental Damage Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Allianz SE (Germany), AXA SA (France), Zurich Insurance Group (Switzerland), China Life Insurance Company Limited (China), Berkshire Hathaway Inc. (U.S.), Prudential plc (U.K.), Munich Re Group (Germany), Assicurazioni Generali S.p.A. (Italy), Japan Post Holdings Co., Ltd. (Japan), MetLife, Inc. (U.S.), Ping An Insurance (Group) Company of China, Ltd. (China), AIG (U.S.), Manulife Financial Corporation (Canada), CNP Assurances (France), Chubb Limited (Switzerland), Aviva plc (U.K.), Swiss Re Ltd. (Switzerland), Sumitomo Life Insurance Company (Japan), Aflac Incorporated (U.S.), and Legal & General Group plc (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Accidental Damage Insurance Market Definition

Accidental Damage Insurance provides coverage for unexpected and unintentional damage to personal belongings or property. It protects against incidents such as dropping a smartphone, spilling liquids on a laptop, or breaking a window. This insurance supplements standard policies, such as home or contents insurance, by covering situations not typically included, such as accidents caused by carelessness. For businesses, it can safeguard essential equipment or assets. While policies vary, exclusions may include intentional damage or general wear and tear. Ideal for individuals seeking peace of mind, accidental damage insurance ensures financial protection and swift repairs or replacements for unforeseen mishaps.

Accidental Damage Insurance Market Dynamics

Drivers

- Increased Ownership of High-Value Items

The growing ownership of high-value items, such as smartphones, laptops, premium vehicles, and home appliances, significantly drives the accidental damage insurance market. Consumers are increasingly investing in gadgets such as foldable smartphones, which are highly susceptible to accidental damage. For instance, the global sale of premium smartphones crossed 150 million units in 2024, leading to a rise in demand for insurance coverage to mitigate repair or replacement costs. Similarly, high-end home appliances, such as smart refrigerators and washing machines, have seen increased adoption, prompting users to opt for insurance policies. This trend ensures financial security and promotes market growth.

- Integration of Value-Added Services

The integration of value-added services, such as instant claim settlement and hassle-free policy renewals, is a significant driver for the accidental damage insurance market. These services enhance customer satisfaction by simplifying processes and reducing wait times. For instance, insurers such as Progressive and Lemonade leverage AI-powered platforms to process claims within minutes, offering users quick resolutions. Similarly, automatic renewal systems ensure continuity of coverage without manual intervention, reducing policy lapses. Such conveniences appeal to tech-savvy consumers and busy professionals, boosting policy adoption. As insurers continue to innovate with personalized digital services, customer loyalty and market growth are expected to strengthen further.

Opportunities

- Rising Demand in Evolving Workplace Dynamics

The shift to remote work has significantly increased the use of personal gadgets, such as laptops, smartphones, and tablets, in home office setups. This creates opportunities for insurers to cater to a growing need for policies covering work-related accidental damages. As companies provide employees with expensive devices or allow BYOD (Bring Your Own Device) practices, the risk of damage increases. Insurers can capitalize by offering tailored solutions, such as gadget-specific coverage or hybrid policies combining personal and professional use. In addition, incorporating quick claim processes and value-added services, such as 24/7 assistance, further strengthens customer appeal, driving market growth and innovation in this sector.

- Frequent Natural Disasters

The increasing frequency of natural disasters such as floods, earthquakes, hurricanes, and wildfires creates significant opportunities in the accidental damage insurance market. These catastrophic events heighten the risk of property and asset damage, prompting individuals and businesses to seek comprehensive insurance coverage. Insurers can capitalize on this demand by offering tailored policies that cover specific disaster-related damages. Regions prone to such events, such as coastal areas or seismically active zones, present untapped potential for market expansion. Furthermore, the inclusion of add-ons such as quick claim settlements and disaster-specific premium plans enhances customer appeal, driving growth in the accidental damage insurance sector.

Restraints/Challenges

- High Claim Costs

The accidental damage insurance market is significantly impacted by high claim costs, particularly in industries such as automotive and property insurance. When insurers face large payouts for damage claims, it results in increased premiums for consumers. As a consequence, the affordability of coverage becomes a barrier for many potential policyholders, leading to lower market penetration. In some cases, insurers may also raise deductibles or reduce coverage options to mitigate these rising costs, which further limits the appeal of accidental damage insurance. The financial burden of high claim payouts not only affects consumers' willingness to purchase insurance but also strains the profitability and sustainability of insurance companies.

- Rising Fraudulent Claims

Rising fraudulent claims present a significant challenge for the accidental damage insurance market. As fraudulent activities increase, insurers face mounting operational costs due to the need for extensive investigations and the payment of illegitimate claims. These fraudulent claims strain resources, diverting attention from genuine claims, and ultimately reduce profitability. The prevalence of fraud leads to higher premiums, which may deter consumers from purchasing policies or lead to customer dissatisfaction. Furthermore, the administrative burden associated with handling fraud cases increases the overall cost of doing business, limiting insurers' ability to effectively manage risks and further hindering market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Accidental Damage Insurance Market Scope

The market is segmented on the basis of type, application, coverage type, distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Death and Dismemberment Insurance

- General Accident Insurance

- Disabilities Insurance

Application

- Enterprise

- Personal

Coverage Type

- Individual

- Group

Distribution Channel

- Brokers

- Direct

- Bancassurance

- Online

Accidental Damage Insurance Market Regional Analysis

The market is analyzed and market size insights and trends are provided by type, application, coverage type, distribution channel as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Asia-Pacific is expected to expand at a significant growth rate in the accidental damage insurance market, driven by a large population base and rapid economic development. The region is witnessing a rise in middle-class consumers who are becoming more insurance-savvy. In addition, government initiatives promoting insurance coverage and financial literacy are expected to support the growth of the market, creating more opportunities for providers and increasing the adoption of accidental damage insurance policies across the region.

North America is expected to dominate the accidental damage insurance market, driven by well-established insurance infrastructures and high levels of consumer awareness. The region’s robust regulatory frameworks and the increasing adoption of insurance products among consumers are key factors contributing to market growth. In addition, the rise in digital platforms and the expanding range of coverage options further support the demand for accidental damage insurance, making North America a leading player in this sector.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Accidental Damage Insurance Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Accidental Damage Insurance Market Leaders Operating in the Market Are:

- Allianz SE (Germany)

- AXA SA (France)

- Zurich Insurance Group (Switzerland)

- China Life Insurance Company Limited (China)

- Berkshire Hathaway Inc. (U.S.)

- Prudential plc (U.K.)

- Munich Re Group (Germany)

- Assicurazioni Generali S.p.A. (Italy)

- Japan Post Holdings Co., Ltd. (Japan)

- MetLife, Inc. (U.S.)

- Ping An Insurance (Group) Company of China, Ltd. (China)

- AIG (U.S.)

- Manulife Financial Corporation (Canada)

- CNP Assurances (France)

- Chubb Limited (Switzerland)

- Aviva plc (U.K.)

- Swiss Re Ltd. (Switzerland)

- Sumitomo Life Insurance Company (Japan)

- Aflac Incorporated (U.S.)

- Legal & General Group plc (U.K.)

Latest Developments in Accidental Damage Insurance Market

- In September 2023, Prudential Financial, Inc., a global leader in the insurance sector, entered into a strategic partnership with EvolutionIQ, an AI-driven technology company. This collaboration aims to enhance Prudential’s disability claims process, leveraging AI to improve claim management, expedite claimant recovery, and help individuals return to work more efficiently and effectively

- In 2021, according to the Insurance Institute for Highway Safety (IIHS), the year witnessed a staggering 39,508 fatal motor vehicle crashes across the United States. This tragic statistic led to an estimated 42,939 fatalities, underlining the urgent need for improved road safety measures and initiatives aimed at reducing such accidents and saving lives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.