Global Accounts Receivable Automation Market

Market Size in USD Billion

CAGR :

%

USD

4.30 Billion

USD

11.35 Billion

2024

2032

USD

4.30 Billion

USD

11.35 Billion

2024

2032

| 2025 –2032 | |

| USD 4.30 Billion | |

| USD 11.35 Billion | |

|

|

|

|

Global Accounts Receivable Automation Market Size

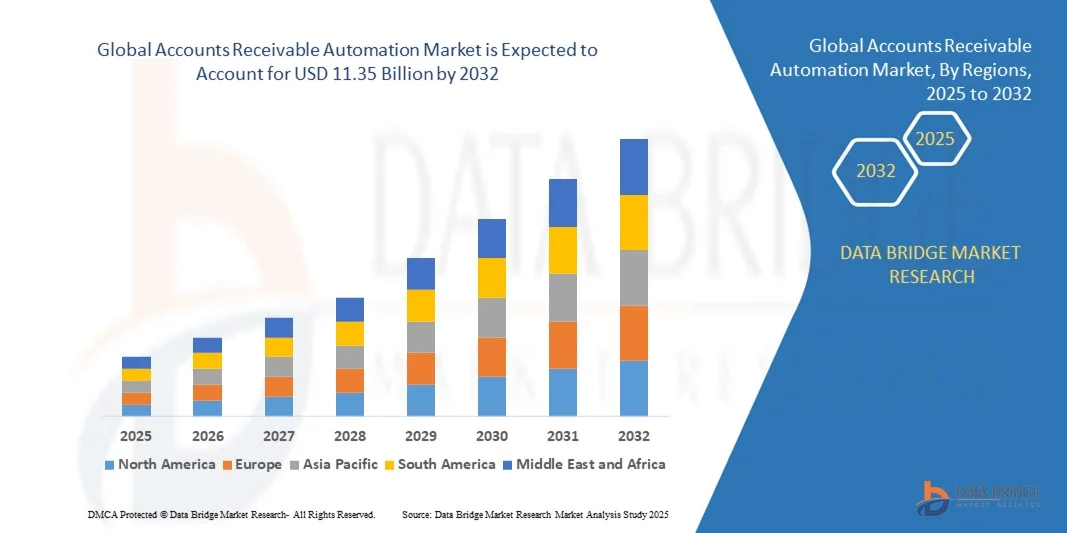

- The global accounts receivable automation market size was valued at USD 4.30 billion in 2024 and is expected to reach USD 11.35 billion by 2032, growing at a CAGR of 12.90% during the forecast period

- The market expansion is driven by the increasing need for streamlined financial operations and improved cash flow management across businesses of all sizes, supported by automation and digital transformation initiatives

- In addition, the rising demand for real-time data access, error reduction, and faster invoice processing is propelling the adoption of accounts receivable automation tools, which is significantly fueling market growth

Global Accounts Receivable Automation Market Analysis

- The global accounts receivable automation market is becoming an essential part of financial operations for businesses worldwide, offering automated invoice processing, payment tracking, and cash application to enhance accuracy, efficiency, and real-time visibility into receivables.

- The increasing adoption of cloud-based solutions, AI-powered analytics, and machine learning capabilities is driving demand for accounts receivable automation, as organizations seek to reduce manual errors, accelerate cash flow, and improve overall working capital management.

- North America led the accounts receivable automation market with the largest revenue share of 31.5% in 2024, supported by early adoption of automation technologies, a strong presence of software vendors, and the high demand for digital transformation among enterprises, particularly in the U.S. and Canada.

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid digitization across industries, expanding SMB sectors, and increased investments in financial technology infrastructure.

- The solutions segment dominated the market with the largest revenue share of 73.7% in 2024, primarily driven by businesses seeking automation tools that handle invoicing, collections, credit management, and dispute resolution

Report Scope and Global Accounts Receivable Automation Market Segmentation

|

Attributes |

Accounts Receivable Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Accounts Receivable Automation Market Trends

Enhanced Efficiency Through AI and Intelligent Process Automation

- A significant and accelerating trend in the Global Accounts Receivable Automation Market is the increasing integration of artificial intelligence (AI) and intelligent process automation (IPA) within AR workflows. This fusion of advanced technologies is transforming traditional receivables management by enhancing operational efficiency, reducing manual intervention, and improving cash flow visibility.

- For instance, leading AR automation platforms like HighRadius and YayPay are leveraging AI-driven predictive analytics to forecast customer payment behavior, enabling finance teams to proactively manage credit risk and optimize collections strategies. Similarly, BlackLine uses AI to automate matching of invoices and payments, significantly reducing reconciliation time.

- AI integration in accounts receivable solutions enables features such as automated invoice delivery based on customer preferences, real-time dispute resolution assistance, and intelligent prioritization of collection activities based on risk and likelihood of payment. For example, some platforms use natural language processing (NLP) to analyze customer communications and flag potentially delayed payments.

- Intelligent process automation further streamlines repetitive tasks such as data entry, invoice generation, and payment reminders. Through RPA (Robotic Process Automation) bots, businesses can automate end-to-end AR processes, allowing finance teams to focus on higher-value tasks like strategic planning and customer relationship management.

- The seamless integration of AR automation tools with enterprise resource planning (ERP) systems and customer relationship management (CRM) platforms provides a centralized and unified financial view. This interconnected ecosystem enables real-time collaboration across finance, sales, and operations teams, improving decision-making and customer experience.

- This trend toward more intelligent, automated, and integrated AR systems is fundamentally reshaping how organizations manage cash flow and working capital. As a result, vendors are developing AI-first AR automation solutions that offer features such as conversational AI for customer interactions, automated dunning workflows, and dynamic credit scoring based on real-time data analytics.

- The demand for AI-powered accounts receivable automation tools is expanding rapidly across industries and geographies, particularly as enterprises seek to improve liquidity, reduce days sales outstanding (DSO), and gain a competitive edge through enhanced financial agility.

Global Accounts Receivable Automation Market Dynamics

Driver

Growing Need Due to Demand for Operational Efficiency and Digital Transformation

-

The increasing pressure on businesses to optimize working capital, reduce manual workloads, and accelerate cash flow cycles is a major driver of demand for accounts receivable (AR) automation solutions. As organizations navigate economic uncertainty and tightening liquidity, efficient AR processes are becoming critical to sustaining business operations.

- For instance, in March 2024, Billtrust launched an AI-enhanced cash application solution aimed at mid-sized enterprises, allowing for faster invoice matching and real-time payment processing. Such developments highlight how companies are actively innovating to address the operational inefficiencies in traditional AR systems.

- As finance teams move away from outdated, spreadsheet-heavy processes, AR automation tools offer features such as automated invoicing, real-time payment tracking, and intelligent collections workflows. These tools help reduce days sales outstanding (DSO), lower bad debt risk, and improve customer satisfaction through faster dispute resolution.

- Moreover, the broader wave of digital transformation across industries—including manufacturing, healthcare, retail, and logistics—is driving investment in back-office automation. As ERP and CRM systems increasingly move to the cloud, integration with AR automation platforms becomes easier and more impactful, enabling unified, data-driven financial operations.

- The rise of remote and hybrid work has also accelerated the need for cloud-based AR solutions that enable finance teams to collaborate, monitor receivables, and manage customer interactions securely from any location. This flexibility has become a key requirement for modern finance departments aiming to remain agile and resilient in a dynamic business environment.

Restraint/Challenge

Concerns Regarding Data Security, Integration Complexities, and High Implementation Costs

- Despite the many benefits of AR automation, several challenges continue to restrain broader adoption—most notably concerns around data security, system integration complexity, and the upfront cost of implementation. These issues can particularly impact small and mid-sized enterprises (SMEs) with limited IT infrastructure or budget.

- For Instance, the increasing use of cloud-based AR platforms raises fears around data privacy, especially in sectors with stringent compliance requirements such as finance, healthcare, and legal. Concerns over exposing sensitive customer and payment data to potential breaches or unauthorized access can make companies hesitant to transition from legacy systems.

- Integration challenges also arise when connecting AR automation tools with diverse legacy ERP platforms, especially in organizations with decentralized or multi-entity structures. Custom integrations often require substantial time and technical expertise, leading to longer implementation cycles and higher costs.

- Additionally, while automation solutions can deliver long-term ROI, the initial investment in software licenses, customization, training, and change management can be substantial—particularly for companies operating on thin margins or in emerging markets. This cost barrier can delay or deter adoption, despite strong interest in process modernization.

- Overcoming these challenges will require AR automation vendors to offer more flexible pricing models, provide robust cybersecurity features (such as encryption, multi-factor authentication, and compliance certifications), and simplify integration through API-based, plug-and-play solutions. Vendor-led education initiatives around ROI and security will also play a crucial role in increasing adoption rates.

Global Accounts Receivable Automation Market Scope

The accounts receivable automation market is segmented on the basis of components, , deployment, organisation size and end user.

- By Component

On the basis of component, the Global Accounts Receivable Automation Market is segmented into solutions and services. The solutions segment dominated the market with the largest revenue share of 73.7% in 2024, primarily driven by businesses seeking automation tools that handle invoicing, collections, credit management, and dispute resolution. These platforms help streamline operations, reduce DSO (days sales outstanding), and enhance overall working capital management. Integration capabilities with ERP systems and real-time analytics have made these solutions highly valuable for large and mid-sized enterprises aiming for operational efficiency and financial transparency.

The services segment is projected to witness the fastest CAGR from 2025 to 2032, owing to growing demand for implementation, consulting, and managed services. As companies adopt AR automation tools, they increasingly rely on vendors for onboarding, system customization, and technical support. Services that facilitate seamless deployment and provide ongoing optimization are becoming essential for long-term ROI.

- By Deployment Mode

On the basis of deployment mode, the Global Accounts Receivable Automation Market is segmented into on-premises and cloud. The cloud segment held the largest market share of 64.3% in 2024, supported by a shift toward digital finance transformation and the growing preference for SaaS-based financial solutions. Cloud deployment offers scalable infrastructure, automatic updates, and remote accessibility—features that are particularly important for organizations operating in distributed or hybrid work environments. Cloud-based platforms also enhance collaboration and real-time visibility across departments, making them ideal for fast-paced businesses.

The cloud segment is also anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising SME adoption and cost-efficiency. While some legacy industries still favor on-premises models for data control and security compliance, the trend is clearly shifting toward cloud solutions due to ease of integration, reduced IT burden, and improved disaster recovery capabilities.

- By Organization Size

On the basis of organization size, the Global Accounts Receivable Automation Market is segmented into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment dominated the market with a 57.6% revenue share in 2024, attributed to their complex operations, large customer bases, and higher invoice volumes. These organizations require robust automation tools with advanced features such as dynamic credit risk scoring, AI-powered collections workflows, and real-time cash forecasting. Large enterprises are also early adopters of integrated financial systems and benefit from AR solutions that scale globally.

The SMEs segment is projected to grow at the fastest CAGR from 2025 to 2032, as automation becomes more accessible through affordable, cloud-based offerings. SMEs are increasingly seeking ways to reduce manual errors, improve collections efficiency, and enhance cash flow visibility. Vendors are responding by offering user-friendly, subscription-based models that minimize upfront costs and provide rapid deployment options tailored to smaller operations.

- By End User

On the basis of end user, the Global Accounts Receivable Automation Market is segmented into BFSI, IT and Telecom, Manufacturing, Healthcare, and Others. The BFSI sector held the largest market share of 31.4% in 2024, driven by the industry's need for timely collections, risk management, and regulatory compliance. Financial institutions use AR automation tools to streamline high-volume transactions, monitor overdue payments, and automate client communications. The ability to integrate with core banking and accounting platforms makes AR automation essential for operational resilience in the BFSI sector.

The healthcare segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by the digital transformation of healthcare billing and patient account management. Automation in healthcare streamlines insurance claims, reduces administrative overhead, and improves revenue cycle management. As providers seek to minimize payment delays and improve patient financial engagement, AR tools that offer intelligent automation and integration with health information systems are becoming increasingly critical.

Global Accounts Receivable Automation Market Regional Analysis

- North America dominated the Global Accounts Receivable Automation Market with the largest revenue share of 31.5% in 2024, driven by widespread digital transformation initiatives and strong demand for financial process automation across industries.

- Organizations in the region prioritize efficiency, real-time financial visibility, and streamlined cash flow management, which has accelerated the adoption of advanced AR automation tools integrated with AI, machine learning, and cloud-based ERP systems.

- The region’s dominance is further supported by a mature IT infrastructure, early adoption of cloud technologies, and a high concentration of large enterprises and fintech companies. In addition, regulatory compliance requirements and the need for robust audit trails have encouraged businesses in sectors like BFSI, healthcare, and manufacturing to invest in accounts receivable automation, solidifying North America’s position as a global leader in this market.

Global Accounts Receivable Automation Market Share

The Accounts Receivable Automation industry is primarily led by well-established companies, including:

- Oracle (U.S.)

- SAP SE (Germany)

- Workday, Inc. (U.S.)

- Bottomline Technologies (DE), Inc. (U.S.)

- Comarch SA (Poland)

- HighRadius (U.S.)

- FinancialForce (U.S.)

- Esker (France)

- Emagia Corporation (U.S.)

- YayPay Inc. (U.S.)

- VersaPay Corporation (Canada)

- KOFAX, Inc. (U.S.)

- Office Torque (U.S.)

- Swiss Post Solutions Inc. (Switzerland)

- API Outsourcing Inc (U.S.)

- Anytime Collect (U.S.)

- numberz (USA)

- OnPay Solutions (U.S.)

- Qvalia AB (Sweden)

- MYOB Technology Pty Ltd (Australia)

What are the Recent Developments in Global Accounts Receivable Automation Market?

- In May 2023, SAP SE, a global leader in enterprise application software, launched a significant upgrade to its SAP S/4HANA Finance solution, introducing enhanced accounts receivable automation features powered by artificial intelligence. The new capabilities include predictive analytics for payment behaviors, automated dispute resolution workflows, and real-time customer risk profiling. This innovation underscores SAP's commitment to optimizing financial operations and enabling businesses to achieve faster collections, reduced DSO, and greater cash flow visibility across industries.

- In March 2023, HighRadius Corporation, a leading provider of autonomous finance software, announced the expansion of its AI-powered Accounts Receivable Suite with new tools focused on cash forecasting and dynamic credit scoring. These features empower organizations to assess credit risk in real time and proactively manage receivables. The update reflects HighRadius' focus on driving intelligent automation and delivering strategic financial insights to large enterprises and mid-market businesses.

- In February 2023, Oracle Corporation introduced advanced machine learning functionalities within its Oracle Fusion Cloud ERP to enhance AR automation capabilities. The update includes intelligent payment matching, customer segmentation for collections, and automated email dunning campaigns. These innovations are designed to reduce manual intervention and improve the accuracy and speed of accounts receivable processes. Oracle’s continued investment in financial automation tools demonstrates its vision to streamline back-office operations and support agile financial management.

- In January 2023, Billtrust, a B2B order-to-cash solutions provider, announced a strategic partnership with Visa to enable automated B2B payments through integrated AR solutions. The collaboration is aimed at accelerating digital payment adoption among enterprise clients, reducing paper checks, and improving remittance data accuracy. This move aligns with Billtrust's mission to digitize and automate the entire AR lifecycle while offering clients secure, scalable, and fast payment processing options.

- In December 2022, Quadient, a global leader in customer communications and AR automation, launched an upgraded version of its YayPay platform, featuring enhanced dashboards, real-time customer insights, and expanded ERP integrations. The new release allows finance teams to better manage workflows, track aging invoices, and improve customer collaboration. The update reflects Quadient’s continued investment in improving user experience, operational transparency, and cash flow optimization for SMEs and large enterprises alike.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.