Global Acetamiprid Market

Market Size in USD Billion

CAGR :

%

USD

1.26 Billion

USD

1.88 Billion

2024

2032

USD

1.26 Billion

USD

1.88 Billion

2024

2032

| 2025 –2032 | |

| USD 1.26 Billion | |

| USD 1.88 Billion | |

|

|

|

|

Acetamiprid Market Size

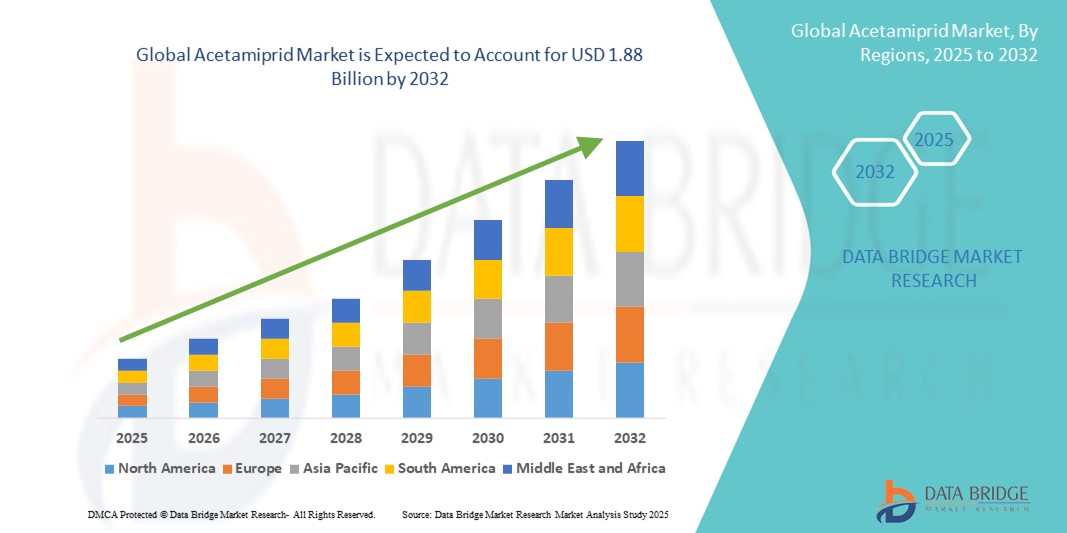

- The global acetamiprid market size was valued at USD 1.26 billion in 2024 and is expected to reach USD 1.88 billion by 2032, at a CAGR of 5.1% during the forecast period

- The market growth is largely fuelled by the increasing demand for effective and selective insecticides in agriculture, rising awareness about crop protection, and the need to improve crop yields amid growing global food demand

- Expanding adoption of modern agricultural practices and government support for crop protection initiatives in developing countries are also significantly contributing to the market expansion

Acetamiprid Market Analysis

- The expanding use of acetamiprid in controlling sap-feeding pests such as aphids, whiteflies, and leafhoppers is driving market growth across major agricultural regions. Its effectiveness against resistant pest strains and compatibility with integrated pest management (IPM) programs enhance its adoption

- Growth in the cultivation of high-value crops such as fruits, vegetables, and cash crops, where pest management is critical, supports increasing acetamiprid demand. The chemical’s favorable environmental profile compared to older pesticides is also encouraging its use among farmers and agribusinesses

- Asia-Pacific dominated the acetamiprid market with the largest revenue share of 38.7% in 2024, driven by the region’s extensive agricultural activities, rising demand for crop protection products, and increasing government initiatives promoting sustainable pest management

- North America region is expected to witness the highest growth rate in the global acetamiprid market, driven by technological advancements in crop protection, increased investment in sustainable agriculture, and expanding demand from both agricultural and non-agricultural sectors

- The liquid form segment dominated the market with the largest revenue share in 2024, driven by its ease of application and higher solubility, making it widely preferred by farmers for foliar sprays and soil treatments. Liquid formulations allow for more uniform distribution and quicker pest control effects, which enhances crop protection efficiency. In addition, innovations in liquid formulation technologies are improving stability and reducing environmental impact, supporting its strong market position

Report Scope and Acetamiprid Market Segmentation

|

Attributes |

Acetamiprid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Development of Eco-Friendly and Biodegradable Acetamiprid Formulations |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Acetamiprid Market Trends

Increasing Adoption of Selective Insecticides for Sustainable Agriculture

- The rising preference for selective insecticides such as acetamiprid is reshaping pest management by targeting specific pests while minimizing harm to beneficial insects. This approach supports sustainable farming practices and reduces environmental impact, aligning with global regulatory trends and consumer demand for eco-friendly products

- Growing awareness about the dangers of broad-spectrum pesticides is accelerating the shift toward acetamiprid, especially in regions with intensive agriculture. Farmers benefit from improved crop protection with fewer negative effects on soil health and biodiversity, driving broader acceptance of acetamiprid-based solutions

- Advancements in formulation technology, such as microencapsulation and controlled release, are enhancing the efficacy and safety profile of acetamiprid products. These innovations improve application precision, reduce chemical runoff, and extend residual activity, making acetamiprid more attractive to modern growers

- For instance, in 2023, several agricultural cooperatives in Brazil reported increased crop yields and reduced pest resistance after switching to acetamiprid formulations developed by leading agrochemical companies. This transition improved pest control efficiency and reduced reliance on multiple pesticide applications

- Despite positive trends, market growth depends on continuous innovation, regulatory compliance, and education to ensure responsible use and maximize benefits. Manufacturers and stakeholders must collaborate on sustainable development and farmer training programs to support long-term adoption

Acetamiprid Market Dynamics

Driver

Rising Demand for Crop Protection and Increasing Global Food Security Concerns

• The growing global population combined with shrinking arable land is creating urgent pressure on agricultural systems to maximize yields. Acetamiprid’s selective insecticidal action enables farmers to effectively control pest populations while preserving beneficial insects, thereby supporting sustainable and productive farming practices. This balance between efficacy and environmental safety makes it a preferred choice in many cropping systems

• Governments worldwide are introducing initiatives and subsidies to promote integrated pest management (IPM) and sustainable agriculture, significantly boosting acetamiprid demand. These policies incentivize farmers to shift away from broad-spectrum pesticides to more targeted, environmentally friendly options, accelerating adoption rates of acetamiprid formulations in key markets. Regulatory support thus acts as a critical growth catalyst

• The expansion of high-value crops such as fruits, vegetables, and cash crops, which are particularly vulnerable to pest damage, is driving stronger demand for acetamiprid. Its compatibility with various IPM programs and cropping systems enhances its utility for commercial growers looking to protect crop quality and yield. As these high-value sectors grow, they continue to fuel acetamiprid’s market penetration

• For instance, in 2022, the European Union expanded approvals for acetamiprid use across multiple crop types, including cereals and vegetables, which strengthened market confidence and encouraged wider application among member states. This regulatory endorsement has boosted grower trust and supported sustained market growth across Europe

• While demand drivers remain robust, the market must continuously navigate challenges such as increasing regulatory scrutiny, the emergence of pesticide-resistant pest populations, and competition from emerging biopesticides. Addressing these issues is essential for sustaining long-term growth and ensuring acetamiprid’s continued relevance in crop protection

Restraint/Challenge

Regulatory Restrictions and Environmental Safety Concerns

• Stringent pesticide regulations and ongoing safety evaluations by agencies such as the U.S. Environmental Protection Agency (EPA) and the European Food Safety Authority (EFSA) have led to tighter usage restrictions on acetamiprid in various regions. Compliance with these evolving regulations often requires costly reformulation and additional safety testing, increasing the operational burden on manufacturers and limiting market expansion opportunities

• Heightened environmental and public health concerns over pesticide residues and potential negative effects on pollinators have intensified scrutiny of neonicotinoid insecticides, including acetamiprid. This has spurred regulatory bodies and consumer advocacy groups to demand safer alternatives, compelling manufacturers to innovate and provide comprehensive safety data to maintain market access and consumer trust

• The limited acceptance of acetamiprid in organic farming, coupled with the rising adoption of biopesticides and natural pest control methods, is reducing its potential user base. In addition, integrated pest management programs are increasingly favoring non-chemical approaches, requiring chemical insecticides such as acetamiprid to demonstrate higher safety and environmental compatibility to remain viable

• For instance, in 2023, several countries across the Asia-Pacific region implemented tighter restrictions on neonicotinoid pesticides, which negatively impacted acetamiprid sales. This regulatory tightening has prompted agrochemical companies to invest in alternative product formulations and sustainable pest control solutions to mitigate market risks and meet evolving regulatory standards

• Overcoming these regulatory and environmental challenges will require continuous investment in research and development, transparent communication with stakeholders, and collaborative efforts within the industry to innovate safer, more effective products. Such proactive strategies are crucial for maintaining acetamiprid’s position as a trusted and sustainable crop protection option

Acetamiprid Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the acetamiprid market is segmented into powder form and liquid form. The liquid form segment dominated the market with the largest revenue share in 2024, driven by its ease of application and higher solubility, making it widely preferred by farmers for foliar sprays and soil treatments. Liquid formulations allow for more uniform distribution and quicker pest control effects, which enhances crop protection efficiency. In addition, innovations in liquid formulation technologies are improving stability and reducing environmental impact, supporting its strong market position.

The powder form segment is expected to witness the fastest growth rate during the forecast period 2025 to 2032, due to its longer shelf life and suitability for dry mix applications. Powdered acetamiprid is often favored in regions where storage conditions are challenging, offering convenience and cost-effectiveness. This form also supports precision dosing and compatibility with various application equipment, driving increased adoption among agricultural users.

- By Application

On the basis of application, the acetamiprid market is segmented into agricultural uses and non-agricultural uses. The agricultural uses segment held the largest market revenue share in 2024, fueled by the increasing demand for effective pest control in crops such as fruits, vegetables, cereals, and cash crops. Acetamiprid’s selective insecticidal properties make it highly suitable for protecting high-value crops against sap-feeding pests, enhancing crop yield and quality. Government initiatives promoting crop protection and sustainable agriculture further bolster this segment’s growth.

The non-agricultural uses segment is expected to witness the fastest growth rate during the forecast period 2025 to 2032, driven by applications in public health, horticulture, and landscaping. Acetamiprid’s use in controlling pests in non-crop environments such as urban green spaces and ornamental plants is gaining traction due to its targeted action and reduced toxicity profile. Increasing awareness of pest management beyond traditional agriculture is expanding market opportunities in this segment.

Acetamiprid Market Regional Analysis

• Asia-Pacific dominated the acetamiprid market with the largest revenue share of 38.7% in 2024, driven by the region’s extensive agricultural activities, rising demand for crop protection products, and increasing government initiatives promoting sustainable pest management

• The region’s large farming population highly values effective and selective insecticides such as acetamiprid that protect high-value crops such as fruits, vegetables, and cereals while minimizing environmental impact. Rapid urbanization and technological adoption further support market growth in Asia-Pacific

China Acetamiprid Market Insight

The China acetamiprid market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s vast agricultural base, rapid urbanization, and growing emphasis on food safety. China’s government initiatives to promote sustainable agriculture and integrated pest management have accelerated acetamiprid adoption. In addition, the expansion of high-value crops and increased exports of agricultural produce are driving demand for effective pest control solutions such as acetamiprid across the country.

Japan Acetamiprid Market Insight

The Japan acetamiprid market is expected to witness the fastest growth rate during the forecast period 2025 to 2032 due to the country’s focus on advanced farming techniques and sustainable pest management. Japanese growers prioritize selective insecticides such as acetamiprid for their efficacy and lower environmental impact. The aging farming population is also encouraging the use of safer, easy-to-apply insecticides, while stringent regulatory standards support market expansion in both crop protection and non-agricultural uses.

Europe Acetamiprid Market Insight

The Europe acetamiprid market is expected to witness the fastest growth rate during the forecast period 2025 to 2032, primarily driven by stringent regulations encouraging safer pesticide use and the demand for environmentally friendly crop protection solutions. The region’s focus on sustainable agriculture and reducing chemical residues in food has increased the preference for selective insecticides such as acetamiprid. Growth is supported by adoption in cereals, fruits, and vegetable crops.

Germany Acetamiprid Market Insight

The Germany acetamiprid market is expected to witness the fastest growth rate during the forecast period 2025 to 2032, driven by the country’s strong emphasis on environmental safety and sustainable agriculture. Regulatory frameworks promote the use of safer pesticides such as acetamiprid, encouraging farmers to adopt integrated pest management practices. Germany’s advanced agricultural research and development infrastructure also facilitates the introduction of innovative formulations, supporting steady market growth.

U.K. Acetamiprid Market Insight

The U.K. acetamiprid market is expected to witness the fastest growth rate during the forecast period 2025 to 2032, propelled by increasing adoption of environmentally friendly pest control solutions in both conventional and organic farming sectors. The demand is supported by government policies advocating sustainable agriculture and reducing chemical residues in food products. In addition, the horticulture and landscaping industries contribute to market expansion by incorporating acetamiprid for effective pest management in non-agricultural applications

North America Acetamiprid Market Insight

The North America acetamiprid market is expected to witness the fastest growth rate during the forecast period 2025 to 2032, supported by the demand for high-performance crop protection products and technological advancements in pesticide formulations. The U.S. market is further driven by increased adoption of selective insecticides to meet regulatory standards and consumer demand for safe, residue-free produce. Awareness regarding crop loss prevention and yield optimization is fueling consistent use of acetamiprid in major farming regions.

U.S. Acetamiprid Market Insight

The U.S. acetamiprid market is expected to witness the fastest growth rate during the forecast period 2025 to 2032, propelled by extensive agricultural production and rising concerns about pest resistance. The adoption of acetamiprid is growing due to its compatibility with integrated pest management programs and its lower environmental footprint compared to conventional insecticides. The market also benefits from ongoing investments in research and product development by major agrochemical companies.

Acetamiprid Market Share

The acetamiprid industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Nippon Soda Co., Ltd. (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- Shandong Rainbow Chemical Co., Ltd. (China)

- Jiangsu Yangnong Chemical Group Co., Ltd. (China)

- Syngenta AG (Switzerland)

- FMC Corporation (U.S.)

- UPL Limited (India)

- Tianjin Jiangtian Chemical Co., Ltd. (China)

- Nanjing Shineway Chemical Co., Ltd. (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.