Global Acetone Market

Market Size in USD Billion

CAGR :

%

USD

7.55 Billion

USD

11.59 Billion

2024

2032

USD

7.55 Billion

USD

11.59 Billion

2024

2032

| 2025 –2032 | |

| USD 7.55 Billion | |

| USD 11.59 Billion | |

|

|

|

|

What is the Global Acetone Market Size and Growth Rate?

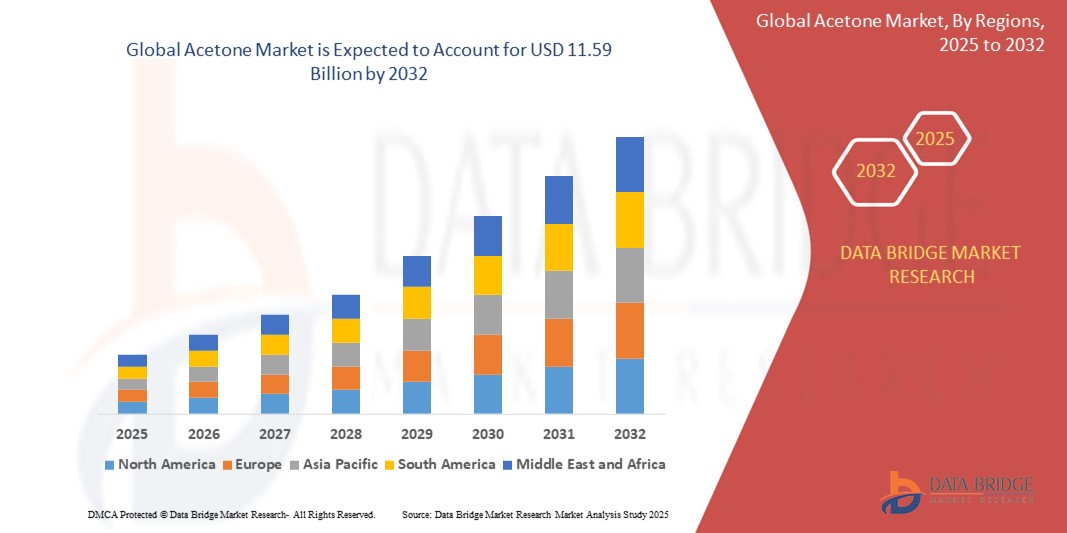

- The global acetone market size was valued at USD 7.55 billion in 2024 and is expected to reach USD 11.59 billion by 2032, at a CAGR of 5.50% during the forecast period

- The acetone market plays a crucial role in the textile industry as a degummer or degreaser for textile products. Acetone effectively removes oils, waxes, and other impurities from textiles during processing, improving fabric quality. With the rising demand for high-quality textiles worldwide, the acetone market has experienced steady growth

- Manufacturers in the textile sector rely on acetone for its efficiency and cost-effectiveness, driving the market's expansion and sustaining its significance in textile production processes

What are the Major Takeaways of Acetone Market?

- The increasing demand for acetone in the pharmaceutical and industrial sectors is propelled by its versatile applications. In pharmaceuticals, acetone serves as a crucial solvent in drug synthesis and formulation processes. Its role extends to industrial applications such as chemical manufacturing, where it is utilized in the production of plastics, adhesives, and coating

- With its efficient solvent properties and compatibility with various substances, acetone plays a pivotal role in enhancing process efficiency and product quality across these sectors, driving its increasing demand and ensuring its status as a cornerstone chemical in pharmaceutical and industrial applications, overall driving the market growth

- Asia-Pacific dominated the Acetone market with the largest revenue share of 46.6% in 2024, driven by rising demand from end-use industries such as automotive, construction, and cosmetics

- North America is projected to grow at the fastest CAGR of 11.24% from 2025 to 2032, driven by growing demand for acetone in pharmaceutical formulations, paints, coatings, and cosmetics

- The Bisphenol A (BPA) segment dominated the Acetone market with the largest market revenue share of 42.3% in 2024, owing to its extensive use in the production of polycarbonate plastics and epoxy resins

Report Scope and Acetone Market Segmentation

|

Attributes |

Acetone Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Acetone Market?

“Green Chemistry and Bio-Based Acetone Innovations”

- A prevailing trend in the global acetone market is the transition toward sustainable and bio-based production methods, driven by environmental regulations and demand for safer, renewable alternatives

- Key players are adopting green chemistry processes to produce Acetone from biomass, agricultural residues, or fermentation-based feedstocks, reducing dependency on fossil fuels and lowering carbon emissions. For instance, Green Biologics Ltd. has developed bio-acetone using renewable feedstocks with improved sustainability metrics

- Growing awareness regarding eco-friendly solvents in pharmaceuticals, personal care, and food packaging industries is pushing companies to innovate with low-toxicity, biodegradable acetone variants

- Manufacturers such as INEOS and LyondellBasell are investing in circular economy initiatives, including closed-loop recycling of acetone-containing products and waste recovery systems to enhance resource efficiency

- The trend is further accelerated by corporate ESG goals and partnerships with green-tech firms to develop certifications such as USDA BioPreferred or REACH-compliant bio-acetone, helping improve regulatory alignment and brand appeal

- This shift towards bio-based acetone is expanding its application in high-purity segments such as electronics and cosmetics and setting a new benchmark for sustainability in the global solvents market

What are the Key Drivers of Acetone Market?

- Rising industrialization and urbanization in emerging economies are significantly increasing demand for Acetone as a key solvent in paints, adhesives, and construction chemicals. Infrastructure growth directly fuels consumption in these sectors

- For instance, in April 2024, Mitsui Chemicals announced capacity expansion in Asia to meet rising regional demand for acetone used in phenol and MIBK production across electronics and construction industries

- The booming personal care and cosmetics industry is another major driver, with Acetone widely used in nail polish removers, skin cleansers, and formulations that require fast-drying properties

- Acetone’s role as a precursor in manufacturing BPA and MMA is crucial for automotive and electronics applications, where durable plastics and resins are in high demand due to lightweighting and miniaturization trends

- The pharmaceutical sector is also expanding its acetone use in API synthesis and laboratory applications, supported by global growth in drug development and distribution

- Together, these demand dynamics are reinforcing Acetone’s position as a versatile industrial chemical with widespread utility across healthcare, automotive, construction, and consumer goods sectors

Which Factor is challenging the Growth of the Acetone Market?

- A key challenge facing the Acetone market is volatility in raw material prices, particularly propylene, which is the primary feedstock in conventional acetone production. Fluctuating oil and gas markets can disrupt supply chains and profit margins

- For instance, during Q1 2024, geopolitical tensions in the Middle East caused a spike in propylene prices, directly impacting production costs for acetone manufacturers such as SABIC and Shell Chemicals

- Environmental and health regulations are tightening, especially concerning acetone’s flammability and VOC emissions. Regulatory compliance under frameworks such as OSHA, REACH, and EPA often leads to reformulation costs and limited use in certain applications

- In addition, competition from alternative green solvents (e.g., ethyl lactate, d-limonene) is gaining traction, especially in the personal care and pharmaceutical industries seeking safer substitutes

- Supply chain disruptions and dependence on petrochemical derivatives also expose the market to uncertainties, prompting a reevaluation of production footprints

- To mitigate these risks, companies are focusing on supply diversification, feedstock innovation, and regulatory engagement to ensure sustained market relevance while meeting environmental and economic expectations

How is the Acetone Market Segmented?

The market is segmented on the basis of application, distribution channel, grade outlook, and end-use industries.

- By Application

On the basis of application, the acetone market is segmented into Methyl Methacrylate (MMA), Bisphenol A (BPA), and Solvents. The Bisphenol A (BPA) segment dominated the Acetone market with the largest market revenue share of 42.3% in 2024, owing to its extensive use in the production of polycarbonate plastics and epoxy resins. BPA is a critical intermediate in manufacturing durable consumer goods and industrial components.

The Methyl Methacrylate (MMA) segment is projected to witness the fastest growth rate of 19.4% from 2025 to 2032, driven by its application in the production of acrylic plastics, paints, and adhesives. The increasing demand for lightweight and shatter-resistant materials in automotive and construction sectors supports this growth.

- By Distribution Channel

On the basis of distribution channel, the acetone market is segmented into Manufacturer to Distributor and Manufacturer to End-User. The Manufacturer to Distributor segment held the largest market share in 2024, primarily due to the well-established distribution networks that enable wide product reach and consistent supply across regions. Distributors serve as essential intermediaries, especially in fragmented regional markets.

However, the Manufacturer to end-user channel is expected to grow at the highest CAGR during the forecast period, driven by strategic partnerships and direct procurement models in large-scale industries such as chemicals, paints & coatings, and pharmaceuticals. This channel enhances cost-efficiency and allows for tailored product offerings.

- By Grade Outlook

On the basis of grade, the acetone market is segmented into Specialty Grade and Technical Grade. The Technical Grade segment accounted for the highest market share of 58.7% in 2024, due to its widespread use in industrial and chemical applications, including solvents, plastics, and adhesives. This grade is economically viable for bulk applications requiring less purity.

The specialty grade segment is anticipated to witness faster growth from 2025 to 2032, fueled by demand from high-purity applications in pharmaceuticals, cosmetics, and electronic components. This segment benefits from stringent quality control and premium pricing.

- By End-Use Industries

On the basis of end-use, the acetone market is segmented into Cosmetics and Personal Care, Electronics, Construction, Automotive, Pharmaceutical, Agricultural Chemicals, Paints and Coatings, and Adhesives. The Paints and Coatings segment dominated the market with a revenue share of 27.1% in 2024, supported by the surge in infrastructure projects, architectural renovations, and industrial coating needs across the globe. Acetone serves as a key solvent in formulating durable and quick-drying coatings.

The cosmetics and personal care segment is expected to record the fastest CAGR from 2025 to 2032, driven by the growing demand for nail polish removers, skin care products, and hair care solutions. The increasing trend toward personal grooming and rising disposable income levels globally contribute to this segment’s expansion.

Which Region Holds the Largest Share of the Acetone Market?

- Asia-Pacific dominated the acetone market with the largest revenue share of 46.6% in 2024, driven by rising demand from end-use industries such as automotive, construction, and cosmetics. The region's strong manufacturing base, favorable economic policies, and abundant raw material availability support large-scale acetone production and consumption

- Growth is further fueled by the presence of key players and increasing investments in downstream industries such as plastics, paints, adhesives, and pharmaceuticals

- Countries such as China, India, and Japan are experiencing robust industrial development, driving demand for acetone in solvent and chemical intermediate applications

China Acetone Market Insight

The China acetone market captured the largest revenue share in Asia-Pacific in 2024, supported by its large-scale chemical manufacturing sector and growing construction activities. Increasing usage in the production of bisphenol A and methyl methacrylate, along with rapid urbanization and automotive demand, is significantly contributing to market expansion.

India Acetone Market Insight

The India acetone market is projected to grow at a strong CAGR throughout the forecast period, driven by expanding industrialization and growing demand for consumer products. Government initiatives such as “Make in India” and increased investments in chemicals, paints, and pharmaceutical industries are supporting market growth.

Japan Acetone Market Insight

The Japan acetone market is growing steadily, underpinned by the country’s advanced manufacturing technologies and strong presence in electronics and automotive industries. Focus on eco-friendly products and sustainable industrial solutions is fostering demand for high-purity acetone in specialty applications.

Which Region is the Fastest Growing in the Acetone Market?

North America is projected to grow at the fastest CAGR of 11.24% from 2025 to 2032, driven by growing demand for acetone in pharmaceutical formulations, paints, coatings, and cosmetics. Technological advancements and increased use of acetone in producing high-performance polymers are enhancing regional market dynamics. Regulatory support for sustainable and low-emission chemical solutions, along with investments in research & development, are further boosting market expansion. The region benefits from a strong presence of major chemical companies and steady demand across construction, automotive, and healthcare sectors.

U.S. Acetone Market Insight

The U.S. acetone market accounted for the largest revenue share in North America in 2024, driven by high demand for acetone-based derivatives in medical, plastic, and electronics industries. The country’s advanced manufacturing infrastructure and growing emphasis on eco-friendly solvents are aiding market growth.

Canada Acetone Market Insight

The Canada Acetone market is witnessing notable growth, supported by expanding chemical and cosmetic industries. Government initiatives to promote green chemistry and investments in specialty chemical production are accelerating demand for acetone across multiple applications.

Mexico Acetone Market Insight

The Mexico Acetone market is growing steadily, fueled by increasing demand from the paints, coatings, and adhesives industries. Industrial expansion, infrastructure projects, and proximity to the U.S. market are encouraging local production and import of acetone-based products.

Which are the Top Companies in Acetone Market?

The Acetone industry is primarily led by well-established companies, including:

- Hempel A/S (Denmark)

- Kansai Paint Co., Ltd (Japan)

- Nycote Laboratories, Inc. (U.S.)

- Diamond Vogel (U.S.)

- Jotun (Norway)

- Ashland Inc. (U.S.)

- RPM International Inc. (U.S.)

- Nippon Paint Co., Ltd. (Japan)

- E.I. Du Pont De Nemours (U.S.)

- DOW (U.S.)

- Koninklijke DSM N.V (Netherlands)

- 3M Co (U.S.)

- Heubach Color (Germany)

- The Magni Group (U.S.)

- Wacker Chemie AG (Germany)

- SK Formulations India (India)

- Bluechem Group (Germany)

- AkzoNobel N.V. (Netherlands)

- The Sherwin-Williams Company (U.S.)

- Axalta Coating Systems Ltd. (U.S.)

- BASF SE (Germany)

What are the Recent Developments in Global Acetone Market?

- In July 2023, the International Monetary Fund (IMF) warned that the global acetone market could be facing a shortage in the near future. The IMF cited rising demand from the chemical and plastics industries, as well as supply disruptions from Russia and China, as the main reasons for the potential shortage. This supply disruptions from major producers such as Russia and China further highlight the need for diversification and investment in acetone production, fostering market expansion and stability

- In June 2023, Eastman Chemical announced that it would be investing $100 million to expand its acetone production capacity at its plant in Kingsport, Tennessee. This expansion is also expected to meet the growing demand for acetone from the chemical and plastics industries

- In June 2023, Kumho P&B Chemicals (CEO Shin Woo-Sung) announced that it has obtained ISCC PLUS certification for its five products (Cumene, Phenol, acetone, Bisphenol-A, and Epoxy resin).This certification attracts eco-conscious consumers, fostering trust and loyalty. Consequently, increased demand for environmentally-friendly acetone drives sales growth, expands market reach, and solidifies Kumho P&B Chemicals' position in the acetone market

- In July 2022, LG Chem announced that it would export 1,200 tons of acetone and 4,000 tons of phenol. According to the company, this is South Korea's largest shipment of products with the ISCC PLUS certification. This large-scale shipment establishes LG Chem as a leading provider of eco-friendly chemicals, driving sales and expanding market share for acetone while promoting sustainability in the industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Acetone Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Acetone Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Acetone Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.