Global Acid Lipase Deficiency Market

Market Size in USD Million

CAGR :

%

USD

784.56 Million

USD

1,847.53 Million

2024

2032

USD

784.56 Million

USD

1,847.53 Million

2024

2032

| 2025 –2032 | |

| USD 784.56 Million | |

| USD 1,847.53 Million | |

|

|

|

|

Acid Lipase Deficiency Market Size

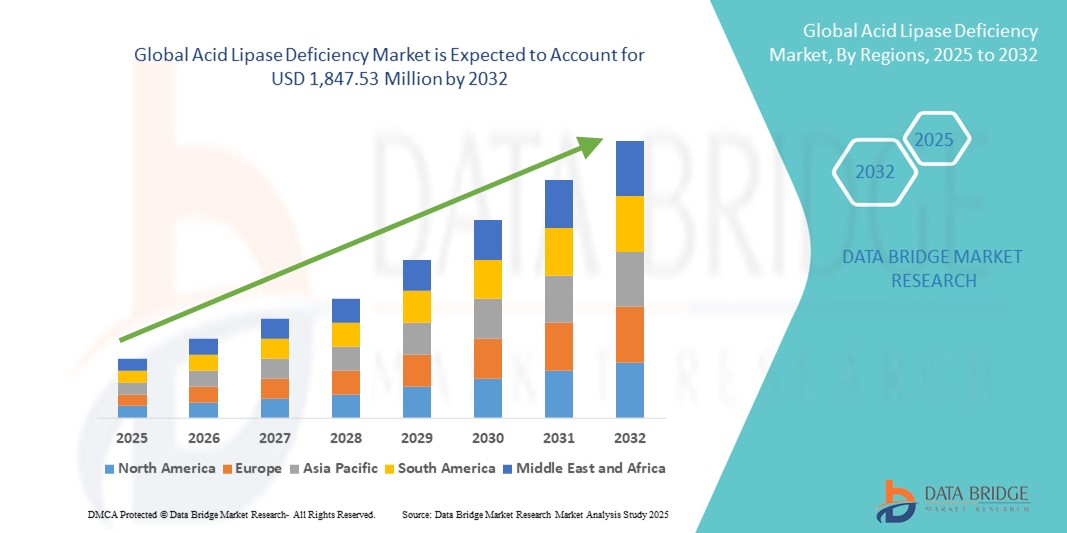

- The global acid lipase deficiency market size was valued at USD 784.56 million in 2024 and is expected to reach USD 1,847.53 million by 2032, at a CAGR of 11.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of rare lysosomal storage disorders and enhanced awareness about acid lipase deficiency (ALD), particularly among healthcare professionals and patient advocacy groups, which is driving earlier diagnosis and intervention strategies

- Furthermore, rising investment in orphan drug development, coupled with advances in enzyme replacement therapy (ERT) and gene therapy platforms, is establishing acid lipase deficiency solutions as a key therapeutic focus. These converging factors are accelerating the uptake of targeted treatment approaches, thereby significantly boosting the industry's growth

Acid Lipase Deficiency Market Analysis

- The acid lipase deficiency market is experiencing steady growth globally, fueled by increased awareness, improved diagnostic capabilities, and advancements in therapeutic options such as enzyme replacement therapy (ERT). As a rare genetic disorder, acid lipase deficiency often goes undiagnosed, but recent efforts to expand newborn screening and physician education have significantly improved early detection and intervention

- The demand for specialized treatment options is rising as patients and healthcare providers seek long-term management solutions that improve survival rates and quality of life. Furthermore, the emergence of research collaborations and rare disease funding initiatives is strengthening the drug development pipeline and fostering innovation in this market segment

- North America dominated the acid lipase deficiency market with the largest revenue share of 41.6% in 2024, driven by an advanced healthcare infrastructure, active rare disease registries, and the presence of key biopharmaceutical companies developing novel treatments. The U.S., in particular, has witnessed a sharp rise in diagnosed cases due to the expansion of genetic testing and inclusion of lysosomal storage disorders in newborn screening panels

- Asia-Pacific is expected to be the fastest growing region in the acid lipase deficiency market during the forecast period, owing to rising public and private investments in healthcare, a growing population base, and an increasing focus on rare diseases. Countries such as China, India, and South Korea are enhancing their diagnostic networks and accelerating access to innovative therapies, which is expected to drive regional growth significantly

- The parenteral segment dominated the acid lipase deficiency market with revenue share of 61.5% in 2024, primarily due to the dominance of ERT and intravenous medication protocols, which require professional administration

Report Scope and Acid Lipase Deficiency Market Segmentation

|

Attributes |

Acid Lipase Deficiency Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Acid Lipase Deficiency Market Trends

Enhanced Convenience Through Early Diagnosis and Therapeutic Advancements

- A significant and accelerating trend in the global acid lipase deficiency market is the enhanced focus on early diagnostic tools and therapeutic advancements, which are substantially improving patient outcomes. The expansion of newborn screening programs and increased clinical awareness have led to earlier detection, enabling timely interventions and better disease management

- For instance, healthcare systems in the U.S. and several European countries have integrated acid lipase deficiency testing into routine screening for lysosomal storage disorders. This shift has allowed for quicker identification of Wolman disease and Cholesteryl Ester Storage Disease (CESD), both of which fall under the acid lipase deficiency spectrum

- Recent innovations in treatment, particularly enzyme replacement therapy (ERT), are reshaping how this genetic disorder is managed. ERT products, such as sebelipase alfa, have demonstrated the ability to reduce lipid accumulation in organs such as the liver and spleen, improving liver function and survival rates in pediatric and adult patients alike. These therapies also reduce the need for invasive procedures such as liver transplantation in severe cases

- The seamless integration of specialized treatment protocols into existing rare disease care pathways is fostering a more coordinated care environment. Hospitals and specialty clinics are increasingly utilizing electronic medical records (EMRs) and genetic counseling tools to streamline case management and ensure patients receive consistent and targeted treatment across their care journey

- This trend towards more accessible, structured, and comprehensive care is fundamentally reshaping the acid lipase deficiency treatment landscape. Consequently, pharmaceutical companies are investing in expanding clinical trial networks and developing next-generation therapies aimed at enhancing the efficacy, tolerability, and accessibility of long-term treatment solutions

- The demand for effective, life-extending treatment options and diagnostic precision is growing rapidly across both developed and developing regions. This is driven by improved disease awareness, patient advocacy group efforts, and supportive reimbursement policies. These dynamics are expected to continue fueling global market growth for acid lipase deficiency therapies over the coming years

Acid Lipase Deficiency Market Dynamics

Driver

Growing Prevalence and Rising Diagnostic Awareness Fueling Demand

- The increasing prevalence of acid lipase deficiency (ALD), a rare lysosomal storage disorder, is driving global demand for improved diagnostic tools and targeted therapeutic options. With more newborn screening programs being implemented and rare disease registries being expanded, the ability to detect ALD earlier has significantly improved, contributing to market growth

- In April 2024, researchers at a leading U.S. university hospital published promising findings on a novel biomarker that could allow for earlier and more accurate detection of Acid Lipase Deficiency. Innovations such as this are expected to support the industry’s progress in timely diagnosis and disease management

- As awareness about ALD continues to increase among healthcare professionals and patient advocacy groups, more individuals are being tested for the condition, especially in at-risk populations. This proactive diagnostic approach is leading to a surge in early interventions and long-term treatment planning

- Pharmaceutical and biotech companies are actively investing in R&D to develop enzyme replacement therapies and gene therapies tailored to ALD, further intensifying the pace of innovation in the market

- Regulatory bodies such as the FDA and EMA are increasingly offering incentives and expedited pathways for the development of orphan drugs, which is fostering greater interest from biopharmaceutical players to target this niche yet high-need segment

Restraint/Challenge

High Treatment Costs and Limited Access to Specialized Therapies

- The treatment landscape for acid lipase deficiency remains limited and heavily reliant on high-cost enzyme replacement therapies, which are often inaccessible to patients in low- and middle-income countries. This affordability issue presents a major barrier to widespread adoption and equitable care

- For instance, the annual cost of treatment using sebelipase alfa, one of the few approved therapies for ALD, can exceed hundreds of thousands of dollars per patient, making it financially challenging for healthcare systems and families without comprehensive insurance coverage

- In addition to the high cost, there is a lack of widespread availability of specialized diagnostic facilities and trained professionals capable of managing ALD, particularly in rural and underserved regions. This infrastructure gap further restricts timely diagnosis and intervention

- Insurance limitations and fragmented reimbursement policies in various countries also hinder access to life-saving therapies, with many patients facing delays or denials of coverage for essential treatments

- To address these challenges, it is essential for stakeholders to advocate for broader insurance support, promote health system strengthening, and encourage tiered pricing strategies by pharmaceutical companies to ensure broader accessibility of treatment options for ALD

Acid Lipase Deficiency Market Scope

The market is segmented on the basis of type, treatment type, route of administration, end user, and distribution channel.

- By Type

On the basis of type, the acid lipase deficiency market is segmented into Wolman Disease, Cholesteryl Ester Storage Disease (CESD), and others. The Wolman Disease segment dominated the market with the largest revenue share of 56.4% in 2024, owing to the severity and early onset of the condition, which requires immediate medical intervention. The demand for rapid diagnostic and therapeutic solutions is high in this segment, often leading to early detection and hospital-based care. The high mortality rate and increasing research on enzyme replacement for Wolman disease are also boosting clinical attention.

The CESD segment is expected to witness the fastest growth rate of 20.9% from 2025 to 2032, driven by the growing awareness of chronic lipid storage disorders and advancements in diagnostic tools. CESD patients often live longer and benefit from long-term treatment, which is fueling demand for enzyme therapy and lipid-lowering medications. In addition, increasing genetic screening and supportive healthcare policies in developed nations are aiding segment growth.

- By Treatment Type

On the basis of treatment type, the acid lipase deficiency market is segmented into medication, hematopoietic stem cell transplantation, enzyme replacement therapy, and others. The enzyme replacement therapy segment held the largest market share of 48.7% in 2024, due to its targeted approach in replacing deficient lysosomal acid lipase enzymes, which significantly improves clinical outcomes. The growing adoption of biologics and FDA approvals for ERT drugs have further driven this dominance. In addition, increasing funding and patient access to specialty treatments in developed markets play a key role.

The hematopoietic stem cell transplantation segment is projected to register the fastest CAGR of 22.4% from 2025 to 2032, owing to its curative potential, particularly for severe cases. Though limited by costs and risks, ongoing advancements in stem cell therapies and increased availability of donor registries are encouraging its use. Rising clinical trial success and collaboration among biotech firms for rare disease solutions are also contributing to growth.

- By Route of Administration

On the basis of route of administration, the acid lipase deficiency market is segmented into oral and parenteral. The parenteral segment accounted for the largest market revenue share of 61.5% in 2024, primarily due to the dominance of ERT and intravenous medication protocols, which require professional administration. Parenteral routes offer rapid absorption and high efficacy, making them ideal for acute treatment scenarios. Increasing healthcare access and expanding infusion centers globally have also propelled demand.

The Oral segment is expected to grow at the fastest CAGR of 18.3% during the forecast period, driven by patient preference for ease of administration and rising availability of oral lipid-modifying agents. Pharmaceutical companies are actively working on oral enzyme formulations and adjunct therapies, which will further expand this route. Moreover, the shift towards homecare and outpatient treatment is supporting growth.

- By End User

On the basis of end user, the acid lipase deficiency market is segmented into hospitals, homecare, specialty clinics, and others. The Hospitals segment dominated the market with a revenue share of 58.1% in 2024, owing to the need for intensive care, complex diagnostic procedures, and administration of advanced therapies such as ERT and HSCT. Hospitals also remain critical for managing severe early-onset cases and complications. The availability of multidisciplinary teams and centralized healthcare services further reinforces their dominance.

The Homecare segment is expected to record the fastest CAGR of 21.2% from 2025 to 2032, due to the growing trend of decentralizing chronic care and the rising use of remote monitoring solutions. Technological advancements such as wearable health devices and home-infusion setups enable patients to manage their condition outside hospital settings. Increased patient awareness and insurance coverage are further fueling the homecare trend.

- By Distribution Channel

On the basis of distribution channel, the acid lipase deficiency market is segmented into hospital pharmacy, online pharmacy, retail pharmacy, and others. The hospital pharmacy segment accounted for the largest revenue share of 49.6% in 2024, supported by the direct linkage with hospital-based treatments such as enzyme therapies and stem cell transplants. These pharmacies ensure strict storage, dosage accuracy, and timely availability of critical medications, particularly for rare diseases.

The Online Pharmacy segment is anticipated to grow at the fastest CAGR of 23.5% from 2025 to 2032, fueled by the increasing digitalization of healthcare, convenience of doorstep delivery, and rising internet penetration. Patients with chronic forms such as CESD benefit from automated refills and prescription management tools. Regulatory support for telehealth and e-prescriptions is also aiding the growth of this channel.

Acid Lipase Deficiency Market Regional Analysis

- North America dominated the acid lipase deficiency market with the largest revenue share of 41.6% in 2024, primarily due to increased awareness, early diagnosis, and availability of advanced therapeutic options

- The region benefits from robust healthcare infrastructure, a high level of clinical research activity, and strong regulatory frameworks supporting the development and approval of treatments for rare metabolic disorders such as acid lipase deficiency

- In addition, government support for rare disease programs and patient advocacy organizations are playing a crucial role in enhancing disease recognition and access to therapies

U.S. Acid Lipase Deficiency Market Insight

The U.S. acid lipase deficiency market accounted for the largest revenue share of 76% in the North America acid lipase deficiency market in 2024. This dominance is attributed to the country’s leading position in rare disease research, strong funding for clinical trials, and presence of key pharmaceutical and biotechnology players. Increased uptake of enzyme replacement therapies (ERT), improved diagnostic capabilities, and greater insurance coverage for rare conditions are contributing to market expansion. The proactive role of the FDA in approving orphan drugs also facilitates faster access to novel treatments for acid lipase deficiency in the U.S.

Europe Acid Lipase Deficiency Market Insight

The Europe acid lipase deficiency market is projected to witness substantial growth over the forecast period, driven by increasing awareness campaigns, advances in diagnostic testing, and growing investment in rare disease research. Several countries in the region are implementing national rare disease plans aimed at improving diagnosis and treatment. The adoption of enzyme replacement therapy and supportive regulatory pathways for orphan drugs are accelerating market uptake. Furthermore, collaborative research initiatives across the EU are strengthening the pipeline for innovative therapies targeting acid lipase deficiency.

U.K. Acid Lipase Deficiency Market Insight

U.K. acid lipase deficiency market is expected to grow at a noteworthy CAGR, supported by heightened awareness among healthcare providers and patients. The National Health Service (NHS) is increasingly focusing on early intervention and genetic screening for rare metabolic disorders. Partnerships between academic institutions and pharmaceutical companies are enhancing research outcomes, while policy frameworks such as the Rare Diseases Framework aim to improve access to diagnostics and treatments for patients with conditions such as acid lipase deficiency.

Germany Acid Lipase Deficiency Market Insight

The Germany acid lipase deficiency market is expanding steadily due to the country’s well-established healthcare infrastructure and emphasis on precision medicine. Strong governmental support for rare disease management, combined with the availability of advanced diagnostic technologies, facilitates early and accurate identification of acid lipase deficiency cases. The presence of multiple biotech firms and academic research centers focused on metabolic and lysosomal storage disorders further supports the development and adoption of effective therapies in Germany.

Asia-Pacific Acid Lipase Deficiency Market Insight

The Asia-Pacific acid lipase deficiency market is projected to grow at the fastest CAGR from 2025 to 2032, driven by improved disease awareness, rising healthcare spending, and growing investments in biotechnology research. Countries such as China, Japan, and India are enhancing their diagnostic capabilities for rare diseases through both public and private sector initiatives. The increasing penetration of genetic testing and broader access to healthcare services in rural areas are expected to accelerate early diagnosis and treatment uptake across the region.

Japan Acid Lipase Deficiency Market Insight

The Japan acid lipase deficiency market is growing rapidly due to its advanced healthcare system, strong government focus on rare diseases, and aging population. The country is investing in genome-based research and personalized medicine to address rare metabolic disorders more effectively. Efforts by healthcare authorities to streamline the approval of orphan drugs, along with rising awareness among clinicians, are expected to further drive market growth in Japan.

China Acid Lipase Deficiency Market Insight

The China acid lipase deficiency market accounted for the largest revenue share of the Asia-Pacific acid lipase deficiency market in 2024. This is largely attributed to the country's expanding healthcare coverage, improved access to genetic testing, and rising diagnosis rates of rare diseases. China's commitment to building a comprehensive rare disease registry and increasing funding for research into lysosomal storage disorders is boosting market momentum. Domestic pharmaceutical companies are also entering the space, aiming to make enzyme replacement therapies more affordable and accessible to the broader population.

Acid Lipase Deficiency Market Share

The acid lipase deficiency industry is primarily led by well-established companies, including:

- Aalexion Pharmaceuticals, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Sanofi S.A. (France)

- Recordati Rare Diseases Inc. (Italy)

- Horizon Therapeutics plc (Ireland)

- Takeda Pharmaceutical Company Limited (Japan)

- Pfizer Inc. (U.S.)

- Amicus Therapeutics, Inc. (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- GSK plc (U.K.)

- BioMarin Pharmaceutical Inc. (U.S.)

- Novo Nordisk A/S (Denmark)

- Novartis AG (Switzerland)

- Lilly (U.S.)

- AbbVie Inc. (U.S.)

- Biogen Inc. (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- Bristol-Myers Squibb Company (U.S.)

Latest Developments in Global Acid Lipase Deficiency Market

- In May 2024, Genethon, a leading gene therapy research organization, presented its LAL‑D gene therapy studies at the ASGCT Annual Meeting in Baltimore, featuring two oral presentations and five posters—highlighting progress toward potentially curative approaches beyond enzyme replacement therapy

- In December 2023, the National Institute for Health and Care Excellence (NICE) delivered a positive recommendation for sebelipase alfa (Kanuma)—the first disease-modifying and life-saving treatment for Wolman disease—markedly improving survival and quality-of-life outcomes within the NHS framework

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.