Global Acid Proof Lining Market

Market Size in USD Billion

CAGR :

%

USD

6.42 Billion

USD

8.49 Billion

2025

2033

USD

6.42 Billion

USD

8.49 Billion

2025

2033

| 2026 –2033 | |

| USD 6.42 Billion | |

| USD 8.49 Billion | |

|

|

|

|

Acid Proof Lining Market Size

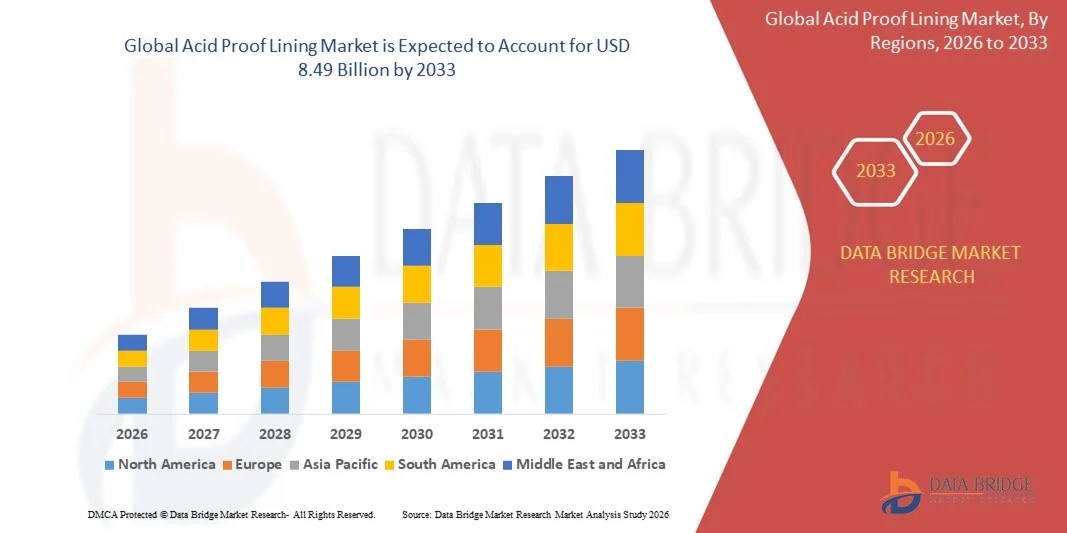

- The global acid proof lining market size was valued at USD 6.42 billion in 2025 and is expected to reach USD 8.49 billion by 2033, at a CAGR of 3.57% during the forecast period

- The market growth is largely fuelled by the increasing demand for corrosion-resistant coatings in chemical, pharmaceutical, and metal processing industries

- Growing industrialization and infrastructure development across emerging economies are further contributing to market expansion

Acid Proof Lining Market Analysis

- The market is witnessing a steady shift toward high-performance linings that offer enhanced chemical resistance, durability, and ease of maintenance

- Increasing awareness about plant safety, operational efficiency, and long-term cost savings is driving the adoption of acid proof lining solutions across industries

- North America dominated the acid proof lining market with the largest revenue share in 2025, driven by increasing industrialization, stringent safety regulations, and the growing need for corrosion-resistant equipment in chemical, pharmaceutical, and metal processing plants

- Asia-Pacific region is expected to witness the highest growth rate in the global acid proof lining market, driven by expanding industrial activities, rising infrastructure projects, and growing demand for durable and cost-effective corrosion-resistant solutions

- The Ceramic & Carbon Brick Lining segment held the largest market revenue share in 2025, driven by its superior chemical resistance, high durability, and suitability for high-temperature industrial processes. These linings are widely adopted in chemical, metal processing, and water treatment plants for long-term protection against corrosive substances

Report Scope and Acid Proof Lining Market Segmentation

|

Attributes |

Acid Proof Lining Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• BASF SE (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Acid Proof Lining Market Trends

Rise of Advanced Corrosion-Resistant Linings

- The growing adoption of advanced acid proof linings is transforming industrial operations by providing enhanced protection against corrosive chemicals and high-temperature processes. These linings allow for longer equipment lifespan, reduced maintenance, and minimized downtime in chemical, pharmaceutical, and metal processing plants. Their improved chemical resistance also prevents unexpected shutdowns, ensuring consistent production output and operational safety

- Increasing demand for durable and high-performance linings in water treatment, pulp and paper, and cement industries is accelerating market growth. These linings help prevent chemical damage, maintain process efficiency, and ensure operational safety in challenging industrial environments. In addition, manufacturers are investing in R&D to develop specialized formulations that can withstand increasingly aggressive chemical compositions

- The development of user-friendly and cost-effective lining materials is making them attractive for both new installations and retrofitting of existing equipment. Easy application and improved durability enable industries to achieve higher efficiency without major process interruptions. These linings also reduce labor requirements for installation and maintenance, lowering overall operational costs

- For instance, in 2023, several chemical manufacturing plants reported a significant reduction in equipment corrosion and maintenance costs after applying next-generation acid proof linings, leading to higher operational efficiency and lower long-term expenditures. Many plants also noted improved safety standards and fewer chemical leak incidents following the upgrades

- While advanced linings are improving safety and durability, market growth depends on continued innovation, technical training for proper application, and cost optimization. Manufacturers must focus on tailored lining solutions for specific industrial requirements to fully capitalize on market opportunities. Adoption also hinges on raising awareness about the benefits of long-term cost savings and environmental compliance

Acid Proof Lining Market Dynamics

Driver

Increasing Industrialization and Stringent Safety Regulations

- Rising industrialization across emerging economies is boosting the demand for acid proof linings in chemical, pharmaceutical, and metal processing plants. The need to protect equipment from aggressive chemical exposure is driving adoption across multiple sectors. Furthermore, expansion in heavy industries such as steel, cement, and fertilizers is creating additional opportunities for lining applications

- Stringent safety and environmental regulations are compelling industries to implement corrosion-resistant linings to prevent hazardous leaks, chemical spills, and operational hazards. Compliance with these standards ensures safer working conditions and reduced environmental risks. Regulatory pressure is expected to rise further, encouraging companies to adopt premium lining solutions proactively

- The growing awareness of long-term cost savings achieved through reduced maintenance, improved equipment lifespan, and minimized process disruptions is supporting market growth. Industries increasingly prioritize reliable lining solutions that balance performance and cost. Enhanced lining durability also minimizes downtime, allowing plants to maintain continuous production cycles with lower operational risk

- For instance, in 2022, several European chemical facilities upgraded their processing equipment with advanced acid proof linings, resulting in enhanced operational safety, reduced downtime, and improved compliance with local regulations. Many of these plants also reported lower chemical wastage and better energy efficiency due to improved process stability

- While industrialization and regulatory compliance are driving demand, continued development of specialized lining materials and improved installation techniques remain critical for sustained adoption. Industry players are expected to focus on tailored solutions for specific process requirements, including high-temperature, high-pressure, and multi-chemical resistance needs

Restraint/Challenge

High Cost and Technical Complexity of Advanced Linings

- The high price of advanced acid proof linings limits adoption among small-scale and cost-sensitive industrial operators. Premium materials and specialized installation techniques make these linings less accessible to smaller plants. In addition, upfront investment costs can be a deterrent even for mid-sized operators despite long-term benefits

- Limited availability of skilled personnel to install and maintain acid proof linings in remote or underdeveloped regions further restricts market penetration. Improper application can reduce effectiveness, increase downtime, and escalate costs. Continuous training and certification programs are needed to ensure correct installation practices and consistent performance

- Supply chain challenges in sourcing high-quality lining materials and specialized adhesives in certain regions impede consistent market growth. Industrial operators may face delays or suboptimal solutions due to logistical constraints. Shortages in raw materials or adhesives can also increase project lead times and operational disruptions

- For instance, in 2023, chemical plants in parts of Sub-Saharan Africa reported delays in retrofitting equipment with acid proof linings due to high costs and lack of trained technicians, impacting operational efficiency. Some plants had to rely on temporary protective measures, which offered limited durability and higher maintenance frequency

- While lining technologies continue to advance, overcoming cost, technical, and supply chain barriers is essential. Market stakeholders must focus on cost-effective solutions, training programs, and scalable installation methods to expand adoption globally. Strategic partnerships with raw material suppliers and service providers can also help mitigate supply and expertise constraints

Acid Proof Lining Market Scope

The market is segmented on the basis of product type, form type, and end use.

- By Product Type

On the basis of product type, the acid proof lining market is segmented into Ceramic & Carbon Brick Lining, Tile Lining, and Thermoplastic Lining. The Ceramic & Carbon Brick Lining segment held the largest market revenue share in 2025, driven by its superior chemical resistance, high durability, and suitability for high-temperature industrial processes. These linings are widely adopted in chemical, metal processing, and water treatment plants for long-term protection against corrosive substances.

The Tile Lining segment is expected to witness the fastest growth rate from 2026 to 2033, due to its cost-effectiveness, ease of installation, and versatility in retrofitting existing equipment. Tile linings are particularly popular for industrial facilities seeking quick application and reliable protection in areas exposed to moderate chemical and mechanical stress.

- By Form Type

On the basis of form type, the market is segmented into Solvent-borne, Waterborne, and Powder-based linings. The Solvent-borne segment dominated in 2025, attributed to its strong adhesion, chemical resistance, and widespread use in high-performance industrial coatings.

The Waterborne segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing environmental regulations, low VOC emissions, and growing demand for eco-friendly corrosion protection solutions in industrial applications.

- By End Use

On the basis of end use, the market is segmented into Marine, Oil and Gas, Power Generation, Construction, Automotive, Transportation, Chemicals, Mining & Metallurgy, and Others. The Chemicals segment held the largest revenue share in 2025, fueled by the high need for corrosion-resistant linings in chemical processing plants.

The Mining & Metallurgy segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing adoption of acid proof linings to protect equipment from highly abrasive and corrosive substances in mineral extraction and metal processing operations.

Acid Proof Lining Market Regional Analysis

- North America dominated the acid proof lining market with the largest revenue share in 2025, driven by increasing industrialization, stringent safety regulations, and the growing need for corrosion-resistant equipment in chemical, pharmaceutical, and metal processing plants

- Industries in the region are prioritizing long-term cost savings through enhanced equipment durability, reduced downtime, and minimized maintenance requirements

- High adoption is further supported by advanced infrastructure, skilled labor availability, and rising awareness of workplace safety and environmental compliance

U.S. Acid Proof Lining Market Insight

The U.S. acid proof lining market captured the largest revenue share in North America in 2025, fueled by widespread modernization of industrial plants and adoption of advanced lining technologies. Manufacturers are increasingly implementing corrosion-resistant solutions to comply with strict environmental and safety standards, while reducing maintenance and operational costs. The growth is further supported by government initiatives promoting industrial safety, sustainability, and technological innovation in equipment protection.

Europe Acid Proof Lining Market Insight

The Europe acid proof lining market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent safety and environmental regulations and rising demand for durable, high-performance linings in chemical and metal processing sectors. European industries are adopting advanced lining solutions to improve operational efficiency, reduce chemical hazards, and comply with sustainability mandates. The region’s strong industrial base, technical expertise, and emphasis on eco-friendly manufacturing are fueling market expansion.

Germany Acid Proof Lining Market Insight

The Germany acid proof lining market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing industrial automation, focus on equipment longevity, and adherence to strict chemical safety standards. German industries are emphasizing technologically advanced, eco-conscious lining solutions for chemical, pharmaceutical, and metal processing plants. The integration of high-performance linings with modern industrial systems is enhancing efficiency, reducing downtime, and ensuring compliance with local safety and environmental regulations.

Asia-Pacific Acid Proof Lining Market Insight

The Asia-Pacific acid proof lining market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rapid industrialization, rising investments in chemical and metal processing plants, and growing awareness of workplace safety. The region’s increasing adoption of high-performance corrosion-resistant linings is supported by government regulations, infrastructure development, and technological advancements. Affordable local manufacturing, skilled labor, and expansion of industrial hubs are further boosting market penetration across APAC countries.

China Acid Proof Lining Market Insight

The China acid proof lining market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid industrial growth, expansion of chemical and pharmaceutical manufacturing plants, and rising demand for corrosion-resistant solutions. The push for modernization, industrial safety, and compliance with environmental regulations is fueling adoption. Strong domestic production capabilities, availability of cost-effective lining materials, and government incentives for industrial safety are key factors propelling the market in China.

Japan Acid Proof Lining Market Insight

The Japan acid proof lining market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high industrial standards, emphasis on safety, and demand for long-lasting corrosion-resistant solutions. Japanese industries are implementing advanced linings in chemical, metal, and power generation plants to enhance operational efficiency and ensure compliance with stringent environmental and safety regulations. The trend is further driven by technological innovation, skilled labor, and rising focus on minimizing maintenance costs.

Acid Proof Lining Market Share

The Acid Proof Lining industry is primarily led by well-established companies, including:

• BASF SE (Germany)

• PPG Industries, Inc. (U.S.)

• The Sherwin-Williams Company (U.S.)

• Ashland, Inc. (U.S.)

• Axalta Coating Systems Ltd. (U.S.)

• Hempel A/S (Denmark)

• Jotun A/S (Norway)

• STEULER-KCH GmbH (Germany)

• Polycorp Ltd. (Canada)

• Koch Industries, Inc. (U.S.)

• The STEBBINS Engineering and Manufacturing Company (U.S.)

• Nittel GmbH & Co KG. (Germany)

• AGRU Kunststofftechnik GmbH (Austria)

• Simona AG (Germany)

• CHRISTEN & LAUDON GmbH (Germany)

• Huerner Funken Malaysia Sdn Bhd. (Malaysia)

• Zu SKO Säureschutz und Kunststoff GmbH (Germany)

• GBT-BÜCOLIT GmbH (Germany)

• Knäpper Oberflächentechnik GmbH (Germany)

• A-SPT (Germany)

Latest Developments in Global Acid Proof Lining Market

- In September 2023, Carboline introduced Hydroplate 6500, 100% solids, ultra-high-build epoxy acid proof lining. The product is designed for concrete and steel assets in severe wastewater applications, providing enhanced chemical resistance and durability. This launch is expected to improve operational efficiency, reduce maintenance costs, and extend equipment lifespan, positively impacting industrial adoption of advanced acid proof linings

- In May 2022, Knight Material Technologies completed the acquisition of Electro Chemical Engineering and Manufacturing Co. (EC) in Emmaus, PA. This strategic acquisition expanded Knight’s acid-proof lining portfolio by incorporating EC’s fluoropolymer vessels and related materials. The move strengthens market presence, broadens product offerings for chemical processing industries, and supports growth in high-performance lining solutions globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Acid Proof Lining Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Acid Proof Lining Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Acid Proof Lining Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.