Global Acidifiers Market

Market Size in USD Billion

CAGR :

%

USD

3.21 Billion

USD

5.17 Billion

2024

2032

USD

3.21 Billion

USD

5.17 Billion

2024

2032

| 2025 –2032 | |

| USD 3.21 Billion | |

| USD 5.17 Billion | |

|

|

|

|

Global Acidifiers Market Size

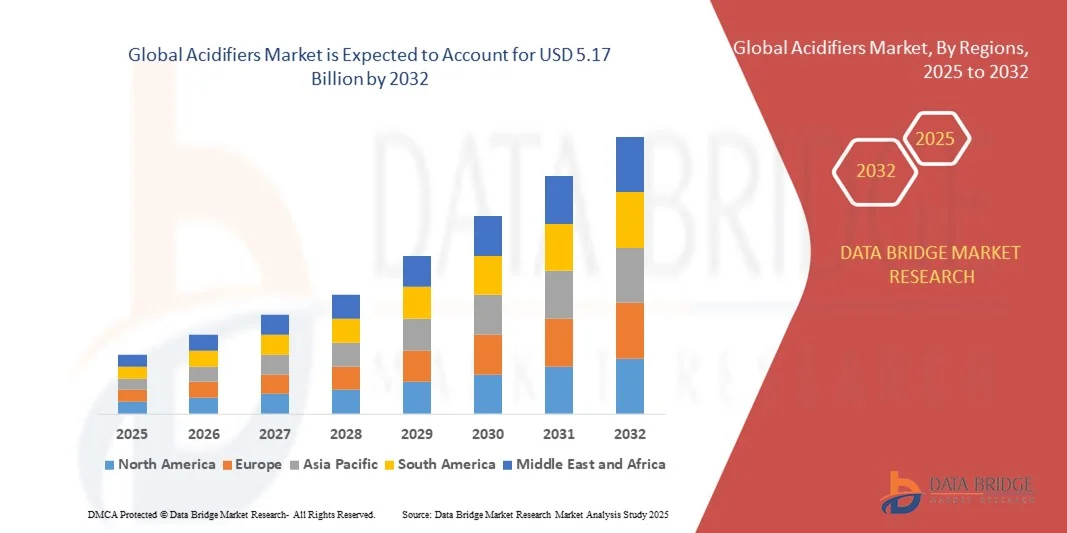

- The global acidifiers market size was valued at USD 3.21 billion in 2024 and is expected to reach USD 5.17 billion by 2032, growing at a CAGR of 6.10% during the forecast period.

- Market expansion is primarily driven by the rising demand for enhanced animal nutrition, improved feed efficiency, and sustainable livestock production practices across emerging and developed economies.

- Additionally, growing concerns over antibiotic resistance and the shift toward natural growth promoters in animal feed are fueling the adoption of acidifiers, positioning them as vital additives in modern animal husbandry systems.

Global Acidifiers Market Analysis

- Acidifiers, used as feed additives to enhance animal gut health and nutrient absorption, are becoming increasingly essential in modern livestock and poultry farming due to their ability to improve feed efficiency, promote growth, and reduce dependence on antibiotics.

- The growing demand for acidifiers is primarily driven by the shift toward antibiotic-free animal production, rising global meat consumption, and increasing awareness of sustainable and efficient animal nutrition practices.

- Asia-Pacific dominated the global acidifiers market with the largest revenue share of 37.01% in 2024, supported by advanced animal husbandry practices, strong regulatory frameworks favoring feed additives, and high demand for meat and dairy products

- North America is expected to be the fastest-growing region in the Global Acidifiers Market during the forecast period, fueled by rapid population growth, rising disposable incomes, and expanding commercial livestock farming across countries like China, India, and Indonesia.

- The propionic acid segment dominated the market with the largest revenue share of 43.2% in 2024, due to its widespread use as an effective mold inhibitor and preservative in animal feed.

Report Scope and Global Acidifiers Market Segmentation

|

Attributes |

Acidifiers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Acidifiers Market Trends

Rising Adoption of Acidifiers in Antibiotic-Free and Sustainable Animal Nutrition

- A significant and accelerating trend in the global Acidifiers Market is the increasing adoption of acidifiers as alternatives to antibiotics in animal feed, driven by growing regulatory restrictions on antibiotic growth promoters (AGPs) and heightened consumer demand for antibiotic-free meat and dairy products. This shift is reshaping feed formulations across poultry, swine, and ruminant sectors.

- For instance, formic and propionic acids are increasingly used in feed to reduce pathogenic bacteria like Salmonella and E. coli, while simultaneously enhancing nutrient digestibility. These organic acids not only promote gut health but also serve as effective tools in maintaining growth performance in livestock without relying on AGPs.

- The functionality of acidifiers has evolved with advancements in feed technology—many now come in coated or buffered forms, allowing targeted release in the gastrointestinal tract for optimal absorption and efficacy. For example, products by companies like Novus International and Biomin are formulated to improve gut microbiota balance and strengthen immune responses in animals, thus supporting more resilient and productive livestock.

- Furthermore, the use of acidifiers aligns with broader sustainability goals in animal agriculture. By improving feed efficiency and nutrient utilization, they contribute to reduced environmental impact, such as lower nitrogen and phosphorus emissions from animal waste. This dual benefit of performance and sustainability is accelerating acidifier integration in commercial feed strategies worldwide.

- Companies such as Perstorp Holding AB and Kemin Industries are at the forefront of innovation, offering advanced blends of organic acids and synergistic additives that are tailored for species-specific needs, ensuring maximum impact with minimal dosage.

- The demand for acidifiers that support antibiotic-free production, enhance gut health, and align with sustainability goals is rapidly growing across global markets, particularly in regions where consumers and regulators are pushing for cleaner, safer, and more responsible animal protein production.

Global Acidifiers Market Dynamics

Driver

Growing Need Due to Rising Demand for Antibiotic-Free and Sustainable Animal Production

-

The increasing focus on reducing antibiotic use in livestock, combined with the rising demand for sustainable and safe animal protein, is a significant driver for the heightened adoption of acidifiers in animal feed.

- For instance, in 2024, several feed additive companies launched innovative acidifier blends designed specifically to replace antibiotic growth promoters, enhancing gut health and immunity without relying on traditional antibiotics. Such product innovations by key players are expected to drive the acidifiers market growth during the forecast period.

- As consumers and regulators become more aware of the risks of antibiotic resistance and the importance of food safety, acidifiers offer effective solutions by improving nutrient absorption, reducing pathogenic bacteria in the gut, and supporting overall animal performance, providing a compelling alternative to conventional antibiotics.

- Furthermore, the growing trend toward sustainable livestock farming and environmentally friendly feed solutions is making acidifiers an integral part of modern animal nutrition strategies, as they help optimize feed efficiency and reduce environmental waste.

- The increasing prevalence of intensive farming practices and the rising demand for high-quality meat, dairy, and poultry products are also propelling the adoption of acidifiers globally. Enhanced awareness among farmers about the benefits of acidifiers in improving animal health and productivity is encouraging widespread use across both developed and emerging markets.

Restraint/Challenge

Concerns Regarding Regulatory Compliance and Cost of Adoption

- Regulatory challenges related to the approval and use of feed additives, including acidifiers, pose a significant hurdle to market expansion in certain regions. Stringent regulations and lengthy approval processes can delay product launches and limit market penetration.

- For instance, varying regulatory frameworks across countries, especially concerning organic acids and their permissible concentrations in feed, create complexities for manufacturers and feed formulators, potentially slowing adoption rates.

- Addressing these regulatory challenges through compliance, continuous research, and collaboration with authorities is crucial for gaining market acceptance. Companies such as Novus International and Kemin Industries actively invest in research and regulatory affairs to ensure product safety and efficacy, reassuring customers and regulators alike.

- Additionally, the relatively higher cost of specialized acidifier blends compared to conventional feed additives can be a barrier for price-sensitive producers, particularly small-scale farmers in developing regions. While bulk organic acids remain affordable, premium products with advanced formulations often come at a higher price point.

- Although prices are gradually becoming more competitive with technological advancements and scaling, the perceived cost premium and regulatory uncertainties may hinder broader adoption, especially where farmers lack awareness of the long-term benefits.

- Overcoming these challenges through harmonized regulations, cost-effective product development, and farmer education on the economic and health benefits of acidifiers will be essential for sustained growth in the global acidifiers market.

Global Acidifiers Market Scope

Acidifiers market is segmented on the basis of type, form, compound, livestock, and animal.

- By Type

On the basis of type, the Global Acidifiers Market is segmented into Propionic Acid, Formic Acid, Lactic Acid, Citric Acid, Sorbic Acid, Malic Acid, and Others. The Propionic Acid segment dominated the market with the largest revenue share of 43.2% in 2024, due to its widespread use as an effective mold inhibitor and preservative in animal feed. It is extensively utilized in poultry and swine diets to maintain feed quality and improve gut health.

The market also benefits from its role in enhancing nutrient absorption and overall animal performance. The Formic Acid segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand as a natural growth promoter and antibiotic alternative in swine and ruminant feed. Its strong antimicrobial properties and ability to optimize digestion make it highly sought after, especially in emerging markets with growing livestock production.

- By Form

On the basis of form, the Global Acidifiers Market is segmented into Dry and Liquid forms. The Dry segment accounted for the largest market revenue share of 56.8% in 2024, favored for its longer shelf life, ease of handling, and compatibility with various feed manufacturing processes. Dry acidifiers are widely preferred in large-scale feed mills due to their stability and convenience during storage and transport.

The Liquid segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand in specialty feeds such as aquaculture and premixes. Liquid acidifiers offer rapid dispersion and absorption, along with dosing flexibility, which are important advantages in improving feed palatability and nutrient uptake in various livestock sectors.

- By Compound

On the basis of compound, the Global Acidifiers Market is segmented into Blended and Single acidifiers. The Blended acidifiers segment dominated the market with a revenue share of 48.5% in 2024, attributed to the combined benefits of multiple organic acids offering broad-spectrum antimicrobial activity and improved gut health. Blended acidifiers are widely adopted in commercial feed formulations to maximize animal performance and feed safety.

The Single acidifier segment is expected to witness the fastest growth rate from 2025 to 2032. This growth is driven by the increasing demand for targeted and cost-effective feed solutions tailored to specific animal species or production requirements, where single acid formulations provide precise functional benefits.

- By Livestock

On the basis of livestock, the Global Acidifiers Market is segmented into Poultry, Swine, Ruminants, Aquaculture, and Others. The Poultry segment held the largest revenue share of 41.3% in 2024, supported by high global poultry production and the widespread use of acidifiers to enhance gut health and feed efficiency, while replacing antibiotic growth promoters.

The Swine segment is expected to record the fastest CAGR during the forecast period, driven by expanding intensive pig farming and increasing awareness of acidifiers’ role in reducing pathogens and improving nutrient absorption. This segment shows strong growth in emerging economies with rising pork consumption.

- By Animal

On the basis of animal, the Global Acidifiers Market is segmented into Ruminant, Poultry, Swine, Aquaculture, and Others. The Poultry segment dominated the market in 2024 with a revenue share of 42.7%, reflecting its extensive application in promoting poultry health, improving feed conversion, and reducing disease risks.

The Aquaculture segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rapid growth in farmed fish and seafood consumption. Acidifiers in aquaculture feed help maintain water quality, support immune function, and enhance nutrient utilization, addressing critical challenges in this expanding sector.

Global Acidifiers Market Regional Analysis

- Asia-Pacific dominated the global acidifiers market with the largest revenue share of 37.01% in 2024, driven by the well-established livestock industry and increasing adoption of acidifiers to improve animal health and feed efficiency.

- The region’s advanced agricultural practices and growing focus on sustainable and antibiotic-free animal farming have boosted demand for acidifiers as natural growth promoters and preservatives in feed formulations.

- This strong market presence is further supported by high awareness among farmers and feed manufacturers regarding the benefits of acidifiers in enhancing nutrient absorption, reducing pathogens, and improving overall livestock productivity, positioning North America as a leading consumer in both poultry and swine sectors.

China Acidifiers Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, supported by its massive livestock population and rapid modernization of the animal feed industry. The country’s growing middle class and increased meat consumption are fueling demand for acidifiers to enhance feed efficiency and ensure food safety. Government policies promoting sustainable livestock production and reducing antibiotic use further boost acidifier adoption. The presence of domestic manufacturers offering cost-effective acidifier solutions is also a key growth driver.

India Acidifiers Market Insight

India’s acidifiers market is experiencing robust growth due to the expanding poultry and dairy sectors, coupled with increasing awareness about animal nutrition and health. The country’s push towards improving livestock productivity and feed quality through natural additives is driving demand for acidifiers like lactic acid and citric acid. Rising disposable incomes and growing meat consumption also contribute to market growth. Additionally, government initiatives supporting organic farming and antibiotic alternatives are expected to further propel market adoption.

U.S. Acidifiers Market Insight

The U.S. acidifiers market captured the largest revenue share of 35% in North America in 2024, driven by the country’s robust livestock industry and increasing demand for natural feed additives to improve animal health and productivity. The growing focus on antibiotic-free and sustainable farming practices has accelerated the adoption of acidifiers such as propionic and formic acids in poultry, swine, and ruminant feed. Additionally, rising awareness among feed manufacturers regarding acidifiers’ benefits in enhancing nutrient absorption and preventing microbial contamination further supports market growth. The U.S. is also witnessing innovation in acidifier blends that optimize feed efficiency, contributing to the market’s strong position.

Europe Acidifiers Market Insight

The Europe acidifiers market is expected to grow steadily during the forecast period, driven by stringent regulations on antibiotic use in animal feed and the rising preference for natural growth promoters. Countries like Germany, France, and the U.K. are adopting acidifiers extensively in poultry and swine feed to improve animal gut health and productivity while adhering to sustainability goals. Increasing urbanization and demand for high-quality meat products also promote the use of acidifiers. The region’s focus on innovation and eco-friendly agricultural inputs is expected to further boost market expansion.

U.K. Acidifiers Market Insight

The U.K. acidifiers market is anticipated to witness notable growth due to rising consumer demand for antibiotic-free meat and stringent government policies regulating feed additives. The growing livestock population and efforts to improve feed conversion ratios through organic acidifiers are key drivers. Moreover, the U.K.’s focus on enhancing animal welfare and sustainable farming practices encourages the use of natural acidifiers such as lactic and citric acids. The increasing number of poultry and swine farms adopting these additives for better health and growth performance also supports market growth.

Germany Acidifiers Market Insight

Germany holds a significant share in the European acidifiers market, propelled by its advanced livestock farming industry and growing focus on sustainable agriculture. The country’s strict regulations on antibiotic use and rising consumer demand for safe meat products are key factors encouraging the adoption of acidifiers like formic acid and propionic acid. German feed manufacturers are actively incorporating acidifiers in animal diets to improve feed efficiency, gut health, and overall livestock productivity. The emphasis on innovation and green farming practices further stimulates market growth.

Global Acidifiers Market Share

The acidifiers industry is primarily led by well-established companies, including:

- Pancosma SA (Switzerland)

- Nutrex NV (Belgium)

- Biomin Holding GmbH (Austria)

- Impextraco NV (Belgium)

- Novus International Inc. (U.S.)

- Perstorp Holding AB (Sweden)

- Kemin Industries Inc. (U.S.)

- Kemira OYJ (Finland)

- Yara International ASA (Norway)

- BASF SE (Germany)

- Koninklijke DSM N.V. (Netherlands)

- Cargill (U.S.)

- Novozymes Inc. (Denmark)

- Addcon (Germany)

- Lallemand Inc. (Canada)

- Beneo Group (Germany)

- Chr. Hansen Holding A/S (Denmark)

What are the Recent Developments in Global Acidifiers Market?

- In April 2023, Evonik Industries AG, a global leader in specialty chemicals, launched a new line of high-performance acidifiers targeted at improving feed efficiency and gut health in livestock across Southeast Asia. This initiative reflects the company's commitment to advancing sustainable animal nutrition solutions by leveraging its expertise in organic acids and feed additives. By focusing on region-specific livestock challenges, Evonik aims to strengthen its presence in the rapidly expanding Global Acidifiers Market.

- In March 2023, Nutreco N.V., a global animal nutrition company, introduced an innovative blend of organic acidifiers designed specifically for poultry and swine in North America. The product aims to enhance gut microbiota balance and improve feed conversion ratios, supporting healthier and more productive livestock. This development underscores Nutreco’s dedication to providing effective and sustainable feed solutions, further solidifying its market leadership.

- In March 2023, Adisseo, a key player in animal nutrition, partnered with the Indian government to promote the use of acidifiers in aquaculture feed formulations as part of a nationwide initiative to boost fish farming productivity. This collaboration highlights Adisseo’s strategic approach to addressing local agricultural challenges through innovative feed additives, supporting the growth of the Global Acidifiers Market in emerging regions.

- In February 2023, Kemin Industries, a global supplier of feed additives, announced a partnership with several major livestock associations in Europe to develop customized acidifier solutions that meet strict regional regulations on antibiotic-free feed. This initiative aims to enhance animal health and performance while ensuring compliance with evolving industry standards, demonstrating Kemin’s commitment to innovation and market adaptation.

- In January 2023, BASF SE, a leading chemical company, launched a new liquid acidifier formulation with enhanced stability and bioavailability for ruminant feed applications at the International Animal Nutrition Conference. The product is designed to improve rumen health and nutrient absorption, offering livestock producers an advanced tool for boosting productivity. This launch highlights BASF’s focus on integrating cutting-edge chemistry with sustainable animal nutrition to capture a larger share of the Global Acidifiers Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Acidifiers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Acidifiers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Acidifiers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.