Global Acoustic Vehicle Alerting Systems Market

Market Size in USD Million

CAGR :

%

USD

601.26 Million

USD

1,587.13 Million

2024

2032

USD

601.26 Million

USD

1,587.13 Million

2024

2032

| 2025 –2032 | |

| USD 601.26 Million | |

| USD 1,587.13 Million | |

|

|

|

|

What is the Global Acoustic Vehicle Alerting Systems Market Size and Growth Rate?

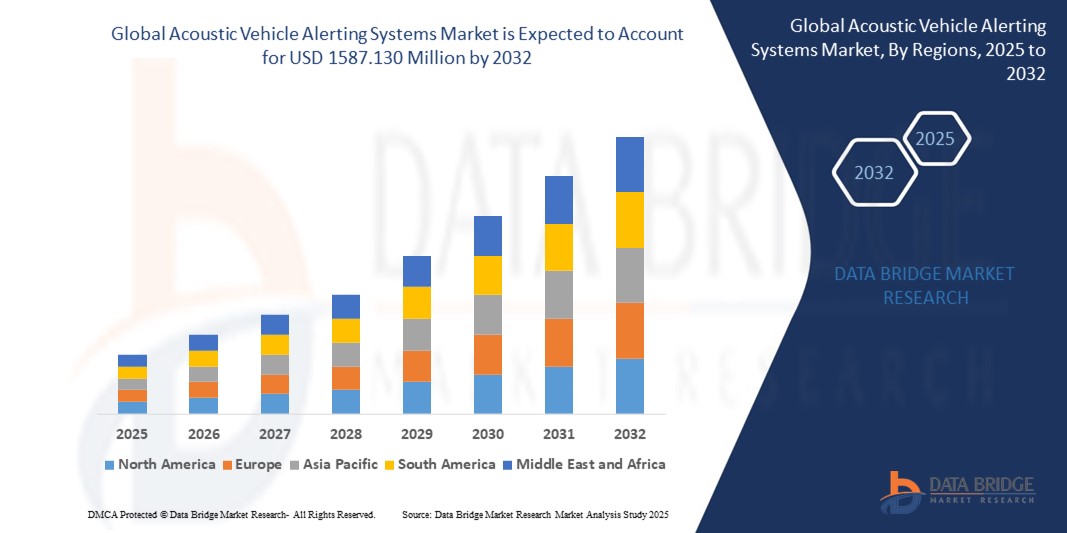

- The global acoustic vehicle alerting systems market size was valued at USD 601.26 million in 2024 and is expected to reach USD 1587.130 million by 2032, at a CAGR of 12.90% during the forecast period

- In the automotive industry, acoustic vehicle alerting systems (AVAS) are crucial for ensuring the safe integration of electric and hybrid vehicles into urban environments. AVAS technology addresses regulatory requirements mandating audible warnings for these vehicles, enhancing pedestrian safety. Automakers invest in acoustic vehicle alerting systems solutions to comply with evolving safety standards and to differentiate their vehicles in a competitive market

What are the Major Takeaways of Acoustic Vehicle Alerting Systems Market?

- As the adoption of electric vehicles rises globally, there is a growing need for acoustic vehicle alerting systems to mitigate risks associated with their quiet operation, ensuring pedestrian safety. With a diverse range of electric vehicles hitting the roads, manufacturers are compelled to integrate acoustic vehicle alerting systems into their designs to comply with regulations and enhance overall safety standards

- This trend fuels the demand for acoustic vehicle alerting systems technology, propelling market growth as automakers prioritize incorporating these systems into their electric vehicle models

- Asia-Pacific dominated the acoustic vehicle alerting systems market with the largest revenue share of 39.27% in 2024, primarily due to the rapid adoption of electric vehicles (EVs), strong government mandates on pedestrian safety, and booming automotive production across China, Japan, India, and South Korea

- North America is projected to grow at the fastest CAGR of 7.2% from 2025 to 2032, driven by a rise in EV sales, tightening safety standards, and regulatory enforcement of acoustic vehicle alerting systems under the U.S. National Highway Traffic Safety Administration (NHTSA)

- The Passenger Cars segment dominated the acoustic vehicle alerting systems market with the largest revenue share of 54.1% in 2024, due to the widespread integration of acoustic vehicle alerting systems in electric and hybrid passenger vehicles in compliance with regulatory mandates in the U.S., Europe, and Asia-Pacific

Report Scope and Acoustic Vehicle Alerting Systems Market Segmentation

|

Attributes |

Acoustic Vehicle Alerting Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Acoustic Vehicle Alerting Systems Market?

“Legislative Push for Pedestrian Safety in Electric Vehicles”

- A key trend reshaping the acoustic vehicle alerting systems (AVAS) market is the mandatory integration of sound systems in electric and hybrid vehicles to enhance pedestrian safety. As EVs operate quietly at low speeds, acoustic vehicle alerting systems provides an artificial sound to alert nearby pedestrians, particularly in urban environments

- Governments worldwide are enforcing regulations to ensure that automakers equip EVs with acoustic vehicle alerting systems. For instance, the U.S. National Highway Traffic Safety Administration (NHTSA) mandates that all EVs emit audible warnings at speeds below 30 km/h. Similarly, the European Union’s Regulation (EU) 540/2014 requires AVAS installation in all new electric and hybrid vehicles since July 2021

- OEMs are investing in intelligent acoustic vehicle alerting systems solutions that adapt sound patterns based on speed, direction, and vehicle behavior. Companies such as Nissan, Tesla, and Hyundai are using signature acoustic signatures for branding while complying with safety norms

- The integration of acoustic vehicle alerting systems with vehicle infotainment and ADAS is also gaining traction, enabling dynamic sound modulation, user customization, and interaction with smart city infrastructure

- With smart mobility and urbanization accelerating, acoustic vehicle alerting systems is becoming a critical component for regulatory compliance, consumer safety, and brand differentiation, especially in the EV segment

What are the Key Drivers of Acoustic Vehicle Alerting Systems Market?

- The growing adoption of electric vehicles (EVs) and hybrids globally is a major driver, as acoustic vehicle alerting systems is now legally required in several regions. This mandates OEMs to include acoustic solutions in their EV product lines, boosting market demand

- In March 2024, HARMAN International launched its new HALOsonic AVAS platform, offering OEMs a scalable solution tailored for regulatory compliance and immersive in-cabin acoustic experiences

- The rise in urban pedestrian traffic and vulnerable road users, such as children, elderly, and visually impaired individuals, is driving the need for vehicle sound alerts in low-speed zones

- Automotive safety awareness and smart city initiatives are encouraging public and private investments in acoustic vehicle alerting systems infrastructure and development, particularly in Europe, the U.S., and Asia-Pacific

- AVAS also supports brand identity and user experience enhancement, allowing manufacturers to embed distinct vehicle sounds that reflect brand ethos and driving behavior

Which Factor is challenging the Growth of the Acoustic Vehicle Alerting Systems Market?

- A key challenge is the lack of global standardization in acoustic vehicle alerting systems sound design and decibel levels. While regions such as the U.S. and Europe have set regulations, inconsistencies across countries can create technical and compliance complexities for manufacturers

- For instance, Japan mandates unique acoustic vehicle alerting systems features tailored to its dense urban structure, while countries in Latin America and Africa are still in early stages of legislation, limiting widespread adoption

- In addition, consumer perception of acoustic vehicle alerting systems noise as intrusive in quiet neighborhoods or eco-sensitive areas can lead to resistance. Striking a balance between safety and noise pollution remains an engineering challenge

- Integration complexities in retrofitting AVAS in older EV models or low-cost electric vehicles further pose hurdles, especially in cost-sensitive markets

- The high cost of advanced acoustic vehicle alerting systems with adaptive sound modulation, connectivity features, and AI capabilities may limit penetration in the entry-level EV segment, restricting full market potential in developing nations

- To overcome these challenges, industry players must focus on affordable acoustic vehicle alerting systems solutions, active collaboration with regulatory bodies, and developing user-customizable, environmentally adaptive sound systems to ensure global scalability and acceptance

How is the Acoustic Vehicle Alerting Systems Market Segmented?

The market is segmented on the basis of vehicle type, propulsion, electric two-wheelers, mounting position, and sales channel.

- By Vehicle Type

On the basis of vehicle type, the acoustic vehicle alerting systems market is segmented into Passenger Cars, Two-Wheelers, and Commercial Vehicles. The Passenger Cars segment dominated the AVAS market with the largest revenue share of 54.1% in 2024, due to the widespread integration of AVAS in electric and hybrid passenger vehicles in compliance with regulatory mandates in the U.S., Europe, and Asia-Pacific. As EV adoption continues to surge in urban and suburban settings, the demand for AVAS systems in this category remains strong.

The Two-Wheelers segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing government mandates for pedestrian safety and the rapid electrification of the two-wheeler segment, especially in densely populated regions such as India and Southeast Asia.

- By Propulsion

On the basis of propulsion, the market is segmented into Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV), and Plug-in Hybrid Electric Vehicle (PHEV). The Battery Electric Vehicle segment held the largest market revenue share in 2024, fueled by the global shift toward zero-emission vehicles and the need for acoustic vehicle alerting systems to compensate for reduced vehicle noise at low speeds.

The Hybrid Electric Vehicle segment is expected to register the fastest growth over the forecast period, due to increasing demand for dual-powertrain vehicles, particularly in regions offering tax incentives and infrastructure support for hybrids.

- By Electric Two-Wheelers

On the basis of electric two-wheelers, the market is segmented into E-Scooter/Moped and E-Motorcycle. The E-Scooter/Moped segment accounted for the largest revenue share of this category in 2024, as these vehicles are increasingly used for urban commuting and delivery services in Asia-Pacific and Europe. Their near-silent operation at low speeds necessitates acoustic vehicle alerting systems integration for pedestrian safety.

The E-Motorcycle segment is projected to grow at the fastest rate from 2025 to 2032, as manufacturers focus on high-performance, street-legal electric bikes with integrated acoustic vehicle alerting systems features to meet regulatory requirements.

- By Mounting Position

On the basis of mounting position, the acoustic vehicle alerting systems market is segmented into Integrated and Separated. The Integrated segment dominated the market in 2024, with the largest revenue share, driven by OEMs preferring factory-fitted acoustic vehicle alerting systems units that blend seamlessly with vehicle architecture and design.

The Separated segment is expected to witness rapid growth during the forecast period, owing to its flexibility in retrofitting and customization, especially in aftermarket installations and for low-speed commercial fleets.

- By Sales Channel

On the basis of sales channel, the market is segmented into OEM and Aftermarket. The OEM segment dominated the acoustic vehicle alerting systems market with the largest revenue share of 67.8% in 2024, supported by government regulations mandating acoustic vehicle alerting systems integration in all new electric and hybrid vehicles. Automakers are increasingly working with acoustic vehicle alerting systems component suppliers to meet evolving safety requirements.

The Aftermarket segment is projected to record the fastest CAGR from 2025 to 2032, driven by retrofitting needs in electric two-wheelers and older EVs, especially in regions such as Southeast Asia and Latin America where legacy vehicles continue to dominate the roads.

Which Region Holds the Largest Share of the Acoustic Vehicle Alerting Systems Market?

- Asia-Pacific dominated the acoustic vehicle alerting systems market with the largest revenue share of 39.27% in 2024, primarily due to the rapid adoption of electric vehicles (EVs), strong government mandates on pedestrian safety, and booming automotive production across China, Japan, India, and South Korea

- The region benefits from an extensive EV ecosystem and proactive regulations, including acoustic vehicle alerting systems requirements for low-noise vehicles under a certain speed threshold

- Moreover, domestic EV manufacturers and international OEMs in the region are accelerating AVAS integration in both passenger and commercial EVs to meet compliance and enhance brand safety appeal

China Acoustic Vehicle Alerting Systems Market Insight

China held the largest market share within Asia-Pacific in 2024 due to being the global leader in EV production and sales. Mandatory acoustic vehicle alerting systems regulations for EVs, effective since 2021, have driven large-scale deployments. Moreover, local tech advancements in sound design and low-cost production give Chinese suppliers a global edge.

Japan Acoustic Vehicle Alerting Systems Market Insight

Japan is steadily expanding its acoustic vehicle alerting systems market through continuous innovation in EV safety. With a highly urbanized population and quiet electric drivetrains, Japanese automakers focus on acoustic vehicle alerting systems technology that mimics engine sounds or offers customizable alerts. Compliance with UNECE standards and domestic safety regulations supports growth.

India Acoustic Vehicle Alerting Systems Market Insight

India's acoustic vehicle alerting systems market is gaining momentum due to rising EV adoption and upcoming mandates for sound devices in electric two-wheelers and compact cars. As cities grow denser and pedestrian safety becomes a concern, acoustic vehicle alerting systems solutions are being integrated into newer EV launches, supported by the government’s FAME II initiative and Make in India program.

Which Region is the Fastest Growing Region in the Acoustic Vehicle Alerting Systems Market?

North America is projected to grow at the fastest CAGR of 7.2% from 2025 to 2032, driven by a rise in EV sales, tightening safety standards, and regulatory enforcement of AVAS under the U.S. National Highway Traffic Safety Administration (NHTSA). Automakers are deploying acoustic vehicle alerting systems technologies in all new electric and hybrid models to meet federal rules, enhancing pedestrian safety in urban areas. Increased consumer awareness and EV incentives further bolster demand.

U.S. Acoustic Vehicle Alerting Systems Market Insight

The U.S. leads North America in acoustic vehicle alerting systems adoption, propelled by NHTSA regulations requiring all EVs to emit alert sounds under 18.6 mph. The growing market for EVs from Tesla, Ford, and GM, combined with demand for customizable vehicle sounds, has spurred innovation in speaker and software-based acoustic vehicle alerting systems.

Canada Acoustic Vehicle Alerting Systems Market Insight

Canada’s acoustic vehicle alerting systems market is steadily growing, supported by green vehicle incentives and safety-driven design mandates. Public awareness of pedestrian safety and urban noise management is increasing, pushing adoption of advanced sound emission systems in EVs, especially in provinces such as Ontario and British Columbia.

Which are the Top Companies in Acoustic Vehicle Alerting Systems Market?

The acoustic vehicle alerting systems industry is primarily led by well-established companies, including:

- Volkswagen (Germany)

- Toyota Kirloskar Motor (India)

- Continental AG (Germany)

- DENSO ELECTRONICS CORPORATION (Japan)

- Siemens (Germany)

- BorgWarner Inc. (U.K.)

- General Motors (U.S.)

- Nissan Motor Co., Ltd. (Japan)

- HARMAN International (U.S.)

- HELLA GmbH & Co. KGaA (Germany)

- Tesla (U.S.)

- Texas Instruments Incorporated (U.S.)

- Honda India (Japan)

- Brigade Electronics Group Plc (U.K.)

- Kendrion N.V. (Netherlands)

- KUFATEC GmbH & Co. KG (Germany)

- Fisker, Inc. (U.S.)

What are the Recent Developments in Global Acoustic Vehicle Alerting Systems Market?

- In July 2023, Maruti Suzuki India Limited, a subsidiary of Suzuki Motor Corporation, launched the hybrid variant of its premium SUV, the Grand Vitara, featuring an Acoustic Vehicle Alerting System (AVAS) aimed at enhancing pedestrian safety. This step reflects the company’s growing emphasis on smart mobility and public safety integration

- In July 2023, Maruti Suzuki India Limited further introduced AVAS technology for its Intelligent Electric Hybrid models of the Grand Vitara, ensuring that drivers and pedestrians receive timely audio cues about the vehicle’s presence. This initiative demonstrates the brand’s dedication to innovating for safer and more sustainable driving experiences

- In September 2022, BlackBerry Limited collaborated with Shanghai Dayin Technology Co., Ltd. to develop the "Yin" 2.0 application, which incorporates BlackBerry QNX acoustics technology and Software-Defined Audio Architecture (SDAA) in Great Wall Motors' intelligent cockpits. Among other audio enhancements, the system includes an AVAS to enrich both in-cabin and external safety awareness, marking a leap forward in vehicle auditory innovation

- In April 2022, Honda Cars India Limited, a subsidiary of Honda Motor Co., Ltd., launched its electric hybrid model, the City e:HEV, in India, equipped with multiple advanced safety features including an Acoustic Vehicle Alerting System (AVAS). This reflects Honda’s ongoing efforts to integrate comprehensive safety into eco-friendly vehicle offerings

- In May 2021, Transports Metropolitans de Barcelona (TMB) awarded a contract to the CAF Group subsidiary for the supply of 30 Urbino 12 hybrid buses, equipped with the AVAS-enabled Arrive & Go mode. This implementation strengthens safety in urban transportation by alerting pedestrians of quiet electric buses approaching

- In May 2021, Volvo Trucks unveiled a new acoustic alert system specifically designed for its electric truck models, incorporating unique sounds to notify pedestrians, cyclists, and nearby road users of an approaching vehicle. This system exemplifies Volvo’s proactive approach to improving public road safety in the electric mobility era

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.