Global Acquired Agranulocytosis Treatment Market

Market Size in USD Billion

CAGR :

%

USD

1,005.50 Billion

USD

1,519.87 Billion

2025

2033

USD

1,005.50 Billion

USD

1,519.87 Billion

2025

2033

| 2026 –2033 | |

| USD 1,005.50 Billion | |

| USD 1,519.87 Billion | |

|

|

|

|

Acquired Agranulocytosis Treatment Market Size

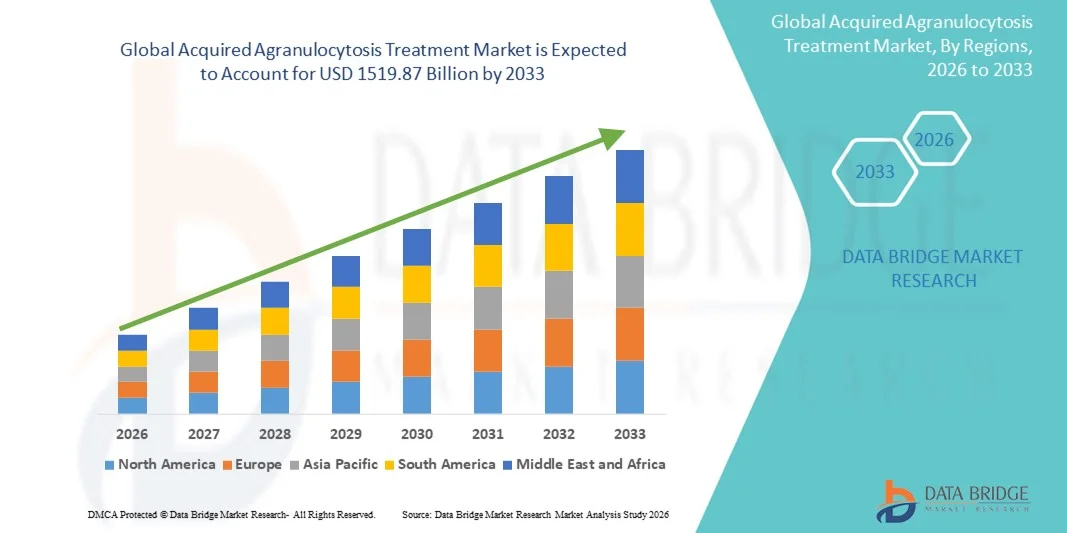

- The global acquired agranulocytosis treatment market size was valued at USD 1,005.5 billion in 2025 and is expected to reach USD 1519.87 billion by 2033, at a CAGR of 5.30% during the forecast period

- The market growth is largely fueled by increasing awareness of rare hematological disorders, technological advancements in diagnostics, and the growing adoption of targeted therapies, leading to improved patient outcomes in both clinical and hospital settings

- Furthermore, rising demand for effective, timely, and personalized treatment options for patients with Acquired Agranulocytosis is driving the adoption of advanced therapies, thereby significantly boosting the industry's growth

Acquired Agranulocytosis Treatment Market Analysis

- Acquired Agranulocytosis treatments, offering targeted therapeutic options for managing severe neutropenia and rare hematological disorders, are increasingly vital components of modern healthcare systems in both adult and pediatric populations due to their efficacy, safety, and potential to improve patient outcomes

- The escalating demand for acquired agranulocytosis treatments is primarily fueled by growing patient awareness, early diagnosis initiatives, and the adoption of advanced therapeutic protocols, resulting in a rising preference for clinically proven and timely interventions

- North America dominated the acquired agranulocytosis treatment market with the largest revenue share of approximately 39.5% in 2025, characterized by strong healthcare infrastructure, high awareness of rare hematological disorders, and the presence of leading pharmaceutical and specialty hematology centers, with the U.S. accounting for the majority of treated cases due to early diagnosis and adoption of advanced therapies

- Asia-Pacific is expected to be the fastest growing region in the acquired agranulocytosis treatment market during the forecast period, registering a projected CAGR of around 9.2%, driven by rising healthcare expenditure, improving hematology services, expanding access to advanced diagnostics, and increasing awareness of rare blood disorders

- The Intravenous segment dominated with 55.1% share in 2025, owing to its suitability for severe agranulocytosis and rapid therapeutic effect

Report Scope and Acquired Agranulocytosis Treatment Market Segmentation

|

Attributes |

Acquired Agranulocytosis Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Acquired Agranulocytosis Treatment Market Trends

Rising Focus on Early Diagnosis and Personalized Therapies

- A major trend in the global acquired agranulocytosis treatment market is the increasing emphasis on early diagnosis and individualized treatment protocols. Clinicians are adopting more sensitive laboratory tests, including complete blood counts, bone marrow evaluation, and antibody screening, to detect neutropenia at an earlier stage

- For instance, in March 2023, the European Hematology Association recommended the integration of routine anti-neutrophil antibody testing and early bone marrow assessments for patients on high-risk medications, enabling faster initiation of personalized therapy

- Integration of multi-disciplinary care teams, including hematologists, immunologists, and pharmacists, is becoming common, ensuring more precise and effective management

- Research into novel biologic therapies and supportive treatments is gaining momentum, reflecting the push toward more targeted approaches

- The trend also includes increased adoption of standardized treatment guidelines by leading hematology societies, improving consistency in care

- Patient education programs for self-monitoring symptoms and adherence to therapy are expanding globally

- Efforts to develop oral formulations and outpatient-friendly therapies are increasing convenience and accessibility

- Diagnostic innovations, including molecular assays and antibody panels, are enhancing the precision of therapy selection

Acquired Agranulocytosis Treatment Market Dynamics

Driver

Growing Incidence and Awareness of Acquired Agranulocytosis

- The increasing prevalence of acquired neutropenia due to medications, autoimmune disorders, or chemotherapy is a key driver of market growth

- For instance, in July 2022, Novartis reported an uptick in referrals for G-CSF therapy following a multicenter study in the US highlighting the rising incidence of drug-induced agranulocytosis among oncology patients

- Rising awareness among clinicians and patients regarding early symptoms, such as fever and recurrent infections, is fueling prompt medical consultation and treatment initiation

- The availability of effective therapies, including G-CSF and immunosuppressants, encourages broader adoption of treatment protocols

- Increased regulatory support and insurance coverage for novel therapies in developed regions are further driving market expansion

- Healthcare infrastructure improvements and the establishment of specialized hematology centers support treatment uptake

- Educational campaigns and professional workshops help clinicians identify and manage rare cases more effectively. Research on drug-induced agranulocytosis is prompting safer prescribing practices and earlier intervention

- Rising demand for hospital-based and outpatient management programs fuels treatment utilization. Global collaborations between research institutions and pharmaceutical companies are accelerating drug development

- Awareness campaigns highlighting the risk of infection in untreated patients reinforce the importance of timely therapy

- Overall, the increasing disease burden combined with improved treatment accessibility underpins market growth

Restraint/Challenge

High Treatment Costs and Limited Access to Specialized Care

- The high cost of biologic therapies, G-CSF injections, and hospital-administered treatments can limit adoption in developing countries or among uninsured populations

- For instance, in February 2024, a report by the World Health Organization highlighted limited access to G-CSF therapy in low-income regions of Sub-Saharan Africa, citing cost barriers and insufficient hospital infrastructure for managing severe neutropenia

- Access to specialized hematology services and monitoring facilities is limited in rural or underserved regions, restricting timely treatment

- Complex dosing regimens and the need for continuous monitoring for severe neutropenia add to logistical challenges

- Potential adverse effects of immunosuppressive therapies, such as infections or cytopenias, can lead to treatment hesitancy among patients and caregivers

- Healthcare systems in some regions may lack standardized protocols for acquired agranulocytosis, affecting consistent care delivery

- Delayed diagnosis due to overlapping symptoms with other hematological disorders can hinder timely treatment

- Poor patient adherence to follow-up and therapy in outpatient settings may reduce effectiveness

- Availability of advanced therapies remains concentrated in major urban centers, limiting widespread use

- While generic supportive drugs exist, access to novel targeted therapies is uneven globally. High costs combined with awareness gaps may slow market penetration in emerging economies

- Addressing these challenges requires expanding healthcare infrastructure, cost-effective treatment models, and increased clinician and patient education globally

Acquired Agranulocytosis Treatment Market Scope

The market is segmented on the basis of treatment, diagnosis, dosage, route of administration, symptoms, end-user, and distribution channel.

- By Treatment

On the basis of treatment, the Acquired Agranulocytosis Treatment market is segmented into Antibiotics, Antifungal, Corticosteroids, Filgrastim, Immunosuppressant Drugs, Bone Marrow Transplant, and Others. The Filgrastim segment dominated the largest market revenue share of 48.5% in 2025, owing to its proven effectiveness in stimulating neutrophil production and preventing severe infections. Hospitals and specialized clinics frequently administer Filgrastim in chemotherapy-induced or drug-induced neutropenia cases. Its rapid action in critical conditions ensures patient safety and minimizes hospitalization duration. Availability in pre-filled syringes enhances convenience and reduces dosing errors. High adoption is driven by strong clinical outcomes and guideline recommendations from hematology societies. Insurance coverage and reimbursement policies further support its uptake. Filgrastim’s use is also expanding in outpatient and home-care programs. Repeated administration for chronic cases reinforces market dominance. Growing awareness among healthcare professionals about neutropenia management contributes to its prevalence. The presence of trained nursing staff ensures safe administration. Clinical studies continue to validate efficacy across age groups. Demand in developed regions remains high due to well-established treatment protocols.

The Antibiotics segment is expected to witness the fastest CAGR of 12.3% from 2026 to 2033, driven by the increasing incidence of infection-related agranulocytosis and prophylactic use. Hospitals and outpatient centers are prescribing broad-spectrum antibiotics to prevent severe complications. Oral and intravenous formulations provide flexibility for acute and chronic management. Growth in telemedicine and home-based care enhances patient adherence to antibiotic regimens. Expanding awareness of secondary infections in neutropenic patients fuels adoption. Pharmaceutical innovations improve tolerability and dosing convenience. Rising geriatric population with comorbidities contributes to increased usage. Strategic collaborations between pharma companies and hospitals boost distribution. Antibiotics are increasingly recommended in clinical guidelines for high-risk patients. Lower cost compared to biologics enhances affordability in emerging markets. Education programs on early infection detection drive timely therapy initiation. Overall, antibiotics are witnessing rapid growth globally.

- By Diagnosis

On the basis of diagnosis, the market is segmented into Blood and Urine Test, Genetic Testing, Bone Marrow Test, Physical Exam, and Others. The Blood and Urine Test segment dominated with 55.2% share in 2025, driven by its simplicity, rapid turnaround, and effectiveness in identifying neutropenia. Routine complete blood counts (CBC) and urinalysis are standard in both hospital and outpatient settings. Early detection enables timely treatment, preventing severe infections. High adoption is observed in oncology, autoimmune, and pharmacovigilance programs. Integration with electronic medical records supports better monitoring. Laboratory infrastructure in developed regions ensures reliable testing. Physicians rely on these tests for acute symptom assessment. Affordable and widely accessible, blood and urine tests are preferred over invasive procedures. Standardization and guideline endorsement promote widespread use. Blood count monitoring is crucial for therapy adjustment in chronic cases. Public awareness campaigns encourage timely testing. Hospitals and clinics emphasize early diagnosis for patient safety.

The Genetic Testing segment is expected to witness the fastest CAGR of 13.1% from 2026 to 2033, as precision medicine becomes increasingly important. Genetic profiling helps identify patients at higher risk for drug-induced agranulocytosis. Innovations in next-generation sequencing (NGS) allow rapid, accurate detection of genetic mutations. Physicians use genetic testing to guide personalized therapy and reduce adverse events. Growth in diagnostic labs and increased awareness among hematologists support adoption. Integration with hospital IT systems facilitates seamless reporting. Government-funded programs in developed countries promote genetic screening. Outpatient centers are increasingly offering genetic counseling along with testing. Expansion of testing facilities in emerging markets drives growth. Education campaigns improve patient acceptance. Testing informs dosage adjustments for biologics and immunosuppressants. Overall, genetic testing is rapidly gaining traction globally.

- By Dosage

On the basis of dosage, the market is segmented into Tablet, Injection, Mouthwash, and Others. The Injection segment dominated with 52.7% share in 2025, owing to rapid effectiveness in severe or acute agranulocytosis cases. Injectable therapies allow direct bloodstream absorption for faster symptom control. Hospitals and emergency care units prioritize injectables for critical management. Filgrastim and corticosteroids are frequently administered via injection. Pre-filled syringes enhance ease of use and reduce dosing errors. Availability in outpatient and home-injection programs expands access. Trained healthcare professionals support safe administration. Repeat dosing in chronic cases reinforces market share. Higher reimbursement rates favor injectables. Strong clinical outcomes ensure physician preference. Critical care protocols often rely on injectable therapy. Adoption is high in developed countries with advanced healthcare infrastructure.

The Tablet segment is expected to witness the fastest CAGR of 10.5% from 2026 to 2033, driven by convenience for long-term therapy and outpatient care. Tablets enable self-administration and improve patient adherence. Oral formulations are preferred for mild or stable cases. Expansion of retail and online pharmacies increases availability. Innovations in dosage forms enhance tolerability, especially for pediatric patients. Home-based treatment programs encourage consistent use. Growing awareness among caregivers supports adoption. Tablets reduce dependency on hospital infrastructure. Cost-effectiveness compared to injections attracts developing regions. Telemedicine and remote monitoring accelerate patient adherence. Clinical guidelines increasingly include oral options for maintenance therapy.

- By Route of Administration

On the basis of route, the market is segmented into Oral, Intravenous, Intramuscular, and Others. The Intravenous segment dominated with 55.1% share in 2025, owing to its suitability for severe agranulocytosis and rapid therapeutic effect. IV therapy allows high-dose drug delivery and immediate symptom control. Hospitals and specialized hematology units extensively use IV administration. Continuous monitoring ensures patient safety. First-line therapies, including Filgrastim and corticosteroids, are often IV-administered. Infrastructure and trained staff facilitate safe infusion. Rapid response in critical care prevents infection-related complications. Adoption is high in emergency and oncology settings. IV therapy ensures accurate dosing for acute management. Clinical efficacy reinforces repeated use. IV administration is supported by hospital protocols for acute neutropenia. Centralized hospital systems streamline supply and administration.

The Oral segment is expected to witness the fastest CAGR of 11.1% from 2026 to 2033, due to convenience for outpatient and long-term therapy. Tablets and capsules allow patients to manage treatment at home. Oral therapy reduces hospital visits and lowers healthcare costs. Telemedicine and digital prescription management accelerate adoption. Expanding pharmacy distribution ensures accessibility. Pharmaceutical innovations improve taste, absorption, and compliance. Home-based management programs support continuous therapy. Patient education promotes adherence. Physicians increasingly recommend oral drugs for mild or stable conditions. Cost-effectiveness and easy storage favor widespread use. Oral therapy is expanding rapidly in emerging markets.

- By Symptoms

On the basis of symptoms, the market is segmented into Fatigue, Fever, Sore Throat, Bleeding Gums, Mouth Sores, and Others. The Fever segment dominated with 46.8% share in 2025, as it is the most common and clinically critical symptom prompting medical intervention. Fever indicates infection due to low neutrophil counts. Hospitals prioritize rapid diagnosis and treatment in febrile patients. Early fever management reduces risk of sepsis. Clinical guidelines recommend immediate therapy initiation. Fever drives hospital admission and injectable therapy usage. Continuous monitoring ensures treatment efficacy. High prevalence among oncology and autoimmune patients reinforces dominance. Fever-based triage is standard in hematology departments. Patient education emphasizes reporting temperature changes. Prompt intervention improves clinical outcomes. Fever monitoring is central to outpatient and home-care programs.

The Fatigue segment is expected to witness the fastest CAGR of 12.2% from 2026 to 2033, driven by growing recognition of early symptom management. Fatigue is often the first sign of neutropenia. Patient awareness programs encourage early consultation. Telemedicine facilitates monitoring and guidance. Fatigue-driven screening increases adoption of diagnostic tests. Physicians prescribe supportive therapy, including Filgrastim and supplements. Remote monitoring devices aid tracking. Early intervention prevents progression to severe cases. Fatigue management supports outpatient care growth. Awareness campaigns highlight the link between fatigue and neutropenia. Adoption is increasing in pediatric and geriatric populations. Pharmaceutical interventions for fatigue are expanding.

- By End-User

On the basis of end-user, the market is segmented into Clinic, Hospital, and Others. The Hospital segment dominated with 61.3% share in 2025, owing to specialized facilities, emergency care, and access to advanced therapies. Hospitals offer integrated diagnostics, therapy, and monitoring. ICUs and hematology units support injectable and IV treatments. Availability of trained hematologists ensures proper case management. Hospitals provide continuous observation and monitoring of critical patients. Multidisciplinary care teams optimize therapy outcomes. Insurance coverage supports treatment uptake. Hospital pharmacies ensure immediate drug availability. Hospitals also provide post-discharge follow-up and patient counseling. Urban hospital networks drive high adoption rates. Hospitals are preferred for severe or acute agranulocytosis cases. Government and private institutions dominate delivery.

The Clinic segment is expected to witness the fastest CAGR of 13.4% from 2026 to 2033, driven by the rise of specialized outpatient hematology and rehabilitation centers. Clinics provide convenient follow-up care and chronic management. Telehealth integration supports remote consultation. Early intervention programs enhance outcomes for pediatric and adult patients. Clinics offer access to oral therapies and home-injection programs. Patient adherence improves due to flexible scheduling. Expansion of diagnostic capabilities at clinics supports localized care. Awareness among caregivers drives adoption. Clinics help reduce hospital congestion. Outpatient management programs enhance long-term treatment continuity. Collaboration with pharmacies ensures timely medication access. Private clinics enhance quality of care and patient satisfaction.

- By Distribution Channel

On the basis of distribution, the market is segmented into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy. The Hospital Pharmacy segment dominated with 58.7% share in 2025, providing immediate access to critical medications. Hospitals maintain cold-chain storage for biologics. Hospital pharmacies support rapid dispensing in acute cases. Integration with hospital management systems ensures supply chain efficiency. Trained staff guide safe administration. Insurance and reimbursement policies favor hospital pharmacy purchases. Repeat prescriptions for chronic therapy sustain demand. Hospitals collaborate with pharma companies for access programs. Regulatory compliance is strictly maintained. Centralized hospital distribution minimizes stock-outs. Urban hospital pharmacies drive market dominance. Strong partnerships with suppliers reinforce reliability.

The Online Pharmacy segment is expected to witness the fastest CAGR of 16.2% from 2026 to 2033, fueled by telemedicine adoption, e-commerce growth, and home-care demand. Patients increasingly prefer doorstep delivery for chronic therapies. Online platforms expand reach to rural and remote areas. Digital tools provide automated refill reminders. E-commerce ensures wider product availability and competitive pricing. Smartphone and internet penetration accelerates adoption in developing markets. Specialty drugs, including injectables, are increasingly offered with home delivery. Patient-friendly packaging enhances usability. Collaboration with logistics providers improves delivery speed. Awareness about home-based care drives growth. Online pharmacies support telehealth prescription integration. The segment is rapidly gaining global market share.

Acquired Agranulocytosis Treatment Market Regional Analysis

- North America dominated the acquired agranulocytosis treatment market with the largest revenue share of approximately 39.5% in 2025

- Supported by a strong and well-established healthcare infrastructure, high awareness of rare hematological disorders, widespread availability of advanced diagnostic facilities

- The presence of leading pharmaceutical companies and specialized hematology treatment centers across the region

U.S. Acquired Agranulocytosis Treatment Market Insight

The U.S. acquired agranulocytosis treatment market accounted for the majority of North America’s share due to its early adoption of advanced treatment protocols, strong focus on rare disease management, and availability of experienced hematologists. The country benefits from robust clinical research activity and well-organized hospital networks, which support early diagnosis, rapid intervention, and effective patient management for acquired agranulocytosis cases.

Europe Acquired Agranulocytosis Treatment Market Insight

The Europe acquired agranulocytosis treatment market is projected to expand at a substantial CAGR during the forecast period, driven by increasing public and clinical awareness regarding blood disorders, supportive government healthcare initiatives, improved access to laboratory testing, and the growing availability of advanced therapies in hospitals and specialty clinics.

U.K. Acquired Agranulocytosis Treatment Market Insight

The U.K. acquired agranulocytosis treatment market is expected to grow at a noteworthy CAGR, supported by strong government-funded healthcare systems, rising investments in rare disease research, improved diagnostic capabilities, and increasing adoption of standardized treatment protocols across hospitals and research institutions.

Germany Acquired Agranulocytosis Treatment Market Insight

The Germany acquired agranulocytosis treatment market is anticipated to expand at a considerable CAGR, driven by advanced medical infrastructure, a strong emphasis on clinical research and innovation, and a growing focus on improving treatment outcomes for patients suffering from drug-induced or autoimmune blood disorders.

Asia-Pacific Acquired Agranulocytosis Treatment Market Insight

The Asia-Pacific acquired agranulocytosis treatment market is expected to grow at the fastest CAGR of around 9.2% during the forecast period (2026–2033), owing to rapidly improving healthcare systems, rising healthcare expenditure, increasing availability of hematology specialists, growing awareness of rare blood conditions, and expanding access to modern diagnostic and treatment facilities in countries such as China, India, and Japan.

Japan Acquired Agranulocytosis Treatment Market Insight

The Japan acquired agranulocytosis treatment market is gaining steady momentum due to its highly developed healthcare system, strong focus on patient safety, early adoption of advanced diagnostic tools, and continuous investments in research aimed at improving the management of rare hematological diseases.

China Acquired Agranulocytosis Treatment Market Insight

The China acquired agranulocytosis treatment market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by rapid expansion of healthcare infrastructure, increasing number of specialty hospitals, rising government initiatives for rare disease management, wider availability of affordable treatment options, and growing awareness among both healthcare providers and patients regarding early diagnosis and effective treatment.

Acquired Agranulocytosis Treatment Market Share

The Acquired Agranulocytosis Treatment industry is primarily led by well-established companies, including:

• Fresenius Kabi (Germany)

• Novartis AG (Switzerland)

• Takeda Pharmaceutical Company Limited (Japan)

• Amgen Inc. (U.S.)

• Gilead Sciences, Inc. (U.S.)

• Sanofi S.A. (France)

• Bristol-Myers Squibb (U.S.)

• Hospira, Inc. (U.S.)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Pfizer Inc. (U.S.)

• AbbVie Inc. (U.S.)

• Astellas Pharma Inc. (Japan)

• Janssen Pharmaceuticals (Belgium)

• Bayer AG (Germany)

• Shire Pharmaceuticals (U.K.)

Latest Developments in Global Acquired Agranulocytosis Treatment Market

- In September 2024, the safety committee of EMA (Pharmacovigilance Risk Assessment Committee, PRAC) recommended updated safety information for metamizole-containing drugs. This update was aimed at improving awareness about the risk of agranulocytosis, guiding healthcare professionals to monitor for early symptoms (e.g. fever, sore throat) and to discontinue treatment promptly if agranulocytosis develops

- In January 2024, a case report was published describing a pediatric patient who developed agranulocytosis after being treated with Methimazole for hyperthyroidism. The patient’s treatment was successfully managed using a combination of supportive therapies including granulocyte-colony stimulating factor (G-CSF), illustrating real-world management strategies for drug-induced agranulocytosis

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.