Global Acquired Angioedema Treatment Market

Market Size in USD Billion

CAGR :

%

USD

1,200.50 Billion

USD

1,746.83 Billion

2025

2033

USD

1,200.50 Billion

USD

1,746.83 Billion

2025

2033

| 2026 –2033 | |

| USD 1,200.50 Billion | |

| USD 1,746.83 Billion | |

|

|

|

|

Acquired Angioedema Treatment Market Size

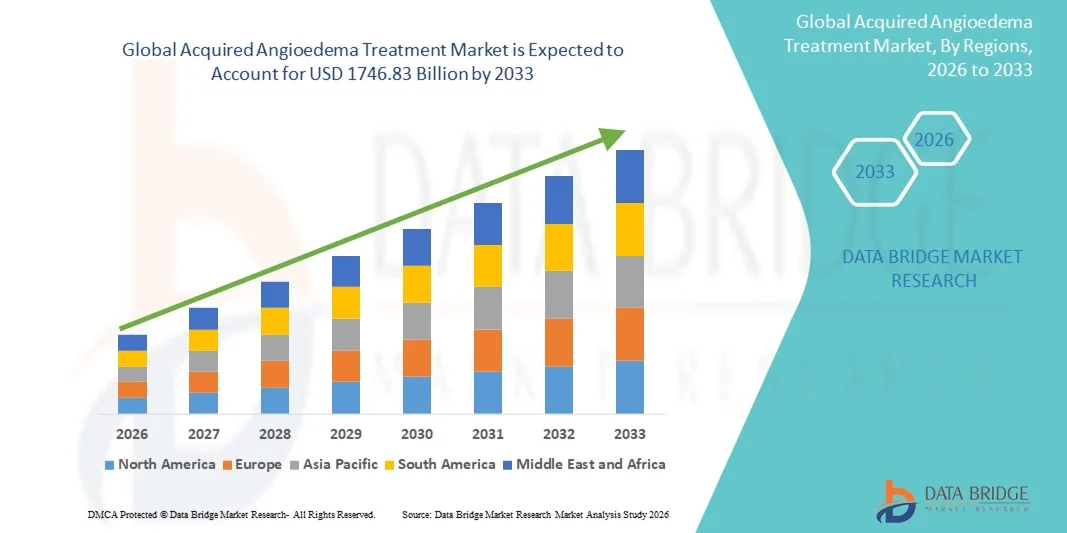

- The global acquired angioedema treatment market size was valued at USD 1,200.5 billion in 2025 and is expected to reach USD 1746.83 billion by 2033, at a CAGR of 4.80% during the forecast period

- The market growth is largely fueled by the increasing prevalence of acquired angioedema and growing awareness regarding early diagnosis and effective disease management, along with ongoing advancements in targeted therapies and biologic treatments aimed at improving patient outcomes in both acute and long-term care settings

- Furthermore, rising demand for safer, faster-acting, and more patient-friendly treatment options, including C1 esterase inhibitors and bradykinin pathway inhibitors, is establishing advanced therapies as the standard of care. These converging factors are accelerating the uptake of Acquired Angioedema Treatment solutions, thereby significantly boosting the industry's growth

Acquired Angioedema Treatment Market Analysis

- Acquired angioedema treatment, which focuses on controlling acute swelling attacks and preventing recurrence through targeted therapies, is becoming an increasingly critical area in rare disease management due to its potential to cause life-threatening complications involving the airway, gastrointestinal tract, and other organs. Advances in biologics, plasma-derived therapies, and bradykinin pathway inhibitors are significantly improving patient outcomes in both hospital and outpatient settings

- The escalating demand for acquired angioedema treatment is primarily driven by increasing awareness of rare immunological disorders, improved diagnostic capabilities, and a growing focus on early intervention and long-term disease management using safer and more effective targeted treatment options

- North America dominated the acquired angioedema treatment market with the largest revenue share of approximately 40% in 2025, supported by strong healthcare infrastructure, high awareness of rare diseases, advanced diagnostic facilities, and the presence of leading pharmaceutical companies. The U.S. accounted for the majority of this share due to better access to innovative therapies and a higher rate of diagnosis and treatment adoption

- Asia-Pacific is expected to be the fastest-growing region in the acquired angioedema treatment market during the forecast period, registering a projected CAGR driven by rising healthcare expenditure, expanding access to specialty treatments, improving diagnostic capabilities, and increasing awareness of rare immune-mediated conditions across countries such as China, India, and Japan

- The Type 1 segment dominated the market with a revenue share of 68.4% in 2025, primarily due to its higher prevalence among diagnosed patients. Type 1 acquired angioedema is commonly linked to lymphoproliferative disorders, making it more frequently identified in clinical settings

Report Scope and Acquired Angioedema Treatment Market Segmentation

|

Attributes |

Acquired Angioedema Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Acquired Angioedema Treatment Market Trends

Enhanced Convenience Through Early Diagnosis and Targeted Therapies

- A significant and accelerating trend in the global acquired angioedema treatment (AAE) market is the growing emphasis on early and accurate diagnosis combined with the wider availability of targeted, disease-specific therapies. This shift is helping reduce misdiagnosis and ensures that patients receive prompt and effective care, particularly in emergency settings

- For instance, the increasing adoption of C1 esterase inhibitor level testing and complement profiling (C4 and C1q levels) in routine diagnostics is enabling faster differentiation between acquired and hereditary forms of angioedema, leading to improved treatment selection and better patient outcome

- The trend is also being strengthened by the expanding use of targeted therapies such as C1 esterase inhibitors, bradykinin receptor antagonists (e.g., icatibant), and kallikrein inhibitors, which are delivering more precise and rapid symptom control during acute attacks. These therapies significantly reduce swelling, hospitalization duration, and the risk of life-threatening airway obstruction

- Furthermore, the integration of standardized treatment protocols in emergency departments and allergy specialty clinics is ensuring a more consistent and streamlined response to angioedema episodes, especially in cases not responsive to antihistamines or corticosteroids

- This trend towards personalized, mechanism-based therapy is reshaping clinical approaches to acquired angioedema management. Consequently, companies such as Takeda, CSL Behring, and BioCryst Pharmaceuticals are investing in the development and wider availability of advanced therapies targeting the bradykinin pathway

- The demand for fast-acting, targeted, and patient-centric treatment options is rising across both hospital and outpatient settings, as awareness among healthcare professionals and patients continues to improve globally

Acquired Angioedema Treatment Market Dynamics

Driver

Rising Prevalence of Underlying Disorders and Improved Awareness

- The increasing prevalence of lymphoproliferative and autoimmune disorders, which are commonly associated with acquired angioedema, is a major driver for the growing demand for effective treatment solutions. As these conditions rise worldwide, so does the incidence of AAE cases requiring urgent medical intervention

- For instance, in recent years, greater awareness among immunologists and allergists has led to a rise in diagnosed cases, which were previously underreported or misdiagnosed as allergic reactions. This improved recognition is directly driving greater demand for diagnostic testing and specialized medications

- As patients and healthcare providers become more informed about the life-threatening risks of untreated angioedema, the adoption of emergency injectable treatments, replacement therapies, and prophylactic medications is increasing significantly

- Furthermore, the expansion of specialty clinics and access to advanced therapeutic products, particularly in urban areas, is strengthening market growth across developed and emerging regions alike

- Growing investments in rare disease awareness campaigns and training programs for healthcare professionals are also playing a critical role in improving diagnosis rates and expanding the addressable patient pool for treatment manufacturers

Restraint/Challenge

High Treatment Costs and Limited Access in Developing Regions

- The high cost of biologic and plasma-derived therapies used in the treatment of acquired angioedema poses a significant challenge to broader market penetration. Many of the most effective drugs, including C1 esterase inhibitors and kallikrein inhibitors, remain expensive and inaccessible to a large segment of the global population

- In developing and underdeveloped regions, limited availability of diagnostic facilities, low disease awareness, and a shortage of trained specialists often result in delayed or inaccurate diagnosis, reducing treatment uptake

- For instance, in parts of Sub-Saharan Africa and Southeast Asia, advanced complement testing and C1 inhibitor assays are available only in a handful of tertiary care centers, forcing many patients to remain undiagnosed or misdiagnosed for years

- Moreover, the complex storage and distribution requirements of some injectable therapies present logistical challenges, especially in remote and rural healthcare settings

- While some governments and healthcare organizations are working to improve rare disease treatment access, inconsistent reimbursement policies and lack of inclusion in national healthcare programs continue to hinder adoption

- Overcoming these challenges through affordable treatment innovations, government support, wider insurance coverage, and expanded medical training programs will be critical for sustainable long-term growth of the acquired angioedema treatment market

Acquired Angioedema Treatment Market Scope

The market is segmented on the basis of type, treatment, diagnosis, dosage, route of administration, end-users, and distribution channel.

- By Type

On the basis of type, the Acquired Angioedema Treatment market is segmented into Type 1 and Type 2. The Type 1 segment dominated the market with a revenue share of 68.4% in 2025, primarily due to its higher prevalence among diagnosed patients. Type 1 acquired angioedema is commonly linked to lymphoproliferative disorders, making it more frequently identified in clinical settings. Increased awareness among healthcare professionals has improved early diagnosis of this form. Patients with Type 1 often experience recurrent, severe swelling episodes, which leads to higher treatment dependency and long-term drug use. Advanced laboratory testing is more effective in identifying Type 1 cases, increasing reported prevalence. The availability of targeted therapies is also greater for Type 1, strengthening its dominance. Hospitals and specialty clinics increasingly focus on managing this group due to predictable disease progression patterns. Ongoing clinical research is further centered on Type 1 mechanisms. Higher hospitalization and follow-up rates are also contributing to greater revenue generation. Growing geriatric population, which is more prone to associated conditions, adds to its dominance. Collectively, these factors sustain its leading market position globally.

The Type 2 segment is expected to witness the fastest CAGR of 11.8% from 2026 to 2033 due to rising improvements in diagnostic accuracy and awareness. Although historically underreported, advancements in immunological and genetic testing are increasing reliable identification of Type 2 cases. Growing focus on personalized medicine is helping differentiate Type 2 from similar conditions. New biomarker-based research is improving detection in early stages. Expanding education among allergists and immunologists is leading to more proper classification. Research funding in rare immune-mediated disorders is also supporting faster growth. The rising number of specialty clinics is contributing to better diagnosis rates. In addition, improved access to healthcare facilities in developing regions is promoting market entry of this segment. Pharmaceutical companies are now including Type 2 patients in clinical trial pipelines. Increased patient registries for rare diseases further boost reporting. Over time, reduced misdiagnosis and better treatment availability will continue to accelerate growth.

- By Treatment

On the basis of treatment, the market is segmented into Icatibant, Rituximab, Ecallantide, Corticosteroids, Antihistamines, Fresh Frozen Plasma (FFP), and Others. The Icatibant segment dominated the market in 2025 with a revenue share of 41.6%. This dominance is driven by its high efficacy in rapidly reducing swelling attacks by blocking the bradykinin receptor. It is commonly prescribed due to its fast onset of action and strong clinical outcomes. Icatibant is especially effective in emergency cases involving face, throat, and abdominal swelling. Physicians prefer it as a frontline therapy for acute episodes. Its proven safety profile supports repeated usage in chronic patients. The increasing number of emergency room visits linked to angioedema symptoms drives its demand. The injectable form allows quick administration in hospitals and at home. Growing reimbursement approvals in multiple countries have also strengthened sales. Strong support from clinical guidelines further increases its adoption. Its inclusion in rare disease treatment programs boosts accessibility. Increasing product availability from major pharmaceutical players strengthens its leading position.

The Rituximab segment is projected to grow at the fastest CAGR of 14.3% from 2026 to 2033 owing to its expanding use in refractory and autoimmune-linked cases. It is gaining recognition as an effective long-term control option. Increased clinical investigations into B-cell targeted therapies are promoting its wider application. Patients unresponsive to conventional therapies are being shifted to Rituximab. The rise in associated lymphoproliferative disorders further drives demand. Growing off-label usage due to successful outcomes supports growth. Advancements in monoclonal antibody manufacturing are reducing treatment costs. Higher physician confidence in biologic therapies boosts prescriptions. Expanded regulatory approvals will enhance acceptance. Increasing hospital infusion centers improve access. The trend toward targeted immunomodulation is accelerating its uptake. Rising investment in biologic research strengthens its long-term growth outlook.

- By Diagnosis

On the basis of diagnosis, the market is segmented into Testing C1-INH and C4, MRI, CT Scan, Autoantibody Test, Laboratory Tests, and Others. Testing C1-INH and C4 dominated the market with a 46.5% share in 2025 because these tests remain the gold standard in confirming acquired angioedema. They provide accurate measurement of complement deficiencies, which are key indicators of the disease. These tests are widely used in hospital laboratories and immunology clinics worldwide. Their high specificity reduces chances of misdiagnosis. Increasing awareness among clinicians has led to routine inclusion of these tests in diagnostic panels. Technological improvement has made test kits faster and more reliable. They are cost-effective compared to imaging procedures. Growing number of autoimmune disorders is increasing demand. The tests are essential for differentiating between hereditary and acquired forms. Educational campaigns are enhancing test adoption. Higher insurance coverage for laboratory testing is also supporting dominance.

Autoantibody testing is expected to grow at the fastest CAGR of 13.1% from 2026 to 2033 due to its increasing role in identifying underlying immune triggers. It is becoming critical for detecting associated autoimmune and lymphatic disorders. Technological advances in immunoassays improve sensitivity and reliability. The expansion of personalized medicine is fueling higher test demand. Research institutions are increasingly adopting autoantibody profiling. Rising prevalence of immune-based disorders encourages wider screening. Improved affordability of advanced assays is increasing access. Integration of AI-based analysis supports more precise detection. Growing partnerships between diagnostic firms and hospitals improve distribution. Expanded laboratory infrastructure in Asia-Pacific will drive further growth. Increasing government focus on rare disease diagnostics will boost this segment.

- By Dosage

By dosage, the market is segmented into Tablet, Injection, Solution, and Others. The Injection segment dominated the market with 52.7% share in 2025 due to its rapid effectiveness in severe and life-threatening cases. Injectable drugs allow direct bloodstream absorption, offering faster symptom control. They are widely used in hospital emergency settings. Many first-line therapies, including biologics, are formulated as injectables. It is preferred for patients with swallowing difficulties due to facial swelling. Availability in pre-filled syringes increases convenience. Increased incidence of acute attacks boosts demand. Strong clinical success supports repeated usage. The presence of trained healthcare professionals to administer injections promotes growth. Expanding home-injection options also contribute to dominance. Higher reimbursement for injectable drugs further strengthens market share.

The Solution segment is expected to witness the fastest CAGR of 12.9% from 2026 to 2033 because of its growing application in topical and oral liquid formulations. Easy administration is encouraging patient compliance. It is ideal for pediatric and elderly populations. Increased home-care treatment adoption boosts demand. Pharmaceutical companies are investing in stable liquid formulations. Growing online availability enhances accessibility. Improved taste-masking techniques increase acceptance. The non-invasive nature supports regular use. Expanding research in oral liquid therapy fuels growth. Increasing prescription by outpatient clinics supports expansion. The flexibility in dosage adjustment further promotes wider use.

- By Route of Administration

On the basis of dosage, the market is segmented into Tablet, Injection, Solution, and Others. The Injection segment dominated the market with a share of 52.7% in 2025 due to its rapid onset of action in severe and life-threatening angioedema attacks. Injectable formulations enable direct delivery into the bloodstream, resulting in faster symptom relief and improved patient outcomes. They are extensively utilized in hospital emergency departments and critical care units for immediate management. Several first-line and biologic therapies for acquired angioedema are primarily available in injectable form, contributing to higher adoption. This dosage form is also preferred for patients experiencing swallowing difficulties caused by facial or throat swelling. The availability of pre-filled syringes and auto-injector devices enhances ease of use and reduces administration errors. The rising incidence of acute and recurrent attacks continues to strengthen demand. Strong clinical efficacy and faster response time support repeated usage among patients. Furthermore, better reimbursement coverage for injectable therapies and increased acceptance of home-based injection options are further reinforcing the dominance of this segment.

The Oral segment is projected to grow at the fastest CAGR of 13.7% from 2026 to 2033 due to rising preference for non-invasive treatments. Tablets and oral solutions are easier for long-term therapy. Improved formulation technologies are increasing effectiveness. Patients prefer oral drugs for maintenance treatment. Higher adherence rate supports better outcomes. Expanding availability of oral medications improves access. Online pharmacies further support distribution. Reduced side effects compared to injections increase acceptance. Growing focus on patient comfort boosts growth. Increased use in mild to moderate cases contributes to rapid expansion.

- By End-Users

On the basis of end-users, the market is segmented into Hospital, Clinic, and Others. The Hospital segment dominated the market with 58.6% share in 2025. Hospitals are the primary point of care for severe and emergency cases. Availability of ICU facilities supports advanced treatment. Higher accuracy in diagnosis boosts treatment rates. Hospitals handle the largest patient inflow. Strong reimbursement coverage favors hospitals. Presence of trained specialists increases trust. Advanced diagnostic tools accelerate treatment decisions. Rising number of admissions supports higher revenue. Government funding strengthens hospital capacity. Research and clinical trials are primarily hospital-based, further increasing dominance.

The Clinic segment is expected to grow at the fastest CAGR of 13.4% from 2026 to 2033 due to rising number of specialized immunology and allergy clinics. Clinics offer faster consultation and lower treatment costs. Increase in urban centers improves accessibility. Growing outpatient treatment trend favors clinics. Follow-up management is mostly clinic-based. Shorter waiting time boosts patient preference. Private healthcare expansion supports growth. Clinics also support early detection. Increasing awareness campaigns are directing patients to specialized centers. This trend is especially strong in Asia-Pacific and Latin America.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy. The Hospital Pharmacy segment dominated the market with a 48.9% share in 2025. Most critical treatments are prescribed and dispensed within hospitals. Immediate drug availability ensures rapid treatment. Hospitals maintain stock of specialized drugs. Strong physician control supports this channel. High patient inflow increases volume. Government and insurance partnerships boost sales. Emergency therapies are only available in this channel. Secure cold storage supports biologic drugs. Better drug monitoring ensures patient safety. Strong supply-chain networks benefit hospital pharmacies.

The Online Pharmacy segment is expected to witness the fastest CAGR of 16.2% from 2026 to 2033, driven by increased digital adoption, telemedicine services, and home-based treatment models. Patients increasingly prefer doorstep delivery for long-duration therapies. Growth of e-commerce healthcare platforms and improved regulatory frameworks are further boosting this segment. The expanding use of smartphones and internet penetration in developing regions will significantly contribute to its rapid expansion. In addition, subscription-based medicine delivery services are making chronic treatment more affordable and consistent for patients.

Acquired Angioedema Treatment Market Regional Analysis

- North America dominated the acquired angioedema treatment market with the largest revenue share of approximately 40% in 2025

- Supported by strong healthcare infrastructure, high awareness of rare diseases, advanced diagnostic facilities, and the presence of leading pharmaceutical companies

- The region benefits from well-established reimbursement frameworks, access to specialized immunology and allergy care, and the early adoption of advanced therapies such as biologics and plasma-derived treatments

U.S. Acquired Angioedema Treatment Market Insight

The U.S. acquired angioedema treatment market accounted for the majority share within North America in 2025 due to better access to innovative therapies, a higher rate of diagnosis, and well-developed clinical infrastructure. Growing physician awareness, availability of advanced diagnostic tools for C1-INH deficiency, and increased use of targeted therapies such as icatibant and rituximab continue to drive market expansion. Additionally, strong support from rare disease foundations and improved patient access to specialized care centers contribute significantly to growth.

Europe Acquired Angioedema Treatment Market Insight

The Europe acquired angioedema treatment market is expected to grow at a steady CAGR during the forecast period, driven by rising awareness of rare immunological conditions and improved access to advanced diagnostic techniques. Increasing government support for rare disease treatment, along with the presence of major pharmaceutical manufacturers, is enhancing the availability of specialized therapies. Continuous investments in healthcare infrastructure and rare disease research are further strengthening market development across the region.

U.K. Acquired Angioedema Treatment Market Insight

The U.K. acquired angioedema treatment market is anticipated to grow consistently, supported by a strong public healthcare system and rising focus on the early diagnosis and effective management of rare diseases. Increased clinician awareness, patient education programs, and the integration of modern diagnostic technologies in hospitals and clinics are contributing to improved detection and treatment rates. Government initiatives in support of rare disease treatment access are expected to further boost market growth.

Germany Acquired Angioedema Treatment Market Insight

The Germany acquired angioedema treatment market is projected to expand at a notable pace due to its advanced healthcare infrastructure and strong emphasis on medical innovation. The availability of specialized treatment centers, improved diagnostic testing capabilities, and increased research in immunological disorders are key drivers. Additionally, Germany’s strong pharmaceutical sector is playing a vital role in advancing treatment options and ensuring patient accessibility.

Asia-Pacific Acquired Angioedema Treatment Market Insight

The Asia-Pacific acquired angioedema treatment market is expected to be the fastest-growing region during the forecast period, registering a high CAGR. This growth is driven by rising healthcare expenditure, improving diagnostic capabilities, expanding access to specialty treatments, and increasing awareness of rare immune-mediated conditions across developing and developed economies. Government initiatives focused on strengthening healthcare systems and expanding rare disease treatment coverage further support regional expansion.

Japan Acquired Angioedema Treatment Market Insight

The Japan acquired angioedema treatment market is gaining strong momentum due to its robust healthcare infrastructure, growing geriatric population, and high investment in research and development. The country’s advanced diagnostic environment enables early detection of acquired angioedema cases. Growing adoption of biologics and increased physician awareness regarding rare conditions are key factors driving sustained market growth.

China Acquired Angioedema Treatment Market Insight

The China acquired angioedema treatment market accounted for the largest revenue share within the Asia-Pacific region in 2025. This growth is attributed to rapidly increasing awareness of rare diseases, expanding hospital infrastructure, and rising investments in advanced diagnostic technologies. Government initiatives aimed at improving access to critical treatments and the growing presence of domestic and international pharmaceutical manufacturers are collectively boosting market expansion in the country.

Acquired Angioedema Treatment Market Share

The Acquired Angioedema Treatment industry is primarily led by well-established companies, including:

• BioCryst Pharmaceuticals (U.S.)

• Pharvaris (Netherlands)

• KalVista Pharmaceuticals (U.K.)

• Ionis Pharmaceuticals (U.S.)

• Pfizer Inc. (U.S.)

• AbbVie Inc. (U.S.)

• Novartis AG (Switzerland)

• Sanofi (France)

• Biogen Inc. (U.S.)

• Regeneron Pharmaceuticals (U.S.)

• Octapharma AG (Switzerland)

• Grifols S.A. (Spain)

Latest Developments in Global Acquired Angioedema Treatment Market

- In February 2023, Polai et al. published an open-access study showing that C1-inhibitor / anti–C1-inhibitor antibody complexes occur in acquired angioedema due to C1-INH deficiency, clarifying diagnostic pitfalls and highlighting that some antibody complexes may be missed by standard assays — a finding that improves diagnostic accuracy and may change how laboratories screen suspected AAE patients

- In September 2023, a bicenter retrospective study (published in J Allergy Clin Immunol Pract, e-published Sept 15, 2023) reported clinical, diagnostic and therapeutic real-world data on 20 AAE-C1-INH patients in Germany — documenting frequent facial swelling, a substantial diagnostic delay (median ~7.5 months), and effective use of off-label icatibant and C1-INH concentrates for on-demand treatment and, in severe cases, off-label long-term prophylaxis. The report emphasized the need for earlier recognition and practical treatment pathways while formal approvals for AAE remain limited

- In September 2024, Pharvaris issued a business update announcing that, following compelling investigator-initiated data, the company intended to expand clinical development of deucrictibant into acquired angioedema due to C1-INH deficiency (AAE-C1INH) — signalling industry interest in pursuing oral small-molecule B2-receptor antagonists for this unmet need and prompting planned clinical programs into AAE

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.