Global Acquired Lipodystrophy Treatment Market

Market Size in USD Billion

CAGR :

%

USD

420.50 Billion

USD

660.16 Billion

2025

2033

USD

420.50 Billion

USD

660.16 Billion

2025

2033

| 2026 –2033 | |

| USD 420.50 Billion | |

| USD 660.16 Billion | |

|

|

|

|

Acquired Lipodystrophy Treatment Market Size

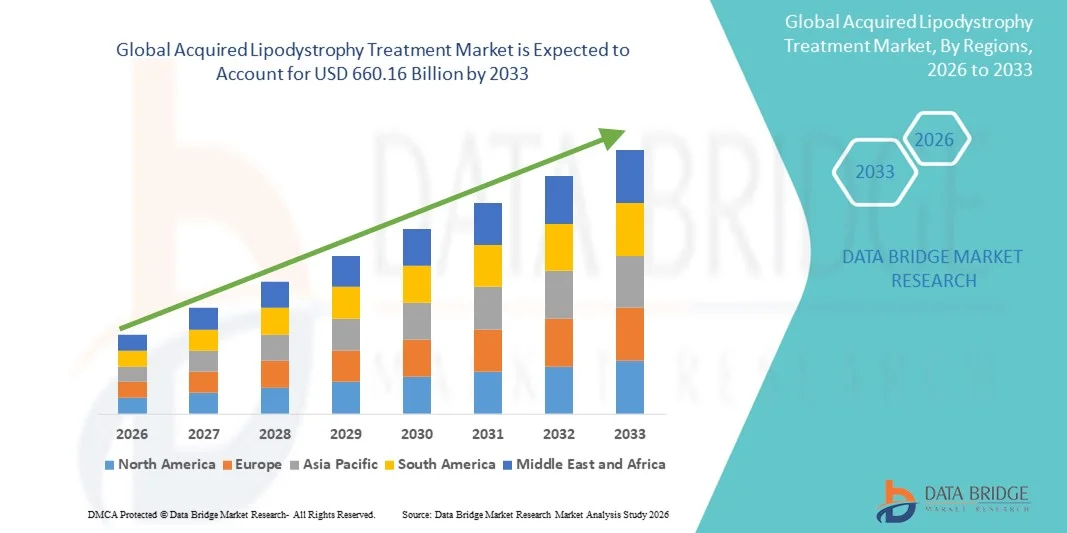

- The global acquired lipodystrophy treatment market size was valued at USD 420.50 billion in 2025 and is expected to reach USD 660.16 billion by 2033, at a CAGR of 5.80% during the forecast period

- The market growth is largely fueled by increasing awareness of metabolic disorders, rising prevalence of HIV-associated lipodystrophy, and advancements in therapeutic options, leading to improved patient outcomes in both clinical and homecare settings

- Furthermore, growing emphasis on personalized treatment approaches, patient monitoring, and combination therapies is accelerating the uptake of Acquired Lipodystrophy Treatment solutions, thereby significantly boosting the industry's growth

Acquired Lipodystrophy Treatment Market Analysis

- Acquired Lipodystrophy Treatment, offering targeted therapeutic interventions for patients with metabolic and HIV-related fat distribution disorders, is increasingly vital in modern healthcare settings due to its efficacy, ease of administration, and ability to improve patient quality of life

- The escalating demand for Acquired Lipodystrophy Treatment is primarily fueled by the rising prevalence of metabolic complications, increasing awareness among healthcare providers and patients, and a growing emphasis on early diagnosis and effective management of acquired lipodystrophy

- North America dominated the acquired lipodystrophy treatment market with the largest revenue share of 42.5% in 2025, attributed to advanced healthcare infrastructure, high diagnosis rates for metabolic and HIV-related complications, and strong presence of leading pharmaceutical companies. The U.S. remains the key contributor, driven by widespread access to specialized clinics, government-funded programs for HIV and metabolic disorders, and early adoption of novel treatment therapies

- Asia-Pacific is expected to be the fastest-growing region in the acquired lipodystrophy treatment market during the forecast period, projected to expand at a CAGR of 22.8% from 2026 to 2033, fueled by increasing healthcare awareness, rising disposable incomes, expanding healthcare facilities, and government initiatives promoting early diagnosis and management in countries such as China, India, and Japan

- The Subcutaneous segment dominated with 45.5% revenue share in 2025, mainly due to Metreleptin therapy delivered subcutaneously offering effective metabolic regulation and patient compliance

Report Scope and Acquired Lipodystrophy Treatment Market Segmentation

|

Attributes |

Acquired Lipodystrophy Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Acquired Lipodystrophy Treatment Market Trends

Emergence of Novel Therapeutic Approaches and Personalized Treatments

- A significant and accelerating trend in the global Acquired Lipodystrophy Treatment market is the shift toward novel therapeutic approaches, including recombinant leptin therapy, gene-targeted interventions, and biologics aimed at improving metabolic outcomes and quality of life

- For instance, in June 2023, the U.S. FDA granted expanded access to metreleptin therapy for patients with generalized and partial lipodystrophy, highlighting the market trend toward targeted and personalized therapies

- Recent studies emphasize precision medicine, with treatment regimens being customized based on the patient’s underlying lipodystrophy type, genetic profile, and metabolic complications

- Biologics such as metreleptin are increasingly recognized for their ability to regulate glycemic control, reduce hypertriglyceridemia, and manage hepatic steatosis in affected patients

- Clinical trials are exploring combination therapies and new delivery mechanisms to enhance efficacy while reducing adverse effects, marking a move toward more patient-centric care

- Medical research institutions are focusing on early intervention strategies to prevent long-term complications associated with Acquired Lipodystrophy, further driving innovation in treatment protocols

- This trend is supported by rising patient awareness, improved diagnostic technologies, and growing collaboration between pharmaceutical companies and healthcare providers to expand therapeutic options

Acquired Lipodystrophy Treatment Market Dynamics

Driver

Rising Incidence of Metabolic Complications and Unmet Medical Needs

- The increasing prevalence of metabolic disorders, insulin resistance, and dyslipidemia in patients with acquired lipodystrophy is a key driver for market growth

- For instance, in March 2024, a multi-center study published in Diabetes Care highlighted that early therapeutic intervention with leptin analogs significantly improved metabolic profiles in patients, promoting broader adoption of targeted therapies

- Growing recognition of the complications associated with lipodystrophy, such as cardiovascular risk, hepatic steatosis, and diabetes, is motivating clinicians to prescribe effective treatments earlier

- The demand for therapies that offer long-term metabolic benefits and improve patient quality of life is propelling the uptake of advanced treatment options

- In addition, regulatory support for orphan drugs and expedited approval pathways for treatments targeting rare metabolic disorders is encouraging pharmaceutical innovation and market expansion

- Healthcare provider awareness campaigns and patient advocacy groups are further facilitating adoption by educating on the importance of early diagnosis and treatment

Restraint/Challenge

High Treatment Costs and Limited Accessibility

- The high cost of biologics and recombinant therapies remains a significant barrier to widespread adoption, particularly in low- and middle-income regions

- For insatnce, a 2023 report by the International Diabetes Federation indicated that limited insurance coverage and high out-of-pocket costs restrict access to metreleptin therapy in several countries

- Complex administration protocols and the need for regular monitoring increase the burden on healthcare providers and patients, potentially limiting adherence

- In addition, there is a scarcity of specialists trained to manage rare metabolic conditions associated with Acquired Lipodystrophy, which may slow treatment uptake

- Challenges in global distribution channels, including hospital pharmacies and specialty clinics, also contribute to uneven accessibility of therapies

- Overcoming these obstacles through cost reduction strategies, expanded insurance coverage, and increased training of healthcare professionals is crucial for sustained growth in the Acquired Lipodystrophy Treatment market

Acquired Lipodystrophy Treatment Market Scope

The market is segmented on the basis of treatment, type, route of administration, diagnosis, symptoms, demographic, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the Acquired Lipodystrophy Treatment market is segmented into Diet, Exercise, Surgery, Metreleptin, Statins, Fibric-acid Derivatives, Hyperglycemic Drugs, Anti-hypertensive Drugs, and Others. The Metreleptin segment dominated the largest market revenue share of 38.5% in 2025, owing to its proven efficacy in regulating metabolic complications such as hyperglycemia and hypertriglyceridemia in generalized and partial lipodystrophy patients. Metreleptin therapy is widely adopted due to its ability to improve insulin sensitivity, reduce hepatic steatosis, and manage severe metabolic dysfunction. Clinical guidelines increasingly recommend Metreleptin for patients with inadequate response to conventional therapies, driving strong adoption. Additionally, growing awareness among healthcare providers and patients regarding its clinical benefits reinforces market dominance. Regulatory approvals and insurance coverage in major markets further contribute to its large revenue share. Real-world evidence demonstrates improved patient outcomes, supporting higher market preference. Hospitals and specialty clinics favor Metreleptin therapy for its reliability and measurable efficacy. Research initiatives continue to explore optimized dosing and long-term benefits, sustaining confidence in its therapeutic potential. The segment also benefits from patient support programs, educational initiatives, and reimbursement schemes.

The Diet and Exercise segment is expected to witness the fastest CAGR of 19.2% from 2026 to 2033, fueled by growing awareness about lifestyle interventions for managing metabolic complications and maintaining adipose tissue function. These non-pharmacological treatments are increasingly recommended as adjunct therapy, promoting preventive care and overall patient well-being. Health-conscious individuals prefer diet modification and structured exercise programs to complement pharmacotherapy. Rising obesity and metabolic syndrome prevalence worldwide also support adoption. Digital health platforms and mobile apps promoting diet and exercise interventions contribute to rapid growth. Nutritionist-led programs and fitness regimens tailored for lipodystrophy patients further accelerate market expansion. Governments and NGOs increasingly promote lifestyle management programs as cost-effective interventions. Clinical studies demonstrate significant improvements in lipid profiles and glycemic control, validating effectiveness. Awareness campaigns and educational outreach strengthen patient engagement. Telehealth and virtual coaching enhance accessibility, driving faster adoption. The affordability and minimal side-effect profile make this segment attractive for emerging markets.

- By Type

On the basis of type, the market is segmented into Acquired Generalized Lipodystrophy (Lawrence syndrome), Acquired Partial Lipodystrophy (Barraquer-Simons syndrome), High Active Antiretroviral Therapy (HAART) induced Lipodystrophy (LD-HIV), and Localized Lipodystrophy. The Acquired Generalized Lipodystrophy (Lawrence syndrome) segment dominated the market with 41.0% revenue share in 2025, due to the severity of metabolic complications requiring early medical intervention and continuous monitoring. Patients with generalized lipodystrophy exhibit extensive fat loss and insulin resistance, increasing the reliance on therapies like Metreleptin and Fibric-acid derivatives. Increased diagnostic accuracy and early detection have strengthened adoption in this segment. Clinical evidence demonstrates significant improvements in glycemic and lipid control with targeted therapies. Specialist care and long-term monitoring programs in major markets contribute to revenue dominance. Growing awareness among endocrinologists and metabolic disorder specialists supports high prescription rates. The segment also benefits from reimbursement policies in developed regions. Rising patient advocacy and support networks enhance adherence to therapy.

The HAART-induced Lipodystrophy (LD-HIV) segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, driven by the increasing global HIV population under antiretroviral therapy and rising metabolic complications associated with long-term HAART use. Improved survival rates among HIV patients have expanded the population at risk of LD-HIV. Innovative treatment options and early intervention strategies for HAART-associated lipodystrophy accelerate market adoption. Awareness campaigns among HIV specialists and patients promote timely management. Clinical studies demonstrate positive outcomes with diet, exercise, and pharmacological therapies. Rising access to antiretroviral therapy in emerging markets fuels demand. Educational initiatives on metabolic side effects of HAART also drive adoption. Integration of lifestyle interventions with medical therapy ensures faster growth. Availability of combination therapies further supports CAGR expansion.

- By Route of Administration

On the basis of administration, the market is segmented into Oral, Intravenous, and Subcutaneous. The Subcutaneous segment dominated with 45.5% revenue share in 2025, mainly due to Metreleptin therapy delivered subcutaneously offering effective metabolic regulation and patient compliance. Subcutaneous injections provide stable bioavailability, ease of home administration, and consistent therapeutic effects. This route is preferred by hospitals and specialty clinics due to safety and controlled dosing. Clinical studies validate superior metabolic outcomes compared to oral or intravenous alternatives. The convenience of self-administration programs enhances adoption. Educational programs for patients ensure correct injection techniques. Insurance coverage and reimbursement support sustained usage. Long-term efficacy and safety data reinforce preference. Specialty pharmacy networks and homecare services strengthen accessibility.

The Oral segment is expected to witness the fastest CAGR of 17.9% from 2026 to 2033, driven by convenience, cost-effectiveness, and the growing adoption of oral statins, fibric-acid derivatives, and hyperglycemic drugs as adjunct therapy. Oral formulations are easier for patients to adhere to, especially in adult and geriatric populations. Integration with routine therapy regimens promotes faster adoption. Increasing availability of generic oral drugs reduces treatment costs. Clinical validation of efficacy encourages healthcare provider prescription. Convenience of administration for long-term management drives rapid growth. Telemedicine and e-prescription services accelerate access. Awareness campaigns about oral interventions enhance patient engagement. Digital reminders and mobile health platforms support compliance. Rising interest in home-based therapy encourages faster adoption.

- By Diagnosis

On the basis of diagnosis, the market is segmented into Skin Biopsy, Blood Tests, Urine Tests, MRI, and X-ray. The Blood Tests segment dominated the market with 42.3% revenue share in 2025, owing to its reliability in detecting metabolic abnormalities such as insulin resistance, hypertriglyceridemia, and liver enzyme changes. Blood tests offer a non-invasive, cost-effective, and widely accepted method for early detection and ongoing monitoring of lipodystrophy-related complications. Clinical guidelines emphasize routine blood tests for both generalized and partial lipodystrophy. Healthcare providers increasingly rely on blood panels to assess therapy efficacy. Blood tests enable personalized treatment adjustments and track patient response over time. Their convenience and reproducibility make them preferred in hospitals and specialty clinics. Automated laboratory systems enhance throughput and accuracy. Rising awareness among clinicians and patients supports frequent testing. Integration with electronic health records streamlines monitoring.

The MRI segment is expected to witness the fastest CAGR of 19.5% from 2026 to 2033, driven by the increasing demand for precise fat distribution imaging and assessment of lipodystrophy severity. MRI provides a detailed, non-invasive evaluation of subcutaneous and visceral fat loss, guiding targeted therapy. Growing adoption in research and specialized care centers accelerates usage. Advancements in imaging technology, including faster scans and enhanced resolution, enhance clinical utility. MRI aids in monitoring disease progression and therapy outcomes. Rising healthcare infrastructure in emerging regions contributes to market expansion. Physicians increasingly rely on MRI to detect early complications. Awareness campaigns highlight the diagnostic benefits for both pediatric and adult populations. Research studies validate MRI as a gold standard for body composition assessment. Enhanced insurance coverage and reimbursement support adoption.

- By Symptoms

On the basis of symptoms, the market is segmented into Hyperphagia, Panniculitis, Acromegaly, Hepatomegaly, Hypertriglyceridemia, Chylomicronemia, and Others. The Hypertriglyceridemia segment dominated the market with 39.8% revenue share in 2025, due to its prevalence in patients with generalized and partial lipodystrophy and its critical role in metabolic complications such as pancreatitis. Management of hypertriglyceridemia through drugs, lifestyle interventions, and Metreleptin therapy drives consistent market adoption. Healthcare providers prioritize therapies that effectively reduce triglyceride levels. Real-world evidence confirms clinical efficacy and safety. Guidelines recommend regular monitoring of lipid profiles. Hospitals and specialty clinics emphasize management protocols to prevent complications. Rising prevalence globally reinforces segment dominance. Patient education on diet and lifestyle complements therapy. Pharmaceutical developments target effective triglyceride reduction. Insurance coverage supports access to treatments addressing this symptom.

The Hyperphagia segment is expected to witness the fastest CAGR of 18.8% from 2026 to 2033, driven by growing recognition of excessive appetite as a key symptom requiring intervention, particularly in pediatric and adult populations. Lifestyle interventions, appetite-regulating drugs, and supportive therapies contribute to rapid adoption. Clinical research highlights improvements in quality of life with targeted management. Parental and caregiver awareness drives timely treatment in pediatric patients. Rising adoption of holistic care models integrates behavioral therapy with pharmacological interventions. Telehealth and digital monitoring enhance patient engagement. Specialty centers emphasize symptom-specific programs. Increased focus on individualized care plans accelerates uptake. Dietary counseling and monitoring tools support adherence. Awareness campaigns highlight the importance of managing hyperphagia to prevent metabolic complications.

- By Demographic

On the basis of demographic, the market is segmented into Adult, Pediatric, and Geriatric. The Adult segment dominated with 44.2% revenue share in 2025, due to the higher prevalence of metabolic complications and the availability of targeted therapies such as Metreleptin and adjunct medications. Adults are more likely to seek treatment due to symptomatic metabolic disorders and associated comorbidities. Clinical trials and research initiatives primarily focus on adult populations, increasing therapy adoption. Specialist care centers cater predominantly to adults. Awareness programs and patient support enhance engagement. Insurance coverage and reimbursement facilitate access. Adult populations have higher healthcare spending capacity, promoting treatment uptake. Long-term monitoring ensures sustained therapy adherence. Hospitals and clinics maintain protocols optimized for adult patients. Rising prevalence of obesity and metabolic syndrome in adults reinforces demand.

The Pediatric segment is expected to witness the fastest CAGR of 20.1% from 2026 to 2033, driven by early diagnosis and increasing awareness among parents and healthcare providers about congenital and acquired forms of lipodystrophy. Pediatric interventions, including Metreleptin and lifestyle management, are gaining traction. Awareness campaigns and advocacy by patient organizations contribute to rapid adoption. Early intervention reduces long-term metabolic complications. Specialized pediatric endocrinology centers promote targeted therapy. Clinical guidelines emphasize early therapeutic management. Insurance coverage for pediatric treatments enhances accessibility. Digital health tools facilitate monitoring and adherence. Research initiatives focus on safety and efficacy in children. Rising incidence of genetic and acquired pediatric cases drives market growth.

- By End-Users

On the basis of end-users, the market is segmented into Clinic, Hospital, and Others. The Hospital segment dominated with 46.5% revenue share in 2025, due to the presence of specialized metabolic disorder units, trained healthcare professionals, and access to advanced treatment options including Metreleptin and drug combinations. Hospitals provide comprehensive diagnostic and therapeutic solutions, driving strong adoption. Hospitals benefit from insurance coverage and government funding. Long-term patient monitoring and follow-up protocols ensure therapy adherence. Hospitals maintain multidisciplinary care teams enhancing treatment outcomes. Clinical evidence supports higher success rates in hospital-managed cases. Hospitals also offer educational programs for patients and caregivers. Advanced laboratory and imaging facilities support accurate diagnosis and therapy monitoring. Rising number of hospitals with endocrine specialization reinforces dominance.

The Clinic segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, fueled by increasing establishment of specialty clinics focusing on metabolic disorders and rare diseases. Clinics provide convenient, accessible, and patient-focused care for early-stage management. Growing adoption of outpatient care and telemedicine accelerates treatment uptake. Clinics offer targeted therapies, lifestyle guidance, and follow-up monitoring. Awareness campaigns by clinics enhance patient enrollment. Digital tools improve adherence tracking and engagement. Clinics in urban areas experience higher patient footfall. Partnerships with pharmaceutical companies support therapy access. Rising number of clinics globally contributes to market expansion.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy. The Hospital Pharmacy segment dominated with 48.1% revenue share in 2025, owing to direct access to prescribed therapies, including Metreleptin, statins, and hyperglycemic drugs, ensuring compliance and proper dosing. Hospital pharmacies support immediate availability post-diagnosis. Integration with hospital systems ensures correct patient-specific dispensing. Clinical oversight during distribution ensures safety and efficacy. Insurance coverage supports hospital pharmacy adoption. Patients benefit from expert guidance on medication administration. Hospitals manage inventory efficiently for rare disease treatments. Reimbursement policies favor hospital pharmacy distribution. Educational support reinforces patient adherence.

The Online Pharmacy segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, driven by convenience, expanding e-commerce adoption, and home delivery services. Online pharmacies provide access to therapies in remote or underserved areas. Teleconsultation integration facilitates prescription management. Growing acceptance of digital healthcare channels accelerates adoption. Online platforms improve therapy adherence through reminders and tracking. Increased penetration of smartphones and internet boosts accessibility. Patients benefit from competitive pricing and subscription models. Rising e-pharmacy regulations enhance trust. Home delivery options support continuity of care. Awareness campaigns and digital marketing drive market growth.

Acquired Lipodystrophy Treatment Market Regional Analysis

- North America dominated the acquired lipodystrophy treatment market with the largest revenue share of 42.5% in 2025, attributed to advanced healthcare infrastructure, high diagnosis rates for metabolic and HIV-related complications, and strong presence of leading pharmaceutical companies

- The remains the key contributor, driven by widespread access to specialized clinics, government-funded programs for HIV and metabolic disorders, and early adoption of novel treatment therapies

- High patient awareness, well-established diagnostic facilities, and robust clinical research initiatives are further supporting the growth of the market in North America, particularly in hospitals, specialty clinics, and research centers, facilitating timely treatment and management of acquired lipodystrophy

U.S. Acquired Lipodystrophy Treatment Market Insight

The U.S. acquired lipodystrophy treatment market captured the largest revenue share of 83% in 2025 within North America, propelled by increasing prevalence of HIV-related and metabolic disorders, government-backed health programs, and early introduction of therapies such as Metreleptin. The growing focus on early diagnosis, personalized treatment plans, and accessibility to specialty healthcare centers is further driving the adoption of treatment solutions across adult, pediatric, and geriatric populations.

Europe Acquired Lipodystrophy Treatment Market Insight

The Europe acquired lipodystrophy treatment market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising awareness of metabolic complications, increased healthcare expenditure, and government initiatives promoting access to advanced therapies. The region is witnessing significant adoption across hospitals, specialty clinics, and research institutes, particularly in countries such as Germany, France, and the U.K., where supportive reimbursement policies encourage early intervention.

U.K. Acquired Lipodystrophy Treatment Market Insight

The U.K. acquired lipodystrophy treatment market is expected to grow at a noteworthy CAGR during the forecast period, fueled by increasing patient awareness, rising prevalence of HIV-related and metabolic disorders, and expanding healthcare infrastructure. Robust clinical programs and strong government support for rare metabolic conditions are further facilitating the adoption of targeted treatment solutions in hospitals and specialty clinics.

Germany Acquired Lipodystrophy Treatment Market Insight

The Germany acquired lipodystrophy treatment market is anticipated to witness considerable growth, driven by high diagnostic rates, advanced healthcare infrastructure, and rising adoption of novel therapies. Germany’s focus on clinical research, government-backed rare disease programs, and increasing awareness among healthcare professionals promotes early intervention and better management of acquired lipodystrophy cases.

Asia-Pacific Acquired Lipodystrophy Treatment Market Insight

The Asia-Pacific acquired lipodystrophy treatment market is poised to grow at the fastest CAGR of 22.8% during the forecast period of 2026 to 2033, fueled by increasing healthcare awareness, rising disposable incomes, expanding healthcare facilities, and government initiatives promoting early diagnosis and management of metabolic and HIV-related disorders in countries such as China, India, and Japan.

Japan Acquired Lipodystrophy Treatment Market Insight

The Japan acquired lipodystrophy treatment market is witnessing growth due to increasing prevalence of metabolic disorders, aging population, and high awareness of treatment options. Advanced healthcare facilities, early diagnosis programs, and supportive government initiatives for rare diseases are encouraging the uptake of treatment solutions across hospitals and specialty clinics.

China Acquired Lipodystrophy Treatment Market Insight

The China acquired lipodystrophy treatment market accounted for the largest revenue share in Asia-Pacific in 2025, driven by expanding healthcare infrastructure, increasing prevalence of HIV and metabolic disorders, growing disposable incomes, and government policies promoting access to innovative therapies. The adoption of treatment solutions is rising across hospitals, specialty clinics, and research centers, further propelling market growth.

Acquired Lipodystrophy Treatment Market Share

The Acquired Lipodystrophy Treatment industry is primarily led by well-established companies, including:

• Amryt Pharma (Ireland)

• Sanofi (France)

• Merck & Co. (U.S.)

• Novartis (Switzerland)

• Pfizer (U.S.)

• Roche (Switzerland)

• Eisai Co., Ltd. (Japan)

• Takeda Pharmaceutical (Japan)

• AbbVie (U.S.)

• GlaxoSmithKline (U.K.)

• AstraZeneca (U.K.)

• Janssen Pharmaceuticals (Belgium)

• Boehringer Ingelheim (Germany)

• ChemoCentryx (U.S.)

• Regeneron Pharmaceuticals (U.S.)

• MannKind Corporation (U.S.)

• Lonza Group (Switzerland)

• Esperion Therapeutics (U.S.)

• Chugai Pharmaceutical (Japan)

• Ferring Pharmaceuticals (Switzerland)

Latest Developments in Global Acquired Lipodystrophy Treatment Market

- In February 2024, metreleptin (MYALEPTA) was approved by Health Canada as a replacement therapy for leptin‑deficient lipodystrophy patients (including both acquired generalized and partial types) aged 2 years and above

- In October 2022, Amryt Pharma announced reimbursement approval for its metreleptin therapy (MYALEPT / MYALEPTA) in the Netherlands for patients with generalized and partial lipodystrophy, expanding access in European markets

- In March 2021, a U.S. expanded access program for metreleptin in acquired generalized lipodystrophy was documented, underlining growing clinical support and real‑world use of the therapy for metabolic complications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.