Global Acrylamide Market

Market Size in USD Billion

CAGR :

%

USD

4.17 Billion

USD

5.96 Billion

2025

2033

USD

4.17 Billion

USD

5.96 Billion

2025

2033

| 2026 –2033 | |

| USD 4.17 Billion | |

| USD 5.96 Billion | |

|

|

|

|

Acrylamide Market Size

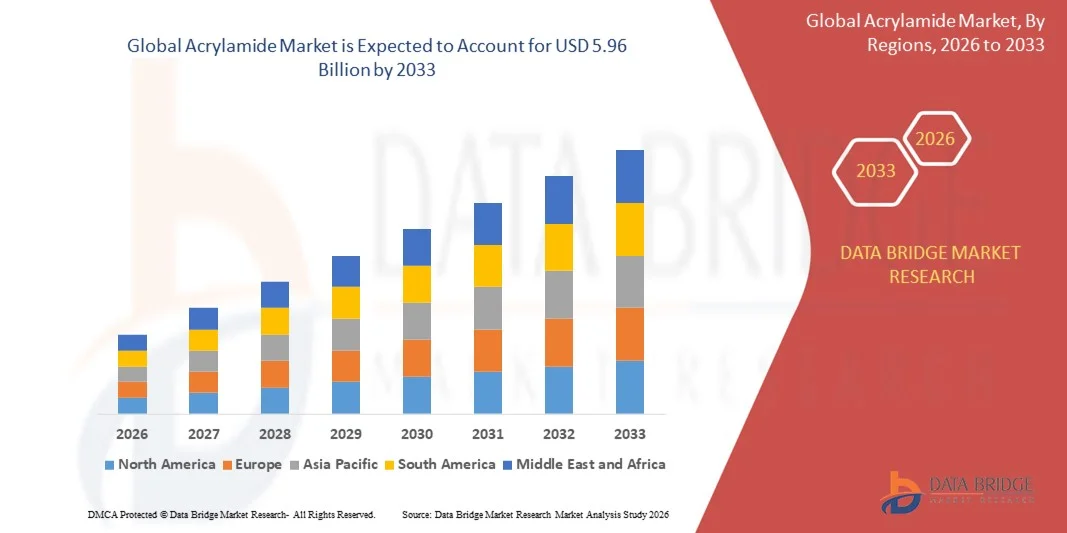

- The global acrylamide market size was valued at USD 4.17 billion in 2025 and is expected to reach USD 5.96 billion by 2033, at a CAGR of 4.57% during the forecast period

- The acrylamide market growth is largely driven by the increasing demand for polyacrylamide in water treatment, mining, and paper industries, which require efficient flocculants and polymers to enhance operational efficiency and environmental compliance

- Furthermore, rising industrialization and urbanization, coupled with the growing need for wastewater management solutions in emerging economies such as India and China, are accelerating the adoption of acrylamide-based products, thereby significantly boosting the market's growth

Acrylamide Market Analysis

- Acrylamide, a key monomer for polyacrylamides, plays a critical role in water treatment, oil recovery, and paper manufacturing due to its ability to improve flocculation, enhance viscosity, and serve as a binding agent in various industrial applications

- The escalating demand for acrylamide is primarily fueled by stringent environmental regulations requiring effective wastewater treatment, increasing investments in industrial infrastructure, and the growing preference for high-efficiency polymer solutions across multiple sectors

- North America dominated the acrylamide market with a share of over 40% in 2025, due to high industrial adoption across water treatment, oil and gas, and paper manufacturing sectors

- Asia-Pacific is expected to be the fastest growing region in the acrylamide market during the forecast period due to rapid industrialization, urbanization, and increasing water treatment initiatives in countries such as China, India, and Japan

- Acrylamide water solution segment dominated the market with a market share of 62.5% in 2025, due to its high solubility, ease of handling, and suitability for large-scale industrial applications. Manufacturers often prefer water solutions due to their simplified storage, transportation, and dosing in various chemical processes. The market also sees strong demand for acrylamide water solutions because of their extensive use in water treatment, enhanced oil recovery, and paper manufacturing, where precise control over concentration is critical. In addition, water solutions are compatible with automated processing systems, improving operational efficiency and reducing safety hazards compared to handling crystalline forms

Report Scope and Acrylamide Market Segmentation

|

Attributes |

Acrylamide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Acrylamide Market Trends

Increasing Adoption of Polyacrylamide in Water Treatment and Industrial Applications

- A significant trend in the acrylamide market is the expanding utilization of polyacrylamide — derived from acrylamide — across water treatment, oil recovery, mining, and paper manufacturing industries due to its superior flocculation, binding, and viscosity‑enhancing properties, which improve purification efficiency and operational performance in large‑scale processes

- For instance, SNF Group has reported elevated demand for its polyacrylamide products in municipal and industrial wastewater treatment projects across North America and Europe, where utilities are upgrading infrastructure to comply with stricter environmental discharge norms, thereby reinforcing the reliance on high‑efficiency polymers

- In the oil and gas sector, acrylamide‑based copolymers are increasingly employed for enhanced oil recovery and drilling fluid conditioning, supporting extraction efficiency in mature fields and contributing to higher upstream productivity

- The paper and pulp industry continues to adopt acrylamide derivatives as retention and drainage aids to boost paper strength and production throughput, as manufacturers respond to quality and sustainability pressures

- Emerging markets such as China and India are witnessing rapid industrialization and urbanization, which amplify demand for water treatment and mining applications that depend on acrylamide‑based solutions, thereby elevating global polyacrylamide consumption

Acrylamide Market Dynamics

Driver

Rising Demand for Efficient Wastewater Management Solutions

- The growing global emphasis on addressing water scarcity, pollution control, and stricter discharge regulations is propelling the demand for acrylamide and its derivatives as key flocculants in wastewater treatment facilities, enabling effective removal of suspended solids and contaminants in municipal and industrial effluents

- For instance, Kemira has expanded its high‑efficiency acrylamide polymer portfolio to meet the needs of advanced water treatment plants in Europe and Asia, where new investments focus on sustainable effluent treatment and regulatory compliance, driving broader adoption of acrylamide‑based solutions

- Industrial sectors such as textiles, chemicals, and food processing are increasingly integrating acrylamide‑derived polymers into their treatment systems, which enhances sludge dewatering, lowers chemical usage, and improves overall process economics

- Government initiatives and funding for water infrastructure development further incentivize utilities and private operators to adopt acrylamide formulations that support long‑term water quality objectives

- The integration of acrylamide products in advanced treatment technologies — including membrane bioreactors and tertiary filtration systems — reinforces this demand by offering higher treatment efficiency and operational flexibility

Restraint/Challenge

High Production Costs and Environmental Concerns

- The acrylamide market faces challenges due to elevated production costs driven by raw material price volatility and the complex processes required to produce high‑purity monomers, which can compress margins and reduce cost competitiveness for manufacturers

- For instance, LG Chem and other producers have acknowledged that rising acrylonitrile feedstock prices — a major input for acrylamide synthesis — increase manufacturing expenses and affect pricing strategies across the supply chain, especially during periods of market disruption

- Environmental and health concerns related to acrylamide monomer handling, residuals, and toxicity necessitate stringent regulatory compliance and safety measures, raising operational expenditures for producers and end users alike

- The need for advanced emissions control, wastewater treatment, and worker safety protocols increases capital and operational costs for facilities, particularly in regions with strict environmental standards

- These combined cost and regulatory pressures limit rapid expansion and can deter smaller firms from investing in large‑scale production or entering new markets, thereby constraining overall market growth

Acrylamide Market Scope

The market is segmented on the basis of product type, application, and end-use industry.

- By Product Type

On the basis of product type, the acrylamide market is segmented into acrylamide water solution and acrylamide crystals. The acrylamide water solution segment dominated the market with the largest market revenue share of 62.5% in 2025, driven by its high solubility, ease of handling, and suitability for large-scale industrial applications. Manufacturers often prefer water solutions due to their simplified storage, transportation, and dosing in various chemical processes. The market also sees strong demand for acrylamide water solutions because of their extensive use in water treatment, enhanced oil recovery, and paper manufacturing, where precise control over concentration is critical. In addition, water solutions are compatible with automated processing systems, improving operational efficiency and reducing safety hazards compared to handling crystalline forms.

The acrylamide crystals segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in specialty applications requiring high-purity acrylamide. For instance, companies such as BASF are increasingly utilizing crystalline acrylamide for advanced polymer synthesis, where controlled purity and minimal moisture content are crucial. Crystalline forms also offer advantages in long-term storage and transport for certain industrial users. The segment’s growth is supported by the expansion of niche chemical industries and rising demand for custom polymer formulations in emerging markets.

- By Application

On the basis of application, the acrylamide market is segmented into enhanced oil recovery, pulp and paper manufacturing, textile sizing, flocculent, thickener, and others. The flocculent segment dominated the market with the largest market revenue share in 2025, driven by its critical role in water treatment processes across municipal and industrial sectors. Flocculants derived from acrylamide are essential for removing suspended solids, improving water clarity, and enhancing wastewater treatment efficiency. In addition, the segment benefits from increasing environmental regulations and government initiatives for clean water management, driving widespread adoption.

The enhanced oil recovery segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising global energy demand and the need for efficient oil extraction methods. For instance, companies such as SNF Floerger utilize acrylamide-based polymers to improve oil displacement and recovery rates in mature oil fields. Acrylamide polymers help reduce water usage and optimize extraction efficiency, making them attractive for both conventional and unconventional oil reservoirs. The segment’s expansion is further supported by technological advancements in polymer flooding techniques and growing investments in energy infrastructure in emerging regions.

- By End Use Industry

On the basis of end use industry, the acrylamide market is segmented into water treatment, oil and gas, personal care and cosmetics, paper and pulp, mining, textile, packaging, and others. The water treatment segment dominated the market with the largest market revenue share in 2025, driven by the widespread need for clean and safe water across municipal, industrial, and commercial applications. Acrylamide-based polymers are extensively used as flocculants to remove impurities, enhance filtration, and meet stringent water quality standards. The segment also benefits from growing urbanization, industrialization, and increasing awareness regarding sustainable water management practices.

The oil and gas segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing investments in enhanced oil recovery and exploration activities. For instance, companies such as Lubrizol employ acrylamide polymers to improve oil recovery efficiency and reduce environmental impact. The segment growth is supported by rising global energy consumption, focus on maximizing output from existing oil fields, and adoption of advanced polymer flooding techniques. Acrylamide’s role in reducing water usage and improving reservoir management positions it as a critical component in the oil and gas sector.

Acrylamide Market Regional Analysis

- North America dominated the acrylamide market with the largest revenue share of over 40% in 2025, driven by high industrial adoption across water treatment, oil and gas, and paper manufacturing sectors

- Manufacturers in the region prioritize acrylamide for its efficiency in flocculent production, enhanced oil recovery, and pulp and paper applications, supported by established chemical processing infrastructure

- The widespread adoption is further supported by stringent environmental regulations, advanced polymer processing technologies, and the presence of leading chemical manufacturers, establishing acrylamide as a key industrial chemical in North America

U.S. Acrylamide Market Insight

The U.S. acrylamide market captured the largest revenue share in 2025 within North America, fueled by extensive use in water treatment and oil recovery processes. Rising demand for high-performance polymers and flocculants is driving growth, alongside investments in municipal and industrial water purification projects. For instance, companies such as BASF and SNF Floerger are expanding production capacities to meet the growing requirement for acrylamide-based polymers. The integration of acrylamide in diverse industrial applications, including paper manufacturing and mining, further propels market expansion.

Europe Acrylamide Market Insight

The Europe acrylamide market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent environmental and water quality regulations and rising industrial polymer demand. Increasing urbanization and growth in the oil and gas, water treatment, and pulp and paper industries are fostering acrylamide adoption. European manufacturers are also emphasizing eco-friendly processing and high-purity acrylamide production. The region is witnessing significant expansion across both large-scale industrial applications and specialty chemical segments.

U.K. Acrylamide Market Insight

The U.K. acrylamide market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing demand for flocculants and polymer additives in water treatment and industrial processes. Rising awareness regarding water quality and industrial efficiency is encouraging chemical processors to adopt high-performance acrylamide products. In addition, the presence of key chemical companies and robust R&D infrastructure is expected to continue stimulating market growth.

Germany Acrylamide Market Insight

The Germany acrylamide market is expected to expand at a considerable CAGR during the forecast period, fueled by high industrial activity in the oil and gas, mining, and pulp and paper sectors. Germany’s well-established chemical industry and emphasis on sustainability support the adoption of environmentally compliant acrylamide products. Manufacturers are increasingly integrating acrylamide in polymer and flocculent applications to enhance efficiency and compliance with local regulations.

Asia-Pacific Acrylamide Market Insight

The Asia-Pacific acrylamide market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid industrialization, urbanization, and increasing water treatment initiatives in countries such as China, India, and Japan. Rising investments in oil recovery, paper manufacturing, and mining are contributing to higher acrylamide consumption. Furthermore, APAC is emerging as a manufacturing hub for chemical intermediates, improving the availability and affordability of acrylamide across industrial sectors.

Japan Acrylamide Market Insight

The Japan acrylamide market is gaining momentum due to the country’s advanced industrial base, emphasis on water quality, and technological innovation in polymer applications. The growing demand for flocculants and thickeners in municipal and industrial water treatment is a major driver. Moreover, Japan’s aging population and increasing focus on efficiency and automation in chemical processing are expected to spur demand for high-performance acrylamide products.

China Acrylamide Market Insight

The China acrylamide market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding industrial base, rapid urbanization, and significant investments in water treatment and oil recovery projects. China stands as one of the largest producers and consumers of acrylamide, with strong domestic manufacturers such as Shandong Haihua and Nantong Xingchen contributing to market growth. The push towards industrial modernization and availability of cost-effective acrylamide products are key factors propelling the market in China.

Acrylamide Market Share

The acrylamide industry is primarily led by well-established companies, including:

- SIBUR International GmbH (Germany)

- Versalis S.p.A. (Italy)

- LG Chem (South Korea)

- SpecialChem (France)

- Rishiroop Ltd. (India)

- PARKER HANNIFIN CORP (U.S.)

- SKF Group (Sweden)

- CGR Products (U.S.)

- NANTEX Industry Co., Ltd. (China)

- ZEON CORPORATION (Japan)

- Synthos (Poland)

- Bharat Polymers (India)

- VarrmasElassto Seals (India)

- ARLANXEO (Germany)

- BRP Manufacturing (U.S.)

- KUMHO PETROCHEMICAL (South Korea)

- LUC Group (France)

- UNITED PLASTIC COMPONENTS INC. (U.S.)

- INEOS (U.K.)

- Plastic Extrusion Technologies (U.S.)

- RTP Company (U.S.)

- Preferred Plastics, Inc. (U.S.)

- Crafted Plastics Inc. (U.S.)

- Select Plastics (U.S.)

- Formosa Plastics Corporation (Taiwan)

- Chi Mei Corporation (Taiwan)

- SABIC (Saudi Arabia)

Latest Developments in Global Acrylamide Market

- In March 2023, Solenis acquired Diversey, a U.S.-based company specializing in hygiene, infection prevention, and cleaning solutions. This strategic acquisition is expected to create significant cross-selling opportunities, particularly by expanding the customer base for Solenis’ water management solutions. The move strengthens the company’s position in the water treatment market and enables integrated offerings, which are likely to drive higher adoption of its chemical solutions across multiple industries

- In June 2022, Black Rose Industries Ltd. inaugurated a commercial production plant in India to manufacture acrylamide solids. This capacity expansion positioned the company as one of the few global producers of acrylamide solids outside China, enhancing its competitive advantage. The move is expected to support increased supply to regional and international markets, reduce dependency on imports, and contribute to meeting growing demand in water treatment, mining, and paper industries

- In February 2022, Kemira advanced its leadership in eco-friendly chemistry solutions by initiating global-scale production of a new polymer derived from renewable resources. The initial batches were delivered to a wastewater treatment facility in the Helsinki Region Environmental Services (HSY) for testing. This development reinforces the market trend toward sustainable water treatment solutions and positions Kemira as a key player in the growing demand for environmentally responsible acrylamide-based products

- In December 2021, Black Rose Industries Ltd. announced the launch of N-Methylol Acrylamide 48%, a derivative of acrylamide liquid, set for commercial release in January 2022. Primarily used as a monomer in latex binders and cross-linkable emulsion polymers, this product expansion strengthens the company’s revenue streams. By diversifying its product portfolio, Black Rose Industries is poised to capture a broader share of the acrylamide derivatives market across multiple industrial applications

- In February 2021, SNF, a leading acrylamide manufacturer, committed to a USD 300 million investment over two years to enhance its U.S. manufacturing capacity. The plan aimed to increase production at its Plaquemine, Louisiana facility by 30 kilotons of polyacrylamide (PAM) and 100 kilotons of acrylamide monomer. This strategic investment is expected to bolster market supply, improve production efficiency, and meet rising global demand, particularly in water treatment and industrial sectors, reinforcing SNF’s leadership in the acrylamide market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Acrylamide Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Acrylamide Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Acrylamide Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.